Antiglaucoma Drugs Market By Product Type (Alpha Agonist, Prostaglandin Analogs, Beta Blockers, Combined Medication, and Others), By Application (Open-angle Glaucoma, Normal-tension Glaucoma, Angle-closure Glaucoma, Congenital Glaucoma, and Others), By Distribution Channel (Hospitals, Pharmacies, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132550

- Number of Pages: 228

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

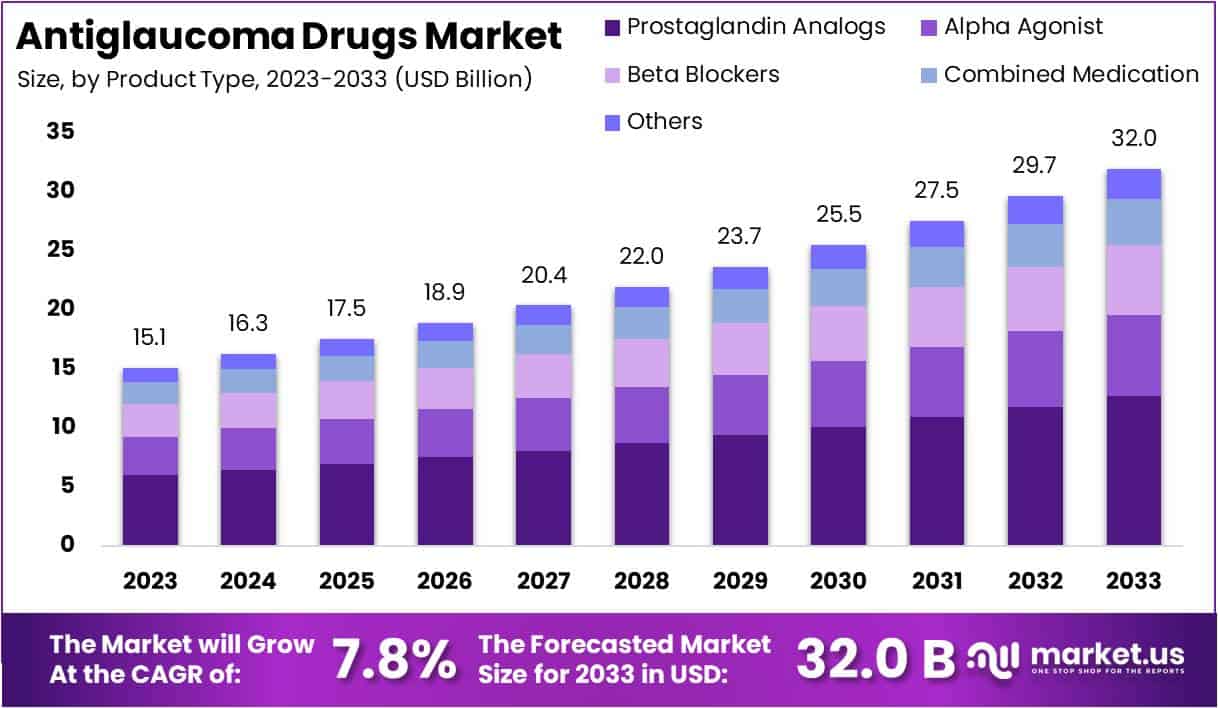

The Global Antiglaucoma Drugs Market size is expected to be worth around US$ 32 Billion by 2033, from US$ 15.1 Billion in 2023, growing at a CAGR of 7.8% during the forecast period from 2024 to 2033.

Increasing prevalence of glaucoma, a leading cause of irreversible blindness, drives growth in the antiglaucoma drugs market, as the demand for early intervention and effective treatments becomes more critical.

In July 2021, the United Nations General Assembly passed a resolution advocating for the inclusion of eye care in universal health coverage, emphasizing the need to address vision loss caused by conditions like glaucoma, short-sightedness, and cataracts. This commitment underscores the importance of accessible treatments, opening avenues for the adoption of novel therapies and the expansion of antiglaucoma drugs.

New developments in drug formulations, including fixed-dose combinations and sustained-release eye drops, offer patients enhanced compliance and more efficient intraocular pressure (IOP) management. With growing attention on personalized medicine, pharmaceutical companies invest in therapies targeting specific patient needs, including those who exhibit resistance to conventional medications.

Additionally, increasing collaborations among pharmaceutical firms and research institutes support drug innovation and accessibility. Opportunities also arise from an aging global population, which faces higher glaucoma risk, creating sustained demand for preventative and long-term treatment options. As awareness of glaucoma’s impact on quality of life rises, the antiglaucoma drugs market remains poised for steady growth, driven by advances that improve both therapeutic outcomes and patient accessibility to care.

