Global Alternative Fuels Market Size, Share Report By Fuel Type (Biofuel, CNG, Electric, Hybrid, Hydrogen, LPG), By Vehicle Type (Commercial Vehicle, Off-Road Vehicle, Passenger Vehicle), By Propulsion Type (Battery Electric Drive, Fuel Cell Electric Drive, Hybrid Electric Drive, Internal Combustion Engine), By End Use (Power Generation, Residential, Transportation, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154806

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

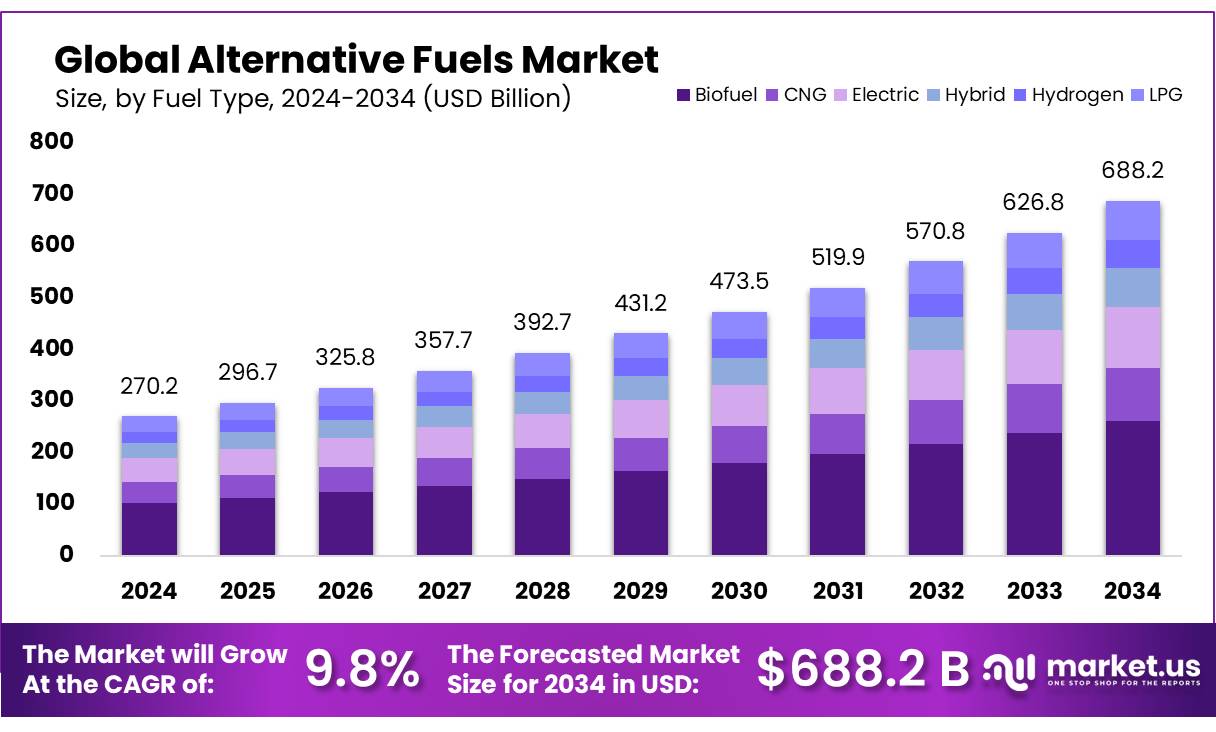

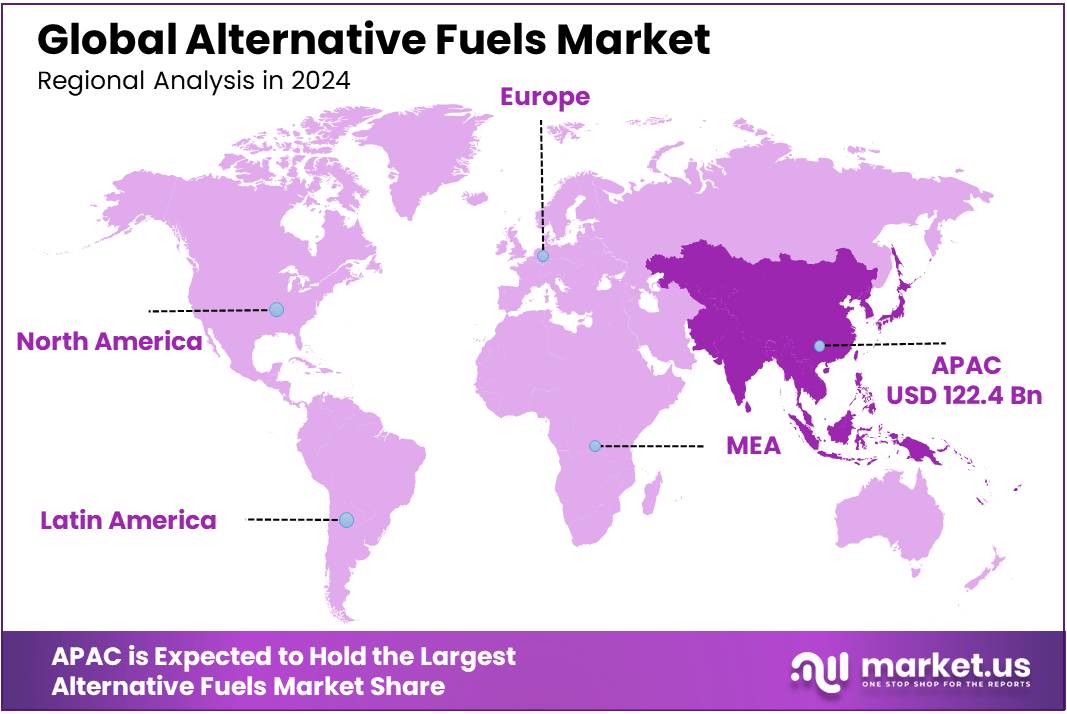

The Global Alternative Fuels Market size is expected to be worth around USD 688.2 Billion by 2034, from USD 270.2 Billion in 2024, growing at a CAGR of 9.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 43.2% share, holding USD 0.4 Billion revenue.

The alternative fuel concentrates sector is positioned at the forefront of the global energy transition, as major governments progressively mandate lower carbon-intensity transportation and industrial fuels. In the United States, the Renewable Fuel Standard (RFS2) under the Energy Independence and Security Act mandates that renewable fuel blending escalate to 36 billion gallons by 2022, with at least 16 billion gallons from cellulosic biofuels, displacing approximately 13.6 billion gallons of petroleum-based fuel, representing about 7% of transport fuel use.

The Indian government has implemented several policies to promote the adoption of alternative fuels. In August 2024, the Union Cabinet approved the modified Pradhan Mantri JI-VAN Yojana, extending its timeline until 2028-29 and expanding its scope to include advanced biofuels produced from lignocellulosic feedstocks, such as agricultural and forestry residues, industrial waste, synthesis gas, and algae.

Additionally, the Sustainable Alternative Towards Affordable Transportation (SATAT) initiative aims to develop 5,000 CBG plants with a total production capacity of 15 million metric tonnes per annum by 2023–24. These initiatives are designed to reduce dependency on fossil fuels, promote cleaner energy sources, and support rural economies.

Driving factors for industrial uptake include regulatory mandates, carbon pricing mechanisms, subsidy frameworks, and increasing corporate sustainability commitments. Lifecycle GHG reduction performance is notable U.S. EPA data indicates corn ethanol yields ~21% reduction, sugarcane ethanol ~61%, cellulosic ethanol up to 129% reduction compared to fossil fuels. Economic incentives, such as farm income gains of USD13 billion annually by 2022, further reinforce growth.

