Global Artificial Insemination Market By Type (Intrauterine Insemination, Intravaginal Insemination, Intracervical Insemination, and Intratubal Insemination), By Source (AIH-Husband, and AID-Donor), By End-user (Hospitals & Fertility Clinics and Home & Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 58298

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

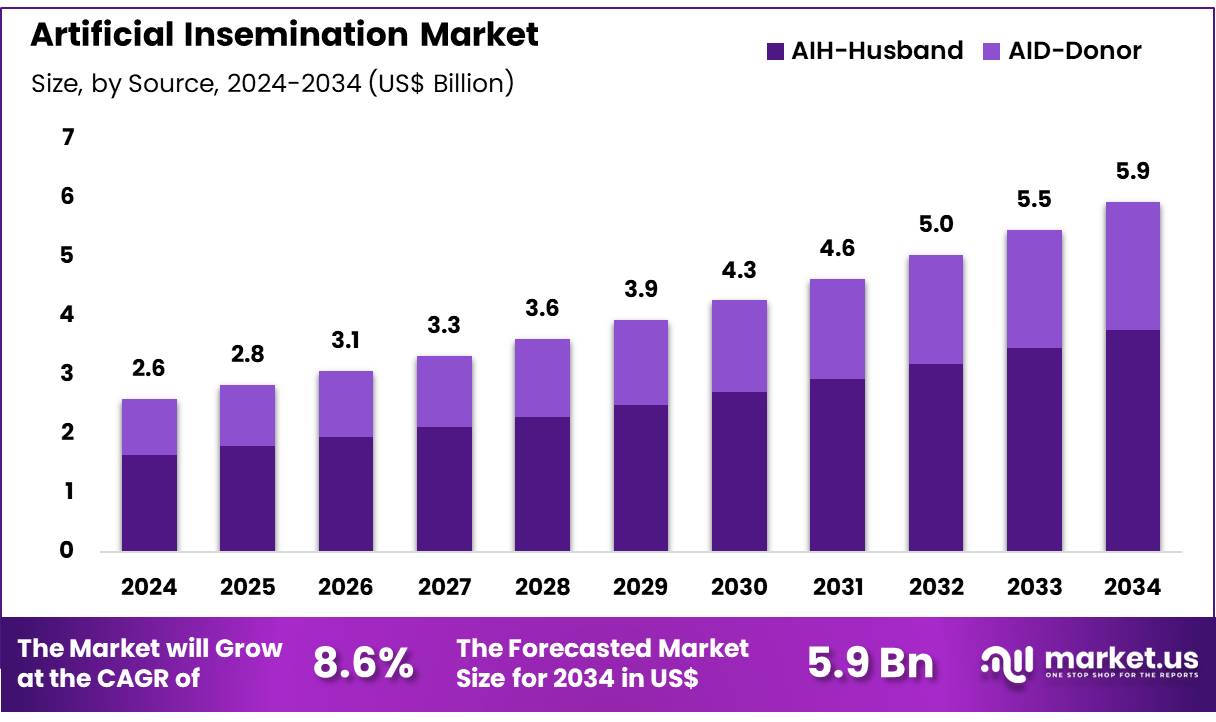

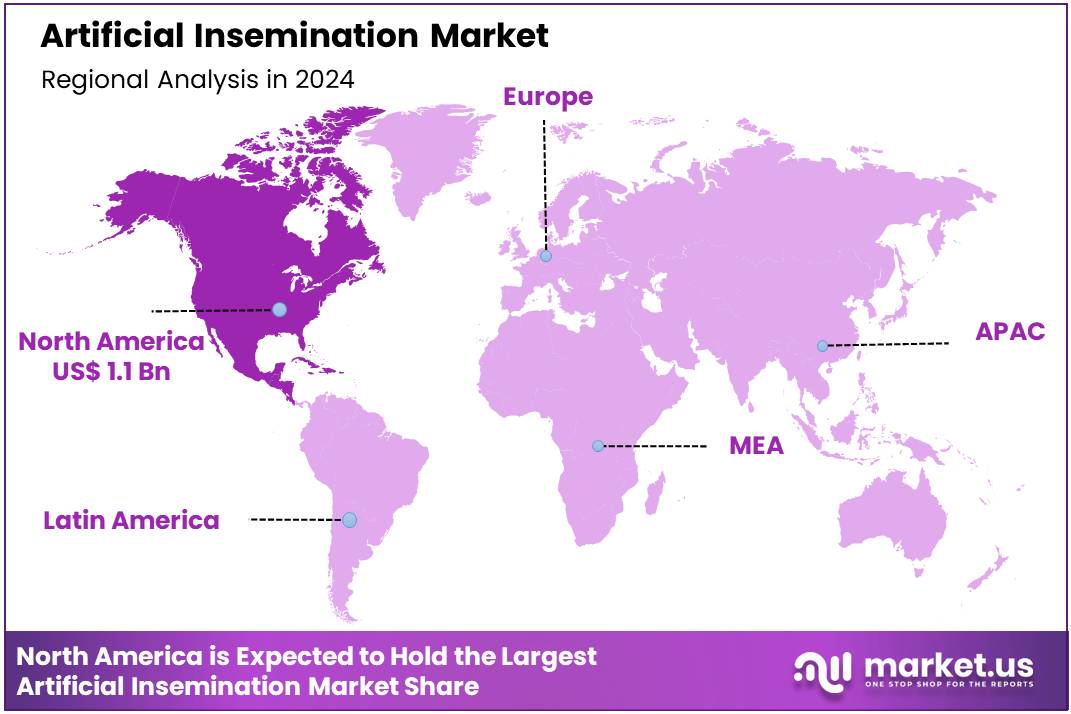

Global Artificial Insemination Market size is expected to be worth around US$ 5.9 Billion by 2034 from US$ 2.6 Billion in 2024, growing at a CAGR of 8.6% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.4% share with a revenue of US$ 1.1 Billion.

Rising infertility rates and a growing global awareness of reproductive health are primary drivers of the artificial insemination market. This technology provides a less invasive and often more affordable alternative to in-vitro fertilization (IVF) for individuals and couples struggling to conceive.

The World Health Organization (WHO) reported in 2023 that approximately one in six people globally experience infertility in their lifetime, highlighting the widespread need for fertility solutions. This high patient volume, combined with an increase in male- and female-factor infertility diagnoses, creates a robust and sustained demand for artificial insemination procedures as a first-line treatment.

Growing industry consolidation and a focus on integrated solutions are key trends shaping the market. Companies are pursuing mergers and acquisitions to create comprehensive platforms that streamline services for fertility clinics and improve patient outcomes.

