Global ARM-Based Servers Market By Core Type (ARM Cortex-A Core Based Servers, ARM Cortex-M Core Based Servers), By OS (Android, iOS, Windows), By Processor (32-bit Operating System ARM-Based Servers, 64-bit Operating System ARM-Based Servers), By Application (Mobile Computing, 3D Graphics, Others), By Vertical (Automotive, Healthcare, Telecommunications, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 178216

- Number of Pages: 397

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Drivers Impact Analysis

- Restraints Impact Analysis

- By Core Type

- By OS

- By Processor

- By Application

- By Vertical

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

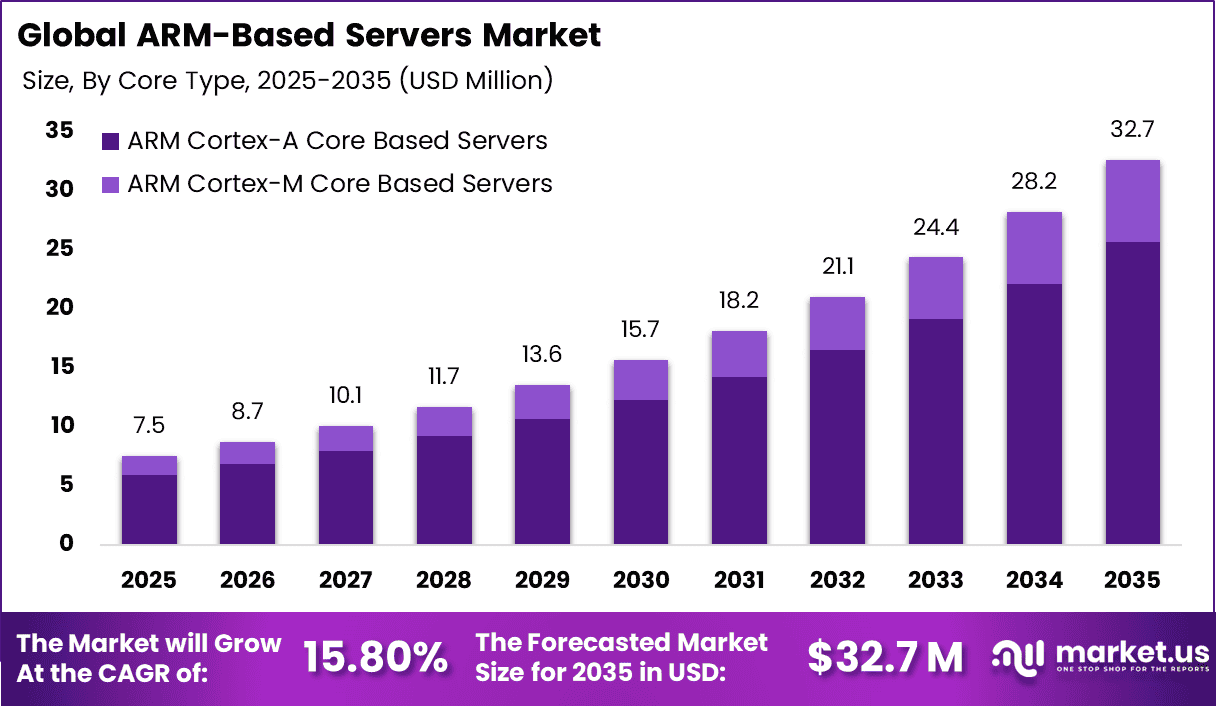

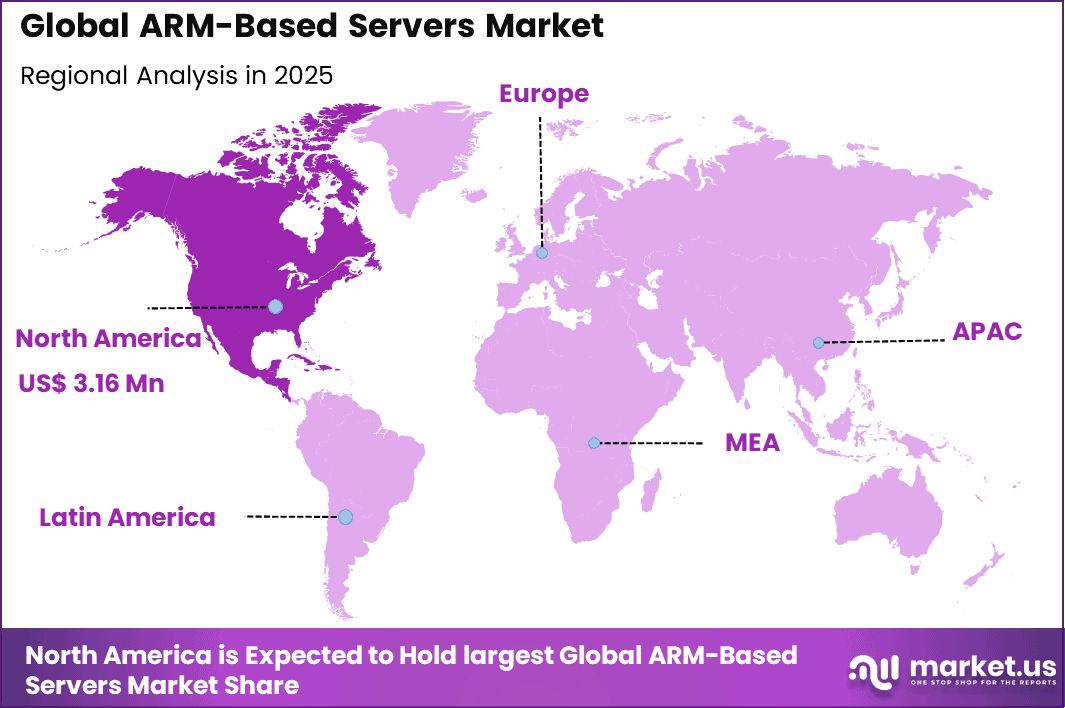

The Global ARM-Based Servers Market generated USD 7.5 million in 2025 and is predicted to register growth from USD 8.7 million in 2026 to about USD 32.7 million by 2035, recording a CAGR of 15.80% throughout the forecast span. In 2025, North America held a dominan market position, capturing more than a 42% share, holding USD 3.16 Million revenue.

The ARM-Based Servers Market refers to server systems built on ARM architecture processors that are designed to deliver energy efficient and scalable computing performance. These servers support diverse workloads including cloud services, web hosting, data analytics, and edge computing applications. ARM architecture is characterized by a focus on reduced power consumption while maintaining competitive processing efficiency.

The market includes hardware platforms, supporting firmware, and ecosystem software that enable deployment of ARM-based servers in enterprise and service provider environments. Growth in this market has been driven by the need for cost effective and efficient compute solutions capable of handling modern workloads. Enterprise data centers and cloud providers are evaluating ARM-based servers as alternatives to traditional x86-based systems for specific use cases.

A principal driver of the ARM-Based Servers Market is the increasing focus on energy efficiency and lower total cost of ownership (TCO). ARM processors are widely recognized for delivering lower power consumption per unit of compute compared with traditional server architectures, which makes them highly relevant for large scale data centers where operating costs are strongly influenced by electricity and cooling requirements.

Demand for ARM-based servers is expanding across cloud computing, edge computing, and content delivery use cases. Cloud providers are adopting ARM-based platforms for scalable and energy efficient infrastructure, particularly for parallelized workloads, while edge deployments benefit from compact designs and efficient thermal performance.

Top Market Takeaways

- By core type, ARM Cortex-A core based servers account for 78.5% of the market, accelerated by open-source software adoption and partnerships with AWS and Microsoft for optimized cloud workloads.

- By OS, Android represents 65.7%, supporting mobile-derived server applications with efficient 64-bit execution and container compatibility.

