Global AR In E-Commerce Market Size, Share, Industry Analysis Report By Component (Hardware, Software), By Technology Type (Marker-based AR, Markerless AR, Anchor-based AR), By Application (Virtual Try-On Solutions, Product Visualization, AR Advertising and Marketing, Personalized Shopping Experience, Virtual Showrooms, Others), By End-User (Large Enterprises, Small & Medium Enterprises (SMEs), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 162244

- Number of Pages: 248

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Consumer Behavior and Preference

- Business Impact and Conversion

- Analyst Viewpoint

- Role of Generative AI

- U.S. Market Size

- Emerging Trends

- Growth Factors

- Component Analysis

- Technology Type Analysis

- Application Analysis

- End-User Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

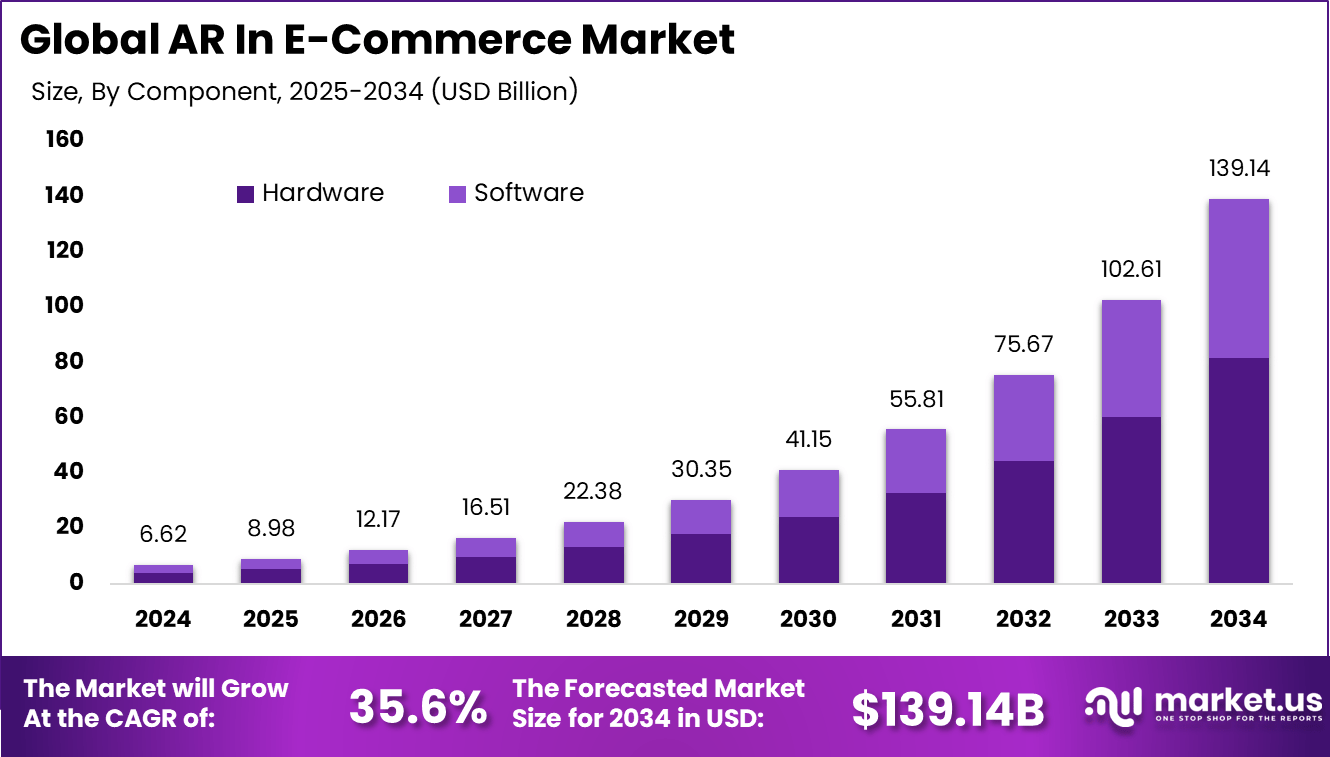

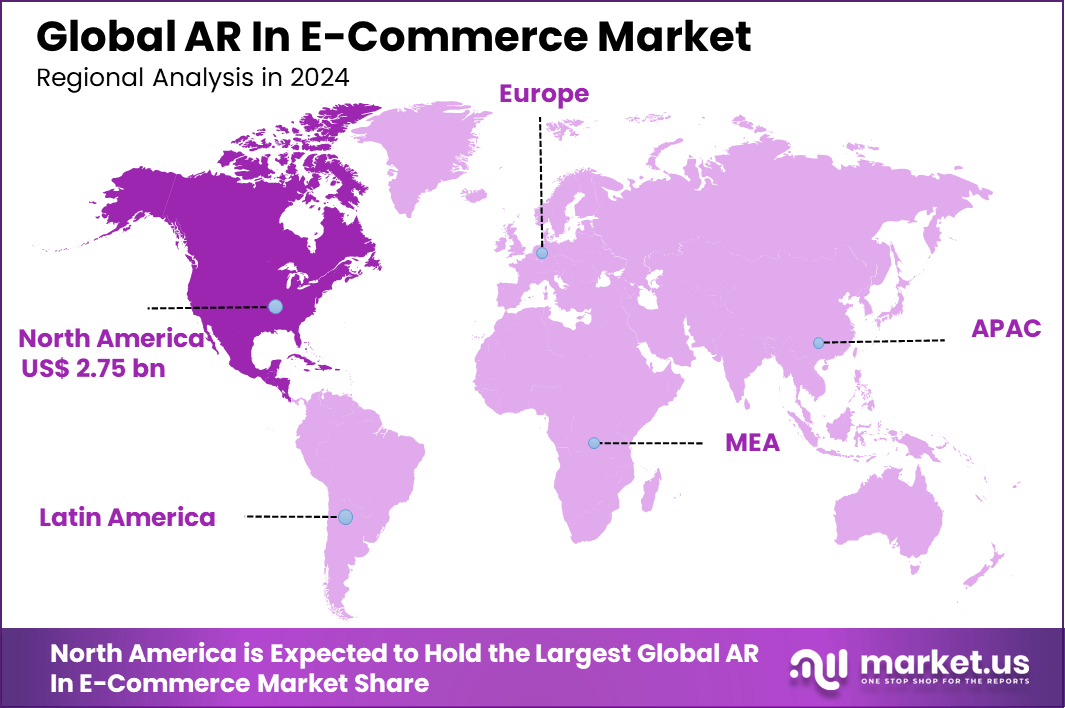

The Global AR in E-Commerce Market size is expected to be worth around USD 139.14 billion by 2034, from USD 6.62 billion in 2024, growing at a CAGR of 35.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 41.6% share, holding USD 2.75 billion in revenue.

Augmented Reality (AR) in e-commerce has become one of the strongest tools reshaping digital shopping. It overlays digital visuals on the real world, allowing customers to try-on clothes, test furniture placement, or check how gadgets might look in their homes before buying. In 2025, more than 60% of consumers in the U.S. regularly use AR features while shopping, and nearly 90% say that AR helps them make better purchase decisions.

Over 70% of online shoppers prefer brands offering AR-enhanced experiences because they reduce uncertainty and increase buying confidence. One major driver is the consumer demand for better product visualisation when shopping online. With returns often high in e-commerce due to mismatch between expectation and reality, AR helps reduce risk by allowing customers to preview items in their context. For example, retailers have found that AR can boost conversion rates and reduce returns.

For instance, in September 2025, Microsoft launched a reimagined Microsoft Marketplace focused on AI apps and tools, including new offerings that support AR-based e-commerce solutions. This marketplace expansion opens new routes for brands and partners to deliver innovative AR commerce experiences.

Demand for AR in e-commerce is driven primarily by categories such as furniture and home décor, fashion and apparel, beauty products, and electronics. In home decor and furniture, buyers want to visualise how a piece will look in their space; AR enables that preview. In fashion and beauty, virtual try-ons help reduce uncertainty. Furthermore, demand is growing in markets with high mobile and internet usage, where consumers are comfortable with interactive shopping experiences.