For instance, in December 2024, Astorg completed its acquisition of both Hamilton Thorne and Cook Medical’s Reproductive Health business, consolidating key players in the assisted reproductive technology sector. This strategic move aims to create a more integrated platform that enhances services for fertility clinics, signaling a significant industry shift toward vertical integration and the provision of end-to-end solutions for a more seamless patient experience.

Increasing technological advancements and a greater emphasis on improving procedural success rates are creating significant opportunities for market expansion. The development of advanced semen analysis techniques and cryopreservation methods is crucial for enhancing the effectiveness of artificial insemination.

A 2024 report from the CDC’s National Center for Health Statistics highlighted a record low in the US fertility rate in 2024, with less than 1.6 births per woman, a trend that is driving a greater number of individuals to seek assisted reproductive technologies. This demographic shift, coupled with innovations in genomics for donor screening and the use of AI to optimize semen preparation, ensures the market will continue to evolve with new applications and improved outcomes.

Key Takeaways

- In 2024, the market generated a revenue of US$ 2.6 Billion, with a CAGR of 8.6%, and is expected to reach US$ 5.9 Billion by the year 2034.

- The type segment is divided into intrauterine insemination, intravaginal insemination, intracervical insemination, and intratubal insemination, with intrauterine insemination taking the lead in 2023 with a market share of 52.3%.

- Considering source, the market is divided into AIH-husband and AID-donor. Among these, AIH-husband held a significant share of 63.4%.

