Global Analog Semiconductor Market Size, Share, Industry Analysis Report By Product Type (Power Management ICs (Voltage Regulators, Power Converters, Battery Management ICs), Amplifiers (Operational Amplifiers, Audio Amplifiers, Instrumentation Amplifiers), Data Converters (ADCs (Analog-to-Digital Converters), DACs (Digital-to-Analog Converters)), Interface ICs (Drivers & Receivers, Multiplexers/Demultiplexers), Discrete Devices (Diodes, Transistors, Thyristors, Others (Sensors & Sensor ICs, Analog Switches))), By Application (Consumer Electronics, Automotive, Industrial, Telecommunications, Healthcare), By Technology (Bipolar Junction Transistor (BJT) ICs, MOSFET & CMOS ICs, JFET ICs, GaN & SiC-based ICs, Others (Hybrid Analog ICs, Mixed-Signal ICs)), By End User (OEMs, Distributors, System Integrators, Others (Research & Development Labs, Government & Defense)), By Regional Analysis, Global Trends and Opportunity, Future Outlook by 2025-2034

- Published date: Sept. 2025

- Report ID: 159839

- Number of Pages: 272

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Analysts’ Viewpoint

- Investment and Business benefits

- Role of Generative AI

- Regional Insights

- By Product Type

- By Application

- By Technology

- By End User

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

