Global Airport 4.0 Market By End Market(Implementation, Upgrade and Services), By Application(Airside, Air Traffic Maintenance, Aircraft Maintenance, Passenger Screening, Others), By Size(Large, Medium, Small), By Operation(Aeronautical, Non-aeronautical), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: August 2024

- Report ID: 127012

- Number of Pages: 378

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

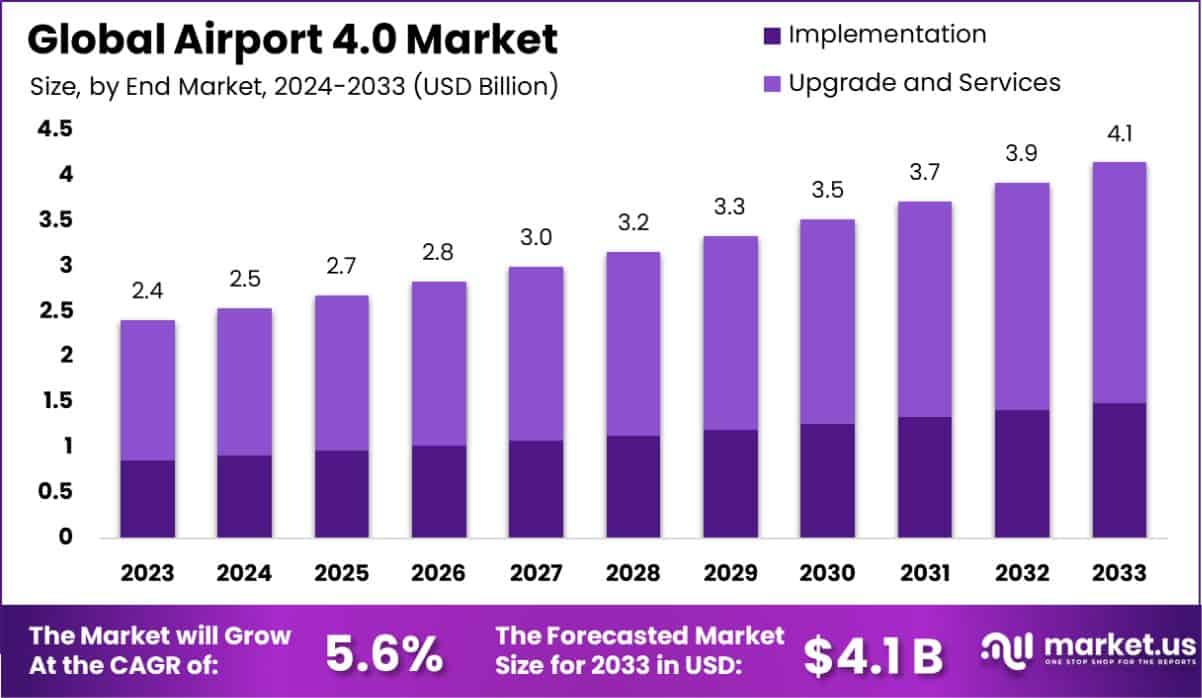

The Global Airport 4.0 Market size is expected to be worth around USD 4.1 Billion By 2033, from USD 2.4 Billion in 2023, growing at a CAGR of 5.6% during the forecast period from 2024 to 2033.

Airport 4.0 represents the integration of Industry 4.0 technologies—like the Internet of Things (IoT), artificial intelligence (AI), and big data analytics—into airport operations. This concept aims to optimize the efficiency, security, and passenger experience by leveraging digital advancements to streamline processes from check-in to boarding.

The Airport 4.0 market is poised for significant growth, driven by the escalating need for enhanced security measures, increased passenger traffic, and higher expectations for operational efficiency. As airports seek to accommodate growing numbers of travelers while maintaining safety and improving traveler satisfaction, they are turning to sophisticated technology solutions offered by Airport 4.0.

Top opportunities within this market include the development of smart infrastructure capable of managing real-time data to reduce wait times and congestion and the implementation of advanced security technologies that enhance threat detection without compromising passenger flow.

The transformation towards Airport 4.0 encapsulates a significant evolution in the utilization of digital technologies aimed at optimizing airport operations, enhancing passenger experience, and ensuring sustainable practices. The progression towards smart airports is being driven by the convergence of advanced technologies such as the Internet of Things (IoT), big data analytics, and artificial intelligence (AI), which collectively streamline airport management and elevate safety protocols.

