Global Analytics of Things Market Size, Share, Industry Analysis Report By Component (Solution, Services), By Organization Size (Small & Medium Enterprises (SMEs), Large Enterprises), By Deployment (On-Premises, Cloud), By Application (Energy Management, Predictive Maintenance, Asset Management, Inventory Management, Remote Monitoring, Others), By Type (Descriptive Analytics, Diagnostic Analytics, Predictive Analytics, Prescriptive Analytic), By End Use (Manufacturing, Energy & Utilities, Retail & E-commerce, Healthcare & Life Sciences, Transportation & Logistics, IT & Telecom, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook by 2025-2034

- Published date: Sept. 2025

- Report ID: 159541

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of Generative AI

- Investment and Business Benefits

- U.S. AoT Market Size

- Component Analysis

- Organization Size Analysis

- Deployment Analysis

- Application Analysis

- Type Analysis

- End Use Analysis

- Emerging Trends

- Growth factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

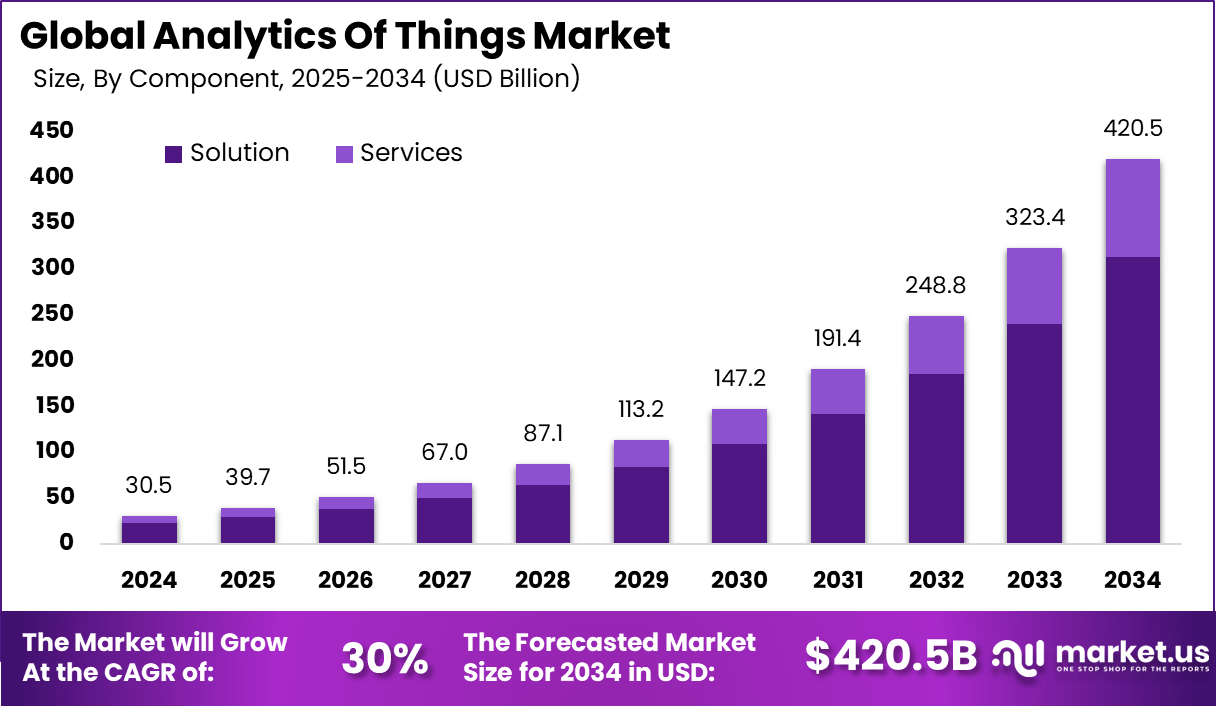

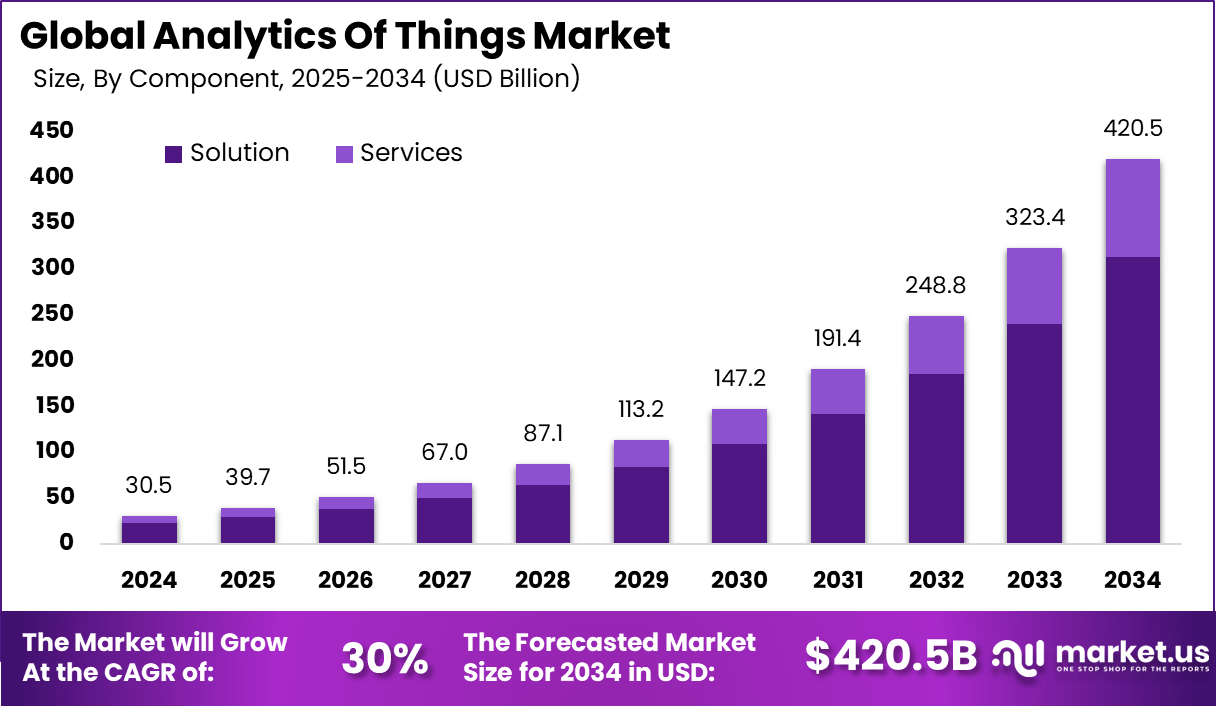

