Global Antibody Production Market Analysis By Product [Instruments (Bioreactors (Multi-Use Bioreactors, Single-Use Bioreactors), Chromatography Systems, Filtration Systems), Consumables (Media, Buffers And Reagents, Chromatography Resins And Columns, Filtration Consumables And Accessories, Others), Software], By Process (Upstream Processing, Downstream Processing), By Type (Polyclonal Antibody, Monoclonal Antibody), By End-Use (Pharmaceutical And Biotechnology Companies, Research Laboratories, Cros And Cdmos), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2023

- Report ID: 53693

- Number of Pages: 292

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

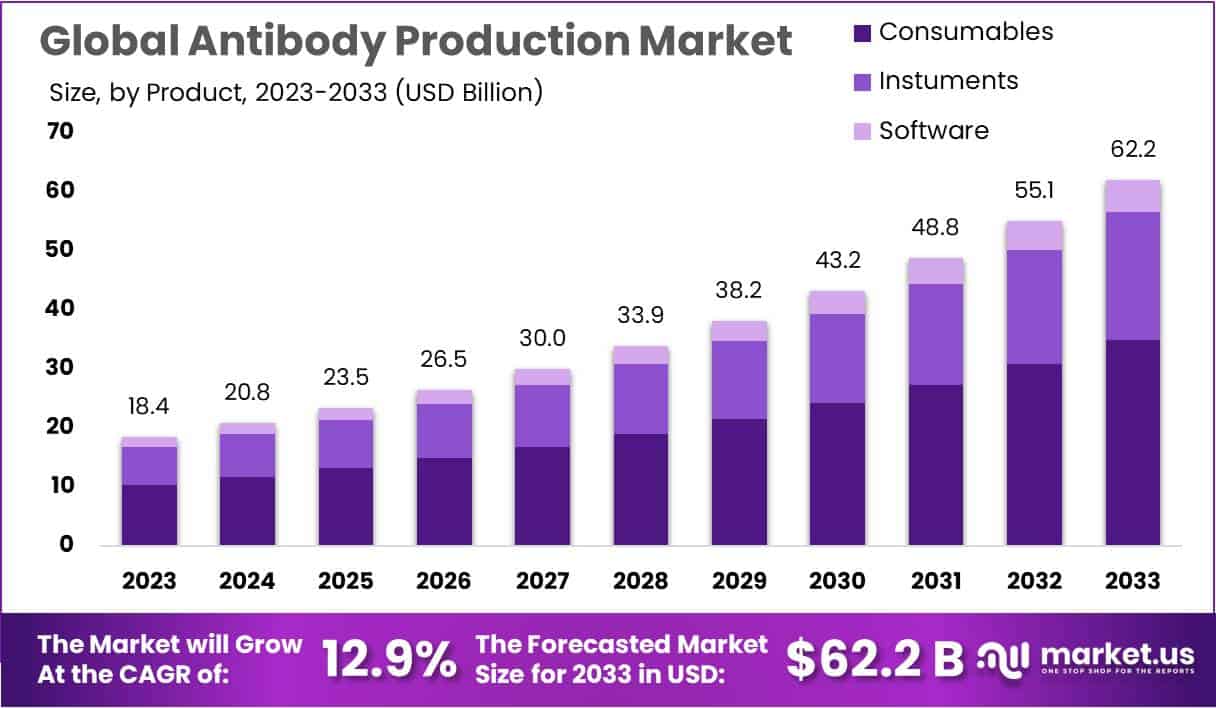

The Antibody Production Market Size is projected to witness substantial growth of approximately USD 62.2 billion by the year 2033. This significant expansion is compared to the market valuation of USD 18.4 billion in 2023. The forecast period, spanning from 2024 to 2033, is expected to register a robust Compound Annual Growth Rate (CAGR) of 12.9%. This exponential growth reflects the increasing demand and advancements in antibody production technologies, emphasizing the market’s potential for substantial expansion over the coming decade.

Antibody production is the immune system’s process of generating antibodies, or immunoglobulins, to combat foreign invaders like bacteria and viruses. This intricate process unfolds as specialized cells, known as antigen-presenting cells, identify and engulf foreign substances, presenting their fragments. Triggering B cells, these immune warriors undergo clonal expansion, rapidly multiplying and differentiating into plasma cells. These plasma cells release large quantities of antibodies into the bloodstream, enabling specific antigen recognition.