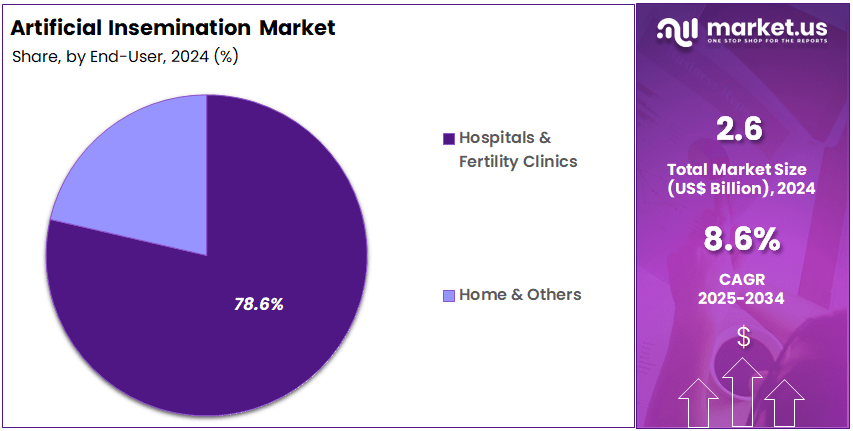

- Furthermore, concerning the end-user segment, the market is segregated into hospitals & fertility clinics and home & others. The hospitals & fertility clinics sector stands out as the dominant player, holding the largest revenue share of 78.6% in the market.

- North America led the market by securing a market share of 42.4% in 2023.

Type Analysis

Intrauterine insemination (IUI) holds the largest share of 52.3% in the artificial insemination market. This segment’s growth is expected to continue due to its increasing use as a first-line treatment for infertility, particularly among couples experiencing unexplained infertility or mild male factor infertility. IUI is anticipated to be favored due to its cost-effectiveness and relatively simple procedure, which eliminates the need for more invasive techniques.

As the global infertility rates rise, coupled with advancements in assisted reproductive technology (ART), the demand for IUI is likely to increase. Furthermore, the increasing awareness of fertility preservation techniques and the growing adoption of IUI in combination with fertility drugs are expected to further contribute to the growth of this segment.

Source Analysis

AIH-Husband (artificial insemination by husband) dominates the source segment, accounting for 63.4% of the market. This growth is driven by the increasing prevalence of male infertility issues and the relatively higher success rates of AIH compared to other forms of insemination. AIH involves using the husband’s sperm for insemination, and with the growing awareness of fertility treatments, many couples are opting for this method as it is less invasive than in vitro fertilization (IVF) and more affordable.

The rise in delayed pregnancies and the increasing number of couples seeking fertility assistance are projected to drive the continued dominance of AIH-Husband. Additionally, improvements in sperm preservation and processing are likely to enhance the success rates of AIH, further increasing its appeal.

End-User Analysis

Hospitals & fertility clinics account for 78.6% of the end-user segment in the artificial insemination market. The increasing demand for professional fertility treatments is expected to drive the growth of this segment. Fertility clinics are anticipated to witness a surge in demand for artificial insemination procedures due to their specialized equipment, expertise, and higher success rates compared to home insemination methods.

The growing awareness of ART, along with better accessibility to these services, is likely to increase the number of patients seeking assisted reproductive technologies at hospitals and fertility clinics. Furthermore, advancements in fertility treatments, coupled with better regulatory frameworks, are expected to make these settings the preferred choice for individuals and couples looking to achieve successful pregnancies through artificial insemination.

Key Market Segments

By Type

- Intrauterine Insemination

- Intravaginal Insemination

- Intracervical Insemination

- Intratubal Insemination

By Source

- AIH-Husband

- AID-Donor

By End-user

- Hospitals & Fertility Clinics

- Home & Others

Drivers

The rising global prevalence of infertility is driving the market.

The artificial insemination market is experiencing significant growth, primarily driven by the societal trend of individuals and couples delaying parenthood. As educational and career opportunities for women expand, the average age of first-time mothers has steadily increased, a factor known to contribute to a higher risk of age-related infertility. This demographic shift is creating a larger pool of potential clients who may require assistance to conceive.

Delaying childbirth means that by the time many people are ready to start a family, they are more likely to face biological challenges that make conception difficult. This drives them to seek out effective and less invasive fertility treatments.

According to the US Centers for Disease Control and Prevention (CDC), the mean age of mothers at first birth in the United States increased from 26.6 in 2016 to 27.5 in 2023, a clear and consistent trend. This figure highlights the growing market of women who may require reproductive assistance, positioning artificial insemination as a vital and expanding market.

Restraints

The high cost and limited insurance coverage are restraining the market.

