Antacids Market By Type (Tablet, Liquid, Others), By Distribution Channel (Hospital pharmacy, Retail pharmacy, Online pharmacy), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 117263

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

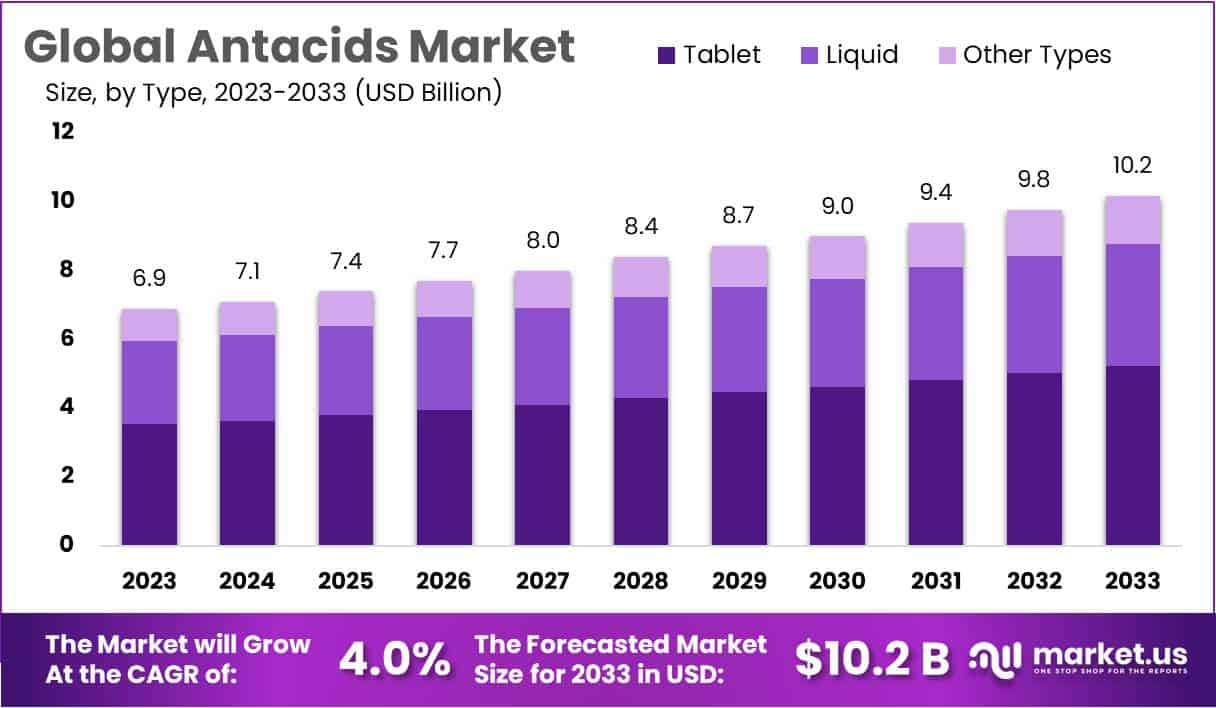

The Global Antacids Market size is expected to be worth around USD 10.2 Billion by 2033, from USD 6.9 Billion in 2023, growing at a CAGR of 4% during the forecast period from 2024 to 2033.

The Antacids Market is a segment of the pharmaceutical industry that focuses on medications designed to neutralize stomach acid and alleviate symptoms of acid reflux, heartburn, and indigestion. Antacids work by reducing the acidity in the stomach, providing relief from discomfort and promoting healing in cases of mild gastrointestinal issues.

Key factors driving the growth of the Antacids Market include the increasing prevalence of gastroesophageal reflux disease (GERD), a rise in lifestyle-related disorders such as obesity and unhealthy dietary habits, and a growing aging population prone to digestive disorders. Additionally, the availability of over-the-counter (OTC) antacid medications in various forms such as tablets, liquids, and chewable tablets contributes to market accessibility and consumer convenience.

Market players in the Antacids Market often focus on product innovation, such as developing formulations with longer-lasting effects or added benefits like reducing bloating or gas. Furthermore, strategic marketing initiatives, partnerships with healthcare providers, and expanding distribution channels contribute to market growth and competitiveness. Overall, the Antacids Market is expected to continue expanding globally due to the increasing demand for digestive health solutions and the availability of effective and accessible antacid medications.

