Global Air Cooler Market By Product Type (Tower Coolers, Dessert Coolers, Others), By Application (Residential, Commercial), By Sales Channel (Departmental Stores, Hypermarkets and Supermarket, Independent Small Stores, Multi-brand Store, Online Retailers, Other Sales Channel, Wholesalers and Distributors), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 12198

- Number of Pages: 330

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

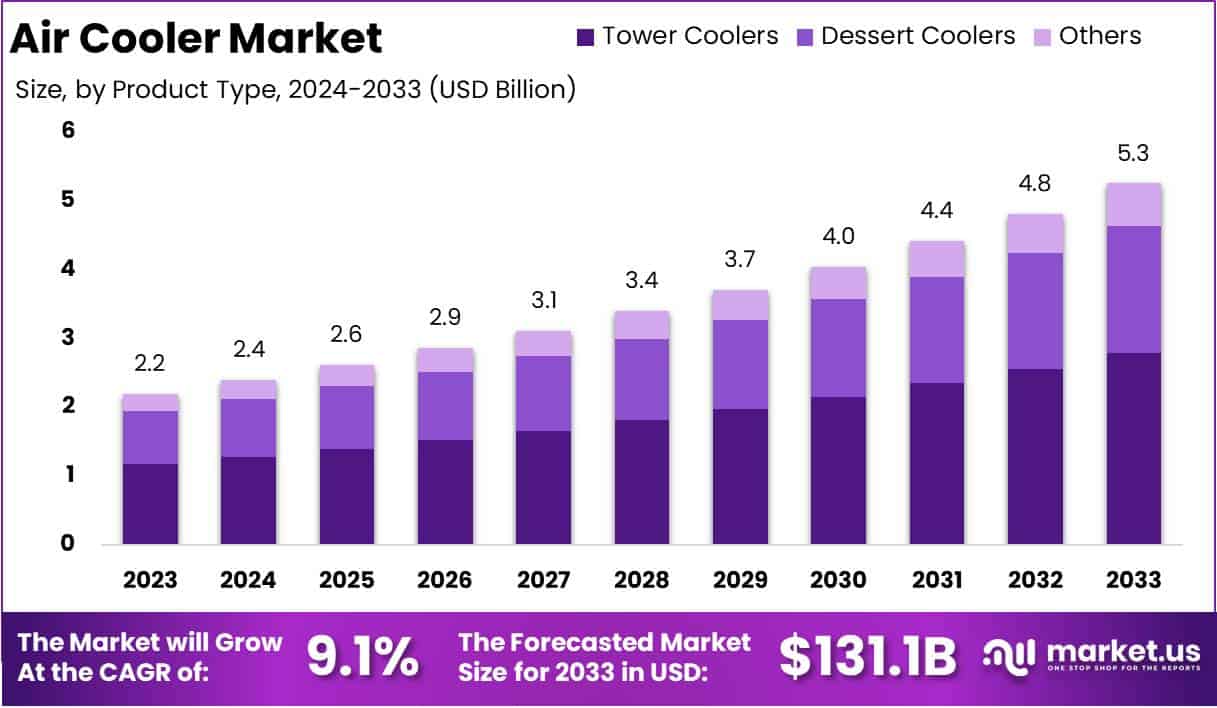

The Global Air Cooler Market size is expected to be worth around USD 5.3 Billion by 2033, from USD 2.2 Billion in 2023, growing at a CAGR of 9.1% during the forecast period from 2024 to 2033.

An air cooler, also known as an evaporative cooler, is a cost-effective and energy-efficient device used for cooling air in residential, commercial, and industrial spaces. Unlike traditional air conditioning systems, air coolers operate by evaporating water to lower the ambient temperature. They are particularly effective in dry and arid regions, providing both cooling and humidification.

Air coolers are valued for their simplicity, lower environmental impact, and reduced operational costs compared to conventional HVAC systems.

With growing awareness of sustainable cooling solutions and the rising demand for affordable alternatives to air conditioners, the air cooler market has witnessed steady expansion. The market also includes ancillary components such as cooling pads and water circulation systems, adding depth to its overall value chain.

Several factors are driving the growth of the air cooler market. Chief among them is the increasing demand for energy-efficient and environmentally friendly cooling solutions. The rising cost of electricity, coupled with growing environmental regulations, has shifted consumer preference towards low-energy cooling technologies.

