Global Aminoglycosides Market Analysis By Product (Neomycin, Tobramycin, Gentamicin, Amikacin, Paromomycin, Streptomycin, Kanamycin, Others), By Route of Administration (Parenteral, Intra-mammary, Topical, Oral), By Application (Veterinary, Skin Infection, Respiratory diseases, UTI & Pelvic Diseases, Other diseases), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2023

- Report ID: 25197

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

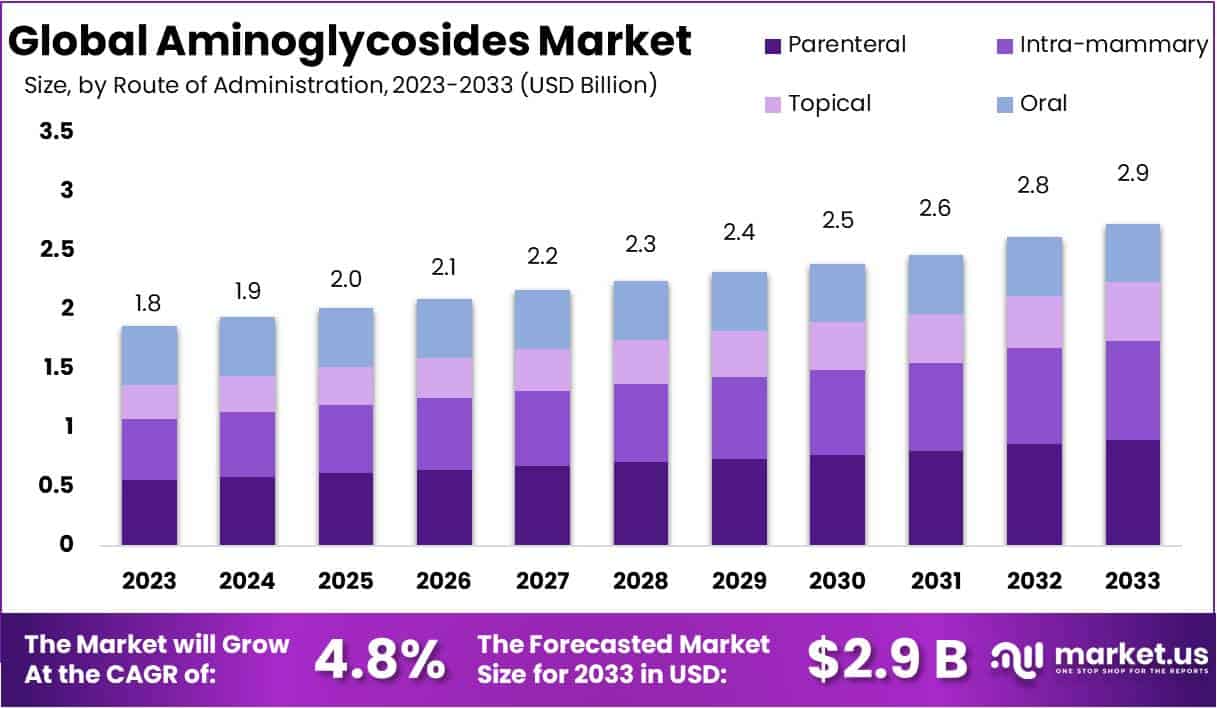

The Aminoglycosides Market Size is projected to witness substantial growth, with an anticipated value of approximately USD 2.9 Billion by the year 2033, compared to its 2023 valuation of USD 1.8 Billion. This growth is expected to occur at a Compound Annual Growth Rate (CAGR) of 4.8% throughout the forecast period spanning from 2024 to 2033.

Aminoglycosides represent a class of antibiotics extensively employed in treating bacterial infections. Renowned for their efficacy against aerobic Gram-negative bacteria, these antibiotics, such as Gentamicin, Amikacin, and Tobramycin, function by impeding bacterial protein synthesis, ultimately leading to bacterial demise. Administration typically occurs through parenteral routes due to their limited oral absorption. Commonly paired with other antibiotics to broaden coverage or enhance synergies, aminoglycosides play a crucial role in serious infections. It’s paramount to note potential adverse effects, including nephrotoxicity and ototoxicity, necessitating vigilant monitoring and dosage adjustments. Despite their potency, aminoglycosides are judiciously employed to balance therapeutic benefits with associated risks.