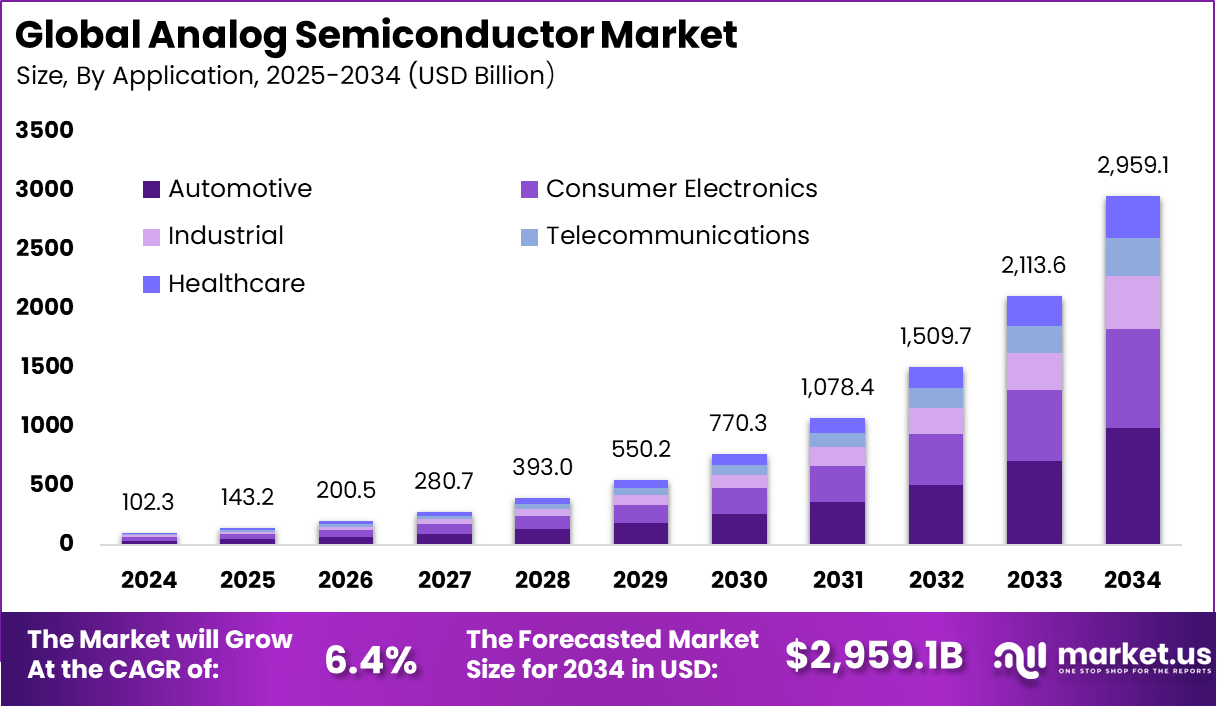

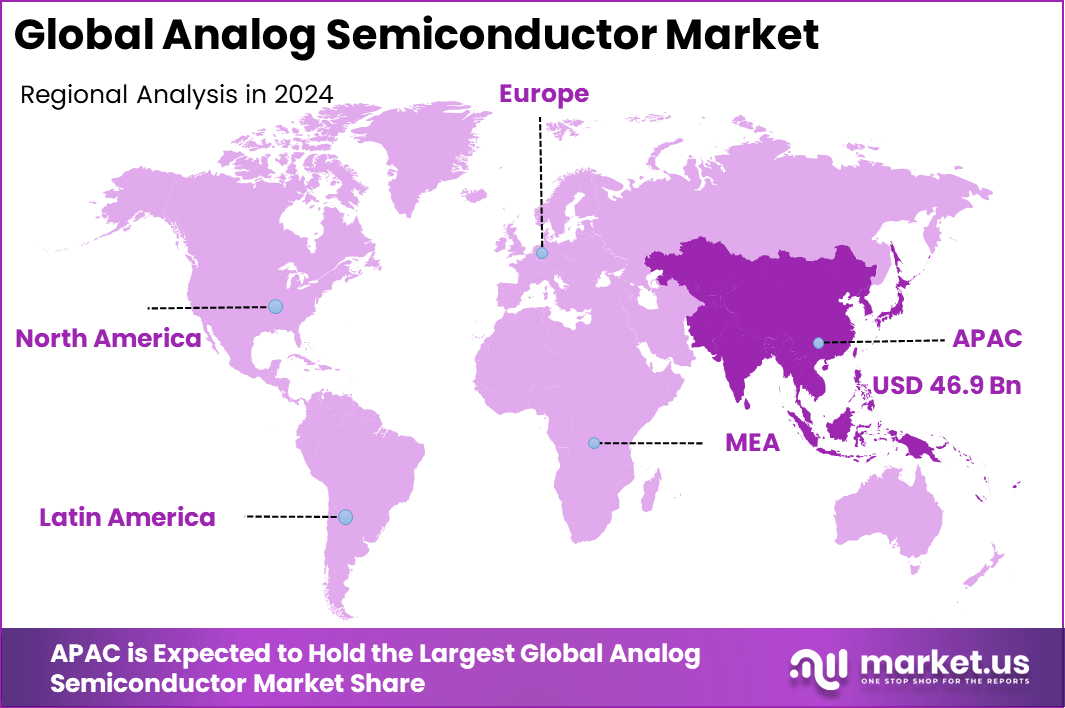

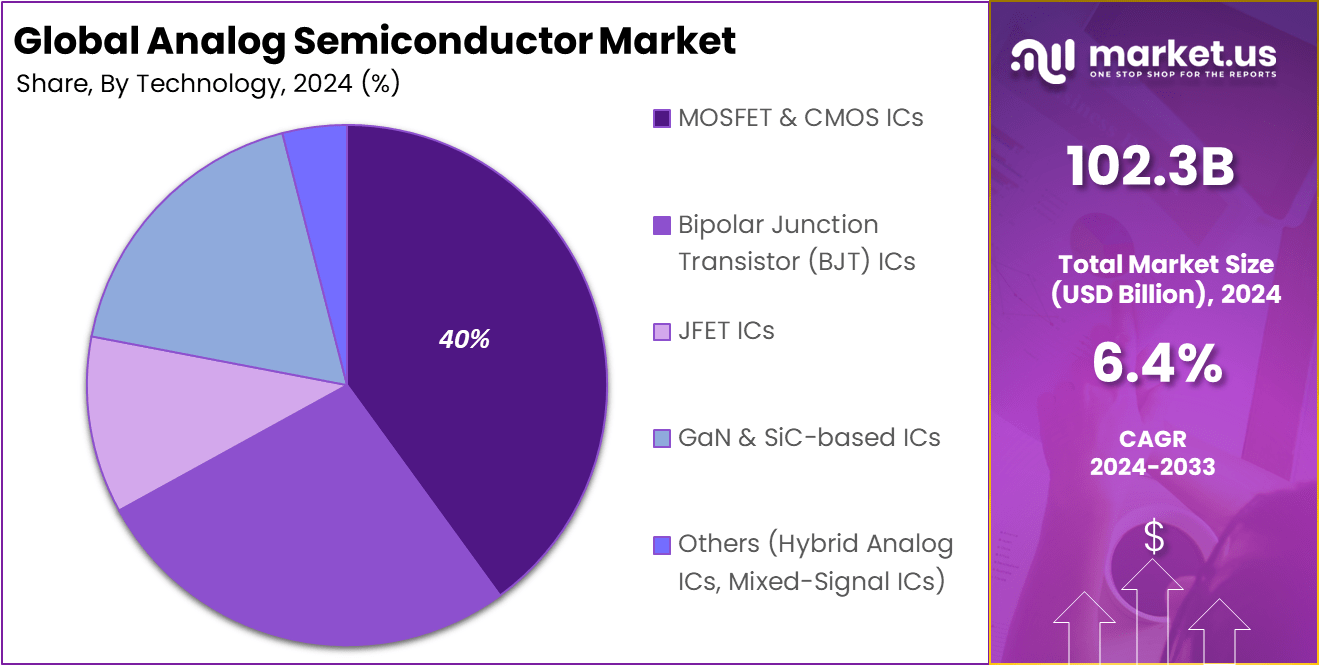

The market size of analog semiconductors was recorded at USD 102.3 billion in 2024 and is projected to register consistent expansion, rising from USD 143.2 billion in 2025 to approximately USD 2,959.1 billion by 2034, growing at a CAGR of 6.4%. In 2024, Asia-Pacific held a dominan market position, capturing more than a 45.9% share, holding USD 46.9 Billion revenue.

The analog semiconductors market consists of integrated circuits and devices that process real-world signals (voltages, currents, frequency, temperature, light, etc.) rather than purely logic or digital signals. These components include operational amplifiers, data converters (ADCs, DACs), power management ICs, voltage regulators, RF amplifiers, analog switches, and interface circuits. Many analog parts are integrated with digital circuits in mixed-signal ICs for sensors, communications, and control systems.

Top driving factors for the analog semiconductors market include the rapid expansion of electric vehicles (EVs) and advanced driver-assistance systems (ADAS). Analog components are vital for battery management, motor control, and sensor systems in EVs. The rising registrations of electric cars, which reached around 14 million globally by 2023, significantly fuel demand.

According to Market.us, The Global Semiconductor Market was valued at USD 840.6 billion in 2024 and is forecasted to grow from USD 907.4 billion in 2025 to about USD 2,010.6 billion by 2034, expanding at a CAGR of 9.20% between 2025 and 2034. In 2024, APAC dominated the market with over 65.7% share, generating USD 552.2 billion in revenue.

Additionally, the growth of IoT ecosystems, encompassing smart homes, industrial automation, and smart cities, depends heavily on analog chips for signal processing and power efficiency. The deployment of 5G networks further intensifies demand for high-performance analog semiconductors due to their role in high-frequency signal transmission and low-latency communication. These factors, combined, create a synergistic effect driving the market upward.

Key Insight Summary

- Power management ICs lead the product segment with 35.8%, driven by demand for efficient energy use in devices.

- Automotive applications account for 33.6%, reflecting rising semiconductor integration in EVs and advanced driver systems.

- MOSFET & CMOS ICs dominate technology share at 40%, supported by their role in power conversion and signal processing.

- OEMs represent the largest end-user group at 50.5%, highlighting direct sourcing for large-scale manufacturing.

