Global All-Weather Landing System Market Size, Share, Industry Analysis Report By Type (Microwave Landing System (MLS), Ground-Based Augmentation System, Instrument Landing System (ILS), By Application (Commercial Service Airport, Non-Commercial Service Airport), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 161039

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

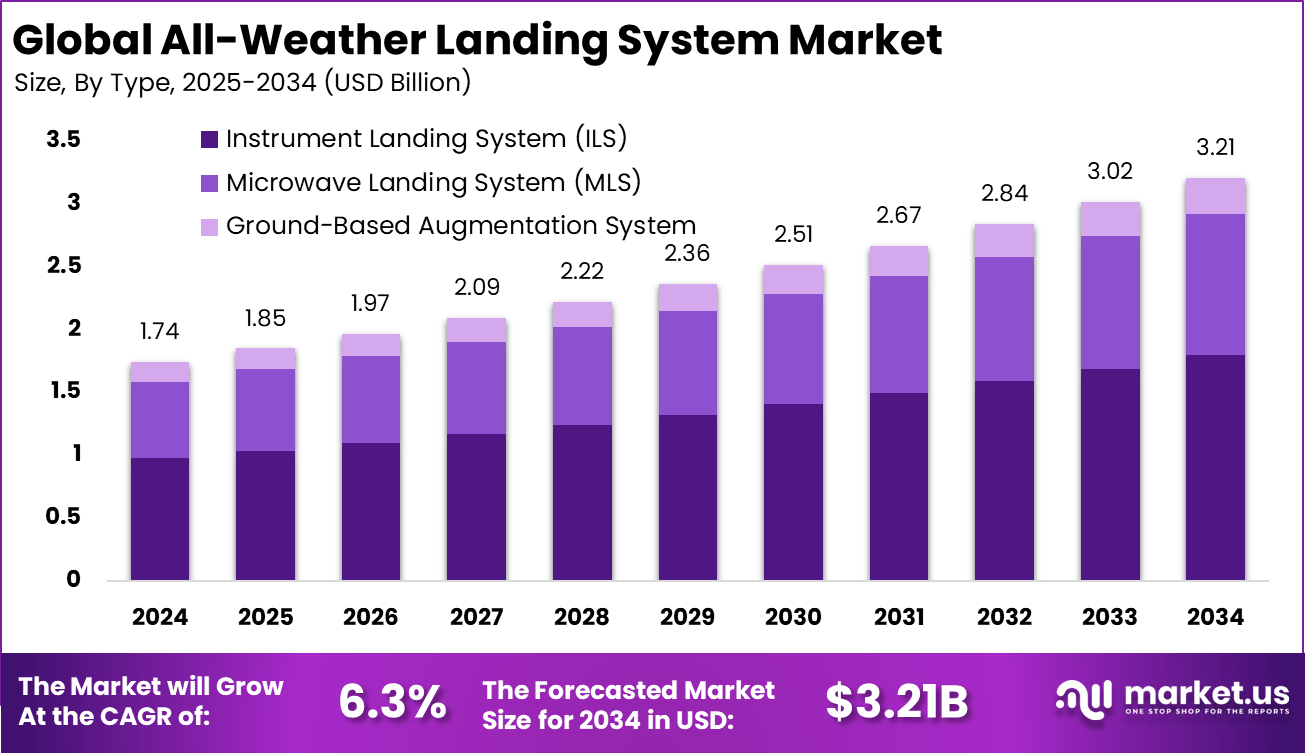

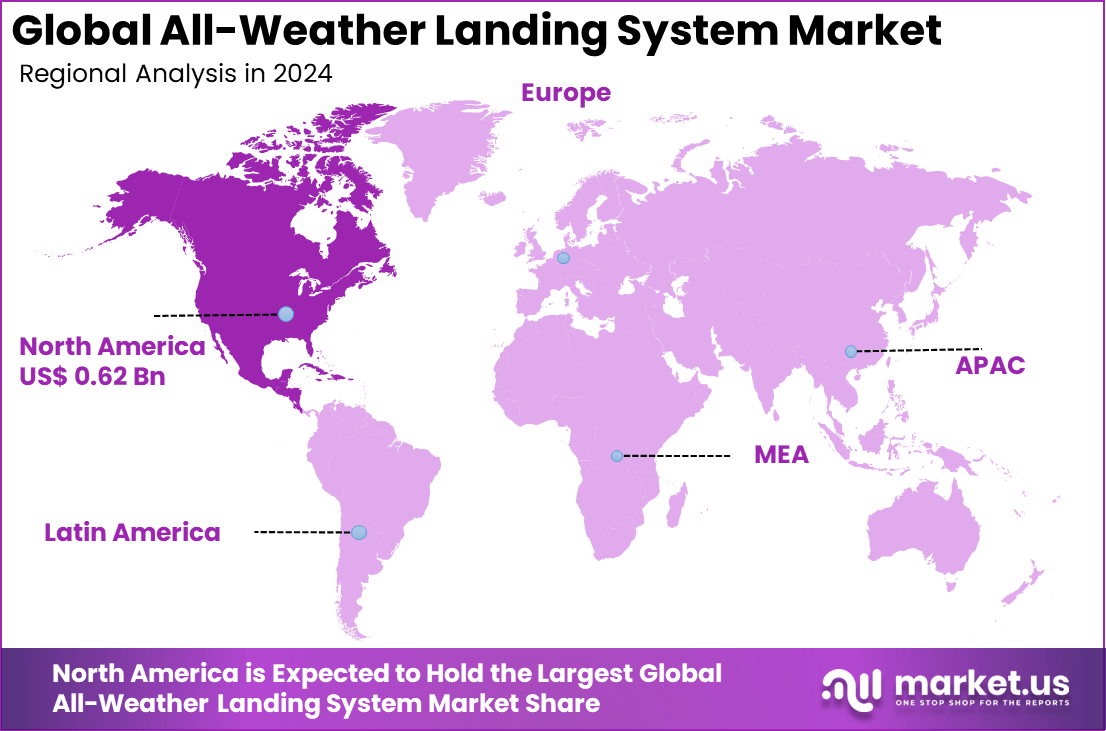

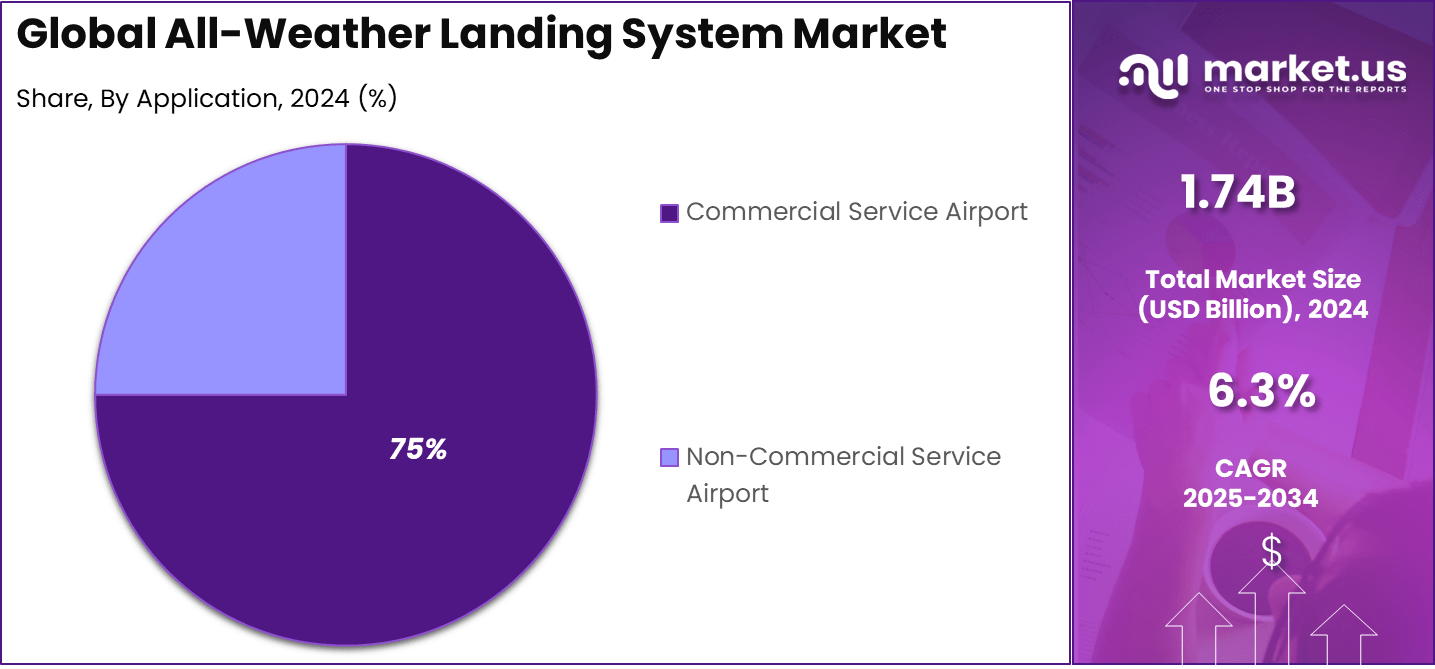

The Global All-Weather Landing System Market size is expected to be worth around USD 3.21 billion by 2034, from USD 1.74 billion in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 36% share, holding USD 0.62 billion in revenue.

An All-Weather Landing System enables aircraft to safely approach and land in conditions of low visibility, adverse weather, or degraded sensor conditions. It typically comprises guidance, instrumentation, signal augmentation (ground or satellite), and runway lighting or visual aids. The system is essential for airports wanting to maintain operational continuity under fog, rain, snow, or other challenging meteorological conditions.

