Global Anti-Reflective Coatings Market; By Layer(Single Layered, Multi-Layered), By Technology(Sputtering, Electron Beam Evaporation, Other Technologies), By Application(Eyewear, Solar, Electronics, Automotive, Other Applications); as well as By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast: 2024-2033

- Published date: Jan 2024

- Report ID: 61991

- Number of Pages: 234

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

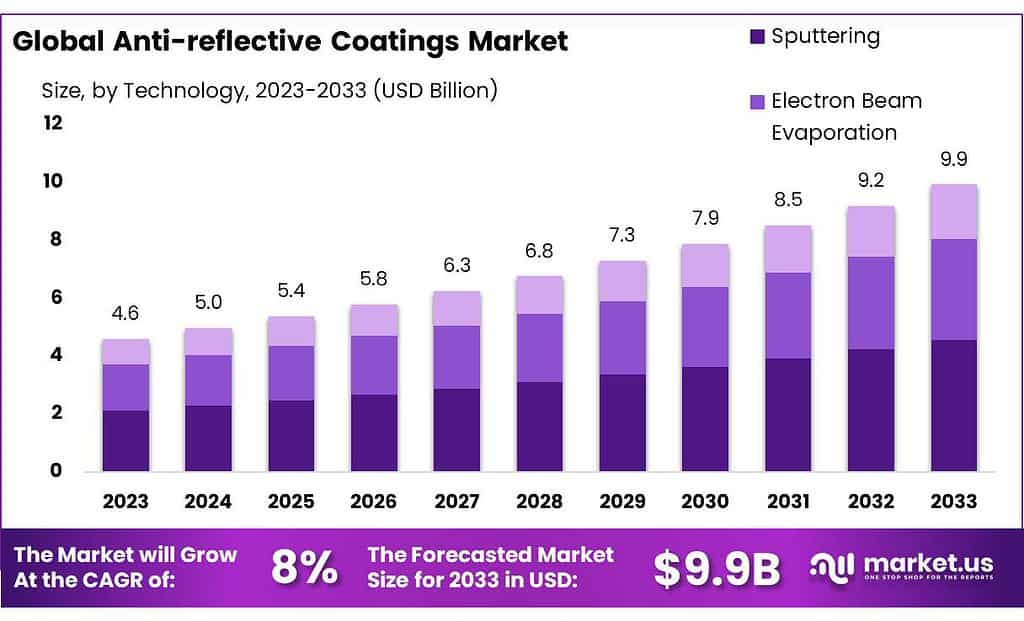

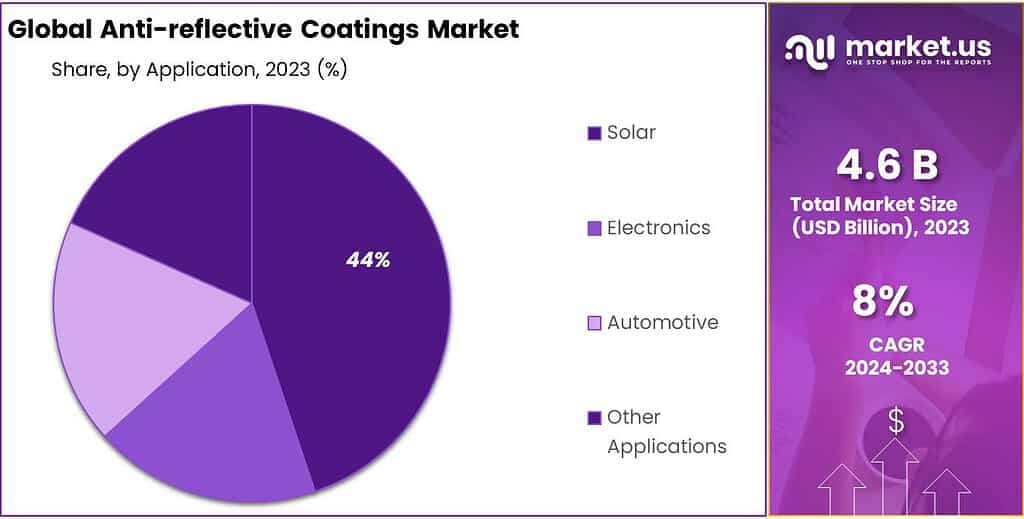

The Anti-reflective Coatings Market size is expected to be worth around USD 9.9 billion by 2033, from USD 4.6 Bn in 2023, growing at a CAGR of 8% during the forecast period from 2023 to 2033.

