Global Aircraft Insurance Market Size, Share Analysis Report By Type (Hull Insurance, Liability Insurance, Passenger Liability Insurance, Freight Insurance), By Aircraft Type (Commercial Aircraft, Cargo Aircraft, Private Jets, Others), By Coverage Type (All Risk, Named Perils, Third Party Liability, Ground Risk), By End Use (Commercial Aviation, Private Aviation, Cargo Transportation), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151693

- Number of Pages: 237

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

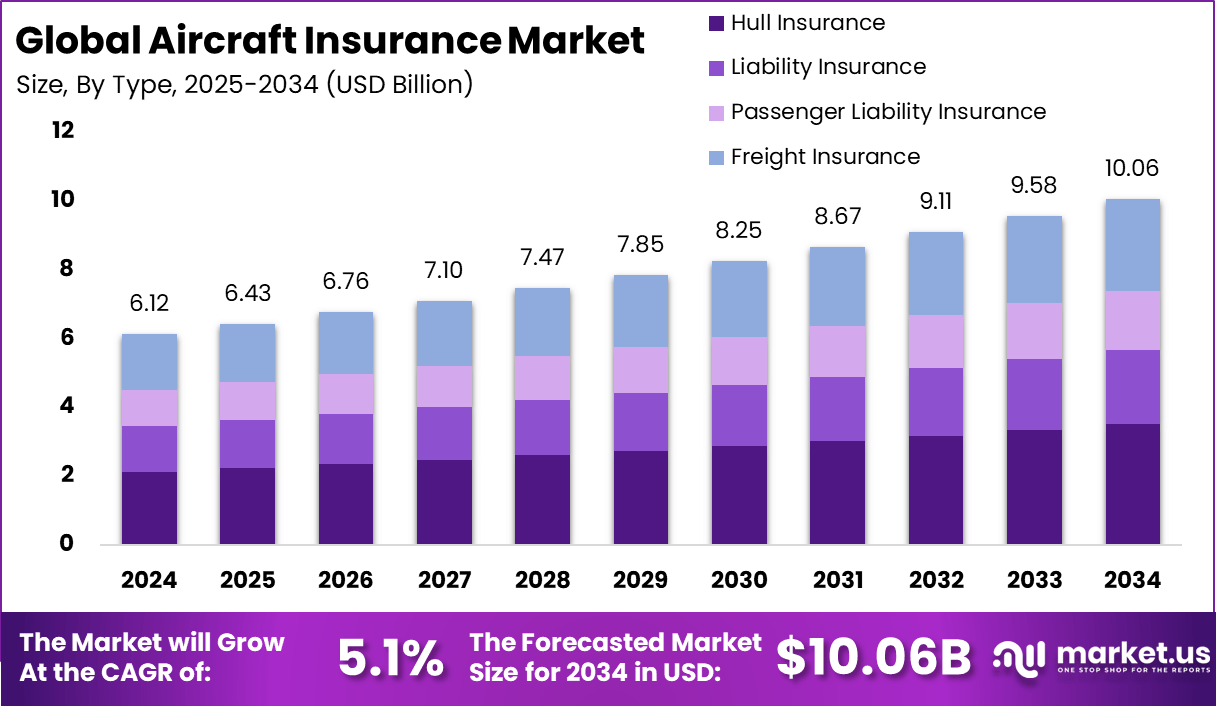

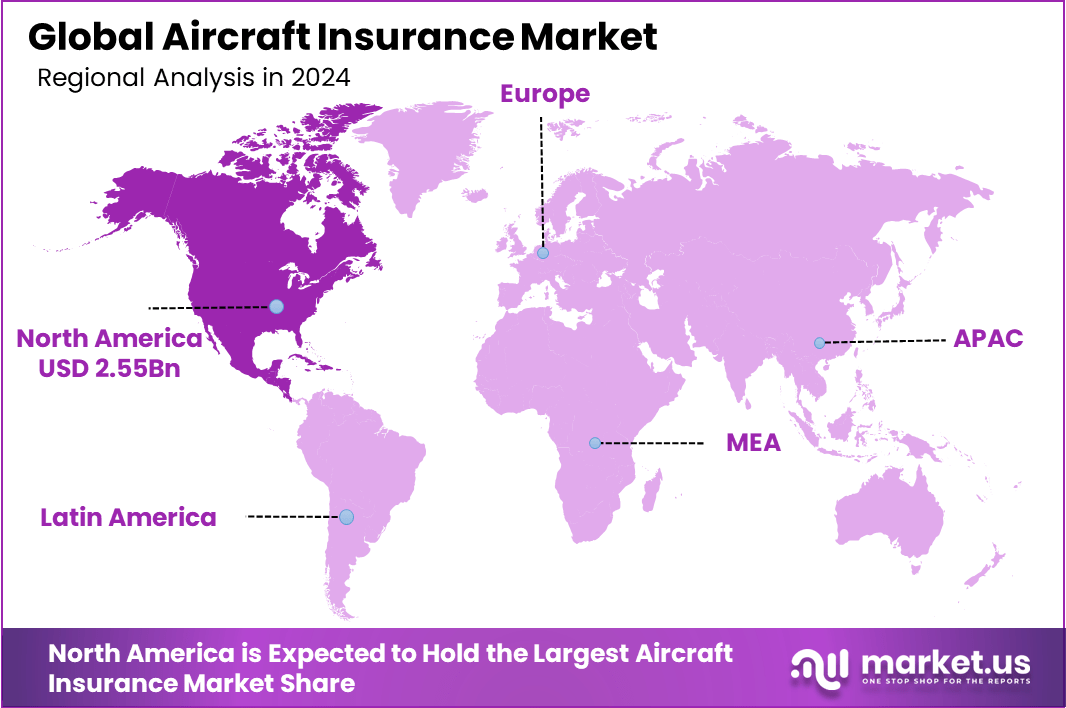

The Global Aircraft Insurance Market size is expected to be worth around USD 10.06 billion by 2034, from USD 6.12 billion in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing around a 41.7% share, holding USD 2.55 Billion in revenue.

The Aircraft Insurance Market is a specialized segment within the insurance industry that provides financial protection for aircraft operators and owners. Coverages broadly include hull damage, liability to passengers and third parties, and protection against war, terrorism, and loss of revenue.

This market has evolved beyond traditional models due to technological innovation and complex risk environments, and it is now influenced by global aviation trends, regulatory frameworks, and the integration of advanced tools.

