Global Antigen Skin Test Market By Test Type (Bacterial Infections, Parasitic Infection, Fungal Infection, and Others), By End-user (Hospitals, Clinics, Ambulatory Surgical Centres, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168933

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

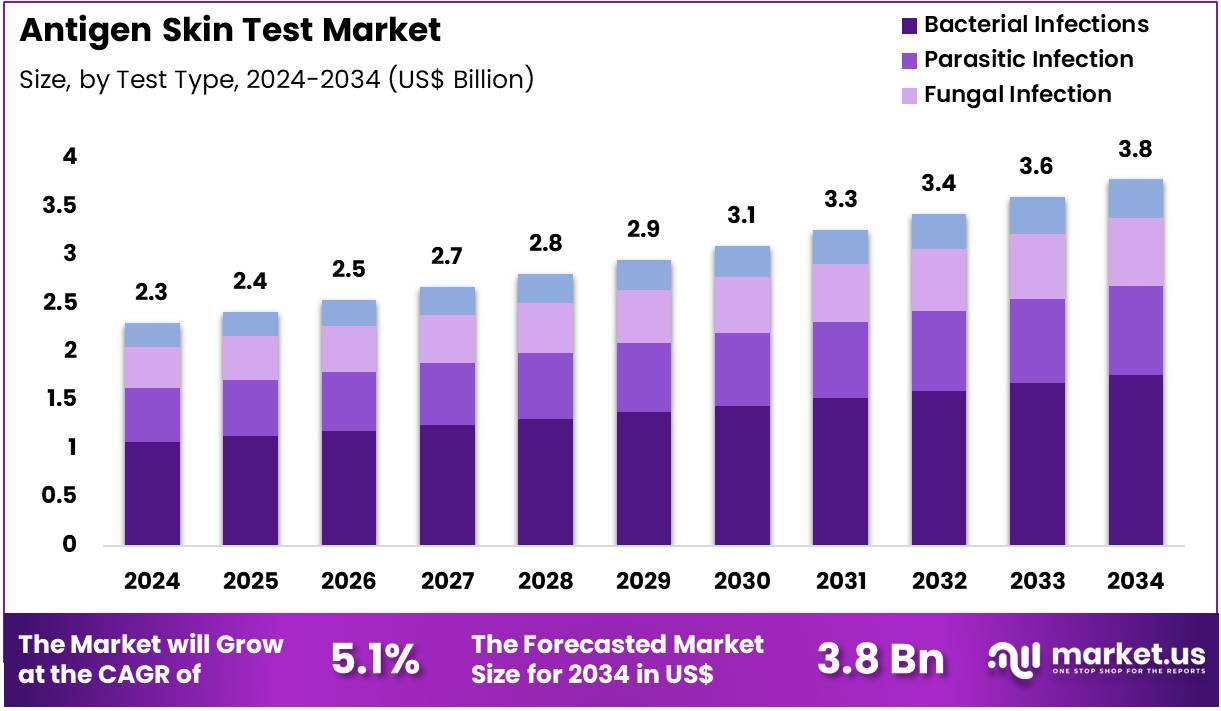

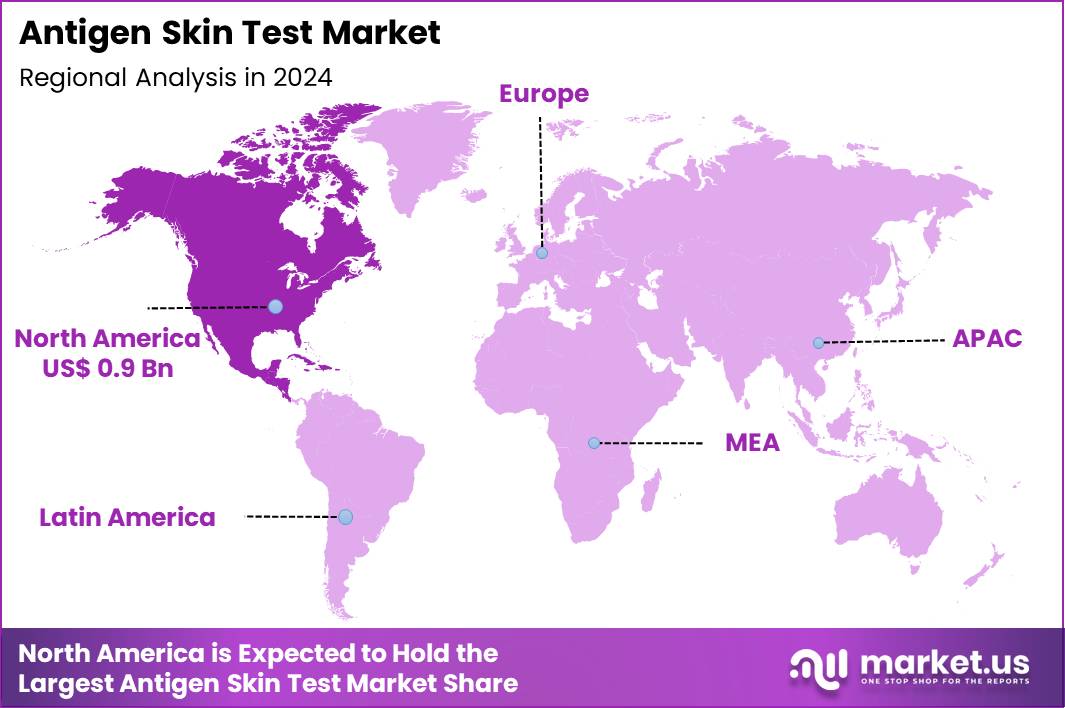

Global Antigen Skin Test Market size is expected to be worth around US$ 3.8 Billion by 2034 from US$ 2.3 Billion in 2024, growing at a CAGR of 5.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.2% share with a revenue of US$ 0.9 Billion.

Increasing prevalence of allergic disorders propels the Antigen Skin Test market, as clinicians rely on immediate hypersensitivity assessments to confirm sensitization and guide immunotherapy decisions accurately. Diagnostic manufacturers refine multi-prick devices and standardized allergen extracts that elicit reproducible wheal-and-flare responses within minutes.

These tests enable food allergy confirmation through peanut and tree nut challenges, respiratory allergen identification for dust mite or pollen rhinitis, venom hypersensitivity evaluation in anaphylaxis survivors, and drug allergy verification for penicillin or local anesthetics. Enhanced device ergonomics create opportunities for pediatric and geriatric applications with reduced discomfort.

ALK-Abelló secured FDA approval in October 2024 for its updated AccuTest allergy skin testing devices featuring smaller tines, delivering superior precision and markedly improved patient comfort during prick procedures. This advancement directly broadens clinical acceptance and expands routine use across diverse age groups.

Growing adoption in personalized immunotherapy planning accelerates the Antigen Skin Test market, as allergists perform baseline reactivity profiling before initiating sublingual or subcutaneous desensitization protocols. Biotechnology firms formulate high-purity glycerinated extracts that minimize false positives from irritant reactions.

Applications encompass pre-treatment stratification for house dust mite sublingual tablets, venom immunotherapy candidate selection via wasp or bee extracts, occupational allergy screening in latex-sensitive healthcare workers, and seasonal allergy phenotyping for targeted environmental controls. Refined testing tools open avenues for combination panels that assess cross-reactivity among related allergens. Pharmaceutical companies increasingly mandate skin testing as entry criteria in phase III immunotherapy trials.

Rising integration with digital documentation systems invigorates the Antigen Skin Test market, as clinics adopt electronic wheal measurement tools and barcode-linked allergen vials for error-free reporting. Technology providers develop smartphone-compatible calipers and imaging software that quantify reactions objectively. These innovations support chronic urticaria evaluation through autologous serum skin testing, contact dermatitis patch testing follow-up with true-test panels, atopic dermatitis flare prediction via baseline IgE-mediated responses, and vaccine hypersensitivity risk assessment in egg-allergic individuals.

