Global Aircraft Generators Market Size, Share, Industry Analysis Report By Generator Type (AC Generators, DC Generators, Hybrid Generators), By Capacity Range (Low Capacity (up to 500 kVA), Medium Capacity (500-1,500 kVA), High Capacity (above 1,500 kVA), By Application (Power Generation, Auxiliary Power, Emergency Power, Others), By Aircraft Type (Fixed-Wing Aircraft, Rotary-Wing Aircraft, Unmanned Aerial Vehicles (UAVs)), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 129659

- Number of Pages: 353

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Analyst Viewpoint

- Investment and Business benefits

- U.S. Aircraft Generators Market Size

- Generator Type Analysis

- Capacity Range Analysis

- Aircraft Type Analysis

- Application Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

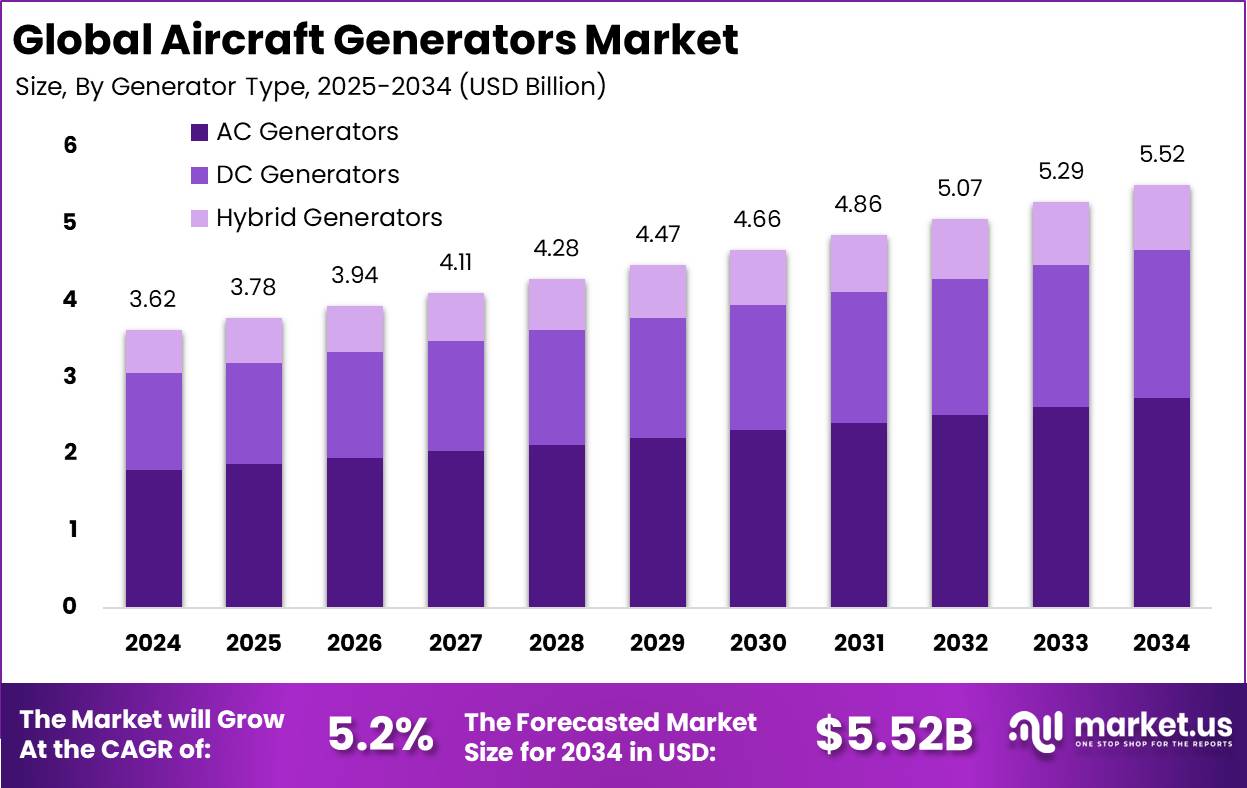

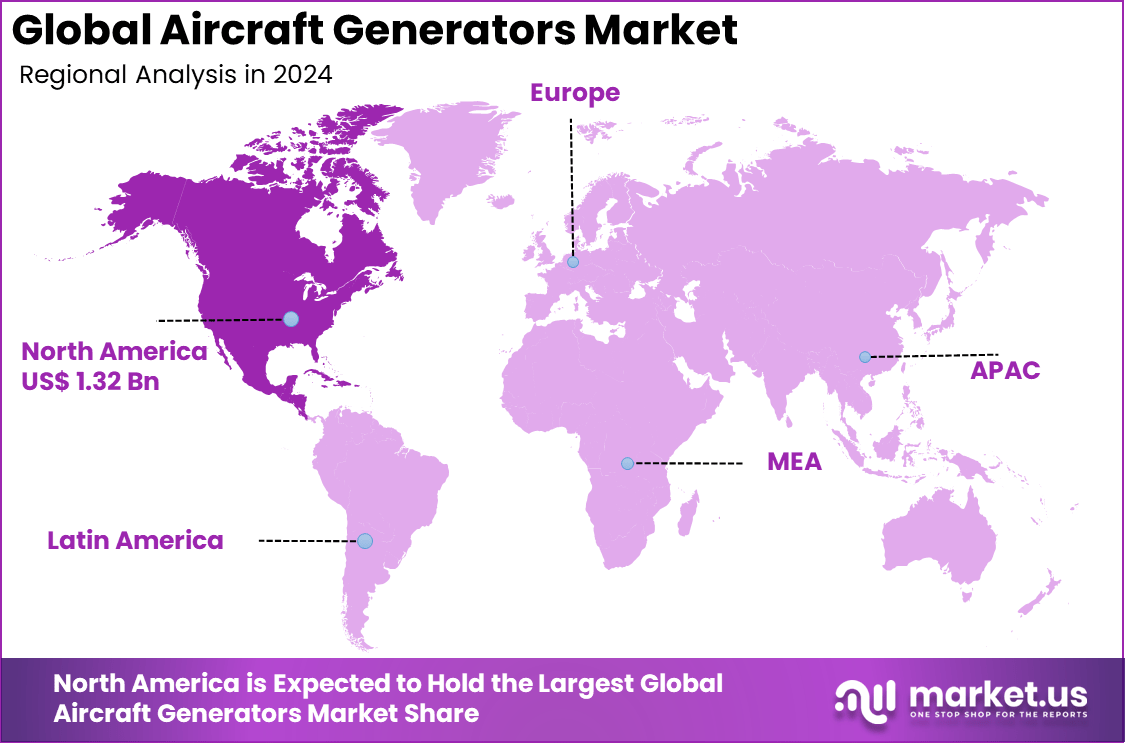

The Global Aircraft Generators Market size is expected to be worth around USD 5.52 billion by 2034, from USD 3.62 billion in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 36.5% share, holding USD 1.32 billion in revenue.

The aircraft generators market refers to the production and supply of generators that provide electrical power for aircraft systems. These generators convert mechanical energy from the engine or auxiliary power unit (APU) into electrical energy for avionics, lighting, environmental control systems, and other onboard loads. They are used across commercial aviation, military aircraft, business jets and unmanned aerial vehicles (UAVs).

A key driver is the growth in global air travel and corresponding increase in aircraft production as airlines renew or expand fleets. Additionally, demand is elevated by the trend toward more electric aircraft and higher electrical loads on board, which require improved generator systems. The need for lightweight, high-efficiency components and fuel-saving measures also supports market growth. Another driver is the retrofit and maintenance activity in aging aircraft fleets, which creates demand for upgraded generator systems.

For instance, in June 2023, Safran signed an agreement with Electra to develop a turbogenerator propulsion system for Electra’s hybrid-electric aircraft. This collaboration reflects the growing focus on innovative and sustainable power solutions in aviation, highlighting advancements in aircraft generator technology aimed at supporting more efficient and environmentally friendly propulsion systems.

Key Takeaway

- The AC Generators segment led with 49.6%, supported by wide use in modern aircraft for stable and efficient power conversion.

- Medium Capacity units ranging from 500–1,500 kVA accounted for 52.4%, reflecting strong demand from commercial and defense aviation fleets.

