Global Apparel Logistics Market Size, Share, Growth Analysis By Service (Warehousing & Distribution, Inventory Management, Freight Forwarding, Returns Management, Others), By Mode Of Transport (Rail Freight, Road Freight, Air Freight, Ocean Freight), By Sales Channel (Online Retailers (E-Commerce), Brick-And-Mortar Stores, Multi-Channel Retailing, Direct To Consumer (D2C)), By End Use (Retailers, Manufacturers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170610

- Number of Pages: 246

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

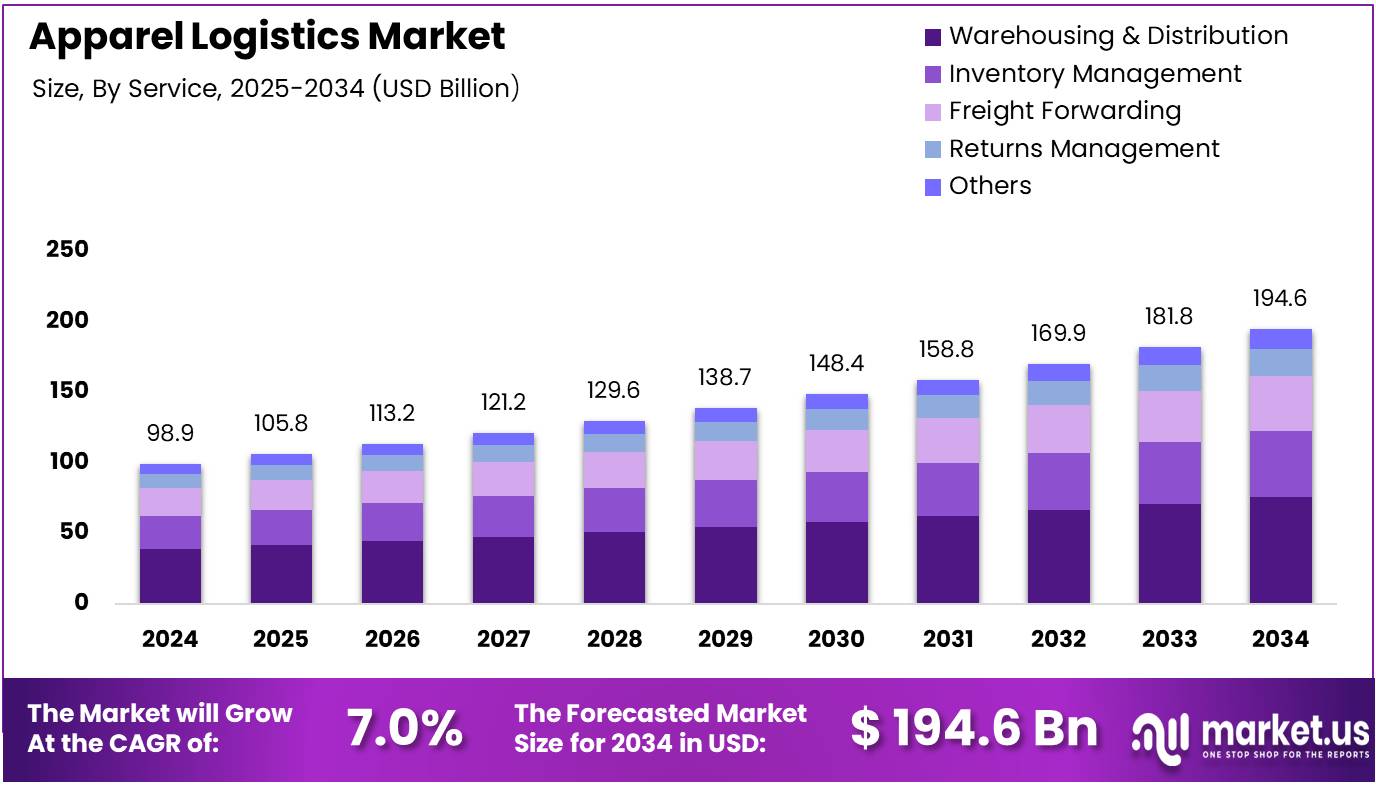

The Global Apparel Logistics Market size is expected to be worth around USD 194.6 Billion by 2034, from USD 98.9 Billion in 2024, growing at a CAGR of 7% during the forecast period from 2025 to 2034.