According to data from Reydar, over 5.64 billion people are connected to the internet, representing more than two-thirds of the global population. Internet penetration in some countries has reached 99%, reflecting the ubiquity of digital access. Mobile usage dominates this landscape, contributing 63% of total web traffic, with users checking their smartphones over 200 times a day.

The rapid digitalization of consumer behavior is transforming eCommerce experiences, with 80% of retail brands expected to adopt augmented reality (AR) for customer engagement by 2025. AR-based online shopping, particularly 3D product visualization, has been observed to be 200% more engaging than traditional formats, highlighting its strong potential to reshape retail interaction.

However, the integration of AR in retail remains uneven. Around 52% of retailers report being unprepared to deploy AR technologies, even as 61% of consumers express a clear preference for brands offering immersive AR experiences. Furthermore, 71% of shoppers indicate they would increase their purchasing frequency if AR options were available, revealing a substantial gap between consumer expectations and retailer readiness.

Key Takeaway

- The Hardware segment captured 58.7%, reflecting strong investment in AR devices that support immersive e-commerce experiences.

- Markerless AR technology led with 68.2%, driven by its flexibility and wider compatibility with mobile and web-based platforms.

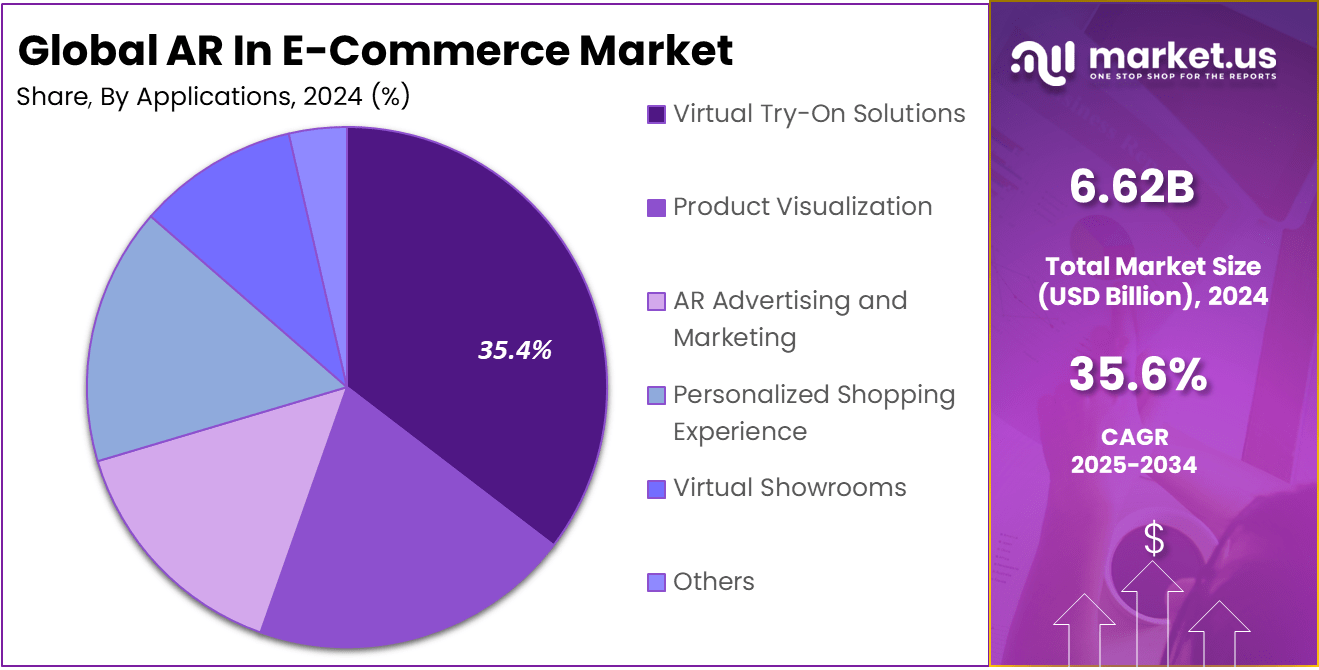

- Virtual Try-On Solutions accounted for 35.4%, highlighting their role in enhancing product visualization and reducing online return rates.