Government policies provide major impetus. India’s Ethanol Blended Petrol (EBP) programme mandates 20 per cent ethanol blending by 2025, projected to save USD 4 billion (₹ 30,000 crore) annually in import substitution by 2025. The national biofuel policy allocated ₹5,000 crore to establish seven second‑generation (2G) bioethanol refineries, as part of a larger spending proposal nearing ₹10,000 crore across 12 planned plants. In 2018, the target was set to deploy 5,000 large‑scale biogas plants capable of producing 15 million tonnes (62 mmcmd) of bio‑CNG annually.

Recent state‑level policies are complementing these. The newly launched Biodev Policy (Amended) 2025 in Bihar supports ethanol and CBG development, with 12 operational ethanol units producing 1,617.5 kilolitres per day, and investment incentives for expansion. In Gujarat, dairy cooperative-led investments of ₹3,300 crore are underway to set up ethanol plants totaling 2,800 KLPD capacity, while 30 CBG plants and 32,550 household biogas units are to be installed at a total investment of ₹1,000 crore—powering 80,000 vehicles annually.

Key Takeaways

- The global Alternative Fuels Market is projected to reach USD 688.2 billion by 2034, up from USD 270.2 billion in 2024, growing at a CAGR of 9.8% during the forecast period.

- Electric held a dominant position, accounting for more than 37.5% of the global alternative fuels market.

- Passenger Vehicles led the market with a share of over 57.1%.

- Battery Electric Drive was the leading segment, holding more than 42.2% market share.