Digital workflows unlock opportunities for tele-allergy consultations and centralized database contributions to epidemiological studies. Healthcare networks actively implement these systems to comply with quality metrics and enhance reimbursement justification through standardized documentation. This technological synergy positions antigen skin testing as a cornerstone of modern allergy practice.

Key Takeaways

- In 2024, the market generated a revenue of US$ 2.3 Billion, with a CAGR of 5.1%, and is expected to reach US$ 3.8 Billion by the year 2034.

- The test type segment is divided into bacterial infections, parasitic infection, fungal infection, and others, with bacterial infections taking the lead in 2024 with a market share of 46.7%.

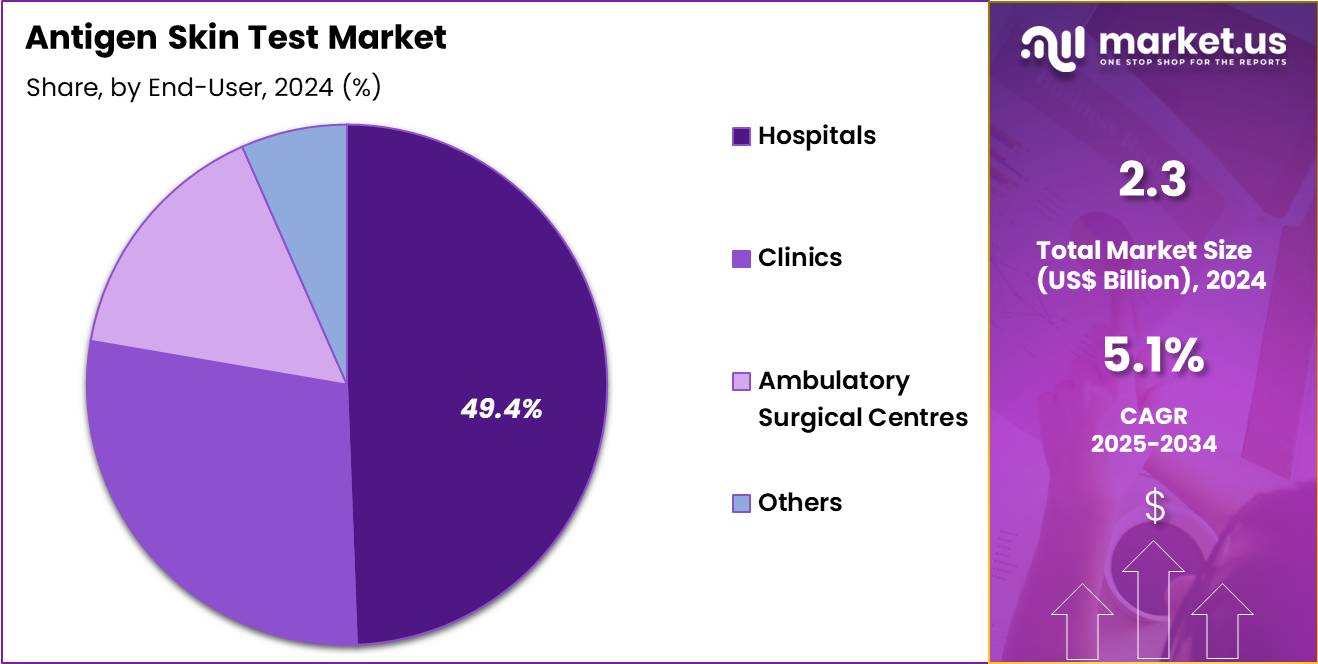

- Considering end-user, the market is divided into hospitals, clinics, ambulatory surgical centres, and others. Among these, hospitals held a significant share of 49.4%.

- North America led the market by securing a market share of 38.2% in 2024.

Test Type Analysis

Bacterial infections, holding 46.7%, are expected to dominate as clinicians rely on antigen skin tests for rapid detection of tuberculosis, diphtheria, brucellosis, and other bacterial conditions. Rising global TB burden strengthens demand for intradermal bacterial antigen testing in both high-incidence and emerging regions. Public-health programs emphasize early detection strategies, increasing routine screening volumes.