- Large enterprises represented 61.4%, as major retailers and brands continue to adopt AR for improved customer engagement and digital transformation.

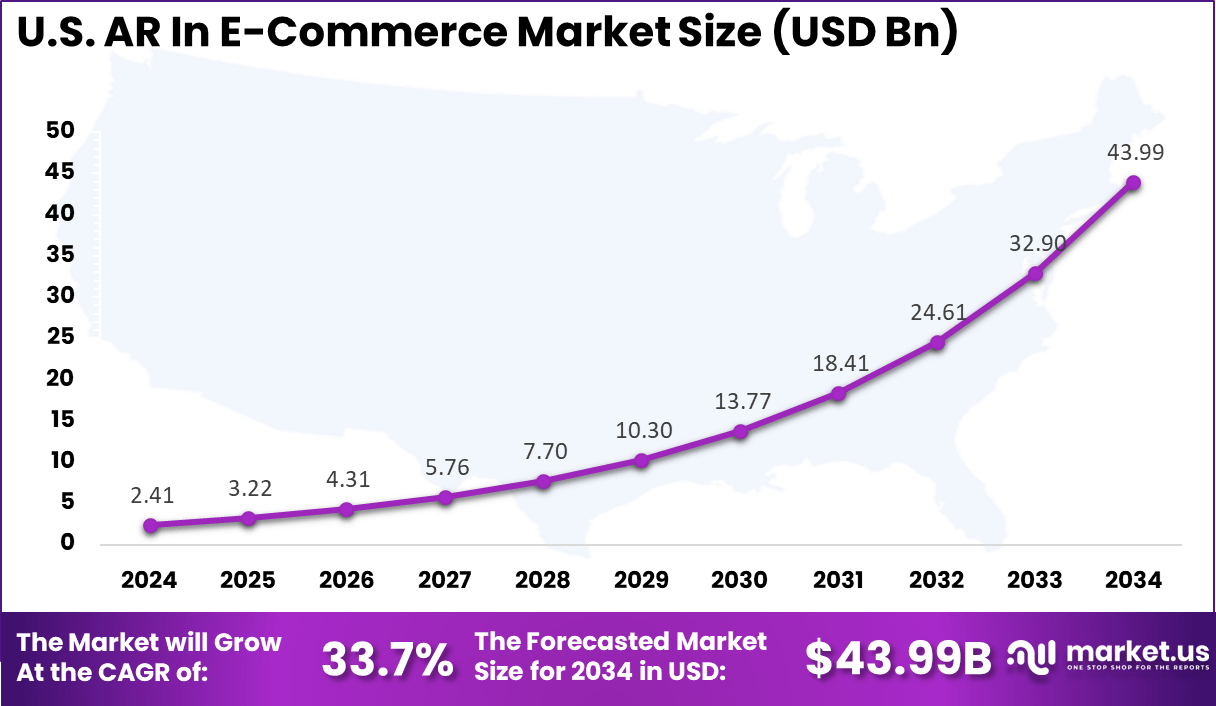

- The US market reached USD 2.41 Billion in 2024, recording a strong 33.7% CAGR, supported by rapid adoption of AR-driven retail experiences.

- North America dominated with 41.6% of the global market, supported by mature digital infrastructure and early adoption by leading e-commerce players.

Consumer Behavior and Preference

The adoption of augmented reality (AR) in retail is reshaping customer expectations and purchasing habits. Surveys indicate that 71% of shoppers would shop more frequently if AR tools were available, showing the potential of immersive technology to drive higher store traffic. Customization is also a powerful motivator, with 40% of consumers willing to pay more for products they can personalize through AR.

AR is increasingly seen as a differentiator in retail experience. About 61% of consumers prefer to shop with retailers that integrate AR, signaling its growing role in brand loyalty. Expectations are also sector-specific, as 43% of shoppers expect beauty brands to incorporate AR features, while 47% expect automotive brands to provide immersive product previews.

