Asia Pacific edtech Market Size, Share, Industry Analysis Report By Deployment Mode (Cloud, On-Premise), By Type (Hardware, Software, Content), By Sector (K-12, Preschool,Higher Education, Other Sectors), By End-User (Business, Consumer), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 160719

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Quick Market Facts

- Analysts’ Viewpoint

- Role of Generative AI

- Investment and Business benefits

- China Market Size

- By Deployment Mode: On-Premise

- By Type: Hardware

- By Sector: K-12

- By End-User: Business

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

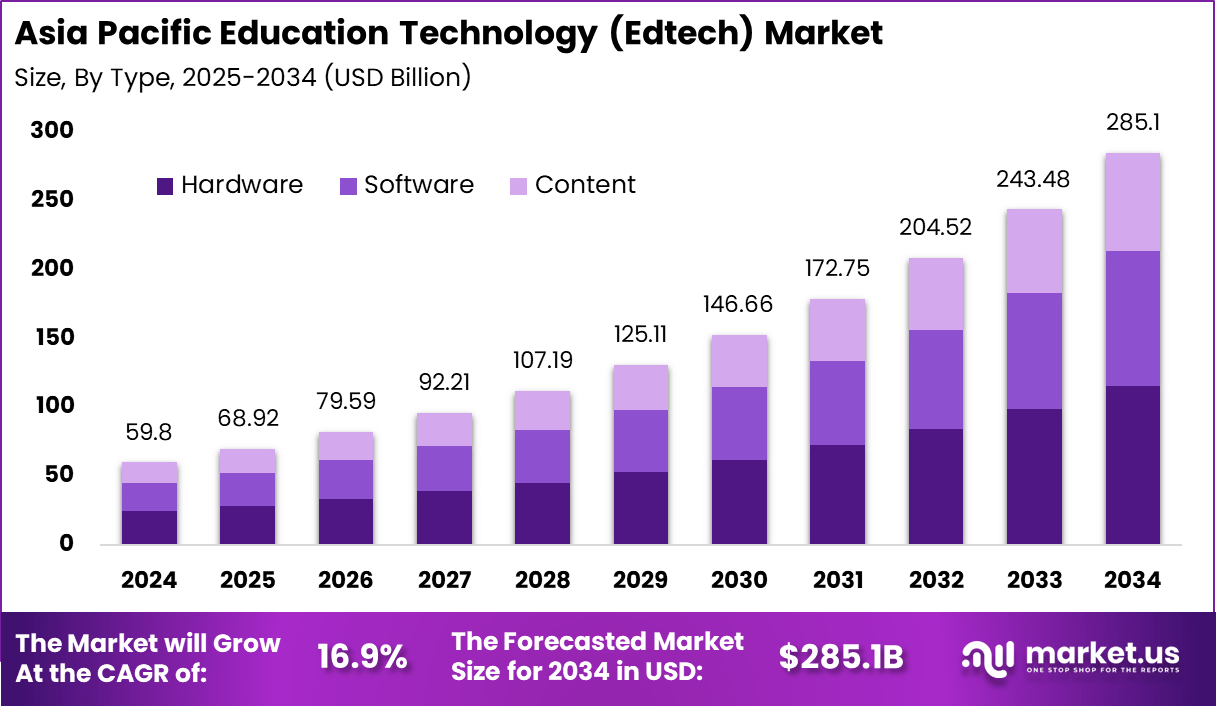

The Asia Pacific edtech Market generated USD 59.8 billion in 2024 and is predicted to register growth from USD 68.92 billion in 2025 to about USD 285.1 billion by 2034, recording a CAGR of 16.9% throughout the forecast span.

The Asia-Pacific (APAC) edtech market is witnessing some of the fastest growth in the world, fueled by the region’s massive youth population, strong cultural emphasis on education, and rapid technological adoption. More than half of the global students aged 15 to 24 live in APAC, creating an unparalleled demand for digital learning solutions. The region is characterized by a fragmented market that includes agile startups and established players competing vigorously.

