Global Antibacterial Glasses Маrkеt by Active Ingredient (Silver, Copper, Zinc), By End-Use (Hospitals, Military, Residential, Food & Beverages, Other End-Uses), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2021-2031

- Published date: Feb 2024

- Report ID: 73867

- Number of Pages: 222

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

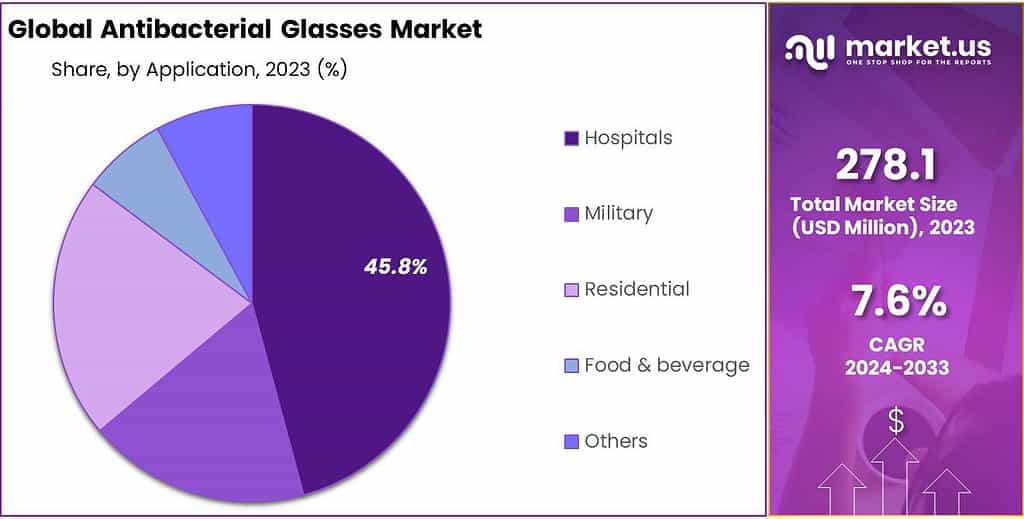

The Antibacterial Glasses Маrkеt size is expected to be worth around USD 578.5 Million by 2033, from USD 278.1 Mn in 2023, growing at a CAGR of 7.6% during the forecast period from 2023 to 2033.

Antibacterial glasses refer to specialized glass products infused with materials possessing antibacterial properties. These glasses are designed to inhibit the growth and spread of bacteria on surfaces, promoting hygiene and reducing the risk of infections in various settings.

Typically used in healthcare, residential, and commercial applications, antibacterial glasses contribute to creating cleaner and safer environments by actively combating microbial contaminants on glass surfaces. The incorporation of antimicrobial agents or coatings in the manufacturing process enhances the glass’s ability to resist bacterial colonization, providing an additional layer of protection against the spread of harmful microorganisms.

Key Takeaways

- Market Expansion: Forecasted to grow from USD 278.1 million in 2023 to USD 578.5 million by 2033, with a CAGR of 7.6%.

- Silver’s Dominance: Over 87.3% of antibacterial glasses utilized silver as the key ingredient in 2023, highlighting its efficacy in antimicrobial protection.

- Healthcare Sector’s Primacy: Hospitals were the largest market segment, accounting for more than 45.8% of usage, emphasizing the need for sterile environments.