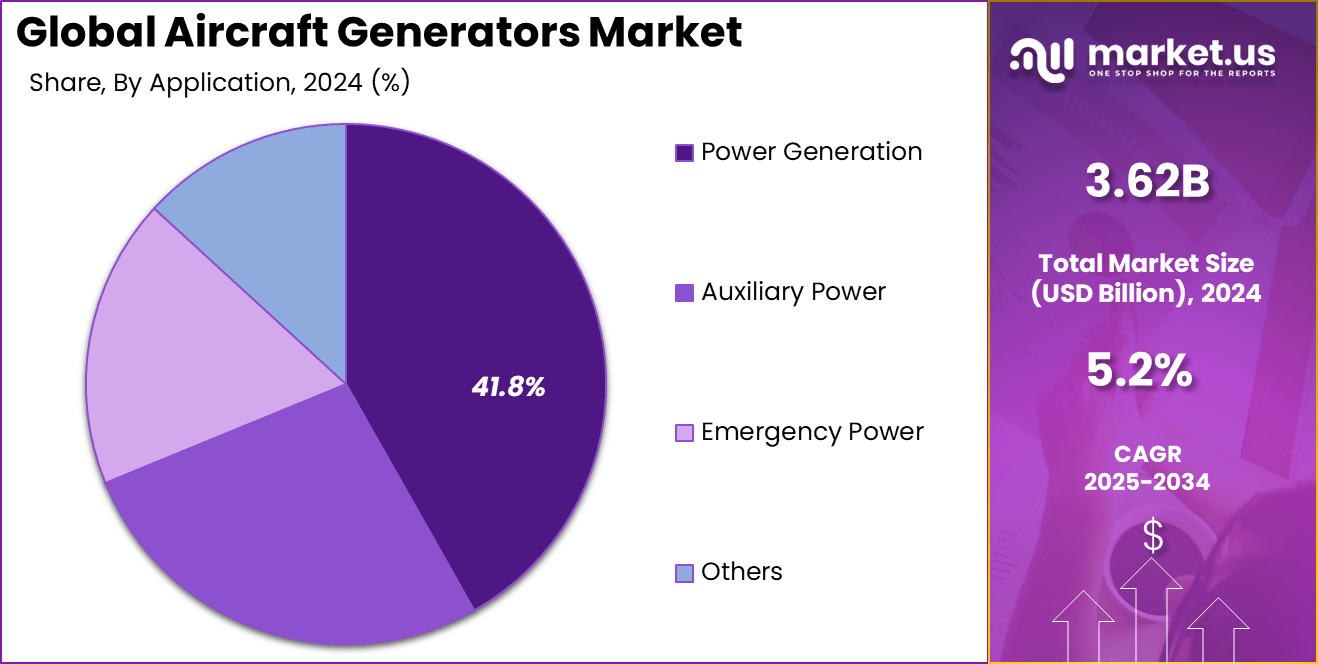

- Power Generation applications held 41.8%, driven by the need for consistent electrical supply across avionics and propulsion systems.

- Fixed-Wing Aircraft dominated with 62.3%, as commercial and business jets remain the primary users of high-capacity generators.