- Asia-Pacific holds the highest regional share at 45.9%, driven by strong manufacturing bases and consumer electronics demand.

Analysts’ Viewpoint

Demand analysis shows that sectors such as automotive, telecommunications, consumer electronics, and industrial automation are increasingly adopting analog semiconductor solutions. For instance, in the communications industry, the surge in smartphone production and data center expansions heighten the need for these components.

In the industrial segment, automation tools and robotics rely on analog chips for safe and reliable operations, which is essential as automation contributes significantly to productivity improvements worldwide. Growing edge computing applications, which require low-latency and energy-efficient components, also boost demand across healthcare, retail, and manufacturing.

Technologies with increasing adoption of analog semiconductors include electric vehicles, 5G networks, IoT devices, and edge computing systems. Electric vehicles require precise power management and sensor integration, while 5G infrastructure depends on analog components like RF amplifiers and signal processing chips to maintain high-speed connectivity.

IoT devices, which count billions in use globally, demand low-power, highly integrated analog solutions to ensure long battery life and efficient data handling. Edge computing technologies are gaining traction as they process data locally, requiring reliable analog components to bridge sensors and cloud systems seamlessly.

Investment and Business benefits

Investment opportunities in the analog semiconductor market arise from increasing demand for power management chips, sensors, and specialized analog components tailored for AI and machine learning applications. Building advanced fabrication facilities specifically for analog chips, focusing on materials for high-frequency and high-power applications, and expanding research into energy-efficient solutions represent promising areas.

The growth in electric vehicle adoption and the rollout of smart city infrastructure also attract investments in next-generation analog technologies to support advanced sensor systems and power control modules. Business benefits from adopting analog semiconductors include improved device efficiency, enhanced product reliability, and competitive advantages through innovation.

Companies integrating advanced analog solutions can extend battery life in consumer devices, improve safety features in vehicles, and enable faster communications networks. This results in higher customer satisfaction, lower operational costs due to energy savings, and the ability to comply with emerging regulations on energy consumption and emissions. Analog semiconductors also offer flexibility in design, allowing businesses to tailor products for specific applications and market needs.

Role of Generative AI

Generative AI is playing a key role in the analog semiconductor industry by accelerating innovation and improving operations across the value chain. It helps companies manage supply chains better by forecasting demand through analyzing large datasets, which minimizes disruptions and production delays.

In manufacturing, generative AI drives predictive maintenance and creates digital twins of factories and products, which enhance efficiency and reduce defect rates. This has led to a significant boost in meeting the rising demand for analog components in applications like AI systems, where precise signal processing and power management are critical.

Regional Insights

In 2024, the Asia-Pacific region captured 45.9% of the market. This leadership is supported by the region’s strong electronics manufacturing base, rapid industrialization, and booming demand for consumer devices and automotive electronics. Countries like China, South Korea, and Taiwan play a central role in both semiconductor production and end-use adoption.

Growth in the region is further supported by government-led investments in semiconductor capacity and the rising need for power-efficient solutions in smart devices and automotive electrification. As APAC continues to strengthen its position in global electronics, it remains the key demand center for analog semiconductors.

By Product Type

In 2024, Power management ICs accounted for 35.8% of the analog semiconductor market. These devices are essential for regulating power flow in electronic systems, converting voltage levels, and ensuring energy efficiency in both consumer and industrial electronics. With the growing demand for energy-saving solutions, power management ICs have become a critical component for battery-powered devices, renewable energy systems, and portable electronics.

The increasing adoption of electric vehicles and the rising need for efficient charging solutions have further strengthened demand for these chips. Their role in reducing power loss and extending device lifespan makes them a preferred choice across multiple industries, reinforcing the leading position of this segment.

By Application

In 2024, the automotive segment held 33.6% share of the market. Analog semiconductors are widely used in vehicles for powertrain control, safety systems, battery management, and infotainment. With more vehicles integrating electronic controls, especially electric and hybrid cars, the demand for these semiconductors continues to grow steadily.

