Amniotic Products Market Analysis By Product (Cryopreserved Amniotic Membrane, Lyophilization Amniotic Membrane), By Applications (Surgical Wounds, Ophthalmology, Others), By End User (Hospitals, Ambulatory Surgical Centers, Specialized Clinics, Research Centers & Laboratory), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 125552

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

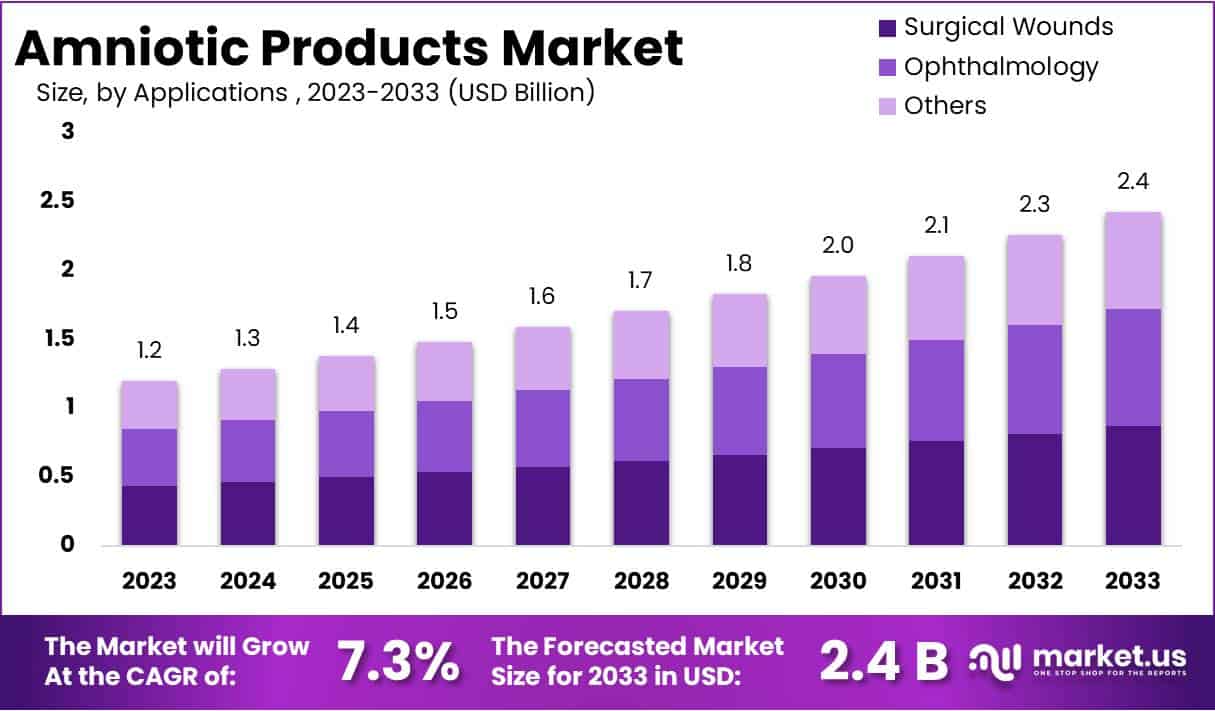

The Global Amniotic Products Market Size is expected to be worth around USD 2.4 Billion by 2033, from USD 1.2 Billion in 2023, growing at a CAGR of 7.3% during the forecast period from 2024 to 2033.

Amniotic products are making significant strides in healthcare, particularly benefiting orthopedics and wound care. These products are rich in cytokines, growth factors, and extracellular matrices, enhancing the healing process for chronic wounds. They act as biological barriers that promote cellular migration and proliferation while reducing inflammation and scarring. Studies highlight their efficacy, with VIVEX Biologics reporting a 40% reduction in healing time for non-healing wounds. This underscores their effectiveness in accelerating recovery and mitigating pain.

In the United States, the regulation of amniotic products is strictly managed by the FDA, especially for many amniotic fluid products that lack approval for claimed conditions like dry eye disease. These products, categorized under Section 351 Biologics, require a Biologics License Application for commercialization. Companies like Amnio Technology are developing minimally manipulated products for homologous use, adhering to FDA regulations to ensure safety and legality in marketing.

The market for amniotic products is also influenced by governmental initiatives, such as the 21st Century Cures Act, which supports regenerative medicine research by streamlining regulatory pathways. This, along with state policies improving perinatal health, creates a conducive environment for market growth. For example, extending postpartum Medicaid coverage enhances maternal healthcare access, indirectly supporting the amniotic products market.