Business Impact and Conversion

For businesses, AR is proving to be a strong performance driver. Shoppers using AR exhibit a 94% higher conversion rate compared to those without AR tools. Engagement levels also rise sharply, with AR experiences delivering 200% more interaction than non-AR formats. AR directly influences purchase intent, with studies showing a 17% increase in consumer willingness to buy when AR is integrated into the shopping journey.

The technology also reduces return rates, as customers gain a clearer understanding of product fit and aesthetics before purchase. A strong example is IKEA, which reported a 200% increase in conversions after launching its AR-powered app, highlighting the tangible business impact of immersive retail technology.

Analyst Viewpoint

Demand for augmented reality (AR) in e-commerce is growing sharply, primarily driven by younger consumers and the integration of AR features on social media platforms. Over 90% of Generation Z shoppers express a strong interest in using AR to improve their online shopping experience, signaling a generational shift towards immersive technology.

Social commerce powered by AR shows a significant impact on product engagement, with some cases reporting up to a 94% increase in conversion rates. Key technologies driving AR adoption in e-commerce include virtual try-on solutions, 3D product overlays, and AR-powered virtual showrooms. These tools allow customers to see how furniture fits into their living spaces or virtually try on makeup and apparel.

Advances in AI integration and powerful mobile processors enhance these AR experiences, providing smoother interactions and generating user data that supports more personalized marketing and product development strategies. Investment in AR for e-commerce is rapidly expanding as technology firms and retailers develop proprietary AR platforms, software development kits, and marketing tools.

Role of Generative AI

Generative AI is improving customer journeys by powering hyper-personalized shopping experiences. Around 39% of online consumers now use generative AI tools to guide purchases, and more than 50% prefer personalized recommendations generated by AI for product discovery. These systems analyze user behavior in real time, suggesting products that suit individual preferences and even generating style previews to visualize how items might look at home or on the shopper.

AI chatbots integrated with AR enhance engagement further. About 35.7% of shoppers say automated product suggestions influence their buying decisions, while 42% value live search features that are powered by generative algorithms. By merging AR visuals with generative AI outputs, brands create a guided yet flexible shopping journey that feels natural and personalized, ultimately driving higher conversion and customer retention.

U.S. Market Size

The market for AR in E-Commerce within the U.S. is growing tremendously and is currently valued at USD 2.41 billion, the market has a projected CAGR of 33.7%. The market is growing due to increasing consumer demand for immersive and interactive shopping experiences. Shoppers want to see how products fit or look before buying, which AR virtual try-ons and visualization tools provide effectively.

Retailers in the U.S. are investing heavily in AR technologies to boost engagement and reduce returned items. High smartphone penetration, advances in AR hardware and software, and consumer familiarity with digital tools further accelerate market growth. These combined elements make the U.S. a prime market for AR-driven e-commerce innovation.

For instance, in October 2025, Meta is expanding AR and VR ad formats through its Horizon Worlds platform, enabling brands to create immersive virtual showrooms and try-ons. By combining AR ads with short-form video on Threads and Instagram Reels, Meta is redefining digital marketing for e-commerce with AI-powered personalization.

In 2024, North America held a dominant market position in the Global AR in E-Commerce Market, capturing more than a 41.6% share, holding USD 2.75 billion in revenue. This dominance is due to its advanced technological infrastructure and strong consumer base. High internet penetration, widespread smartphone use, and the presence of major retail and technology companies contribute significantly to the region’s market share.

Moreover, government support for digital innovation and investments in smart retail solutions provides an encouraging environment for AR adoption. The region’s consumers also tend to be early adopters of new technologies, fueling market growth and solidifying North America’s dominance globally.

For instance, in September 2025, Amazon further cemented North America’s dominance in AR for e-commerce by developing consumer-focused augmented reality glasses aimed at rivaling Meta’s offerings. These AR glasses are designed to enhance the online shopping experience by enabling users to interact with products and virtual content more naturally and intuitively.

