Global Artificial Intelligence Chipsets Market, By Chipset Type, By Application, By Computing Technology, By Vertical, as well as By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast: 2023-2032

- Published date: May 2023

- Report ID: 65197

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The global artificial intelligence chipsets market was valued at USD 13.64 billion in 2021 and is expected to reach USD 429.35 billion at a CAGR of 36.8% between 2023 and 2032. The rise in e-commerce adoption and the popularity of social media have led to an enormous increase in data volumes. This market is growing positively due to this rapid increase in data volume.

These chipsets address the demand for faster processing because of enabled machine learning. Tech industry giants are driven to develop high-speed processors because of the growing interest in machine learning and computer vision. The market for artificial intelligence chips has significantly increased owing to the exponential penetration of smartphones.

This market report gives a detailed analysis of the Artificial Intelligence Chipsets industry share, market size, growth, key trends, driving factors, competitive landscape, and other key factors.

Global Artificial Intelligence Chipsets Market Analysis

Chipset Analysis

There are four main types of accelerators: FPGA, ASIC, CPU, and GPU. Compared to all other types of chipsets in 2021, the GPU segment dominated the artificial intelligence chipsets market. Many tech giants, such as Arm Limited, Apple Inc., Qualcomm Technologies Inc., Advanced Micro Devices Inc., and Samsung Electronics Co. Ltd., use GPUs integrated with core CPUs to build their artificial intelligence chipsets.

While GPUs increase the speed and performance of chipset computing, major companies use GPU as the main processor and CPU as an auxiliary processor when building artificial intelligence chipsets. NVIDIA Corporation, for example, offers integrated modules of GPU and CPU only for inference and training workload domains.

ASIC, which is used to build high-performance processors, is also helping to augment this market for artificial intelligence chipsets. Google, for example, has developed its Cloud TPU and Edge TPU using ASIC architecture.

Other accelerator types include Intelligent Processing Unit, Neural Network Processors (NNP), Neural Processing Units (NPU), Reduced Information Set Computer (RISC), and Radio Processing Units (RPU). Some tech companies also use these accelerator types.

Workload Domain Analysis

The workload domain segment can be divided into inference and training. The training segment holds a significant portion of the market. In 2021, several tech giants, including NVIDIA Corporation, Intel Corporation, Xilinx Inc., Advanced Micro Devices, Inc., and Google Inc., worked to develop training chipsets.

The inference chipset market, managed by over 40 tech companies, includes at least 20 startups and is expected to be the most promising. This is due to the increasing need for edge computing and safety and privacy concerns. Currently, most training takes place in the cloud/data center, but inference can be done both at the edge and in the cloud.

Many Google enables applications can be used for training, including maps and organizational datasets. Inference includes autonomous vehicles, surveillance cameras, mobile devices, and intelligent machines. NVIDIA Corporation’s GPU segment dominates the market for training chipsets.

It boasts massively parallel architectures and is a dominant player in the artificial intelligence chipsets market. The training workload dominates the market share for AI chipsets. There is a growing trend toward the edge of the cloud by major players, which shows a healthy growth of the inference workload.

Computing Technology Analysis

There are two types of computing technology: cloud AI computing and end-to-end AI computing. Due to the increased use of technology to train workload-based chipsets, cloud computing dominated 2021’s market for AI chipsets. Cloud-based computing is growing because of its increasing use in data centers to improve efficiency, reduce operational costs, and better infrastructural control.

Artificial intelligence chipsets are offered by companies such as Intel Corporation, Google Inc., NVIDIA Corporation, and Advanced Micro Devices Inc., which facilitate edge and cloud computing. This segment generates the most revenue for these chipset companies.

Chip deployment is shifting towards edge computing, however, because of a significant increase in edge computing use for different products, such as autonomous cars, smartphones, and surveillance systems, currently, the majority of artificial intelligence chipsets deployed to the edge are used for inference purposes.

However, the edge-based artificial Intel chipsets used for training are still being developed. Many large companies, including Google Inc., Baidu Inc., and Graph core, offer AI chipsets that can be deployed on the cloud and at the edge. These chipset companies offer artificial intelligence chipsets that can be deployed on the cloud to train and at the edge to infer.

Vertical Analysis

Based on vertical, the artificial intelligence chipsets market can be divided as follows: healthcare, manufacturing, automotive, retail, and marketing, among others. The market share for AI chipsets was significant in 2018 due to the increasing use of artificial intelligence chipsets in smartphones and other devices.

Apple Inc., for example, has developed its A11 Bionic Chip and A12 Bionic Chip high-performance processors. These chips consist of core CPUs that are integrated with GPUs to accelerate. Samsung also developed neural processing units to support its future AI applications.

These chipsets have also helped to drive significant growth in the automotive market. NVIDIA Corporation offers these chipsets, namely DGX or Jetson AGX, used for autonomous vehicles. Due to the increasing number of applications such as cloud computing and IoT, the market for artificial intelligence chipsets is growing.