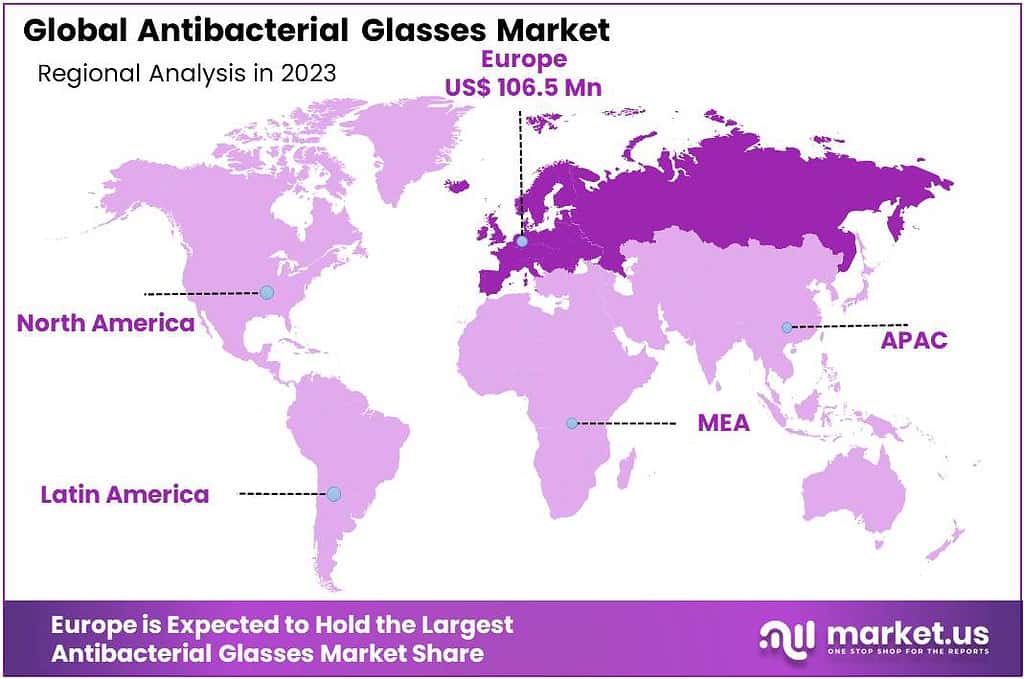

- Regional Leadership: Europe led in revenue share (over 38.3% in 2023), with significant contributions from the electronics and automotive sectors.

By Active Ingredient

In 2023, the antibacterial glass market showed that Silver was the big leader, holding more than 87.3% of the market. So, in 2023, it turned out that most antibacterial glasses had Silver as their main ingredient. People like using Silver in antibacterial glasses because it’s good at stopping bacteria.

When you treat glasses with Silver, it helps keep bacteria from growing, making surfaces cleaner. The reason Silver is a big deal in the market is because it works well, and you can find it being used in lots of different places.

Apart from Silver, there are other ingredients, like Copper and some others, used in making antibacterial glasses. Each of these ingredients has its special qualities, and companies may pick them based on what they need or like. For instance, Copper is also known for being good at stopping the growth of microbes.

Knowing which ingredient is leading the market is important for both the companies making the glasses and the people buying them. It helps to understand what choices are more popular and effective, affecting how the glasses are made and chosen. As things change in the market, paying attention to these ingredients helps everyone keep up with the newest things happening in antibacterial glass technology.

By Application

In 2023, the antibacterial glasses market showed that Hospitals were in the lead, holding more than 45.8% of the market. So, in 2023, a lot of antibacterial glasses were used in hospitals. Hospitals prefer antibacterial glasses because they help maintain a cleaner environment.

These glasses, with their ability to reduce bacteria growth, contribute to the overall hygiene standards crucial in healthcare settings. The dominance of hospitals in the market indicates that the healthcare sector highly values the benefits offered by antibacterial glasses.

Antibacterial glasses are not just for hospitals; they have a role in other places too. The Military might use them to add extra protection and keep things clean. In homes, people use these glasses to make living spaces healthier. Even in the Food & Beverage industry, these glasses are used to keep things clean and meet hygiene standards in places where food is prepared. So, these glasses help in different places to make sure things are safe and clean.

Understanding which application leads the market is important for glass manufacturers and those using these glasses. It gives insights into where these glasses are most valued and needed. As the market evolves, keeping an eye on the dominant applications helps in adapting to the changing needs and demands in different sectors.

Key Market Segments

By Active Ingredient

- Silver

- Copper

- Others

By Application

- Hospitals

- Military

- Residential

- Food & Beverage

- Electronics

- Others

Driving Factors

In 2023, the market for antibacterial glasses grew a lot because people and industries wanted to keep things clean. The special thing about these glasses is that they can stop bacteria from growing, making them a popular choice for keeping different places clean. Hospitals, especially, played a big part in this growth.

