Global Alkyl Ether Sulfates Market Size, Share, And Business Benefits By Product Type (Sodium Lauryl Ether Sulfate, Ammonium Lauryl Ether Sulfate, Others), By Application (Personal Care, Detergents and Cleaners, Pharmaceuticals, Others), By Distribution Channel (Indirect, Direct), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 163136

- Number of Pages: 213

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

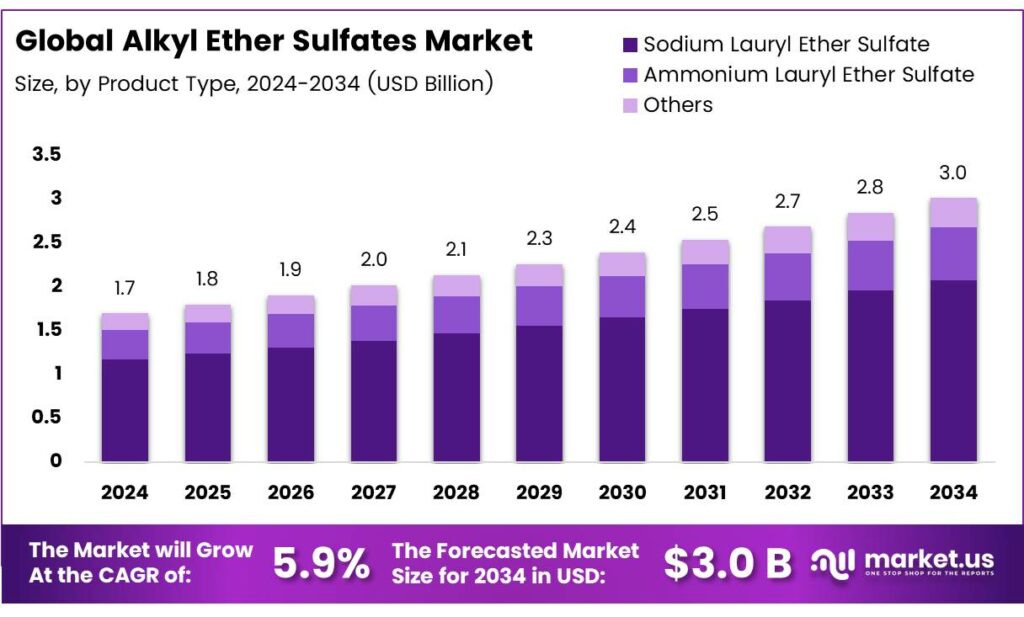

The Global Alkyl Ether Sulfates Market size is expected to be worth around USD 3.0 Billion by 2034, from USD 1.7 Billion in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034.

Alkyl ether sulfates are key anionic surfactants in cleaning products, with ethoxylation influencing their equilibrium surface properties. However, dynamic surface tension (DST) at the air-water interface is critical for understanding foaming behavior. This study examines the impact of ethoxylation on both equilibrium and dynamic surface tension, as well as foaming ability, in sodium dodecyl sulfate (SDS), primary alkyl sulfate (PAS), and sodium lauryl ether sulfate (SLES).

Interestingly, micellar SLES solutions showed poorer DST reduction compared to SDS due to enhanced micellar stability. Foaming performance in both submicellar and micellar solutions correlated closely with observed DST behavior. NaCl addition lowered both equilibrium and DST, while SLES demonstrated superior hardness tolerance, as ethoxy groups bind Ca²⁺ ions, preventing interaction with sulfate head groups.

Prior art references highlight various alkyl ether sulfate applications. EP-A-1354872 describes amine salts of sulfuric esters with 0.1–10 oxyalkylene units (C₂–C₄). WO 00/58428 discloses self-thickening cleaning compositions containing ethoxylated or propoxylated alkyl ether sulfates. WO 99/65972 covers aqueous emulsions using anionic surfactants with 0.5–10 ethylene/propylene oxide units. WO 95/15408 involves sulfate/sulfonate surfactants in aluminum etching baths.