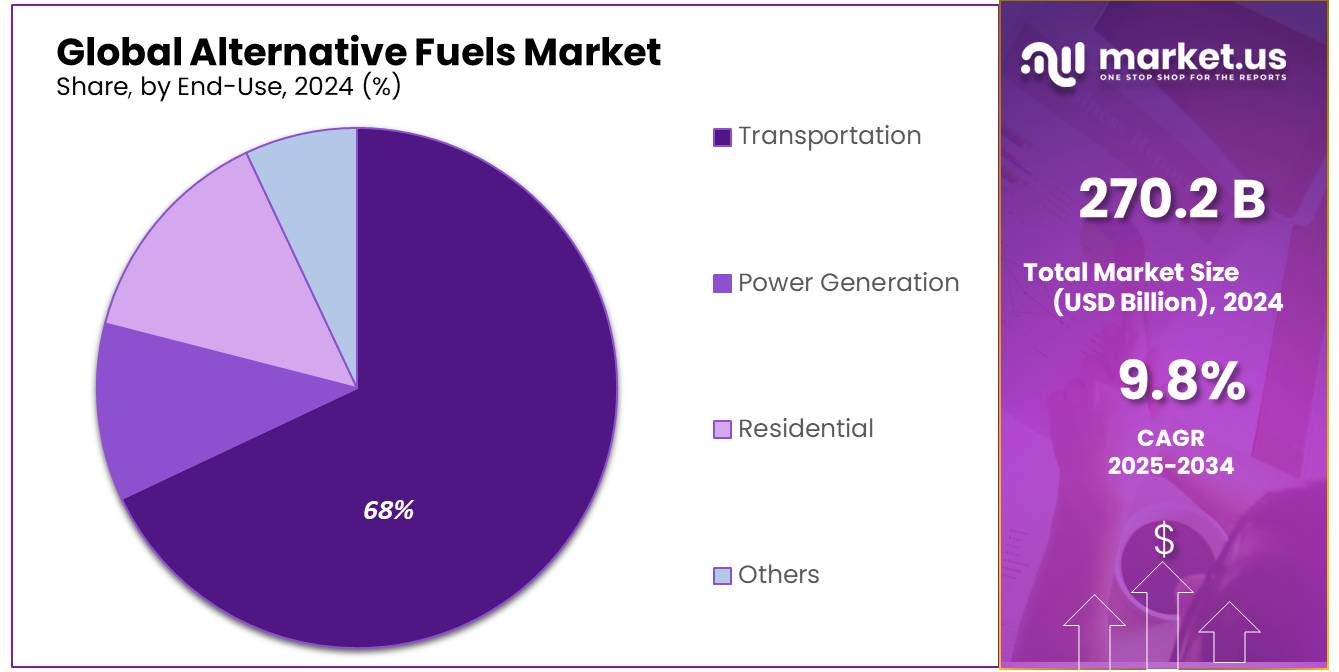

- The Transportation segment dominated, contributing more than 68.9% to the overall market.

- North America was the leading regional market, capturing 43.2% share, which translated to a market value of approximately USD 0.4 billion.

By Fuel Type Analysis

Electric dominates with 37.5% share due to rising EV adoption and supportive energy infrastructure.

In 2024, Electric held a dominant market position, capturing more than a 37.5% share in the global alternative fuels market by fuel type. This strong share reflects the rapid expansion of electric vehicle (EV) sales, growing investment in charging networks, and rising consumer interest in clean transportation solutions. The increasing use of electric powertrains in both passenger and commercial vehicles has significantly boosted electricity’s contribution as an alternative fuel.

Additionally, many governments have introduced incentives for EV purchases and infrastructure development, further driving electric fuel adoption. As countries continue to set stricter emission regulations and transition toward zero-emission transport, electricity is expected to maintain its leading position in the alternative fuels segment in 2025 as well, supported by renewable energy integration and battery technology improvements.

By Vehicle Type Analysis

Passenger Vehicle leads with 57.1% share, driven by high consumer demand and strong EV rollout.

In 2024, Passenger Vehicle held a dominant market position, capturing more than a 57.1% share in the alternative fuels market by vehicle type. This strong lead can be linked to the growing popularity of electric and hybrid passenger cars across urban and suburban areas. Rising fuel prices, awareness about environmental impact, and expanding government subsidies have all encouraged consumers to shift toward alternative fuel-powered cars.

Automakers have also accelerated the launch of new electric and biofuel-compatible passenger models, widening options for buyers. As infrastructure for alternative fuels continues to grow—especially for electric charging—this segment is expected to maintain its momentum into 2025, supported by rising middle-class income levels and evolving urban mobility preferences.

By Propulsion Type Analysis

Battery Electric Drive dominates with 42.2% share, supported by clean energy push and EV affordability.

In 2024, Battery Electric Drive held a dominant market position, capturing more than a 42.2% share in the alternative fuels market by propulsion type. This growth was mainly powered by the rising demand for fully electric vehicles that run on rechargeable batteries, offering zero tailpipe emissions. Governments across major economies provided financial incentives, tax exemptions, and infrastructure support to promote battery electric models.

At the same time, falling battery costs and increasing driving range made these vehicles more accessible to everyday consumers. Automakers also focused on expanding their all-electric portfolios, launching models across various price points. Moving into 2025, the adoption of Battery Electric Drive is expected to remain strong as countries prioritize net-zero goals and invest further in clean mobility solutions.

By End Use Analysis

Transportation dominates with 68.9% share, led by rising fuel switch in road, air, and rail sectors.

In 2024, Transportation held a dominant market position, capturing more than a 68.9% share in the alternative fuels market by end use. This strong share was mainly driven by the growing shift from conventional fossil fuels to cleaner alternatives across vehicles, aviation, and rail systems. Public and private sector efforts to reduce carbon emissions led to a rise in electric vehicles, biofuel-powered fleets, and pilot programs for sustainable aviation fuel.

Countries around the world introduced policies to phase out diesel and petrol vehicles while supporting infrastructure development for alternative fuels. Major logistics and public transport networks also adopted cleaner fuels to meet stricter environmental regulations. Looking ahead to 2025, the transportation segment is expected to maintain its leading role, supported by ongoing fuel transition efforts and growing demand for sustainable mobility.