The aminoglycosides market is significantly influenced by several key factors. Firstly, the escalating incidence of bacterial infections, particularly in hospital environments, serves as a pivotal driver for the increased utilization of aminoglycosides. Ongoing research and development endeavors aimed at introducing novel formulations or enhancing existing ones contribute substantively to the market’s expansion.

Moreover, the market is influenced by the competitive environment, as numerous pharmaceutical companies are actively engaged in manufacturing and distributing aminoglycoside antibiotics. Stringent regulatory environments and approval processes for new antibiotics also play a crucial role in influencing market dynamics. Simultaneously, initiatives focused on raising awareness about the judicious use of antibiotics and the potential consequences of antibiotic resistance have the potential to impact market trends. Lastly, economic conditions and healthcare expenditure in different regions can influence the accessibility and affordability of aminoglycosides, further shaping the global landscape for these critical antibiotics.

Key Takeaways

- Market Growth: Aminoglycosides market to grow at a 4.8% CAGR, reaching USD 2.9 Billion by 2033 from its 2023 valuation of USD 1.8 Billion.

- Product Leadership: Gentamicin dominates with a market share of 32.5%, reflecting consumer and professional preference for its efficacy.

- Administration Preference: Parenteral administration holds a significant 30.8% market share, favored for rapid action in severe infections.

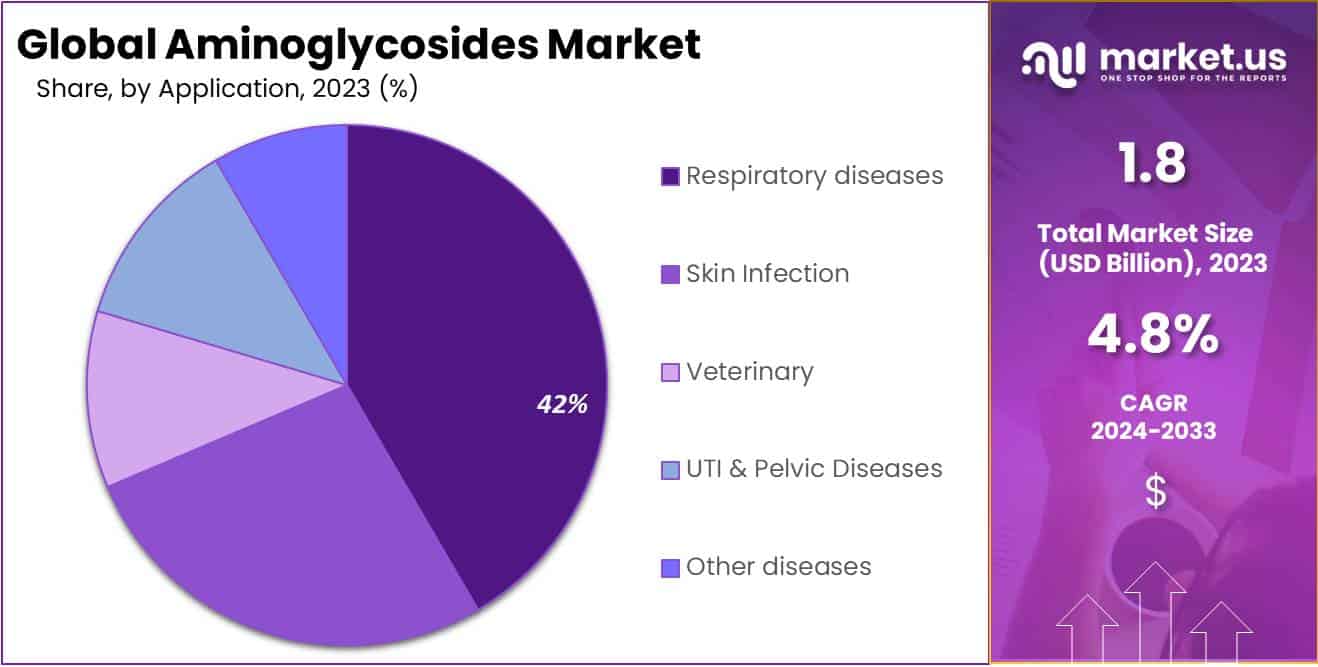

- Application Focus: Respiratory Diseases segment leads with 41.6% market share, addressing the rising prevalence of respiratory ailments.