Top Driving Factors for the AWLS market include the constant increase in global air traffic, which pushes the demand for safer and more reliable landings regardless of environmental conditions. Safety mandates from aviation authorities worldwide drive the adoption of these systems, as they align with international standards for aircraft operations.

Additionally, modernization efforts at airports to accommodate higher flight volumes and operational efficiency fuel demand for AWLS upgrades and new installations. Technological progress such as GPS augmentation, millimeter-wave radar, and AI-driven automation further accelerate market growth. Passenger traffic surged by over 28% year-on-year in recent months globally, underscoring the operational pressure airports face to maintain safety under all weather scenarios.

In August 2025, the International Air Transport Association (IATA) reported a continued recovery in passenger traffic post-pandemic. Total traffic, measured in revenue passenger kilometers (RPKs), increased by 4.6% compared to August 2024, with global RPK reaching about 896 billion. Domestic traffic saw a modest rise of 1.5% year-over-year, supported by record-high load factors, despite subdued growth in some markets like the US.

The rise in domestic traffic in China (3.4% increase) and India (0.4% increase) helped offset weaker markets. International traffic experienced a stronger increase of 6.6% compared to August 2024, driven primarily by Asia Pacific carriers whose international traffic grew by 9.8% year-over-year. International RPKs recovered to levels close to but still below pre-COVID benchmarks.

All regions showed positive growth, with African airlines leading at 8.9% rise in passenger traffic. The global load factor for August reached a record 86.0%, with international load factor at 85.8%, indicating highly efficient utilization of available capacity. Airline schedules are projected to increase capacity by 3.4% in October 2025 to meet ongoing travel demand

For instance, in October 2024, Noida International Airport (Jewar) successfully calibrated its advanced Instrument Landing System (ILS) and Precision Approach Path Indicator (PAPI). These systems are designed to ensure safe flight operations even during adverse weather conditions such as fog and heavy rain.

Key Takeaway

- In 2024, the Instrument Landing System (ILS) segment dominated with a 56% share, reflecting its critical role in ensuring safe aircraft landings under poor visibility.

- The Commercial Service Airports segment led with a strong 75% share, highlighting widespread deployment at large passenger and cargo airports.

