Global Antidepressants Market By Drug Class (Reuptake Inhibitors, Serotonin-Norepinephrine Reuptake Inhibitors, Tricyclic Antidepressants, Serotonin Antagonist, Selective Serotonin Reuptake Inhibitors, Monoamine Oxidase Inhibitors, and Others), By Indication (Major Depressive Disorder, Attention Deficit Hyperactivity Disorder, Anxiety Disorders, and Others), By Route of Administration (Oral and Injectable), By End-User (Hospitals & Specialty Centres and Homecare), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2033

- Published date: April 2025

- Report ID: 146709

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

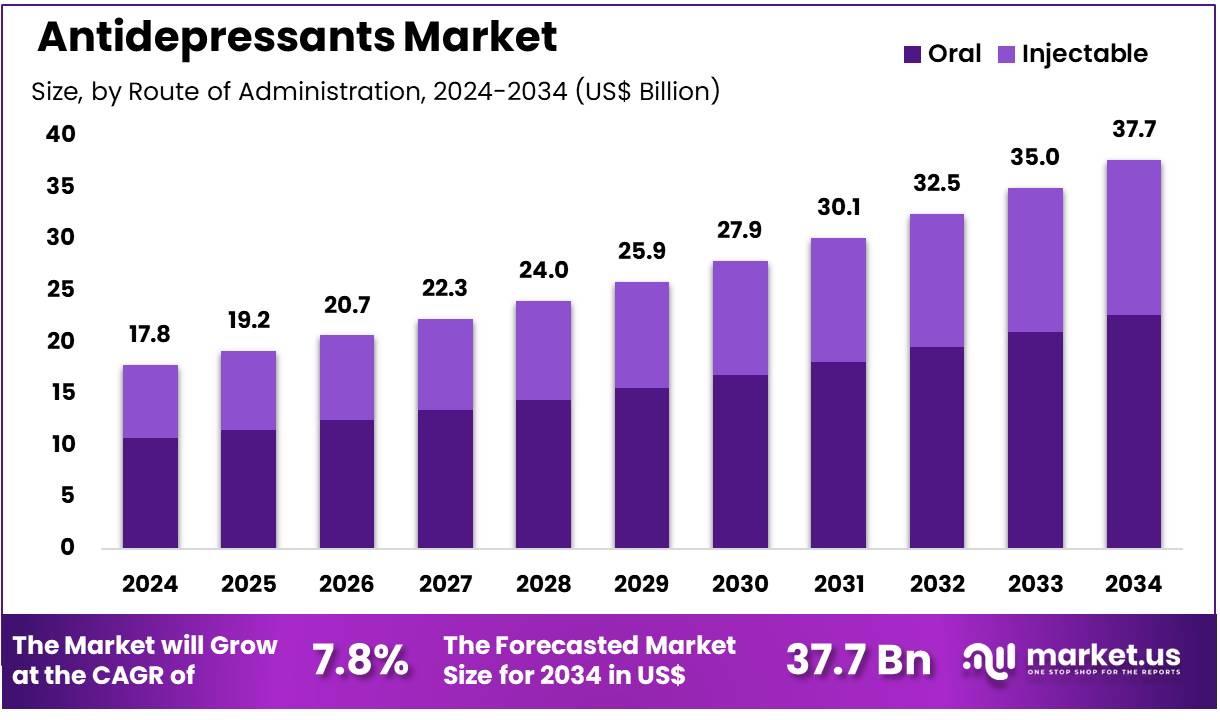

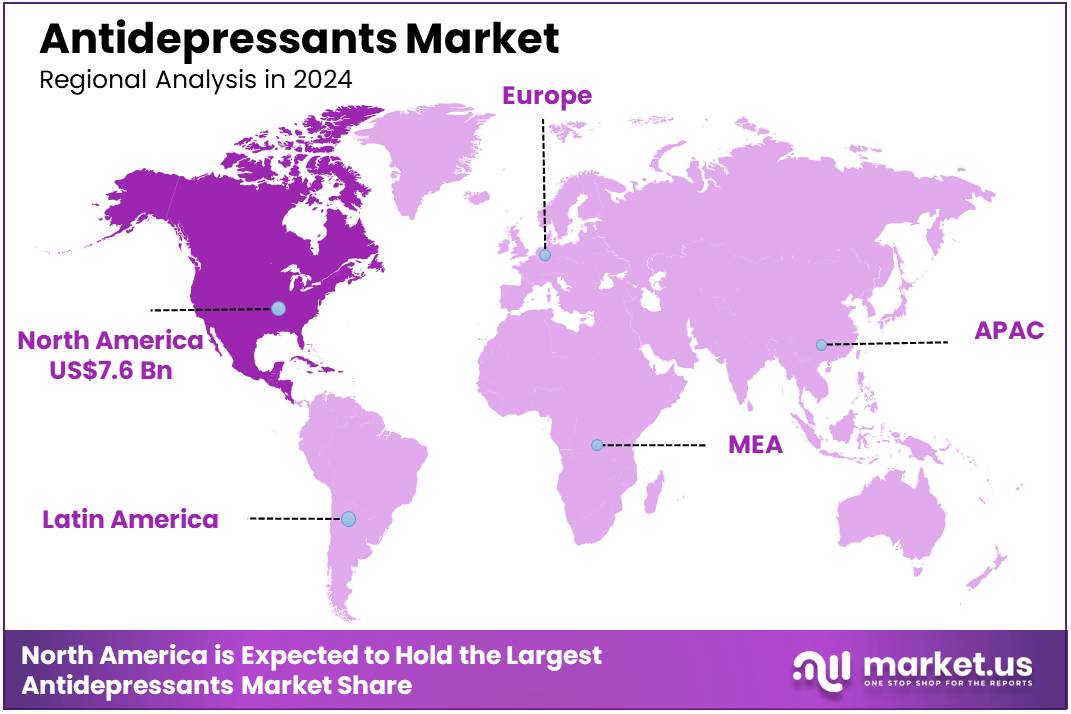

Global Antidepressants Market size is expected to be worth around US$ 37.7 billion by 2034 from US$ 17.8 billion in 2024, growing at a CAGR of 7.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.6% share with a revenue of US$ 7.6 Billion.

Increasing awareness of mental health conditions and the growing prevalence of depression and other mood disorders drive the expansion of the antidepressants market. Rising societal focus on mental well-being and the need for effective treatments have created significant opportunities for pharmaceutical companies to develop innovative therapies.

Recent trends indicate a shift toward faster-acting medications with fewer side effects, improving patient adherence and outcomes. In August 2022, Axsome Therapeutics received approval from the US FDA for Auvelity, a combination of dextromethorphan and bupropion, used to treat major depressive disorder in adults.

This treatment is notable for its rapid onset of action, showing effects within a week of use. The success of such drugs contributes to the growing demand for advanced antidepressants, positioning the market for continued growth. Companies continue to explore new formulations and personalized approaches to meet the evolving needs of patients with depression, anxiety, and other related disorders.

Key Takeaways

- In 2024, the market for antidepressants generated a revenue of US$ 17.8 billion, with a CAGR of 7.8%, and is expected to reach US$ 37.7 billion by the year 2033.

- The drug class segment is divided into reuptake inhibitors, serotonin-norepinephrine reuptake inhibitors, tricyclic antidepressants, serotonin antagonist, selective serotonin reuptake inhibitors, monoamine oxidase inhibitors, and others, with selective serotonin reuptake inhibitors taking the lead in 2024 with a market share of 53.5%.

- Considering indication, the market is divided into major depressive disorder, attention deficit hyperactivity disorder, anxiety disorders, and others. Among these, major depressive disorder held a significant share of 52.7%.

