Global Application-Specific Integrated Circuit Market By Product Type (Full Custom ASIC, Semi-Custom ASIC, and Programmable ASIC), End-Use Industry (Telecommunication, Consumer Electronics, Automotive, Healthcare, Other End-Use Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2032

- Published date: April 2024

- Report ID: 65186

- Number of Pages: 364

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

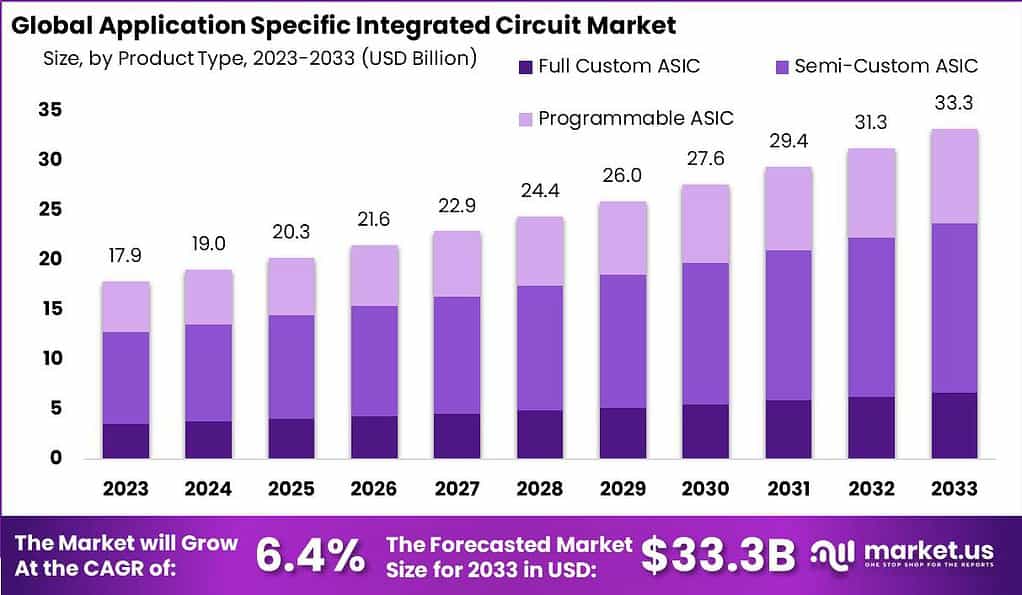

The Global Application Specific Integrated Circuit Market size is expected to be worth around USD 33.3 Billion by 2033, from USD 17.9 Billion in 2023, growing at a CAGR of 6.4% during the forecast period from 2024 to 2033.

An Application-Specific Integrated Circuit (ASIC) is a specialized type of computer chip that is designed for a specific application or task. Unlike general-purpose chips, such as CPUs or GPUs, ASICs are tailored to perform a single function with high efficiency and speed. They are commonly used in various industries, including telecommunications, automotive, aerospace, and consumer electronics.

The ASIC market is experiencing significant growth due to the increasing demand for high-performance electronics that require specialized computing tasks. The expansion of industries like consumer electronics, automotive, and telecommunications, which often use ASICs to improve product functionality, drives this growth. This market is also influenced by the rise of smart technologies and IoT (Internet of Things) devices, which utilize ASICs to enhance connectivity and performance.

The demand for ASICs has been steadily growing due to the increasing complexity of electronic devices and the need for specialized functionality. For example, ASICs are commonly used in smartphones to handle tasks like image processing, wireless communication, and power management. In the automotive industry, ASICs are employed in advanced driver assistance systems (ADAS) and autonomous driving technologies.

In 2023, the adoption of Application-Specific Integrated Circuits (ASICs) in new product developments by semiconductor companies increased significantly to 82% from 72% in 2022. This shift underscores a growing preference for customized chip solutions that cater to specific operational requirements.