Key Takeaways

- In 2023, the market for antiglaucoma drugs generated a revenue of US$ 15.1 billion, with a CAGR of 7.8%, and is expected to reach US$ 32.0 billion by the year 2033.

- The product type segment is divided into alpha agonist, prostaglandin analogs, beta blockers, combined medication, and others, with prostaglandin analogs taking the lead in 2023 with a market share of 39.6%.

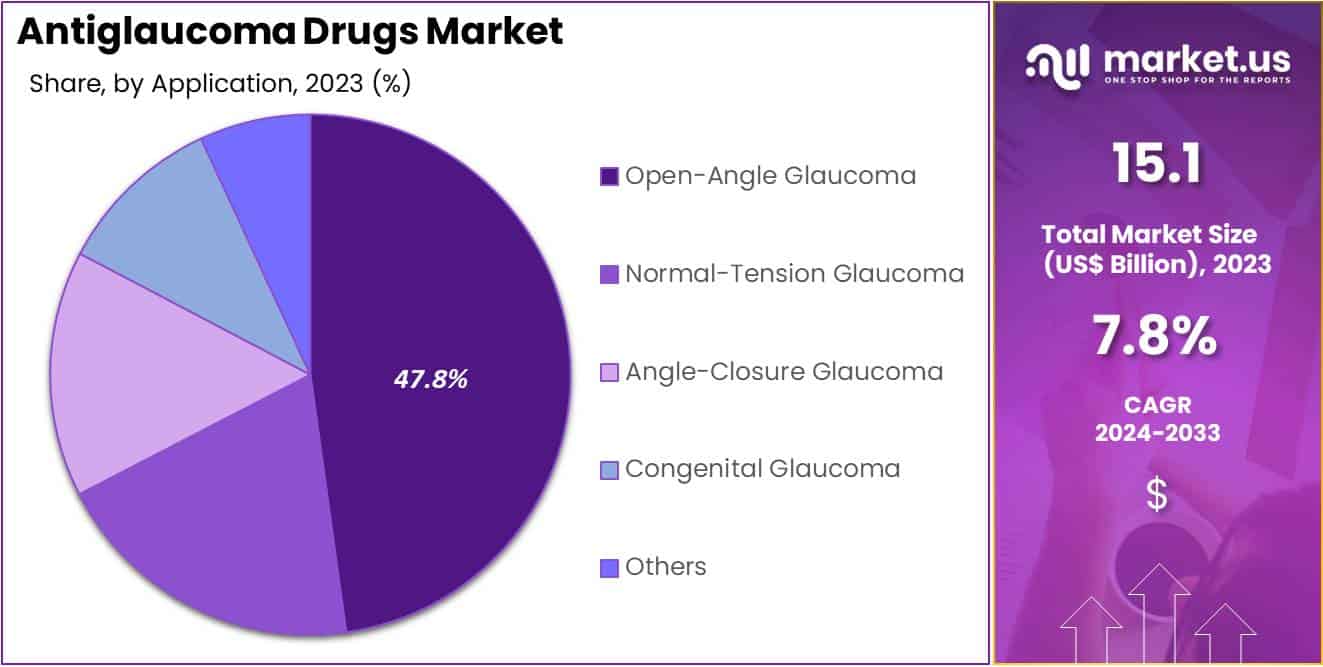

- Considering application, the market is divided into open-angle glaucoma, normal-tension glaucoma, angle-closure glaucoma, congenital glaucoma, and others. Among these, open-angle glaucoma held a significant share of 47.8%.

- Furthermore, concerning the distribution channel segment, the market is segregated into hospitals, pharmacies, and others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 51.5% in the antiglaucoma drugs market.