- According to a Nature study, the worldwide combined prevalence of gastroesophageal reflux disease (GORD) was reported at 13.98%, indicating a significant proportion of the population affected by this condition characterized by stomach acid backing up into the esophagus.

- A study conducted by Cedars-Sinai revealed that gastroesophageal reflux disease (GERD), a digestive disorder causing heartburn and other discomfort, affects nearly one-third of American adults weekly. Despite the use of popular medications for GERD, many individuals continue to experience symptoms.

Key Takeaways

- In 2023, the market for antacids generated a revenue of USD 6.9 billion, with a CAGR of 4.0%, and is expected to reach USD 10.2 billion by the year 2033.

- The Antacids Market is divided into tablets, liquids, and other formulations, with tablets taking the lead in 2023 with a market share of 51.3%.

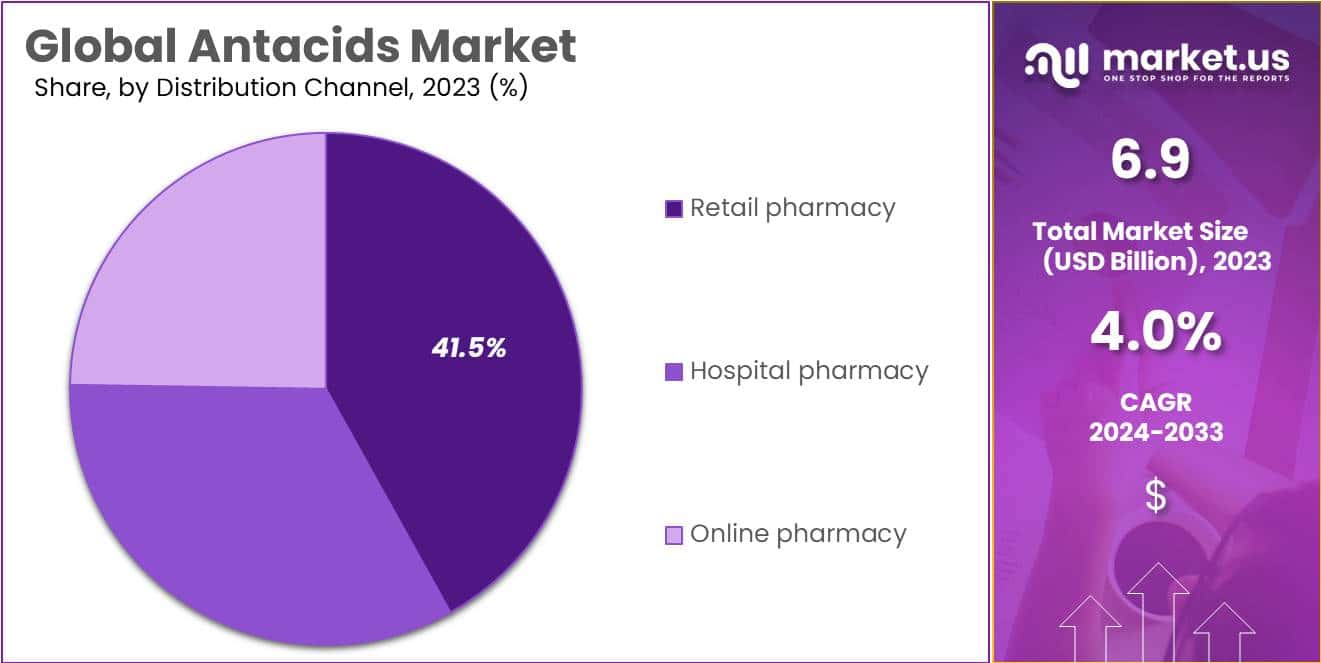

- Furthermore, concerning end-use segmentation, the retail pharmacy sector stands out as the dominant player, holding the largest revenue share of 41.5% in the Antacids Market.