Additionally, the market benefits from rising disposable incomes in emerging economies, where air coolers offer a more affordable alternative to traditional air conditioning systems. Seasonal temperature spikes due to global warming also fuel demand for air cooling solutions, especially in regions experiencing extreme heat waves.

The demand for air coolers is particularly robust in developing regions across Asia-Pacific, Latin America, and the Middle East, where high temperatures and limited access to expensive air conditioning systems drive adoption. In these regions, air coolers serve as an accessible solution for middle-income households.

Moreover, increasing urbanization and the growth of the construction sector especially in residential and commercial spaces are bolstering the demand for air cooling systems. This trend is further amplified by consumer preferences for products with low maintenance and long operational lifespans.

The air cooler market presents significant opportunities for innovation and growth. One of the key areas is technological advancement, including the integration of smart technologies such as IoT-enabled air coolers that allow remote control and energy optimization. Furthermore, expanding product portfolios to include hybrid systems that combine air cooling with air purification can tap into the growing demand for indoor air quality solutions.

Geographically, untapped markets in Africa and Southeast Asia offer growth potential due to rising urbanization and economic development. Additionally, the increased focus on sustainability presents opportunities for companies to develop air coolers with enhanced water efficiency and recyclable components.

According to Novamax India, air coolers consume up to 75% less energy than conventional air conditioners, resulting in significant cost savings over time.

According to Premier Industries, Inc., residential evaporative coolers consume between 3 to 15 gallons of water per hour, translating to an annual water cost ranging from $25 to $120, based on a rate of $0.008 per gallon. Routine maintenance, including pad replacements and cleaning, incurs additional annual expenses of $100 to $150 for residential units. Commercial systems, due to their complexity, face higher maintenance costs, ranging from $300 to $1,000 annually.

The operational lifespan of these coolers spans 10 to 15 years, contingent on quality and upkeep. Replacement involves initial purchase and potential disposal fees of $50 to $100. Accessories such as thermostats and remote controls can add $50 to $200 to the overall budget. Upgrades for enhanced performance or smart home integration may cost between $100 and $500.

Financing options, including leasing, offer monthly rates of $100 to $300, while purchasing plans may require $50 to $250 monthly over one to five years. Government rebates, acknowledging energy efficiency, provide incentives ranging from $50 to $500.

Key Takeaways

- The global air cooler market is projected to grow from USD 2.2 billion in 2023 to USD 5.3 billion by 2033, at a robust CAGR of 9.1% during the forecast period.

- Tower Coolers lead with a 46.2% market share in 2023, driven by their space-saving designs and widespread adoption in urban households.

