Global Aseptic Filling Machine Market Based on Type (Tabletop Filling Machine, Stand-alone Filling Machine), Based on Operation (Fully Automatic, Semi-automatic), Based on Form (Liquid, Semi-solid, Powder), Based on End-Use (Food & Beverage, Pharmaceutical, Cosmetics, Other End-Uses), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 14273

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

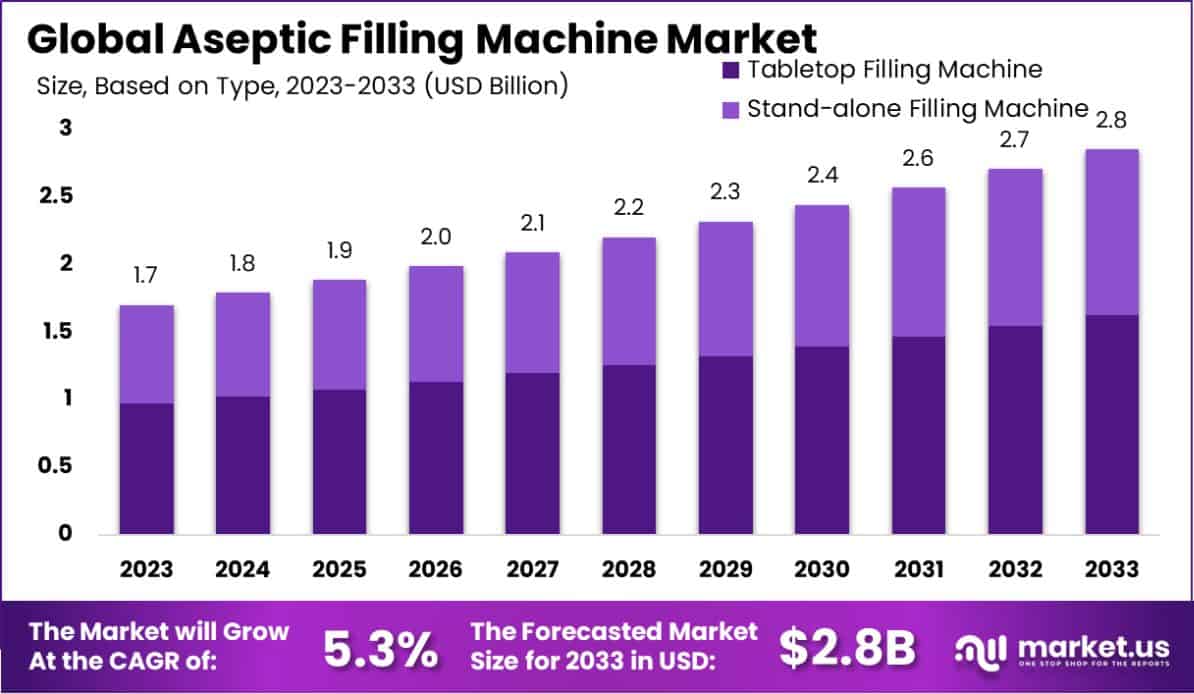

The Global Aseptic Filling Machine Market size is expected to be worth around USD 2.8 Billion by 2033, From USD 1.7 Billion by 2023, growing at a CAGR of 5.3% during the forecast period from 2024 to 2033.

An aseptic filling machine is a specialized equipment designed to sterilize food products, pharmaceuticals, and other consumables before packaging, ensuring that they are free from contamination and microbes. This process significantly extends the shelf life of products without the need for preservatives, maintaining both their quality and safety.

The aseptic filling machine market refers to the global industry centered around the production and sale of these machines. This market is driven by the growing demand from industries that require sterile processing environments and precise filling systems, such as pharmaceuticals, dairy products, and other food and beverage sectors.

The primary growth driver for the aseptic filling machine market is the increasing stringency of health and safety regulations worldwide, which compel manufacturers to adopt sophisticated sterile processing techniques.

Demand for aseptic filling machines is surging due to the rising consumption of convenience and on-the-go food products that require reliable, extended shelf-life packaging solutions.

The market presents significant opportunities for the development of more technologically advanced, flexible, and efficient machines that can handle a variety of packaging formats and product types, responding to the diverse needs of the rapidly evolving food and healthcare sectors.