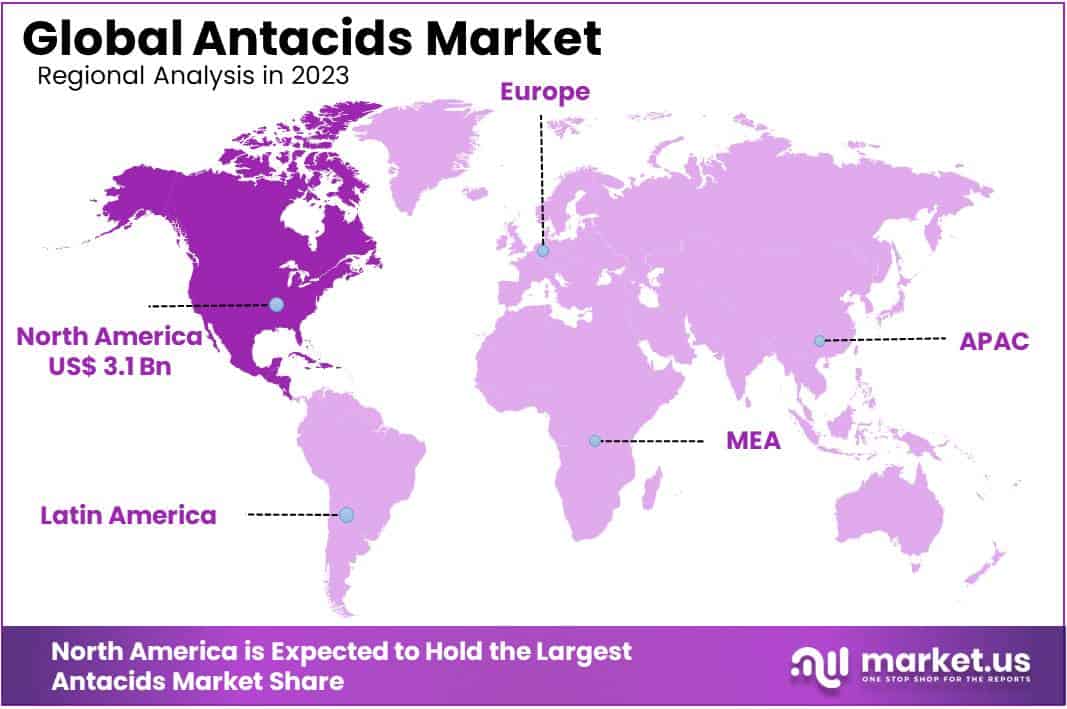

- North America led the market by securing a market share of 45.6% in 2023.

Type Analysis

The market is categorized into tablets, liquids, and other forms based on type, with tablets leading in 2023, by claiming a market share of 51.3%. Chewable tablets in various flavors enhance patient compliance, and tablets offer precise dosage control and convenient storage compared to other forms. These advantages are driving the growth of the tablets segment in the forecast period.

The growth of the tablets segment in the Antacids Market is propelled by several key advantages, particularly in the form of chewable tablets and traditional tablets. Chewable tablets come in various flavors, which not only enhance patient compliance but also make the medication more palatable and enjoyable for consumers.

This is especially beneficial for individuals who may have difficulty swallowing pills or who prefer a more pleasant experience when taking medication. Moreover, tablets offer precise dosage control, allowing healthcare providers to accurately prescribe the right amount of medication for each patient. This precision is crucial in ensuring optimal therapeutic effects while minimizing the risk of adverse reactions or underdosing.

Distribution Channel Analysis

The Antacids Market is segmented based on end-use into hospital pharmacy, retail pharmacy, and online pharmacy. The dominance of the retail pharmacy segment, with its largest revenue share of 41.5% in the Antacids Market, can be attributed to several key factors that contribute to its appeal and convenience for consumers.

One significant factor is the easy access provided by retail pharmacy outlets, which are often located in easily accessible locations such as shopping centers, neighborhoods, and commercial areas. This accessibility makes it convenient for consumers to purchase antacids without having to travel long distances or wait for delivery, enhancing the overall customer experience.

Moreover, retail pharmacy outlets offer a wide range of healthcare products, including antacids, under one roof. This convenience allows consumers to fulfill multiple healthcare needs in a single visit, saving time and effort. Additionally, the presence of trained pharmacists in retail pharmacies enables consumers to seek professional advice, guidance, and recommendations regarding the use of antacids and other medications, enhancing trust and confidence in the products.