The resurgence of air travel post-pandemic has been marked by a robust recovery, as evidenced by the International Air Transport Association’s (IATA) 2022 data. Global airlines transported approximately 4.5 billion passengers and managed a total of 8.5 trillion Revenue Passenger Kilometers (RPK), demonstrating vigorous demand. The supply side was equally strong, with airlines offering about 10.7 trillion Available Seat Kilometers (ASK).

Moreover, the air freight segment transported 54 million tonnes of cargo, underscoring its crucial role in global trade. These metrics not only reflect a rebound in air travel but also suggest a growing dependency on airports equipped with advanced technological capabilities. As such, the demand for integrated systems that facilitate efficient operations and sustainable practices is expected to surge, positioning the Airport 4.0 market on a trajectory of accelerated growth and innovation.

Key Takeaways

- The Global Airport 4.0 Market size is expected to be worth around USD 4.1 Billion By 2033, from USD 2.4 Billion in 2023, growing at a CAGR of 5.6% during the forecast period from 2024 to 2033.

- In 2023, Upgrade and Services held a dominant market position in the By End Market segment of the Airport 4.0 Market, capturing more than a 64.3% share.

- In 2023, Airside held a dominant market position in the By Application segment of the Airport 4.0 Market, capturing more than a 27.5% share.

- In 2023, Large held a dominant market position in the By Size segment of the Airport 4.0 Market, capturing more than a 42.5% share.

- In 2023, Non-aeronautical held a dominant market position in the By Operation segment of the Airport 4.0 Market, capturing more than a 53.5% share.

- Asia Pacific dominated a 36.8% market share in 2023 and held USD 0.88 Billion revenue of the Airport 4.0 Market.

By End Market Analysis

In 2023, Upgrade and Services held a dominant market position in the “By End Market” segment of the Airport 4.0 Market, capturing more than a 64.3% share. This significant market penetration can be attributed to the escalating demand for advanced technological integration and enhanced operational efficiency at airports globally. As smart airports increasingly adopt Internet of Things (IoT) technologies, artificial intelligence (AI), and automation systems, the need for comprehensive upgrades and robust service support has intensified.

The Upgrade and Services segment benefits from continuous investments in smart technologies aimed at optimizing passenger experience and streamlining airport operations. The implementation of such technologies is essential not only for enhancing current functionalities but also for expanding capabilities to handle larger passenger volumes and more complex logistical tasks.

This sector’s growth is further propelled by regulatory requirements and security protocols which necessitate regular system upgrades and maintenance. As airports strive to achieve higher standards of security and operational efficiency, the demand for specialized services that can integrate seamlessly with existing infrastructure while minimizing disruptions to daily operations is anticipated to rise. Thus, the Upgrade and Services segment is expected to maintain its leadership position, driven by these ongoing technological advancements and the critical need for their integration within the airport environment.

By Application Analysis

In 2023, Airside held a dominant market position in the “By Application” segment of the Airport 4.0 Market, capturing more than a 27.5% share. This prominence is primarily driven by the critical need for enhanced air traffic maintenance and efficient aircraft operations within the increasingly digital and interconnected airport ecosystem. As airports transition to smarter, more automated operations, the integration of advanced technologies in airside operations—including real-time data analytics for air traffic control and predictive maintenance for aircraft—is paramount.

The growth in the Airside segment is further supported by substantial investments in safety and efficiency improvements, which are essential to handling the rising global air traffic volumes. Technologies that enable more precise aircraft monitoring and predictive maintenance have become indispensable, facilitating timely interventions and reducing downtime, which in turn enhances overall airport efficiency and safety.

Moreover, the push for stringent security measures and more thorough passenger screening processes using biometric and artificial intelligence technologies has also contributed to the expansion of this segment. Looking forward, the Airside segment is expected to continue its growth trajectory, fueled by ongoing advancements in technology and the increasing emphasis on optimizing operational efficiency and security at airports worldwide.

By Size Analysis

In 2023, Large airports held a dominant market position in the “By Size” segment of the Airport 4.0 Market, capturing more than a 42.5% share. This leading position reflects the significant role that large airports play in the global aviation industry, characterized by their capacity to handle substantial passenger volumes and their adoption of advanced technological solutions. Large airports are at the forefront of implementing innovative technologies such as biometrics for security checks, sophisticated baggage handling systems, and comprehensive customer service solutions powered by artificial intelligence.