ASICs, tailored for particular client needs, can incur substantial costs, typically ranging from approximately $200 million to $300 million based on their complexity and scale. The year also saw a hefty investment of $3.1 billion in developing tools, intellectual property libraries, and ecosystem support essential for ASIC design.

The global market for ASIC units is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2022 to 2027. Concurrently, Programmable Logic Device (PLD) units and Field-Programmable Gate Array (FPGA) shipments are also on the rise, with expected growth rates of 8.9% and 6.2% respectively through 2027.

North America and Japan dominate approximately 50% of Value Multicore SoC (System-on-Chip) design starts, reflecting their leading roles in advanced semiconductor development. Notably, ASICs demonstrated a 25% performance increase and a 20% reduction in power consumption over general-purpose counterparts, enhancing their suitability for high-demand tasks in AI and ML.

In the infrastructure sector, 75% of cloud service providers and data center operators integrated ASIC-based accelerators, achieving a notable 15% improvement in computing efficiency. This trend is complemented by significant investments of $2.6 billion in packaging and interconnect technologies to encourage broader ASIC adoption.

For system-on-chip (SoC) designs, 2023 was marked by enhanced efficiencies, including a 22% reduction in time-to-market and an 18% decrease in development costs. ASIC-based mobile processors also saw a 20% increase in power efficiency, significantly extending battery life in mobile devices.

The year concluded with 78% of semiconductor foundries and OSAT providers expanding their advanced ASIC integration services, up from 65% in the previous year. Additionally, 70% of electronic system designers favored ASIC-based modular architectures to streamline product development and improve design flexibility

Key Takeaways

- The Application Specific Integrated Circuit (ASIC) Market is estimated to reach USD 33.3 billion by 2033, reflecting a robust Compound Annual Growth Rate (CAGR) of 6.4% from 2024 to 2033.

- In 2023, the Semi-Custom ASIC segment held the dominant market share, accounting for over 51.4% of the global market. Semi-custom ASICs offer flexibility and cost-effectiveness, appealing to various industries by balancing performance with development costs.

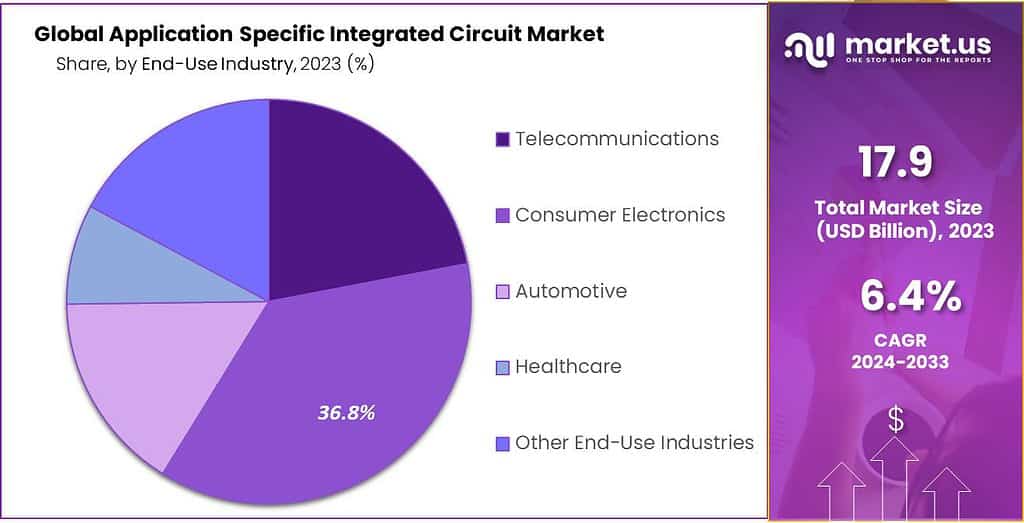

- Consumer Electronics emerged as the leading segment in 2023, capturing more than 36.8% of the ASIC market. ASICs play a crucial role in optimizing performance and features while minimizing power consumption in devices like smartphones, tablets, smart TVs, and wearables.