As cars move closer to becoming “computers on wheels”, analog chips are vital for sensor interfaces, connectivity, and real-time communication between critical systems. This growth is supported by increasing electronic content per vehicle, especially in emerging fields like ADAS and autonomous driving.

By Technology

In 2024, MOSFET and CMOS ICs together captured 40% of the analog semiconductor market. These technologies are known for their efficiency and scalability, making them highly suitable for applications involving switching, signal processing, and power amplification. Their ability to handle both low-voltage portable devices and high-power industrial systems reflects their versatility.

MOSFETs are particularly critical in power management and motor control, while CMOS technology enables integration of analog and digital functions on a single chip. With industries demanding smaller, faster, and more power-efficient devices, the use of MOSFET and CMOS ICs is on a strong upward trajectory.

By End User

In 2024, Original equipment manufacturers (OEMs) contributed 50.5% to market demand, highlighting their role as the largest end-user segment. OEMs rely on analog semiconductors to integrate power-efficient and reliable components into their products, whether in electronics, automotive, or industrial equipment.

Their dominance also stems from their direct influence on design specifications, allowing them to drive innovation in semiconductors for advanced system integration. As OEMs continue to push for performance improvements in consumer devices and automotive systems, their dependence on analog solutions is expected to remain substantial.

Emerging Trends

Among emerging trends in the analog semiconductor market, the growing shift towards energy-efficient devices stands out strongly. This is especially notable in sectors such as IoT and automotive, where battery life and power consumption are crucial.

The adoption of new materials like gallium nitride (GaN) and silicon carbide (SiC) is also gaining momentum, as these materials enhance performance and efficiency. Another important trend is the rising integration of analog functions within system-on-chip (SoC) designs, which allows more compact and multifunctional devices.

Automotive electronics, particularly for electric vehicles (EVs) and advanced driver-assistance systems, represent a major driver of demand for analog components. Additionally, the expansion of 5G technology and smart city projects is fueling the need for analog chips capable of supporting faster, low-latency data transfer and sophisticated sensor systems.

Growth Factors

Growth factors in the analog semiconductor sector include rapid expansions in IoT devices and the automotive electrification trend. IoT ecosystems involve billions of connected devices requiring efficient analog solutions for signal conditioning and power management.

The increasing complexity of electronic devices demands more highly integrated analog solutions that also reduce power usage. Furthermore, the electric vehicle market’s growth directly impacts demand for power management ICs, battery monitoring, and motor control components.

The rise in smart city initiatives, which require advanced energy and transportation management systems, also supports the market’s growth. These factors collectively are driving the analog semiconductor market at an annual growth rate around 6% or higher, with Asia Pacific being a particularly strong contributor due to its large IoT and manufacturing base.

Key Market Segments

By Product Type

- Power Management ICs

- Voltage Regulators

- Power Converters

- Battery Management ICs

- Amplifiers

- Operational Amplifiers

- Audio Amplifiers

- Instrumentation Amplifiers

- Data Converters

- ADCs (Analog-to-Digital Converters)

- DACs (Digital-to-Analog Converters)

- Interface ICs

- Drivers & Receivers

- Multiplexers/Demultiplexers

- Discrete Devices

- Diodes

- Transistors

- Thyristors

- Others (Sensors & Sensor ICs, Analog Switches)

By Application

- Consumer Electronics

- Smartphones & Tablets

- Wearables

- Home Appliances

- Automotive

- ADAS Systems

- Infotainment

- EV Power Management

- Industrial

- Factory Automation

- Robotics

- Process Control

- Telecommunications

- Networking Equipment

- Wireless Infrastructure

- Healthcare

- Medical Imaging

- Diagnostic Devices

- Others (Aerospace & Defense, Energy Management)

By Technology

- Bipolar Junction Transistor (BJT) ICs

- MOSFET & CMOS ICs

- JFET ICs

- GaN & SiC-based ICs

- Others (Hybrid Analog ICs, Mixed-Signal ICs)

By End User

- OEMs

- Distributors

- System Integrators

- Others (Research & Development Labs, Government & Defense)

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Growth of Electric Vehicles and Automotive Electrification

The growth of electric vehicles (EVs) is a major driver for the analog semiconductor market. Analog semiconductors play critical roles in EVs for power management, battery charging, sensor systems, and motor control. With global EV registrations reaching 14 million by 2023, demand for analog components in this sector has surged.