Key Market Segments

By Type

- Tablet

- Liquid

- Others

By Distribution Channel

- Retail pharmacy

- Hospital pharmacy

- Online pharmacy

Drivers

Growing Prevalence of GI Disorders

The rising prevalence of gastrointestinal disorders such as acid reflux, heartburn, and indigestion is a significant driver of the Antacids Market. Factors such as unhealthy dietary habits, sedentary lifestyles, stress, and obesity contribute to the increasing incidence of these disorders, leading to a growing demand for antacid medications among affected individuals.

Increasing Availability of OTC Medications

The availability of OTC antacid medications plays a crucial role in driving market growth. OTC antacids are easily accessible to consumers without the need for a prescription, making them convenient for self-medication and quick relief from symptoms. The wide range of antacid products available over the counter, including tablets, liquids, and chewable tablets, caters to diverse consumer preferences and contributes to market expansion.

Restraints

Regulatory Challenges

Regulatory challenges, including stringent approval processes, compliance requirements, and potential recalls, can hinder the introduction of new antacid products or expansions of existing ones, leading to delays and increased costs for market players. Regulatory bodies may impose stringent guidelines and requirements on the manufacturing, marketing, and distribution of antacid medications. Compliance with these regulations can be complex and costly for companies, leading to delays in product launches, increased operational expenses, and limited market access.

Shifting Consumer Preference

Another restraint is the increasing consumer preference for natural remedies and alternative therapies for digestive issues. This trend is driven by concerns about the long-term use of pharmaceutical medications, side effects, and a growing emphasis on holistic health and wellness. As a result, some consumers may opt for dietary changes, herbal supplements, or lifestyle modifications instead of traditional antacids, impacting market demand and growth potential for pharmaceutical antacid products.

Advancements in medical technology and the development of new therapeutic approaches, such as proton pump inhibitors (PPIs), H2 blockers, and natural remedies, provide consumers with a range of choices beyond traditional antacids. This increased competition from alternative treatments could potentially slow down the growth of the Antacids Market as consumers explore different options based on efficacy, safety, and cost-effectiveness.

Opportunities

Technological advancements present a promising opportunity for market players to innovate and introduce new antacid formulations with enhanced efficacy, improved safety profiles, and targeted delivery mechanisms. For example, the development of advanced formulations such as prolonged-release tablets, fast-dissolving tablets, or combination therapies can cater to specific patient needs and preferences, driving market growth through differentiated offerings.

Furthermore, the increasing demand for OTC antacids in emerging markets represents a substantial opportunity for market expansion. As healthcare infrastructure improves, disposable incomes rise, and consumer awareness about digestive health grows, the demand for accessible and affordable antacids without the need for prescription is on the rise.

Market players can capitalize on this trend by expanding their presence in emerging markets, launching tailored OTC products, and implementing effective marketing strategies to reach a broader consumer base. Additionally, strategic partnerships with local distributors, retail chains, and healthcare providers can facilitate market penetration and enhance brand visibility, further leveraging the opportunity presented by the growing demand for OTC antacids in emerging economies.

Impact of Macroeconomic / Geopolitical Factors

Government policies, taxation, trade regulations, interest rates, and inflation rates can significantly impact the Antacids Market. Changes in government policies related to healthcare, pharmaceuticals, and consumer safety can influence the approval process for antacid medications, affecting market entry, product availability, and pricing.

Taxation policies can impact production costs, pricing strategies, and overall profitability for companies in the Antacids Market. Trade regulations and tariffs can affect the import and export of raw materials and finished products, leading to supply chain disruptions and cost fluctuations. Fluctuations in interest rates and inflation rates can affect consumer purchasing power, demand for healthcare products, and investment decisions by market players.

Higher interest rates may deter investment in research and development or expansion initiatives, while inflation can lead to increased production costs and pricing pressures. Overall, government policies and economic factors play a crucial role in shaping the operating environment and growth prospects of the Antacids Market, influencing market dynamics, competitiveness, and profitability for industry stakeholders.

Latest Trends

One of the latest trends in the Antacids Market is the growing focus on natural and herbal antacid alternatives. Consumers are increasingly seeking natural remedies for digestive discomfort, leading to the rise of herbal antacids made from plant-based ingredients such as ginger, licorice, and peppermint. These natural formulations are perceived as safer and more sustainable options, aligning with the growing trend of holistic and wellness-focused healthcare.