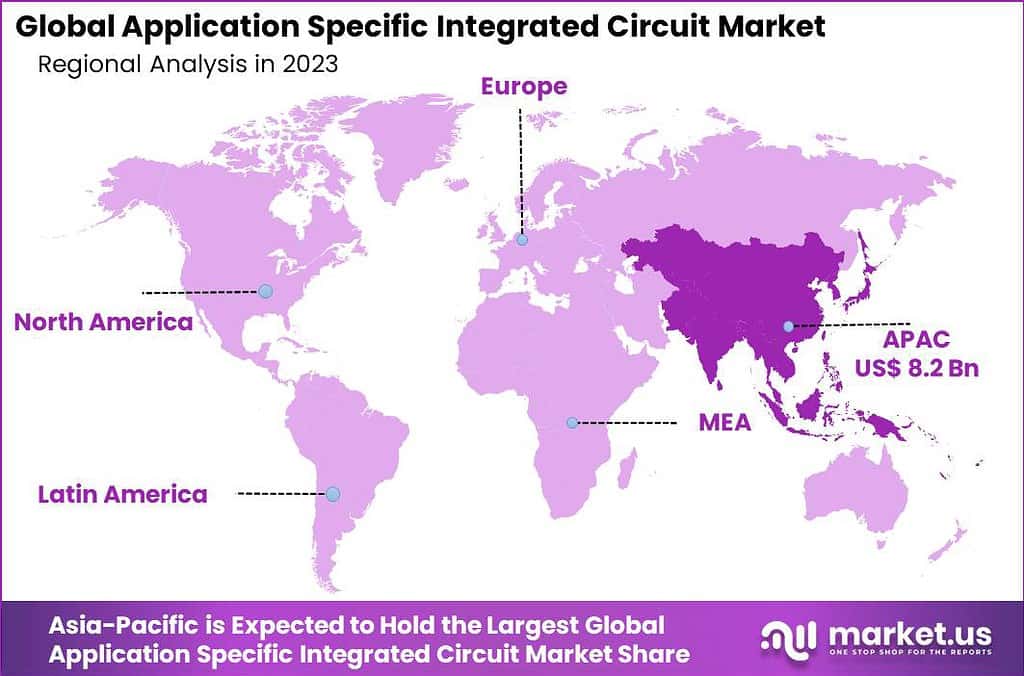

- In 2023, Asia-Pacific held a dominant market position in the Application Specific Integrated Circuit (ASIC) market, capturing more than a 45.9% share.

Products Type Analysis

In 2023, the Semi-Custom ASIC segment held a dominant market position, capturing more than a 51.4% share of the global market. This segment’s leadership can be attributed to its flexibility and cost-effectiveness, which make it highly appealing across various industries.

Semi-custom ASICs, which include both standard-cell ASICs and gate array ASICs, offer a middle ground between fully customized circuits and completely programmable solutions. They allow for customization in parts of the circuit while keeping other sections fixed, which helps in balancing performance with development costs.

The popularity of Semi-Custom ASICs is further driven by their widespread adoption in applications that require specific, yet not completely unique, processing capabilities. For instance, they are extensively used in automotive applications, consumer electronics, and telecommunications equipment, where they enhance the functionality of devices without the need for a fully custom solution, thereby reducing the time and cost associated with the chip design.

Moreover, the ability to reuse existing partial designs in semi-custom ASICs enables faster production cycles and quicker time-to-market for new technologies. The demand for these chips is also supported by the ongoing advancements in technology, such as the expansion of 5G networks and the increasing incorporation of AI (Artificial Intelligence) and IoT (Internet of Things) in devices, which require efficient and high-performance semiconductor solutions.

As industries continue to demand more specialized and high-speed processing capabilities while managing costs, the Semi-Custom ASIC segment is expected to maintain its market lead, presenting significant opportunities for growth and innovation in the field.