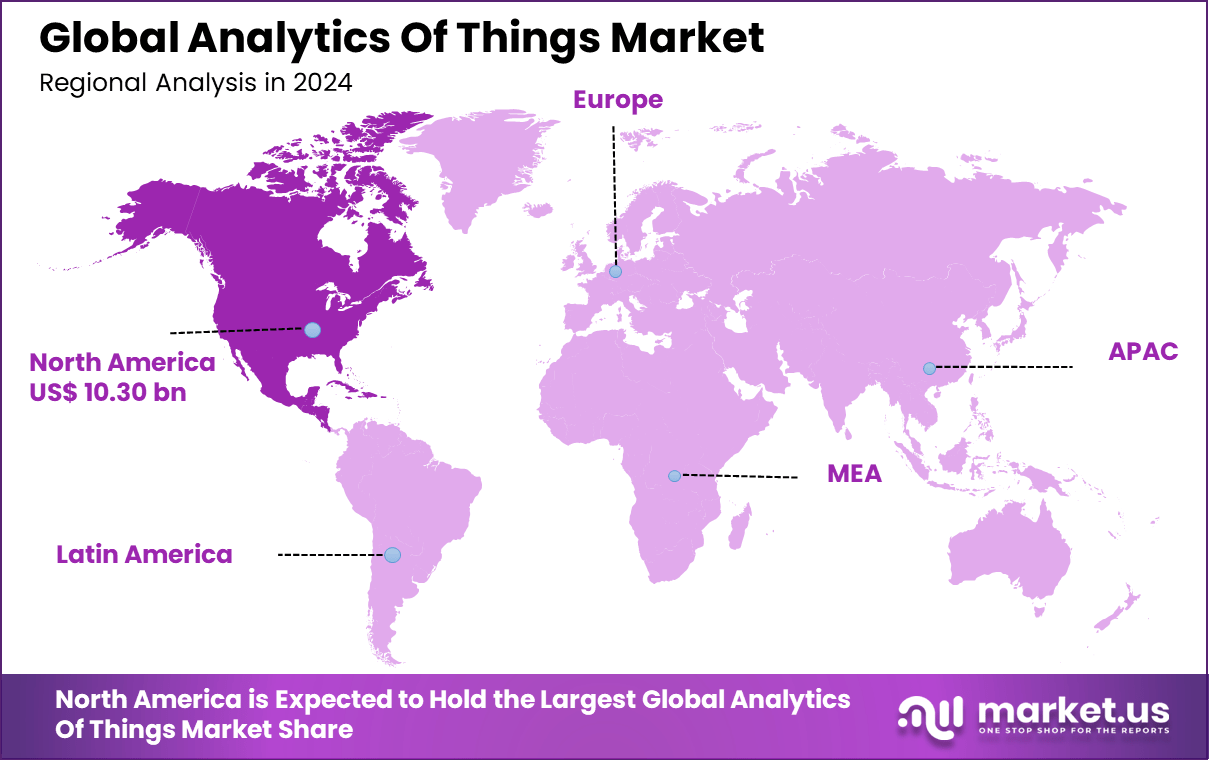

The Global Analytics Of Things Market size is expected to be worth around USD 420.5 billion by 2034, from USD 30.5 billion in 2024, growing at a CAGR of 30% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 33.8% share, holding USD 10.30 billion in revenue.

The Analytics of Things (AoT) Market refers to solutions that analyze data generated by Internet of Things (IoT) devices to derive insights, support decisions, and enable optimizations. In effect, AoT combines the connectivity of devices and sensors with analytics tools (descriptive, predictive, or prescriptive) to turn raw device data into actionable information. The market includes software platforms, analytics services, data pipelines, and integrations with device and cloud systems.

Top driving factors behind the AoT market include the rapid increase in connected devices worldwide, which creates vast volumes of data that require intelligent analysis. Advances in technologies such as artificial intelligence, machine learning, edge computing, and 5G networks are accelerating the processing and accuracy of analytics.

For example, more than 90% of enterprises report positive returns from implementing IoT use cases, reflecting strong demand for AoT solutions. Demand for AoT is being driven by the rising adoption of several enabling technologies. Cloud computing platforms allow scalable data storage and processing, while edge computing helps analyze data closer to the source, reducing latency and bandwidth costs.

For instance, in December 2024, OpenText highlighted its latest innovations in analytics at OpenText World 2024, focusing on the future of Analytics of Things (AoT). The company introduced new solutions designed to enhance data-driven decision-making across industries, emphasizing the integration of IoT data with advanced analytics.

Key Takeaway

- By component, Solutions dominated with 74.4%, reflecting the central role of software-driven platforms in processing and analyzing IoT data.

- By organization size, Large Enterprises accounted for 68.4%, showing their stronger adoption capacity compared to smaller firms.

- By deployment, On-Premises models led with 58.6%, highlighting ongoing reliance on in-house infrastructure despite cloud growth.