The substantial market share held by large airports is supported by their ability to invest in and deploy extensive infrastructural and technological upgrades, which are less feasible for medium and small-sized airports due to budget constraints. Additionally, the strategic importance of large airports as international hubs necessitates continuous enhancement of operational efficiency and passenger experience, driving further investments in Airport 4.0 technologies.

As the demand for improved efficiency and enhanced passenger experience continues to grow, large airports are likely to maintain their market dominance. They serve as pivotal nodes in the global air travel network, where innovation and scale converge to set benchmarks for the rest of the industry.

By Operation Analysis

In 2023, Non-aeronautical operations held a dominant market position in the “By Operation” segment of the Airport 4.0 Market, capturing more than a 53.5% share. This segment encompasses a wide range of activities beyond traditional airport functions, including retail services, parking, rentals, and hospitality services within airport premises. The increasing contribution of non-aeronautical revenue streams is indicative of the evolving business models of airports, which are transforming into comprehensive service providers with amenities that enhance the passenger experience.

The rise in the non-aeronautical sector is primarily driven by the growing recognition of the value in diversifying revenue sources, particularly as airlines face fluctuating operational costs and thin profit margins. Airports have thus expanded their focus on optimizing and increasing the profitability of commercial spaces, luxury shopping experiences, sophisticated dining options, and other passenger-centric services. These enhancements not only improve the traveler’s experience but also stabilize airport revenues, making them less dependent on aeronautical income.

As airports continue to innovate and adapt to changing consumer preferences and technological advancements, the non-aeronautical segment is expected to sustain its market leadership. This trend reflects a broader shift in airport management strategies, focusing on maximizing revenue per passenger and enriching the travel experience through a variety of services and amenities.

Key Market Segments

By End Market

- Implementation

- Upgrade and Services

By Application

- Airside

- Air traffic Maintenance

- Aircraft Maintenance

- Passenger Screening

- Others

By Size

- Large

- Medium

- Small

By Operation

- Aeronautical

- Non-aeronautical

Drivers

Airport 4.0 Market Growth Drivers

The evolution towards Airport 4.0 is driven by several pivotal factors that are reshaping the landscape of airport operations and passenger experiences. At the core, technological integration plays a crucial role, with advancements in digitalization, automation, and data analytics enhancing efficiency and reducing operational costs.

The implementation of IoT (Internet of Things) devices, AI (Artificial Intelligence) solutions, and biometric technologies are streamlining processes from check-in to boarding, thus improving the overall flow and safety of airports. Additionally, the increasing demand for real-time data exchange is pushing airports to adopt smart technologies that facilitate enhanced communication and management systems.

These innovations not only bolster security and operational efficiency but also elevate the customer experience by offering personalized and interactive services. This shift towards smarter airports is aligned with growing passenger volumes and heightened expectations for convenience and rapid service, marking a significant stride in the airport industry’s evolution.

Restraint

Challenges Facing Airport 4.0 Adoption

The transition to Airport 4.0 is not without its challenges, with significant barriers impacting its widespread adoption. High initial costs for implementing advanced technologies pose a major restraint, as airports require substantial investment to integrate systems like AI, IoT, and biometrics.

Additionally, there are concerns about data privacy and cybersecurity, as the increase in data flows heightens the risk of breaches and threats, necessitating robust security measures. The complexity of modernizing existing infrastructure also presents a hurdle, especially in older airports where integrating new technologies with legacy systems can be problematic.

Furthermore, the need for specialized skills and training for staff to manage and operate these sophisticated systems can slow down adoption and increase operational costs. These factors collectively contribute to the cautious approach many airports take towards fully embracing the Airport 4.0 model.

Opportunities

Expanding Opportunities in Airport 4.0

The Airport 4.0 market offers expansive opportunities primarily through enhanced passenger experiences and operational efficiencies. The integration of advanced technologies such as artificial intelligence, machine learning, and Internet of Things (IoT) devices enables airports to optimize both the passenger journey and backend operations.

For instance, automated check-ins, security checks, and personalized communication can significantly reduce waiting times and improve customer satisfaction. Additionally, the vast amount of data generated by these technologies provides valuable insights into passenger behaviors and preferences, allowing for more targeted services and marketing strategies.