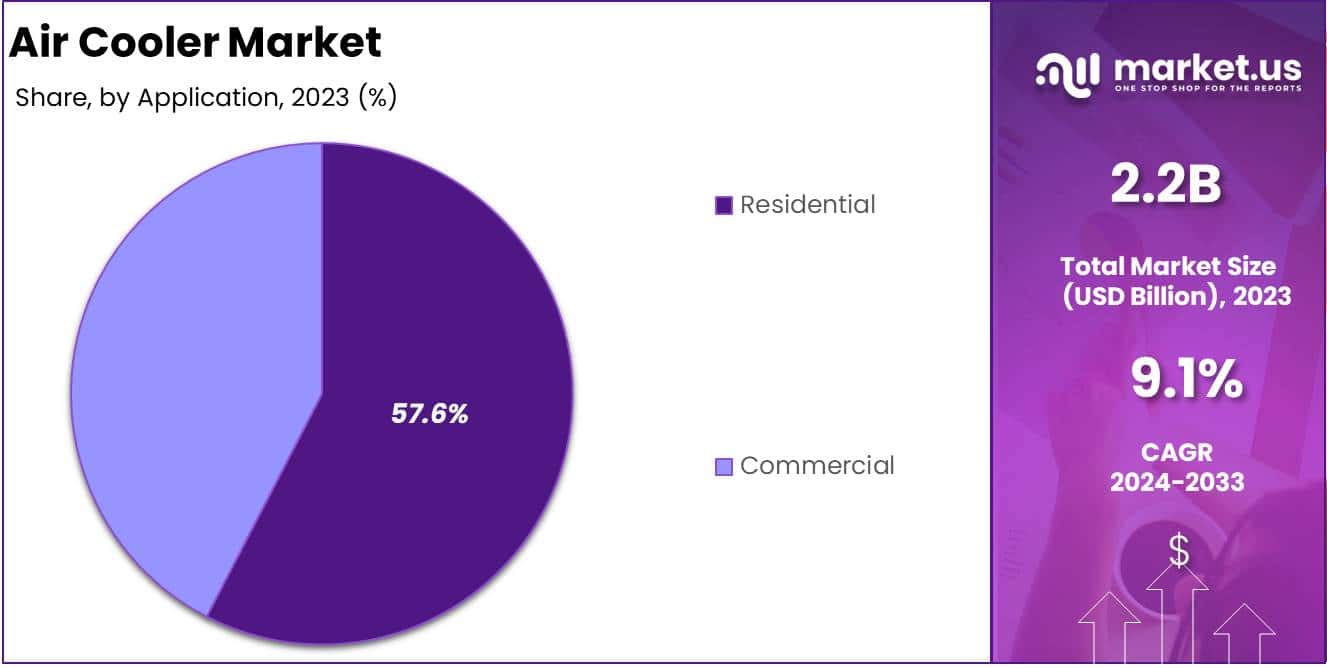

- The Residential segment dominates with a 57.6% share, fueled by rising urbanization and demand for affordable cooling solutions.

- Multi-brand Stores hold the top position with a 32.3% share, benefiting from diverse product offerings and competitive pricing.

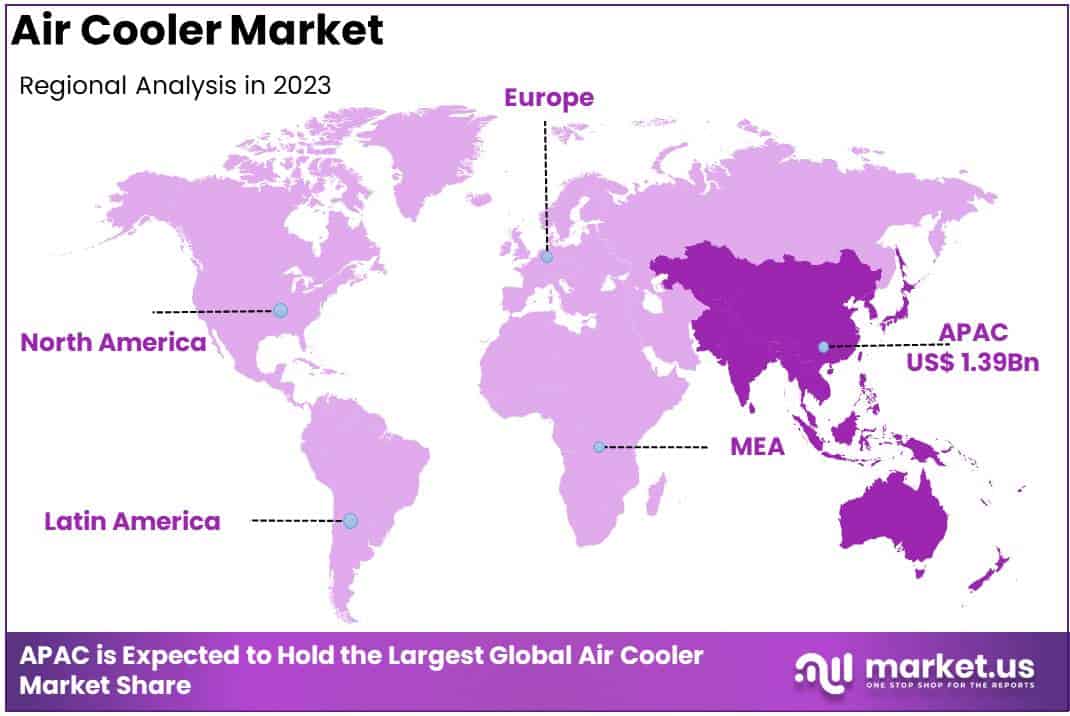

- Asia Pacific leads with a commanding 63.6% market share in 2023, driven by rapid urbanization, economic growth, and high cooling demand.

By Product Analysis

Tower Coolers Dominating the Air Cooler Market with a 46.2% Share

In 2023, Tower Coolers held a dominant position in the Air Cooler market by product type, capturing over 46.2% of the market share. Their compact design, efficient cooling capabilities, and widespread adoption in urban households have solidified their leadership in the segment. The demand for Tower Coolers continues to grow, driven by rising consumer preference for space-saving and energy-efficient solutions.