The Aseptic Filling Machine market is witnessing significant technological advancements and robust investments, signaling a strong growth trajectory. This market’s evolution is exemplified by the strategic deployment of innovative filling technologies by leading players, such as Amul Dairy.

The integration of SIG filling lines—specifically, the Slimline 12 and XSlim 24 models—underscores a pivotal shift towards enhancing production capabilities and efficiency in packaging solutions.

These machines notably increase throughput with capacities of up to 12,000 carton packs per hour, accommodating a versatile range of volumes, and thereby optimizing operational flexibility and output.

Concurrently, substantial capital investments are fostering advancements in sterile processing environments, as evident in the installation of twin lyophilizers and large-scale isolator filling lines within new facilities. This development is part of a broader $100 million initiative aimed at bolstering production infrastructures to meet rigorous safety and quality standards.

Additionally, the sector benefits from significant financial endorsements, such as the $100 million in grants awarded by Lilly Endowment to the Purdue Research Foundation, which further enhances research capabilities through facilities like the Birck Nanotechnology Centre.

These developments collectively enhance the aseptic filling machine market’s capacity for innovation and its ability to meet the increasing demand for safe, efficient, and technologically advanced aseptic filling solutions.

The market’s growth is supported by these technological integrations and investments, reflecting a trend toward more sophisticated, scalable, and flexible production capabilities.

Key Takeaways

- The Global Aseptic Filling Machine Market size is expected to be worth around USD 2.8 Billion by 2033, From USD 1.7 Billion by 2023, growing at a CAGR of 5.3% during the forecast period from 2024 to 2033.

- In 2023, Stand-alone Filling Machines held a dominant market position in the Based on Type segment of the Aseptic Filling Machine Market, with a 57.2% share.

- In 2023, Fully Automatic held a dominant market position in the Based on Operation segment of the Aseptic Filling Machine Market.

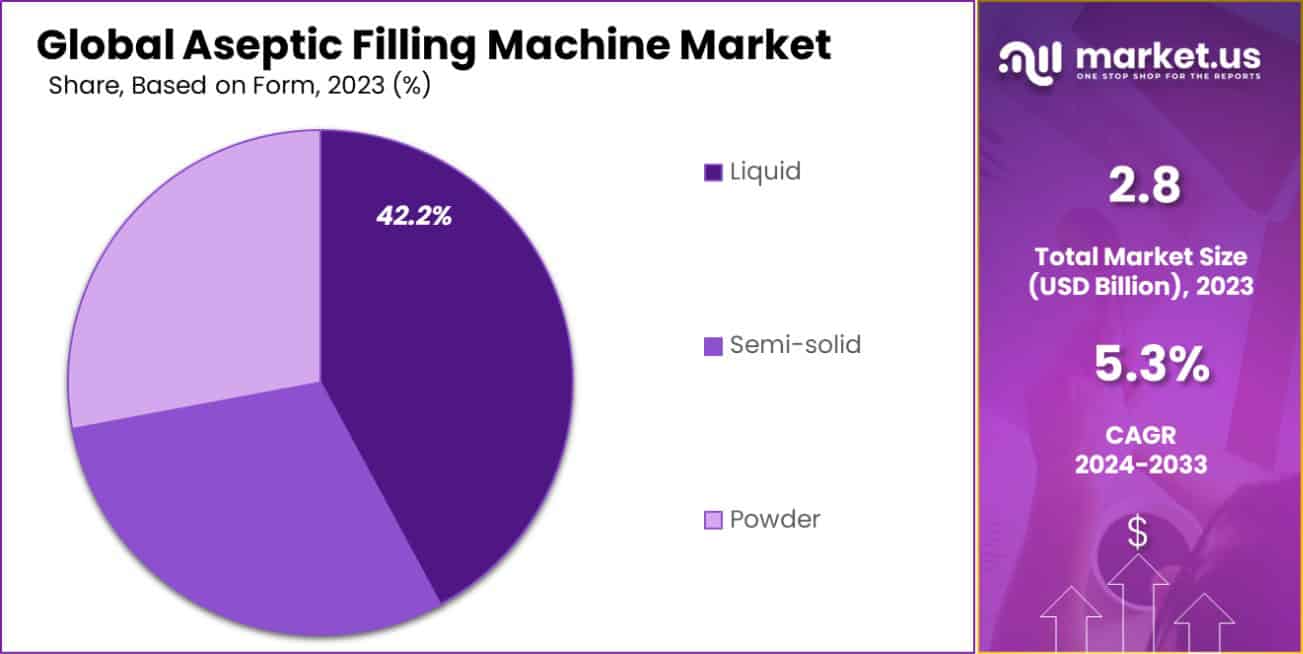

- In 2023, Liquid held a dominant market position in the Based on Form segment of the Aseptic Filling Machine Market, with a 42.2% share.