The Anti-reflective Coatings market encompasses the industry focused on developing and providing coatings that minimize light reflection off surfaces. These coatings are applied to various surfaces such as optical lenses, eyeglasses, solar panels, and digital screens. The primary function of anti-reflective coatings is to enhance light transmission through the surface, significantly reducing glare and reflection. This improvement in light transmission enhances visual clarity and reduces strain on the eyes when used on eyewear or digital displays.

In industries like optics, consumer electronics, solar energy, and automotive, these coatings are crucial for optimizing the performance and user experience of various products. For instance, in the eyewear industry, they provide clearer vision by reducing reflections on lenses, while solar panels, increase energy efficiency by allowing more light absorption.

The market for anti-reflective coatings is driven by technological advancements, growing consumer demands for high-performance optics and displays, and the increasing adoption of solar energy solutions. Market growth is influenced by factors such as innovation in coating technologies, environmental sustainability concerns, and the evolving needs of industries that utilize these coatings.

Key Takeaways

- Market Growth: Projected to reach USD 9.9 billion by 2033, growing from USD 4.6 billion in 2023, at a CAGR of 8%.

- Eyewear Segment Lead: In 2023, held over 32.4% market share, driven by increasing demand for anti-glare glasses.

- Solar Segment Significance: Shows substantial share due to growing need for efficient solar panels.

- Vacuum Deposition Technology: Dominated with a 37.3% share in 2023, favored for precise coating applications.

- Growth in Electronics: Essential for enhancing display quality in consumer electronics.

- Advancements in Automotive: Increasing use for better visibility in displays and windshields.

- Single-Layered Coatings Popularity: Captured more than 35% market share in 2023, known for cost-effectiveness.

- Rise of Multi-Layered Coatings: Gaining popularity for superior performance despite smaller market share.

- Asia Pacific Market Dominance: Led with over 34% revenue share in 2023, growth expected in consumer electronics.

By Layer

In 2023, single-layered anti-reflective coatings held a dominant market position, capturing more than a 35% share. This segment’s leadership is primarily due to the simplicity and cost-effectiveness of single-layered coatings. They are widely used in applications requiring basic glare reduction, such as in standard eyewear and simple optical devices.

The appeal of single-layered coatings lies in their straightforward manufacturing process and lower production costs, making them accessible to a wide range of consumers and industries.

On the other hand, Multi-Layered anti-reflective coatings, while holding a smaller market share, are gaining popularity for their enhanced performance. These coatings are characterized by multiple thin films layered together, each designed to target a specific range of light wavelengths.

This structure allows for superior reduction in reflection and higher clarity, especially in complex optical systems like high-end cameras, telescopes, and advanced digital displays. The demand for multi-layered coatings is driven by high-end applications in photography, astronomy, and the high-tech sector, where optimal light transmission and minimal glare are crucial.

By Technology

In 2023, Vacuum Deposition technology in the Anti-reflective Coatings market held a dominant position, capturing more than a 37.3% share. This technology’s lead is attributed to its precision and efficiency in coating application. Vacuum Deposition allows for uniform distribution of the coating material, resulting in consistent and high-quality anti-reflective coatings. It is particularly favored in industries requiring precision optics, such as in medical devices and high-end camera lenses.

Electronic Beam Evaporation technology, while holding a significant market share, is known for its ability to deposit complex multi-layer coatings. This method uses an electron beam to vaporize the coating material, which then condenses on the substrate. It’s widely used in applications demanding high precision and durability, such as aerospace and military optics.

Sputtering technology also plays a vital role in the market. It involves ejecting atoms from a target material to the substrate, creating a dense and high-quality coating. This technology is especially relevant in the electronics industry for applications like display screens and photovoltaic cells, where durability and clarity are crucial.