- The objective is to deliver alkyl ether sulfate salts of formula I that offer advantageous performance in laundry and cleaning formulations. These salts are incorporated at 0.01–40 wt% (preferably 0.1–35 wt%, especially 0.1–30 wt%) to achieve optimal cleaning in synergy with other components. Total anionic surfactants in the composition reach up to 40 wt% (especially ≤35 wt%, particularly ≤30 wt%).

Alkyl ether sulfate salts derived from alkoxylated alcohols that are subsequently sulfonated. These salts feature propylene and butylene oxide units, and optionally ethylene oxide units, between the alcohol backbone and the sulfate group. They are specifically designed for use as anionic surfactants in laundry detergents and cleaning compositions. While alkyl ether sulfates are known in the prior art, the novel structural incorporation of propylene/butylene oxide units aims to enhance performance characteristics.

Key Takeaways

- The Global Alkyl Ether Sulfates Market is expected to grow from USD 1.7 billion in 2024 to USD 3.0 billion by 2034 at a 5.9% CAGR.

- Sodium Lauryl Ether Sulfate dominated By Product Type in 2024 with 68.9% share due to rich lather, cleaning efficacy, and formulation stability.

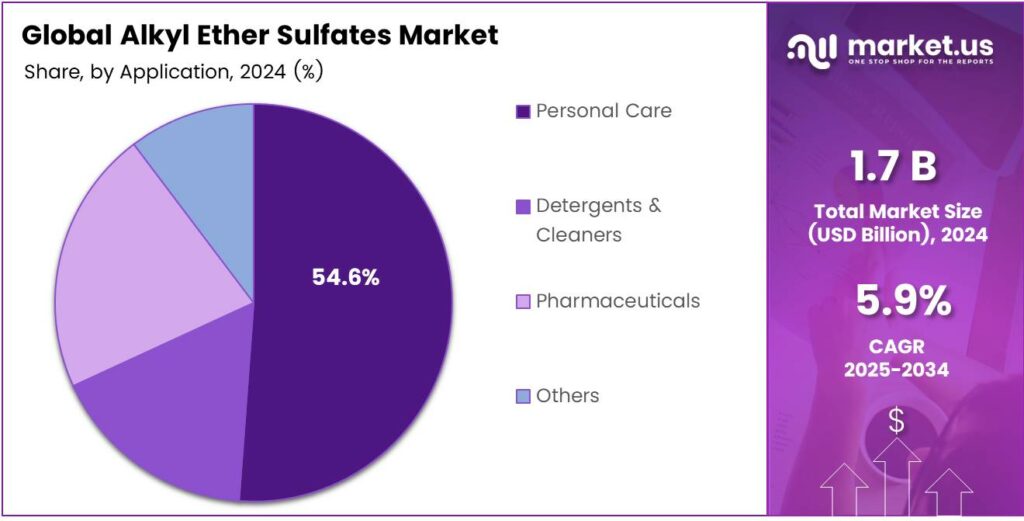

- Personal Care led By Application in 2024 with a 54.6% share, driven by daily use in shampoos/body washes and urbanization/beauty trends.

- Indirect distribution channel held 67.3% share in 2024, leveraging wholesalers/retailers for broad access and cost reduction.