- In 2023, Food & Beverage held a dominant market position in The End-Use segment of the Aseptic Filling Machine Market.

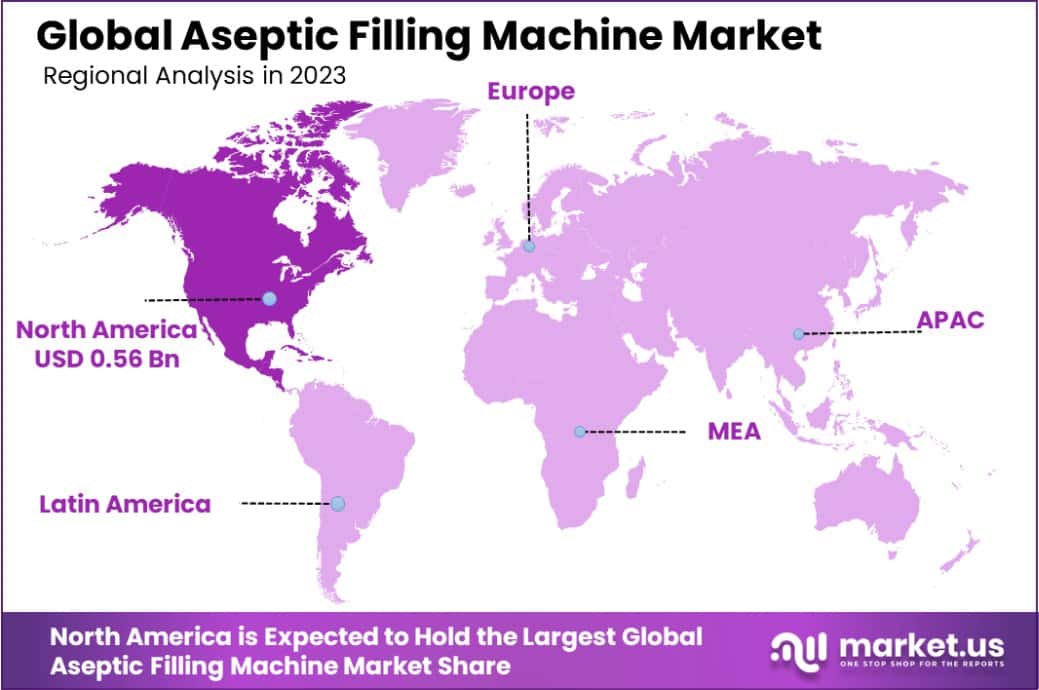

- North America dominated a 33.5%, market share in 2023 and held USD 0.56 Billion in revenue of the Aseptic Filling Machine Market.

Based on Type Analysis

In 2023, the Stand-alone Filling Machine segment secured a dominant position within the “Based on Type” category of the Aseptic Filling Machine Market, commanding a 57.2% market share. Comparatively, the Tabletop Filling Machine held a less significant portion of the market.

The prominence of Stand-alone Filling Machines can be primarily attributed to their extensive application in large-scale production environments, where their efficiency and capacity to handle substantial volumes significantly reduce operational time and costs.

The superior market share of Stand-alone Filling Machines underscores their pivotal role in meeting the high-volume demands of industries such as pharmaceuticals, food and beverages, and cosmetics. These sectors require stringent aseptic conditions to ensure product safety and longevity, which these machines reliably provide.

Furthermore, advancements in automation and integration technologies have enhanced the operational efficacy of Stand-alone Filling Machines, bolstering their adoption across various industries.

The market dynamics suggest a continued growth trajectory for Stand-alone Filling Machines, driven by innovations in machine functionality and increasing demand for hygienic and efficient production processes.

The ongoing development in this segment is expected to further consolidate its market position, reflecting broader trends in industrial automation and regulatory compliance.