Investment in this sector is driven by substantial research activities aimed at broadening therapeutic applications and improving efficacy. In 2023, the National Institutes of Health allocated $24 million to research centers focusing on maternal health, indicating a growing interest in medical innovations. These funds are primarily used for clinical trials and securing regulatory approvals, essential for expanding market reach and impact.

Regulatory frameworks such as those from the Centers for Medicare & Medicaid Services (CMS) ensure the development of safe and effective applications. CMS’s introduction of a “Birthing-Friendly” hospital designation and updates to Medicare payments reflect an ongoing commitment to enhancing health equity and quality. With Medicaid and CHIP covering over 42% of all U.S. births, these policies are crucial in addressing the national crisis in pregnancy-related mortality and morbidity.

Key Takeaways

- Market Growth: Projected growth from USD 1.2 billion in 2023 to USD 2.4 billion by 2033, at a CAGR of 7.3%.

- Product Segment Dominance: Cryopreserved Amniotic Membrane leads with over 52% market share in 2023, preferred for its efficacy and long shelf life.

- Leading Applications: Surgical Wounds lead application segments, holding over 36% market share, benefiting from the products’ healing enhancement properties.

- Primary End Users: Hospitals are the main end users, accounting for more than 41% of the market, utilizing amniotic products across multiple applications.

- New Opportunities: Increasing use in regenerative medicine, driven by the products’ innate healing properties, opens up new market opportunities.

- Trend in Orthopedics: Rising use in orthopedics and sports medicine due to proven benefits in inflammation reduction and healing enhancement.

- Regional Leadership: North America dominates the market with a 34% share, supported by advanced healthcare infrastructure and significant R&D investments.

Product Analysis

In 2023, the Cryopreserved Amniotic Membrane segment held a dominant market position in the product segment of the Amniotic Products Market, capturing more than a 52% share. This dominance is attributed to the extensive use of cryopreserved membranes in various therapeutic applications, including ophthalmology, wound care, and surgical wounds. These membranes are preferred for their higher efficacy and longer shelf life compared to other forms.

The segment benefits from ongoing advancements in preservation technologies that enhance the biological properties and usability of amniotic tissues. Additionally, increasing clinical evidence supporting the effectiveness of cryopreserved amniotic membranes in promoting healing and reducing inflammation has bolstered their adoption.

Conversely, the Lyophilization Amniotic Membrane segment also shows significant market engagement. Although smaller in market share, this segment is driven by the cost-effectiveness and ease of storage of lyophilized products. These membranes are slowly gaining traction in markets with limited access to sophisticated storage facilities.

Applications Analysis

In 2023, the Surgical Wounds segment held a dominant market position in the Applications Segment of the Amniotic Products Market, capturing more than a 36% share. This prominence stems from the rising demand for advanced healing solutions in surgery. Amniotic products offer enhanced healing properties, reducing inflammation and scarring in surgical sites. As surgical techniques evolve and the number of surgeries increases globally, the demand for effective wound care solutions like amniotic products is expected to grow.

The Ophthalmology segment also shows significant potential within the amniotic products market. These products are increasingly used in treating various eye conditions, such as corneal ulcers and dry eye syndrome. Their natural healing elements promote faster recovery and minimal side effects, which is vital in delicate ocular surgeries. The segment’s growth is supported by the rising prevalence of eye diseases and the aging population, which is more susceptible to ophthalmic issues.

Other applications of amniotic products include orthopedics, chronic wounds, and cosmetic procedures, each contributing to the market expansion. These products are valued for their ability to reduce healing time and improve patient outcomes across diverse medical fields. As research deepens and healthcare providers become more aware of the benefits, the use of amniotic products is set to broaden, promising robust growth in various medical applications.

End User Analysis

In 2023, hospitals held a dominant market position in the end-user segment of the Amniotic Products Market, capturing more than a 41% share. This significant portion reflects hospitals’ extensive use of amniotic products in various therapeutic and surgical applications. Ambulatory surgical centers followed, with a substantial market share, emphasizing their role in outpatient procedures.

Specialized clinics are also noteworthy contributors to market dynamics. These clinics often focus on targeted treatments, which frequently utilize amniotic products for their regenerative properties. Meanwhile, research centers and laboratories constitute a smaller but vital market segment. They primarily engage in the development and testing of new applications for amniotic products.