- Furthermore, concerning the route of administration segment, the market is segregated into oral and injectable. The oral sector stands out as the dominant player, holding the largest revenue share of 60.2% in the antidepressants market.

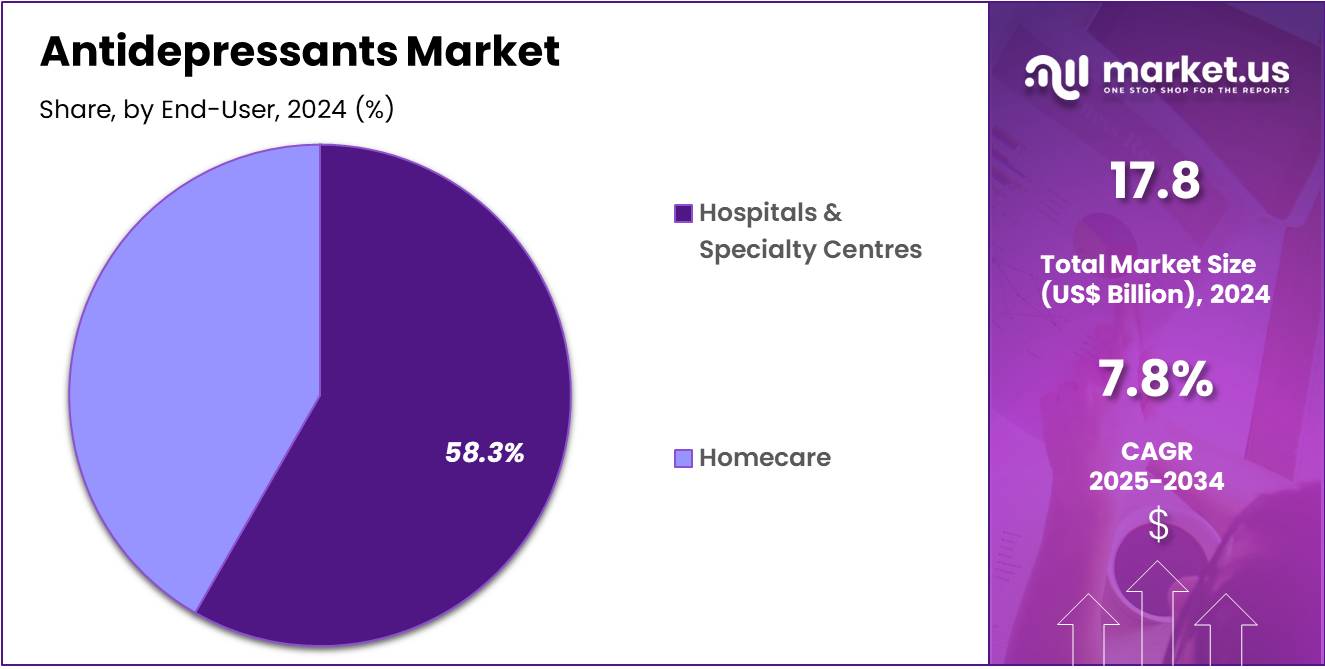

- The end-user segment is segregated into hospitals & specialty centres and homecare, with the hospitals & specialty centres segment leading the market, holding a revenue share of 58.3%.

- North America led the market by securing a market share of 42.6% in 2024.

Drug Class Analysis

The selective serotonin reuptake inhibitors segment led in 2024, claiming a market share of 53.5% owing to their effectiveness and relatively favorable side effect profiles compared to other antidepressant classes. SSRIs, which include drugs like fluoxetine, sertraline, and escitalopram, are anticipated to remain the first-line treatment for major depressive disorder and other anxiety-related conditions.

Their ability to specifically target serotonin reuptake, improving mood regulation, will likely continue to drive demand. Furthermore, growing awareness and reduced stigma surrounding mental health are expected to boost patient access to SSRIs, fueling market growth.

Indication Analysis

The major depressive disorder held a significant share of 52.7% as the global prevalence of depression continues to rise. With the increasing recognition of mental health issues and the growing population, MDD remains one of the leading causes of disability worldwide.