Hospitals adopt standardized bacterial skin test antigens that ensure better sensitivity and consistent clinical interpretation. Research groups study immune responses to bacterial pathogens, raising test utilization in academic centres. Diagnostic campaigns in rural and underserved areas expand demand for simple, low-infrastructure tests. Pharmaceutical companies conducting vaccine and immunology trials also increase use of bacterial skin tests.

Growing antimicrobial resistance concerns intensify the need for accurate diagnosis to guide targeted therapy. Awareness programs highlight early testing benefits, expanding patient participation. These factors keep bacterial infections anticipated to remain the leading test type.

End-User Analysis

Hospitals, holding 49.4%, are anticipated to dominate as they manage the highest patient inflow requiring diagnostic evaluation for infectious diseases. Clinicians depend on antigen skin tests to guide timely treatment decisions, especially for bacterial infections such as TB. Hospitals expand infectious-disease units and screening programs, increasing daily testing throughput. Rising incidence of chronic and acute infections strengthens test adoption across outpatient and inpatient departments.

Larger hospitals invest in standardized antigen testing supplies to ensure accuracy and reproducibility. Emergency departments rely on rapid skin-based diagnostics for immediate risk assessment. Multidisciplinary teams use test results to plan follow-up care and preventive strategies.

Public-health surveillance programs often operate through hospital networks, raising testing volumes. Hospitals also participate in research and vaccination studies that incorporate antigen skin testing. These growth drivers keep hospitals projected to remain the dominant end-user segment in the antigen skin test market.

Key Market Segments

By Test Type

- Bacterial Infections

- Parasitic Infection

- Fungal Infection

- Others

By End-user

- Hospitals

- Clinics

- Ambulatory Surgical Centres

- Others

Drivers

Increasing Incidence of Tuberculosis is Driving the Market

The rising global incidence of tuberculosis has become a key driver for the antigen skin test market, as these tests, particularly the tuberculin skin test, remain a cornerstone for detecting latent TB infection in high-burden regions. This trend is exacerbated by factors such as urbanization and HIV co-infection, necessitating widespread screening to identify asymptomatic carriers and prevent active disease progression.

Public health programs in endemic areas are prioritizing affordable skin tests for their simplicity and low cost, integrating them into national elimination strategies. Manufacturers are enhancing test formulations to improve readability and reduce subjective interpretation errors. Regulatory bodies endorse skin tests for initial screening in resource-limited settings, complementing molecular diagnostics for confirmation.

Collaborative initiatives between international organizations and local governments facilitate kit distributions, ensuring supply in remote communities. The economic rationale supports expanded testing, as early detection averts costly treatment for advanced TB. Professional guidelines recommend annual skin testing for at-risk groups, embedding the method in routine health checkups.

This driver spurs innovations in dual-antigen tests, combining tuberculin with specific antigens for higher specificity. Educational campaigns target healthcare workers to optimize test administration and result evaluation. The World Health Organization reported an estimated 10.8 million new tuberculosis cases worldwide in 2023.

Restraints

False Positive Results Due to BCG Vaccination is Restraining the Market

The high rate of false positives in antigen skin tests caused by prior BCG vaccination continues to restrain market growth, leading to overdiagnosis and unnecessary follow-up testing in vaccinated populations. This cross-reactivity confounds interpretation, particularly in countries with universal BCG programs, reducing the test’s reliability for latent TB detection. Healthcare providers often require confirmatory tests like IGRA, increasing overall diagnostic costs and complexity.

The restraint limits the test’s utility in low-prevalence areas, where false positives dilute screening efficiency. Regulatory warnings highlight the issue, prompting caution in guideline recommendations. Manufacturers struggle to develop BCG-independent antigens, facing prolonged validation periods. These limitations perpetuate inequities, as unvaccinated groups benefit more from skin testing.