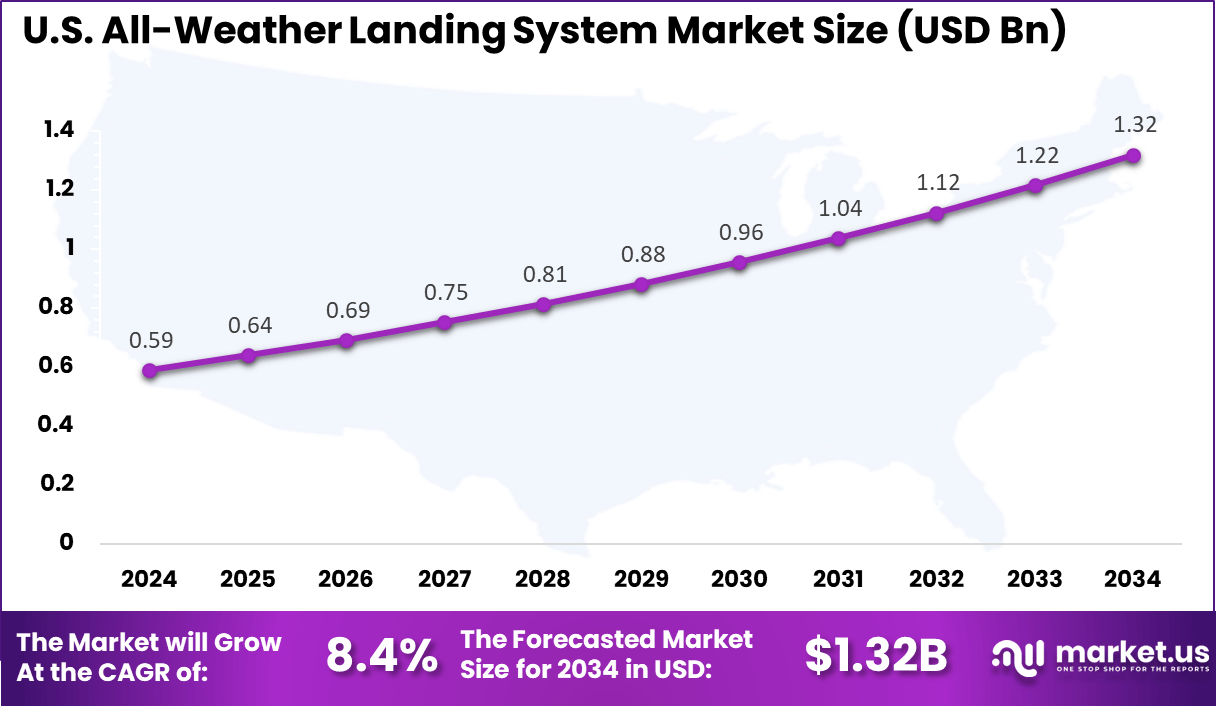

- The US market was valued at USD 0.59 billion in 2024 and is growing at a robust CAGR of 8.4%, supported by investments in aviation safety infrastructure.

- North America captured more than 36%, driven by modernization programs, regulatory compliance, and heavy air traffic volumes across the region.

Role of Generative AI

Generative AI is increasingly playing a transformative role in aviation safety, including in all-weather landing systems. By generating highly realistic synthetic data and enhancing weather prediction models, generative AI supports more accurate forecasting of challenging weather conditions that impact landings.

For example, new AI models can simulate extreme weather scenarios more sharply and realistically than traditional predictive models, which allows pilots and air traffic controllers to prepare for specific landing conditions.

Studies show that turbulence prediction using AI can reach up to 90% accuracy, enabling flight crews to make better decisions and improve passenger safety. Additionally, generative AI aids in real-time weather updates and route optimization that can reduce fuel consumption by up to 10%, improving overall flight efficiency.

Impact on aviation safety

Landing and takeoff are statistically the riskiest portions of a flight, but AWLS greatly mitigate these risks.

- Reduced landing-phase accidents: Despite accounting for just 4% of total flight time, the final approach and landing phases were responsible for 47% of fatal accidents from 2015 to 2024, based on Boeing’s analysis. AWLS play a crucial role in lowering these numbers.

- Improved overall safety: The global commercial flight accident rate declined from 4.9 per million flights in 2005 to 1.9 in 2023, according to the International Civil Aviation Organization (ICAO). The widespread implementation of advanced landing systems is a key factor in this trend.

- IOSA-registered airlines are safer: Airlines with IATA Operational Safety Audit (IOSA) registration, which includes strict operational and safety standards, had a significantly lower accident rate (0.92 per million flights) than non-IOSA carriers (1.70 per million flights) in 2024.