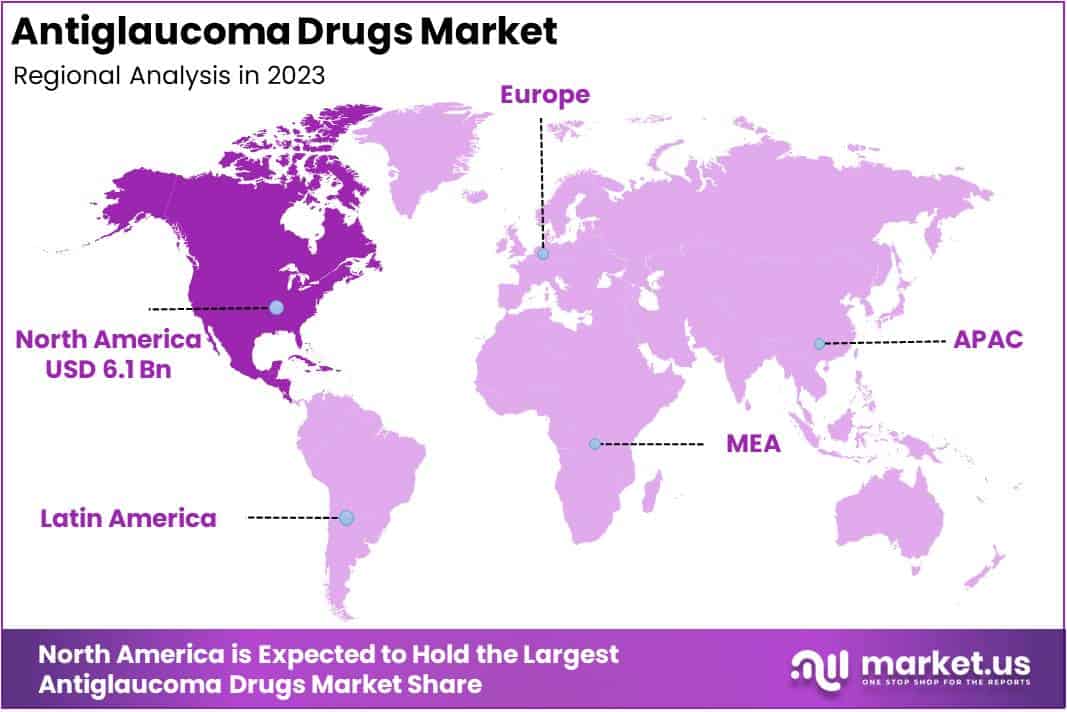

- North America led the market by securing a market share of 40.3% in 2023.

Product Type Analysis

The prostaglandin analogs segment led in 2023, claiming a market share of 39.6% owing to its effectiveness in reducing intraocular pressure (IOP). Prostaglandin analogs provide long-lasting IOP reduction by increasing the outflow of aqueous humor, which has made them a preferred option among healthcare providers for glaucoma management.

The rising prevalence of glaucoma, especially among the aging population, drives demand for effective treatment solutions, with prostaglandin analogs at the forefront. Additionally, advancements in drug formulations improve patient tolerance and compliance, further supporting this segment’s growth. Growing awareness of glaucoma’s risks and the importance of timely intervention encourage more patients to seek reliable treatment options.

Favorable reimbursement policies for prostaglandin analogs in many regions enhance accessibility, while research efforts focus on improving the efficacy of these drugs. These factors are likely to position prostaglandin analogs as a primary choice in the antiglaucoma drug market.

Application Analysis

The open-angle glaucoma held a significant share of 47.8% due to its high prevalence and chronic nature. Open-angle glaucoma remains the most common form of glaucoma globally, particularly affecting older adults, which significantly increases the demand for effective long-term treatment. Increased awareness and proactive screenings contribute to earlier diagnoses, resulting in a higher number of patients requiring treatment.

Healthcare providers prefer targeted drug therapies for open-angle glaucoma due to their efficacy in managing intraocular pressure over time. Advancements in diagnostic technologies allow for better monitoring and tailored treatment approaches, improving patient outcomes and supporting the growth of this segment.

Additionally, government and nonprofit health organizations increasingly promote eye health initiatives that encourage early diagnosis and treatment. These trends collectively position open-angle glaucoma as a dominant segment in the antiglaucoma drug market.

Distribution Channel Analysis

The hospitals segment had a tremendous growth rate, with a revenue share of 51.5% as hospitals remain a primary source for comprehensive glaucoma diagnosis and treatment. Hospitals offer advanced diagnostic tools and specialized care, which makes them a preferred choice for patients requiring consistent glaucoma management.

The increasing incidence of glaucoma, coupled with a rise in hospital admissions related to eye care, boosts demand for antiglaucoma drugs in hospital settings. Hospitals’ ability to provide personalized treatment plans, including surgery and drug-based interventions, further supports this segment’s expansion.

Additionally, government initiatives aimed at improving healthcare infrastructure in developing regions enhance access to glaucoma treatment in hospital settings. Partnerships between hospitals and pharmaceutical companies facilitate access to advanced antiglaucoma drugs, which strengthens this distribution channel. As a result, hospitals are likely to maintain a significant role in delivering antiglaucoma therapies to patients.