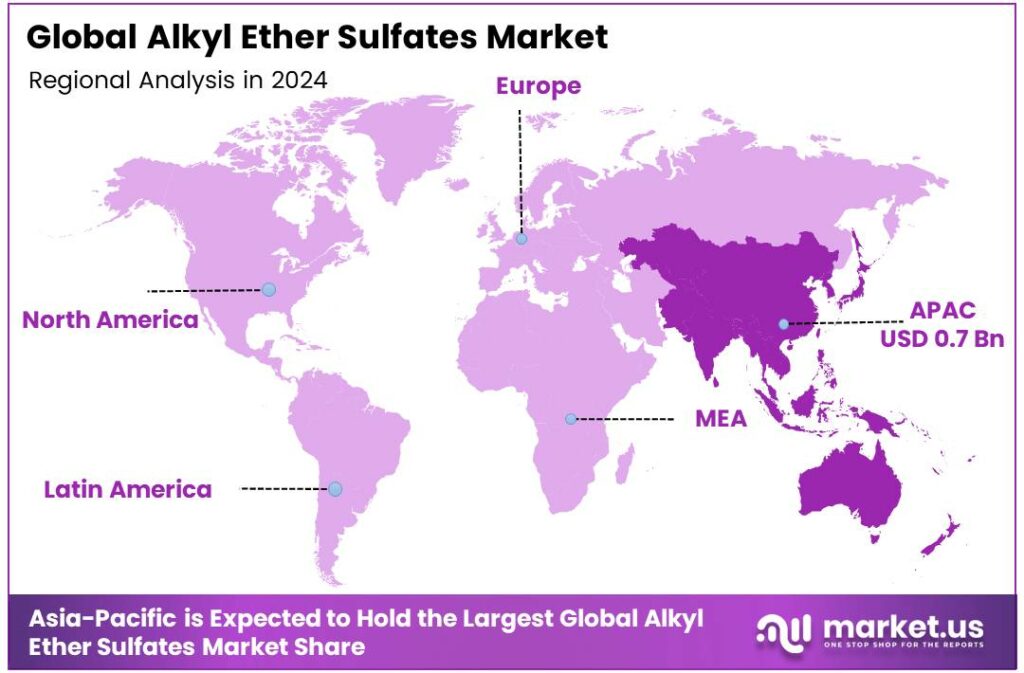

- Asia-Pacific dominated regionally in 2024 with a 43.8% share of USD 0.7 billion.

By Product Type

Sodium Lauryl Ether Sulfate dominates with 68.9% due to its superior foaming and cleansing properties.

In 2024, Sodium Lauryl Ether Sulfate held a dominant market position in the By Product Type Analysis segment of the Alkyl Ether Sulfates Market, with a 68.9% share. This sub-segment leads because it excels in creating rich lather and effective cleaning. Manufacturers prefer it for its stability in formulations. As a result, it drives growth in personal care products. Demand surges with rising hygiene awareness, ensuring steady expansion.

Ammonium Lauryl Ether Sulfate plays a key role in the market, offering mild cleansing alternatives. It suits sensitive skin formulations, reducing irritation risks. Brands increasingly adopt it for eco-friendly shampoos. This shift boosts its adoption in natural product lines. Consequently, it supports sustainable trends, carving a niche despite the dominant leader.

By Application

Personal Care dominates with 54.6% due to high consumer demand for grooming essentials.

In 2024, Personal Care held a dominant market position in the By Application Analysis segment of the Alkyl Ether Sulfates Market, with a 54.6% share. This segment thrives on daily use in shampoos and body washes. It benefits from urbanization and beauty trends.

Thus, it fuels market innovation and volume sales effectively. Detergents and Cleaners form another vital area, relying on alkyl ether sulfates for powerful stain removal. Households and industries use them widely for efficiency. This application grows with cleaning product advancements.

Hence, it maintains relevance in everyday hygiene routines. Pharmaceuticals incorporate these sulfates in specialized formulations for drug delivery. They enhance solubility and stability in creams. Regulatory approvals drive cautious growth. Overall, it contributes to health-focused innovations steadily.

By Distribution Channel

Indirect dominates with 67.3% due to extensive reach through intermediaries.

In 2024, Indirect held a dominant market position in the By Distribution Channel Analysis segment of the Alkyl Ether Sulfates Market, with a 67.3% share. This channel leverages wholesalers and retailers for broad access. It lowers costs for end-users significantly.

Therefore, it accelerates product penetration across regions. Direct distribution targets bulk buyers like manufacturers directly. It ensures quality control and faster delivery. Companies favor it for customized orders. As a result, it builds strong B2B relationships efficiently.