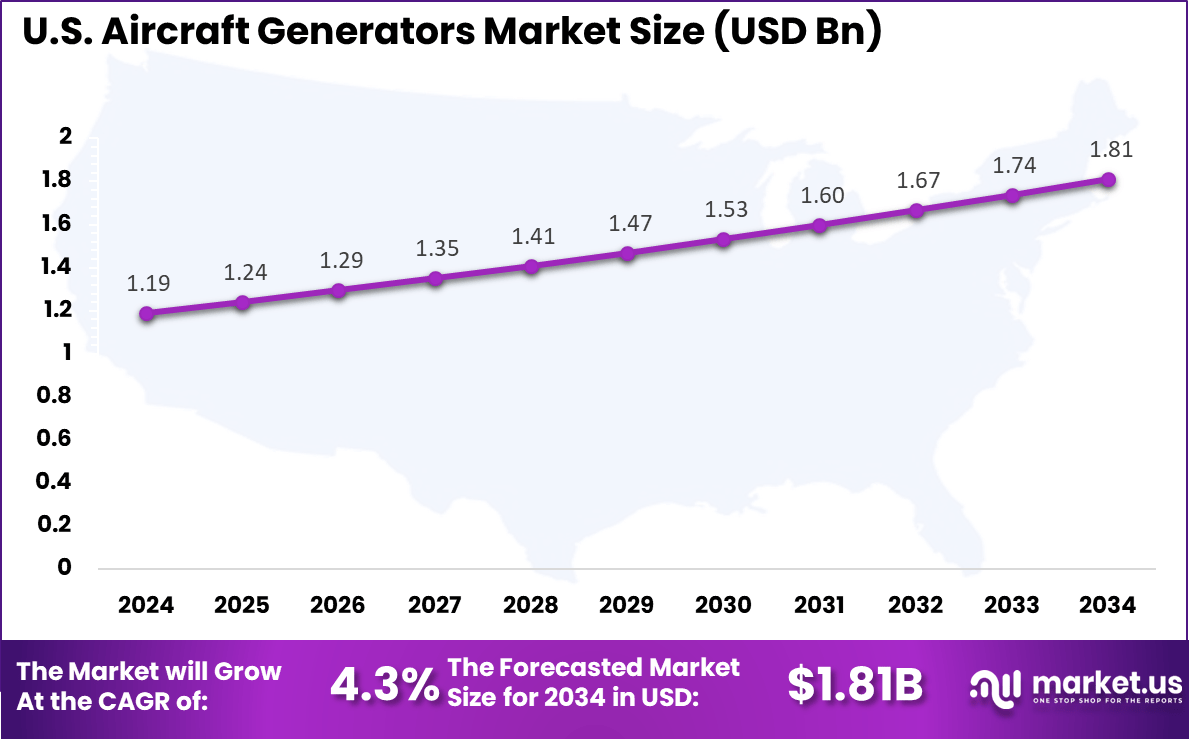

- The US market reached USD 1.19 Billion in 2024 with a steady 4.3% CAGR, supported by strong aircraft production and maintenance activities.

- North America captured 36.5% of the global market, maintaining leadership through advanced aerospace manufacturing and robust defense procurement.

Analyst Viewpoint

Demand for advanced aircraft generators is growing steadily as the aviation industry shifts towards more electric and hybrid propulsion systems. According to government-related sources, hybrid-electric aircraft adoption is expanding at an estimated rate exceeding 25% annually, underlining the importance of highly efficient and durable power generation systems.

Commercial aviation, military, and unmanned aerial vehicles all require generators that offer consistent reliability with minimal maintenance. Brushless generators and integrated starter generators (ISGs) are increasingly preferred since they provide better performance and a longer lifespan compared to traditional models.

Technology adoption centers on brushless designs, integrated starter generators, and digital systems that enable real-time condition monitoring and predictive maintenance. This helps reduce aircraft downtime and optimize maintenance schedules, improving overall fleet availability. Lightweight materials like composites and high-strength alloys are now common in generator construction, helping reduce aircraft weight and thus fuel consumption.

Investment and Business benefits

Investment opportunities in the aircraft generators market emerge from rising electrification trends and government support for clean aviation technologies. The shift to hybrid and electric propulsion creates demand for next-generation generator designs.

Expanding aviation markets, especially in regions like Asia-Pacific, offer growth potential. Additionally, investments in research for integrating alternative energy sources and improving power density present promising avenues. However, these opportunities require navigating regulatory hurdles and high certification costs.

Business benefits of advanced aircraft generators include increased energy efficiency leading to cost savings, enhanced system reliability reducing downtime, and easier compliance with evolving environmental standards. Adaptable generator systems allow airlines and manufacturers to future-proof aircraft fleets against technological shifts. Enhanced safety through smart diagnostics also reduces the risk of in-flight failures.

U.S. Aircraft Generators Market Size

The market for Aircraft Generators within the U.S. is growing tremendously and is currently valued at USD 1.19 billion, the market has a projected CAGR of 4.3%. The market is growing due to the increasing demand for efficient and reliable power systems in commercial and military aircraft.

Rising aircraft production rates, technological improvements to reduce weight and enhance durability, and government initiatives to update aging fleets are key factors. Additionally, the shift toward electric propulsion systems and increased electrical loads onboard modern aircraft is stimulating investment and innovation in generator technology.

For instance, in June 2025, Collins Aerospace advanced its leadership in the U.S. aircraft generators market by developing a powerful 1-megawatt motor designed to support hybrid-electric flight demonstrators. This breakthrough motor is part of Collins’ broader strategy to lead in sustainable aviation technologies by enabling more electric and hybrid-electric propulsion systems.