Automakers require efficient analog chips to optimize vehicle performance, energy use, and safety features, which fuels market expansion. Investment in high-efficiency solutions tailored for EV applications continues to propel industry growth. For instance, power management ICs in EVs regulate battery life and help improve driving range, a key customer priority.

Moreover, the automotive sector accounted for the largest revenue share (over 30%) in analog semiconductors in 2024, driven by electric and smart vehicles. In addition to EVs, advanced driver assistance systems (ADAS) and automotive infotainment systems rely on analog chips that process real-world signals. This multi-faceted automotive demand highlights the expanding role of analog semiconductors in vehicle electrification and automation.

Restraint

Supply Chain and Raw Material Challenges

The analog semiconductor market faces significant restraints due to supply chain disruptions and raw material shortages. Geopolitical tensions, particularly trade restrictions between key countries, have led to tariffs and difficulty in procuring critical components such as silicon and rare earth elements. These disruptions cause procurement delays and raise manufacturing costs.

For example, ongoing trade conflicts have resulted in extended lead times, limiting the availability of analog components for industries like automotive and consumer electronics. This tight supply situation pressures manufacturers and can slow overall market growth.

In addition to geopolitical issues, the analog semiconductor industry depends heavily on few suppliers for essential materials, magnifying vulnerability to shortages. This dependence leads to higher prices for end users and challenges in maintaining consistent production levels. These supply chain issues raise costs and restrict the industry’s ability to meet growing demand. Ensuring supply reliability and diversifying sources remain key priorities to reduce this restraint.

Opportunity

Expansion of IoT and Edge Computing

The rapid expansion of Internet of Things (IoT) devices and edge computing represents a significant opportunity for analog semiconductors. IoT devices require analog components for sensor data acquisition, signal conditioning, power management, and communication with digital systems.

Increasing integration of smart homes, industrial automation, healthcare wearables, and smart cities creates rising demand for energy-efficient, highly integrated analog chips. Millions of connected devices generate real-time data that must be processed efficiently at the edge, relying on analog semiconductors optimized for low power and compact form factors.

Edge computing, which reduces latency by processing data closer to its source, further drives analog semiconductor demand. Analog chips in edge devices ensure accurate signal conversion and reliable communication with the cloud. This trend aligns with growing industrial and consumer adoption of automated and intelligent systems.

Challenge

High Manufacturing Costs and Technological Demands

One key challenge facing the analog semiconductor market is the high cost of manufacturing and development. Analog semiconductor production requires complex fabrication processes and precision engineering, which drive up costs compared to digital chip manufacturing.

Additionally, rapid technological advancements require large investments in research and development to keep pace with evolving customer requirements. This creates pressure on manufacturers to balance innovation with cost-efficiency. The analog semiconductor lifecycle is shorter due to constant upgrades and the need for enhanced performance, especially in power efficiency and integration.

Manufacturers also face pressure to reduce time-to-market while maintaining quality, which adds operational complexity. High development costs combined with intense competition can narrow profit margins and pose risks to long-term industry sustainability. Companies must continuously innovate while managing costs to overcome these challenges and remain competitive in a dynamic market environment.

Competitive Analysis

The Analog Semiconductor Market is driven by leading players such as Texas Instruments, Analog Devices, STMicroelectronics, and NXP Semiconductors. These companies provide a wide range of analog ICs including amplifiers, power management chips, and data converters that are critical for consumer electronics, automotive, and industrial systems.