Based on Operation Analysis

In 2023, the Fully Automatic segment held a dominant market position in the “Based on Operation” category of the Aseptic Filling Machine Market. This segment’s predominance is a reflection of its critical role in optimizing production efficiencies and reducing labor costs across multiple industries requiring aseptic processing.

Fully automatic aseptic filling machines are preferred for their ability to streamline operations and enhance the consistency of product quality. These machines minimize human intervention, thereby reducing the risk of contamination and ensuring compliance with stringent regulatory standards for cleanliness and aseptic conditions.

Their advanced control systems allow for precise filling, capping, and packaging, which are essential for maintaining the sterility and integrity of pharmaceuticals, food and beverages, and other sensitive products.

The trend toward automation in manufacturing environments has significantly influenced the growth of this segment. As companies invest in smarter and more connected manufacturing technologies, the demand for fully automatic aseptic filling machines is expected to continue rising.

This demand is further supported by the growing emphasis on safety and hygiene in product manufacturing, propelled by evolving consumer expectations and regulatory pressures. The integration of IoT and AI technologies in these systems is anticipated to drive further advancements, making fully automatic machines even more integral to aseptic filling processes.

Based on Form Analysis

In 2023, the Liquid segment held a dominant market position in the “Based on Form” category of the Aseptic Filling Machine Market, with a 42.2% share. This was followed by the Semi-solid and Powder segments.

The strong performance of the Liquid segment is underpinned by the extensive application of these machines in industries such as pharmaceuticals, beverages, and dairy products, where precision and sterility are paramount.

The preference for liquid aseptic filling machines is primarily driven by the need for high-speed, accurate filling capabilities that maintain product integrity and extend shelf life without preservatives. These machines are engineered to handle a variety of liquid viscosities and compositions, ensuring efficient processing while adhering to strict cleanliness and aseptic standards.

The market’s inclination towards liquid aseptic filling solutions can also be attributed to technological advancements that have enhanced machine versatility and reliability, making them suitable for a broad range of liquid products.

As industries continue to emphasize sustainable and safe production methods, the demand for liquid aseptic filling machines is expected to persist, supported by innovations in machine design and automation that improve throughput and reduce waste. This trend highlights the sector’s ongoing commitment to meeting the dynamic needs of modern production environments.

Based on End-Use Analysis

In 2023, the Food & Beverage sector held a dominant market position in the “Based on End-Use” category of the Aseptic Filling Machine Market. This prominence underscores the critical role aseptic filling technologies play in maintaining the safety, quality, and longevity of food and beverage products.

Aseptic filling machines are indispensable in the Food & Beverage industry due to their ability to process and package products in a sterile environment, which significantly reduces the likelihood of microbial contamination and extends product shelf life without the need for preservatives. The demand in this segment is propelled by the increasing consumer preference for convenient, safe, and healthy food options that require sophisticated packaging solutions.

The robust growth of the Food & Beverage segment within the aseptic filling machine market is also a reflection of stringent regulatory standards that mandate the use of advanced processing technologies to ensure food safety. Additionally, the shift towards more sustainable packaging solutions and the reduction of food waste are key factors driving the adoption of these machines.

As manufacturers continue to innovate and improve the efficiency and adaptability of aseptic filling machines, their integration into Food & Beverage production lines is expected to deepen, further cementing this segment’s market leadership.

Key Market Segments

Based on Type

- Tabletop Filling Machine

- Stand-alone Filling Machine

Based on Operation

- Fully Automatic

- Semi-automatic

Based on Form

- Liquid

- Semi-solid

- Powder

Based on End-Use

- Food & Beverage

- Pharmaceutical

- Cosmetics

- Other End-Uses

Drivers

Drivers of the Aseptic Filling Machine Market

The expansion of the aseptic filling machine market is primarily driven by the increasing demand for packaged food and pharmaceutical products that require stringent sterility. The shift towards sustainable and efficient packaging solutions further fuels this growth, as aseptic filling machines offer significant advantages in preserving the freshness and extending the shelf life of products without the need for preservatives.

These machines cater to the growing consumer preference for convenience and healthy eating, as they efficiently handle and package temperature-sensitive and perishable goods.