In 2024, North America held a dominant market position in the Global Aircraft Generators Market, capturing more than a 36.5% share, holding USD 1.32 billion in revenue. This dominance is due to the region’s strong aerospace manufacturing base, substantial research and development investments, and established supply chains.

The North American market also benefits from governmental support for aerospace advancements and modernization initiatives across commercial and military sectors. The region’s focus on developing more electric aircraft and sustainable aviation solutions further reinforces its leadership. Companies within North America lead innovation in generator design, producing efficient, lightweight, and high-performance solutions that meet evolving market needs.

Generator Type Analysis

In 2024, The AC Generators segment held a dominant market position, capturing a 49.6% share of the Global Aircraft Generators Market. This dominance is due to their ability to deliver stable and efficient electrical power essential for aircraft operations.

AC generators are widely used across commercial and military aircraft, as they offer performance benefits such as efficient transmission over long distances, reliability, and compatibility with modern avionics and electrical systems. This makes them the favored choice to meet the growing electrical load demands within aircraft architectures.

The advantages of AC generators include better integration with existing aircraft power systems and the capability to support increased power needs as aircraft designs evolve. Their sustained dominance in the market reflects ongoing advancements that improve efficiency, reduce weight, and enhance durability.

For Instance, in April 2025, Panasonic Avionics partnered with Airbus to co-develop the future Connected Aircraft platform, focusing on enhancing onboard architecture and elevating in-flight entertainment and connectivity systems. This innovative collaboration aims to integrate advanced electrical systems that support the growing reliance on AC generators for efficient power distribution in fixed-wing aircraft.

Capacity Range Analysis

In 2024, the Medium Capacity (500-1,500 kVA) segment held a dominant market position, capturing a 52.4% share of the Global Aircraft Generators Market. This range offers an ideal balance between power output and physical size to support the operational requirements of a majority of commercial fixed-wing aircraft.

Medium capacity generators efficiently power the increasing electrical demands of avionics, in-flight entertainment, and lighting systems while maintaining manageable weight and size constraints critical for aircraft design. The preference for this capacity range is driven by the widespread adoption of more electric aircraft concepts, which rely on electrical rather than hydraulic and pneumatic systems.

This shift increases the electrical load onboard, making medium-capacity generators essential for a reliable and efficient power supply. Manufacturers focus on this capacity segment to meet evolving aircraft requirements for fuel efficiency and lower emissions, contributing to the segment’s strong market presence.

For instance, in October 2025, Eaton showcased advanced power management solutions at Aero India 2025, emphasizing smart systems and power distribution technologies designed to support medium capacity aircraft generators (500-1,500 kVA). Eaton’s focus on reliability and local manufacturing optimizes generator performance and maintenance, aligning with the growing demand in the power generation segment of aircraft.

Aircraft Type Analysis

In 2024, The Fixed-Wing Aircraft segment held a dominant market position, capturing a 62.3% share of the Global Aircraft Generators Market. This is mainly due to the large volume of commercial passenger and cargo fixed-wing aircraft globally. These aircraft require robust generator systems to support a wide range of electrical functions for flight safety, passenger comfort, and operational efficiency on long and short-haul routes.

The steady growth of the global commercial aviation sector drives demand for fixed-wing aircraft generators. As air travel continues to rise worldwide, the need for efficient and reliable power systems tailored to fixed-wing aircraft remains significant. Innovations in generator technology for these aircraft focus on improving power density, reducing weight, and enhancing energy efficiency, aligning with the evolving demands of the sector.

For Instance, in October 2024, Curtiss-Wright expanded capabilities for flight control related to fixed-wing aircraft by developing control actuation products supporting aerodynamic performance enhancements. Their systems, integrated into aircraft wings, align closely with the power demands of fixed-wing platforms.

Application Analysis

In 2024, The Power Generation segment held a dominant market position, capturing a 41.8% share of the Global Aircraft Generators Market. Generators here are primarily tasked with supplying vital electrical power for avionics, onboard communication, control systems, and environmental comfort features. The shift to more electric aircraft designs amplifies the importance of reliable and continuous power output to ensure flight safety and passenger comfort.

The increasing number of electrically powered systems inside aircraft is driving steady growth in this segment. Modern aircraft require constant energy for navigation, control, and operational systems, which demands generators that can maintain performance across various flight phases. Innovations focus on power management integration and system redundancy to ensure an uninterrupted power supply during all flight conditions.