By Application

In 2023, Eyewear emerged as a leading segment in the Anti-reflective Coatings market, holding more than a 32.4% share. This significant market position is largely due to the increasing demand for anti-reflective eyeglasses that enhance visual comfort and reduce glare. The widespread use of anti-reflective coatings in both prescription and non-prescription eyewear has been a key driver, appealing to consumers seeking improved visual clarity and aesthetics.

The Solar segment also holds a substantial share in the market. Anti-reflective coatings in solar panels increase light absorption and boost efficiency, making them a critical component in the expanding solar energy sector. This growth is fueled by the global shift towards renewable energy sources and the continuous advancements in solar technology.

In the Electronics sector, anti-reflective coatings are essential for enhancing the display quality of various devices like smartphones, tablets, and monitors. This segment benefits from the rapid growth in consumer electronics, where there is a constant demand for improved screen readability and durability.

The Automotive industry is another significant user of anti-reflective coatings, applying them in vehicle displays and windshields to enhance driver visibility and safety. The integration of more sophisticated display technologies in modern vehicles drives the demand in this segment.

Кеу Маrkеt Ѕеgmеntѕ

By Layer

- Single Layered

- Multi-Layered

By Technology

- Sputtering

- Electron Beam Evaporation

- Other Technologies

By Application

- Eyewear

- Solar

- Electronics

- Automotive

- Other Applications

Drivers

Anti-reflective coatings have seen incredible market growth driven by renewable energy sources such as solar PV. As more people turn to renewable sources for electricity generation, anti-reflective coatings may see significant surges in their usage on PV panels and thus driving market expansion in related sectors like anti-reflective coatings.

Anti-reflective coatings play an essential part in increasing solar panel efficiency by minimizing reflection and increasing light absorption, and it makes perfect sense that their use would form part of the solar energy ecosystem.

Anti-reflective coatings’ anticipated expansion is not only evidence of solar industry expansion but also represents a shift in our energy landscape. With rising needs for energy combined with conscious efforts to reduce our dependence on fossil fuels, market dynamics have undergone radical transformation; and this transition not only involves changes to energy supplies themselves but also advances and innovations supporting them.

As we progress, it’s exciting to watch how interdependent industries respond to the growing demand for renewable energy solutions. An expansion of the anti-reflective coatings market is just one indicator of this ripple effect caused by more people adopting renewable sources of power.

Restraints

Cost constraints pose a significant challenge. The intricate manufacturing processes and premium materials involved in producing these coatings contribute to higher production costs. This can limit widespread adoption, particularly in regions where cost-effective solutions are imperative for market penetration. Technological challenges remain a hurdle.

Balancing effectiveness, durability, and cost-efficiency in these coatings is an ongoing struggle. Developing coatings capable of withstanding diverse environmental conditions without degradation is crucial for their widespread acceptance.

Stringent regulatory and compliance standards add complexity. Meeting diverse regional regulations and environmental standards while maintaining cost-effectiveness can be demanding. Compliance becomes a crucial aspect that can impact the feasibility of these coatings in various markets.

Intense competition and the necessity for continuous innovation are persistent challenges. Companies need to invest heavily in research and development to stay ahead. This perpetual need for innovation can strain resources and affect profit margins.

The complexity of installation and maintenance processes for these coatings is another factor. Skilled labor and intricate application methods can deter adoption. Simplifying these processes or providing comprehensive training and support could mitigate this restraint.

Supply chain disruptions from certain regions or suppliers for raw materials may pose a threat to production and distribution. Navigating these challenges requires strategic planning, innovation and cost-effective solutions in order to sustain growth within the anti-reflective coatings market.

Opportunities

The landscape of anti-reflective coatings presents numerous opportunities for market growth and evolution. One of the primary drivers is the escalating adoption of solar energy worldwide. With solar power installations on the rise, the demand for anti-reflective coatings, critical for optimizing solar panel efficiency, is experiencing a parallel surge. This correlation positions the coatings market at the forefront of the renewable energy revolution, driving its growth and relevance.

Materials science and nanotechnology offer coatings markets a promising pathway. Through ongoing innovation, such developments could result in coatings that are both more cost-effective and durable – revolutionizing their market and opening it up to applications other than solar panels.