Manufacturers like ON Semiconductor, Renesas Electronics, Infineon Technologies, and Microchip Technology are strengthening their positions by focusing on automotive-grade analog devices, power electronics, and energy-efficient solutions. Skyworks Solutions, Broadcom, and Qualcomm dominate in wireless connectivity and RF analog components, supporting the growth of 5G, IoT, and mobile communications.

Additional contributors such as Maxim Integrated, Toshiba Electronics, ROHM Semiconductor, Sony Semiconductor, and Fujitsu Semiconductor provide specialized analog chips for imaging, sensing, and consumer applications. Companies like Cree (Wolfspeed), Semtech, Vishay Intertechnology, and Diodes Incorporated focus on power devices, discrete components, and signal conditioning solutions.

Top Key Players in the Market

- NXP Semiconductors

- ON Semiconductor

- STMicroelectronics

- Renesas Electronics

- Texas Instruments

- Analog Devices

- Maxim Integrated

- Infineon Technologies

- Microchip Technology

- Skyworks Solutions

- Broadcom

- Qualcomm

- Toshiba Electronics

- ROHM Semiconductor

- Sony Semiconductor

- Fujitsu Semiconductor

- Diodes Incorporated

- Cree (Wolfspeed)

- Semtech

- Vishay Intertechnology

- Others

Recent Developments

- August 2025: Infineon Technologies completed acquisition of Marvell’s Automotive Ethernet business for $2.5 billion, reinforcing its leadership in automotive semiconductors and expanding opportunities in software-defined vehicles and physical AI applications like humanoid robots. The acquisition includes a design-win pipeline worth around $4 billion by 2030.

- July 2025: Texas Instruments announced a major investment of more than $60 billion to build seven semiconductor fabs across Texas and Utah, supporting over 60,000 US jobs. This is the largest investment in foundational semiconductor manufacturing in US history, aimed at expanding capacity for analog and embedded processing chips critical for vehicles, smartphones, and data centers.

Report Scope

Report Features Description Market Value (2024) USD 102.3 Bn Forecast Revenue (2034) USD 2,959.1 Bn CAGR(2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (Power Management ICs (Voltage Regulators, Power Converters, Battery Management ICs), Amplifiers (Operational Amplifiers, Audio Amplifiers, Instrumentation Amplifiers), Data Converters (ADCs (Analog-to-Digital Converters), DACs (Digital-to-Analog Converters)), Interface ICs (Drivers & Receivers, Multiplexers/Demultiplexers), Discrete Devices (Diodes, Transistors, Thyristors, Others (Sensors & Sensor ICs, Analog Switches))), By Application (Consumer Electronics, Automotive, Industrial, Telecommunications, Healthcare), By Technology (Bipolar Junction Transistor (BJT) ICs, MOSFET & CMOS ICs, JFET ICs, GaN & SiC-based ICs, Others (Hybrid Analog ICs, Mixed-Signal ICs)), By End User (OEMs, Distributors, System Integrators, Others (Research & Development Labs, Government & Defense)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape NXP Semiconductors, ON Semiconductor, STMicroelectronics, Renesas Electronics, Texas Instruments, Analog Devices, Maxim Integrated, Infineon Technologies, Microchip Technology, Skyworks Solutions, Broadcom, Qualcomm, Toshiba Electronics, ROHM Semiconductor, Sony Semiconductor, Fujitsu Semiconductor, Diodes Incorporated, Cree (Wolfspeed), Semtech, Vishay Intertechnology, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Analog Semiconductor MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Analog Semiconductor MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- NXP Semiconductors

- ON Semiconductor

- STMicroelectronics

- Renesas Electronics

- Texas Instruments

- Analog Devices

- Maxim Integrated

- Infineon Technologies

- Microchip Technology

- Skyworks Solutions

- Broadcom

- Qualcomm

- Toshiba Electronics

- ROHM Semiconductor

- Sony Semiconductor

- Fujitsu Semiconductor

- Diodes Incorporated

- Cree (Wolfspeed)

- Semtech

- Vishay Intertechnology

- Others