Global Air Charter Broker Market By Type (Passenger Charter, Cargo Charter), By Application (Private Charter Services, Business Charter Services), By Broker Categories (Agent of the Customer, Agent of the Air Carrier, Indirect Air Carrier), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 105823

- Number of Pages: 328

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

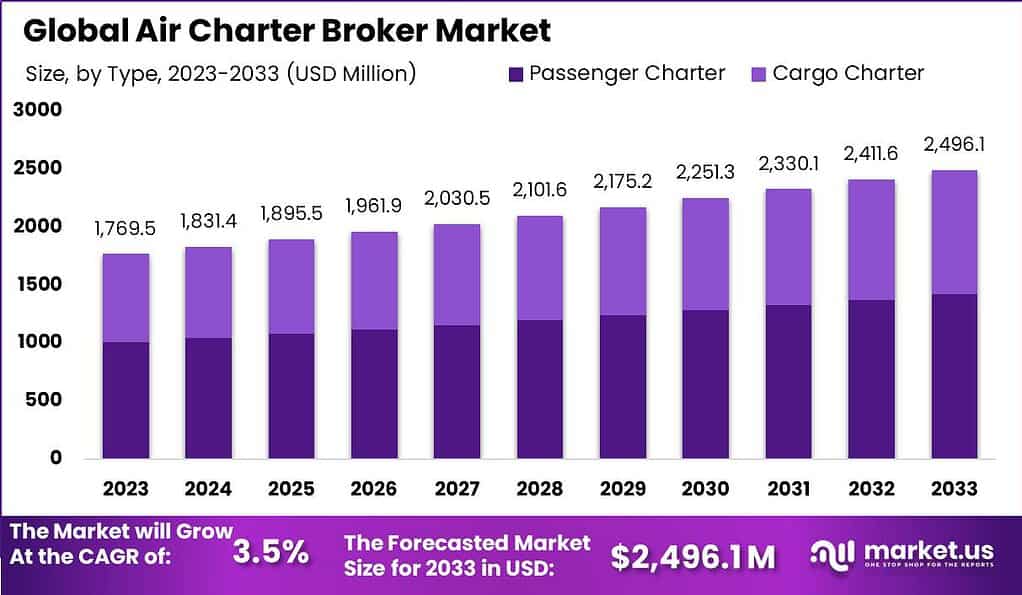

The Global Air Charter Broker Market size is expected to be worth around USD 2,496.1 Million by 2033, from USD 1,769.5 Million in 2023, growing at a CAGR of 3.5% during the forecast period from 2024 to 2033.

An air charter broker acts as an intermediary between individuals or organizations seeking private air transportation and the operators or owners of private aircraft. Air charter brokers provide services that facilitate the booking and arrangement of charter flights, offering clients a range of options based on their specific requirements, such as aircraft type, flight itinerary, and passenger capacity.

The air charter broker market has seen steady growth due to the increasing demand for private air travel and the convenience it offers. Air charter brokers provide valuable expertise and assistance in navigating the complexities of chartering an aircraft, including flight planning, aircraft selection, negotiation of terms, and ensuring compliance with safety regulations. They serve as a one-stop solution for clients, simplifying the process of chartering a private aircraft and providing access to a wide network of aircraft operators.

The rise of the global luxury travel sector, growing business aviation needs, and the desire for personalized and efficient travel experiences have fueled the demand for private air charter services. Air charter brokers leverage their industry knowledge, relationships with aircraft operators, and access to real-time availability to offer clients tailored solutions that meet their specific travel requirements.

However, the air charter broker market also faces challenges. The highly competitive nature of the industry necessitates that air charter brokers differentiate themselves through exceptional customer service, reliability, and transparency. Building and maintaining strong relationships with reputable aircraft operators and ensuring compliance with safety standards and regulations are vital for long-term success.

The air charter broker market presents opportunities for growth and innovation. Air charter brokers can expand their services to cater to niche markets, such as sports teams, celebrities, and government officials. They can also leverage technology to enhance the booking process, improve customer experiences, and provide value-added services, such as ground transportation and concierge services.