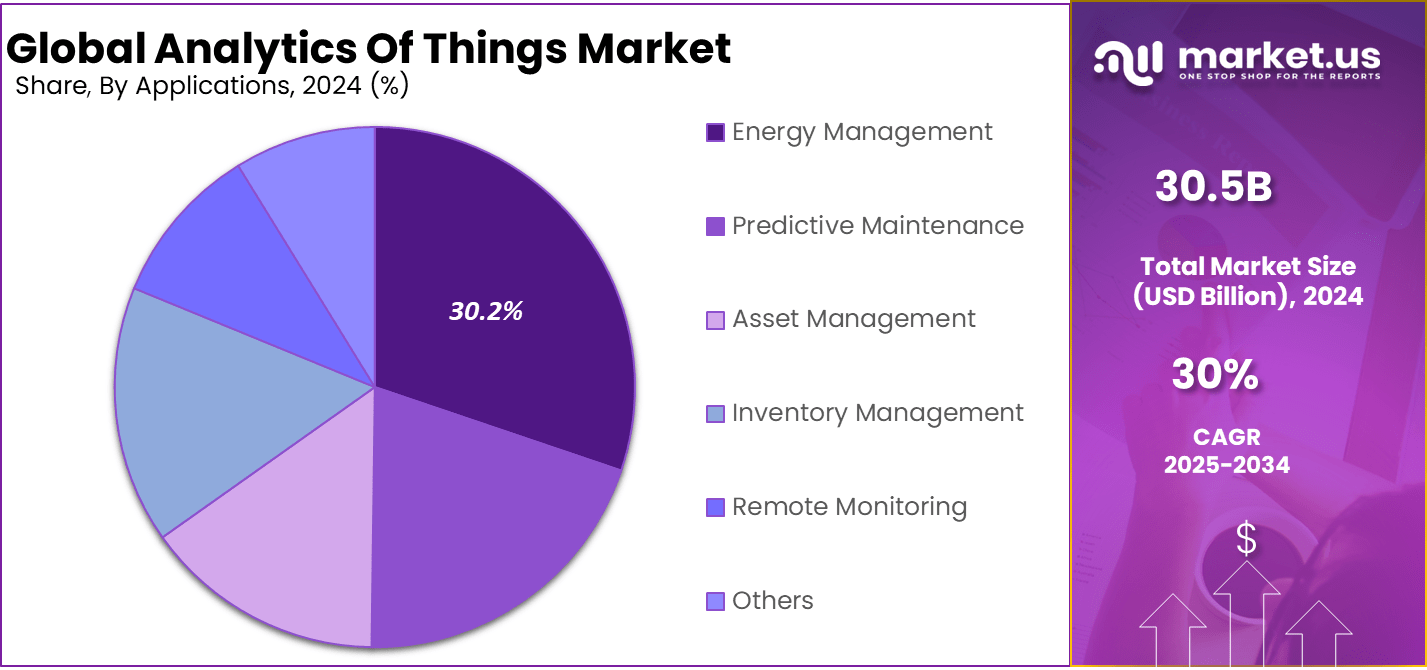

- By application, Energy Management captured 30.2%, underlining the demand for optimizing energy use across industries.

- By type, Descriptive Analytics held 35.6%, showing its importance in providing historical insights as a foundation for advanced analytics.

- By end use, Manufacturing led with 28.5%, reflecting its heavy reliance on IoT-enabled analytics for production efficiency and process improvement.

- Regionally, North America dominated with 33.8%, while the U.S. alone contributed about USD 8.24 billion, supported by a high CAGR of 27.2%.

Role of Generative AI

The role of Generative AI in Analytics of Things (AoT) has become substantial in 2025, as it enhances the ability to turn vast amounts of raw IoT data into actionable insights more efficiently. Generative AI automates data preparation, uncovers deep patterns, and delivers predictive analytics in real time, helping organizations optimize operations and decision-making quickly.

By 2026, nearly 80% of organizations are expected to integrate generative AI into their data workflows, showing the rapid adoption of this technology in analytics. It also improves accessibility by enabling non-experts to query data in natural language, thus democratizing analytics beyond technical teams.