The Top Driving Factors include the consistent expansion of global air travel – both passenger and cargo – as fleet sizes continue to grow. Additionally, advancements in aircraft manufacturing and operations, stricter regulatory requirements, and heightened awareness of risk management are contributing to increased demand for tailored coverage solutions.

According to Market.us, The Global Aircraft Market reached approximately USD 414.8 billion in 2023, with North America holding a dominant 43.2% share, generating around USD 179.19 billion in revenue. This leadership is supported by strong aviation infrastructure and defense investments in the region. The market is expected to grow at a CAGR of 3.7%, reaching nearly USD 596.5 billion by 2033.

In terms of Demand Analysis, Demand is being driven by both commercial and general aviation. Commercial airlines represent the largest segment due to their scale and regulatory requirements, while private jets, helicopters, and UAVs (drones) are the fastest growing subsegments, reflecting increased private and business usage. Growth is especially strong in Asia‑Pacific, aided by rising incomes, air traffic volumes, and infrastructure development.

Key Insight Summary

- In 2024, the Hull Insurance segment led the Aircraft Insurance market, holding a 34.8% share, driven by rising demand for airframe protection and operational risk coverage.

- The Commercial Aircraft segment captured 58.4% of the global market, reflecting its large fleet base and higher insured asset value compared to private aviation.

- The All Risk segment held a significant 41.8% share, indicating strong preference for comprehensive coverage among aviation operators.