Additionally, advancements in technology have led to enhanced machine functionality and reliability, thereby reducing operational costs and increasing production speed, which in turn attracts more businesses to invest in aseptic filling capabilities.

This trend is reinforced by stringent regulatory standards for food safety and quality, compelling manufacturers to adopt aseptic processing methods.

Restraint

Challenges in Aseptic Filling Machine Adoption

One significant restraint in the aseptic filling machine market is the high initial investment required for equipment and technology. These machines are typically more expensive than conventional filling systems due to their sophisticated sterilization capabilities and advanced automation technologies.

This high cost can deter small and medium enterprises (SMEs) from adopting aseptic filling solutions, limiting market growth predominantly to well-established and financially robust companies.

Furthermore, the complexity of aseptic processes demands skilled operators and continuous maintenance, increasing operational costs and posing a challenge for manufacturers with limited technical expertise.

Additionally, stringent regulatory requirements for aseptic processing can complicate compliance for companies, particularly those in regions with less developed regulatory frameworks, further restricting market expansion.

Opportunities

Expanding Opportunities in Aseptic Filling

The aseptic filling machine market presents significant opportunities, particularly from the increasing global demand for sterile and preservative-free beverages and pharmaceuticals. This trend is bolstered by rising health awareness and the fast-growing pharmaceutical sector, which requires reliable and efficient packaging solutions to ensure product safety and compliance with health regulations.

Additionally, the push towards sustainable practices offers opportunities for innovations in eco-friendly aseptic packaging, appealing to environmentally conscious consumers and companies aiming to reduce their environmental footprint.

Emerging markets, with growing middle-class populations and urbanization, also provide fertile ground for the expansion of aseptic technologies. These regions are experiencing a surge in demand for high-quality packaged foods and drinks, driving further investment in aseptic filling machines to meet these needs efficiently.

Challenges

Market Hurdles for Aseptic Machines

The aseptic filling machine market faces several challenges that could hinder its growth. One of the primary concerns is the technological complexity of aseptic filling systems, which requires significant expertise and continuous innovation to maintain operational efficiency and comply with evolving health standards.

This complexity can lead to high maintenance and repair costs, making it financially burdensome for some companies to sustain long-term operations. Additionally, the need for stringent sterilization processes raises the bar for entry, as companies must ensure contamination-free operations to avoid product recalls and damage to brand reputation.

The market also contends with the fluctuating costs of raw materials and components, which can affect the profitability and pricing strategies of aseptic filling machine manufacturers. These economic and operational pressures require ongoing adaptation and investment, posing a challenge for market participants.

Growth Factors

Growth Drivers for Aseptic Machines

The aseptic filling machine market is poised for growth, driven by several key factors. The increasing demand for convenience foods and pharmaceutical products that require high standards of hygiene and extended shelf life supports the adoption of aseptic technology.

This trend is further fueled by rising consumer awareness about the health benefits of preservative-free products. Additionally, the global shift towards sustainable packaging solutions is encouraging the food and beverage industry to invest in aseptic filling technology, which offers efficient smart packaging with minimal environmental impact.

Technological advancements are also enhancing machine efficiency and adaptability, making them more attractive to industries looking for cost-effective, scalable, and flexible production capabilities. These factors, combined with the expanding global food and beverage market, particularly in emerging economies, are key contributors to the robust growth of the aseptic filling machine market.

Emerging Trends

Emerging Trends in Aseptic Filling

Emerging trends in the aseptic filling machine market are shaping its future growth, led by technological innovations such as industrial robotics and automation. These advancements enhance the precision and speed of aseptic filling processes, thereby increasing production efficiency and reducing human error.

There is also a growing trend towards modular aseptic filling machines that offer customizable options for various product types, accommodating the diverse needs of the food, beverage, and pharmaceutical industries.

Additionally, the integration of Internet of Things (IoT) technology is becoming more prevalent, allowing for real-time monitoring and data analysis to optimize operations and maintain high standards of sterilization and product quality.

The push for sustainable packaging solutions continues to drive innovation in eco-friendly materials and energy-efficient designs, further positioning aseptic filling technology as a key player in the future of safe and sustainable production.

Regional Analysis

The aseptic filling machine market is segmented into five key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, each presenting unique growth dynamics and opportunities.