This market is also driven by the continuous enhancements of existing technologies and new technologies like 5G networks, artificial intelligence, and the significant growth in industrial electronics and automobiles.

Key Market Segmentation:

By Chipset Type

- CPU (Central Processing Unit)

- GPU

- ASIC

- Other Chipsets

By Application

- Inference

- Training

By Computing Technology

- Edge AI Computing

- Cloud AI Computing

By Vertical

- Healthcare

- Manufacturing

- Automotive

- Retail & e-Commerce

- Other Verticals

Market Dynamics

Artificial intelligence is a technology that has evolved to become the most widely used technology over the last few years. It is expected to be a promising technology in future smart devices. It is being deployed in every aspect of society and the economy in an increasing manner. It facilitates intelligence of services and products. This technology is widely used in finance, education, and logistics. It is essential to include these chipsets in any AI-enabled applications.

There are many applications of AI technology. These include autonomous vehicles, intelligent robots, and smart healthcare; Smart cities, smart finance, smart security, intelligent hardware, self-service store, and intelligent education. AI technology can be multifaceted because it uses algorithm mechanisms, applications, chipset types, and computing technology.

Artificial intelligence runs the basic applications of image/video, sound, and speech. Smart devices equipped with AI Chipsets can possess the enormous potential to collect billions of data from IoT sensors and devices and drive market growth. The main drivers of the artificial intelligence chipsets market are a growing size and complex data sets, which drive the demand for AI and the use of AI to enhance consumer service and decrease operating costs.

It also supports device control and high-volume computation. These applications can be run at the edge by chipsets. Several tech companies are developing artificial intelligence chipsets that can produce high-speed computing processors capable of simultaneously supporting large data sets and multiple applications.

Intel Corporation, for example, created Intel Nervana Neural Network Processors to support inference and training workloads. These chipsets were specifically developed to meet high-speed computing requirements for artificial intelligence.

The increasing demand for personal care products, such as regular checks, medical devices, and wearable devices, is accelerating the number of AI-enabled healthcare products in the world market. The graphics processing unit (GPU) segment is expected to have the biggest artificial intelligence chipset market share over the forecast period.

The Nervana Neural Network processors, dedicated accelerators, focus on artificial intelligence to give users the best intelligent option at the right moment. This has facilitated the widespread adoption of this chipset across various industries, including automotive, healthcare, manufacturing, and other consumer electronics.

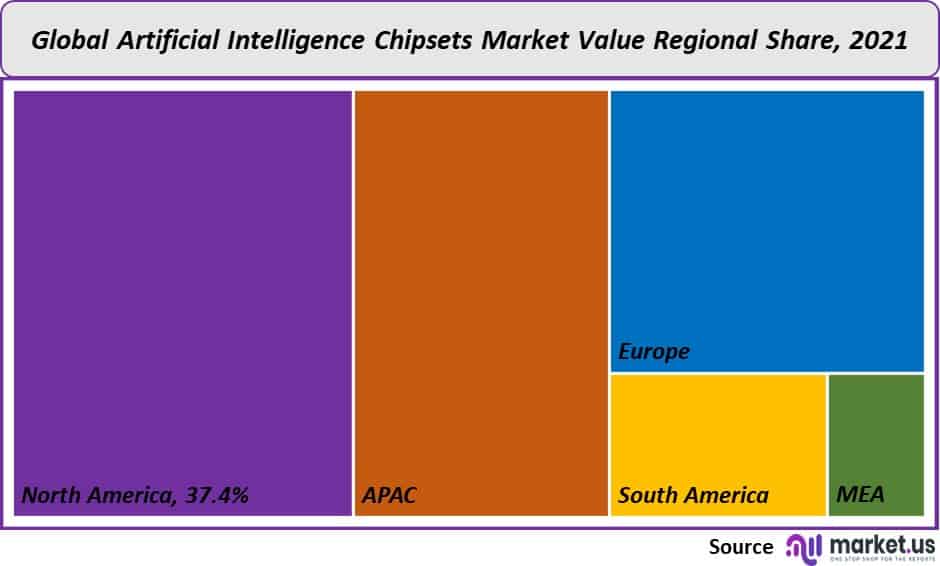

Regional Analysis

In 2021, the markets in North America accounted for 37.4% of the global market share due to large U.S.-based tech companies in this artificial intelligence chipsets market. Vast populations characterize North America with improved purchasing power, ongoing infrastructure investments, and an increasing emphasis by respective governments on in-house AI application production.

According to the National AI R&D Strategic Plan, the Federal government has increased its investments in basic AI R&D. This plan was created to improve access to high-quality data and cyber infrastructure. Major regions covered in the report are as follows.