Another trend is the expansion of online sales channels for antacids. With the increasing prevalence of e-commerce platforms and digital healthcare services, consumers now have more options to purchase antacid medications online. This trend is driven by factors such as convenience, accessibility, and the ability to compare prices and product reviews easily.

Additionally, there is a growing emphasis on product innovation and differentiation in the Antacids Market. Market players are introducing new formulations with added benefits such as fast-acting relief, long-lasting effects, and improved taste. These innovations cater to diverse consumer preferences and enhance the overall user experience with antacid medications.

Furthermore, personalized medicine and tailored treatment options are gaining traction in the Antacids Market. Healthcare providers are increasingly customizing antacid regimens based on individual patient needs, symptoms, and medical history, leading to more targeted and effective treatment outcomes.

Regional Analysis

North America is leading the Antacids Market

North America emerges as the leading market for antacids, capturing a significant revenue share of 45.6% in 2022. This dominance is attributed to several key factors, including a well-established and developed healthcare system and infrastructure, high levels of disposable income among consumers, an increasing geriatric population prone to digestive issues, and a rising prevalence of digestive disorders in the region.

According to a study published in the Gut journal, the prevalence of GERD in North America is estimated to be 18% to 28%. These factors collectively contribute to the robust demand for antacids and solidify North America’s position as a major market player in the global antacids industry.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to achieve the fastest compound annual growth rate (CAGR) of 5.4% over the forecast period in the Antacids Market. This growth is attributed to several factors, including high unmet clinical needs, the availability of effective treatment methods, increasing disposable income among consumers, and rising awareness about the availability of these products.

Additionally, the presence of major players such as GlaxoSmithKline plc, Pfizer Inc., and Abbott is anticipated to contribute to market expansion in the region. Furthermore, improvements in healthcare infrastructure and growing investments by market players are expected to further boost the growth of the Antacids Market in Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Antacids Market is characterized by the presence of numerous multinational players and small-scale companies, all vying to capture higher market shares. Key players in the market employ various strategies such as new product launches, geographical expansion, and forming joint ventures to strengthen their market position. These strategies enable companies to introduce innovative products, expand their presence in new regions, and leverage partnerships to enhance their offerings and competitive edge in the market.

Top Key Players in Antacids Market

- GlaxoSmithKline plc

- Bayer AG

- Boehringer Ingelheim International GmbH

- Reddy’s Laboratories Ltd.

- Sanofi

- Reckitt Benckiser Group plc

- Sun Pharmaceuticals Ltd.

- Takeda Pharmaceutical Company Limited

- Pfizer Inc.

- Procter & Gamble

- Other Key Players

Recent Developments

- In March 2023, Wonderbelly™, a company focused on digestive health medicine and clean ingredients, unveiled its Wonderbelly Antacid™ chewable tablets.

- In March 2024, ENO, a digestive brand previously under GlaxoSmithKline Consumer Healthcare and now part of Haleon, introduced a new product called ‘ENO Chewy Bites.’ These are chewable antacids available in two flavors: Tangy Lemon and Zesty Orange. This launch expands ENO’s product line to offer consumers more options for managing digestive discomfort in a convenient and enjoyable format.

Report Scope

Report Features Description Market Value (2023) USD 6.9 billion Forecast Revenue (2033) USD 10.2 billion CAGR (2024-2033) 4.0% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type – Tablet, Liquid, Others; By Distribution Channel – Hospital pharmacy, Retail pharmacy, Online pharmacy Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape GlaxoSmithKline plc, Bayer AG, Boehringer Ingelheim International GmbH, Dr. Reddy’s Laboratories Ltd., Sanofi, Reckitt Benckiser Group plc, Sun Pharmaceuticals Ltd., Takeda Pharmaceutical Company Limited, Pfizer Inc., Procter & Gamble and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- GlaxoSmithKline plc

- Bayer AG

- Boehringer Ingelheim International GmbH

- Reddy’s Laboratories Ltd.

- Sanofi

- Reckitt Benckiser Group plc

- Sun Pharmaceuticals Ltd.

- Takeda Pharmaceutical Company Limited

- Pfizer Inc.

- Procter & Gamble

- Other Key Players