For Instance, in January 2025, Woodward partnered with Moog to support next-generation military tiltrotor aircraft, focusing on control solutions that ensure reliable power generation for onboard systems. Their work highlights the critical role of dependable power generation in mission-critical aircraft applications, aligning with the major market segment dedicated to power generation.

Emerging Trends

Emerging trends in the aircraft generator market highlight a strong shift towards electrification and smart technologies. More Electric Aircraft (MEA) systems, which require higher output and sophisticated power management, are becoming standard. Lightweight materials and brushless generators built for fuel efficiency dominate design priorities.

Digitalization and predictive maintenance supported by sensor analytics have improved generator reliability and lifespan by around 25%. Also, hybrid-electric propulsion and environmental sustainability are emerging as key trends, with market growth increasingly fueled by these innovations and a reported 36.9% rise in global air travel in 2023 compared to the previous year, further driving demand for advanced generators.

Growth Factors

Growth in the aircraft generator market is primarily driven by expanding air travel and aircraft production. Increasing demand for reliable onboard electrical power to support advanced avionics and entertainment systems is pushing innovation in generator technologies. This growth is supported by a global increase in air passenger traffic of nearly 37% in 2023 compared to 2022.

Additionally, the push for more fuel-efficient and lighter power systems and the rise of hybrid and electric propulsion are strong growth factors. Manufacturers are investing heavily in lighter, more compact generators while meeting rigorous safety and performance standards.

Key Market Segments

By Generator Type

- AC Generators

- DC Generators

- Hybrid Generators

By Capacity Range

- Low Capacity (up to 500 kVA)

- Medium Capacity (500-1,500 kVA)

- High Capacity (above 1,500 kVA)

By Application

- Power Generation

- Auxiliary Power

- Emergency Power

- Others

By Aircraft Type

- Fixed-Wing Aircraft

- Rotary-Wing Aircraft

- Unmanned Aerial Vehicles (UAVs)

Drivers

Growing Demand for More Electric Aircraft

This dominance is due to the increasing adoption of More Electric Aircraft (MEA) systems that require efficient and lightweight power sources. As the aviation industry strives to improve fuel efficiency and reduce carbon emissions, there is a significant shift towards electric propulsion and electric systems aboard aircraft.

These systems rely heavily on advanced generators to supply power to avionics, lighting, communication, and environmental controls, making high-performance generators essential to aircraft operation. This trend, combined with the overall growth in global air travel and new aircraft production, is propelling market expansion.

For instance, in April 2025, Panasonic Avionics partnered with Airbus to co-develop a future connected aircraft platform focusing on innovative in-flight systems. This collaboration highlights the growing demand for more electric aircraft systems that require sophisticated electrical power solutions like advanced generators to support increased connectivity and onboard electronics. Such industry moves underscore the shift towards more electric designs in aviation, driving market growth.

Restraint

High Initial Investment and Regulatory Costs

One key restraint in the aircraft generators market is the large upfront investment required to develop and certify new generator technologies. Designing generators that meet the rigorous safety, performance, and environmental standards of the aviation industry involves considerable research and development costs.

Additionally, meeting certification requirements imposed by authorities such as the FAA and EASA extends product development timelines and increases expenses. These factors limit quicker adoption, especially for smaller manufacturers or emerging markets. Moreover, fluctuating prices of critical raw materials like rare-earth metals used in high-performance components add to production costs, making it a challenge to keep prices competitive and accessible worldwide.

For instance, in July 2025, Eaton faced challenges due to high costs and regulatory hurdles in bringing their latest aircraft generator designs to market. The company highlighted the extended certification timelines and substantial investment required to meet evolving safety and environmental standards.

Opportunities

Advances in Lightweight Generator Technologies

There is a significant opportunity for growth through the development of next-generation lightweight and compact generators. Innovations in materials science and power management technology enable the production of generators with higher energy density and efficiency, helping to reduce overall aircraft weight and improve fuel economy.

Such advancements align with the industry’s push for sustainable aviation solutions and more electric aircraft platforms. Besides meeting the needs of new aircraft models, these innovations also create aftermarket opportunities for upgrading existing fleets with improved generators. Regions like Asia-Pacific, with expanding aviation sectors and rising air travel demand, present fertile ground for deploying these advanced generator systems.