This technology-driven approach not only enhances security and efficiency but also opens new revenue streams, such as through data monetization and tailored retail offerings. As airports continue to evolve into fully integrated smart hubs, the potential for innovation and growth in this sector remains substantial, promising a more connected and efficient future for air travel.

Challenges

Key Challenges in Airport 4.0 Implementation

Adopting Airport 4.0 technologies introduces significant challenges that can hinder progress. A primary concern is the substantial investment required to upgrade infrastructure with advanced digital solutions such as AI, IoT, and biometric systems. These technologies demand not only initial capital but also ongoing maintenance and updates.

Additionally, there is a considerable gap in digital skills among existing airport staff, requiring extensive training and potentially new hires, which further increases operational costs. Cybersecurity emerges as a critical issue, with the integration of more digital services increasing vulnerability to cyberattacks, thus requiring stronger security protocols and continuous monitoring.

Lastly, regulatory compliance poses a complex challenge as airports must navigate a landscape of international and local regulations regarding data protection, passenger privacy, and technology deployment, complicating the implementation of new solutions. These factors collectively slow the transition toward a fully integrated, smart airport environment.

Growth Factors

- Technological Advancements: Implementation of cutting-edge technologies like AI, IoT, and robotics streamlines airport operations, reducing delays and increasing efficiency in passenger processing and luggage handling.

- Increased Passenger Traffic: Rising global air travel demands more efficient airport systems to handle higher volumes of passengers and luggage without compromising on service quality or security.

- Demand for Enhanced Security: Advanced security technologies like biometric verification and automated surveillance systems are crucial for improving safety and regulatory compliance, driving investments in Airport 4.0 solutions.

- Government Initiatives: Many governments are pushing for the modernization of transport infrastructures, providing funding and policy support for airports to adopt smarter technologies and improve overall travel experiences.

- Sustainability Pressures: With a growing focus on reducing environmental impact, airports are adopting smarter solutions to manage resources better, reduce waste, and improve energy efficiency.

- Passenger Expectations: Modern travelers expect seamless, personalized experiences. Airports employing smart technologies can offer tailored services, from targeted retail offerings to real-time flight updates, enhancing customer satisfaction and loyalty.

Emerging Trends

- Self-Service Technologies: Automated kiosks for check-in and baggage drop are becoming standard, reducing wait times and empowering passengers to manage their travel details independently.

- Biometric Identification: Facial recognition and fingerprint scanning are increasingly used for identity verification, streamlining security checks and boarding processes while enhancing safety measures.

- Artificial Intelligence (AI): AI is used for predictive maintenance of airport facilities and equipment, optimizing operations, and minimizing downtime through proactive service schedules.

- Seamless Connectivity: Free, high-speed Wi-Fi and the integration of IoT devices across airport environments ensure constant connectivity, improving passenger communication and airport service management.

- Sustainability Initiatives: Airports are implementing green technologies such as solar panels and smart energy management systems to reduce carbon footprints and promote sustainable operations.

- Enhanced Data Analytics: Advanced data analytics are utilized to analyze passenger flow and behavior, helping airports optimize staffing, security, and retail services based on real-time data.

Regional Analysis

The Airport 4.0 market is experiencing significant growth across various regions, each demonstrating unique characteristics and adoption rates.

In North America, the market is driven by strong technological infrastructure and regulatory support, facilitating the integration of AI, IoT, and biometric systems across major airports. This region focuses on enhancing security measures and operational efficiency through advanced technology.

Europe is notable for its emphasis on sustainability and efficiency. European airports are adopting Airport 4.0 technologies to reduce carbon footprints and improve energy management, supported by stringent EU regulations on environmental conservation and data protection.

Asia Pacific is the dominant region in the Airport 4.0 market, holding a 36.8% share with a market value of USD 0.88 billion. Rapid urbanization, increasing air travel demand, and significant investments in airport infrastructure projects are key growth drivers in this region.

The Middle East & Africa region is rapidly adopting Airport 4.0 technologies, focusing on creating state-of-the-art facilities to boost tourism and economic growth. Investments in smart airport solutions are aimed at enhancing the passenger experience and operational efficiencies.

In Latin America, despite economic variability, there is a growing interest in modernizing airport infrastructures to support increased air traffic and improve security standards through technology upgrades.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, Cisco Systems, Honeywell International, Inc., and IBM Corporation are pivotal players in the global Airport 4.0 market, each contributing distinct technological advancements and solutions that drive the transformation of airport operations.