There’s an increasing focus on environmental concerns and sustainability, creating an opportunity for eco-friendly coatings. Companies that can meet stringent environmental standards and provide coatings aligned with sustainability goals are likely to gain a competitive edge, catering to the demand for greener solutions in various industries.

Beyond solar panels, there’s a burgeoning demand for anti-reflective coatings in diverse sectors. From consumer electronics to automobiles, the need for glare reduction and improved optical performance opens doors for expansion. This diversification of applications widens the market scope, offering new avenues for growth. Expansion into new geographical regions also presents an opportunity.

As renewable energy initiatives gain steam globally and emergent economies alike, the anti-reflective coatings market can find itself with the opportunity to penetrate new markets. Strategic collaborations among manufacturers, technology developers, solar panel companies can drive innovation, product development, market penetration, creating synergies that benefit the industry overall. In order to seize this chance successfully requires long-term planning, investment in research and development, and an adaptive approach tailored towards meeting consumer and industry demands alike.

Challenges

The complexity of developing anti-reflective coatings that meet stringent requirements in terms of effectiveness, durability, and cost-efficiency persists as a significant challenge. Advancing technology to strike this balance while keeping production costs reasonable remains an ongoing hurdle for manufacturers in this sector.

Moreover, the sophisticated manufacturing processes and high-quality materials involved in producing these coatings contribute to elevated production costs. This cost factor poses a challenge, potentially limiting widespread adoption, especially in markets sensitive to pricing dynamics.

Meeting diverse regional regulations and environmental standards while maintaining cost-effectiveness is another demanding aspect for manufacturers. Compliance with stringent regulations adds complexity and cost to the production process, impacting accessibility to various markets.

The highly competitive nature of the market necessitates continuous innovation, compelling companies to invest consistently in research and development. This perpetual need for innovation strains resources and may impact profit margins, creating a challenging balancing act for market players.

Installation and maintenance complexities also act as barriers to adoption. The specialized skills and equipment required for applying and sustaining these coatings present challenges. Simplifying application methods or providing comprehensive training and support could alleviate this hurdle.

Dependency on specific regions or suppliers for raw materials exposes the market to supply chain disruptions, affecting production and distribution. Such uncertainties in the supply chain can significantly impact the availability and pricing of crucial materials.

As much as these coatings increase solar panel efficiency, concerns remain regarding their environmental impacts during production and disposal. Balancing performance with sustainability remains a constant challenge for manufacturers in this space.

Tackling these challenges requires an integrated plan encompassing technological advancement, cost optimization, regulatory compliance, innovation and sustainable practices. Successfully navigating these hurdles will be key for companies aiming for sustainable growth in the anti-reflective coatings sector.