The educational culture in APAC values academic success as a pathway to career and social advancement, driving strong parental willingness to invest in supplementary digital education. This deep-rooted priority has helped the edtech momentum grow steadily, encompassing K-12, language learning, STEM education, exam preparation, and corporate training.

According to exploding topics, The education technology sector is growing quickly across corporate, school, and higher education environments. Corporate EdTech alone is valued at $27.5 billion, with digital learning now considered the most widely used method for employee skill development. Since 2020, K-12 schools have seen a 99% rise in EdTech usage, and about 65% of students in this segment use technology-based tools every day.

Based on data from wifitalents, In higher education, more than 70% of students regularly rely on digital learning platforms, and over 70% of colleges plan to introduce at least one online undergraduate program within the next three years. Technology-driven solutions continue to attract investment and innovation, with EdTech startups securing more than $5 billion in funding in 2023.

Mobile learning alone accounts for nearly 60% of the total global market, showing a clear preference for flexible, on-the-go access. AI-based learning platforms have seen a 50% increase in adoption in the last two years, while emerging technologies such as virtual and augmented reality are expected to grow at a CAGR of 42% between 2024 and 2030.

Gamified learning models are also gaining traction, increasing student motivation by 30%. Around 85% of teachers say that EdTech tools improve student engagement, and the online tutoring segment is projected to expand at a CAGR of 15.2% from 2023 to 2030. However, retention remains a concern, with online learning showing a 25% retention rate compared to 58% in traditional classrooms.

Top Market Takeaways

- By deployment mode, on-premise solutions lead with 70.3%, showing preference for localized control and data protection in educational setups.

- By type, hardware holds 40.5%, driven by demand for digital devices, smart boards, and classroom connectivity tools.

