Global AR and VR Training Market Size, Share Analysis Report By Component (AR/VR Devices, Software, Services), By Application (Healthcare and Medical Training, Aerospace and Defence Training, Industrial Training, Educational Training, Retail Training, Corporate/Enterprise Training, Others), By Organization Size (Small and Mid-sized Organization, Large Organizations), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152347

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

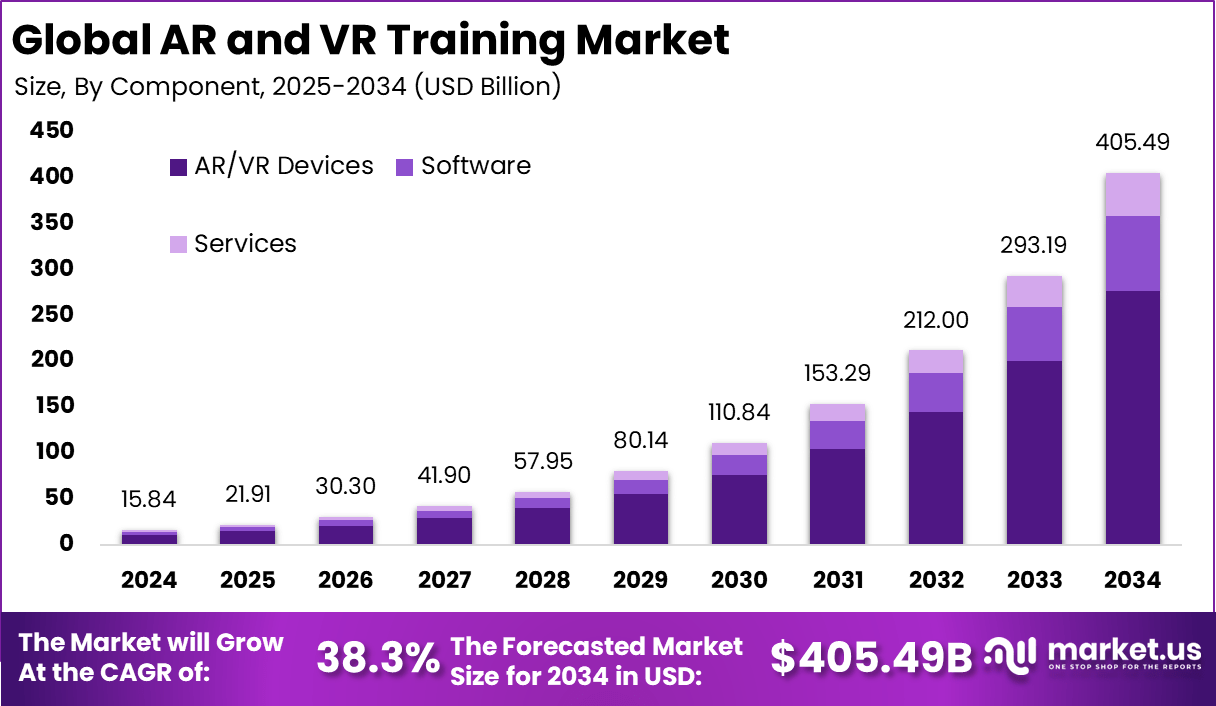

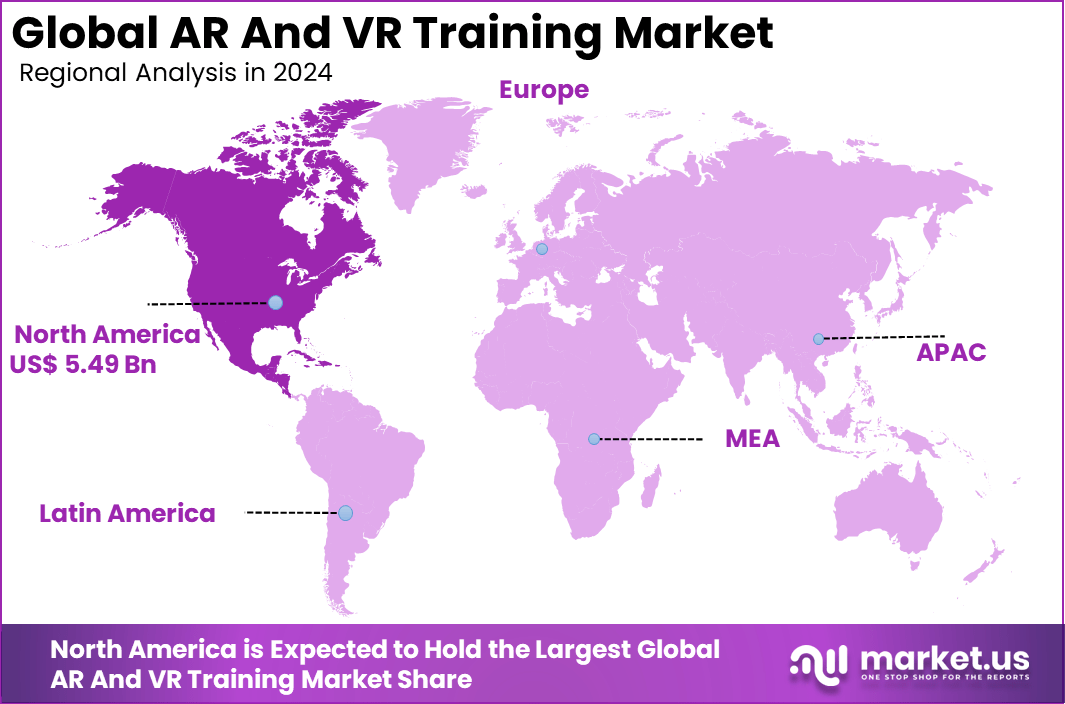

The Global AR And VR Training Market size is expected to be worth around USD 405.49 billion by 2034, from USD 15.84 billion in 2024, growing at a CAGR of 38.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34.7% share, holding USD 5.49 billion in revenue.

The AR and VR training market refers to immersive learning solutions that enable realistic, interactive experiences for employee onboarding, technical skills, compliance protocols, and scenario practice. These solutions replace traditional classroom methods with richer simulations suitable for complex or hazardous environments. Rapid innovation in hardware and software has elevated AR/VR from novelty toward mainstream enterprise adoption.

Growth is primarily driven by the desire for cost‑effective, immersive training experiences that improve learning retention and reduce risk. Technological breakthroughs that lower headset prices and enhance visual fidelity are also enabling broader access. Moreover, demand for remote and distributed training programs continues to rise as enterprises seek scalable workforce development models.