Policy shifts toward IGRA in high-income settings further marginalize traditional skin tests. The challenge discourages investment in skin test enhancements, favoring alternative technologies. Mitigation through adjusted cutoffs remains controversial due to variable sensitivity. In a 2024 study, the positivity rate for the tuberculin skin test was 53.96%, significantly higher than 10.37% for the ESAT6-CFP10 skin test, indicating substantial false positives.

Opportunities

Expansion of TB Screening in High-Burden Countries is Creating Growth Opportunities

The intensification of tuberculosis screening initiatives in high-burden countries is creating substantial growth opportunities for the antigen skin test market, leveraging the test’s affordability for mass campaigns. These programs target migrants and close contacts, demanding large-scale kit procurement to achieve elimination goals by 2030. Opportunities arise in customizing tests for local strains, enhancing relevance in diverse epidemiological contexts.

Regulatory alignments with global standards facilitate tender processes, securing long-term contracts for suppliers. Partnerships with non-governmental organizations enable distribution to underserved rural areas, broadening market reach. This expansion supports hybrid screening models, combining skin tests with digital tracking for improved follow-up. Economic incentives from donor funding offset logistics costs, promising volume-based pricing advantages.

Training modules for community health workers integrate skin test protocols, fostering sustained usage. These developments position the market for innovations in stable, heat-resistant formulations. Long-term, successful screenings generate data for policy refinements, reinforcing test demand. The World Health Organization identifies 30 high-burden countries that account for 85% of global TB cases in 2022.

Impact of Macroeconomic / Geopolitical Factors

Economic headwinds and healthcare spending caps challenge clinics to cut back on antigen skin test inventories, slowing routine allergy screenings in underserved communities. Growing patient advocacy for personalized diagnostics and insurance expansions, however, encourage providers to stock these tests for comprehensive immune profiling.

Geopolitical strains in Central American trade corridors delay allergen extract shipments from key producers, inflating timelines and costs for test kit assemblers worldwide. These strains, however, motivate firms to build diversified extraction partnerships and automate blending processes that enhance product shelf life. U.S. Section 301 tariffs at 25% on Chinese-imported diagnostic reagents, ongoing into late 2025, raise material expenses for American distributors and tighten margins on bulk orders.

Suppliers address this directly by shifting to USMCA-eligible sources and qualifying for exclusion processes that stabilize pricing. In total, these factors sharpen operational focus and encourage cross-border ingenuity. The antigen skin test market pushes ahead with real promise, converting obstacles into opportunities for more efficient, accessible allergy management that benefits patients everywhere.

Latest Trends

Introduction of Antigen-Specific Skin Tests is a Recent Trend

The development of antigen-specific skin tests for tuberculosis has marked a notable trend in 2024, offering improved specificity over traditional tuberculin tests by using recombinant ESAT-6 and CFP-10 antigens. This innovation reduces false positives from BCG vaccination, enabling more accurate latent TB detection in vaccinated populations. The trend emphasizes ease of administration, with single-visit readouts comparable to IGRA without blood handling.

Developers are validating these tests in clinical trials, demonstrating sensitivity rates exceeding 90% for active TB. Regulatory approvals in multiple countries accelerate rollout, positioning them as alternatives in low-resource settings. This shift integrates with digital health apps for result logging, enhancing surveillance capabilities. Competitive efforts focus on multiplex versions targeting co-infections like HIV. Broader adoption in immigration screening highlights the test’s practicality for large-scale use.

The trend intersects with vaccine research, using skin tests for immune response evaluation. Ethical guidelines address equitable access to prevent disparities in implementation. The World Health Organization endorsed antigen-based skin tests for TB infection detection in its 2024 fact sheet, noting their potential to complement existing diagnostics.

Regional Analysis

North America is leading the Antigen Skin Test Market

North America accounted for 38.2% of the overall market in 2024, and the region experienced steady growth as hospitals, public-health programs, and specialty clinics expanded skin-based diagnostic screening for tuberculosis, fungal allergies, and hypersensitivity conditions. Providers increased test utilization because early detection of latent TB became a priority across high-risk populations, including immunocompromised patients and recent immigrants.