The antibody production market, a dynamic sector pivotal in the manufacturing and distribution of antibodies, is witnessing robust growth due to advancements in biotechnology and healthcare. Monoclonal and polyclonal antibodies play a critical role in therapeutic applications, particularly in targeted cancer treatments, autoimmune disease management, and diagnostic assays.

The market, segmented by antibody types, applications, and end-users, caters to pharmaceutical giants, specialized biotech firms, and contract manufacturing organizations. Notable trends include personalized medicine development and ongoing technological innovations, positioning the industry for sustained expansion. However, regulatory challenges, cost-effectiveness, and the global impact of the COVID-19 pandemic underscore the need for continual adaptation and innovation.

Key Takeaways

- Market Growth: The antibody Production Market is set to reach USD 62.2 billion by 2033, with a robust 12.9% CAGR from 2024 to 2033.

- By Product: Consumables, led by Media and Chromatography Resins, held 56.1% market share in 2023, pivotal for biomanufacturing efficiency.

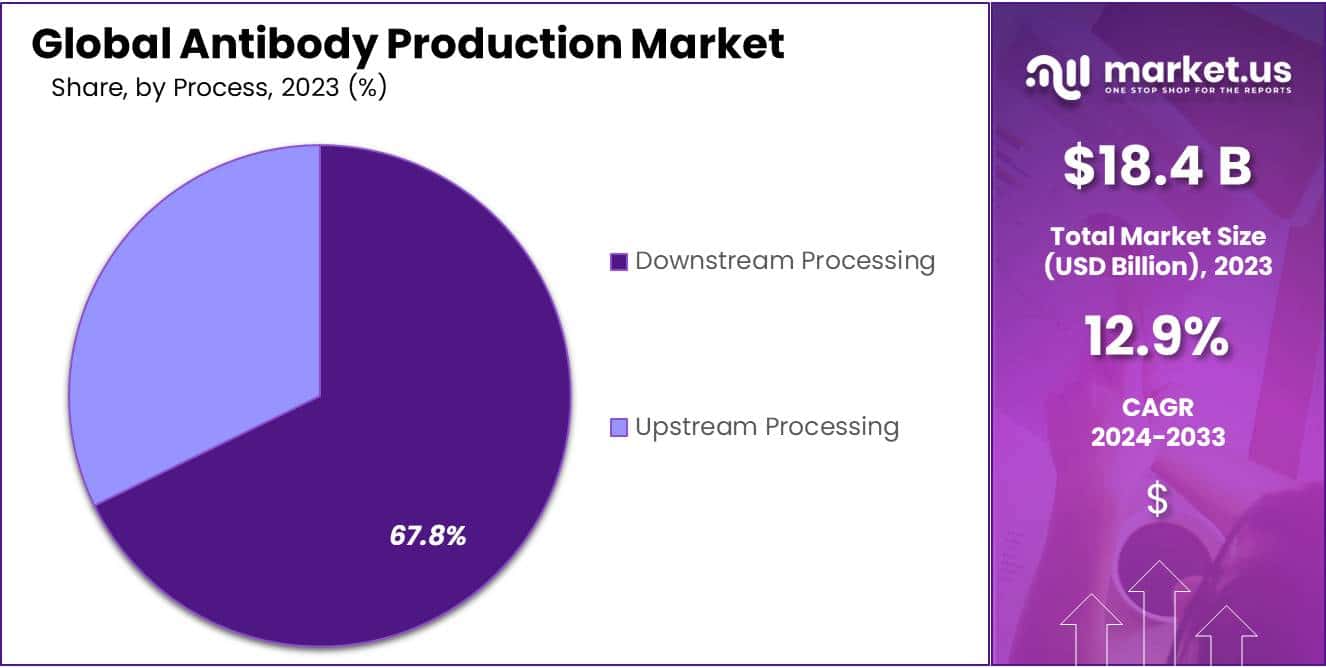

- By Process: Downstream Processing commanded 67.8% market share in 2023, highlighting industry focus on efficient purification techniques.

- By Type: Monoclonal Antibodies claimed a significant 63.9% market share in 2023, underscoring their targeted therapeutic and diagnostic appeal.