For instance, in June 2025, UNESCO launched an AR/VR training program aimed at equipping Thai educators with the skills necessary for effective ocean conservation education. The immersive training leverages AR and VR technologies to provide hands-on learning experiences, allowing educators to engage students in environmental science through realistic, interactive simulations.

Organizations are increasingly allocating training budgets toward AR/VR to meet expectations for measurable results and modern learning modalities. Sectors such as healthcare, defense, and manufacturing show especially high demand due to their need for precision and safety in real environments. Learners also prefer interactive and engaging formats that traditional courses cannot replicate.

According to the findings from takeaway-reality, VR-based training has shown remarkable improvements in learning outcomes, with effectiveness increasing by 76% compared to traditional methods. It has also significantly reduced training time by up to 75%, allowing organizations to save resources while ensuring faster skill development. These advantages make VR a highly efficient and scalable solution for workforce training across diverse operational settings.

Moreover, VR has proven to enhance knowledge retention, with employees retaining up to 80% of the content even after a year. Industries such as healthcare, aviation, mining, and others are experiencing transformative benefits through VR implementation, as it provides immersive and realistic environments that improve safety, engagement, and long-term competency.

Key Takeaway

- In 2024, the global AR and VR training market was valued at around USD 15.84 billion and is projected to grow to nearly USD 405.49 billion by 2034, registering a strong CAGR of 38.3%. Adoption is rising sharply across industries.