The apparel logistics market encompasses specialized supply chain operations managing clothing and fashion products from manufacturing through final delivery. This sector orchestrates warehousing, inventory management, transportation, and distribution services specifically tailored for fashion retailers and brands. Consequently, the market addresses unique challenges including seasonal demand fluctuations, rapid style changes, and stringent quality requirements throughout the supply chain network.

Market growth continues accelerating as fashion retailers prioritize operational efficiency and customer satisfaction. Companies increasingly recognize that streamlined logistics operations directly impact profitability and brand reputation. Therefore, investment in advanced logistics infrastructure becomes essential for maintaining competitive advantages. The sector particularly benefits from expanding e-commerce penetration, which fundamentally transforms traditional distribution models and necessitates sophisticated fulfillment capabilities.

Digital transformation presents substantial opportunities for apparel logistics providers. Businesses are actively implementing automation technologies, artificial intelligence, and data analytics to optimize warehouse operations and delivery performance. Furthermore, sustainability initiatives drive innovation in packaging solutions and transportation methods. These technological advancements enable companies to enhance visibility, reduce operational costs, and improve responsiveness to fluctuating market demands across diverse geographic regions.

Government regulations significantly influence operational frameworks within the apparel logistics sector. Authorities worldwide implement stricter customs procedures, labor standards, and environmental compliance requirements. Additionally, trade policies and tariff structures impact cross-border movement of fashion merchandise. Companies must navigate these evolving regulatory landscapes while maintaining service quality standards, requiring substantial investment in compliance infrastructure and workforce training programs.

The digital revolution reshapes industry dynamics significantly. According to research, 63% of companies have adopted technology solutions to track and evaluate their supply chain’s effectiveness. Moreover, apparel accounts for 23% of online retail sales in the United States, highlighting the sector’s digital prominence. However, e-commerce apparel returns range between 20% and 30%, creating reverse logistics challenges that demand innovative solutions and specialized handling processes for sustainable growth.

Key Takeaways

- Global Apparel Logistics Market is projected to reach USD 194.6 Billion by 2034 from USD 98.9 Billion in 2024, with a CAGR of 7%.

- By Service Analysis shows Warehousing & Distribution leading with a 39.5% market share in 2024.

- By Mode Of Transport Analysis indicates Rail Freight dominance at 48.1% in 2024 due to cost-effectiveness and reliability.