A significant restraint on the artificial insemination market is the high out-of-pocket cost and the widespread lack of comprehensive insurance coverage for fertility treatments. Unlike other medical procedures, artificial insemination is often classified as an elective service, which means patients must bear the full financial burden.

The average cost of a single insemination cycle can range from a few hundred to several thousand dollars, a price point that is prohibitive for a large portion of the population. This financial barrier can force individuals and couples to delay or abandon treatment, regardless of their medical need. This issue is particularly acute in the United States, where, according to a 2024 analysis of fertility treatment costs, the average self-pay cost for an intrauterine insemination (IUI) cycle can range from US$1,175 to US$7,305, depending on whether it is a natural or stimulated cycle. The significant financial outlay required for a procedure that does not guarantee success represents a major obstacle to market expansion and a source of considerable stress for patients.

Opportunities

The growing acceptance among diverse family types is creating growth opportunities.

A key growth opportunity in the artificial insemination market lies in the growing acceptance and utilization of assisted reproductive technologies (ART) among a broader demographic, including same-sex couples and single parents by choice. As societal norms evolve and legal protections expand, more individuals and couples who cannot conceive through traditional means are turning to AI to build their families. This demographic shift is creating a new, strong market segment that is increasingly comfortable with the process.

The Centers for Disease Control and Prevention’s (CDC) 2022 ART Surveillance Report provides compelling data on this trend. The report indicated that for the first time, a significant number of ART cycles were performed for lesbian couples, gay couples, and single women. The report also highlights a clear trend toward using donor sperm, which is a key component of AI, to create these families, showcasing an expanding patient base for these services.

Impact of Macroeconomic / Geopolitical Factors

The artificial insemination market is highly sensitive to macroeconomic and geopolitical factors. The rising global prevalence of infertility and a growing social acceptance of assisted reproductive technologies are key demand drivers. However, these services are often costly and typically not fully covered by insurance, making the market vulnerable to economic downturns. High inflation can erode consumer savings and disposable income, causing potential patients to delay or forego treatment, directly impacting clinic revenues.

Geopolitical tensions and trade disputes pose significant challenges to the industry’s supply chain, which relies on a global network of manufacturers for specialized medical equipment, lab instruments, and cryo-storage tanks. New US trade policies have introduced significant cost volatility, with tariffs on medical devices and their components from key trade partners like China and the EU.

These tariffs, which can be as high as 54% on Chinese imports and 20% on EU-sourced goods, increase the operational costs for fertility clinics. This forces clinics to either absorb the added expenses or pass them on to patients, potentially making the treatments less accessible and creating uncertainty in a market that depends heavily on consumer financial stability.

Latest Trends

The rise of at-home insemination kits and digital services is a recent trend.

A defining trend in 2024 is the accelerated development of at-home artificial insemination kits and accompanying digital tools. This innovation is transforming the market by making the process more accessible, private, and affordable. These kits typically include all the necessary components for an individual to perform insemination in the comfort of their own home, which removes the need for expensive and often intimidating clinic visits.

The kits are often paired with mobile applications that provide step-by-step instructions, ovulation tracking, and support communities. This trend is further evidenced by a surge in intellectual property filings in this area. A search of the US Patent and Trademark Office (USPTO)’s database reveals that in 2024, multiple utility patents and design patents were granted for at-home insemination devices and related fertility-tracking apps, confirming a strong focus on innovation within this segment of the market. This technological advancement is democratizing access to fertility services and lowering the barrier to entry for prospective parents.

Regional Analysis

North America is leading the Artificial Insemination Market

The artificial insemination market in North America has shown significant expansion in 2024, with the region holding a 42.4% global market share. This robust growth is largely attributed to demographic shifts, increasing public awareness, and the widespread adoption of advanced reproductive technologies. According to the US Centers for Disease Control and Prevention (CDC), in 2022, there were 435,426 assisted reproductive technology (ART) cycles performed on 251,542 unique patients in the United States, which resulted in 94,039 live-birth deliveries. This data highlights the substantial use of fertility treatments in the country.

A major driver for this increase is the notable decline in fertility rates across the region. Statistics Canada reported that in 2022, the total fertility rate in the country reached a record low of 1.33 children per woman, marking one of the largest annual decreases among high-income nations. This trend is further compounded by the continuous rise in the average age of first-time mothers, reaching 31.6 years in Canada in 2022, as individuals increasingly delay parenthood.