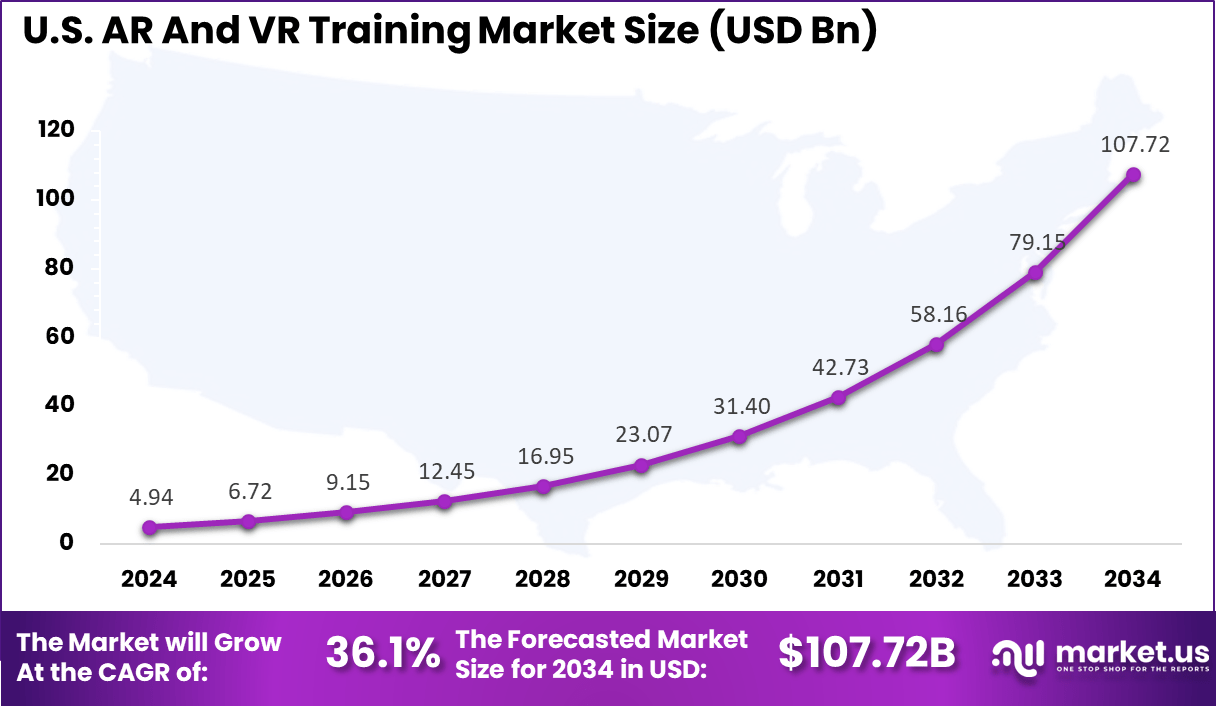

- North America led the market with a 34.7% share, generating about USD 5.49 billion in revenue. Within the region, the United States contributed approximately USD 4.94 billion and is growing at a CAGR of 36.1%.

- By component, AR/VR devices held the largest share at 68.4%, reflecting the critical role of hardware in delivering immersive training experiences.