Key Market Segments

By Product

- Cryopreserved Amniotic Membrane

- Lyophilization Amniotic Membrane

By Applications

- Surgical Wounds

- Ophthalmology

- Others

By End User

- Hospitals

- Ambulatory Surgical Centers

- Specialized Clinics

- Research Centers & Laboratory

Drivers

Increasing Prevalence of Chronic Wounds and Ulcers

The increasing prevalence of chronic wounds and ulcers, notably diabetic foot ulcers (DFUs), is a significant driver for the amniotic products market. DFUs are complex wounds associated with diabetes, posing substantial risks including severe infections and amputations. Approximately 18.6 million individuals globally suffer from DFUs annually, with the U.S. reporting 1.6 million cases each year. These ulcers contribute to 80% of lower extremity amputations in diabetic patients.

Amniotic membrane (AM) products are recognized for their healing properties, particularly in treating such hard-to-heal wounds. The efficacy of AM in accelerating healing stems from its biological composition, which supports wound closure and reduces inflammation. Clinical studies have shown that treatment with AM significantly enhances healing rates in DFU patients compared to standard care alone, with notable improvements observed within 6 to 12 weeks of application.

This therapeutic potential is increasingly crucial as the global burden of diabetes—and by extension, DFUs—continues to rise, emphasizing the need for effective and innovative wound care solutions. The use of AM in wound care not only addresses the immediate healing needs but also helps in reducing the long-term healthcare costs associated with chronic ulcers, further underscoring its importance in contemporary medical treatments.

Restraints

Regulatory and Ethical Challenges

In the Amniotic Products Market, regulatory and ethical challenges significantly restrain growth. The FDA’s stringent oversight specifically targets amniotic tissue-based products. Notably, only those products designated for wound care have received FDA clearance for billing, explicitly excluding orthopedic and pain management applications. This regulatory specificity considerably limits the scope of amniotic product applications, thus impacting market growth by delaying the introduction of innovative treatments.

Moreover, the regulatory pathway for new amniotic products, such as the ReNu amniotic suspension allograft for knee osteoarthritis, is notably rigorous. It requires two well-controlled Phase 3 clinical trials. The ReNu program, for instance, has enrolled over 1,100 patients in its trials, demonstrating the substantial investment and time commitment needed to meet FDA standards. The intense scrutiny and the protracted timeline to market readiness—projected submission by the end of 2025 for ReNu—exemplify the challenges faced by manufacturers.

Ethical debates further complicate the landscape, influencing public perception and market acceptance of amniotic products. These regulatory and ethical hurdles collectively underscore the restrained growth potential of the market, as they limit the rapid deployment of new technologies and restrict market expansion into broader therapeutic areas.

Opportunities

Expanding Applications In Regenerative Medicine

One notable opportunity in the Amniotic Products Market centers around its burgeoning application in regenerative medicine. This sector is witnessing an increased use of amniotic products, such as membranes and fluids, that are vital for various medical interventions, including wound healing and tissue regeneration. According to industry insights, the demand for amniotic products is fueled by their innate healing properties and the ability to facilitate cellular activities crucial for medical treatments.

A pioneering example in the sector is StimLabs, which has introduced products like Revita and Ascent that leverage the unique properties of amniotic tissues for regenerative purposes. These products encapsulate the non-viable cellular components, which are significant for regenerative medical applications, highlighting the potential of amniotic products in enhancing medical outcomes across a range of applications from wound care to surgical enhancements.

Trends

Growing Adoption in Orthopedics and Sports Medicine

The adoption of amniotic products in orthopedics and sports medicine is escalating, underpinned by their promising effects in healing enhancement and inflammation reduction in musculoskeletal injuries. These products, sourced from amniotic fluid, are rich in cytokines, growth factors, and hyaluronic acid, which are vital for joint health.

Clinical uses of amniotic fluid allografts have demonstrated beneficial outcomes, particularly in treating conditions like plantar fasciitis and osteoarthritis, enhancing joint functionality and reducing pain. These products usually contain little to no live stem cells post-processing, yet their regenerative components are effective in tissue repair and inflammation mitigation.

Ensuring the safety of these treatments involves stringent donor screening and processing standards, adhering to the American Association of Tissue Banks (AATB) and the U.S. Food and Drug Administration (FDA) guidelines. Although the application of amniotic products in clinical settings is not yet widespread and remains experimental in many areas, the growing body of research and clinical trials suggests a significant potential for these biological materials in managing and treating sports-related and orthopedic conditions.