U.S. Market Size

The market for All-Weather Landing Systems within the U.S. is growing tremendously and is currently valued at USD 0.59 billion, the market has a projected CAGR of 8.4%. The market is growing tremendously due to the increasing demand for advanced aviation infrastructure to support rising air traffic and ensure safety during adverse weather conditions.

U.S. airports are modernizing to handle more flights, especially in densely populated regions, while meeting stringent regulatory requirements for low-visibility operations. Additionally, government investments in infrastructure modernization and the push for more precise, reliable landing systems further drive the adoption of all-weather landing technologies across the country.

For instance, in April 2025, the U.S. Navy enhanced its capabilities by deploying new precision approach and landing radar beacons on aircraft carriers. These advanced systems are designed to improve aircraft landing accuracy during low-visibility conditions, ensuring safe operations in all weather environments. This development underscores the U.S.’s continued leadership in the all-weather landing system sector.

In 2024, North America held a dominant market position in the Global All-Weather Landing System Market, capturing more than a 36% share, holding USD 0.62 billion in revenue. This dominance is due to the region’s advanced aviation infrastructure, high adoption of cutting-edge technologies, and stringent safety regulations.

The U.S. and Canada have invested heavily in airport modernization, including upgrading landing systems to improve operational efficiency and safety during adverse weather conditions. Additionally, the presence of major global aviation players, along with strong government support and funding for infrastructure development, further solidifies North America’s leading market share.

For instance, in November 2024, Boeing and the U.S. Navy successfully simulated MQ-25 carrier recovery using an F-35 automated landing system, demonstrating North America’s continued leadership in all-weather landing technologies. This collaboration highlights advancements in autonomous landing capabilities, improving precision and reliability in challenging conditions.

Type Analysis

In 2024, Instrument Landing System (ILS) is the dominant segment in the all-weather landing system market, accounting for 56% of the market share. ILS is widely adopted due to its reliability in providing precise lateral and vertical guidance to aircraft during landing in low visibility and adverse weather conditions. It enhances safety by enabling accurate runway approaches, even in challenging environments such as fog, rain, or snow. This system is highly trusted by airports and airlines worldwide for safe aircraft landings.

The prevalence of ILS is driven by strict regulatory safety standards globally and the growing air traffic that demands robust landing solutions. Airports continually invest in maintaining and upgrading ILS infrastructure to comply with aviation safety mandates. Given that many commercial airports rely on this technology for reliable operations, ILS’s role in ensuring operational continuity during all weather conditions remains critical to the aviation sector.

For Instance, in February 2025, Chennai International Airport upgraded its infrastructure with a new Instrument Landing System (ILS) to enhance landing precision and safety, particularly during adverse weather conditions. This new ILS will allow the airport to support operations in low-visibility scenarios, ensuring continued safety and efficiency in its high-traffic environment.

Application Analysis

In 2024, Commercial service airports dominate the application segment with a commanding 75% share. These airports support major passenger and cargo airlines, where maintaining uninterrupted operations regardless of weather is a priority to avoid costly delays and cancellations. All-weather landing systems in these airports improve overall operational efficiency and passenger safety by allowing landings under poor visibility conditions.

The high volume of traffic at commercial airports further fuels the adoption of AWLS technology. Operators at these airports prioritize advanced navigation and landing aids to keep flights on schedule and enhance safety. As the aviation industry focuses on modernization, commercial airports lead in implementing AWLS solutions owing to their strategic importance in global transportation.

For instance, in January 2023, Ranchi’s Birsa Munda Airport was equipped with a new Instrument Landing System (ILS) to enhance its operational capacity, especially during adverse weather conditions. This upgrade is part of a broader trend of improving all-weather landing systems at commercial service airports across India.

Emerging Trends

Emerging trends in the all-weather landing system market include the integration of AI and automation to enhance precision and decision-making during aircraft approach and landing. The use of advanced algorithms and sensor fusion technologies is becoming more common, boosting system resilience and reliability even in extreme weather.

The adoption of satellite-based navigation augmentation like SBAS and the evolution of ground-based augmentation systems (GBAS) are expanding the system’s operational capabilities. Market data indicates a rise in automated flight procedures incorporating all-weather landing capabilities, which reflects growing industry demand for safer and more efficient air travel even in challenging environments.