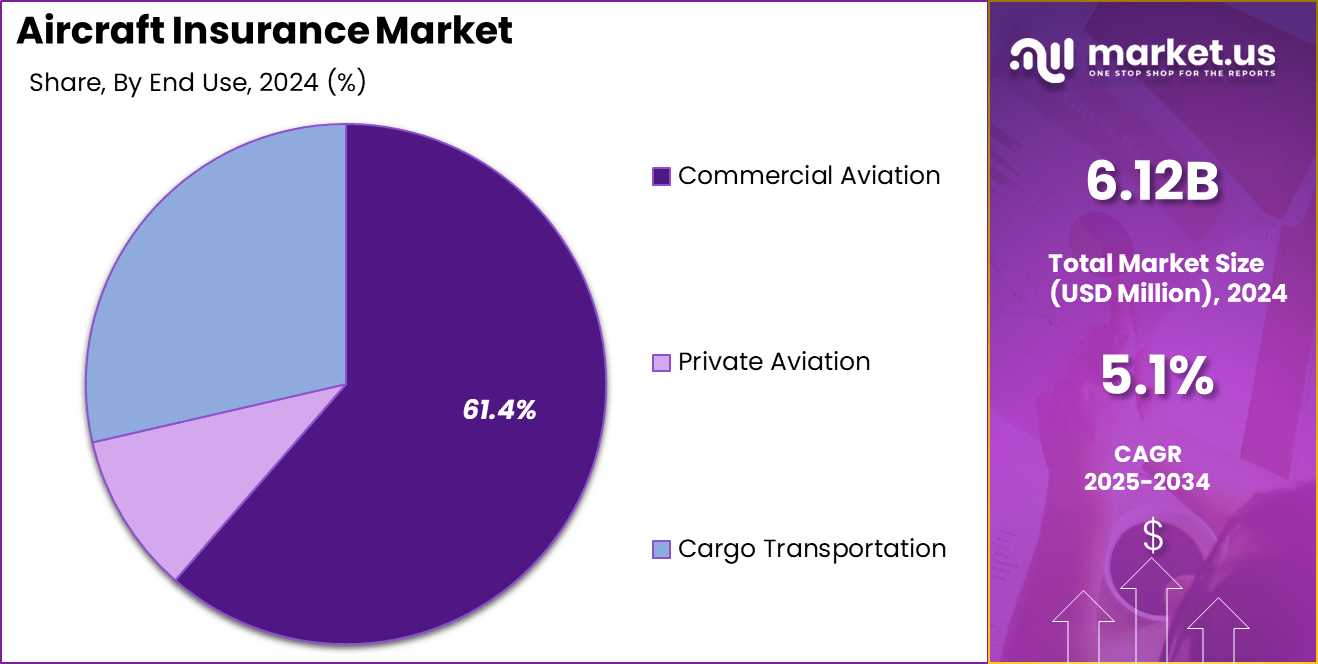

- Within end-use sectors, the Commercial Aviation segment dominated with a 61.4% share, driven by increasing passenger traffic and growing aircraft leasing activities.