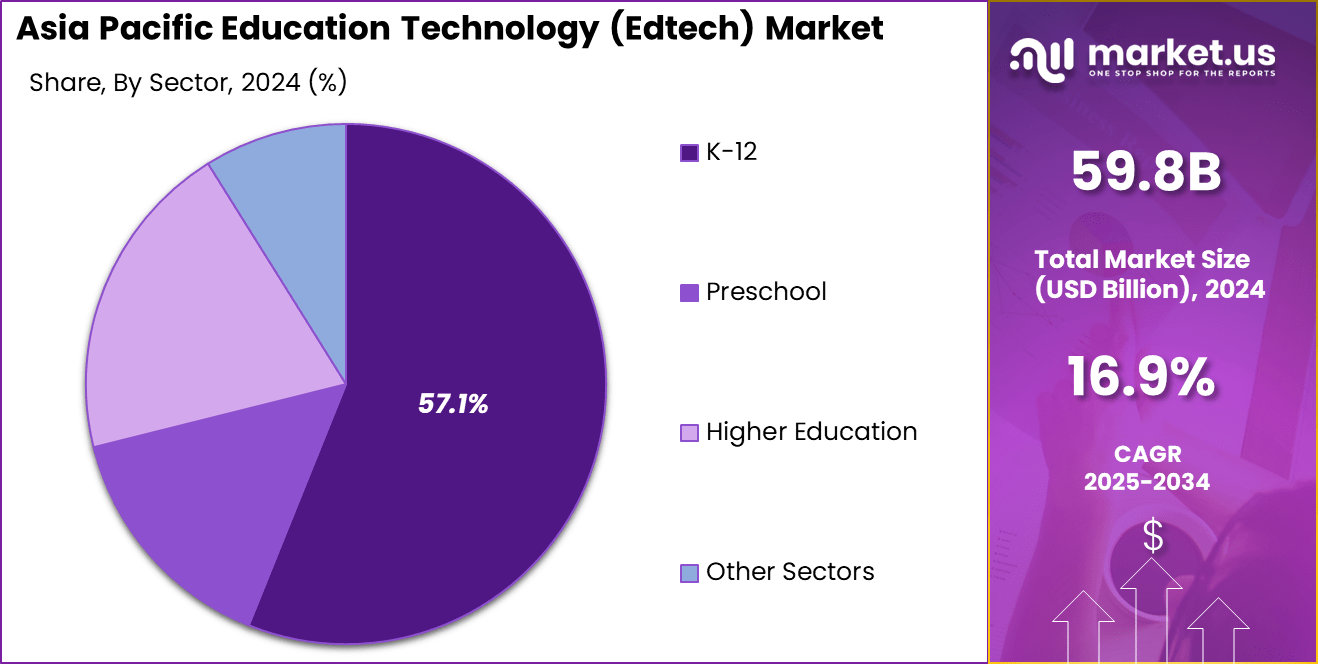

- By sector, K-12 dominates with 57.1%, highlighting the rapid integration of digital platforms in schools across the region.

- By end-user, businesses account for 68%, as corporations invest heavily in e-learning and workforce training.

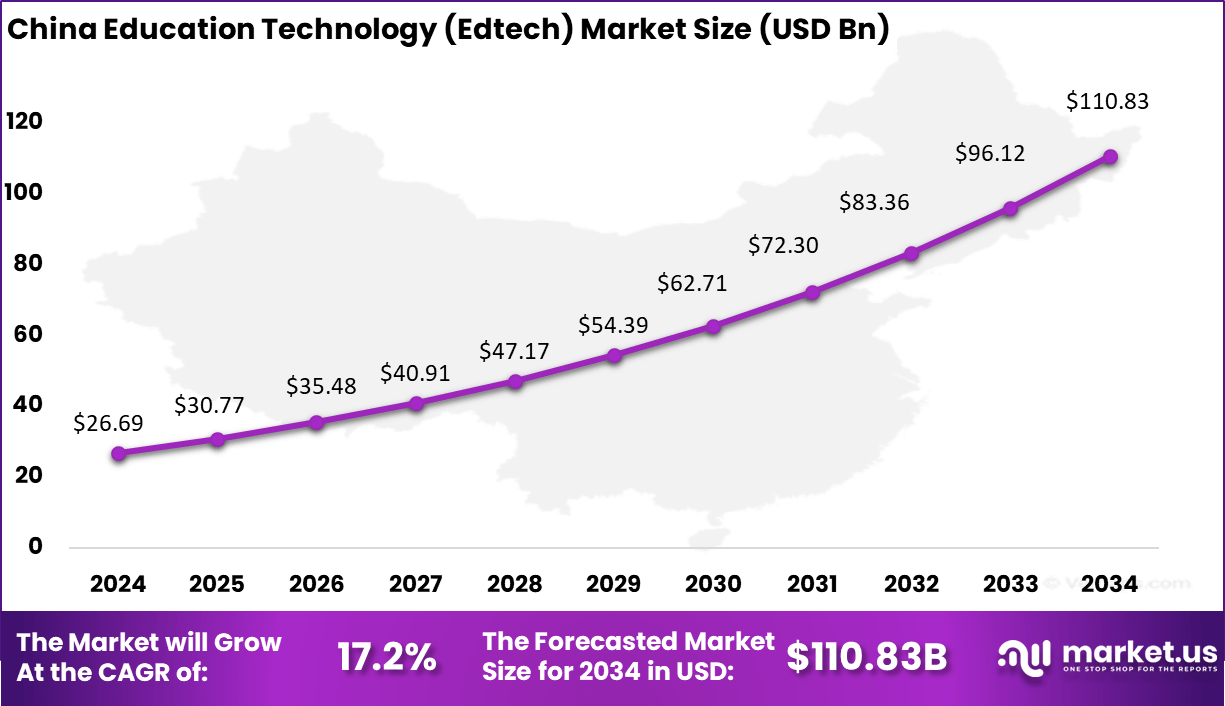

- The China market reached USD 26.69 billion and is expanding at a strong CAGR of 17.2%, underscoring its leadership in regional EdTech adoption.

Quick Market Facts

- Cloud deployment shows a steady rise from 28.6% in 2019 to 29.7% in 2024.

- On-Premise deployment gradually declines from 71.4% to 70.3% in the same period.

- Hardware share steadily decreases from 41.5% in 2019 to 40.5% in 2024.