End-Use Industry Analysis

In 2023, the Consumer Electronics segment held a dominant market position within the Application Specific Integrated Circuit (ASIC) market, capturing more than a 36.8% share. This segment’s leading status is driven by the extensive use of ASICs in a wide range of consumer devices such as smartphones, tablets, smart TVs, and wearable technology. ASICs are favored in these applications for their ability to optimize performance and enhance features while minimizing power consumption and maximizing space efficiency.

The proliferation of smart consumer devices that require high-speed processing capabilities and advanced connectivity features continues to fuel the demand for ASICs in the consumer electronics industry. These devices often require specialized chips to handle specific tasks like image processing, audio processing, and wireless communication efficiently. The ability of ASICs to be tailored to meet these precise requirements allows manufacturers to develop more innovative and competitive products.

Moreover, the ongoing trend towards smart homes and the increasing consumer expectation for seamless device integration and automation further underpins the growth of the ASIC market in consumer electronics. As technology evolves and consumer demands for faster, smarter, and more energy-efficient devices grow, the consumer electronics segment is expected to maintain its leadership, offering substantial opportunities for market expansion and technological advancements in ASIC development.

Key Market Segments

By Product Type

- Full Custom ASIC

- Semi-Custom ASIC

- Programmable ASIC

End-Use Industry

- Telecommunication

- Consumer Electronics

- Automotive

- Other Applications

Driver

Increased Demand for Consumer Electronics

The growth in the ASIC market can largely be attributed to the surging demand for consumer electronics such as smartphones, tablets, and wearable devices. These gadgets require compact and efficient components that optimize their functionality while minimizing power consumption and space usage.

ASICs are designed to meet these specific requirements by integrating all necessary features into a single chip, which enhances the performance of the devices. The continuous innovations in consumer technology drive the need for customized, high-performance integrated circuits, supporting the expansion of the ASIC market.

Restraint

High Development Costs

One significant restraint in the ASIC market is the high cost associated with the design and development of customized chips. The process of developing an ASIC is complex and resource-intensive, involving detailed design and extensive testing to ensure that the chips meet specific customer requirements. This makes ASICs less attractive for small-scale applications or for companies with limited budgets, as the initial investment and risk are considerably higher compared to using standard off-the-shelf integrated circuits.

Opportunity

Expansion into Automotive Electronics

The ASIC market has a promising opportunity in the expansion into automotive electronics. Modern vehicles increasingly rely on advanced electronics for functionalities such as navigation, safety, and connectivity. ASICs can be tailored to meet the rigorous demands of automotive applications, offering durability and high performance under extreme conditions. As the automotive industry continues to innovate towards more autonomous and connected vehicles, the demand for specialized ASICs is expected to grow, presenting a lucrative avenue for market expansion.

Challenge

Rapid Technological Changes

The ASIC market faces the challenge of rapid technological changes. The pace at which new technologies are developed and adopted can outstrip the speed of ASIC development. Once an ASIC is designed, it is specific to a particular application and cannot be easily modified. This inflexibility means that advancements in underlying technology or shifts in consumer preferences can render existing ASICs obsolete, posing a constant challenge for manufacturers to stay relevant and competitive in a fast-evolving market.

Growth Factors

- IoT Integration: The proliferation of Internet of Things (IoT) devices in industries like healthcare, automotive, and home automation is a major growth driver. ASICs, with their ability to provide high performance in small form factors, are essential for powering these smart devices efficiently.

- 5G Technology: The rollout of 5G networks globally is spurring demand for new telecommunications equipment that requires high-speed, high-efficiency ASICs. These chips are crucial for handling increased data loads and supporting enhanced mobile broadband and ultra-reliable communications.

- Energy Efficiency: There is a growing emphasis on energy conservation across various sectors. ASICs are designed to perform specific functions more efficiently than general-purpose integrated circuits, leading to lower power consumption in devices.