Key Regions and Countries Covered in This Rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

To gain a greater market share, vendors in the artificial intelligence chipsets market are focused on expanding their customer base. Vendors are now collaborating with other associations to do so. NVIDIA Corporation and Continental AG teamed up in 2018 to bring AI-powered self-driving vehicle systems built on NVIDIA Drive’s platform.

This partnership allowed the development and design of AI self-driving vehicles of automation levels 2 through 5. Both companies were focused on self-driving solutions that used NVIDIA’s system on a chip, DRIVE Xavier. Arm Limited and NVIDIA Corporation joined forces in 2018 to provide deep learning inferencing for the Internet of Things and consumer electronics devices on the global market.

To implement machine learning, the chipset companies integrated NVIDIA’s open-source deep-learning accelerator architecture into Arm’s Project Trillium platform. This collaboration enabled IoT chip companies like IoT Chips to integrate AI into their platforms to offer intelligent and affordable products to the consumer electronics market.

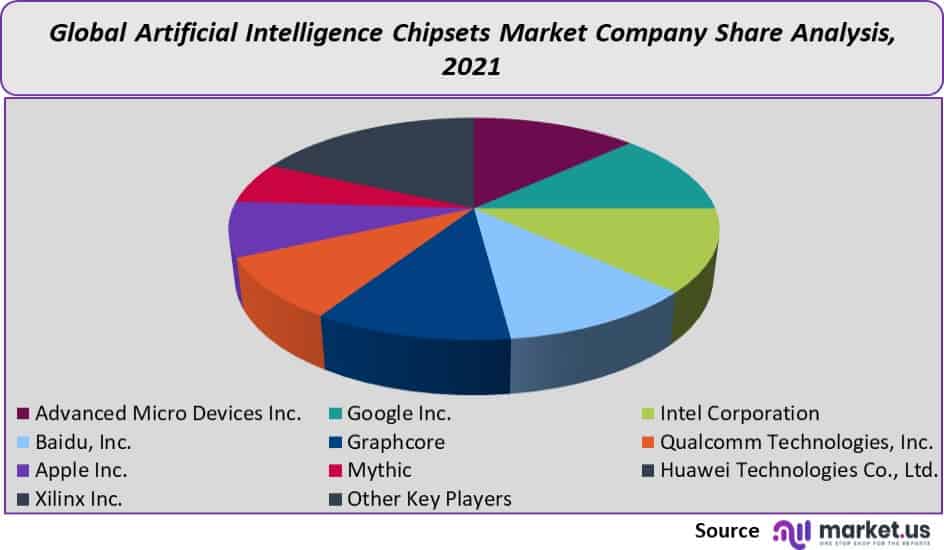

Key chipset companies included in this industry are Advanced Micro Devices Inc., Google Inc., Intel Corporation, Baidu Inc., Graphcore Limited, etc. These major players focus on acquisitions, new product launches to further market expansion.

Artificial Intelligence Chipsets Market Key Рlауеrѕ:

- Advanced Micro Devices Inc.

- Google Inc.

- Intel Corporation

- Baidu Inc.

- Graphcore Limited

- Qualcomm Technologies Inc.

- Apple Inc.

- Mythic

- Huawei Technologies Co. Ltd.

- Xilinx, Inc.

- IBM Corporation

- Samsung Electronics Co.

- Fujitsu Limited

- XMOS Limited

- Micron Technology Inc.

- Other Key Players

These are the key companies in Artificial Intelligence Chipsets Market

For the Artificial Intelligence Chipset Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Market Size in 2022

USD 13.64 billion

Growth Rate

36.83%

Forecast Value in 2032

USD 429.35 billion

Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What will be the market size of the Artificial Intelligence Chipsets Market in 2022?In 2022, the Artificial Intelligence Chipsets Market will reach USD 18.66 billion.

What CAGR is projected for the Artificial Intelligence Chipsets market?The Artificial Intelligence Chipsets market is expected to grow at 36.83% CAGR (2023-2032).

Name the major industry players in the Artificial Intelligence Chipsets.Advanced Micro Devices Inc., Google Inc., Intel Corporation, Baidu Inc., Graphcore Limited, Qualcomm Technologies Inc., and Other Key Players are the main vendors in Artificial Intelligence Chipsets.

What are the main business areas for the Artificial Intelligence Chipsets industry?North America and APAC are the top countries in which the Artificial Intelligence Chipsets industry operates.

Artificial Intelligence Chipset MarketPublished date: May 2023add_shopping_cartBuy Now get_appDownload Sample

Artificial Intelligence Chipset MarketPublished date: May 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Advanced Micro Devices Inc.

- Google Inc.

- Intel Corporation

- Baidu Inc.

- Graphcore Limited

- Qualcomm Technologies Inc.

- Apple Inc.

- Mythic

- Huawei Technologies Co. Ltd.

- Xilinx, Inc.

- IBM Corporation

- Samsung Electronics Co.

- Fujitsu Limited

- XMOS Limited

- Micron Technology Inc.

- Other Key Players