Regional Analysis

In 2023, North America held a dominant market position in the amniotic products market, capturing more than a 34% share and achieving a market value of USD 0.4 billion. North America’s market dominance in amniotic products is driven by advanced healthcare infrastructure, significant R&D investments, and increased awareness.

The region’s developed healthcare system enables the integration of innovative medical technologies, supported by leading institutions and specialized clinics. This infrastructure aids in the efficient distribution and utilization of amniotic products, enhancing market growth.

Investments in R&D have positioned North America at the forefront of the amniotic products market. Numerous biotech and pharmaceutical companies are engaged in developing new applications, resulting in continuous product innovations. These advancements enhance the therapeutic potential of amniotic products in medical fields such as wound care, orthopedics, and ophthalmology.

Growing awareness and acceptance among healthcare professionals and patients further propel the market. The recognized benefits of amniotic products, such as promoting wound healing and reducing inflammation, drive their adoption. Educational initiatives and positive clinical outcomes boost confidence in these products.

A strong regulatory framework ensures safety and efficacy, with guidelines established by the FDA and Health Canada. This environment fosters innovation while maintaining high standards. As demand for regenerative medicine rises, North America’s influence is expected to grow, driven by ongoing advancements and a commitment to improving patient outcomes.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the amniotic products market, key players like Allosure Inc., Amnio Technology LLC, Applied Biologics LLC, FzioMed Inc., and others play crucial roles. Allosure Inc. is recognized for its innovative biologics from amniotic tissue used in wound care and orthopedics. Its focus on research and development has led to advanced solutions that improve patient outcomes and broaden market reach. Their strong distribution network and strategic partnerships solidify their market position.

Amnio Technology LLC specializes in amniotic-derived allografts for wound care, orthopedic, and surgical uses, emphasizing quality and compliance with industry standards. The company’s investment in clinical research underlines the efficacy of its products and enhances its market reputation. Applied Biologics LLC focuses on regenerative medicine, offering amniotic tissue products designed for healing in orthopedics and wound care. Their advanced processing techniques ensure product quality.

FzioMed Inc. develops absorbable surgical biomaterials, including those from amniotic tissue, to reduce post-surgical scarring. These companies, along with other key players, drive growth through innovation, strategic collaborations, and continuous research and development investments, meeting the evolving needs of healthcare professionals.

Market Key Players

- Allosure Inc.

- Amnio Technology LLC

- Applied Biologics LLC

- FzioMed Inc.

- Human Regenerative Technologies LLC

- Integra Lifesciences Holdings Corporation

- Corza Ophthalmology

- MiMedx Group Inc.

- Skye Biologics Inc.

- Tissue-Tech Inc.

Recent Developments

- May 2023: CareDx’s AlloSure Lung donor-derived cell-free DNA (dd-cfDNA) testing service received Medicare coverage. This service allows for non-invasive monitoring of lung transplant patients, reducing the need for invasive biopsies and improving early detection of acute rejection and infections. AlloSure Lung has been rapidly adopted in over 60% of lung transplant centers in the U.S..

- February 2022: Amnio Technology launched two new dual-layer allografts, PalinGen® Dual-Layer Membrane and Dual Layer PalinGen® X-Membrane. These products are minimally manipulated, homologous use, and chorion-free, designed for patients with non-healing acute and chronic wounds, surgical wounds, and burns. The dual-layer membranes have increased durability and slower resorption, making them suitable for surgical applications.

Report Scope

Report Features Description Market Value (2023) USD 1.2 Billion Forecast Revenue (2033) USD 2.4 Billion CAGR (2024-2033) 7.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Cryopreserved Amniotic Membrane, Lyophilization Amniotic Membrane), By Applications (Surgical Wounds, Ophthalmology, Others), By End User (Hospitals, Ambulatory Surgical Centers, Specialized Clinics, Research Centers & Laboratory) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Allosure Inc., Amnio Technology LLC, Applied Biologics LLC, FzioMed Inc., Human Regenerative Technologies LLC, Integra Lifesciences Holdings Corporation, Corza Ophthalmology, MiMedx Group Inc., Skye Biologics Inc., Tissue-Tech Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Allosure Inc.

- Amnio Technology LLC

- Applied Biologics LLC

- FzioMed Inc.

- Human Regenerative Technologies LLC

- Integra Lifesciences Holdings Corporation

- Corza Ophthalmology

- MiMedx Group Inc.

- Skye Biologics Inc.

- Tissue-Tech Inc.