Growth Factors

Several growth factors drive the adoption and development of all-weather landing systems. Increased air traffic volume worldwide demands reliable landing solutions to maintain operational efficiency. Regulatory mandates and safety standards from bodies like the FAA and ICAO require the implementation of advanced landing systems that meet stringent criteria to ensure consistent aviation safety.

Moreover, investments in airport infrastructure modernization, especially in high-density and emerging markets, are fueling demand. The impact of climate change resulting in more frequent severe weather events has also highlighted the need for robust landing technologies that can operate safely under all conditions.

Key Market Segments

By Type

- Microwave Landing System (MLS)

- Ground-Based Augmentation System

- Instrument Landing System (ILS)

By Application

- Commercial Service Airport

- Non-Commercial Service Airport

Drivers

Increasing Air Traffic and Safety Demand

The expanding global air traffic volume is a strong driver for the all-weather landing system market. As more flights take place across continents, the need for safe, reliable landing capabilities in all weather conditions has never been more critical. Airports and airlines seek systems that ensure aircraft can land safely despite fog, rain, snow, or low visibility. This demand bolsters investments in advanced landing technologies that minimize delays and improve operational safety.

The growing adoption of sophisticated systems like Instrument Landing Systems (ILS), Ground-Based Augmentation Systems (GBAS), and Microwave Landing Systems (MLS) also reflects this trend. These technologies help manage the increasing air traffic safely and efficiently, making them essential to modern aviation infrastructure and encouraging market expansion.

Investments in airport modernization and infrastructure upgrades further propel the market, as airports prioritize enhanced safety measures to handle higher passenger volumes under varying weather conditions. This growing emphasis on operational safety and the need to reduce weather-related disruptions make the all-weather landing system market poised for sustained growth over the next decade

For instance, in October 2025, India announced the launch of two new international airports in Delhi and Mumbai as part of a broader effort to expand aviation capacity and modernize infrastructure. These new airports will feature state-of-the-art technologies, including advanced all-weather landing systems, to ensure safe operations in all weather conditions.

Restraint

High Initial Investment and Maintenance Costs

One significant restraint for the all-weather landing system market is the high cost associated with installation, operation, and ongoing maintenance. These systems require substantial upfront capital investment, which can be prohibitive, especially for smaller airports or those in developing countries.

Besides procurement costs, the long-term expenses of maintaining the system to meet stringent safety and performance standards add to the financial burden. This can delay or limit adoption by airport authorities who must balance budgets with the pressing need for enhanced landing safety.

Additionally, technological complexity means continuous upgrades are necessary, further straining budgets. Regulatory compliance also mandates rigorous certification processes that increase both time and cost before deployment. These financial and operational challenges may slow the pace at which airports and aviation operators implement all-weather landing solutions, particularly in less affluent markets, restraining overall market growth despite rising demand.

Opportunities

Growing Adoption in Emerging Markets

Emerging markets offer substantial growth opportunities for the all-weather landing system industry. Rapid urbanization, increasing air travel demand, and government investments in airport infrastructure modernization characterize these regions. Asia-Pacific, in particular, is witnessing active expansion in its civil aviation sector, leading to greater demand for aviation safety technologies, including all-weather landing systems.

Many airports in these regions are upgrading their facilities to comply with international safety standards and to support increasing passenger traffic, making them prime candidates for AWLS adoption. Opportunities also stem from technological advancements that improve system accuracy, affordability, and integration capabilities.

Innovations such as satellite-based augmentation systems (SBAS) and multi-sensor fusion technologies make all-weather landing systems more accessible and effective. Vendors focusing on cost efficiency and tailored solutions for emerging markets can capture significant market share. Furthermore, governments in these regions increasingly enforce stringent aviation safety regulations, boosting demand as compliance becomes mandatory.

For instance, in March 2024, Astronics Corporation launched the next-generation Typhon T-400, a dual Line Replaceable Unit (LRU) system designed to offer cost savings and high performance for aviation applications. This new system is aimed at enhancing aircraft systems, including those critical for all-weather landing operations, reflecting Astronics’ commitment to advancing technology in the aviation sector.