Advances in research, along with a greater focus on personalized treatment approaches, are likely to enhance the efficacy of antidepressants for MDD. Furthermore, the high economic and social burden associated with untreated depression will likely drive demand for antidepressant treatments, contributing to the growth of this segment.

Route of Administration Analysis

The oral segment had a tremendous growth rate, with a revenue share of 60.2% as oral administration remains the preferred route for most antidepressant therapies. Oral formulations of antidepressants, such as tablets and capsules, are anticipated to maintain dominance due to their ease of use, convenience, and cost-effectiveness compared to injectable forms.

The increasing focus on patient adherence and the introduction of extended-release oral formulations that reduce side effects are projected to drive market growth. Oral antidepressants’ wide acceptance among patients and healthcare providers is likely to continue fueling their market share.

End-User Analysis

The hospitals & specialty centres segment grew at a substantial rate, generating a revenue portion of 58.3% due to the crucial role these institutions play in the treatment of severe mental health conditions, including treatment-resistant depression. Hospitals and specialty centers, equipped with multidisciplinary teams and advanced therapeutic options, provide comprehensive care for patients requiring intensive treatment.

The increasing number of patients seeking specialized mental health services, coupled with the expansion of dedicated mental health units in hospitals, will likely drive the demand for antidepressants. As awareness of mental health issues grows, more patients are expected to receive antidepressant therapies in these settings, contributing to market growth.

Key Market Segments

Drug Class

- Reuptake Inhibitors

- Serotonin-Norepinephrine Reuptake Inhibitors

- Tricyclic Antidepressants

- Serotonin Antagonist

- Selective Serotonin Reuptake Inhibitors

- Monoamine Oxidase Inhibitors

- Others

Indication

- Major Depressive Disorder

- Attention Deficit Hyperactivity Disorder

- Anxiety Disorders

- Others

Route of Administration

- Oral

- Injectable

End-User

- Hospitals & Specialty Centres

- Homecare

Drivers

Rising Global Burden of Depressive Disorders is driving the market

The increasing prevalence of depressive disorders worldwide is a significant driver for the antidepressants market. Depression is a leading cause of disability globally, affecting individuals across all age groups and socioeconomic backgrounds. The World Health Organization (WHO) estimated in 2024 that approximately 5% of adults worldwide suffer from depression.

Factors such as increased awareness, reduced stigma associated with mental health, and improved diagnostic capabilities are contributing to a higher number of individuals being diagnosed and seeking treatment for depression.

Furthermore, the long-term nature of depressive disorders often necessitates extended pharmacological treatment, sustaining the demand for antidepressant medications. This substantial and growing patient population underscores the critical need for effective antidepressant therapies, thereby driving market expansion.

Restraints

Side Effects and Safety Concerns are restraining the market

Despite their efficacy, antidepressants are often associated with various side effects and safety concerns that can restrain market growth. Common side effects include nausea, weight gain, sexual dysfunction, and drowsiness, which can impact patient compliance and lead to discontinuation of treatment. More serious, though less common, concerns such as increased suicidal ideation in younger individuals at the start of treatment and the risk of serotonin syndrome or withdrawal symptoms upon abrupt cessation also contribute to cautious prescribing and patient apprehension.

The US Food and Drug Administration (FDA) mandates boxed warnings on all antidepressants regarding the potential risk of increased suicidal thoughts and behaviors in children, adolescents, and young adults. These well-documented adverse effects necessitate careful monitoring and can influence treatment choices, potentially limiting the widespread adoption of certain antidepressant medications.

Opportunities

Development of Novel Antidepressants with Improved Profiles is creating growth opportunities

Continuous advancements in neuropharmacology are leading to the development of novel antidepressants with improved efficacy, faster onset of action, and fewer side effects, creating significant growth opportunities in the market. Research is focusing on new targets beyond the traditional monoamine system, such as the glutamate pathway and GABA receptors.