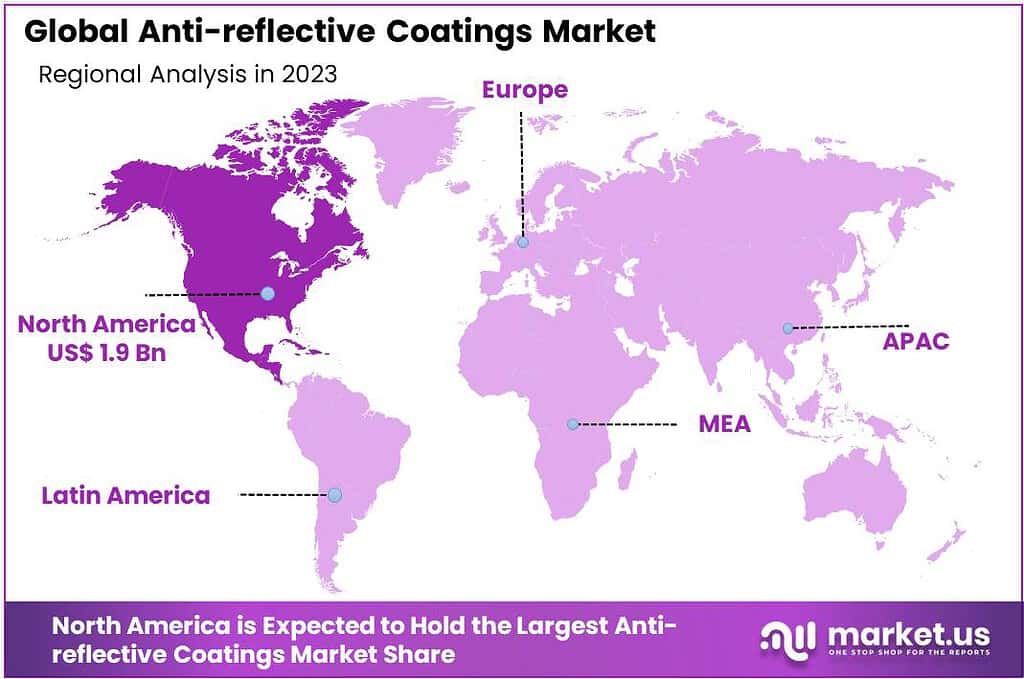

Regional Analysis

Asia Pacific (APAC) had the largest revenue share at over 34% in 2023. Over the forecast period, this region is expected to index a significant increase in AR coatings used in consumer electronics products, including smartphones, tablets, smartwatches, and cameras.

There are many undiagnosed cases of sight correction in North America, which presents significant growth opportunities for the eyewear industry. Changing consumer lifestyles and technological advances have increased from nearsightedness. This is expected to lead to increased product use in these major regions over the next nine years.

Europe will register significant growth due to a high level of health consciousness among its citizens. Due to the need for added protection from harmful radiation emitted by computers and smartphones, there has been a high demand for appropriate eyeglasses.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Key strategies being adopted by companies include expansion endeavors and new product development. Due to the rapid increase in demand, many companies, including Royal DSM and Honeywell, have begun to focus on the solar application market.

Royal DSM’s new KhepriCoat anti-reflective coating manufacturing plant was opened at Chemelot, Netherlands. This coating is used primarily for solar applications. Zeiss introduced DuraVision silver. This was done to expand its portfolio of lens coatings. This product would allow the company to reach a wider price-conscious customer base.

Маrkеt Кеу Рlауеrѕ

- Royal DSM

- Honeywell International Inc.

- Janos Technology LLC

- Carl Zeiss

- DuPont

- Essilor

- Hoya Corporation

- iCoat Company LLC

- PPG Industries

- Other Key Players

Recent Developments

2023 Royal DSM (Netherlands): Unveiled a new self-cleaning anti-reflective coating for eyeglasses that repels water and dust, enhancing both clarity and longevity. Partnered with a leading automotive manufacturer to develop next-generation anti-reflective coatings for car windshields, improving driver visibility and safety.

2023 Honeywell International Inc. (US): Secured a patent for a novel anti-reflective coating technology featuring enhanced scratch resistance, ideal for high-traffic public displays and touchscreens. Collaborated with a major aircraft manufacturer to develop anti-reflective coatings for airplane windows, optimizing energy efficiency and passenger comfort.

Report Scope

Report Features Description Market Value (2022) US$ 4.6 Bn Forecast Revenue (2032) US$ 9.9 Bn CAGR (2023-2032) 8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Layer(Single Layered, Multi-Layered), By Technology(Sputtering, Electron Beam Evaporation, Other Technologies), By Application(Eyewear, Solar, Electronics, Automotive, Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Royal DSM, Honeywell International Inc., Janos Technology LLC, Carl Zeiss, DuPont, Essilor, Hoya Corporation, iCoat Company LLC, PPG Industries, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Size of Anti-reflective Coatings Market?Anti-reflective Coatings Market size is expected to be worth around USD 9.9 billion by 2033, from USD 4.6 Bn in 2023

What CAGR is projected for the Anti-reflective Coatings Market?The Anti-reflective Coatings Market is expected to grow at 5.6% CAGR (2023-2032).Name the major industry players in the Anti-reflective Coatings Market?Royal DSM, Honeywell International Inc., Janos Technology LLC, Carl Zeiss, DuPont, Essilor, Hoya Corporation, iCoat Company LLC, PPG Industries, Other Key Players

Anti-reflective Coatings MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample

Anti-reflective Coatings MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Royal DSM

- Honeywell International Inc.

- Janos Technology LLC

- Carl Zeiss

- DuPont

- Essilor

- Hoya Corporation

- iCoat Company LLC

- PPG Industries

- Other Key Players