Emerging Trends

The growing comfort with AR interfaces has made immersive shopping mainstream. Nearly 60% of people in the U.S. regularly use AR, and 90% of shoppers have tried or are open to AR-assisted purchases. Consumers now expect virtual try-on features and dynamic previews that help them visualize purchases before committing. In some sectors like fashion and furniture, AR integration has raised conversion rates by nearly 94%.

Another clear trend is consumer demand for transparency and authenticity. Roughly 73% of online shoppers are willing to pay more for products that provide transparent AR experiences where they can view materials or assembly details. This shift reflects how AR is no longer a novelty – it has become core to brand trust and purchase confidence in e-commerce.

Growth Factors

Smartphone adoption and high-speed networks remain foundational growth drivers. By 2025, 35-40% of U.S. internet users will engage with AR features regularly, and 80% of retailers plan to integrate AR into their platforms. Strong consumer demand for visual confidence and easy product comparison keeps fueling adoption among retailers large and small.

AI-driven personalization is another major driver. With 89% of companies using or testing AI in retail, AR personalization has turned into a key differentiator. These experiences shorten decision cycles by helping shoppers virtually test, try, and interact with products in real-life contexts. This mix of convenience and realism encourages repeat visits and long-term engagement.

Component Analysis

In 2024, The Hardware segment held a dominant market position, capturing a 58.7% share of the Global AR in E-Commerce Market. This dominance is due to the increasing adoption of AR-enabled devices such as smartphones, tablets, AR glasses, and head-mounted displays. Retailers are investing heavily in robust hardware infrastructure to ensure seamless and immersive shopping experiences for consumers. The constant advancements in sensors, optics, and spatial computing technologies further fuel growth in this segment.

Hardware plays a crucial role in enabling smooth interaction between the physical and digital worlds, creating an engaging experience that online shoppers seek. As more consumers demand immersive, realistic visualizations, the importance of high-quality AR hardware continues to rise, making it a core component of the market’s expansion.

For Instance, in September 2023, Apple enhanced its AR capabilities embedded in its devices via ARKit updates, improving the hardware-software synergy for AR applications in e-commerce. Apple’s robust hardware, including LiDAR sensors in iPhones and iPads, supports precise spatial mapping. This allows users to place and interact with true-to-scale virtual products in their space, making the shopping experience more realistic and engaging.

Technology Type Analysis

In 2024, the Markerless AR segment held a dominant market position, capturing a 68.2% share of the Global AR in E-Commerce Market. Unlike marker-based AR, it does not depend on physical markers or QR codes for interaction, providing users with a far more flexible and natural experience. This technology overlays virtual objects directly onto the real-world environment, which resonates well with consumers looking for effortless and realistic engagements.

Its versatility across multiple devices, like smartphones and tablets, makes it highly preferred for various applications such as virtual clothing try-ons and furniture placement visualizations. Markerless AR supports spontaneous and location-independent use, which enhances convenience and enriches customer experiences. The technology’s ability to adapt fluidly to real-world spaces makes it a favored choice in the e-commerce sector.

For instance, in October 2025, Google continued to expand its ARCore platform, which offers developers powerful tools to build markerless AR experiences. Google’s technology allows apps to overlay realistic virtual objects onto real-world environments without requiring markers, facilitating natural and flexible user interactions essential for e-commerce applications like furniture visualization or fashion try-ons.

Application Analysis

In 2024, The Virtual Try-On Solutions segment held a dominant market position, capturing a 35.4% share of the Global AR in E-Commerce Market. This dominance is due to their ability to bridge the gap between online shopping and the tactile in-store experience. This application allows customers to see how apparel, accessories, makeup, or eyewear would look on them virtually, reducing ambiguity around fit and style.

By enabling these interactive experiences, virtual try-ons elevate customer confidence and satisfaction. Such solutions also significantly cut down return rates by giving shoppers realistic previews before purchase. The popularity of virtual try-ons is growing rapidly, especially in the fashion and beauty sectors, where appearance and personalization are key decision factors.