Key Market Segments

By Fuel Type

- Biofuel

- Biodiesel

- Biogas

- Ethanol

- CNG

- Electric

- Hybrid

- Hydrogen

- Fuel Cell

- Internal Combustion Engine

- LPG

By Vehicle Type

- Commercial Vehicle

- Off-Road Vehicle

- Passenger Vehicle

By Propulsion Type

- Battery Electric Drive

- Fuel Cell Electric Drive

- Hybrid Electric Drive

- Internal Combustion Engine

By End Use

- Power Generation

- Residential

- Transportation

- Others

Emerging Trends

Co-Blending of Ethanol and Fuel Ethers: A Strategic Shift in India’s Biofuel Landscape

India is intensifying its efforts to transition towards cleaner energy sources, with a significant focus on enhancing its biofuels program. A notable development in this direction is the adoption of co-blending strategies, particularly the combination of ethanol with fuel ethers like Methyl Tert-Butyl Ether (MTBE) and Ethyl Tert-Butyl Ether (ETBE). This approach aims to improve fuel quality, reduce emissions, and decrease dependency on imported fossil fuels.

- The Energy and Resources Institute (TERI), in collaboration with the Asian Clean Fuels Association (ACFA), has highlighted the potential benefits of this co-blending strategy. According to their report, the Indian MTBE market is projected to grow at a compound annual growth rate (CAGR) of 5.9% by 2030, with 75% of this production intended for gasoline-blending applications.

The integration of fuel ethers into the ethanol blend offers several advantages. It enhances the Research Octane Number (RON) of the fuel, leading to better engine performance and reduced knocking. Additionally, this strategy facilitates the use of lower-value hydrocarbons like C4 and C5 streams in gasoline production, making the blending process more cost-effective.

Furthermore, the co-blending of ethanol and fuel ethers can help mitigate the rise in Reid Vapor Pressure (RVP) associated with higher ethanol blending percentages, thereby maintaining fuel stability and reducing evaporative emissions.

The Indian government’s commitment to advancing biofuels is evident in its policy initiatives. The target of achieving 20% ethanol blending in petrol by 2025–26 underscores the nation’s dedication to reducing carbon emissions and promoting sustainable energy practices. Incorporating fuel ethers into this strategy represents a pragmatic approach to achieving these goals while addressing technical and economic challenges.

Drivers

Government Policy Support for Biofuels

A significant driver for the growth of alternative fuels in India is the robust policy support provided by the government, particularly in the biofuels sector. The National Policy on Biofuels, introduced in 2018 and amended in 2022, has been instrumental in promoting the production and use of biofuels across the country. This policy outlines clear targets and financial incentives to develop the sector, aiming to reduce dependence on fossil fuels, promote sustainable development, and address environmental concerns.

Under this policy, the government has set an ambitious target of achieving 20% ethanol blending in petrol by the end of 2025. This initiative has led to significant investments in biofuel infrastructure.

- For instance, in Gujarat, Amul has pioneered India’s first large-scale trial producing bioethanol from whey, a dairy byproduct, and plans to invest ₹70 crore in expanding this initiative, potentially generating ₹700 crore in additional farmer income. Similarly, 14 companies in the state plan to invest ₹3,300 crore in new ethanol facilities with a combined capacity of 2,800 kilolitres per day.

The government’s support extends beyond financial incentives. The Pradhan Mantri JI-VAN Yojana, launched in 2019, provides financial assistance to bio-refineries to increase the production of second-generation (2G) ethanol derived from agricultural waste and non-food biomass. This initiative aims to promote the establishment of biofuel plants and encourage innovation in biofuel technologies.