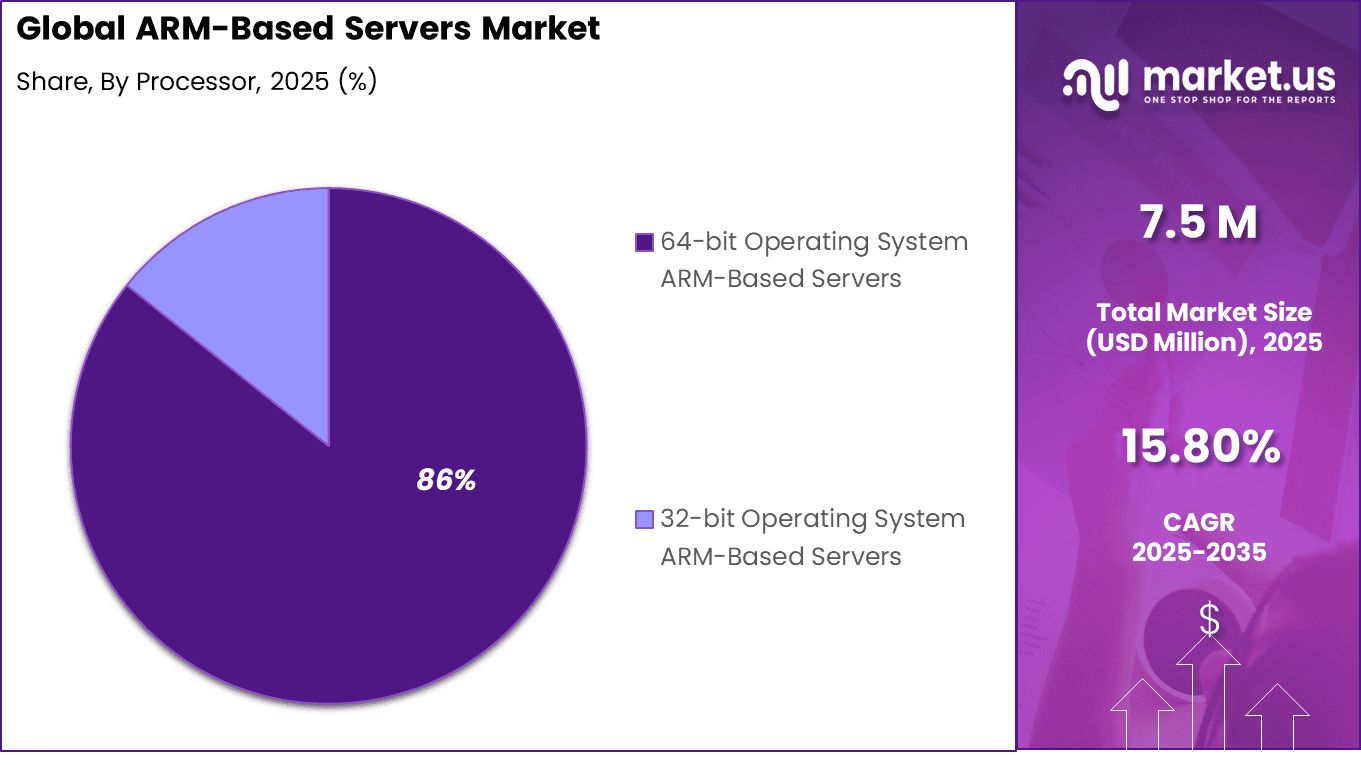

- By processor, 64-bit operating system ARM-based servers capture 85.7%, preferred for AI, HPC, and cloud-native tasks with superior parallel processing and energy efficiency.

- By application, mobile computing holds 30.4%, leveraging ARM’s low-power architecture for edge servers and hybrid mobile-cloud environments.

- By vertical, telecommunications commands 34.7%, deploying ARM servers for 5G infrastructure, NFV, and telco cloud with reduced TCO.