According to International Air Transport Association, it is estimated that by 2023, more than 75% of air charter brokers will offer online booking platforms and mobile apps. This trend aims to streamline the charter booking process, making it more convenient and accessible for customers. The introduction of these digital platforms will enable clients to browse aircraft options, compare prices, and book their desired charters with ease.

Additionally, a projection by AviationToday suggests that by 2023, over 60% of air charter brokers will adopt blockchain technology. This technology enables secure data sharing and transparent transactions, enhancing trust and efficiency in the industry. By leveraging blockchain, brokers can ensure the integrity and immutability of flight records, contracts, and financial transactions, providing a reliable and tamper-proof system for all stakeholders involved.

Research from Aviation Pros indicates a projected 40% increase in the implementation of AI and ML compared to the previous year. These technologies can assist in automating various processes, such as demand forecasting, route optimization, and personalized customer recommendations. By harnessing the power of AI and ML, air charter brokers can improve operational efficiency, enhance the customer experience, and make data-driven decisions.

Key Takeaways

- Air Charter Broker Market size is expected to be worth around USD 2,496.1 Million by 2033.

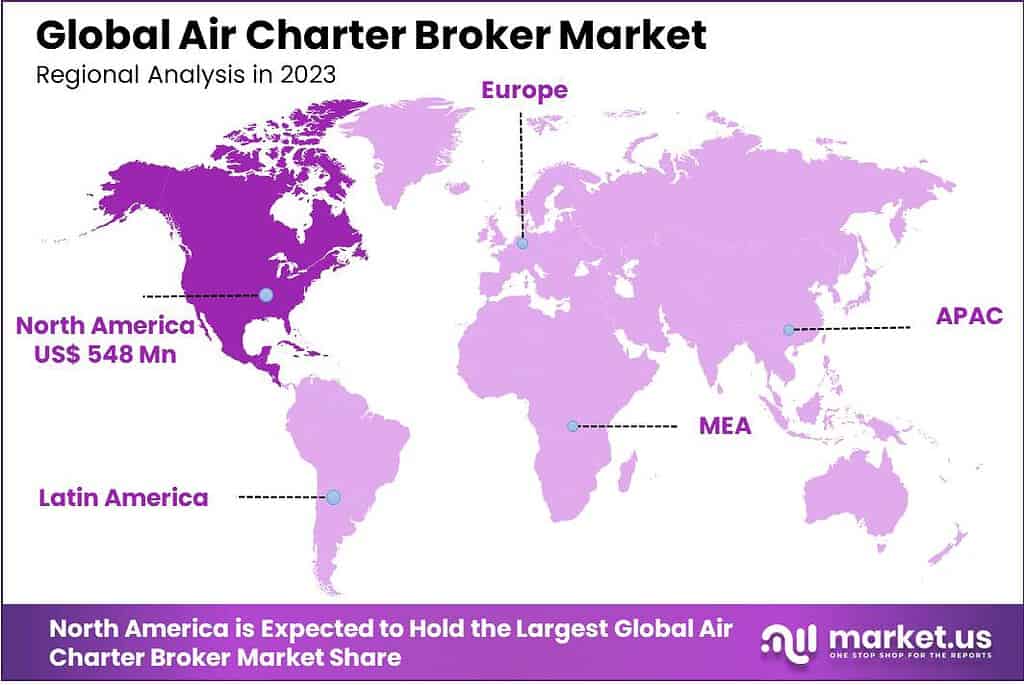

- In 2023, North America held a dominant market position in the air charter broker industry, capturing more than a 31% share.

- In 2024, the adoption of virtual reality (VR) and augmented reality (AR) technologies for showcasing aircraft interiors and amenities by air charter brokers is expected to increase by 30% year-over-year.

- By 2023, more than 70% of air charter brokers will provide carbon offsetting options to meet the demand for sustainable air travel.

- In 2024, the use of predictive analytics and data mining for optimizing charter flight routes and pricing is projected to grow by 25%.