For instance, in August 2025, Mitsubishi Electric unveiled a new series of lightweight, high-efficiency generators designed for hybrid-electric aircraft, capitalizing on the opportunity to serve emerging propulsion technologies. Their advancements aim to improve power density while reducing weight, contributing to enhanced aircraft performance.

Challenges

Supply Chain Disruptions and Component Availability

Supply chain issues remain a significant challenge for the aircraft generators market. Geopolitical tensions, trade restrictions, and manufacturing delays can lead to disruptions that hamper production schedules and increase costs. Such instability not only impacts original equipment manufacturers (OEMs) but also affects maintenance and aftermarket services.

For instance, in December 2024, Collins Aerospace’s prototype development of high-voltage power distribution systems highlights the technical complexity and component requirements that can be delayed by supply disruptions. Such dependencies on specialized materials and components illustrate the ongoing challenges of maintaining a consistent supply chain in this market.

Key Players Analysis

The Aircraft Generators Market is led by major aerospace and electrical system manufacturers such as Honeywell, Collins Aerospace, Safran Electrical Power, and Rolls-Royce. These companies provide high-efficiency generators designed for commercial, military, and business aircraft. Their focus on lightweight construction, high power density, and reliability supports advanced aircraft platforms with growing electrical load demands.

Key contributors including Eaton, Mitsubishi Electric, Meggitt, Woodward, and Hamilton Sundstrand develop integrated power generation systems that ensure stable energy supply for avionics, propulsion systems, and cabin operations. Their advancements in hybrid-electric and more-electric aircraft architectures are enhancing energy efficiency and sustainability across the aviation sector.

Additional participants such as Panasonic Avionics, GKN Aerospace, Thales, Curtiss-Wright, L3Harris Technologies, and Hirschmann Automation, along with other key players, offer supporting technologies including power electronics, monitoring systems, and automation solutions. Their continued investment in innovation and global partnerships strengthens the reliability and performance of next-generation aircraft electrical systems.

Top Key Players in the Market

- Panasonic Avionics

- Eaton

- CurtissWright

- Mitsubishi Electric

- Meggitt

- Woodward

- Collins Aerospace

- GKN Aerospace

- L3Harris Technologies

- Safran Electrical Power

- RollsRoyce

- Hamilton Sundstrand

- Honeywell

- Thales

- Hirschmann Automation

- Others

Recent Developments

- In Early 2025, Collins Aerospace opened a $50 million advanced electric power systems lab, “The Grid”, focused on developing high-power-density motors and generators, including a 1MW permanent magnet motor designed for hybrid-electric propulsion, reinforcing its leadership in aircraft electrical power innovations.

- In September 2025, Panasonic Avionics and Intellian Technologies unveiled a new LEO-only terminal system designed for retrofit with a modular, lightweight design aimed at improving in-flight connectivity while reducing aircraft fuel burn and supporting sustainability goals through efficient power use.

Report Scope

Report Features Description Market Value (2024) USD 3.62 Bn Forecast Revenue (2034) USD 5.52 Bn CAGR(2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Generator Type (AC Generators, DC Generators, Hybrid Generators), By Capacity Range (Low Capacity (up to 500 kVA), Medium Capacity (500-1,500 kVA), High Capacity (above 1,500 kVA), By Application (Power Generation, Auxiliary Power, Emergency Power, Others), By Aircraft Type (Fixed-Wing Aircraft, Rotary-Wing Aircraft, Unmanned Aerial Vehicles (UAVs) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Panasonic Avionics, Eaton, Curtiss-Wright, Mitsubishi Electric, Meggitt, Woodward, Collins Aerospace, GKN Aerospace, L3Harris Technologies, Safran Electrical Power, Rolls-Royce, Hamilton Sundstrand, Honeywell, Thales, Hirschmann Automation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Aircraft Generators MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Aircraft Generators MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Panasonic Avionics

- Eaton

- CurtissWright

- Mitsubishi Electric

- Meggitt

- Woodward

- Collins Aerospace

- GKN Aerospace

- L3Harris Technologies

- Safran Electrical Power

- RollsRoyce

- Hamilton Sundstrand

- Honeywell

- Thales

- Hirschmann Automation

- Others