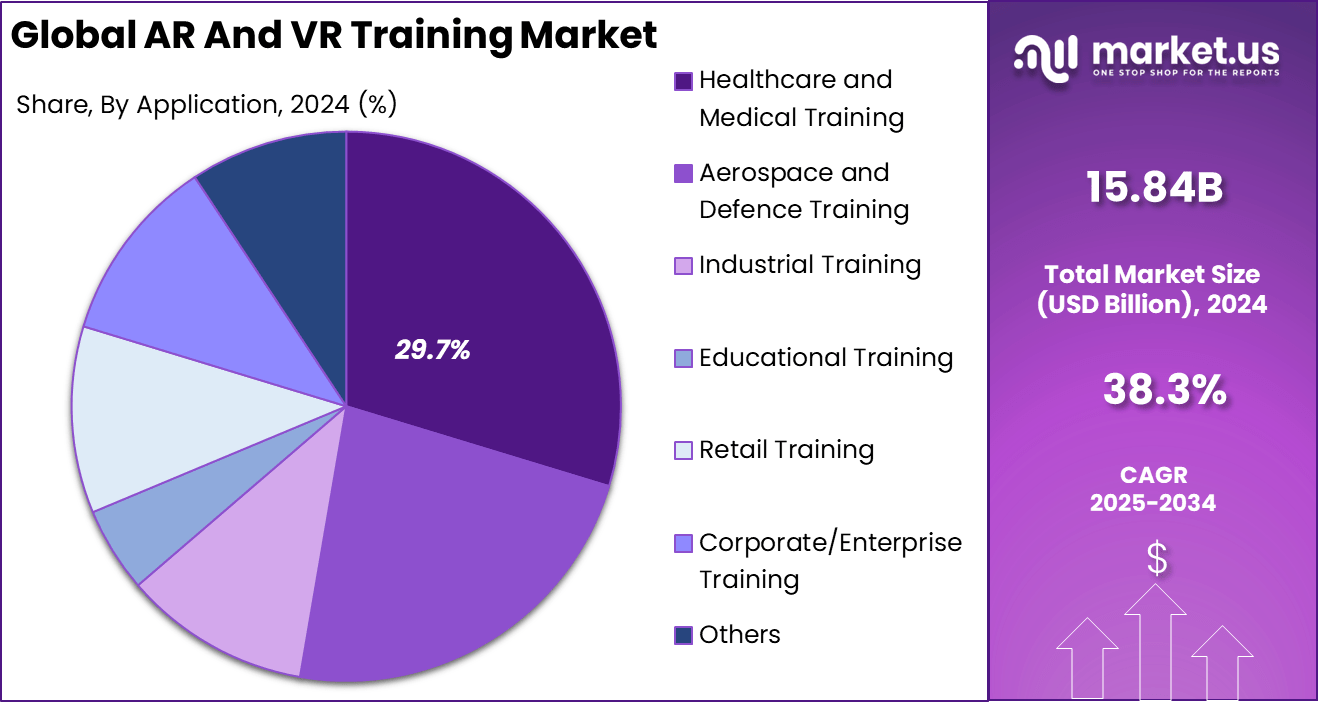

- By application, healthcare and medical training accounted for 29.7%, driven by demand for realistic, risk-free medical simulations.

- By organization size, large organizations dominated with 67.3% of the market, highlighting their capacity to invest in advanced training technologies.

- Market growth is supported by the need for effective, scalable, and engaging training solutions that improve skill retention and operational safety.

U.S. Market Size

The market for AR And VR Training within the U.S. is growing tremendously and is currently valued at USD 4.94 billion, the market has a projected CAGR of 36.1%. The market is experiencing significant growth due to the increasing investments in technology across various industries, including healthcare, manufacturing, and defense.

AR/VR is being adopted by these fields to improve training efficiency, reduce risks, and cut costs. Also, there has been a surge in demand driven by the need for remote and virtual educational solutions, especially after the COVID-19 outbreak. Robust technological infrastructure and innovation benefit the United States, leading to the widespread use of immersive training resources in various fields.

For instance, in February 2025, Microsoft and Anduril Industries announced an expanded partnership to advance the U.S. Army’s Integrated Visual Augmentation System (IVAS) program. This collaboration leverages Microsoft’s mixed reality technologies and Anduril’s expertise in defense systems to enhance the training and operational capabilities of military personnel.

In 2024, North America held a dominant market position in the Global AR And VR Training Market, capturing more than a 34.7% share, holding USD 5.49 billion in revenue. This dominance is due to its strong technological infrastructure, high adoption of innovative solutions, and significant investments in research and development.

Key industries in the region, including healthcare, defense, automotive, and manufacturing, are using AR and VR increasingly for training purposes, both to increase efficiency and reduce operational risks. In addition, North America’s presence of major technology companies and startups developing AR/VR continues to strengthen its position in the market.

For instance, in May 2024, TD Bank launched immersive VR tools to enhance training and collaboration across North America. These innovative tools aim to connect colleagues and facilitate more effective learning by simulating real-world scenarios and enabling interactive training experiences. By leveraging virtual reality, TD Bank is improving employee engagement and fostering more efficient skill development, particularly in areas such as customer service and compliance.

Component Analysis

In 2024, The AR/VR Devices segment held a dominant market position, capturing a 68.4% share of the Global AR And VR Training Market. This dominance is due to This dominance is due to the critical role that devices, such as headsets, motion controllers, and haptic feedback systems, play in delivering immersive and interactive training experiences.

As these devices continue to evolve with improved performance, affordability, and user comfort, they are becoming increasingly essential across industries like healthcare, defense, and manufacturing, driving widespread adoption and growth in the market.

For Instance, in July 2025, Apple was reported to be developing seven new AR/VR devices, signaling the company’s growing commitment to the immersive technology market. These devices are expected to enhance Apple’s ecosystem by offering advanced AR and VR experiences for both consumers and enterprises. The devices aim to support a wide range of applications, from immersive entertainment and gaming to professional training and enterprise solutions.

Application Analysis

In 2024, the Healthcare and Medical Training segment held a dominant market position, capturing a 29.7% share of the Global AR And VR Training Market. The demand in this sector has been driven mainly by the increasing need for realistic, risk-free simulations that allow medical professionals to practice complex procedures.