For Instance, in August 2025, L’Oréal Paris enhanced its AR-powered “Style My Hair” app that enables users to virtually try on hairstyles, colors, and makeup using facial recognition technology. This application helps consumers experiment with beauty looks in real time before purchasing products, vastly improving decision-making and satisfaction.

End-User Analysis

In 2024, The Large Enterprises segment held a dominant market position, capturing a 61.4% share of the Global AR in E-Commerce Market. This dominance is due to their ability to invest in advanced AR technologies to enhance customer experience and differentiate themselves in a competitive landscape. These organizations leverage AR to build immersive shopping platforms that attract and retain tech-savvy consumers.

Their extensive customer reach and investment capacity allow for broad AR integration, from virtual try-on features to interactive product displays. Large enterprises are leveraging AR as part of their digital transformation initiatives to enhance user experience, improve sales, and boost brand loyalty.

For Instance, in May 2023, IKEA launched an upgraded AR integration through its IKEA Place app and the live beta project IKEA Studio. These solutions allow customers to visualize furniture in their homes with precise measurements and interactive features, helping them make confident purchase decisions.

Key Market Segments

By Component

- Hardware

- HMD (Head-Mounted Display)

- Smart Glass

- Head-up Display (HUD)

- Handheld Devices

- Others

- Software

By Technology Type

- Marker-based AR

- Markerless AR

- Anchor-based AR

By Application

- Virtual Try-On Solutions

- Product Visualization

- AR Advertising and Marketing

- Personalized Shopping Experience

- Virtual Showrooms

- Others

By End-User

- Large Enterprises

- Small & Medium Enterprises (SMEs)

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Better Product Visualization

Augmented reality enhances online shopping by allowing consumers to see products in a realistic setting before purchasing. This technology helps bridge the gap between the physical and digital worlds, providing a more immersive experience. Customers no longer rely solely on images or descriptions but can interactively view how a product will look and fit in their environment.

This improved visualization builds customer confidence in their buying decisions, which often leads to higher conversion rates. The ability to visualize products from different angles and in their own space reduces doubts and increases trust. As a result, many brands have observed a significant increase in sales and a decrease in product returns through AR enablement.

For instance, in January 2025, Inter IKEA Systems B.V. continued to lead with its IKEA Place app, which allows customers to use AR to visualize furniture in their actual homes before purchase. This initiative has helped reduce returns and improve buyer confidence significantly. IKEA combines AR with AI for personalized space and product recommendations, enhancing the interactive shopping experience for customers.

Restraint

High Implementation Costs

Implementing AR technology involves substantial expenses related to software development and 3D modeling. Many businesses, especially smaller ones, find the costs of creating high-quality AR experiences prohibitive. The need for specialized skills and ongoing maintenance further adds to these financial challenges.

Moreover, integrating AR across multiple devices and platforms demands additional investment to ensure compatibility and performance. For many retailers, the high initial costs act as a barrier to adoption, delaying the widespread integration of AR into their e-commerce platforms despite its potential benefits.

For instance, in April 2024, Snap Inc. faced challenges due to the high development costs of its AR Spectacles with advanced micro projectors and AI features. Although promising, the expensive hardware and ongoing investment in app development posed barriers to mass adoption and monetization in the near term. The company is targeting developers first to build apps before the consumer launch.

Opportunities

Increased Consumer Engagement

AR offers a unique opportunity to make online shopping more engaging and interactive. By allowing consumers to virtually try products or see how they fit into their lives, brands can create memorable experiences that go beyond traditional e-commerce methods. This engagement can translate into higher customer satisfaction and stronger brand loyalty.

The interactive nature of AR enhances the shopping journey, making it more fun and personalized. As a result, consumers are more likely to spend more time exploring products and make purchase decisions more quickly. This level of engagement provides brands with a competitive edge in a crowded marketplace.

For instance, in June 2025, Meta Platforms, Inc. is expanding AR shopping features across its Facebook and Instagram platforms, enabling virtual try-ons and personalized 3D product demos. Meta’s approach, inspired by pioneers like Pinterest, provides consumers with immersive, tailored shopping journeys that improve engagement and drive repeat purchases through AR ads and virtual try-ons.