Desert Coolers accounted for 31.4% of the market share in 2023, showcasing robust demand in regions with hot and dry climates. Known for their high cooling capacity and suitability for larger spaces, Desert Coolers remain a preferred choice in industrial and semi-urban areas. The segment benefits from increasing investments in infrastructure and commercial spaces, boosting its growth potential.

The Others category, comprising personal coolers, window coolers, and hybrid models, captured 22.4% of the market share in 2023. This segment serves niche markets, catering to diverse consumer preferences and specialized applications. The segment’s growth is supported by product innovations and targeted marketing strategies aimed at specific customer needs.

By Application Analysis

Residential Segment Dominating the Air Cooler Market with a 57.6% Share

In 2023, the Residential segment secured a dominant position in the Air Cooler market by application, capturing over 57.6% of the market share. This growth is fueled by increasing urbanization, rising disposable incomes, and the demand for cost-effective cooling solutions in households.

Residential air coolers are favored for their affordability, energy efficiency, and ease of use, making them a popular choice across both urban and rural areas.

The Commercial segment accounted for 42.4% of the market share in 2023, driven by the growing adoption of air coolers in offices, retail spaces, and industrial settings. This segment benefits from the demand for large-scale cooling solutions that are both economical and environmentally friendly.

The ongoing expansion of commercial infrastructure globally is expected to further propel the growth of this segment.

By Sales Channel Analysis

Multi-brand Store Dominating Sales Channel with 32.3% Market Share

In 2023, Multi-brand Stores held a dominant position in the Air Cooler market, capturing a significant 32.3% share. These stores benefit from diverse product offerings and strategic locations, catering to a wide consumer base seeking variety and value under one roof.

Their ability to showcase multiple brands fosters competitive pricing, making them a preferred choice for consumers.

Hypermarkets and Supermarkets accounted for 20.5% of the Air Cooler market in 2023. Their widespread network, coupled with the convenience of one-stop shopping, attracts both urban and suburban consumers. Additionally, promotional discounts and seasonal offers drive considerable foot traffic.

Online Retailers emerged as a fast-growing sales channel, contributing 18.7% to the Air Cooler market. The rise of e-commerce platforms has been fueled by increasing internet penetration, ease of product comparison, and home delivery services. The ability to offer extensive product ranges and competitive pricing boosts their appeal, especially among tech-savvy consumers.

Independent Small Stores captured 12.4% of the market, maintaining their relevance through personalized service and strong community ties. These stores are particularly significant in rural and semi-urban areas, where they offer accessibility and tailored recommendations.

Wholesalers and Distributors accounted for 8.1% of the Air Cooler market in 2023. They play a crucial role in ensuring product availability across various retail formats, particularly in less accessible regions. Their influence in bulk distribution keeps the supply chain efficient and cost-effective.

Departmental Stores held a modest 5.6% share of the Air Cooler market. Although their market share is smaller, these stores appeal to customers seeking a more curated shopping experience, often emphasizing premium brands and exclusive products.

Other Sales Channels, including specialty and pop-up stores, accounted for the remaining 2.4% of the market. These channels cater to niche markets and offer unique selling points, such as limited-time offers or innovative product features, enhancing consumer choice.

Key Market Segments

By Product Type

- Tower Coolers

- Dessert Coolers

- Others

By Application

- Residential

- Commercial

By Sales Channel

- Departmental Stores

- Hypermarkets/Supermarket

- Independent Small Stores

- Multi-brand Store

- Online Retailers

- Other Sales Channel

- Wholesalers/Distributors

Driver

Escalating Global Temperatures and Climate Change

The intensification of global warming has led to a significant rise in average temperatures worldwide, directly influencing the demand for cooling solutions. As regions experience prolonged heatwaves and higher peak temperatures, the necessity for efficient and accessible cooling mechanisms becomes paramount.

Air coolers, known for their energy efficiency and cost-effectiveness compared to traditional air conditioning systems, have emerged as a preferred choice among consumers seeking relief from the heat. This surge in demand is particularly evident in developing economies where affordability and energy conservation are critical considerations.

Moreover, urbanization has exacerbated the urban heat island effect, where metropolitan areas experience higher temperatures than their rural counterparts due to human activities and infrastructure. This phenomenon has further amplified the need for effective cooling solutions in densely populated cities.

Air coolers, with their lower energy consumption and minimal environmental impact, align well with the growing emphasis on sustainable living and environmental responsibility. Consequently, the escalating global temperatures, coupled with increased urbanization, are pivotal drivers propelling the growth of the air cooler market.