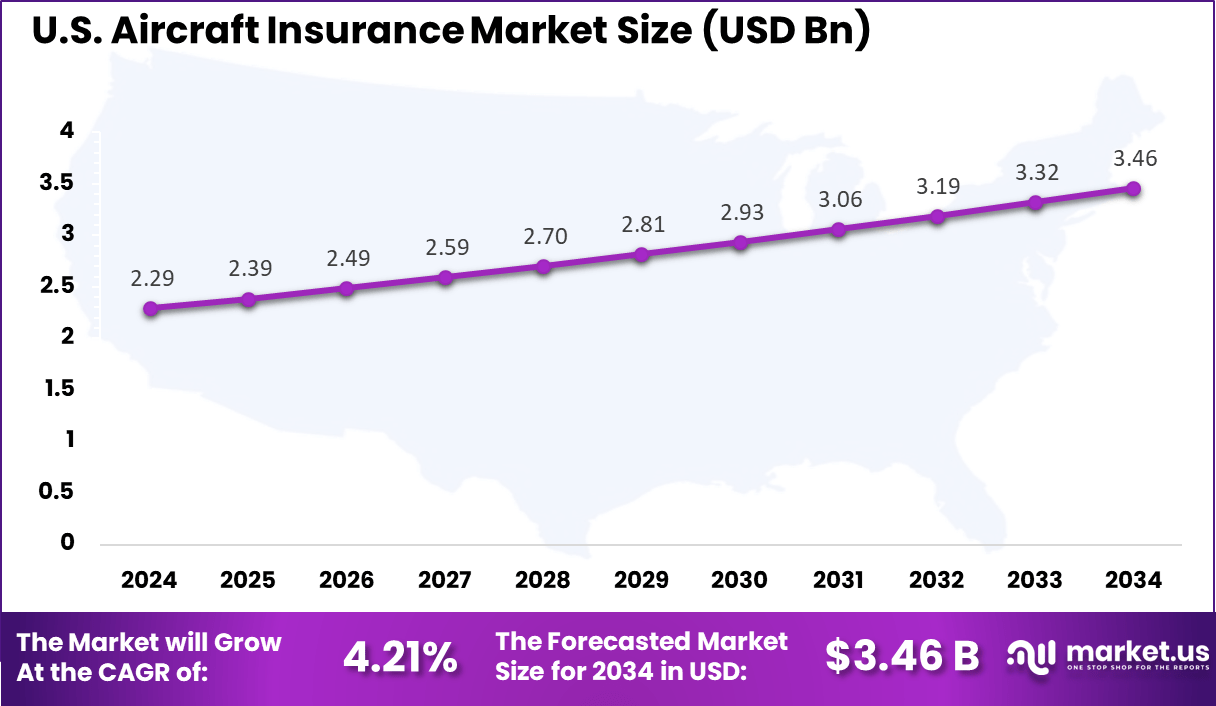

- The U.S. Aircraft Insurance market was valued at USD 2.29 billion in 2024, registering a healthy CAGR of 4.21%, supported by a mature aviation infrastructure and regulatory compliance mandates.

- North America maintained market leadership, accounting for 41.7% of the global Aircraft Insurance market, underscoring its dominance in global aviation operations and fleet value.

U.S. Market Size

The U.S. Aircraft Insurance Market is witnessing steady expansion, currently valued at approximately USD 2.29 billion. This growth is being propelled by rising air traffic, an expanding aircraft fleet, and favorable regulatory backing.

The Federal Aviation Administration (FAA) continues to play a key role by enforcing safety standards and offering operational guidance, which strengthens insurer confidence. With a projected CAGR of 4.21%, the market is expected to grow further as demand for both commercial and private air travel increases across the country.

For instance, the FAA, having a budget of over USD 17 billion for the fiscal year 2023, has been crucial in the market growth. A major part of the budget is dedicated to improving aviation safety, infrastructure, and industry support that, in turn, has a direct impact on the aircraft insurance sector.

The ongoing and significant rise in the volume of air travel in the United States is the other major factor driving the growth of the market. According to a report by the U.S. Department of Transportation (DOT), the U.S. is expected to handle around 40% of the world’s air travel market share by 2023. This implies an increase in the number of airplanes, and as a result, there will be a greater need for a wider insurance sector.

In 2024, North America held a dominant market position in the global Aircraft Insurance market, capturing more than a 41.7% share. North America is still a dominant region in the global aircraft insurance market, being largely associated with strong government investments and the infrastructure of aviation.

In 2023, the U.S. General Aviation (GA) direct market collected USD 2.9 billion in the form of written premiums, representing the size of the market, which grew by 7% compared with the previous year and 84% since 2018.

Another factor driving the market is the expansion of the fleet and the increasing demand for insurance. It is also worth mentioning that the U.S. DOT Federal Aviation Administration (FAA) has been at the forefront of the transition to the Next Generation Air Transportation System (NextGen). This system controls not only air traffic but also the safety, efficiency, and capacity of the National Airspace System.

Type Analysis

In 2024, Hull Insurance segment held a dominant market position, capturing more than a 34.8% share. This segment exhibits a commanding presence due to its core focus on the physical protection of high‑value aircraft assets. Given that aircraft represent one of the most significant capital investments within aviation, comprehensive coverage for hull damage remains a top priority for operators.