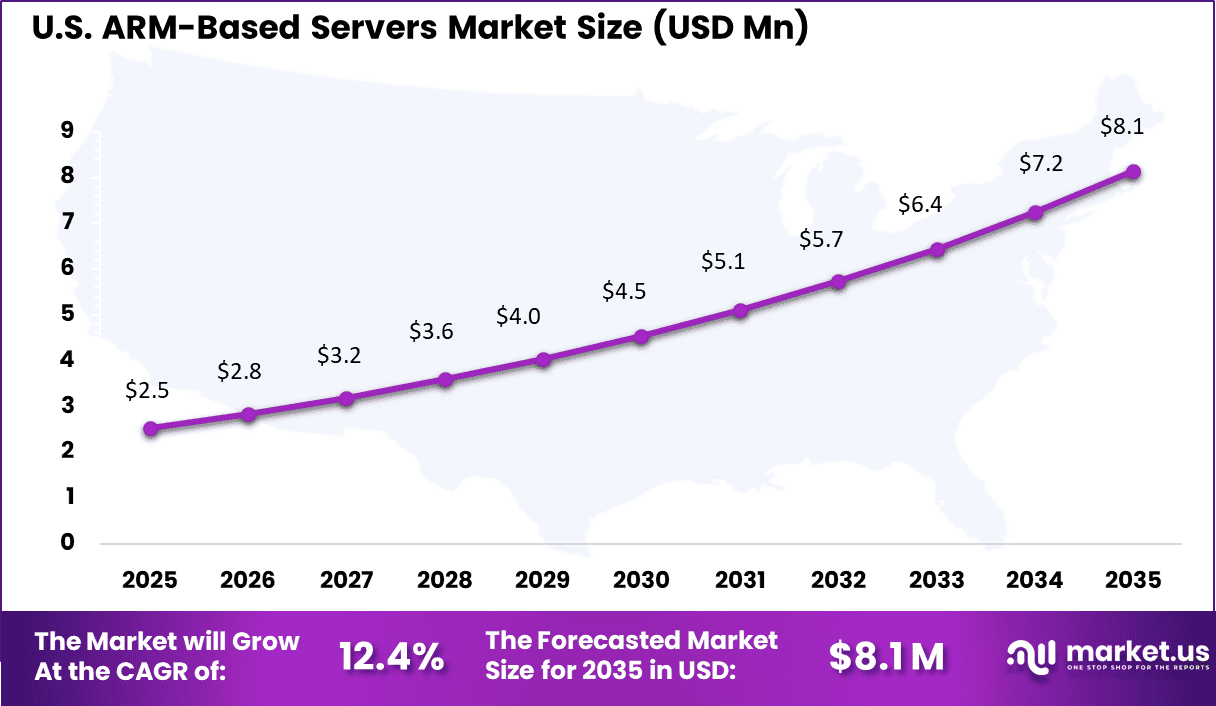

- By region, North America leads with 42.0% of the global market, where the U.S. is valued at USD 2.53 billion with a projected CAGR of 12.4%, driven by hyperscale data centers and green computing initiatives.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Rising demand for energy-efficient data center infrastructure +4.1% North America, Europe Short to medium term Growing adoption of cloud-native and hyperscale workloads +3.6% North America, Asia Pacific Medium term Increasing need for cost-optimized compute performance +3.1% Global Medium term Expansion of edge computing and distributed architectures +2.6% Asia Pacific, North America Medium term Diversification away from traditional x86 server dominance +2.4% Global Medium to long term Restraints Impact Analysis

Key Restraint Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Software compatibility and ecosystem limitations -3.3% Global Short to medium term Enterprise hesitation in migrating mission-critical workloads -2.8% North America, Europe Medium term Limited vendor diversity compared to x86 architecture -2.4% Global Medium term Performance benchmarking concerns in certain workloads -2.1% Global Medium term High transition and integration costs -1.8% Global Medium to long term By Core Type

ARM Cortex-A core based servers account for 78.5% of the ARM-based servers market. These cores are widely adopted due to their balance between performance efficiency and power optimization. Enterprises increasingly prefer Cortex-A architectures for handling cloud-native workloads and distributed applications. The design supports high scalability while maintaining lower energy consumption compared to traditional server architectures. This efficiency advantage strengthens their dominant position in data center deployments.

Cortex-A cores are optimized for multi-threaded processing and virtualization environments. Their architecture enables improved workload density without significantly increasing power requirements. This makes them suitable for hyperscale data centers and edge computing environments. Organizations aiming to reduce operational costs are adopting these energy-efficient server configurations. The consistent focus on performance per watt continues to drive strong demand for Cortex-A based systems.

By OS

Android accounts for 65.7% of the operating system segment within ARM-based servers. The widespread adoption of Android in mobile and embedded ecosystems has supported its extension into server-side applications. Developers benefit from a familiar environment that supports rapid application deployment. This compatibility strengthens integration across mobile devices and backend infrastructure. As a result, Android-based server deployments continue to expand steadily.

Android’s open-source framework allows customization for telecom, IoT, and edge computing use cases. Its lightweight structure aligns well with ARM architecture efficiency goals. Enterprises use Android-based server systems to manage distributed mobile computing environments. The ecosystem of development tools and application frameworks further enhances usability. These factors collectively explain its significant share within the OS category.

By Processor

64-bit operating system ARM-based servers dominate with 85.7% share. The transition from 32-bit to 64-bit architecture has enabled higher memory addressing and improved processing capabilities. Modern enterprise workloads require enhanced computational performance for analytics, virtualization, and cloud services. 64-bit ARM processors support larger datasets and advanced multi-core configurations. This technical advancement drives widespread enterprise adoption.