Key Market Segments

By Product Type

- Alpha Agonist

- Prostaglandin Analogs

- Beta Blockers

- Combined Medication

- Others

By Application

- Open-angle Glaucoma

- Normal-tension Glaucoma

- Angle-closure Glaucoma

- Congenital Glaucoma

- Others

By Distribution Channel

- Hospitals

- Pharmacies

- Others

Drivers

Increasing Prevalence of Eye Problems

Increasing prevalence of eye conditions, including glaucoma, drives the demand in the antiglaucoma drugs market. In December 2022, NVISION Eye Centers reported that approximately 34 million people in the United States had myopia, a significant risk factor for glaucoma development. Additionally, data from the Brien Holden Vision Institute indicates that by 2050, nearly half of the global population could experience myopia, with around 5 billion at risk for preventable vision impairment.

This rise in eye health issues heightens the need for effective treatments to prevent or manage glaucoma, which, if untreated, may lead to permanent vision loss. Glaucoma’s high incidence, particularly among older adults, intensifies the demand for medications to slow disease progression and preserve eyesight.

Healthcare providers are expected to focus on early intervention, expanding the market for antiglaucoma drugs as both awareness and diagnosis rates increase. This upward trend in eye problems, combined with aging populations, anticipates sustained growth in the demand for effective glaucoma management solutions.

Restraints

Rising Availability of Subpar Treatments

Rising availability of subpar treatments restrains growth in the antiglaucoma drugs market by undermining patient trust and treatment efficacy. Low-quality or ineffective drugs, particularly in regions with limited regulatory oversight, impede patients from achieving optimal therapeutic outcomes. Such treatments may fail to control intraocular pressure effectively, causing progressive vision loss and dissatisfaction among patients.

This challenge is expected to restrict adoption rates as healthcare providers and patients seek more reliable options. Furthermore, lack of access to advanced therapies in low-income areas compounds the issue, as these regions may face a disproportionate reliance on inadequate alternatives. The persistence of such treatments likely hampers market growth by reducing the overall effectiveness of glaucoma care, necessitating improved regulation and quality assurance in the global supply of antiglaucoma medications.

Opportunities

Growing Awareness for Glaucoma

Growing awareness for glaucoma prevention and early diagnosis presents a significant opportunity for the antiglaucoma drugs market. In March 2023, the World Glaucoma Association launched World Glaucoma Week, an annual initiative dedicated to increasing global awareness about this potentially blinding disease. Reports from the Glaucoma Journal in June 2023 noted that around 3 million cases of glaucoma are recorded in the U.S., underscoring the need for proactive management strategies.

The British Journal of Ophthalmology further highlighted in July 2021 that primary open-angle glaucoma (POAG) affects approximately 2% of adults over 40 and 10% of those over 75 in the UK, making it the most common type of glaucoma. As awareness initiatives help more people understand the importance of timely intervention, healthcare providers are anticipated to see an increase in demand for effective antiglaucoma treatments. This focus on education and screening likely drives the market forward by promoting early diagnosis and enhancing patient adherence to prescribed therapies.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the antiglaucoma drugs market, shaping demand, accessibility, and costs. Economic growth typically supports increased healthcare spending, allowing for expanded access to eye care and treatments for glaucoma. Conversely, economic downturns can limit patient access to these drugs, as reduced disposable incomes lead to a prioritization of more immediate healthcare needs.

Geopolitical tensions and trade restrictions disrupt global supply chains, causing delays and increased costs for key ingredients in drug manufacturing. This situation often results in higher prices, limiting availability for patients in regions heavily reliant on imports.

However, countries investing in healthcare and medical research infrastructure are driving the development of more accessible and affordable treatments. Positive government initiatives focused on addressing chronic health conditions like glaucoma indicate a promising outlook for the market, which remains essential in managing this prevalent condition worldwide.

Latest Trends

Increasing Drug Approvals by Government Organizations

Growing drug approvals by regulatory bodies drive the antiglaucoma drugs market, enabling faster access to innovative treatments for patients. Government organizations increasingly recognize the need to address rising glaucoma cases, approving new drugs that offer enhanced efficacy and fewer side effects. For example, in December 2022, Thea Pharma announced that the FDA approved Iyuzeh, an ophthalmic solution containing latanoprost, specifically formulated to treat ocular hypertension effectively.