Hull Insurance is also often mandated under aviation financing and leasing agreements, ensuring its continued prominence. The leading position of Hull Insurance is further reinforced by its essential role in risk management. Insurers view hull risk as fundamental, with coverage spanning loss due to collisions, fire, and ground damage.

The segment’s appeal arises from the predictability of underwriting analysis: historical data on hull incidents, repair costs, and incident frequency contribute to relatively stable premium modeling. In a market characterized by expensive aircraft and inflation‑driven repair costs, Hull Insurance retains structural importance.

The continuous increase in the number of passengers and goods transported further enhances the significance of hull insurance for comprehensive coverage. Thus, the fleet expansion and the increasing risks in modern air travel make hull insurance the dominating segment in the global aircraft insurance market.

Aircraft Type Analysis

In 2024, the Commercial Aircraft segment held a dominant market position, capturing more than a 58.4% share. This segment’s leadership is explained by its extensive exposure to passenger and freight operations, which form the backbone of global aviation activity. As airlines ramp up their fleets to accommodate rising air travel and cargo demands, insurers align coverage to match these trends.

Commercial aircraft typically carry high-value assets and face diverse risk exposures – from airframe damage and passenger liability to third-party liability – making comprehensive insurance both essential and regulatory mandated. The predominance of the Commercial Aircraft segment is further strengthened by predictable underwriting models.

According to the IATA, the growth of passenger air traffic worldwide is predicted to increase up to 8 billion passengers in 2037. This indicates that there will be a large number of commercial aircraft all around the world in the future. This is validated through the frequent purchase of new airplanes by the major airlines.

Insurers leverage rich operational data – covering flight hours, maintenance records, incident frequency, and route risks – to assess premiums and manage exposures. As compliance requirements intensify across major jurisdictions, operators are incentivized to maintain robust coverage, reinforcing the segment’s stability.

For example, Emirates Airlines in 2023 placed an order for 50 Airbus A350 aircraft for about USD 16 billion. This also means that the demand for commercial aircraft insurance has been on the rise as well, with the sharp increase in air traffic, which has in turn pushed airlines into procuring more new aircraft.

Coverage Type Analysis

In 2024, All Risk segment held a dominant market position, capturing more than a 41.8% share. This outcome is primarily attributed to its comprehensive coverage framework, which protects aircraft against virtually all perils not explicitly excluded.

Operators value the clarity and breadth of protection – whether aircraft is in motion or stationary – reducing ambiguity in claims and minimizing disputes. The broad nature of All Risk policies places the burden of proof on the insurer to demonstrate exclusions, thereby offering greater confidence to aircraft owners.

Moreover, the All Risk coverage type aligns with the pressing needs of a modern aviation industry facing diverse and evolving threats. From in-flight incidents such as hard landings or turbine failures to ground hazards like hailstorms, vandalism, or theft, this segment addresses a wide risk spectrum.

The preference for such inclusive protection is reinforced by the documented rise in aviation repair costs and loss frequencies related to collision and ground handling incidents . As repair expenses rise, certainty in coverage becomes vital, solidifying All Risk as the default choice for many operators seeking robust asset protection.

End Use Analysis

In 2024, Commercial Aviation segment held a dominant market position, capturing more than a 61.4% share. This dominance is attributable to the scale and frequency of operations undertaken by commercial airlines. As passenger travel continues its rebound and global route networks expand, the need for insurance that safeguards against hull damage, passenger liability, and third-party claims grows proportionally.

The high utilization of commercial aircraft – measured in daily flight cycles and hours – increases exposure, making comprehensive coverage essential. Insurers rely on detailed historical data covering incident frequency, maintenance cycles, and route-specific risk profiles to assess premiums and structure policies that reflect this elevated risk exposure.

Commercial aviation’s leading share is further reinforced by regulatory mandates and stakeholder requirements. Many jurisdictions prescribe minimum coverage levels for commercial carriers – creating a baseline demand. Meanwhile, aircraft financiers often impose insurance obligations as part of lease or loan agreements.

This institutional framework ensures that airlines maintain comprehensive and compliant coverage. In addition, the public visibility of commercial flight incidents adds reputational risk, prompting airlines to select insurance solutions that include robust liability frameworks and rapid claims handling protocols.