Investment and Business Benefits

Investment opportunities in the AoT market are robust due to the expanding number of IoT devices and growing awareness of data-driven decision-making. Investors are increasingly funding companies developing AI-based analytics platforms, edge computing infrastructure, and secure IoT data management solutions.

Interest is particularly high in sectors such as industrial IoT, smart cities, healthcare, and transportation, where the impact of AoT can be transformative. However, challenges such as data privacy concerns and a shortage of skilled personnel remain key considerations for investors. Business benefits of adopting AoT include increased operational efficiency, better risk management, enhanced innovation capacity, and improved supply chain management.

Through predictive analytics and automated insights, companies reduce operational disruptions and improve their responsiveness to market changes. AoT also supports sustainable practices by enabling better resource tracking and energy management, which are increasingly important for regulatory compliance and corporate responsibility.

U.S. AoT Market Size

The market for Analytics of Things within the U.S. is growing tremendously and is currently valued at USD 8.24 billion, the market has a projected CAGR of 27.2%. The market is growing tremendously due to the country’s strong technological infrastructure, widespread adoption of IoT devices, and a thriving ecosystem of innovation.

U.S. companies are leveraging AoT to enhance operational efficiency, improve customer experiences, and drive digital transformation across sectors like healthcare, manufacturing, and smart cities. Additionally, advancements in AI, machine learning, and edge computing are enabling real-time data analytics, making AoT solutions increasingly essential for businesses aiming to stay competitive.

For instance, in September 2022, Microsoft highlighted the dominance of the U.S. in Analytics of Things (AoT) with its advancements in Azure IoT solutions. The blog emphasized how U.S.-based companies are leading the way in implementing IoT analytics to optimize operations across various industries. Microsoft’s robust cloud infrastructure and IoT platforms are empowering organizations to scale data analytics solutions effectively.

In 2024, North America held a dominant market position in the Global Analytics Of Things Market, capturing more than a 33.8% share, holding USD 10.30 billion in revenue. This dominance is due to its advanced technological infrastructure, high IoT device adoption, and significant investments in digital transformation across industries.

The region’s strong presence of leading tech companies, particularly in the U.S., has driven the development of innovative AoT solutions. Additionally, the increasing demand for real-time analytics in sectors like healthcare, manufacturing, and smart cities, combined with favorable government initiatives, has further solidified North America’s market leadership.

For instance, in March 2024, Cisco Systems received approval from European regulators for its acquisition of Splunk, a leader in data analytics. This move underscores North America’s dominance in Internet of Things (IoT) analytics, as Cisco, based in the U.S., continues to expand its influence in the sector.

Component Analysis

In 2024, the Solutions accounted for the largest share at 74.4% in the Analytics of Things market. Enterprises are adopting solutions that provide integrated platforms for connecting devices, analyzing data streams, and generating actionable insights. These offerings simplify complex IoT data handling by providing pre-built analytical capabilities tailored to real-time environments.

The preference for solutions rather than standalone services also reflects the rising need for scalability and compatibility across industries. As connected devices increase, enterprises look for platforms that can unify disparate data formats while reducing operational complexity, making solution-based models more attractive.

For Instance, in July 2024, Amazon Web Services (AWS) unveiled new advancements for scalable IoT analytics on its platform. This solution is designed to help businesses manage and analyze large volumes of IoT data by offering seamless scalability, low-latency processing, and real-time insights.

Organization Size Analysis

In 2024, Large enterprises held 68.4% of the market. These organizations manage vast IoT ecosystems across facilities, supply chains, and customer touchpoints, creating high demand for structured analytics. Their larger budgets and in-house expertise allow them to invest in platform-based tools and customized deployment.

Smaller companies often face resource limitations, whereas large enterprises can allocate dedicated teams for IoT analytics, driving their adoption rate higher. Their focus on predictive insights and advanced optimization further reinforces their lead in this space.

For instance, in September 2024, Oracle and Amazon Web Services (AWS) announced a strategic partnership to enhance IoT analytics for large enterprises. This collaboration aims to provide large organizations with integrated solutions that combine Oracle’s enterprise-grade data management and AWS’s cloud infrastructure.