Restraint

Limited Effectiveness in High Humidity Environments

While air coolers offer numerous advantages, their performance is significantly hindered in regions with high humidity levels. The fundamental operation of air coolers relies on the evaporation of water to cool the air however, in humid conditions, the air’s capacity to absorb additional moisture diminishes, leading to reduced cooling efficiency.

This limitation restricts the applicability of air coolers in tropical and coastal areas where humidity is consistently high, thereby constraining market growth in these regions.

Additionally, consumer dissatisfaction stemming from inadequate cooling performance in humid climates can adversely affect the market’s reputation and slow adoption rates. To mitigate this restraint, manufacturers are investing in research and development to enhance the efficiency of air coolers in diverse climatic conditions.

Innovations such as hybrid cooling technologies and advanced materials are being explored to improve performance in humid environments. However, until these advancements become mainstream, the inherent limitation of air coolers in high humidity areas remains a significant challenge to market expansion.

Opportunity

Integration of Smart Technologies

The advent of smart home technologies presents a substantial opportunity for the air cooler market. Consumers are increasingly seeking appliances that offer convenience, connectivity, and energy efficiency.

Integrating smart features into air coolers, such as remote control via mobile applications, voice-activated commands, and adaptive cooling based on room occupancy, can significantly enhance user experience and drive market growth.

These innovations not only cater to the tech-savvy demographic but also align with the broader trend towards home automation and the Internet of Things (IoT).

Furthermore, smart air coolers can provide real-time data on energy consumption, maintenance needs, and air quality, empowering users to make informed decisions and optimize usage.

This data-driven approach appeals to environmentally conscious consumers aiming to reduce their carbon footprint. By capitalizing on the integration of smart technologies, manufacturers can differentiate their products in a competitive market, attract a broader customer base, and foster brand loyalty, thereby unlocking new avenues for growth and profitability.

Trends

Rising Consumer Preference for Eco-Friendly Cooling Solutions

There is a growing consumer shift towards environmentally sustainable products, driven by increased awareness of climate change and environmental degradation. Air coolers, which typically consume less energy and utilize water as a cooling medium without harmful refrigerants, are perceived as more eco-friendly compared to traditional air conditioning systems.

This perception has led to a surge in demand for air coolers among environmentally conscious consumers seeking to minimize their ecological impact.

Manufacturers are responding to this trend by developing air coolers with enhanced energy efficiency, recyclable materials, and reduced carbon emissions during production and operation. Marketing strategies emphasizing the environmental benefits of air coolers are resonating with consumers, further driving market growth.

This trend is not only influencing individual purchasing decisions but also impacting procurement policies of businesses and institutions aiming to adopt greener practices. The alignment of air coolers with the global movement towards sustainability positions the industry favorably for continued expansion in the coming years.

Regional Analysis

Asia Pacific Leads the Air Cooler Market with 63.6% Share

In 2023, Asia Pacific emerged as the dominant force in the global air cooler market, holding an impressive 63.6% market share and generating approximately USD 1.39 billion in revenue. The region’s leading position can be attributed to a combination of favorable climatic conditions, rapid urbanization, and rising disposable incomes in major economies such as China and India.

Consumers in these countries increasingly prefer air coolers due to their affordability and energy efficiency compared to traditional air conditioning systems. The region’s consistently high temperatures and humid conditions drive the demand for cooling solutions, while government initiatives promoting sustainable and energy-efficient appliances further boost market growth.

Additionally, manufacturers are leveraging advanced technologies to offer innovative products that cater to the region’s diverse consumer base. The focus on developing eco-friendly and cost-effective cooling solutions aligns with Asia Pacific’s growing awareness of energy conservation and climate change, further strengthening its market dominance.

In North America, the air cooler market continues to grow steadily as consumers seek energy-efficient and sustainable cooling alternatives. The region’s demand is driven by heightened awareness of environmental sustainability and rising energy costs.

Areas with hot summers, particularly in the southern United States, are witnessing increased adoption of air coolers. Although North America holds a smaller market share compared to Asia Pacific, it remains a crucial market, bolstered by the region’s regulatory focus on reducing energy consumption and carbon emissions.

Europe’s air cooler market benefits from a strong consumer focus on sustainability. Stricter EU energy regulations and the region’s commitment to reducing greenhouse gas emissions have made air coolers an attractive option. The market is poised for steady growth as heatwaves become more frequent, driving demand for eco-friendly cooling solutions.