They used antibacterial glasses a lot to make sure their places were super clean. Hospitals are extra careful about infections, and these glasses helped a lot to keep things clean and safe, especially with the global health concerns we had. So, in simple words, more people and places wanted antibacterial glasses to keep everything clean, and hospitals were a big part of this.

The market for antibacterial glasses got a boost from the food and beverage industry. They needed to follow strict rules about keeping things super clean, especially in places where they prepare food. So, more and more places in this industry started using antibacterial glasses to meet these rules.

People became more aware of food safety, and this made them want antibacterial solutions for a cleaner environment in places where food is made. Homes also played a role in making the market grow. People at home wanted things that could make their living spaces healthier. This made them choose antibacterial glasses for their homes.

In summary, the market for antibacterial glasses had a strong growth in 2023. This was because everyone, from hospitals to the food industry to people at home, wanted to make sure things were clean and safe. These reasons are expected to keep shaping the market in the future, as everyone continues to prioritize having a clean and safe environment.

Restraints

In 2023, the market for antibacterial glasses faced certain challenges or restraints that affected its growth. One significant restraint was the increased costs associated with adopting antibacterial glasses. The special properties that make these glasses antibacterial also add to their production costs. This made them more expensive compared to regular glasses, and some buyers might find it challenging to invest in these costlier options, impacting the market’s growth.

Moreover, the dependency on specific active ingredients, such as silver, posed a restraint. Since silver dominated the market, any disruptions in the supply or increased prices of silver could affect the overall production and affordability of antibacterial glasses. This dependence on a single active ingredient introduced vulnerability to market dynamics, and variations in the availability or cost of silver could impact the market negatively.

Stringent regulations related to environmental practices and safety standards also posed a challenge. Compliance with these regulations required investments in technology and processes, potentially increasing production costs. This added complexity and could affect the competitiveness of antibacterial glass manufacturers in the market.

In 2023, using antibacterial glasses faced some challenges. Some industries or places didn’t use antibacterial glasses much because they didn’t see it as important. This made it harder for the market to grow in those areas. In the end, even though good things were helping the antibacterial glasses market grow, there were also challenges like higher costs, depending on specific ingredients, following rules, and not everyone using them everywhere. To keep growing and staying strong, the antibacterial glasses market needs to find ways to deal with these challenges.

Opportunities

In 2023, the market for antibacterial glasses held several opportunities for growth and improvement. One major opportunity came from the increasing awareness of the importance of hygiene in different places. As more people and industries realized how crucial it is to keep things clean, the demand for antibacterial glasses went up.

These glasses are unique because they can help reduce the growth of bacteria, making them a top choice for places that prioritize cleanliness. In 2023, the market for antibacterial glasses had significant opportunities for growth and improvement. One notable opportunity stemmed from the expanding use of antibacterial glasses in various industries.

Sectors such as healthcare, food and beverage, and residential areas recognized the benefits of using antibacterial glasses to maintain high cleanliness standards. As these industries continued to grow, the demand for antibacterial solutions was expected to increase, presenting a positive outlook for the market.

Additionally, the continuous innovation and development of antibacterial glass technologies created opportunities for improvement. Ongoing research and development activities in this field opened up new possibilities for enhancing the effectiveness and applications of antibacterial glasses.

These innovations could lead to the development of more advanced and versatile antibacterial glass solutions, further driving market growth. In conclusion, the antibacterial glasses market in 2023 had promising opportunities driven by the expanding adoption across industries and ongoing advancements in technology. Companies focusing on these opportunities were well-positioned for growth and success in a market that continued to evolve and adapt to changing needs and expectations.

In summary, the antibacterial glasses market in 2023 showcased numerous opportunities driven by the growing awareness of hygiene, increasing demand across various industries, and ongoing technological advancements. Companies that recognized and capitalized on these opportunities were well-positioned for growth and success in a market that continued to evolve and adapt to changing needs and expectations.