AR and VR enable hands-on training without the need for live patients, reducing risks and improving skills in areas such as surgery, diagnostics, and emergency response. Additionally, the rising focus on remote learning and telemedicine has further accelerated adoption in this sector.

For instance, in July 2024, MediSim VR introduced Chennai’s first VR medical training center, aimed at providing immersive, hands-on training for healthcare professionals. This center uses virtual reality to simulate medical procedures, allowing doctors, nurses, and medical students to practice complex surgeries and emergency scenarios in a safe, risk-free environment.

Organization Size Analysis

In 2024, The Large Organizations segment held a dominant market position, capturing a 67.3% share of the Global AR And VR Training Market. This dominance stems from large organizations’ strong financial resources, allowing significant investments in immersive technologies and custom content development.

Their ability to scale AR/VR training enhances onboarding, compliance, and skills development across locations. With substantial budgets for hardware, software, and integration, they implement comprehensive training programs, boosting productivity and innovation while maintaining a competitive edge in sectors like automotive, healthcare, and defense.

For Instance, in October 2024, Emirates, one of the largest airlines globally, announced that 23,000 of its cabin crew professionals would undergo VR training in collaboration with Airbus and Boeing. This large-scale initiative, involving immersive virtual reality, aims to enhance the training experience by simulating real-life scenarios that cabin crew members may encounter.

Key Market Segments

By Component

- AR/VR Devices

- Head-mounted Displays (HMD)

- Smart Glasses

- Heads-up Display (HUD)

- Others

- Software

- AR/VR Software/Tools

- AR/VR SDKs

- Services

- AR/VR Design and Development

- AR/VR Consulting

- Integration and Development

- Support Services

By Application

- Healthcare and Medical Training

- Aerospace and Defence Training

- Industrial Training

- Educational Training

- Retail Training

- Corporate/Enterprise Training

- Others

By Organization Size

- Small and Mid-sized Organizations

- Large Organizations

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend Analysis

One of the most significant emerging trends in AR and VR training is the integration of artificial intelligence to create adaptive and learner‑centric training modules. Modern AR and VR platforms now feature real‑time feedback mechanisms, emotion recognition, and dynamically changing scenarios based on user performance.

This trend is enabling immersive training to go beyond static simulations and offer highly personalized learning paths, which improves both engagement and skill retention. The shift toward individualized immersive experiences is being widely adopted in high‑skill industries where traditional training is less effective.

This evolution reflects broader organizational goals of improving productivity through more effective workforce development. As AR and VR hardware becomes more capable and AI‑driven analytics become more reliable, industries such as healthcare, aviation, and defense increasingly see immersive training as a strategic asset. The trend toward personalization also aligns with workforce expectations, as employees increasingly prefer experiential learning over lecture‑based methods.

Driver Analysis

The key driver of AR and VR training adoption is the growing recognition that immersive technologies reduce risk while improving learning outcomes. Organizations across healthcare, manufacturing, and defense sectors value how these tools allow employees to safely practice complex tasks in a simulated environment before applying skills in real‑world settings.

Studies have shown that immersive practice leads to better knowledge retention and faster skill acquisition compared to conventional training. These clear performance advantages have encouraged organizations to accelerate deployment. Additionally, technological advancements have made these tools more accessible than ever before.

Innovations such as 5G connectivity, higher‑resolution headsets, improved haptic feedback, and robust development platforms have significantly lowered the barriers to entry. This has enabled a broader range of organizations, including mid‑sized enterprises, to explore immersive training solutions. The combined benefits of improved learning efficiency and technological readiness continue to drive the market forward.

Restraint Analysis

A major restraint facing the AR and VR training market is the substantial upfront investment required for hardware and custom content development. Smaller organizations and educational institutions often lack the resources to invest in specialized headsets, controllers, and bespoke training scenarios.

Even in larger enterprises, the budgetary justification for immersive systems can be challenging when compared to more familiar traditional methods. These high costs can slow decision‑making and limit adoption to larger players with established technology budgets. Furthermore, technical and infrastructure challenges continue to restrict widespread use.

Many regions still lack the necessary network bandwidth or reliable connectivity to support high‑quality VR experiences, especially cloud‑enabled ones. Motion sickness and discomfort remain common among users, and there is also a shortage of skilled developers who can create effective immersive training content. Together, these barriers can reduce the appeal of AR and VR solutions despite their potential benefits.