- Software share shows consistent growth, rising from 27.1% to 28.7%.

- Content share remains relatively stable but shows a slight dip from 31.3% to 30.8%.

- Business segment dominates but shows a slight decline from 69.0% in 2019 to 68.0% in 2024.

- Consumer share rises gradually from 31.0% to 32.0% during the same period.

- K-12 remains the largest sector, rising from 55.4% in 2019 to 57.1% in 2024.

- Preschool is stable but shows a slight increase from 10.8% to 11.0%.

- Higher Education shows a gradual decline from 19.3% to 18.5%.

- Other Sectors decline steadily, falling from 14.5% to 13.4%.

Analysts’ Viewpoint

Top driving factors for the APAC edtech market include the rise in internet penetration and affordable mobile technology, which enable access to learning anytime and anywhere. Governments across APAC are also pushing for digital education policies aimed at smart classrooms, infrastructure investments, and skill-based learning initiatives.

Rapid automation and digital transformation have made lifelong upskilling essential for professionals, further pushing demand for innovative edtech platforms. The demand is also enhanced by rural-urban educational disparities, with online platforms bridging gaps that traditional schooling often cannot address. These factors combine to create a potent growth environment and encourage the adoption of personalized and adaptive learning experiences leveraging AI and data analytics

The increasing adoption of technologies in APAC’s edtech space revolves around artificial intelligence, machine learning, and data analytics to create personalized learning experiences tailored to individual students’ needs and preferences. Platforms use AI to track progress and recommend customized content and assessments.

Mobile learning solutions, gamification, and cloud-based platforms are also becoming mainstream, facilitating engagement and accessibility. AI skill-building tools and virtual concierges are recent innovations that help learners efficiently build relevant skills. The use of low-bandwidth solutions seeks to make education accessible in less connected rural areas, demonstrating inclusiveness alongside technological progress.

Role of Generative AI

The Asia-Pacific (APAC) education technology landscape is rapidly evolving, with generative AI playing a central role in transforming learning experiences. Generative AI is helping students by creating personalized lessons, enabling remote learning, and breaking language barriers through real-time translation.

In APAC, AI-driven personalized learning systems have improved student outcomes by up to 30%, highlighting how this technology adapts to diverse educational needs. Generative AI helps close urban–rural education gaps by delivering quality, adaptive content in local languages, allowing students to learn at their own pace anywhere.

Investment and Business benefits

Investment opportunities in APAC’s edtech market remain significant despite recent funding slowdowns following the pandemic. The sector is supported by venture capital, private equity, and institutional investments aimed at scaling startups, innovating content, and expanding user bases.

Major focus areas for funding include AI-driven personalized learning, skill-building platforms, and hybrid learning models that integrate digital and in-person education. Southeast Asia, in particular, hosts a vibrant startup scene with nearly 3,000 edtech companies, reflecting sustained investor interest driven by the region’s demographic and policy tailwinds. Although funding rounds became more selective in 2024, the market showed recovery with substantial capital infusion.

Business benefits from edtech adoption in APAC include enhanced learning engagement through gamification and interactive content, broader reach to underserved populations, and greater flexibility in educational delivery. Schools and institutions benefit from efficient resource allocation, scalable delivery models, and data insights that improve instructional quality.

Corporate training and upskilling programs become more accessible, helping businesses maintain workforce competitiveness. Additionally, personalized learning contributes to better performance outcomes, leading to higher student satisfaction and retention. Automation of administrative tasks through AI also aids institutions in reducing operational costs.

China Market Size

China stands out as a significant contributor to the Asia Pacific EdTech market, with its sector valued around USD 26.69 billion. The country enjoys a robust CAGR of 17.2%, underscoring rapid growth fueled by increasing internet penetration, government backing for smart education, and widespread adoption of AI-powered learning tools.

Despite regulatory shifts such as the “Double Reduction” policy, which impacted tutoring services, the market has adapted by pivoting toward online and technology-driven educational models. Chinese institutions and businesses rapidly embrace digital transformation, employing AI, virtual classrooms, and advanced hardware to support diverse learning needs. This dynamic environment positions China as a leading force in shaping education technology trends in the region.