- End-Use Landscape: Pharmaceutical and Biotechnology Companies dominated with 56.7% market share, emphasizing their pivotal role in market advancement.

- Market Drivers: Rising demand for therapeutic antibodies, biotechnology advancements, and healthcare infrastructure investments propel a 12.9% CAGR.

- Challenges: High production costs, regulatory approvals, limited capacities, and contamination risks hinder market growth.

- Notable Trends: Increasing collaboration, sustainability focus, and AI integration in antibody production processes are notable industry trends.

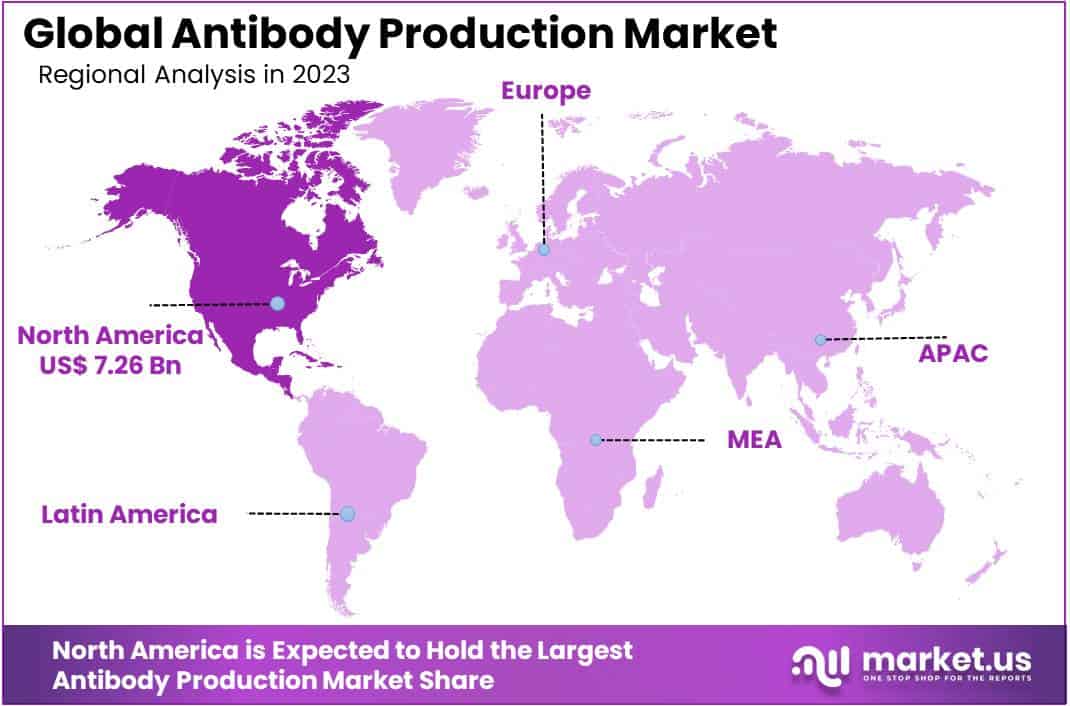

- Regional Dynamics: North America leads with 39.5% market share (USD 7.26 billion), driven by advanced facilities, while Asia-Pacific shows rapid momentum.

- Future Outlook: Continuous adaptation, innovation, and navigating regulatory challenges are crucial for stakeholders to shape the evolving antibody production landscape.

Product Analysis

In 2023, the Antibody Production market showcased a prominent trend with the Consumables segment securing a leading market position, accounting for over 56.1% of the total market share. This segment encompasses various essential components vital for the antibody production process.

Consumables, which include Media, Buffers and Reagents, Chromatography Resins and Columns, and Filtration Consumables and Accessories, emerged as a pivotal force driving market growth. These components play a crucial role in the intricate process of antibody production, contributing to the overall efficiency and success of the biomanufacturing ecosystem.

The significance of Consumables lies in their indispensable function as supporting elements, ensuring the seamless operation of bioreactors, chromatography systems, and filtration systems. These consumables act as the lifeblood of the antibody production process, facilitating the optimal environment for the growth and development of antibodies.

Media, Buffers, and Reagents act as the foundation for cell culture, providing the necessary nutrients and conditions for cells to thrive. Chromatography Resins and Columns play a pivotal role in the purification of antibodies, ensuring high quality and purity. Filtration Consumables and Accessories are essential for separating and purifying the antibody product, contributing to the overall yield and efficacy.