Opportunity Analysis

One promising opportunity in this space is the potential to integrate AR and VR training platforms with AI and cloud‑based delivery models. Artificial intelligence can analyze user performance in real time and adjust the training content to target individual weaknesses, making the process more efficient and effective.

Meanwhile, cloud‑hosted platforms allow enterprises to deliver immersive training remotely, removing the need for all employees to gather at a physical site. This scalability aligns perfectly with the increasingly distributed nature of modern workforces. These innovations also open the door to new markets and industries.

Sectors that have historically been underserved by advanced training tools, such as retail, hospitality, and public services, can now adopt cloud‑based AR and VR training with minimal capital outlay. By enabling high‑quality, remote‑accessible immersive experiences, companies can reach wider audiences and improve workforce readiness across locations. This creates an avenue for growth beyond the traditional high‑skill industries.

Challenge Analysis

One of the key challenges in scaling AR and VR training solutions lies in the lack of standardization and inconsistent content quality. Many organizations face difficulty integrating immersive training modules with existing learning management systems or aligning them with regulatory requirements.

Inconsistent user experiences and poorly designed simulations can undermine confidence in the technology and reduce its effectiveness. This limits the ability of companies to deploy immersive solutions at scale. Another significant challenge is organizational resistance and user reluctance.

Many employees and managers remain unfamiliar with immersive technologies and are hesitant to transition away from more traditional learning methods. Without adequate training on how to use AR and VR tools effectively, adoption can stall or even fail. Organizations must invest not just in technology but also in change management strategies to foster a culture that embraces immersive learning.

Key Players Analysis

Microsoft and Seiko Epson Corporation lead the AR and VR training market with strong enterprise solutions and advanced hardware. Microsoft leverages its mixed reality tools for scalable training applications, while Seiko Epson focuses on precision optics for industrial and educational use. Both emphasize innovation and partnerships, strengthening their presence across global markets.

Upskill Inc., Eon Reality, and Atheer, Inc. stand out with adaptive, industry-specific platforms. Upskill delivers real-time connected worker solutions, while Eon Reality integrates AI for immersive education. Atheer focuses on interactive AR tools that improve productivity. Their focus on usability and customization drives adoption among diverse sectors.

Sixense Enterprise, VR Vision Inc., and 8ninths, Inc. bring immersive and creative solutions to niche markets. Sixense specializes in motion-based simulations, VR Vision customizes onboarding experiences, and 8ninths develops interactive AR for skill development. Datamatics and Fusion VR enhance the market by offering integrated, client-centric platforms that address cost and efficiency needs.

Top Key Players in the Market

- Microsoft

- Upskill Inc.

- Seiko Epson Corporation

- Eon reality

- Atheer, Inc.

- Sixense enterprise

- VR Vision Inc.

- 8ninths, Inc.

- Datamatics

- Fusion VR

- Others

Recent Developments

- In June 2025, EON Reality unveiled a comprehensive platform pricing structure alongside new products and an enhanced portfolio designed to revolutionize AR/VR training solutions. The updated offerings, including the Digital Twin IQ and WealthWeaver Incubator, aim to provide scalable, customizable immersive training options for both enterprises and educational institutions.

- In June 2025, Seiko Epson Corporation announced its participation in the “Future Creation Robot Week” during Expo 2025 in Osaka, Japan. At the event, Epson will showcase its latest advancements in AR technologies, including the Moverio smart glasses. These glasses are designed to support immersive training and remote collaboration across various sectors.

Report Scope

Report Features Description Market Value (2024) USD 15.84 Bn Forecast Revenue (2034) USD 405.49 Bn CAGR (2025-2034) 38.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (AR/VR Devices, Software, Services), By Application (Healthcare and Medical Training, Aerospace and Defence Training, Industrial Training, Educational Training, Retail Training, Corporate/Enterprise Training, Others), By Organization Size (Small and Mid-sized Organization, Large Organizations) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft, Upskill Inc., Seiko Epson Corporation, Eon Reality, Atheer, Inc., Sixense Enterprise, VR Vision Inc., 8ninths, Inc., Datamatics, Fusion VR, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Microsoft

- Upskill Inc.

- Seiko Epson Corporation

- Eon reality

- Atheer, Inc.

- Sixense enterprise

- VR Vision Inc.

- 8ninths, Inc.

- Datamatics

- Fusion VR

- Others