Key Market Segments

By Type

- Hull Insurance

- Liability Insurance

- Passenger Liability Insurance

- Freight Insurance

By Aircraft Type

- Commercial Aircraft

- Cargo Aircraft

- Private Jets

- Others

By Coverage Type

- All Risk

- Named Perils

- Third Party Liability

- Ground Risk

By End Use

- Commercial Aviation

- Private Aviation

- Cargo Transportation

Emerging Trend

Integration of Advanced Analytics and Telematics

The incorporation of data analytics, AI-assisted tools, and telematics in underwriting processes has gained traction within the aviation insurance sector. Insurers are increasingly utilising flight‑operational quality assurance (FOQA) systems, digital twins, and real‑time monitoring to gain a more nuanced understanding of risk profiles. This approach enables underwriters to differentiate between operators with proactive safety management and standard-risk fleets.

Gradually, this trend is transitioning from proof-of-concept to broader adoption. Early evidence of evolving market maturity has been observed as insurers introduce parametric products and customized coverage for emerging aircraft types such as eVTOLs and drones. These developments illustrate how analytics and telematics are reshaping risk segmentation and pricing models in aviation insurance .

Drivers

Rising Cost of Aircraft Repair and Claims Inflation

One principal driver shaping the aircraft insurance market is the sustained increase in claims inflation, particularly driven by escalating repair costs. Advances in composite materials, avionics, and electric propulsion are enhancing aircraft capabilities – but also raising the expense and technical difficulty of part replacements. With aircraft parts more complex and costly, insurers face steeper claim payouts.

This upward pressure on claims costs is exerting influence on underwriting practices, resulting in tougher risk scrutiny and more restrictive policy terms. Insurers are increasingly factoring in pilot training depth, maintenance backgrounds, and geographic operation zones before agreeing on premiums. The ripple effect means commercial operators are experiencing higher risk premiums, and underwriters are adjusting capacity or reinsurance structures.

Restraint

High Premium Costs and Volatile Risk Environment

The aircraft insurance industry is being restrained by persistently high premium costs. These elevated rates are largely a result of insurers needing to offset the financial impact of frequent claims, especially those related to natural disasters, geopolitical disruptions, and specialized liabilities such as cyber‑attacks.

The complexity of risk profiling for modern aircraft, which now incorporate advanced avionics, autonomous systems, and digital connectivity, intensifies the underwriting challenge. As a consequence, carriers and private operators face financial pressure that can reduce their appetite for comprehensive coverage, leading to potential gaps in risk protection.

Additionally, the cyclical nature of premium pricing presents a further limitation on market expansion. Insurers periodically increase rates to rebuild reserves following catastrophic losses or in response to rising reinsurance costs. Such market behavior creates uncertainty for operators considering coverage renewal or fleet expansion.

Opportunities

Emerging Technologies and Market Segments

The rise of unmanned aerial vehicles (UAVs), electric and hybrid propulsion aircraft, and the growing use of digital platforms are offering new prospects for insurers. These technological innovations are expanding the ecosystem of airborne assets, opening demand for specialized insurance products.

UAVs, for example, present unique liability and hull risks, creating scope for customized policy development. Similarly, the introduction of electric aircraft brings new underwriting domains tied to battery technology, charging infrastructure, and associated regulatory frameworks .

Furthermore, advancements in digital analytics, artificial intelligence, and blockchain technology have created significant efficiencies in risk assessment, pricing, and claims handling. Insurers embracing these digital solutions can streamline underwriting, reduce administrative costs, and enhance precision in loss prediction.

Challenges

Legal Uncertainty and Cyber Vulnerability

A major challenge facing the aircraft insurance market stems from increasing legal uncertainty in policy interpretation and asset recoverability. A landmark case has arisen in London’s High Court, where insurers- including major firms – are disputing liability for aircraft stranded in Russia.

The core of the dispute revolves around whether the incidents constitute total losses under war‑risk or all‑risk coverage. This legal ambiguity introduces significant financial exposure for insurers and owners alike, highlighting a structural risk in contract language and jurisdictional coverage definitions.