It is evident that the Consumables segment is not only a significant contributor but also a linchpin in the intricate web of bioprocessing. The dominance of this segment highlights the industry’s dependence on reliable and efficient consumables, making it a focal point for manufacturers and stakeholders alike in the pursuit of advancing antibody production technologies.

Process Analysis

In 2023, the Downstream Processing segment held a dominant market position in the Antibody Production market, commanding a substantial market share of over 67.8%. This indicates a significant preference and traction within the industry for the downstream phase of antibody production.

Downstream Processing is a crucial step in the production chain, encompassing purification and isolation processes that refine the harvested antibodies. Companies are increasingly recognizing the importance of efficient downstream processes to ensure the production of high-quality antibodies.

On the other hand, Upstream Processing, while essential, held a slightly lower market share in 2023. This phase involves the initial steps of cell culture, fermentation, and antibody expression. The market dynamics suggest a nuanced balance, highlighting the emphasis on refining processes downstream after the initial production steps.

The dominance of Downstream Processing is attributed to the growing demand for streamlined and cost-effective purification techniques. As companies seek to optimize their production pipelines, the downstream phase becomes pivotal in ensuring the removal of impurities and obtaining antibodies in their purest form.

Looking ahead, this trend is indicative of the industry’s focus on enhancing the quality and efficiency of antibody production. It underscores the significance of refining processes post-expression, aligning with the overarching goal of delivering high-quality antibodies for various therapeutic and diagnostic applications.

Type Analysis

In the dynamic landscape of the Antibody Production Market in 2023, the Monoclonal Antibody segment emerged as the frontrunner, securing a commanding market share of over 63.9%. This indicates a significant preference and trust placed by end-users in the unique attributes offered by monoclonal antibodies.

Monoclonal antibodies, characterized by their specificity and uniform structure, have positioned themselves as indispensable tools in various therapeutic and diagnostic applications. Their dominance in the market is attributed to their targeted approach, ensuring precision in addressing specific antigens.

On the other hand, the Polyclonal Antibody segment, while contributing meaningfully to the market, held a comparatively smaller share. Polyclonal antibodies, with their diverse range of binding sites, remain valuable in certain research and diagnostic scenarios. However, the broader applicability and therapeutic efficacy of monoclonal antibodies have propelled them to the forefront of antibody production preferences.

As we navigate the intricate landscape of antibody production, it is evident that the market dynamics are influenced by the distinct advantages offered by each antibody type. Monoclonal antibodies, with their precision and targeted capabilities, continue to shape and dominate the market, showcasing the ongoing evolution and specialization within the antibody production sector.”

End-use Analysis

In 2023, the Antibody Production market showcased a remarkable performance, with the Pharmaceutical and Biotechnology Companies segment emerging as the frontrunner. This dynamic sector secured a dominant market position, commanding an impressive share of more than 56.7%. The robust presence of pharmaceutical and biotechnology companies underscores their pivotal role in driving advancements in antibody production.

Research Laboratories, another significant player in the market, contributed substantially to the landscape. This segment, marked by its commitment to scientific exploration and innovation, accounted for a notable portion of the market share, demonstrating the collaborative efforts within the industry.

Meanwhile, Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs) played a crucial role in the antibody production ecosystem. These entities, specializing in outsourced services, exhibited a commendable share, showcasing the growing reliance on external expertise for efficient antibody development and manufacturing processes.

As we navigate the evolving landscape of antibody production, it is clear that the market is driven by a synergistic interplay among pharmaceutical and biotechnology companies, research laboratories, CROs, and CDMOs. This intricate network of contributors highlights the collaborative nature of the industry, where each segment plays a vital role in advancing the field and meeting the ever-increasing demand for high-quality antibodies.

Key Market Segments

Product

- Instruments

- Bioreactors

- Multi-Use Bioreactors

- Single-Use Bioreactors

- Chromatography Systems

- Filtration Systems

- Bioreactors

- Consumables

- Media

- Buffers And Reagents

- Chromatography Resins And Columns

- Filtration Consumables And Accessories

- Others

- Software

Process

- Upstream Processing

- Downstream Processing

Type

- Polyclonal Antibody

- Monoclonal Antibody

End-Use

- Pharmaceutical And Biotechnology Companies

- Research Laboratories

- Cros And Cdmos

Drivers

Increasing Demand for Therapeutic Antibodies

The increasing occurrence of diverse diseases, such as cancer and autoimmune disorders, is fueling the desire for therapeutic antibodies and propelling the antibody production market.