North America is the dominating region, accounting for 33.5% of the market with a value of USD 0.56 billion, driven by stringent regulatory standards and high adoption rates in the food and pharmaceutical sectors.

Europe follows closely, leveraging its advanced manufacturing infrastructure and strong focus on sustainable packaging solutions. The Asia Pacific region is witnessing rapid growth due to increasing urbanization, rising disposable incomes, and expanding smart manufacturing capabilities, particularly in China and India.

The market in the Middle East & Africa is emerging, fueled by economic diversification efforts and growing demand for food safety. Latin America shows potential growth driven by improvements in healthcare infrastructure and rising consumer awareness about food hygiene.

Collectively, these regional markets underscore a robust global demand for aseptic filling technologies, with Asia Pacific projected to exhibit the highest growth rate in the coming years due to its burgeoning food and beverage industry and increasing investments in pharmaceutical manufacturing.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global aseptic filling machine market features prominent contributions from key players such as ALFA LAVAL, Bausch Strobel SE + Co. KG, and Dara Pharma, each bringing distinct technologies and market strategies that enhance the competitive dynamics of the sector.

ALFA LAVAL stands out for its extensive expertise in fluid handling and separation technologies, which are crucial in the aseptic process. The company has been focusing on expanding its product line to include more energy-efficient and technologically advanced aseptic filling systems that cater to the stringent sterilization standards required in the food, dairy, and pharmaceutical industries.

Their commitment to innovation is evident in their latest offerings, which emphasize not only performance but also sustainability, aligning with the global push towards environmentally responsible manufacturing practices.

Bausch Strobel SE + Co. KG excels in providing highly precise and reliable aseptic filling machines tailored for the pharmaceutical industry. Their machines are designed to ensure maximum sterility, which is paramount in the production of injectables and other sensitive pharmaceutical formulations.

In 2023, Bausch Strobel’s focus on integrating digital features, such as IoT connectivity for real-time monitoring and process optimization, underscores their strategy to lead through technological advancement and connectivity.

Dara Pharma continues to leverage its specialization in aseptic processing technology to serve both the pharmaceutical and biotech industries. Their machines are recognized for their modular design, allowing for flexibility and scalability, which is particularly beneficial for companies looking to adapt quickly to market changes or expand their production capabilities.

Dara Pharma’s approach to accommodating a wide range of container types and sizes demonstrates its commitment to meeting diverse client needs, positioning it as a versatile and adaptive leader in the market.

Collectively, these companies underscore a robust, innovation-driven approach to capturing leadership in the aseptic filling machine market, with each player focusing on specific aspects of technological advancement, customer-centric solutions, and market adaptability.

Top Key Players in the Market

- ALFA LAVAL

- Bausch Strobel SE + Co. KG

- Dara Pharma

- GEA

- Groninger & Co. Gmbh

- JBT

- Krones AG

- SaintyCo

- Serac Group

- Syntegon Technology GmbH

- Other Key Players

Recent Developments

- In April 2024, Heritage Foods Limited partners with SIG to introduce aseptic carton packs, enhancing packaging flexibility and meeting diverse consumer needs with a new filling line in Telangana.

- In October 2023, Milky Mist Dairy invested in three SIG filling machines in Tamil Nadu, enhancing aseptic carton pack production and expanding sustainable packaging options across diverse formats.

Report Scope

Report Features Description Market Value (2023) USD 1.7 Billion Forecast Revenue (2033) USD 2.8 Billion CAGR (2024-2033) 5.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Based on Type (Tabletop Filling Machine, Stand-alone Filling Machine), Based on Operation (Fully Automatic, Semi-automatic), Based on Form (Liquid, Semi-solid, Powder), Based on End-Use (Food & Beverage, Pharmaceutical, Cosmetics, Other End-Uses) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ALFA LAVAL, Bausch Strobel SE + Co. KG, Dara Pharma, GEA, Groninger & Co. Gmbh, JBT, Krones AG, SaintyCo, Serac Group, Syntegon Technology GmbH, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Aseptic Filling Machine MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Aseptic Filling Machine MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ALFA LAVAL

- Bausch Strobel SE + Co. KG

- Dara Pharma

- GEA

- Groninger & Co. Gmbh

- JBT

- Krones AG

- SaintyCo

- Serac Group

- Syntegon Technology GmbH

- Other Key Players