Furthermore, the Sustainable Alternative Towards Affordable Transportation (SATAT) initiative promotes the production and use of compressed biogas (CBG) as an alternative to conventional fuels. The government encourages private-sector participation to set up plants that utilize organic waste, including municipal solid waste and agricultural residue, for CBG production.

Restraints

Feedstock Availability and Supply Chain Challenges

One of the primary challenges hindering the growth of alternative fuels in India is the inconsistent and unreliable supply of feedstock. This issue is particularly evident in the production of compressed biogas (CBG) and second-generation (2G) biofuels, which rely heavily on agricultural residues and organic waste. The seasonal nature of crop residues, coupled with inadequate collection and storage infrastructure, leads to significant fluctuations in feedstock availability.

- For instance, in Punjab, while the state plans to manage 14.8 lakh tonnes of paddy straw by 2025, current efforts have only resulted in the utilization of 2.5 lakh tonnes through operational CBG projects. The remaining feedstock often goes uncollected or is burned, contributing to air pollution and undermining the intended environmental benefits of biofuel initiatives .

The lack of a robust supply chain exacerbates this problem. Inefficient logistics, inadequate storage facilities, and poor coordination between stakeholders lead to high transportation costs and spoilage of perishable feedstock. These issues not only increase production costs but also deter potential investors due to the perceived financial risks. Moreover, the absence of standardized quality metrics for feedstock further complicates the situation, as variations in calorific value and moisture content can affect the efficiency and output of biofuel plants .

Government initiatives like the Sustainable Alternative Towards Affordable Transportation (SATAT) scheme and the Pradhan Mantri JI-VAN Yojana aim to address these challenges by promoting the establishment of CBG plants and providing financial support for 2G biofuel refineries. However, the success of these programs is contingent upon the development of a reliable and efficient feedstock supply chain. Without significant investments in infrastructure, technology, and stakeholder coordination, the full potential of India’s biofuel sector remains untapped.

Opportunity

Dairy Sector’s Role in Bioethanol Production

A significant growth opportunity in India’s alternative fuels sector lies in leveraging the dairy industry’s byproducts, particularly whey, to produce bioethanol. This approach not only addresses waste management issues but also aligns with the government’s Ethanol Blended Petrol (EBP) programme, which aims to achieve 20% ethanol blending in petrol by 2025. The success of this initiative is exemplified by Amul’s recent breakthrough in converting cheese whey into bioethanol.

- In a large-scale trial, Amul utilized 4.5 lakh litres of whey to produce 20,000 litres of rectified spirit with 96.71% ethanol purity. Building on this success, Amul plans to invest ₹70 crore in a bioethanol plant with a daily capacity of 50,000 litres, potentially generating an additional ₹700 crore in income for its 3.6 million farmer-owners.

This innovative approach not only provides a sustainable solution to waste management but also contributes to the national goal of reducing dependence on fossil fuels. The government’s support through schemes like the Pradhan Mantri JI-VAN Yojana, which offers financial assistance for setting up advanced biofuel projects, further facilitates the growth of such initiatives.

By tapping into the dairy sector’s potential, India can enhance its bioethanol production capacity, support rural economies, and make significant strides towards energy sustainability. The successful implementation of Amul’s model could serve as a blueprint for other dairy cooperatives across the country, fostering a circular economy and promoting the use of renewable energy sources.

Regional Insights

North America dominates the alternative fuels market with 43.2% share, reaching USD 0.4 billion in 2024

In 2024, North America emerged as the leading region in the global alternative fuels market, capturing a dominant share of 43.2%, which translated to a market value of approximately USD 0.4 billion. This significant regional lead can be attributed to a strong regulatory push, technological advancements, and growing environmental awareness across the United States and Canada.

The U.S. government has actively promoted the use of clean fuels through national frameworks such as the Renewable Fuel Standard (RFS) and the Inflation Reduction Act, which includes extensive funding and tax credits for clean hydrogen, sustainable aviation fuel, and electric vehicle (EV) infrastructure. As of 2024, the U.S. had over 3.5 million EVs on the road and more than 160,000 public charging stations, supporting the transition to electric-based propulsion in transportation.