For instance, Esketamine, a nasal spray approved by the FDA, offers a novel mechanism of action by targeting the NMDA receptor and has shown rapid antidepressant effects in treatment-resistant depression. Additionally, new drugs like Gepirone, approved in 2023, act as serotonin receptor agonists with a potentially favorable side effect profile.

The development of such innovative treatments that address the limitations of existing antidepressants, particularly in terms of speed of action and tolerability, is expected to drive market growth by offering better options for patients who have not responded well to traditional therapies.

Impact of Macroeconomic / Geopolitical Factors

The antidepressants market is influenced by several macroeconomic factors. Economic growth typically correlates with increased healthcare spending, improving access to antidepressant medications for individuals with conditions like major depressive disorder and anxiety disorders. Conversely, economic downturns can strain healthcare budgets, potentially limiting access to necessary treatments. Inflation can drive up the costs of pharmaceutical production, potentially resulting in higher prices for consumers.

Geopolitical events, such as trade disputes or global health emergencies, can disrupt the supply chains for active pharmaceutical ingredients and finished antidepressant drugs, leading to price volatility and potential shortages. The increasing global prevalence of mental health disorders is a significant driver for market growth; the World Health Organization estimates that over 300 million people worldwide suffer from depression.

The recent US announcement of a potential 10% baseline tariff on imported pharmaceutical products, including antidepressants, introduces uncertainty into the market. While the US has a domestic pharmaceutical industry, a significant volume of both active ingredients and finished antidepressant medications are imported. For instance, in 2024, the US antidepressant drugs market was valued at approximately US$6.8 billion.

Tariffs could increase the cost of these imported medications, potentially leading to higher prices for American patients. Given that generic drugs constitute a large portion of antidepressant prescriptions (around 90% of prescriptions dispensed in the US are generics), tariffs could erode their cost advantage, impacting affordability and access, particularly for price-sensitive patients.

While the stated aim of tariffs is often to encourage domestic production, shifting manufacturing for complex pharmaceuticals can be a long and involved process, and in the short term, increased costs could burden the healthcare system and potentially limit access to essential antidepressant therapies.

Latest Trends

Increasing Focus on Personalized Medicine in Depression Treatment is a recent trend

A notable recent trend in the antidepressants market is the growing emphasis on personalized medicine approaches to optimize treatment outcomes. Recognizing the heterogeneity of depression and individual responses to medication, clinicians are increasingly utilizing genetic testing to identify potential variations in drug metabolism and receptor sensitivity. This information can help in selecting the most appropriate antidepressant and dosage for a specific patient, potentially improving efficacy and reducing the likelihood of adverse effects.

Furthermore, research into biomarkers that can predict treatment response is gaining momentum. The development of diagnostic tools that can better characterize subtypes of depression and predict which patients are most likely to benefit from specific treatments represents a significant shift towards a more tailored and effective approach to managing this complex disorder. This trend towards personalized therapy has the potential to enhance treatment success rates and improve patient satisfaction in the antidepressants market.

Regional Analysis

North America is leading the Antidepressants Market

North America dominated the market with the highest revenue share of 42.6% owing to increasing awareness of mental health and greater access to diagnosis and treatment. The National Institute of Mental Health (NIMH) reported that in 2022, an estimated 23.1% of US adults had any mental illness, representing approximately 59.3 million people, indicating a substantial portion of the population potentially requiring treatment.

The Substance Abuse and Mental Health Services Administration (SAMHSA) reported in 2023 that 52.9 million adults aged 18 or older had a mental illness in 2021, representing 21.6% of this population, further highlighting the significant prevalence of these conditions. Furthermore, the NIMH continues to support extensive research on the causes and treatments for depression, indicating a sustained focus on addressing this condition.