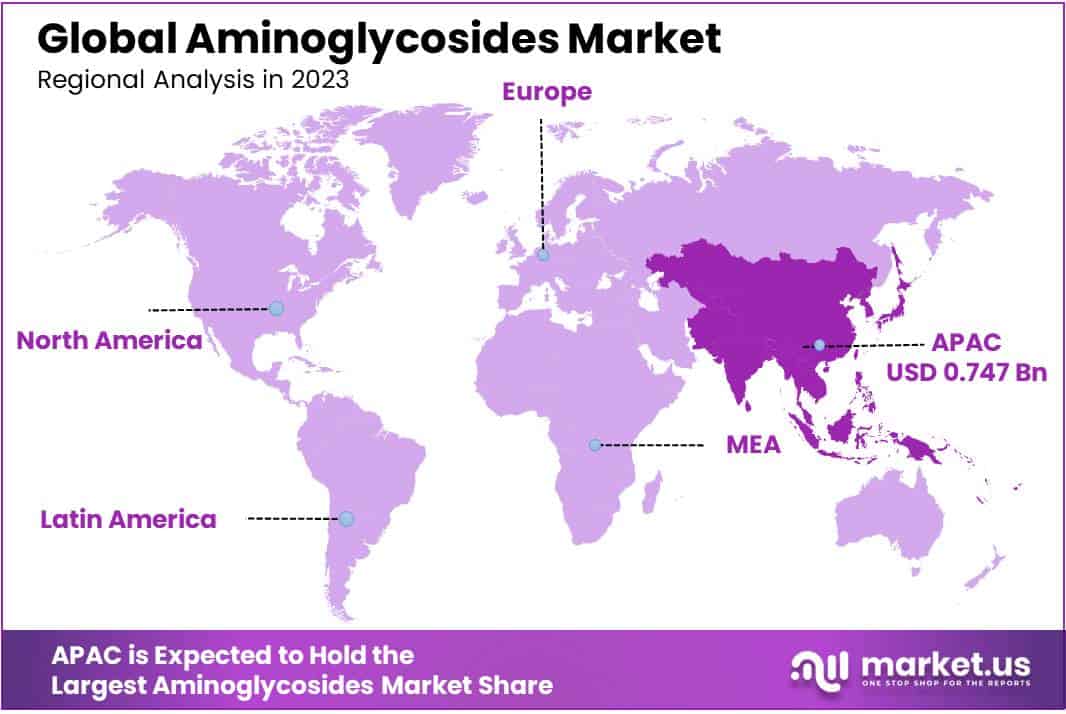

- Regional Dominance: Asia-Pacific (APAC) commands 41.5% of the market, driven by healthcare needs, population growth, and economic development.

- Driver – Infection Incidence: Growing bacterial infections propel aminoglycosides demand globally.

- Opportunity – Emerging Markets: Untapped potential in emerging markets offers growth opportunities, with APAC showcasing substantial influence.

- Innovation Drive: Ongoing research for novel compounds and personalized medicine approaches present growth avenues for the market.

- Restraint – Safety Concerns: Adverse effects like ototoxicity and nephrotoxicity limit aminoglycoside usage.

- Trend – Combination Therapies: Growing trend of combining aminoglycosides with other antibiotics for enhanced effectiveness in treatment outcomes.

Product Analysis

In 2023, the Aminoglycosides market showcased a notable dominance within its product segments, with Gentamicin emerging as the frontrunner. Gentamicin, a vital component in the antibiotic arsenal, commanded a substantial market share, securing more than a 32.5% hold. This indicates a robust preference for Gentamicin among consumers and healthcare professionals alike.

The widespread adoption of Gentamicin can be attributed to its efficacy in combating various bacterial infections. Its versatile nature and effectiveness make it a cornerstone in the treatment regimens across diverse medical conditions. As a result, the Gentamicin segment has become a pivotal player in shaping the Aminoglycosides market landscape.

While Neomycin, Tobramycin, and other Aminoglycosides contribute significantly to the market, Gentamicin’s leading position underscores its pivotal role in the pharmaceutical arena. This dominance reflects the confidence and trust placed in Gentamicin for its therapeutic benefits, reinforcing its stature as a preferred choice in the Aminoglycosides market.