Key Market Segments

By Product Type

- Sodium Lauryl Ether Sulfate

- Ammonium Lauryl Ether Sulfate

- Others

By Application

- Personal Care

- Detergents and Cleaners

- Pharmaceuticals

- Others

By Distribution Channel

- Indirect

- Direct

Emerging Trends

Increased regulatory focus on sustainable formulation and renewables

-

In anionic surfactants like alkyl-ether sulfates (AES), regulatory and consumer pressures drive a shift to renewable materials and better biodegradability. EU Regulation (EC) No 648/2004 states detergents comprise 4.2% of EU chemicals production value, with France, Germany, Italy, Poland, and Spain accounting for 85%.

Within that framework, the European Parliament’s February 2024 report on the revision of the regulatory regime sets out requirements such as introducing mandatory targets for renewable raw materials and recycled content in detergents, alongside biodegradable organic ingredients.

The European surfactant and detergent industry shows that the total tonnage of alkyl sulfates (AS) and those contained in AES in Europe was approximately 178,400 t. While that figure does not isolate pure AES, it gives a scale of surfactant volumes under regulatory scrutiny. As regulators push for greener surfactants, formulations containing AES are experiencing increased demand for feedstocks from plant-based origins, lower footprints, and easier biodegradation profiles.

Restraints

Regulatory and environmental pressure limit growth

One of the major restraints facing the expansion of the Alkyl Ether Sulfates (AES) market is the tightening of regulatory requirements and the increasing scrutiny of surfactants’ environmental impact. In the European Union, the current Detergents Regulation (EC No 648/2004) mandates that surfactants used in detergents must be fully biodegradable.

The revision proposal issued in April 2023 further increases the regulatory burden by extending digital product-passport requirements, stricter labelling, and new risk-management obligations for detergents and surfactants. Effluent concentrations from sewage treatment plants measured at about 10.18 µg/L (adjusted EU estimate for alkyl sulphates).

The simple fact is that as regulatory frameworks evolve, AES producers must invest more in advanced treatment, trace-constituent control, and stringent documentation. For example, for surfactants to remain legally acceptable, they must pass ultimate biodegradability tests defined under the Regulation. Many chemical companies or detergent makers may switch to optimized or alternative surfactants with perceived lower compliance burden, which limits pure AES growth in certain markets.

Drivers

Hygiene push and cold-wash habits lift AES

-

Rising hygiene awareness, public programs, and evolving laundry habits drive AES demand. Since 2015, 1.6 billion more people gained basic hygiene access, raising global coverage from 66% to 80% by 2024, yet 1.7 billion remain without. This gap and growing access fuel soap and detergent demand in new and existing markets, where AES provides mildness, foam, and cost-effectiveness.

Governments are pushing this further. India’s Swachh Bharat Mission places sustained focus on handwashing stations, cleanliness monitoring, and ODF-Plus outcomes in villages—practical measures that expand the installed base of facilities, which, in turn, need soaps and cleaners using surfactants like AES.

Taken together, more people with access to hygiene services, government programs that build and audit facilities, habitual laundry volumes shifting to cold cycles, and a robust surfactant production backbone—create a durable, volume-led pull for AES across detergents, shampoos, body washes, and household cleaners.

Opportunity

Rising global access to hand-hygiene facilities

One of the key drivers for the growth of alkyl ether sulfates (AES) is the expanding global effort to strengthen hand-washing and hygiene infrastructures — especially in households and institutions. As more people gain reliable access to soap and water, demand for surfactant‐rich cleansing agents such as AES rises.

This upward trend provides the chemical and cleaning-product industry with a broader base of end-users of detergents and soaps that incorporate AES. Because AES is a common anionic surfactant used in shampoos, body-washes, detergents, and hand-cleansers, its volume growth is tied not just to population growth but to improved hygiene adoption.

As more homes and institutions are wired for hand-washing, the need for effective soap cleansing formulas goes up. In parallel, the global initiative Hand Hygiene for All Global Initiative by the World Health Organization and UNICEF seeks to embed hand-hygiene in national policies, ensure soap & water availability, and promote behaviour change.

Regional Analysis

Asia–Pacific dominates the Alkyl Ether Sulfates market with a 43.8% share, valued at USD 0.7 Billion.