In parallel, the aviation sector is experiencing increased vulnerability to cyber‑threats. Modern aircraft and airport systems are embedded with complex ICT infrastructures that are accessible across multiple interfaces. These systems are increasingly targeted by sophisticated adversaries, such as state‑affiliated advanced persistent threat groups.

Key Players Analysis

AXA XL, Allianz Global Corporate & Specialty SE, and Swiss Re Corporate Solutions Ltd lead the global aircraft insurance market. These companies provide comprehensive coverage across hull, liability, and war risk segments. Their strong capital base and reinsurance backing enhance underwriting capacity. The focus remains on digital platforms for faster policy management and claims.

QBE Aviation, Willis Towers Watson, Aon plc, and AIG continue to expand aviation insurance through brokerage, underwriting, and advisory services. QBE offers tailored policies for general aviation and charter operators. Willis and Aon use data analytics to support pricing strategies and loss forecasting. AIG provides flexible coverages backed by extensive claims support.

Starr Aviation, Great American Insurance, Global Aerospace Inc., and Tokio Marine HCC serve both commercial and general aviation segments. Their expertise in underwriting small fleets, UAVs, and fixed-base operators adds niche value. Munich Re, Hallmark Financial, Old Republic Aerospace, and Chubb Limited focus on reinsurance, structured policies, and specialty aerospace programs.

Top Key Players in the Market

- AXA XL

- Allianz Global Corporate & Specialty SE

- Swiss Re Corporate Solutions Ltd

- QBE Aviation

- Willis Towers Watson

- Aon plc

- AIG (American International Group Inc.)

- Starr Aviation (Starr Indemnity & Liability Company)

- Great American Insurance Company

- Global Aerospace Inc.

- Tokio Marine HCC

- Munich Reinsurance Company

- Hallmark Financial Services Inc.

- Old Republic Aerospace Inc.

- Chubb Limited

- Others

Recent Developments

- On February 26, 2025, Swiss Re announced its exit from primary aviation insurance to focus exclusively on reinsurance. This strategic shift reflects the company’s response to the growing complexities and risks within the aviation sector, impacting its direct aviation insurance offerings.

- On May 2, 2025, AXA XL launched a bespoke aviation insurance product tailored to general aviation clients in the UK. This new offering provides flexible coverage options to meet the unique needs of private and recreational flying, ensuring a more personalized approach to aviation insurance.

- On January 1, 2025, Allianz Commercial partnered with Redline Underwriting to introduce a general aviation insurance solution targeting small and medium-sized aircraft operators in Latin America and the Caribbean. This partnership aims to offer comprehensive coverage for private, pleasure, and business aircraft in the region.

Report Scope

Report Features Description Market Value (2024) USD 6.12 Bn Forecast Revenue (2034) USD 10.6 Bn CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Hull Insurance, Liability Insurance, Passenger Liability Insurance, Freight Insurance), By Aircraft Type (Commercial Aircraft, Cargo Aircraft, Private Jets, Others), By Coverage Type (All Risk, Named Perils, Third Party Liability, Ground Risk), By End Use (Commercial Aviation, Private Aviation, Cargo Transportation) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AXA XL, Allianz Global Corporate & Specialty SE, Swiss Re Corporate Solutions Ltd, QBE Aviation, Willis Towers Watson, Aon plc, AIG, Starr Aviation, Great American Insurance Company, Global Aerospace Inc., Tokio Marine HCC, Munich Reinsurance Company, Hallmark Financial Services Inc., Old Republic Aerospace Inc., and Chubb Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AXA XL

- Allianz Global Corporate & Specialty SE

- Swiss Re Corporate Solutions Ltd

- QBE Aviation

- Willis Towers Watson

- Aon plc

- AIG (American International Group Inc.)

- Starr Aviation (Starr Indemnity & Liability Company)

- Great American Insurance Company

- Global Aerospace Inc.

- Tokio Marine HCC

- Munich Reinsurance Company

- Hallmark Financial Services Inc.

- Old Republic Aerospace Inc.

- Chubb Limited

- Others