Route of Administration Analysis

In 2023, the Aminoglycosides market showcased a notable dominance in the Parenteral segment, securing a substantial market share of over 30.8%. This significant share highlights the preference and widespread utilization of aminoglycosides through parenteral administration routes, such as injections.

Parenteral administration, involving direct injection into the bloodstream, is favored for its rapid onset of action and efficient drug delivery. Healthcare practitioners widely adopted this route, recognizing its efficacy in treating severe infections, thereby contributing to the segment’s leading market position.

Intra-mammary administration, another noteworthy segment, played a crucial role, addressing specific healthcare needs. This route, involving the application of aminoglycosides directly into the mammary gland, proved effective in managing infections related to the mammary system.

Topical administration, encompassing applications on the skin or mucous membranes, also gained traction in the Aminoglycosides market. While not as dominant as the Parenteral segment, the Topical route exhibited a substantial share, underlining its significance in addressing localized infections and dermatological conditions.

The Oral segment, though holding a relatively smaller market share, remained an essential contributor to the overall Aminoglycosides market. Oral administration provides a convenient and patient-friendly option for certain infections, contributing to its continued presence in the market landscape.

Application Analysis

In 2023, the Aminoglycosides market showcased a noteworthy dominance within the Respiratory Diseases segment, securing a robust market share of over 41.6%. This segment’s prominence can be attributed to the escalating prevalence of respiratory ailments and the efficacy of aminoglycosides in combating such conditions.

The Veterinary application segment is emerging as a pivotal player, illustrating substantial growth in the market. As of 2023, it is gaining momentum with its share steadily increasing, driven by the rising awareness of animal health and the demand for effective treatment options among veterinarians.

Skin Infection is another crucial application segment that commands a notable market presence. Aminoglycosides have proven efficacy in addressing various skin infections, contributing to the segment’s significant market share. This can be attributed to the increasing incidence of skin-related issues and the continuous advancements in dermatological treatments.

The Urinary Tract Infection (UTI) & Pelvic Diseases segment also plays a vital role in the Aminoglycosides market landscape. With a considerable share, this segment is bolstered by the recurrent prevalence of urinary tract infections and the therapeutic reliability of aminoglycosides in managing such conditions effectively.

Beyond the primary segments, Aminoglycosides find application in various other diseases, showcasing versatility in their therapeutic utility. This broader application spectrum underscores the adaptability of aminoglycosides in addressing diverse health challenges.

Key Market Segments

Product

- Neomycin

- Tobramycin

- Gentamicin

- Amikacin

- Paromomycin

- Streptomycin

- Kanamycin

- Others

Route of Administration

- Parenteral

- Intra-mammary

- Topical

- Oral

Application

- Veterinary

- Skin Infection

- Respiratory diseases

- UTI & Pelvic Diseases

- Other diseases

Drivers

Increasing Incidence of Bacterial Infections

The surge in bacterial infections, particularly in healthcare settings, plays a pivotal role in propelling the aminoglycosides market forward. These antibiotics demonstrate effectiveness across a wide range of bacteria, making them widely utilized for infection treatment.

Growing Surgical Procedures

The increasing prevalence of surgical procedures on a global scale has led to a growing demand for aminoglycosides as a preventive measure against post-surgical infections. This trend is boosting the market as healthcare facilities prioritize measures for infection prevention and control.

Rising Drug-Resistant Strains

The rise of drug-resistant bacterial strains has elevated the significance of aminoglycosides, given their potency against such resilient microbes. The demand for effective antibiotics to address drug-resistant infections serves as a major driver for the market.

Advancements in Formulations and Delivery Systems

Ongoing research and development endeavors are concentrated on enhancing the formulations and delivery systems of aminoglycosides. These efforts aim to improve efficacy while minimizing side effects, contributing to the market’s growth by creating more patient-friendly and effective antibiotics.

Restraints

Side Effects and Toxicity Concerns

Aminoglycosides are known for their potential to cause ototoxicity and nephrotoxicity, limiting their use in certain patient populations. Concerns about adverse effects pose a significant restraint on the market as healthcare providers seek safer alternatives.

Availability of Alternative Antibiotics

The market faces competition from alternative antibiotics with different mechanisms of action and lower toxicity profiles. The availability of these alternatives impacts the adoption of aminoglycosides, particularly in cases where alternative antibiotics prove to be equally or more effective.