Advancements in Biotechnology

Ongoing progress in biotechnology, especially in genetic engineering and cell culture technologies, is elevating the efficiency and scale of antibody production processes, fostering market expansion.

Booming Research and Development Activities

The expansion of research and development efforts in immunology, oncology, and infectious diseases is generating a demand for antibodies, driving growth in the antibody production market.

Growing Investments in Healthcare Infrastructure

A global uptick in investments in healthcare infrastructure, coupled with government initiatives supporting biopharmaceutical research, is creating a favorable environment for the flourishing of the antibody production market.

Restraints

High Production Costs

The complex and intricate nature of antibody production processes, along with the requirement for specialized equipment and skilled personnel, contributes to high production costs, restraining market growth.

Stringent Regulatory Approvals

Stringent regulatory requirements for the approval of antibody-based therapeutics can lead to delays in product launches, hindering the overall growth of the antibody production market.

Limited Manufacturing Capacities

Challenges related to scalability and limited manufacturing capacities for certain production systems may result in supply chain disruptions, impacting the market’s ability to meet growing demand.

Risk of Contamination

The susceptibility of antibody production processes to contamination poses a significant challenge, as it can compromise product quality and safety, necessitating stringent quality control measures.

Opportunities

Expanding Horizons in Personalized Medicine

There’s a notable shift towards personalized medicine, emphasizing the creation of tailored antibodies based on individual patient profiles. This trend offers a promising avenue for growth within the antibody production market.

Innovative Breakthroughs in Downstream Processing

Continual progress in downstream processing technologies, marked by enhanced purification methods and chromatography techniques, is paving the way for more cost-effective and streamlined antibody production.

Surging Popularity of Monoclonal Antibodies

The increasing use of monoclonal antibodies in various therapeutic applications, notably in the realm of cancer treatment, is unlocking fresh possibilities for market expansion and diversification.

Exploring New Frontiers in Emerging Markets

Untapped therapeutic areas and the burgeoning potential for market growth in emerging economies are providing companies with opportunities to broaden their market presence and augment revenue streams.

Trends

Rising Trend of Collaboration and Partnerships

A growing trend in the biopharmaceutical sector involves increased collaboration and partnerships between biopharmaceutical companies and contract manufacturing organizations (CMOs). This collaborative approach facilitates the sharing of resources and expedites the production of antibodies, showcasing a prominent trend in the industry.

Focus on Sustainable and Animal-Free Production

There is a growing trend toward sustainable and animal-free antibody production methods, driven by ethical considerations and environmental concerns, influencing the development of alternative production platforms.

Utilization of Artificial Intelligence in Antibody Discovery

The integration of artificial intelligence and machine learning in antibody discovery processes is becoming a notable trend, aiding in the identification of potential therapeutic candidates more efficiently.

Regional Analysis

In 2023, North America stood out in the Antibody Production Market, grabbing a big piece of the pie with over 39.5% market share, totaling a hefty USD 7.26 billion for the year. This means it’s the go-to region for antibody production activities.

The impressive market dominance in North America can be attributed to advanced research facilities, robust infrastructure, and a strong focus on cutting-edge technologies. It’s like the hub for antibody production, attracting major players and investments.

Moving to Europe, it’s holding its ground with a respectable position in the market. European countries contribute significantly, making up a substantial portion of the global antibody production landscape. Their expertise in biotechnology and research capabilities play a vital role.

The Asia-Pacific region is rapidly gaining momentum and making significant strides. There’s a clear uptick in investments, technological progress, and a heightened focus on healthcare, positioning Asia-Pacific as a prominent player in the antibody production arena. It’s akin to witnessing a rising star ascending in the global market.

In contrast, other regions are still finding their footing. The Middle East and Africa, while showing potential, have a smaller slice of the market. Limited resources and infrastructure hinder rapid growth, but there’s potential for expansion with the right strategies.