- By 2023, over 80% of air charter brokers will integrate real-time flight tracking and monitoring capabilities into their platforms.

- In 2024, the adoption of voice-enabled virtual assistants for air charter booking and management is expected to increase by 35%.

- By 2023, more than 65% of air charter brokers will offer integrated trip planning services, including ground transportation and accommodation arrangements.

- In 2024, the use of drones for aircraft inspections and maintenance by air charter brokers is projected to grow by 20%.

Type Analysis

In 2023, the Passenger Charter segment held a dominant position within the Air Charter Broker market, capturing a significant share of the industry. This leadership can be attributed to the increasing demand for personalized and flexible travel options, particularly among high-net-worth individuals, corporate executives, and in sectors requiring urgent personnel transport. The growing preference for private travel due to its convenience, time efficiency, and heightened privacy standards has further propelled the segment’s growth.

Moreover, the resurgence of global tourism, following easing travel restrictions, has significantly contributed to the expansion of passenger charter services. The segment’s superiority is also bolstered by technological advancements in booking platforms, making access to private jet charters more user-friendly and transparent, thereby enhancing customer experience and satisfaction.

The Passenger Charter segment’s advancement is underscored by compelling market dynamics, including the escalating emphasis on luxury travel experiences and the corporate sector’s ongoing need for efficient and secure transportation solutions. Industry reports indicate a notable annual growth rate, with projections suggesting a continued upward trajectory.

This growth is partly due to the segment’s ability to offer tailor-made travel solutions that address the specific needs of clients, ranging from individual leisure travelers to large corporate groups. The integration of sustainability initiatives, such as carbon offset programs and the utilization of newer, more fuel-efficient aircraft, has also started to play a crucial role in attracting environmentally conscious consumers, further solidifying the Passenger Charter segment’s leading position in the market.

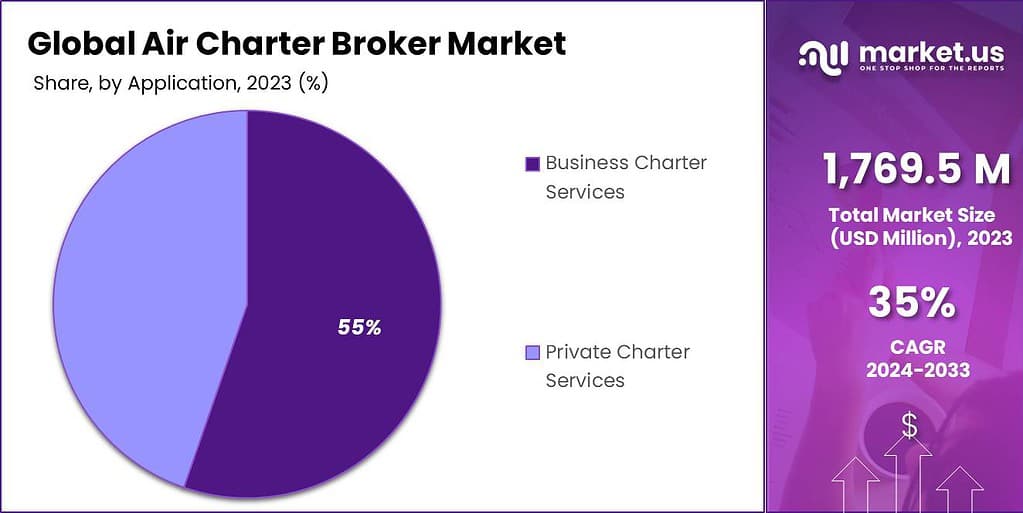

Application Analysis

In 2023, the Business Charter Services segment held a dominant market position within the Air Charter Broker Market, capturing a more substantial share compared to its counterparts. This prominence is largely attributed to the escalating demand for bespoke travel solutions by corporations, government bodies, and the sports and entertainment sectors, which prioritize efficiency, flexibility, and confidentiality.

The ability to schedule flights according to precise business needs, bypass long security lines, and access more airports closer to final destinations has markedly enhanced productivity for businesses. This segment’s growth is further supported by the global economic recovery, fostering increased international business travel and corporate events.