- Consumer Electronics Innovation: Advances in consumer electronics, such as smartwatches, fitness trackers, and augmented reality headsets, drive demand for customized ASICs that can provide the necessary functionality in compact sizes.

- Healthcare Advancements: The healthcare sector’s increasing reliance on technology for diagnostic and therapeutic devices, which require precise and reliable chip solutions, supports the continued growth of the ASIC market.

Emerging Trends

- AI and Machine Learning: ASICs are increasingly being tailored for artificial intelligence (AI) and machine learning applications. These specialized chips are capable of processing AI algorithms faster and more efficiently, which is critical for applications ranging from autonomous vehicles to smart assistants.

- Edge Computing: As computation moves closer to the source of data (edge computing), there is a rising need for ASICs that can process data on-site, reducing latency and improving speed in applications like real-time data processing and autonomous decision-making.

- Flexible ASICs: There is a trend towards developing more flexible ASICs that can be updated post-deployment to adapt to new technologies and standards. This flexibility is being achieved through programmable logic components integrated within ASICs.

- Integration of Advanced Sensors: ASICs are being integrated with advanced sensors for better data acquisition and analysis, particularly in applications such as wearable health monitors and industrial automation systems.

- Quantum Computing: Although still in early stages, the potential integration of ASICs with quantum computing elements points to future trends where ASICs could handle complex computations that are beyond the scope of classical computing technologies. This development is anticipated to open new frontiers in computing power and efficiency.

Regional Analysis

In 2023, Asia-Pacific held a dominant market position in the Application Specific Integrated Circuit (ASIC) market, capturing more than a 45.9% share. The demand for Application Specific Integrated Circuit in Asia-Pacific was valued at USD 8.2 billion in 2023 and is anticipated to grow significantly in the forecast period.

This leadership can be attributed to several pivotal factors, notably the expansive semiconductor manufacturing base in countries such as China, South Korea, and Taiwan. These nations have established themselves as global hubs for electronic production, benefiting from robust governmental support, substantial investments in technology infrastructure, and a well-established supply chain optimized for electronic manufacturing.

The region’s dominance is further bolstered by its rapid adoption of advanced technologies, including 5G, artificial intelligence, and the Internet of Things (IoT), which extensively utilize ASICs for enhanced performance and efficiency. The proliferation of these technologies in Asia-Pacific is supported by a strong ecosystem of R&D activities, led by both local and international companies investing heavily in innovation centers throughout the region.

Moreover, the increasing demand for consumer electronics, such as smartphones and portable computing devices, which are heavily reliant on ASICs, continues to drive substantial market growth. Data indicates a sustained increase in these sectors, with projections suggesting a continued upward trajectory influenced by rising consumer electronics sales and technological advancements.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

An Application Specific Integrated Circuit (ASIC) is a type of integrated circuit that is specifically designed for a particular application or task. It is customized to perform a specific function, unlike general-purpose integrated circuits.

The Application Specific Integrated Circuit (ASIC) market features a dynamic landscape with several key players that shape the industry. These companies are pivotal in driving innovation and addressing the diverse needs of sectors like telecommunications, automotive, and consumer electronics.

Key players in the ASIC market are companies that are actively involved in the design, development, and manufacturing of ASICs. These players possess expertise in creating customized solutions for specific applications, catering to the unique needs of different industries.

Top Market Leaders

- Samsung Electronics Co. Ltd.

- Taiwan Semiconductor Manufacturing Company

- GlobalFoundries Inc.

- Infineon Technologies AG

- United Microelectronics Corporation

- Intel Corporation

- NVIDIA Corporation

- OmniVision Technologies Inc.

- Tekmos Inc.

- STMicroelectronics N.V.

- Analog Devices, Inc.