Such approvals are anticipated to expedite the introduction of novel therapeutics in the market, addressing a crucial need in eye care. The expansion of regulatory pathways for rare diseases and conditions further supports market growth, enabling companies to bring advanced formulations to patients faster. As healthcare systems prioritize early and effective glaucoma management, this trend likely strengthens the market’s expansion, benefiting both providers and patients by improving treatment accessibility.

Regional Analysis

North America is leading the Antiglaucoma Drugs Market

North America dominated the market with the highest revenue share of 40.3% owing to the high prevalence of glaucoma among aging populations and advancements in treatment options. Open-angle glaucoma, the most common form of the disease, affected approximately 2.7 million Americans aged 40 and older in 2022, according to National Glaucoma Research. With glaucoma impacting 80 million individuals worldwide and projected to reach 111 million by 2040, there is an urgent demand for effective therapies.

In North America, increased awareness of early screening and the availability of advanced treatments, such as prostaglandin analogs and combination therapies, have expanded access to glaucoma management. Innovations in drug delivery methods, such as sustained-release formulations, have also improved treatment adherence and patient outcomes. Government programs and expanded insurance coverage for vision care have further supported market growth, helping patients access essential antiglaucoma therapies and fueling steady demand in the region.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to an aging population and rising glaucoma diagnoses. Santen Pharmaceutical Co. Ltd. and UBE Corporation, two Japan-based companies, launched OMLONTI (Omidenepag Isopropyl Ophthalmic Solution) in September 2022, following FDA approval.

This eye drop formulation targets the reduction of elevated intraocular pressure (IOP) in patients with primary open-angle glaucoma or ocular hypertension, underscoring the region’s focus on addressing the rising demand for glaucoma treatment options. Expanding healthcare infrastructure in countries like China and India is anticipated to improve access to eye care, supported by growing awareness initiatives about the importance of early diagnosis.

Additionally, rising healthcare expenditures and government support for ophthalmic care are likely to make glaucoma treatments more accessible and affordable, thereby bolstering market growth. With these trends, the Asia Pacific market for antiglaucoma drugs is expected to grow substantially as healthcare systems strengthen across the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the antiglaucoma drugs market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the antiglaucoma drugs market pursue various strategies to foster growth and increase market share.

They prioritize research to develop novel therapies that offer improved efficacy and fewer side effects, addressing unmet needs in glaucoma management. Collaborations with ophthalmology clinics and research institutions help advance clinical trials and expedite regulatory approvals. Companies expand their distribution networks globally, with a particular focus on regions experiencing high prevalence of glaucoma.

Additionally, educational outreach to healthcare providers and patients raises awareness about early diagnosis and available treatments, boosting demand for advanced therapies.

Top Key Players in the Antiglaucoma Drugs Market

- Santen Pharmaceutical

- Novartis

- Nicox SA

- New World Medical

- Lumenis

- Johnson & Johnson

- Ellex Medical Lasers

- Allergan

- Abbott Laboratories

Recent Developments

- In October 2022: Nicox SA announced that its medication, NCX 470 0.1%, effectively lowered intraocular pressure (IOP) in Phase 3 clinical trials. This development, along with a strong pipeline of other drugs such as GS010 by GenSight and QLS-101 by Qlaris Bio, is significant for the antiglaucoma drugs market, as it adds innovative treatment options to address glaucoma, fostering competition and driving market growth.

- In June 2022: the U.S. Food and Drug Administration (FDA) approved OMLONTI eye drops, developed by Santen Pharmaceutical Co., Ltd. and UBE Corporation, to treat elevated IOP in patients with open-angle glaucoma or ocular hypertension. This approval is relevant to the antiglaucoma drugs market as it introduces a new, effective therapy for managing glaucoma-related IOP, enhancing treatment choices and supporting market expansion.

Report Scope

Report Features Description Market Value (2023) US$ 15.1 billion Forecast Revenue (2033) US$ 32.0 billion CAGR (2024-2033) 7.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Alpha Agonist, Prostaglandin Analogs, Beta Blockers, Combined Medication, and Others), By Application (Open-angle Glaucoma, Normal-tension Glaucoma, Angle-closure Glaucoma, Congenital Glaucoma, and Others), By Distribution Channel (Hospitals, Pharmacies, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Santen Pharmaceutical, Novartis, Nicox SA, New World Medical, Lumenis, Johnson & Johnson, Ellex Medical Lasers, Allergan, and Abbott Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Santen Pharmaceutical

- Novartis

- Nicox SA

- New World Medical

- Lumenis

- Johnson & Johnson

- Ellex Medical Lasers

- Allergan

- Abbott Laboratories