Deployment Analysis

In 2024, On-premises deployment captured 58.6% share. Many enterprises continue to prefer in-house infrastructure for managing sensitive IoT data flows, especially in sectors where control and security are top priorities. On-premises systems also offer more flexibility in customization and integration with legacy equipment.

However, this reliance on local deployment reflects the balance companies strike between cloud scalability and data sovereignty. Industries like energy, defense, and healthcare are more inclined towards on-premises setups to maintain compliance and ensure complete oversight at operational levels.

For Instance, in March 2025, Esri announced enhancements to its real-time IoT analytics capabilities, focusing on on-premises solutions for organizations seeking greater control over their data. By leveraging Esri’s advanced GIS technology, companies can process and analyze IoT data on-premises, ensuring faster decision-making and reducing reliance on cloud infrastructure.

Application Analysis

In 2024, Energy management represented 30.2% of applications in the market. With connected energy grids and smart infrastructure, enterprises are increasingly using analytics to identify efficiency gains and reduce waste. Real-time monitoring of resource consumption allows organizations to prevent outages and lower costs.

This application area is also influenced by sustainability goals. Companies are making analytics-driven decisions around energy conservation, demand response, and renewable energy integration, highlighting energy management as a central driver for AoT adoption.

For Instance, in July 2025, SolarEdge expanded its energy management capabilities by acquiring Hark Systems, a company specializing in IoT-based analytics for energy management. This acquisition allows SolarEdge to integrate advanced IoT analytics into its energy solutions, enabling real-time monitoring, predictive maintenance, and optimization of energy consumption.

Type Analysis

In 2024, Descriptive analytics accounted for 35.6% of usage. Organizations initially turn to descriptive models for understanding and visualizing historical IoT data. This method provides a clear view of past performance, which helps build the foundation for more advanced predictive or prescriptive analytics.

The growing share of descriptive analytics reflects the need for simplicity and adoption readiness. Enterprises adopt it as a first step before expanding into deeper insights, making it an entry point toward building advanced IoT data strategies.

For Instance, in December 2021, Amazon Web Services (AWS) introduced a solution to enrich datasets for descriptive analytics using AWS Glue and AWS Glue DataBrew. This toolset enables organizations to easily clean, prepare, and transform their IoT data for better descriptive analytics.

End Use Analysis

In 2024, Manufacturing held 28.5% of the end-use share. Connected machinery, automated production lines, and predictive maintenance models are driving usage in this sector. Manufacturers depend on real-time monitoring to minimize downtime and improve operational efficiency.

Aside from maintenance, analytics supports supply chain planning and quality control by processing vast sensor data. This has turned manufacturing into a key adopter of Analytics of Things, creating a strong base for continued digital integration.

For instance, in July 2025, AWS launched a solution to enhance Industrial IoT analytics by combining Amazon Data Firehose and Amazon S3 Tables with Apache Iceberg. The initiative is designed to simplify IoT data processing and storage in manufacturing, enabling efficient collection, management, and analysis of real-time sensor data to support operational efficiency, predictive maintenance, and quality control.

Emerging Trends

Emerging trends in Analytics of Things in 2025 include the shift toward edge computing, where nearly three-quarters of enterprise-generated data is processed right at the edge rather than in centralized clouds. This enables faster decisions, lower latency, and reduced bandwidth consumption, which is vital for IoT environments. Enhanced AI techniques, including agentic AI that can perform multistep analytics autonomously, are also growing.

Real-time data processing on IoT devices, TinyML for running machine learning on small devices, and advanced security measures like AI-driven threat detection are reshaping how Analytics of Things platforms operate. The number of connected IoT devices grew by about 13% year-over-year recently, surpassing 18 billion devices, reflecting the increasing scope of data for AoT systems to analyze.