The US Food and Drug Administration (FDA) approved several new formulations and delivery methods for depression treatments in recent years, aiming to improve patient adherence and outcomes. This regulatory activity reflects the ongoing need for effective therapies for depressive disorders.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing recognition of mental health issues and expanding healthcare infrastructure. The World Health Organization (WHO) highlights that mental health disorders are a growing concern in the Asia Pacific region, although stigma and access to care remain challenges. However, there is increasing government focus on mental health services in several countries.

For instance, the National Mental Health Programme in India has been actively working to integrate mental healthcare with general healthcare services. Furthermore, growing urbanization and changing lifestyles in many Asia Pacific countries are contributing to increased stress levels, potentially leading to a higher prevalence of depressive disorders. As awareness campaigns and improved access to mental health professionals continue to expand, the demand for effective treatments for depression is expected to rise across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market for medications treating depression pursue growth through several avenues. They heavily invest in research and development to discover novel compounds and enhance the efficacy and safety profiles of existing treatments. Strategic collaborations, licensing agreements, and acquisitions enable these companies to broaden their therapeutic pipelines and expand their market reach globally.

Furthermore, they actively seek approvals for new indications and formulations to address a wider spectrum of depressive disorders. A significant focus on increasing awareness, reducing stigma associated with mental health conditions, and improving access to care also contributes to their market expansion.

Pfizer Inc. is a global biopharmaceutical company headquartered in New York City. Established in 1849, Pfizer applies science and its global resources to bring therapies to people that extend and significantly improve their lives. The company strives to set the standard for quality, safety, and value in the discovery, development, and manufacture of healthcare products, including medicines and vaccines.

Pfizer’s diverse portfolio addresses a wide range of therapeutic areas, including internal medicine, vaccines, oncology, inflammation and immunology, and rare diseases. With a commitment to innovation and global health, Pfizer collaborates with healthcare providers, governments, and communities to support and expand access to reliable and affordable healthcare worldwide.

Top Key Players

- Mallinckrodt

- Johnson & Johnson

- GlaxoSmithKline plc.

- Endo Pharmaceuticals plc

- Lundbeck

- Avet Pharmaceuticals Inc.

- Aurobindo Pharma

- Sun Pharmaceutical Industries Limited

Recent Developments

- In April 2022, Lundbeck’s antidepressant vortioxetine, branded as Trintellix and Brintellix, demonstrated superior efficacy in a head-to-head trial against Pfizer’s desvenlafaxine (Pristiq). The study focused on patients with Major Depressive Disorder (MDD) who had shown partial improvement with selective serotonin reuptake inhibitors (SSRIs).

- In March 2022, Sun Pharmaceutical Industries Limited entered into a patent licensing agreement with Lundbeck to market its own version of vortioxetine in India under the name VORTIDIF. This partnership allows Sun Pharma to distribute vortioxetine in the Indian market, providing an important treatment option for MDD patients.

Report Scope

Report Features Description Market Value (2024) US$ 17.8 billion Forecast Revenue (2034) US$ 37.7 billion CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug Class (Reuptake Inhibitors, Serotonin-Norepinephrine Reuptake Inhibitors, Tricyclic Antidepressants, Serotonin Antagonist, Selective Serotonin Reuptake Inhibitors, Monoamine Oxidase Inhibitors, and Others), By Indication (Major Depressive Disorder, Attention Deficit Hyperactivity Disorder, Anxiety Disorders, and Others), By Route of Administration (Oral and Injectable), By End-User (Hospitals & Specialty Centres and Homecare) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Mallinckrodt, Johnson & Johnson, GlaxoSmithKline plc., Endo Pharmaceuticals plc, Lundbeck, Avet Pharmaceuticals Inc., Aurobindo Pharma, and Sun Pharmaceutical Industries Limited. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Mallinckrodt

- Johnson & Johnson

- GlaxoSmithKline plc.

- Endo Pharmaceuticals plc

- Lundbeck

- Avet Pharmaceuticals Inc.

- Aurobindo Pharma

- Sun Pharmaceutical Industries Limited