Challenges

Technical Limitations and Accessibility

One of the main hurdles for AR in e-commerce is the need for suitable hardware, such as advanced smartphones or AR glasses, which not all consumers own. Limited access to compatible devices restricts the reach of AR features and hampers a seamless shopping experience for a broader audience.

In addition, developing AR experiences that work flawlessly across various devices and operating systems is complex and costly. Technical issues like lag, poor graphics, or usability problems can frustrate users and diminish the perceived value of AR. Continuous technical improvements are necessary to overcome these barriers.

For instance, in October 2025, Apple Inc. is investing heavily in new AR/VR devices and the iOS AR ecosystem. However, the varying performance across different user devices and the ongoing evolution of web AR standards create a challenge in delivering seamless experiences to all users. Developers must adapt apps to Apple’s ARKit standards to avoid compatibility issues, which limits immediate AR adoption at scale.

Key Players Analysis

The AR in E-Commerce Market is led by technology giants such as Google LLC, Apple Inc., Meta Platforms, Inc., and Microsoft. These companies provide AR development frameworks, spatial computing tools, and AI-driven visualization technologies that power immersive online shopping experiences. Their platforms enable retailers to deliver 3D product previews, virtual try-ons, and real-time interaction features that increase customer engagement and conversion rates.

E-commerce and retail innovators including Amazon.com, Inc., Shopify Inc., and Inter IKEA Systems B.V. have integrated AR into their digital platforms to enhance product discovery and reduce return rates. These companies utilize AR visualization for furniture placement, apparel fitting, and product customization, allowing shoppers to make more informed purchasing decisions. Their efforts are central to scaling AR adoption in mainstream retail environments.

Lifestyle and beauty-focused platforms such as Snap Inc., Houzz Inc., L’Oréal Paris, Perfect Corp., and Pinterest, along with other emerging participants, contribute by combining AR with AI personalization and social commerce. Their technologies help users visualize beauty products, home décor, and fashion items in real-world settings, merging entertainment with digital shopping. Collectively, these players are reshaping the e-commerce experience through realism, interactivity, and personalized engagement.

Top Key Players in the Market

- Google LLC

- Inter IKEA Systems B.V.

- Apple Inc.

- Meta Platforms, Inc.

- Amazon.com, Inc.

- Snap Inc.

- Microsoft

- Houzz Inc.

- L’Oréal Paris

- Shopify Inc.

- Perfect Corp.

- Others

Recent Developments

- In October 2025, Google LLC launched its 2025 Search Revolution, enhancing e-commerce with AI and AR. It offers hyper-personalized product searches using conversational AI and AR-powered product previews, predicted to boost conversion rates by 30%. Visual search and voice commerce are expected to grow significantly, reshaping online shopping behavior.

- In June 2025, Meta Platforms, Inc. expanded AR retail presence via mixed reality experiences on WebXR browser, starting with Puma’s All-Pro shoe. Features include virtual sizing and product customization in real-time, showcasing the future potential of AR shopping.

Report Scope

Report Features Description Market Value (2024) USD 6.62 Bn Forecast Revenue (2034) USD 139.1 Bn CAGR(2025-2034) 35.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software), By Technology Type (Marker-based AR, Markerless AR, Anchor-based AR), By Application (Virtual Try-On Solutions, Product Visualization, AR Advertising and Marketing, Personalized Shopping Experience, Virtual Showrooms, Others), By End-User (Large Enterprises, Small & Medium Enterprises (SMEs) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Google LLC, Inter IKEA Systems B.V., Apple Inc., Meta Platforms, Inc., Amazon.com, Inc., Snap Inc., Microsoft, Houzz Inc., L’Oréal Paris, Shopify Inc., Pinterest, Perfect Corp., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Google LLC

- Inter IKEA Systems B.V.

- Apple Inc.

- Meta Platforms, Inc.

- Amazon.com, Inc.

- Snap Inc.

- Microsoft

- Houzz Inc.

- L'Oréal Paris

- Shopify Inc.

- Perfect Corp.

- Others