Growth factors

Several growth factors support the expansion of Analytics of Things. The rise in IoT device adoption continues to fuel data generation, creating demand for analytics solutions that can handle large-scale, real-time data. Adoption of AI and machine learning technologies in analytics workflows has grown to nearly 65% of organizations investigating or using AI for data insights.

Improvements in AI-powered automation reduce manual data processing and enable faster, more accurate forecasting, improving operational efficiency. Additionally, the need for privacy and data security in IoT environments drives investment in edge analytics to keep sensitive data local. Indeed, enterprise spending on IoT increased by about 10 percent year-over-year, signaling continued confidence in analytics-driven IoT.

Key Market Segments

By Component

- Solution

- Services

By Organization Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Deployment

- On-Premises

- Cloud

By Application

- Energy Management

- Predictive Maintenance

- Asset Management

- Inventory Management

- Remote Monitoring

- Others

By Type

- Descriptive Analytics

- Diagnostic Analytics

- Predictive Analytics

- Prescriptive Analytics

By End Use

- Manufacturing

- Energy & Utilities

- Retail & E-commerce

- Healthcare & Life Sciences

- Transportation & Logistics

- IT & Telecom

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Drivers

Growing Use of Internet of Things (IoT)

The main driver boosting the Analytics of Things market is the rapid increase in IoT device deployments across multiple sectors. IoT devices generate massive amounts of data through sensors and connected hardware, which organizations need to analyze for insights.

Analytics of Things integrates analytics capabilities with IoT, allowing real-time interpretation and decision making from this continuous data flow. For instance, industries like infrastructure management, automation, and security management rely heavily on AoT to transform raw sensor data into actionable business intelligence.

For instance, in August 2024, Amazon Web Services (AWS) introduced emerging architecture patterns for integrating IoT and generative AI on its cloud platform. This development highlights advancements in data processing technologies that enable more efficient and intelligent analysis of IoT data.

Restraint

Data Privacy and Security Concerns

A significant restraint on the growth of Analytics of Things is the challenge of ensuring data privacy and security. IoT devices handle a substantial volume of sensitive and personal information, making them attractive targets for cyberattacks and data breaches.

Smart home systems that monitor user behavior or health trackers that collect biometric data must protect this information from unauthorized access. Failure to implement strong security measures can lead to data leaks, financial losses, and erosion of consumer trust.

For instance, in February 2022, UNESCO highlighted significant data privacy and security concerns surrounding the Internet of Things (IoT) in its report on inclusive policy development. The report emphasized the risks associated with the vast amount of personal and sensitive data generated by IoT devices, particularly in areas such as healthcare, smart cities, and personal wearables.

Opportunities

Adoption of Analytics of Things (AoT) in Healthcare

The healthcare industry is increasingly turning to AoT to enhance patient care. With real-time data collection from wearables, smart devices, and monitoring systems, healthcare providers can detect early signs of diseases, offer personalized treatment plans, and improve patient outcomes.

Analytics of Things in healthcare can streamline workflows, reduce readmission rates, and enable better decision-making. This opportunity offers tremendous potential for improving the overall efficiency and effectiveness of healthcare delivery while enhancing the patient experience.

For instance, in November 2024, Benjamin Joseph, a healthcare specialist, joined the SAS IoT Partner Ecosystem to drive the adoption of Analytics of Things (AoT) in healthcare. This collaboration aims to leverage advanced IoT and data analytics to enhance patient care, streamline operations, and improve outcomes.

Challenges

Managing Data Volume and Complexity

A key challenge in Analytics of Things is handling the sheer volume and complexity of data generated by millions of IoT devices. The variety of data types – ranging from sensor readings to multimedia – requires robust systems that can unify, store, and analyze this information efficiently.

For instance, each device may produce data in different formats with varying frequencies, making it difficult to integrate and extract meaningful insights at scale. This creates network strain and storage capacity issues, requiring scalable infrastructure and advanced data management strategies.