These processors are particularly suitable for high-performance computing and enterprise applications. They enable better parallel processing and improved application scalability. Enhanced security features embedded within 64-bit systems also strengthen enterprise confidence. Organizations migrating to modern infrastructure increasingly standardize on 64-bit ARM platforms. The combination of performance and efficiency supports its overwhelming dominance in the processor segment.

By Application

Mobile computing represents 30.4% of the ARM-based servers market by application. The rapid growth of smartphones, tablets, and connected devices has increased backend server demand optimized for mobile workloads. ARM-based servers efficiently manage lightweight applications, content delivery, and real-time mobile services. Their power-efficient architecture aligns well with distributed mobile infrastructure requirements. This makes them suitable for handling large volumes of mobile-generated data.

Cloud services supporting mobile applications require scalable and energy-efficient backend systems. ARM servers help telecom operators and service providers reduce infrastructure costs while maintaining performance. Edge computing deployments further strengthen this segment, as mobile data processing increasingly occurs closer to users. Continuous expansion of mobile ecosystems sustains demand for ARM-based server solutions.

By Vertical

The telecommunications sector holds 34.7% of the ARM-based servers market. Telecom operators require scalable and energy-efficient infrastructure to support data traffic growth. ARM-based servers are increasingly deployed for network functions virtualization and software-defined networking applications. Their lower power consumption contributes to operational cost efficiency. This makes them attractive for large-scale telecom data centers.

The rollout of advanced connectivity technologies has further increased server demand. Telecom companies use ARM-based systems to support edge nodes and distributed network architectures. Virtualized core networks benefit from ARM’s efficient processing capabilities. The sector’s ongoing digital transformation initiatives continue to drive adoption. Telecommunications remains a primary vertical supporting market expansion.

Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook ARM-based server manufacturers Very High Medium North America, Asia Pacific Strong niche growth potential Cloud service providers High Medium North America, Europe Infrastructure diversification strategy Semiconductor and chip designers High Medium Asia Pacific Performance-per-watt optimization focus Private equity firms Medium Medium North America, Europe Selective consolidation opportunities Venture capital investors Medium High North America Innovation in ARM server ecosystem tools Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~%) Primary Function Geographic Relevance Adoption Timeline Advanced ARM server-grade processors +4.5% High performance-per-watt computing Global Short to medium term Cloud-native container and Kubernetes optimization +3.8% Workload portability Global Medium term Edge computing deployment frameworks +3.2% Distributed processing Asia Pacific, North America Medium term AI and inference acceleration integration +2.7% Data center efficiency North America Medium to long term High-density and low-power data center design +2.3% Infrastructure optimization Global Long term Emerging Trends

In the ARM-Based Servers market, a growing trend is the adoption of energy-efficient processor architectures for workloads that benefit from parallel processing and lower power draw. Organisations are beginning to deploy these servers for specific tasks such as web hosting, content delivery, and scale-out compute clusters where the balance of performance and power efficiency is a priority.

This trend reflects a search for alternatives to traditional server designs, particularly in environments where cooling and power costs are a concern. Another emerging pattern is the refinement of software stacks to run smoothly on ARM-based platforms, enabling more predictable performance and reducing integration challenges for developers and operations teams.

Growth Factors

A primary growth factor in this market is the demand for reduced operating costs in data centre environments. ARM-based server designs are characterised by lower power use, which helps organisations manage electricity and cooling expenses in everyday operations. This cost sensitivity is particularly acute for service providers and research institutions that operate large server farms with tight budget constraints.

Another important driver is the increasing diversity of workloads in modern IT environments, where compute tasks no longer centre solely on high-frequency numerical processing but include distributed, lightweight applications that can run efficiently on alternative processor designs. As more organisations seek flexible compute options that align with their unique workload profiles, interest in ARM-based servers continues to strengthen.