- Renesas Electronics Corporation

- Other Key Players

Recent Developments

- In 2023, Samsung Electronics has been actively enhancing its ASIC capabilities through various strategic moves. Notably, Samsung announced its collaboration with Ambarella to supply the latter with Samsung’s 5-nanometer process technology for Ambarella’s new automotive AI central domain controller, CV3-AD685. This technology is designed to advance autonomous driving vehicle safety systems by improving AI processing performance, power, and reliability.

- In September 2023, Intel announced its plan to develop an Application-Specific Integrated Circuit (ASIC) accelerator aimed at enhancing the efficiency of fully homomorphic encryption (FHE). This technology allows data to remain encrypted even during processing, ensuring secure computations. Intel’s initiative will include the release of a beta version of a software toolkit for developers, expected later in the year, to facilitate encrypted computing.

- Previously, in April 2022, Intel launched an ASIC designed for blockchain applications, focusing on energy-efficient hashing necessary for proof-of-work consensus networks. This product supports SHA-256 hashing and is tailored to provide the necessary computing power and energy efficiency, contributing to sustainability and scalability in blockchain operations.

Report Scope

Report Features Description Market Value (2023) USD 17.9 Bn Forecast Revenue (2033) USD 33.3 Bn CAGR (2024-2033) 6.4% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Full Custom ASIC, Semi-Custom ASIC, and Programmable ASIC), End-Use Industry (Telecommunication, Consumer Electronics, Automotive, Healthcare, Other End-Use Industries) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Samsung Electronics Co. Ltd., Taiwan Semiconductor Manufacturing Company, GlobalFoundries Inc., Infineon Technologies AG, United Microelectronics Corporation, Intel Corporation, NVIDIA Corporation, OmniVision Technologies Inc., Tekmos Inc., STMicroelectronics N.V., Analog Devices Inc., Renesas Electronics Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is an Application Specific Integrated Circuit (ASIC)?An Application Specific Integrated Circuit (ASIC) is a type of integrated circuit customized for a specific application or purpose, such as a particular electronic device or function. Unlike general-purpose integrated circuits like microprocessors, ASICs are designed to perform specific tasks efficiently.

How big is Application Specific Integrated Circuit Market?The Global Application Specific Integrated Circuit Market size is expected to be worth around USD 33.3 Billion by 2033, from USD 17.9 Billion in 2023, growing at a CAGR of 6.4% during the forecast period from 2024 to 2033.

What are the key drivers of growth in the ASIC market?The increasing demand for specialized and high-performance electronic devices across various industries is a key driver of growth in the ASIC market. Additionally, advancements in design tools, manufacturing processes, and packaging technologies contribute to the proliferation of ASICs.

What are the challenges faced by the ASIC industry?One of the challenges in the ASIC industry is the high upfront cost and development time associated with designing custom chips. Additionally, rapid technological advancements and evolving market demands require continuous innovation and investment in research and development.

Who are the key players in application specific integrated circuit market?Some key players operating in the application specific integrated circuit market include Samsung Electronics Co. Ltd., Taiwan Semiconductor Manufacturing Company, GlobalFoundries Inc., Infineon Technologies AG, United Microelectronics Corporation, Intel Corporation, NVIDIA Corporation, OmniVision Technologies Inc., Tekmos Inc., STMicroelectronics N.V., Analog Devices Inc., Renesas Electronics Corporation, Other Key Players

Which products type analysis segment accounted for the largest application specific integrated circuit market share?In 2023, the Semi-Custom ASIC segment held a dominant market position, capturing more than a 51.4% share of the global market.

Application Specific Integrated Circuit MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Application Specific Integrated Circuit MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Samsung Electronics Co. Ltd.

- Taiwan Semiconductor Manufacturing Company

- GlobalFoundries Inc.

- Infineon Technologies AG

- United Microelectronics Corporation

- Intel Corporation

- NVIDIA Corporation

- OmniVision Technologies Inc.

- Tekmos Inc.

- STMicroelectronics N.V.

- Analog Devices, Inc.

- Renesas Electronics Corporation

- Other Key Players