Such demographic changes create a growing demand for assisted reproductive services. The established and well-regulated healthcare infrastructure in North America, supported by favorable insurance and government policies, makes these procedures more accessible and contributes directly to the market’s sustained growth.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The artificial insemination market in Asia Pacific is expected to grow considerably during the forecast period, driven by a confluence of rising infertility rates and supportive government policies. The region’s vast population and an accelerating trend of delayed parenthood are projected to create a sustained demand for reproductive health services. For instance, data from China’s National Health Commission indicates that the prevalence of infertility has increased, now affecting approximately one in five couples of reproductive age.

In response to these demographic challenges, governments across the region are implementing policies to make assisted reproductive technologies more accessible. Japan’s Ministry of Health, Labour, and Welfare released data in 2024 showing that the nation’s total fertility rate dropped to a new record-low of 1.15. This statistic underscores the urgency for government support for fertility treatments.

Meanwhile, the Indian government’s 2022 Assisted Reproductive Technology (Regulation) Act and its 2024 amendments are likely to provide a clearer and more inclusive legal framework for fertility treatments, including the use of donor gametes. Such developments reinforce ethical and legal frameworks while expanding access to a wider range of patients. These supportive government initiatives and the increasing willingness of couples to seek medical assistance are anticipated to fuel market expansion throughout the Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leaders in the reproductive health market are finding growth by focusing on technological advancements in semen selection, embryo culture, and cryopreservation, which is directly improving success rates. They are also actively pursuing strategic collaborations and acquisitions to expand their offerings and get into new therapeutic areas, from human fertility to livestock breeding. Businesses are further broadening their global presence, especially in developing markets, to tap into growing demand. This mix of innovation and smart business strategy is critical for staying ahead in this fast-paced field.

Illumina, a global leader in genomics, holds a dominant position in the human genetics market. The company’s business model is centered on a razor-and-blades strategy, selling its high-throughput DNA sequencing instruments, which then drives recurring revenue from the sale of consumables and reagents. Illumina’s strategy involves continuously investing heavily in research and development to advance its core sequencing technology and expand its applications.

The company also pursues strategic partnerships with pharmaceutical companies and academic institutions to accelerate breakthroughs in personalized medicine, disease research, and consumer genomics. This model has made Illumina a foundational partner in the global life science research community.

Top Key Players

- Vitrolife

- Rocket Medical plc

- Rinovum Women’s Health, LLC

- Pride Angel

- Kitazato Corporation

- HI-TECH SOLUTIONS

- Genea Pty Limited

- FUJIFILM Irvine Scientific

- Conceivex, Inc.

- Astorg

Recent Developments

- In March 2025, Astorg introduced Nexpring Health as the new brand name for its expanded global MedTech business in assisted reproductive technology. The rebranding reflects the company’s strategic acquisitions and signals a unified direction for the combined entity moving forward.

- In May 2024, Vitrolife announced its acquisition of eFertility, marking a significant step in its strategy to promote standardization and digitalization across IVF clinics worldwide. This acquisition strengthens Vitrolife Group’s position in the global fertility market, enhancing its digital solutions and service offerings.

Report Scope

Report Features Description Market Value (2024) US$ 2.6 Billion Forecast Revenue (2034) US$ 5.9 Billion CAGR (2025-2034) 8.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Intrauterine Insemination, Intravaginal Insemination, Intracervical Insemination, and Intratubal Insemination), By Source (AIH-Husband, and AID-Donor), By End-user (Hospitals & Fertility Clinics and Home & Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Vitrolife, Rocket Medical plc, Rinovum Women’s Health, LLC, Pride Angel, Kitazato Corporation, HI-TECH SOLUTIONS, Genea Pty Limited, FUJIFILM Irvine Scientific, Conceivex, Inc., Astorg. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Artificial Insemination MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Artificial Insemination MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Vitrolife

- Rocket Medical plc

- Rinovum Women’s Health, LLC

- Pride Angel

- Kitazato Corporation

- HI-TECH SOLUTIONS

- Genea Pty Limited

- FUJIFILM Irvine Scientific

- Conceivex, Inc.

- Astorg