Allergy clinics conducted more antigen-based skin evaluations as environmental allergen exposure rose across urban areas. Hospitals strengthened pre-employment and pre-procedural screening requirements, which further increased procedural volume. The CDC reported 9,615 tuberculosis cases in the United States in 2023, marking the highest annual count since 2013 and directly contributing to higher demand for skin-based TB screening tools.

Academic centers broadened research on immune reactivity, encouraging greater adoption of standardized skin-test reagents. These factors collectively supported notable regional market expansion in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to record strong growth during the forecast period as healthcare systems intensify screening programs for infectious and allergic diseases across densely populated regions. Hospitals increase skin-based testing for TB exposure as countries reinforce national elimination strategies. Allergy clinics expand diagnostic services due to rising asthma and environmental-sensitivity cases linked to rapid urbanization.

Public-health agencies promote early identification of latent TB in schoolchildren, healthcare workers, and migrant communities, boosting demand for reliable skin-based immunodiagnostics. Diagnostic laboratories scale distribution networks to improve reagent availability throughout Southeast Asia.

The World Health Organization reported 2.16 million tuberculosis cases in India in 2022, highlighting the region’s urgent need for widespread screening. Clinical researchers enhance immune-response studies, requiring standardized skin-test panels. These combined developments position Asia Pacific for sustained diagnostic expansion in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading firms in the antigen-skin test domain sharpen their competitive edge by expanding their test portfolios beyond standard allergen prick assays to include skin-based diagnostics for fungal, bacterial and infectious-disease antigens, thereby appealing to a broader clinical base. They invest in product innovation that produces easy-to-use, high-sensitivity reagents and skin-test kits tailored for resource-limited or decentralized diagnostic settings, improving access across emerging markets.

They strengthen global reach by building distributor networks and forging partnerships with hospitals and public-health screening programs in regions with rising infectious-disease burden. They reinforce lab adoption by aligning tests with regulatory standards and launching training and support services to ensure correct implementation in diverse clinical environments. They pursue expansion through mergers or alliances with niche diagnostic firms, enabling them to integrate new antigen panels quickly and respond to evolving disease profiles.

One notable player, bioMérieux SA, uses its broad in-vitro diagnostics platform, global distribution infrastructure, and diverse reagent and instrument lineup to support robust infection and allergy diagnostics, thereby positioning itself strongly within the antigen-skin test market.

Top Key Players

- Thermo Fisher Scientific, Inc.

- QIAGEN N.V.

- BioMérieux SA

- Abbott Laboratories

- DiaSorin S.p.A.

- Siemens Healthineers

- Bio‑Rad Laboratories, Inc.

- Ortho Clinical Diagnostics

Recent Developments

- In January 2025, the FDA released strengthened guidance related to donor screening for Mycobacterium tuberculosis. Because PPD skin testing is commonly used to detect Mtb infection, the updated guidance reinforces the need for dependable screening practices to minimize transmission risks associated with HCT/Ps.

- In April 2024, Beckman Coulter Life Sciences introduced its Basophil Activation Test, a flow cytometry–based assay. Although performed in vitro rather than on the skin, this test offers a sensitive option for confirming IgE-mediated allergic responses, helping clarify uncertain skin test results and supporting broader adoption of reliable allergy testing workflows.

Report Scope

Report Features Description Market Value (2024) US$ 2.3 Billion Forecast Revenue (2034) US$ 3.8 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Test Type (Bacterial Infections, Parasitic Infection, Fungal Infection, and Others), By End-user (Hospitals, Clinics, Ambulatory Surgical Centres, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, QIAGEN N.V., BioMérieux SA, Abbott Laboratories, DiaSorin S.p.A., Siemens Healthineers, Bio‑Rad Laboratories, Ortho Clinical Diagnostics. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Thermo Fisher Scientific, Inc.

- QIAGEN N.V.

- BioMérieux SA

- Abbott Laboratories

- DiaSorin S.p.A.

- Siemens Healthineers

- Bio‑Rad Laboratories, Inc.

- Ortho Clinical Diagnostics