By Deployment Mode: On-Premise

In 2024, On-premise deployment dominates the Asia Pacific EdTech market, commanding a significant 70.3% share. This mode remains preferred by educational institutions that emphasize direct control over sensitive data and infrastructure. Many schools and organizations adopt on-premise solutions to comply with strict regulations around student privacy and data governance, ensuring their systems remain secure and manageable locally.

A major driver for on-premise preference is the need for uninterrupted and reliable access to educational tools, especially where internet connectivity may be inconsistent. Institutions also benefit from the flexibility to customize their digital learning environments to fit specific pedagogical practices, supporting smoother integration into existing IT systems. This approach suits larger schools and businesses investing in long-term infrastructure for digital education.

Market Share By Deployment Mode (%), 2019-2024

Deployment Mode 2019 2020 2021 2022 2023 2024 Cloud 28.6% 28.8% 29.0% 29.3% 29.5% 29.7% On-Premise 71.4% 71.2% 71.0% 70.7% 70.5% 70.3% By Type: Hardware

In 2024, the hardware segment leads the Asia Pacific EdTech market with a 40.5% share. This reflects the region’s growing investment in physical educational technology tools such as interactive displays, tablets, projectors, and audio-visual equipment that facilitate immersive and interactive learning experiences. Hardware acts as the essential foundation enabling digital content delivery and hybrid learning models across institutions.

Growth in this segment is partly fueled by government initiatives aimed at bridging the digital divide in education. Many countries within Asia Pacific, including India and China, are pushing to equip classrooms with robust and affordable devices to enable equal access to digital learning. Increasing demand for durable and multi-functional education devices also supports continued hardware adoption in both urban and rural settings.

Market Share By Type (%), 2019-2024

Type 2019 2020 2021 2022 2023 2024 Hardware 41.5% 41.3% 41.1% 40.9% 40.7% 40.5% Software 27.1% 27.4% 27.8% 28.1% 28.4% 28.7% Content 31.3% 31.2% 31.1% 31.0% 30.9% 30.8% By Sector: K-12

In 2024, the K-12 sector accounts for the largest share, 57.1%, of the EdTech market in Asia Pacific. This substantial share highlights the focus on digital education solutions that cater to foundational schooling years, driven by schools’ needs to enhance learning outcomes and student engagement through technology. Initiatives to integrate AI, gamification, and adaptive learning systems are particularly prominent within this sector.

Market Share By Sector (%), 2019-2024

Sector 2019 2020 2021 2022 2023 2024 K-12 55.4% 55.7% 56.1% 56.5% 57.0% 57.1% Preschool 10.8% 10.8% 10.9% 10.9% 10.9% 11.0% Higher Education 19.3% 19.2% 19.0% 18.8% 18.7% 18.5% Other Sectors 14.5% 14.3% 14.0% 13.8% 13.4% 13.4% Public and private educational institutions are adopting digital platforms for personalized learning, real-time progress tracking, and remote education delivery. The demographic weight of school-age children in Asia Pacific, coupled with the emphasis on improving literacy and skill development, supports ongoing expansion in the K-12 EdTech segment. The trend toward hybrid classrooms continues to accelerate its adoption.

By End-User: Business

In 2024, Businesses represent a commanding 68% share within the EdTech end-user segment. This reflects the rising importance of corporate training and workforce skill development in the region. Companies increasingly deploy EdTech platforms to improve employee learning outcomes, enhance productivity, and meet evolving industry demands through upskilling and reskilling programs.

The growth of remote working models has further fueled demand for digital learning solutions that offer flexibility and scalability. Many businesses invest in customized learning management systems and e-learning content to provide continuous professional development and compliance training. The rise of industry-specific digital tools and certification platforms also bolster this segment’s prominence in the overall EdTech market.