In 2024, the Asia-Pacific region emerged as the dominating region in the Alkyl Ether Sulfates market, accounting for 43.8% of global revenue around USD 0.7 billion. This commanding share reflects a combination of strong regional drivers, rapid urbanisation across economies such as India and China, and increasing disposable incomes.

The robust growth of end-use markets like detergents, shampoos, body washes, and industrial cleaning agents has amplified the consumption of AES surfactants. Supply-side factors further bolster the region’s dominance: a well-established manufacturing base, relatively lower raw material and labour costs, and infrastructure investments in chemical processing assets.

Regulatory momentum favouring biodegradable and mild surfactants has encouraged the adoption of AES in eco-aware formulations, complementing premiumisation trends in the Asia-Pacific. Despite this, challenges persist: feedstock price volatility, environmental compliance pressures, and competition from alternative surfactant technologies may restrain growth.

Nonetheless, given the region’s scale, structural growth in end-use sectors, and favourable manufacturing economics, the Asia-Pacific market is expected to maintain its lead position, offering substantial volume and value opportunities for AES producers and suppliers.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE leverages its integrated value chain and massive production scale to be a dominant force in the Alkyl Ether Sulfates market. Its strong R&D capabilities focus on developing sustainable and high-performance surfactant solutions, catering to diverse industries like personal care and home cleaning. With a vast global distribution network and a reputation for quality and innovation.

Stepan Company is a world-leading merchant manufacturer of surfactants, with Alkyl Ether Sulfates being a core product line. Its strategic focus on production efficiency and a global manufacturing footprint allows it to serve major consumer goods companies reliably. Stepan emphasizes custom solutions and technical support, working closely with clients in the detergents and personal care sectors.

Clariant AG distinguishes itself in the Alkyl Ether Sulfates market through a strong emphasis on sustainability and bio-based innovations. Its ECO label products, derived from renewable feedstocks like palm kernel or coconut oil, appeal to brands seeking greener formulations. Clariant focuses on providing high-value, specialized solutions for personal care and industrial applications, often prioritizing performance and environmental compatibility over competing solely on price.

Top Key Players in the Market

- BASF SE

- Stepan Company

- Clariant AG

- Huntsman Corporation

- Kao Corporation

- Galaxy Surfactants Ltd.

- Evonik Industries AG

- Henkel AG and Co. KGaA

- Godrej Industries Limited

- Akzo Nobel N.V.

Recent Developments

- In 2025, BASF highlighted that its Care Chemicals division holds leading positions across highly relevant alkoxylation product lines, amines, ethoxylates, alcohol alkoxylates/ethoxylates, EO/PO copolymers, and emphasized a focus on sustainability, innovation, and deeply integrated value chains.

- In 2024, Clariant partnered with OMV to reduce carbon emissions in ethylene production, a key feedstock for AES ethoxylation, aligning with EU sustainability goals and supporting greener surfactant chains. The company collaborated with Dow to boost North American production of eco-friendly surfactants, responding to demand for low-impact formulations.

Report Scope

Report Features Description Market Value (2024) USD 1.7 Billion Forecast Revenue (2034) USD 3.0 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Sodium Lauryl Ether Sulfate, Ammonium Lauryl Ether Sulfate, Others), By Application (Personal Care, Detergents and Cleaners, Pharmaceuticals, Others), By Distribution Channel (Indirect, Direct) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Stepan Company, Clariant AG, Huntsman Corporation, Kao Corporation, Galaxy Surfactants Ltd., Evonik Industries AG, Henkel AG and Co. KGaA, Godrej Industries Limited, Akzo Nobel N.V. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Alkyl Ether Sulfates MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Alkyl Ether Sulfates MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Stepan Company

- Clariant AG

- Huntsman Corporation

- Kao Corporation

- Galaxy Surfactants Ltd.

- Evonik Industries AG

- Henkel AG and Co. KGaA

- Godrej Industries Limited

- Akzo Nobel N.V.