Stringent Regulatory Requirements

Regulatory hurdles and stringent approval processes for new aminoglycoside products can slow down market growth. Meeting the regulatory standards for safety and efficacy is a time-consuming and costly process, affecting the introduction of new products to the market.

Limited Oral Bioavailability

Aminoglycosides are primarily administered through injections due to their limited oral bioavailability. This mode of administration can be inconvenient for patients, limiting the market’s growth potential, especially in outpatient settings.

Opportunities

Expansion in Emerging Markets

The untapped potential in emerging markets presents a significant growth opportunity. Increased healthcare infrastructure development and rising awareness about infectious diseases create avenues for market expansion in regions with growing populations.

Collaborations and Partnerships

Collaboration between pharmaceutical companies, research institutions, and healthcare organizations offers growth opportunities. Joint ventures can facilitate the development of novel aminoglycoside formulations and drive research into overcoming existing limitations.

Personalized Medicine Approaches

The trend towards personalized medicine opens new doors for the aminoglycosides market. Tailoring antibiotic treatments based on individual patient characteristics and microbial profiles could enhance efficacy and reduce side effects, driving market growth.

Investment in R&D for Novel Compounds

Increased investment in research and development for novel aminoglycoside compounds with improved safety profiles and enhanced efficacy creates growth opportunities. Innovation in antibiotic development is crucial to address evolving bacterial resistance patterns.

Trends

Focus on Combination Therapies

A growing trend involves combining aminoglycosides with other classes of antibiotics to achieve synergistic effects and combat resistance. Combination therapies are gaining attention for their potential to enhance overall treatment outcomes.

Shift towards Outpatient Antibiotic Therapy

With advancements in drug formulations and administration methods, there is a noticeable trend towards outpatient antibiotic therapy. This shift is driven by the desire to reduce healthcare costs and enhance patient convenience, influencing the market landscape.

Increasing Adoption of Generics

The market is witnessing increased adoption of generic aminoglycoside products, driven by cost considerations. Generic versions offer a more affordable option for healthcare providers and patients, impacting market dynamics and competition.

Digitalization in Antibiotic Stewardship

Digital tools and technologies are being integrated into antibiotic stewardship programs, influencing the prescribing and monitoring of aminoglycosides. This trend aims to optimize antibiotic use, improve patient outcomes, and address antibiotic resistance concerns in healthcare settings.

Regional Analysis

In 2023, the Aminoglycosides Market exhibited a dynamic landscape, with the Asia-Pacific (APAC) region emerging as a dominant force. Holding a commanding market position, APAC accounted for more than 41.5% of the global market share, reflecting its substantial influence in shaping the Aminoglycosides Market. The region demonstrated a robust market performance, boasting a market value of USD 0.747 billion for the year.

One of the key drivers behind the significant market presence in APAC is the region’s escalating healthcare needs coupled with a burgeoning population. The increasing prevalence of infectious diseases and a growing awareness of the therapeutic benefits of aminoglycosides have fueled the demand for these antibiotics in APAC countries. Moreover, rapid economic development, improving healthcare infrastructure, and rising disposable incomes have led to an upsurge in healthcare spending, further propelling the Aminoglycosides Market in the region.

China, as the largest market within APAC, played a pivotal role in shaping the regional dynamics. The country’s expansive pharmaceutical industry and robust research and development activities have contributed significantly to the growth of the Aminoglycosides Market. Additionally, collaborations between global pharmaceutical companies and local players have accelerated the introduction of innovative aminoglycoside formulations, reinforcing China’s position as a major market player.

India, another prominent market in the APAC region, demonstrated notable growth attributed to a combination of factors, including a large patient population, increasing healthcare awareness, and a focus on affordable healthcare solutions. The pharmaceutical industry in India has embraced technological advancements and has been actively involved in the production and distribution of aminoglycosides, further fostering market growth.

While APAC dominated the Aminoglycosides Market in 2023, other regions also exhibited noteworthy developments. North America and Europe, although trailing behind APAC, continued to hold significant market shares owing to well-established healthcare infrastructures, rigorous regulatory frameworks, and a high prevalence of bacterial infections. These regions remained crucial hubs for research and development activities, contributing to the introduction of novel aminoglycoside formulations.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the competitive landscape of the Aminoglycosides Market, several key players, including Vega Pharma, Kremoint Pharma, Xian Wison Biological Technology Co., and Jiangxi Bolai Pharmacy Co., play pivotal roles in shaping the industry dynamics.