Cisco Systems is at the forefront with its robust networking solutions that facilitate seamless data flow and connectivity within airport infrastructures. Cisco’s expertise in secure, scalable network architectures is crucial for supporting the IoT deployments and data-intensive applications that Airport 4.0 initiatives rely on. This enables smarter communication systems and more efficient operational management, positioning Cisco as a leader in the digital transformation of airports.

Honeywell International, Inc. leverages its strong presence in automation and control technologies to enhance various airport systems, from security to building management. Honeywell’s integrated solutions improve not only the safety and security of airport environments but also contribute to sustainability goals through energy-efficient technologies and systems, making it a key player in creating greener, smarter airports.

IBM Corporation brings advanced data analytics and artificial intelligence capabilities to the Airport 4.0 market. IBM’s AI-powered platforms offer predictive maintenance, operational insights, and customer service enhancements, enabling airports to optimize operations and enhance passenger experiences. IBM’s commitment to innovation supports airports in managing complex data and systems effectively, driving significant improvements in operational efficiency and passenger satisfaction.

Top Key Players in the Market

- Cisco system

- Honeywell International, Inc.

- IBM Corporation

- RTX

- Siemens AG

- SITA

- Smart airport system SAS

- Thales

- T-system international

- Huawei Technologies Co, Ltd.

Recent Developments

- In July 2023, SITA secured funding to develop a next-generation airport operations management platform, which they expect to improve operational response times by up to 40%.

- In June 2023, Siemens AG expanded its airport logistics portfolio in June 2023 by acquiring a software company specializing in baggage handling solutions, aiming to reduce luggage processing time by 25%.

- In May 2023, RTX launched a new AI-based security screening system, enhancing efficiency and accuracy in airport operations by 30%.

Report Scope

Report Features Description Market Value (2023) USD 2.4 Billion Forecast Revenue (2033) USD 4.1 Billion CAGR (2024-2033) 5.6% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By End Market(Implementation, Upgrade and Services), By Application(Airside, Air Traffic Maintenance, Aircraft Maintenance, Passenger Screening, Others), By Size(Large, Medium, Small), By Operation(Aeronautical, Non-aeronautical) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Cisco system, Honeywell International, Inc., IBM Corporation, RTX, Siemens AG, SITA, Smart airport system SAS, Thales, T-system international, Huawei Technologies Co, Ltd. Customization Scope Customization for segments at the regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Airport 4.0?Airport 4.0 represents the integration of Industry 4.0 technologies—like the Internet of Things (IoT), artificial intelligence (AI), and big data analytics—into airport operations. This concept aims to optimize the efficiency, security, and passenger experience by leveraging digital advancements to streamline processes from check-in to boarding.

How big is Airport 4.0 Market?The Global Airport 4.0 Market size is expected to be worth around USD 4.1 Billion By 2033, from USD 2.4 Billion in 2023, growing at a CAGR of 5.6% during the forecast period from 2024 to 2033.

What are the key factors driving the growth of the Airport 4.0 Market?The move towards Airport 4.0 is propelled by technological advancements like IoT, AI, and biometrics, enhancing efficiency, security, and passenger experience, and meeting the demands for convenience and swift services.

What are the emerging trends and advancements in the Airport 4.0 Market?Emerging Airport 4.0 trends include self-service technologies, biometric identification, AI for maintenance, seamless connectivity, sustainability initiatives, and enhanced data analytics to optimize operations and improve passenger experiences.

What are the major challenges and opportunities in the Airport 4.0 Market?Airport 4.0 offers enhanced passenger experiences and efficiencies via advanced technologies like AI and IoT, boosting security and revenue opportunities. Challenges include high costs, skill gaps, cybersecurity risks, and regulatory hurdles.

Who are the leading players in the Airport 4.0 Market?Cisco system, Honeywell International, Inc., IBM Corporation, RTX, Siemens AG, SITA, Smart airport system SAS, Thales, T-system international, Huawei Technologies Co, Ltd.

-

-

- Cisco system

- Honeywell International, Inc.

- IBM Corporation

- RTX

- Siemens AG

- SITA

- Smart airport system SAS

- Thales

- T-system international

- Huawei Technologies Co, Ltd.