Challenges

Regulatory Complexity and Certification Delays

A major challenge in the all-weather landing system market is navigating complex regulatory environments that govern certification and operational approvals. Aviation authorities worldwide impose rigorous safety standards for these systems, requiring extensive testing and validation. This process ensures reliability but often results in prolonged certification timelines, delaying market entry and system upgrades.

Furthermore, differing regulations across countries and regions present challenges for system manufacturers and airport operators aiming for standardized implementations. The need to comply with multiple regulatory frameworks increases the cost and complexity of deployment projects. Combined with the technical necessity for system integration with existing airport infrastructure, these regulatory hurdles can impede swift market growth.

For instance, in March 2025, Leonardo S.p.A. updated its Industrial Plan for 2029, focusing on technological advancements in radar and sensor systems, which are critical to all-weather landing operations. The company’s strategic plan emphasizes innovation in aerospace and defense, aiming to enhance its offerings in areas like precision navigation and improved safety for aviation.

Key Players Analysis

The All-Weather Landing System Market is dominated by leading aerospace and defense firms such as Astronics Corporation, Cobham plc, Collins Aerospace, and Honeywell International Inc. These companies are recognized for their advanced avionics, navigation, and precision landing solutions that enhance aircraft safety and operational reliability in adverse weather conditions. Their continued investments in R&D strengthen global aviation infrastructure modernization.

European technology leaders including Indra Sistemas S.A., Leonardo S.p.A., Mopiens Inc., and Multi Electric–OCEM Airfield play a vital role in supplying high-precision landing aids and integrated airfield lighting systems. Their systems are designed to meet international aviation safety standards, improving runway visibility and reducing delays caused by poor weather.

Prominent global players such as NEC Corporation, Raytheon Technologies Corporation, Saab AB, Sierra Nevada Corporation, and Thales Group, along with other key participants, focus on next-generation landing systems utilizing radar, satellite navigation, and AI-based automation. Their technological innovations contribute to enhanced airport efficiency, supporting the shift toward smarter and safer aviation ecosystems.

Top Key Players in the Market

- Astronics Corporation

- Cobham plc

- Collins Aerospace

- Honeywell International Inc.

- Indra Sistemas S.A.

- Leonardo S.p.A.

- Mopiens Inc.

- Multi Electric- OCEM Airfield

- NEC Corporation (AT&T Inc.)

- Raytheon Technologies Corporation

- Saab AB

- Sierra Nevada Corporation

- Thales Group

- Other Key Players

Recent Developments

- In December 2025, Avianca selected Honeywell’s cockpit technologies for its new Airbus A320neo fleet to enhance operational performance and efficiency. This includes Honeywell’s advanced systems, which improve safety and reliability during various flight conditions, including all-weather operations.

- In December 2024, Indra Sistemas S.A. secured a contract to supply a new long-range radar to the Thai Air Force. This radar system, designed to enhance defense capabilities, is also crucial for improving all-weather landing operations, as it enables better detection and monitoring in adverse weather conditions.

- In August 2025, Astronics Corporation raised its 2025 guidance citing strong momentum in aerospace business including support for commercial aircraft linefit and retrofit projects, highlighting ongoing demand for advanced aircraft systems

Report Scope

Report Features Description Market Value (2024) USD 1.74 Bn Forecast Revenue (2034) USD 3.21 Bn CAGR(2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Microwave Landing System (MLS), Ground-Based Augmentation System, Instrument Landing System (ILS), By Application (Commercial Service Airport, Non-Commercial Service Airport) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Astronics Corporation, Cobham plc, Collins Aerospace, Honeywell International Inc., Indra Sistemas S.A., Leonardo S.p.A., Mopiens Inc., Multi Electric- OCEM Airfield, NEC Corporation (AT&T Inc.), Raytheon Technologies Corporation, Saab AB, Sierra Nevada Corporation, Thales Group, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  All-Weather Landing System MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

All-Weather Landing System MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Astronics Corporation

- Cobham plc

- Collins Aerospace

- Honeywell International Inc.

- Indra Sistemas S.A.

- Leonardo S.p.A.

- Mopiens Inc.

- Multi Electric- OCEM Airfield

- NEC Corporation (AT&T Inc.)

- Raytheon Technologies Corporation

- Saab AB

- Sierra Nevada Corporation

- Thales Group

- Other Key Players