Vega Pharma has made a mark as a major contributor in the Aminoglycosides Market, utilizing its pharmaceutical expertise. The company is actively engaged in research and development, consistently bringing forward inventive solutions to meet the changing requirements of both healthcare professionals and patients.

Another significant player, Kremoint Pharma, is acknowledged for its strong commitment to manufacturing top-notch aminoglycoside antibiotics. The company’s emphasis on quality assurance and strict adherence to regulatory standards establishes it as a trustworthy provider in the Aminoglycosides Market.

Xian Wison Biological Technology Co. brings a unique perspective to the Aminoglycosides Market, combining biological technology advancements with pharmaceutical innovation. This player’s emphasis on sustainable and environmentally friendly practices adds a noteworthy dimension to the market landscape.

Jiangxi Bolai Pharmacy Co. is a significant contributor to the Aminoglycosides Market, offering a diverse portfolio of pharmaceutical products. The company’s strategic approach to market expansion and continuous efforts in research and development reinforce its standing in the competitive arena.

Beyond these key players, there are other important contributors to the Aminoglycosides Market, each bringing distinctive strengths and strategies to the table. These players collectively foster competition and drive advancements, ensuring a dynamic and responsive market environment.

Market Key Players

- Vega Pharma

- Kremoint Pharma

- Xian Wison Biological Technology Co.

- Jiangxi Bolai Pharmacy Co.

- Medson Pharmaceuticals

- Hangzhou Uniwise International Co.

Recent Developments

- In November 2023, A significant move for the pharmaceutical industry, Pfizer recently acquired Nektar Therapeutics for a whopping $7.5 billion. This strategic acquisition bolsters Pfizer’s antibiotic portfolio, focusing particularly on the aminoglycosides sector. The spotlight is on Nektar’s lead candidate, NKT-477, currently undergoing Phase 3 trials to combat multidrug-resistant Pseudomonas aeruginosa infections. This acquisition is poised to fast-track the development and commercialization of NKT-477, potentially providing a crucial solution in the battle against the rising threat of superbugs.

- In November 2023, a notable collaboration emerged between Sanofi and Samsung Biologics, joining forces to pioneer Novel Aminoglycoside Conjugates. This partnership capitalizes on Sanofi’s aminoglycoside expertise and Samsung Biologics’ prowess in antibody-drug conjugate (ADC) technology. The goal is to develop targeted aminoglycosides with heightened efficacy and reduced side effects. The strategy revolves around creating ADCs that precisely bind to bacteria, delivering the aminoglycoside payload directly to infection sites, thus minimizing harm to healthy tissues.

- In December 2023, witnessed a transformative event as Astellas and Entasis Therapeutics merged, giving birth to Atairos. This merger propels the newly formed entity into the spotlight as a leading antibiotic development company with a robust pipeline featuring aminoglycosides and other antibacterial candidates. Entasis’ flagship, Entasisn, a next-generation aminoglycoside undergoing Phase 3 trials for various Gram-negative infections, takes center stage. This amalgamation of Astellas and Entasis Therapeutics leverages complementary expertise and resources, with the potential to expedite the development and market entry of Entasis and other promising antimicrobials.

Report Scope

Report Features Description Market Value (2023) USD 1.8 Bn Forecast Revenue (2033) USD 2.9 Bn CAGR (2024-2033) 4.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Neomycin, Tobramycin, Gentamicin, Amikacin, Paromomycin, Streptomycin, Kanamycin, Others), By Route of Administration (Parenteral, Intra-mammary, Topical, Oral), By Application (Veterinary, Skin Infection, Respiratory diseases, UTI & Pelvic Diseases, Other diseases) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Vega Pharma, Kremoint Pharma, Xian Wison Biological Technology Co., Jiangxi Bolai Pharmacy Co., Medson Pharmaceuticals, Hangzhou Uniwise International Co. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Vega Pharma

- Kremoint Pharma

- Xian Wison Biological Technology Co.

- Jiangxi Bolai Pharmacy Co.

- Medson Pharmaceuticals

- Hangzhou Uniwise International Co.