Additionally, determining which data is essential to transmit and analyze versus what can be filtered at the edge remains a technical obstacle. Organizations must invest in sophisticated analytics platforms that can reduce data dimensionality and process real-time streams without losing critical information. Without solutions to these issues, the value generated by AoT could be limited.

Key Players Analysis

The Analytics of Things (AoT) market is led by major cloud providers such as Amazon Web Services, Microsoft, and Google (Alphabet Inc.). These firms offer scalable platforms that connect IoT data with real-time analytics and AI capabilities. Their services support large-scale use in smart cities, logistics, and industrial automation, driving widespread adoption across global enterprises.

Hardware and network leaders like Cisco, Dell, and Hewlett Packard Enterprise are enhancing edge analytics to process data closer to the source. Meanwhile, enterprise software providers including SAP, Oracle, and SAS Institute offer robust analytics platforms integrated into core business systems, supporting advanced forecasting and decision-making in finance, retail, and healthcare.

Firms like Salesforce, Teradata, Software AG, and OpenText are expanding IoT analytics through AI integration and cloud-based tools. PTC focuses on industrial analytics, while Aeris delivers telecom-centric IoT solutions. Accenture plays a key role in consulting and system integration. The presence of other niche players further strengthens innovation and industry-specific deployments.

Top Key Players in the Market

- Accenture

- Aeris

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- Dell Inc.

- Hewlett Packard Enterprise Development LP

- Google (Alphabet Inc.)

- OpenText Web

- Microsoft

- Oracle

- PTC

- Salesforce, Inc.

- SAP SE

- SAS Institute Inc.

- Software AG

- Teradata

- Others

Recent Developments

- June 2025 – Amazon Web Services launched multiple advanced AI and analytics products including Amazon Transform, a service using agentic AI to simplify infrastructure modernization; enhanced Amazon Bedrock and SageMaker AI with expanded model libraries and hyper-efficient training capabilities; and invested over $390 million in generative AI accelerator programs and research.

- March 2024 – Cisco completed its $28 billion acquisition of Splunk, enhancing its analytics and security monitoring capabilities. This move positions Cisco as a leader in real-time data analytics critical to managing AI-driven enterprise operations.

- October 2025 – Dell Technologies reaffirmed its Internet of Things strategy with ongoing investment exceeding $1 billion over three years in IoT products, edge computing solutions, and partner ecosystems to drive real-time data analytics closer to the edge.

- July 2025 – Hewlett Packard Enterprise closed its acquisition of Juniper Networks, expanding its cloud-native AI-driven portfolio for networking and analytics. Juniper’s revenue contribution is expected to nearly triple to $5.9 billion by 2026, supporting HPE’s strong analytics and hybrid cloud growth.

Report Scope

Report Features Description Market Value (2024) USD 30.5 Bn Forecast Revenue (2034) USD 420.5 Bn CAGR(2025-2034) 30% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solution, Services), By Organization Size (Small & Medium Enterprises (SMEs), Large Enterprises), By Deployment (On-Premises, Cloud), By Application (Energy Management, Predictive Maintenance, Asset Management, Inventory Management, Remote Monitoring, Others), By Type (Descriptive Analytics, Diagnostic Analytics, Predictive Analytics, Prescriptive Analytic), By End Use (Manufacturing, Energy & Utilities, Retail & E-commerce, Healthcare & Life Sciences, Transportation & Logistics, IT & Telecom, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Accenture, Aeris, Amazon Web Services, Inc., Cisco Systems, Inc., Dell Inc., Hewlett Packard Enterprise Development LP, Google (Alphabet Inc.), OpenText Web, Microsoft, Oracle, PTC, Salesforce, Inc., SAP SE, SAS Institute Inc., Software AG, Teradata, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Analytics of Things MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Analytics of Things MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Accenture

- Aeris

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- Dell Inc.

- Hewlett Packard Enterprise Development LP

- Google (Alphabet Inc.)

- OpenText Web

- Microsoft

- Oracle

- PTC

- Salesforce, Inc.

- SAP SE

- SAS Institute Inc.

- Software AG

- Teradata

- Others