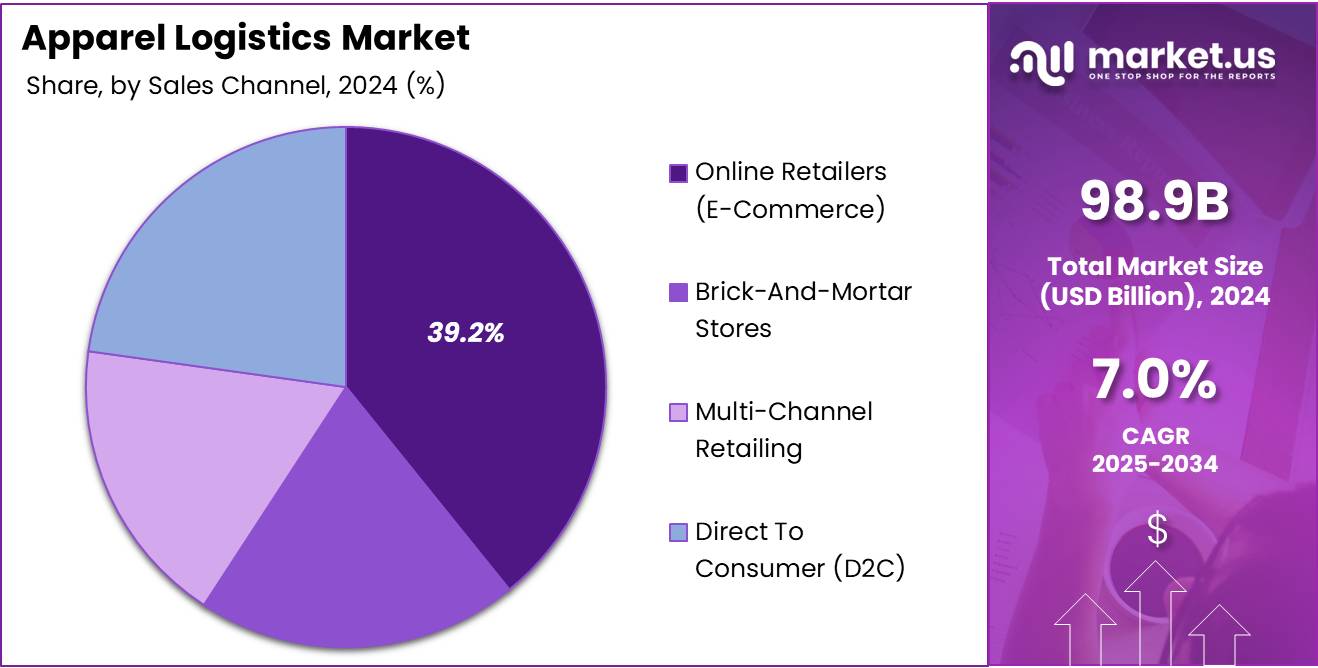

- By Sales Channel Analysis reveals Online Retailers (E-Commerce) holds 39.2% market share in 2024, reflecting e-commerce growth.

- By End Use Analysis demonstrates Retailers lead with 69.3% share in 2024 because of extensive distribution networks.

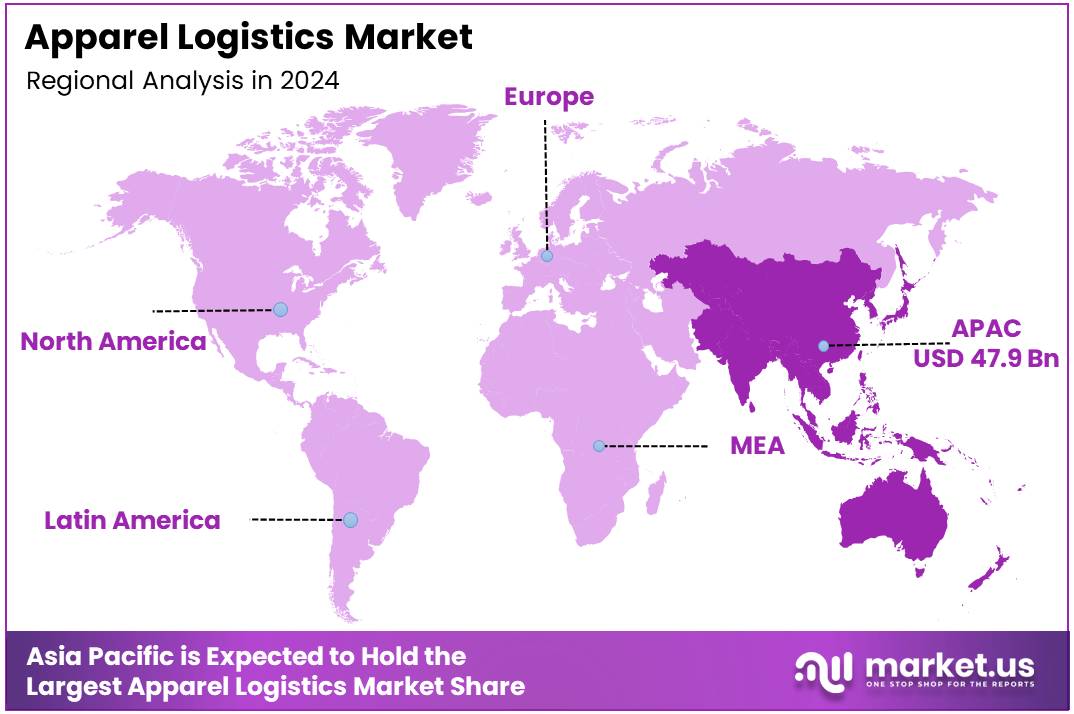

- Asia Pacific dominates the regional market with 48.5% share, valued at USD 47.9 Billion in 2024.

By Service Analysis

Warehousing & Distribution dominates with 39.5% due to its critical role in managing inventory flow and ensuring timely delivery.

In 2024, Warehousing & Distribution held a dominant market position in the By Service Analysis segment of Apparel Logistics Market, with a 39.5% share. This segment’s leadership stems from increasing supply chain complexity, requiring sophisticated storage facilities and efficient distribution networks. Companies prioritize warehousing solutions to maintain optimal stock levels while ensuring rapid order fulfillment.

Inventory Management enables apparel companies to optimize stock levels and reduce holding costs. Advanced technologies like RFID tracking enhance supply chain visibility. This segment helps minimize stockouts while preventing excess inventory, thereby improving operational efficiency and profitability.

Freight Forwarding facilitates international trade by coordinating shipments across multiple carriers and borders. This service manages customs clearance and route optimization for apparel companies sourcing globally. The segment grows as brands expand internationally and diversify manufacturing locations.