The Middle East & Africa region continues to grow its air cooler market presence, driven by harsh climatic conditions and economic development. Air coolers, being both cost-effective and energy-efficient, are gaining traction, particularly in urban areas. However, product innovation remains key to overcoming challenges posed by high humidity levels in parts of this region.

Latin America, while an emerging market, displays significant potential for air cooler growth. Countries like Brazil and Mexico are seeing rising adoption due to increasing urbanization and a shift toward energy-efficient appliances. As awareness grows, the region is expected to contribute more prominently to the global air cooler market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global air cooler market is poised for significant growth in 2024, driven by rising demand for energy-efficient and cost-effective cooling solutions. Key players in the market exhibit diverse strengths that position them well in an increasingly competitive landscape.

Adidas AG, though primarily known for its sportswear, has ventured into innovative cooling technologies, leveraging its brand equity and global reach to penetrate niche markets.

Bajaj Electricals India stands out with its strong distribution network and an extensive portfolio catering to varied consumer preferences, particularly in emerging markets.

Similarly, De’ Longhi Appliances S.r.l., renowned for its premium home appliances, capitalizes on European demand for high-end, energy-efficient cooling systems.

Fujian Jinghui Environmental Technology Co., Ltd. is a prominent player in Asia, focusing on environmentally friendly and technologically advanced air cooling solutions. Havells India Ltd, with its deep market penetration in India, benefits from its strong brand loyalty and continuous innovation in smart and IoT-enabled coolers.

Honeywell International Inc. leverages its global footprint and advanced R&D capabilities to offer industrial and residential cooling solutions tailored to diverse climatic conditions.

NewAir, a leader in portable cooling, appeals to a growing customer base seeking flexibility and convenience, while Seeley International maintains its edge through cutting-edge evaporative cooling technology.

Lastly, Symphony, a global leader in air coolers, continues to dominate with its broad product range, innovative designs, and strong presence in both developed and emerging markets. Together, these companies drive market evolution through innovation, strategic expansions, and customer-centric solutions.

Top Key Players in the Market

- Bajaj Electricals India

- De’ Longhi Appliances S.r.l.

- Fujian Jinghui Environmental Technology Co., Ltd.

- Havells India Ltd

- Honeywell International Inc.

- NewAir

- Seeley International

- Symphony

Recent Developments

- In October 17, 2024, Schneider Electric announced the acquisition of a controlling interest in Motivair Corporation, a company specializing in liquid cooling and advanced thermal management for high-performance computing systems. This acquisition reinforces Schneider’s commitment to energy-efficient solutions for data centers.

- In July 23, 2024, Johnson Controls finalized an agreement to sell its Residential and Light Commercial HVAC business to Bosch Group for $8.1 billion. The deal includes Johnson Controls’ North America Ducted business and its global residential joint venture with Hitachi, valued at $6.7 billion for Johnson Controls.

- In March 1, 2024, Vertiv announced its participation in Data Centre World, scheduled for March 6-7, 2024, at ExCeL London. Vertiv will present its latest power, cooling, and IT infrastructure solutions, providing data center professionals with hands-on experience and expert insights.

- In September 30, 2024, Honeywell completed the $1.81 billion acquisition of Air Products’ LNG process technology and equipment business. This strategic purchase expands Honeywell’s portfolio of advanced solutions for energy transformation.

- In November 20, 2023, Vertiv emphasized growing demand for AI and sustainability in its 2024 data center trends forecast. The report highlights the industry’s challenges in balancing energy efficiency, cost management, and the infrastructure needs of AI-capable computing systems.

Report Scope

Report Features Description Market Value (2023) USD 2.2 Bn Forecast Revenue (2033) USD 5.3 Bn CAGR (2024-2033) 9.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Tower Coolers, Dessert Coolers, Others), By Application (Residential, Commercial), By Sales Channel (Departmental Stores, Hypermarkets and Supermarket, Independent Small Stores, Multi-brand Store, Online Retailers, Other Sales Channel, Wholesalers and Distributors) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bajaj Electricals India, De’ Longhi Appliances S.r.l., Fujian Jinghui Environmental Technology Co., Ltd., Havells India Ltd, Honeywell International Inc., NewAir, Seeley International, Symphony Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bajaj Electricals India

- De’ Longhi Appliances S.r.l.

- Fujian Jinghui Environmental Technology Co., Ltd.

- Havells India Ltd

- Honeywell International Inc.

- NewAir

- Seeley International

- Symphony