Challenges

In 2023, the antibacterial glasses market faced certain challenges that influenced its growth trajectory. One significant challenge was the dependency on specific active ingredients, particularly silver, which held a dominant market position. This reliance on a single active ingredient could pose challenges in terms of supply chain stability and potential limitations in addressing evolving bacteria strains.

The increased costs associated with incorporating antibacterial properties into glasses were a notable challenge. The production processes and the use of specialized materials can contribute to higher manufacturing expenses, potentially impacting product pricing and market affordability.

Regulatory compliance also emerged as a challenge, as manufacturers needed to adhere to evolving standards and regulations related to antibacterial products. Meeting these compliance requirements required investments in technology and processes, potentially affecting production costs and overall market competitiveness.

Varying adoption rates across different industries and regions posed a challenge. Some sectors or geographic areas might not prioritize or immediately recognize the need for antibacterial glasses, limiting the market’s growth potential in those specific areas. The antibacterial glasses market had good growth, but there were some tough parts too.

Dealing with these challenges, like depending a lot on one active ingredient, higher costs, following rules, and different adoption rates, was really important for the market to keep growing and stay steady.

Regional Analysis

Europe held the highest revenue share at over 38.3% in 2023. This is driven by prominent electronic device manufacturers utilizing antibacterial glass in products like laptops, LCD televisions, navigation systems, and cell phones, particularly in the automotive sector.

North America is anticipated to contribute significantly to revenue growth in 2022, fueled by technological advancements and rising market demand for antibacterial glasses across various industries. Europe is poised for robust revenue growth, attributed to key players in the region and the increasing demand for water purification and industrial wastewater treatment applications.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

In the competitive landscape of the Antibacterial Glasses market, several key players play pivotal roles in shaping industry dynamics. Prominent among these is Corning Incorporated, a renowned innovator in glass technologies, spearheading advancements in antibacterial glass solutions.

AGC Inc., specializing in glass products, significantly contributes to the market’s growth with its diverse applications. Saint-Gobain, a leading glass manufacturer, stands out for providing cutting-edge antibacterial glass solutions across various industries.

Top Key Players

- AGC Inc

- Beijing JiYan-Tech Co. Ltd

- BÜFA Glas GmbH & Co. KG

- Corning Inc.

- Essex Safety Glass Ltd.

- Innovative Glass Corp

- Ishizuka Glass Co. Ltd

- Kastus Technologies Ltd.

- Morley Glass & Glazing Ltd.

- Nippon Electric Glass Co. Ltd

- Saint-Gobain Group

- Smartglass International Ltd.

Recent Developments

2023 AGC Inc: Expanded production capacity for antimicrobial glass.

Report Scope

Report Features Description Market Value (2023) USD 278.1 Mn Forecast Revenue (2033) USD 578.5 Mn CAGR (2023-2032) 7.6% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Active(Ingredient, Silver, Copper, Others), By Application(Hospitals, Military, Residential, Food & Beverage, Electronics, Others)0 Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape AGC Inc, Beijing JiYan-Tech Co. Ltd, BÜFA Glas GmbH & Co. KG, Corning Inc., Essex Safety Glass Ltd., Innovative Glass Corp, Ishizuka Glass Co. Ltd, Kastus Technologies Ltd., Morley Glass & Glazing Ltd., Nippon Electric Glass Co. Ltd, Saint-Gobain Group, Smartglass International Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Antibacterial Glasses МаrkеtPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Antibacterial Glasses МаrkеtPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- AGC Inc

- Beijing JiYan-Tech Co. Ltd

- BÜFA Glas GmbH & Co. KG

- Corning Inc.

- Essex Safety Glass Ltd.

- Innovative Glass Corp

- Ishizuka Glass Co. Ltd

- Kastus Technologies Ltd.

- Morley Glass & Glazing Ltd.

- Nippon Electric Glass Co. Ltd

- Saint-Gobain Group

- Smartglass International Ltd.