Returns Management addresses product returns, particularly in e-commerce where return rates remain high. Efficient reverse logistics help recover value through restocking or refurbishment. This segment enhances customer satisfaction by providing hassle-free return experiences while minimizing costs.

Others encompasses specialized services including labeling, packaging customization, and quality inspections. These ancillary services support apparel companies seeking comprehensive logistics solutions. The segment provides additional value through tailored operational support and enhanced service delivery.

By Mode Of Transport Analysis

Rail Freight dominates with 48.1% due to its cost-effectiveness and reliability for long-distance inland transportation.

In 2024, Rail Freight held a dominant market position in the By Mode Of Transport Analysis segment of Apparel Logistics Market, with a 48.1% share. This mode offers economic advantages for transporting large apparel volumes across continental distances. Rail networks provide consistent schedules and reduced carbon emissions, aligning with sustainability initiatives adopted by brands.

Road Freight provides essential first-mile and last-mile connectivity between manufacturing facilities, warehouses, and retail outlets. This mode offers flexibility in reaching locations without rail or port access. The segment adapts quickly to changing delivery requirements, supporting just-in-time inventory strategies.

Air Freight serves time-sensitive shipments and high-value apparel items requiring rapid delivery. Fashion houses utilize this mode for seasonal collections and runway samples needing urgent international transport. Air freight’s speed remains invaluable for managing tight production deadlines and capitalizing on opportunities.

Ocean Freight handles bulk shipments for long-haul international routes connecting manufacturing hubs with consumer markets globally. This mode offers the lowest per-unit transportation costs, making it ideal for large-volume orders. Containerization advancements continue enhancing ocean freight’s efficiency and reliability.

By Sales Channel Analysis

Online Retailers (E-Commerce) dominates with 39.2% due to the rapid digital transformation and changing consumer shopping preferences.

In 2024, Online Retailers (E-Commerce) held a dominant market position in the By Sales Channel Analysis segment of Apparel Logistics Market, with a 39.2% share. Digital transformation has revolutionized apparel shopping with consumers preferring online platforms for convenience and variety. This channel demands sophisticated logistics networks for individual order fulfillment, rapid delivery expectations, and efficient returns processing.

Brick-And-Mortar Stores maintain relevance despite digital disruption, offering tangible shopping experiences and immediate product availability. Traditional retail requires logistics focused on bulk shipments and store replenishment systems. This channel benefits from established infrastructure and continues serving customers preferring physical product examination.

Multi-Channel Retailing integrates online and offline experiences, creating complex logistics requirements spanning multiple fulfillment points. This approach enables buy-online-pickup-in-store options for seamless shopping. Retailers need flexible logistics systems synchronizing inventory across all touchpoints while maintaining consistent service quality.

Direct To Consumer (D2C) channels empower apparel brands to control distribution entirely, eliminating intermediaries and building direct customer relationships. This model requires brands to develop internal logistics capabilities or partner with third-party providers. D2C strategies offer higher margins while demanding significant investments in infrastructure.

By End Use Analysis

Retailers dominate with 69.3% due to their extensive distribution networks and direct consumer engagement.

In 2024, Retailers held a dominant market position in the By End Use Analysis segment of Apparel Logistics Market, with a 69.3% share. Retailers command the largest logistics footprint, managing complex supply chains connecting manufacturers to consumers. Their operations encompass bulk shipments, multi-store distribution, inventory management, and returns processing. Major retail chains invest heavily in logistics infrastructure for competitive advantages through faster delivery and better product availability.

Manufacturers represent the production side, handling raw material procurement, work-in-progress inventory, and finished goods distribution. This segment focuses on inbound logistics for sourcing fabrics and outbound logistics for delivering completed products. Manufacturers adopt lean principles requiring precise logistics coordination to minimize costs while ensuring production continuity.

Key Market Segments

By Service

- Warehousing & Distribution

- Inventory Management

- Freight Forwarding

- Returns Management

- Others

By Mode Of Transport

- Rail Freight

- Road Freight

- Air Freight

- Ocean Freight

By Sales Channel

- Online Retailers (E-Commerce)

- Brick-And-Mortar Stores

- Multi-Channel Retailing

- Direct To Consumer (D2C)

By End Use

- Retailers

- Manufacturers

Drivers

Surge in Online Retailer Shipments Driving Warehousing & Distribution Demand

The apparel logistics market is experiencing strong growth due to the rapid increase in online shopping. More consumers are buying clothes through e-commerce platforms, which has created higher demand for warehouse space and efficient distribution networks. Retailers need advanced storage facilities to handle growing order volumes quickly and accurately.