To sum it up, North America is the powerhouse, Europe is holding its own, Asia-Pacific is on the rise, and other regions are gradually making strides in the Antibody Production Market. Each region brings its unique strengths and challenges, shaping the overall dynamics of this vital sector.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Illumina stands out as a key player in the Antibody Production Market with its cutting-edge genomic sequencing technologies. Their innovative platforms enable researchers to explore and understand antibody characteristics with unprecedented precision. Illumina’s commitment to advancing genomic research contributes significantly to the evolution of antibody production methodologies.

Thermo Fisher Scientific plays a pivotal role in the Antibody Production Market, offering a comprehensive range of life sciences solutions. Their expertise spans from antibody development to production, providing researchers with robust tools for efficient and high-quality antibody manufacturing. Thermo Fisher Scientific’s diverse portfolio contributes substantially to accelerating advancements in antibody-related research.

Pacific Biosciences brings a unique perspective to the Antibody Production Market with its focus on long-read sequencing technologies. This enables a more in-depth understanding of antibody structures and functions. The company’s commitment to advancing sequencing capabilities contributes to refining antibody production processes and ensuring the development of superior antibodies.

BGI, a global genomics leader, plays a significant role in the Antibody Production Market by offering comprehensive solutions for antibody research. Leveraging their expertise in genomics, BGI contributes to the optimization of antibody development and production workflows. The company’s global presence and collaborative approach further enhance its impact on advancing antibody-related technologies.

In addition to the industry giants mentioned, other key players collectively contribute to the vibrancy of the Antibody Production Market. These players, often characterized by niche expertise and specialized technologies, bring diversity to the market landscape. Their contributions, though varied, collectively drive innovation and address specific needs within the antibody production ecosystem.

Market Key Players

- Illumina Inc.

- Thermo Fisher Scientific Inc.

- Pacific Biosciences of California Inc.

- BGI

- QIAGEN

- Agilent Technologies

- PerkinElmer Inc.

- ProPhase Labs Inc.

- Psomagen

- Azenta US Inc.

Recent Developments

- In August 2023, Eli Lilly and Company caught everyone’s attention by announcing their big $6.1 billion purchase of Protagonist Therapeutics, a company working on new medicines for chronic inflammatory conditions. This move is a major step for Lilly, expanding their projects into areas like inflammatory bowel disease and ulcerative colitis.

- In September 2023, AbbVie introduced Skyrizi (ixekizumab), a cool new treatment for people dealing with serious plaque psoriasis. Skyrizi is a special medicine that blocks the IL-23 pathway, which causes inflammation in psoriasis.

- In October 2023, AstraZeneca and Daiichi Sankyo teamed up for an exciting project. They’re working together to create innovative cancer treatments called antibody-drug conjugates (ADCs). AstraZeneca knows a lot about ADC technology, and Daiichi Sankyo is a pro in developing drugs for cancer. This collaboration is making waves in the world of medicine.

- In November 2023, Amgen shared encouraging news with the public, revealing positive Phase 3 results for AMG 520. This bispecific antibody, targeting EGFR and VEGFR2, demonstrated significant improvements in progression-free survival (PFS) compared to traditional chemotherapy. The study specifically highlighted the positive impact of AMG 520 in the treatment of patients with KRAS wild-type metastatic colorectal cancer.

Report Scope

Report Features Description Market Value (2023) USD 18.4 Bn Forecast Revenue (2033) USD 62.2 Bn CAGR (2024-2033) 12.9% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product [Instruments (Bioreactors (Multi-Use Bioreactors, Single-Use Bioreactors), Chromatography Systems, Filtration Systems), Consumables (Media, Buffers And Reagents, Chromatography Resins And Columns, Filtration Consumables And Accessories, Others), Software], By Process (Upstream Processing, Downstream Processing), By Type (Polyclonal Antibody, Monoclonal Antibody), By End-Use (Pharmaceutical And Biotechnology Companies, Research Laboratories, Cros And Cdmos) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Illumina Inc., Thermo Fisher Scientific Inc., Pacific Biosciences of California Inc., BGI, QIAGEN, Agilent Technologies, PerkinElmer Inc., ProPhase Labs Inc., Psomagen, Azenta US Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Illumina Inc.

- Thermo Fisher Scientific Inc.

- Pacific Biosciences of California Inc.

- BGI

- QIAGEN

- Agilent Technologies

- PerkinElmer Inc.

- ProPhase Labs Inc.

- Psomagen

- Azenta US Inc.