Key Market Segments

By Core Type

- ARM Cortex-A Core Based Servers

- ARM Cortex-M Core Based Servers

By OS

- Android

- iOS

- Windows

By Processor

- 32-bit Operating System ARM-Based Servers

- 64-bit Operating System ARM-Based Servers

- By Application

- Mobile Computing

- 3D Graphics

- Internet of Things (IoT)

- Smart Homes

- Wearables

- Sensors

- Enterprise and Infrastructure Networking

- Wireless Communications

- Others

By Vertical

- Automotive

- Healthcare

- Telecommunications

- Oil & Gas Extraction

- Bioscience

- Industrial Automation

- Others

Regional Analysis

North America accounts for 42.0% of the ARM-based servers market, supported by strong cloud infrastructure expansion and early adoption of energy-efficient computing architectures. Hyperscale data centers and enterprise IT providers in the region are increasingly deploying ARM-based servers to improve performance per watt and reduce operational costs. Demand is driven by rising data center workloads, sustainability targets, and the need to optimize power consumption without compromising processing capability.

The U.S. market is valued at USD 2.53 Bn and is expanding at a CAGR of 12.4%, reflecting steady integration of ARM-based systems into mainstream server infrastructure. Adoption is influenced by growth in cloud-native applications, microservices architectures, and large-scale storage and compute environments. Growth is further supported by increasing focus on power optimization, edge computing deployments, and long-term infrastructure modernization across enterprise and public cloud operators.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

Processor and architecture innovators such as Arm Limited, Advanced Micro Devices, Inc., Ampere Computing LLC, and Marvell play a central role in the ARM-based servers market. These companies focus on energy-efficient, high-core-count processors optimized for cloud and edge workloads. Their designs support scalability and reduced power consumption. Demand is driven by hyperscale data center expansion and the need for cost-efficient computing.

Enterprise and ecosystem enablers such as Red Hat, Inc., SUSE, and Linaro Limited strengthen software compatibility for ARM-based servers. Cloud Software Group, Inc. supports virtualization and workload portability. These players enhance adoption through optimized operating systems and developer tools. Adoption is supported by growing interest in open architecture and cloud-native applications.

Regional and diversified technology providers such as Huawei Technologies Co., Ltd. and Texas Instruments Incorporated contribute to server hardware and embedded ARM ecosystem development. These vendors focus on integration with networking and edge infrastructure. Other emerging players expand innovation and regional production capacity. This competitive landscape supports steady growth of ARM-based servers across cloud, telecom, and enterprise environments.

Top Key Players in the Market

- Advanced Micro Devices, Inc

- Ampere Computing LLC

- ARM Limited

- Cloud Software Group, Inc.

- Huawei Technologies Co., Ltd.

- Linaro Limited

- Marvell

- Red Hat, Inc.

- SUSE

- Texas Instruments Incorporated

- Others

Future Outlook

The future outlook for the ARM-Based Servers Market is strong as demand for energy-efficient and high-performance computing continues to grow. Adoption of ARM-based servers is expected to increase because these systems offer lower power consumption and scalable performance for cloud, edge, and data center workloads.

Support from major technology providers and improvements in software compatibility will further enable broader deployment. Growth can be attributed to rising needs for cost-effective infrastructure, sustainability goals, and expansion of cloud services. Overall, the market is expected to expand as organizations prioritize efficient and flexible server architectures.

Recent Developments

- SoftBank dropped a massive $6.5B to acquire Ampere in April 2025 (closing H2 2025), folding it into its ARM ecosystem alongside Graphcore for sustainable AI data centers.

- Marvell snapped a $210M minority stake in a European ARM server board firm in August 2024, boosting custom SoC designs; echoes their ongoing ThunderX roadmap for cloud-edge perf gains.

Report Scope

Report Features Description Market Value (2025) USD 7.5 Million Forecast Revenue (2035) USD 32.7 Million CAGR(2025-2035) 15.80% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software/Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Application (Impact Analysis for Schema Changes, Data Quality Issue Root-Cause Analysis, Others), By End-User Industry (Banking, Financial Services, and Insurance, Healthcare and Life Sciences, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Advanced Micro Devices, Inc, Ampere Computing LLC, ARM Limited, Cloud Software Group, Inc., Huawei Technologies Co., Ltd., Linaro Limited, Marvell, Red Hat, Inc., SUSE, Texas Instruments Incorporated, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Advanced Micro Devices, Inc

- Ampere Computing LLC

- ARM Limited

- Cloud Software Group, Inc.

- Huawei Technologies Co., Ltd.

- Linaro Limited

- Marvell

- Red Hat, Inc.

- SUSE

- Texas Instruments Incorporated

- Others