Fast-fashion brands are pushing logistics providers to adopt better inventory management systems. These companies launch new collections frequently and need real-time tracking of stock levels across multiple locations. Efficient inventory control helps reduce waste and ensures popular items remain available for immediate shipment.

Time-sensitive delivery requirements are driving the adoption of faster transportation modes. Air and rail freight services are becoming more popular for moving apparel products across long distances. These methods help brands meet customer expectations for quick delivery while maintaining product quality during transit.

Restraints

Inconsistent Regulatory Policies Across Cross-Border Trade Routes

The apparel logistics sector faces challenges from varying regulations in different countries. Import duties, customs procedures, and compliance requirements change across borders, making international shipping complex and costly. Companies must navigate multiple regulatory frameworks, which slows down delivery times and increases operational expenses.

Another significant barrier is the lack of integration between inventory and distribution systems. Many apparel companies still use separate software for tracking stock and managing shipments. This disconnection creates data gaps, leading to errors in order fulfillment and difficulty in maintaining accurate inventory counts. Poor system integration also prevents companies from gaining complete visibility over their supply chain operations.

Growth Factors

Expansion of Customized Returns Management Solutions for E-Commerce Apparel

The apparel logistics market presents promising opportunities through specialized returns handling services. Online clothing purchases have high return rates, creating demand for efficient reverse logistics solutions. Companies that offer streamlined return processes, including easy pickup options and fast refund processing, can capture significant market share in the e-commerce segment.

Artificial intelligence is opening new possibilities for improving freight operations. AI-driven platforms can analyze multiple factors like traffic patterns, weather conditions, and delivery schedules to determine optimal shipping routes. These smart systems help reduce fuel costs, improve delivery speed, and minimize environmental impact through better planning.

Sustainability is becoming a key differentiator in apparel logistics. Retailers are increasingly seeking eco-friendly packaging materials and green supply chain practices. Logistics providers that integrate biodegradable packaging, recyclable materials, and carbon-neutral delivery options across different sales channels can attract environmentally conscious brands and consumers.

Emerging Trends

Rising Adoption of Smart Warehousing Solutions with IoT Sensors

The apparel logistics industry is rapidly embracing technology-driven warehouse management. IoT sensors and connected devices are being installed in storage facilities to monitor inventory levels, temperature conditions, and product movement automatically. These smart systems provide real-time data that helps managers make faster decisions and reduce manual errors in handling apparel items.

Direct-to-consumer business models are reshaping logistics partnerships. Apparel brands are increasingly bypassing traditional retail channels and shipping directly to customers. This shift requires specialized logistics services that can handle smaller, more frequent shipments while maintaining cost efficiency and delivery speed for individual consumers.

Predictive analytics tools are transforming how apparel companies plan for demand. By analyzing historical sales data, seasonal trends, and market signals, these systems forecast future demand with greater accuracy. This allows logistics providers to position inventory strategically and adjust transportation capacity before demand spikes occur.

Regional Analysis

Asia Pacific Dominates the Apparel Logistics Market with a Market Share of 48.5%, Valued at USD 47.9 Billion

The Asia Pacific region commands the largest position in the global apparel logistics market, accounting for a market share of 48.5% and valued at USD 47.9 billion. The region’s dominance is driven by its extensive manufacturing base, with countries like China, Vietnam, Bangladesh, and India serving as major apparel production hubs. Rapid e-commerce growth, expanding middle-class population, and increasing internet penetration are compelling brands to establish sophisticated logistics networks for efficient order fulfillment and last-mile delivery across diverse markets.

North America Apparel Logistics Market Trends

North America represents a significant market characterized by mature e-commerce operations and advanced automation investments to address labor shortages. Consumer expectations for faster shipping and seamless returns are driving demand for efficient supply chain management and last-mile delivery services. Nearshoring initiatives, particularly in Mexico’s manufacturing corridor, are repositioning distribution strategies and supporting the development of bi-national logistics centers to optimize regional supply chains.

Europe Apparel Logistics Market Trends

The European apparel logistics market is experiencing growth fueled by omnichannel retail strategies and sustainability initiatives driving eco-friendly transportation solutions. The fast fashion trend necessitates agile supply chains capable of supporting rapid design-to-delivery cycles, while cross-border e-commerce within the European Union increases demand for efficient international logistics networks. The region’s dense population centers and relatively short distances create favorable conditions for advanced warehousing and distribution operations.