Furthermore, North America is home to some of the world’s largest producers of biofuels, particularly ethanol and renewable diesel, with the U.S. producing over 15 billion gallons of ethanol annually. Canada has also implemented a Clean Fuel Regulation that mandates fuel suppliers to reduce the carbon intensity of fuels by 15% by 2030.

The rapid adoption of battery electric and hybrid vehicles, supported by state-level clean fuel standards and corporate sustainability goals, continues to drive demand in the region. Looking ahead to 2025, North America is expected to retain its dominant position due to continuous investments in clean energy technologies, supply chain localization efforts, and robust government policy support.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BP Plc is actively involved in the alternative fuels sector, focusing on biofuels, green hydrogen, and sustainable aviation fuel (SAF). The company operates large-scale biofuel production through its joint ventures in Brazil and has committed to producing 100,000 barrels per day of SAF by 2030. BP is also investing in hydrogen projects across the UK, U.S., and Australia. Its strategic shift toward low-carbon energy positions it as a key player in advancing global clean fuel solutions.

Sasol Ltd. plays a leading role in alternative fuels through its Fischer-Tropsch technology, producing synthetic fuels from natural gas and coal. The company is now pivoting toward greener pathways, including green hydrogen and sustainable fuels, particularly in South Africa. Sasol is involved in developing green hydrogen hubs and partnering on projects to reduce carbon emissions in aviation and industrial sectors. This transition aligns with its long-term target to achieve net-zero emissions by 2050.

General Electric (GE) contributes to the alternative fuels market primarily through its power generation and aviation divisions. GE Aerospace is testing engines compatible with 100% sustainable aviation fuel (SAF), while GE Vernova supports hydrogen-ready turbines for power plants. The company has partnered with global energy leaders to advance low-carbon solutions. Its innovation in gas turbine technologies and SAF research is strengthening the global adoption of cleaner fuel alternatives in both aviation and power sectors.

Top Key Players Outlook

- BP Plc

- Sasol Ltd.

- General Electric Company

- EI DuPont

- ExxonMobil Corporation.

- Cosan

- Archer Daniel Midland

- Neste

- INEOS Enterprises

Recent Industry Developments

In 2024, Sasol Ltd. continued advancing its role in alternative fuels with clear progress in green hydrogen and sustainable aviation fuel (SAF) initiatives. As part of its energy transition plan, Sasol aimed to produce 3.5 tons per day of green hydrogen by October 2024, powered by new renewable energy projects including a 69 MW Msenge Emoyeni wind farm in Eastern Cape that reached commercial operation in October 2024.

In 2024, GE Aerospace successfully completed baseline and component tests for a hybrid-electric engine for single-aisle jets—delivered as part of NASA’s RISE/HyTEC efforts—aiming to reduce fuel burn by 5‑10% and debut in the 2030s.

Report Scope

Report Features Description Market Value (2024) USD 270.2 Bn Forecast Revenue (2034) USD 688.2 Bn CAGR (2025-2034) 9.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Fuel Type (Biofuel, CNG, Electric, Hybrid, Hydrogen, LPG), By Vehicle Type (Commercial Vehicle, Off-Road Vehicle, Passenger Vehicle), By Propulsion Type (Battery Electric Drive, Fuel Cell Electric Drive, Hybrid Electric Drive, Internal Combustion Engine), By End Use (Power Generation, Residential, Transportation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BP Plc, Sasol Ltd., General Electric Company, EI DuPont, ExxonMobil Corporation., Cosan, Archer Daniel Midland, Neste, INEOS Enterprises Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BP Plc

- Sasol Ltd.

- General Electric Company

- EI DuPont

- ExxonMobil Corporation.

- Cosan

- Archer Daniel Midland

- Neste

- INEOS Enterprises