Market Share By End-User (%), 2019-2024

End-User 2019 2020 2021 2022 2023 2024 Business 69.0% 68.8% 68.6% 68.4% 68.2% 68.0% Consumer 31.0% 31.2% 31.4% 31.6% 31.8% 32.0% Emerging Trends

Emerging trends in APAC edtech in 2025 include the rise of hyper-personalized learning powered by AI, alongside growing adoption of virtual and augmented reality (VR/AR) for immersive education. Around 60% of educators already use AI daily to tailor education, while VR/AR applications are expanding to provide hands-on, experiential learning in safe virtual settings.

Additionally, microlearning formats delivering short, focused lessons are gaining popularity to match shrinking attention spans, though balanced with deep understanding needs. These trends reflect a shift towards more engaging, flexible, and skill-centric education, driven by both technology and changing learner expectations.

Growth Factors

Growth factors driving the APAC edtech space include the region’s large youth population, with over 55% of the world’s students residing in APAC, creating immense demand for accessible digital education. Rapid urbanization, rising middle-class incomes, and growing digital infrastructure also play a role.

Governments are pushing initiatives for digital classrooms and skill-based education, and technology penetration is improving access in rural areas. AI-powered tools and platforms support continuous upskilling, making education more relevant to today’s workforce needs. The importance of academic achievement culturally fuels adoption of innovative learning solutions across diverse markets

Key Market Segments

By Deployment Mode

- Cloud

- On-Premise

By Type

- Hardware

- Software

- Content

By Sector

- K-12

- Preschool

- Higher Education

- Other Sectors

By End-User

- Business

- Consumer

Driver

Growing Digitalization and Government Support

The education technology market in APAC is being driven strongly by increasing digitalization of the education sector supported by government initiatives. Countries like India, China, and Japan are rapidly adopting digital learning tools such as Learning Management Systems (LMS) and mobile learning platforms.

Government programs focusing on digital literacy and infrastructure investments, such as India’s Digital India initiative and China’s AI-based education policies, are accelerating integration of technology into classrooms. This broad-based push ensures more schools and learners have access to digital education, directly fueling market growth.

Furthermore, the rise in internet penetration and smartphone availability has amplified access to edtech solutions across both urban and rural areas. This digital shift has made education more flexible and personalized, enhancing engagement for students of all ages. The combination of public sector momentum and growing private sector innovation is creating a robust environment that sustains accelerating adoption and investment in edtech services across the region.

Restraint

Digital Divide and Uneven Internet Access

Despite rapid growth, the APAC edtech market faces substantial limitations due to uneven internet connectivity and infrastructural disparities. Many rural and underserved areas still lack reliable high-speed internet, limiting digital learning accessibility. This digital divide creates challenges in implementing uniform education technologies and results in unequal learning opportunities between urban and remote regions.

Such limitations restrain the overall market’s reach and slow down full-scale adoption of digital education platforms. Additionally, issues like lack of technological awareness, affordability barriers, and limited access to digital devices compound the problem.

Nonprofit organizations and governments are attempting to bridge this gap through low-bandwidth solutions and device distribution programs, but progress remains gradual. Until these infrastructural and socio-economic obstacles are adequately addressed, the digital divide will remain a key restraint on APAC edtech growth.

Opportunity

Personalized and Adaptive Learning Technologies

A significant opportunity in the APAC edtech market lies in the growing demand for personalized and adaptive learning solutions. With advancements in data analytics, artificial intelligence, and machine learning, edtech platforms can now tailor content to individual learners’ needs, preferences, and progress.

This enhances learning outcomes by providing customized recommendations, adaptive assessments, and feedback mechanisms that were not feasible with traditional methods. The adoption of such intelligent technologies is increasing across the region as platforms cater to diverse learning styles and educational levels – from K-12 institutions to corporate training.

Personalized learning not only improves student engagement but also meets the rising expectations of parents, educators, and employers, thereby opening new revenue streams and differentiating providers in this competitive market. This area is poised for robust growth as stakeholders invest in innovation to enhance educational experiences.

Challenge

Intense Market Competition and Profitability Pressure

One of the biggest challenges for the APAC edtech market is intense competition, resulting in price wars and shrinking profit margins. The market is crowded with numerous domestic startups and established global players like Coursera, BYJU’s, and Pearson competing for market share.