Middle East and Africa Apparel Logistics Market Trends

The Middle East and Africa region presents emerging opportunities driven by increasing urbanization, rising disposable incomes, and expanding retail infrastructure in key metropolitan areas. The region’s strategic location at the crossroads of major trade routes makes it attractive for logistics providers. However, infrastructure disparities and varying economic development levels create operational challenges, though investments in port modernization and free trade zones are improving connectivity.

Latin America Apparel Logistics Market Trends

Latin America represents an emerging market with growing potential driven by increasing e-commerce penetration and expanding consumer demand for fashion products. The rising middle class and urbanization trends create opportunities for retailers, necessitating sophisticated logistics solutions. However, infrastructure gaps, regulatory complexities, and economic volatility in certain countries require logistics providers to adopt flexible and localized strategies for effective market navigation.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Apparel Logistics Company Insights

Ceva Logistics has strengthened its position through strategic investments in technology-enabled warehousing solutions and automated distribution centers tailored specifically for fashion and apparel clients. The company’s emphasis on omnichannel fulfillment capabilities has resonated well with brands navigating the retail-to-digital transition. Their focus on real-time inventory visibility and rapid order processing has enabled clients to meet consumer expectations for faster delivery timelines.

DB Schenker continues to differentiate itself through its comprehensive end-to-end solutions that integrate air, ocean, and land transportation with specialized garment-on-hanger facilities and quality control services. The company’s expertise in managing complex compliance requirements across multiple jurisdictions adds significant value for international fashion retailers.

Deutsche Post DHL Group maintains its leadership through its extensive global network and dedicated fashion logistics division, offering value-added services including retail-ready packaging, labeling, and reverse logistics management. TThe integration of predictive analytics and AI-driven demand forecasting tools has enhanced their ability to optimize inventory placement across distribution networks.

DSV has expanded its apparel logistics footprint through strategic acquisitions and organic growth, emphasizing flexible, scalable solutions that accommodate seasonal demand fluctuations inherent to the fashion industry. Their contract logistics capabilities enable brands to optimize inventory management across multiple channels. The company’s investment in automated sorting systems and cross-docking facilities has significantly reduced transit times for time-sensitive fashion merchandise.

Top Key Players in the Market

- Ceva Logistics

- DB Schenker

- Deutsche Post DHL Group

- DSV

- Hellmann Worldwide Logistics

- Apparel Logistics Group Inc.

- Logwin AG

- PVS Fulfillment-Service GmbH

- Bollore Logistics

- GAC Group

Recent Developments

- In December 2025, Gildan Activewear finalized its massive acquisition of HanesBrands. This strategic move aims to establish a global leader in basic apparel with a more vertically integrated and efficient supply chain, improving production and distribution efficiency.

- In July 2025, LVMH Luxury Ventures acquired a minority stake in the French knitwear brand Molli. This reflects a growing trend of luxury conglomerates investing directly in their supply chain partners to secure production and logistical stability.

- In March 2025, Swap raised $40 million in Series B funding to expand its AI-powered e-commerce logistics platform. The platform streamlines shipping, returns, forecasting, and inventory management for apparel brands, enhancing operational efficiency.

- In June 2024, Amazon announced an $11 billion investment in Germany to strengthen its cloud (AWS) and logistics infrastructure. The initiative targets faster fulfillment and improved delivery performance for its European apparel and retail categories.

Report Scope

Report Features Description Market Value (2024) USD 98.9 Billion Forecast Revenue (2034) USD 194.6 Billion CAGR (2025-2034) 7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service (Warehousing & Distribution, Inventory Management, Freight Forwarding, Returns Management, Others), By Mode Of Transport (Rail Freight, Road Freight, Air Freight, Ocean Freight), By Sales Channel (Online Retailers (E-Commerce), Brick-And-Mortar Stores, Multi-Channel Retailing, Direct To Consumer (D2C)), By End Use (Retailers, Manufacturers) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Ceva Logistics, DB Schenker, Deutsche Post DHL Group, DSV, Hellmann Worldwide Logistics, Apparel Logistics Group Inc., Logwin AG, PVS Fulfillment-Service GmbH, Bollore Logistics, GAC Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ceva Logistics

- DB Schenker

- Deutsche Post DHL Group

- DSV

- Hellmann Worldwide Logistics

- Apparel Logistics Group Inc.

- Logwin AG

- PVS Fulfillment-Service GmbH

- Bollore Logistics

- GAC Group