Larger companies leverage economies of scale to offer low-cost or freemium models that smaller players struggle to match, putting pressure on profitability. Additionally, differentiation among products is limited, forcing companies to compete largely on price or marketing rather than innovation.

Intellectual property issues and the high cost of content development add complexity to success in this space. For newer or smaller firms, maintaining sustainable growth and investing in product development while competing with dominant players remains a critical challenge in APAC’s vibrant yet crowded edtech landscape.

Competitive Analysis

The Asia Pacific Edtech Market is driven by global and regional digital learning leaders such as Coursera Inc., BYJU’S, Chegg Inc., and 2U Inc. These companies offer online degree programs, test preparation, professional upskilling, and tutoring services tailored to diverse learners. BYJU’S has built strong regional momentum through localized content and interactive platforms, while Coursera and Chegg focus on certification programs and academic partnerships across the region.

Major technology and platform-based companies including Amazon Inc., Alphabet Inc. (Google LLC), and Blackboard Inc. provide cloud-based learning tools, digital classrooms, and AI-assisted education services. Their offerings support hybrid learning models used by schools, universities, and corporate training programs. edX Inc., in collaboration with leading institutions, expands access to high-quality online education through professional and academic micro-credentials.

Regional and specialized players such as Instructure, Inc., Udacity, Inc., Edutech, and upGrad Education Private Limited support skill-based learning, LMS platforms, and workforce development. UpGrad has gained strong traction in India and Southeast Asia with employment-focused courses and university tie-ups. A growing pool of other key players continues to boost market adoption through localized content, language-based platforms, and digital outreach in both urban and rural education systems.

Top Key Players in the Market

- Coursera Inc.

- BYJU’S

- Chegg Inc.

- 2U Inc.

- Amazon Inc.

- Blackboard Inc.

- Edutech

- Alphabet Inc. (Google LLC)

- edX Inc.

- Instructure, Inc.

- Udacity, Inc.

- upGrad Education Private Limited

- Other Key Players.

Recent Developments

- In March 2025, CleverTap joined with upGrad to add a deep-learning module to upGrad’s Digital Marketing and Product Management courses. These programs are run with support from Duke CE and MICA. The goal is to help students learn how to use AI tools, improve customer engagement, and apply these skills in real business situations.

- In March 2025, the Delhi government signed an agreement with the BIG Institute, the National Skill Development Corporation International, and Physics Wallah. Through this plan, more than 1.63 lakh government-school students will receive free online coaching for NEET and CUET exams.

- In March 2025, Microsoft Education partnered with Adobe to bring Adobe Creative Cloud apps into Microsoft Teams for Education. This will help teachers and students use better creativity tools directly in their digital classrooms.

- In January 2025, Banco Santander partnered with Coursera to give 10,000 scholarships. These scholarships provide one year of access to over 13,000 online courses and certificates from companies like Google, IBM, AWS, and Microsoft. The aim is to help people build skills in areas such as cybersecurity, marketing, and data science.

Report Scope

Report Features Description Market Value (2024) USD 59.8 Bn Forecast Revenue (2034) USD 285.1 Bn CAGR(2025-2034) 16.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Deployment Mode (Cloud, On-Premise), By Type (Hardware, Software, Content), By Sector (K-12, Preschool,Higher Education, Other Sectors), By End-User (Business, Consumer) Competitive Landscape Coursera Inc., BYJU’S, Chegg, Inc., Blackboard Inc., Edutech, Google LLC, edX Inc., Instructure, Inc., Udacity, Inc., upGrad Education Private Limited, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Asia Pacific Edtech MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Asia Pacific Edtech MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Coursera Inc.

- BYJU’S

- Chegg Inc.

- 2U Inc.

- Amazon Inc.

- Blackboard Inc.

- Edutech

- Alphabet Inc. (Google LLC)

- edX Inc.

- Instructure, Inc.

- Udacity, Inc.

- upGrad Education Private Limited

- Other Key Players.