The rise of digital platforms for easy booking and management of charter services has also played a critical role in making business charter services more accessible and appealing to a broader audience. The Business Charter Services segment’s growth is characterized by a heightened emphasis on time-saving and the provision of an environment conducive to private work, crucial for high-level executives and professionals.

According to industry analyses, this segment has not only retained a substantial portion of the market share but is also projected to witness continued expansion, driven by the rising number of small and medium-sized enterprises (SMEs) recognizing the value of private charter in enhancing business productivity and agility. The integration of advanced technologies for real-time tracking, in-flight connectivity, and enhanced safety measures has further elevated the appeal of business charter services, aligning with corporate clients’ increasing demands for quality and reliability.

Broker Categories Analysis

In 2023, the Agent of the Customer segment held a dominant market position in the air charter broker market, capturing a significant share. This segment refers to air charter brokers who primarily act as representatives and advocates for the customers seeking private air transportation. They work closely with clients to understand their travel requirements, preferences, and budget constraints, and then leverage their industry knowledge and network of aircraft operators to find the most suitable charter options.

The leading position of the Agent of the Customer segment can be attributed to several key factors. Firstly, these brokers prioritize the interests and needs of their customers, providing personalized services and tailored solutions. By offering a wide range of aircraft options, flight itineraries, and pricing alternatives, they ensure that clients have access to the best possible charter experience. Additionally, their expertise in negotiating favorable terms, ensuring compliance with safety regulations, and managing logistics contributes to their market dominance.

Moreover, the Agent of the Customer segment benefits from the growing demand for private air travel and the increasing preference for customized and efficient travel experiences. As individuals and organizations seek more flexible and convenient alternatives to commercial flights, they turn to air charter brokers who can provide dedicated and personalized services. The Agent of the Customer segment has capitalized on this trend by building strong relationships with reputable aircraft operators, maintaining a vast network, and utilizing advanced technology to streamline the booking process.

Key Market Segmentation

By Type

- Passenger Charter

- Cargo Charter

By Application

- Private Charter Services

- Business Charter Services

By Broker Categories

- Agent of the Customer

- Agent of the Air Carrier

- Indirect Air Carrier

Regional Analysis

In 2023, North America held a dominant market position in the air charter broker industry, capturing more than a 31% share. The demand for Air Charter Broker in North America was valued at USD 548 Million in 2023 and is anticipated to grow significantly in the forecast period.

The region’s leading position can be attributed to several factors that contribute to its robust market presence. Firstly, North America has a well-established and mature private aviation sector, with a high concentration of affluent individuals, businesses, and corporations that frequently utilize private air travel. The region’s strong economic growth, coupled with a culture of convenience and luxury, has driven the demand for air charter broker services.

Furthermore, North America benefits from a developed infrastructure, including a vast network of airports and fixed-base operators (FBOs), which facilitate seamless operations and accessibility for charter flights. The region also boasts a diverse fleet of private aircraft, providing clients with a wide range of options to choose from based on their travel needs and preferences.

Additionally, North America has a highly competitive air charter broker market, with several established players and a thriving ecosystem of industry stakeholders. These brokers differentiate themselves by offering exceptional customer service, personalized experiences, and deep industry expertise. The presence of major financial centers and multinational corporations in cities like New York, Los Angeles, and Chicago generates a consistent demand for private air travel and drives the growth of the air charter broker market in North America.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis refers to the process of evaluating and studying the major companies or organizations that have a significant impact on a particular industry or market. It involves assessing the key players’ market position, business strategies, competitive strengths, product or service offerings, financial performance, and other relevant factors.

The air charter broker market is a dynamic and competitive industry that connects customers with private aircraft operators for personalized air travel solutions. Several key players have emerged in this market, offering a range of services and expertise to cater to the diverse needs of their clients.

Some of the companies that are profiled in this report are:

- Air Charter Service

- Air Partner

- Chapman Freeborn

- Foxtrot Charter

- Buteair

- Europair

- Stratos Jet Charters

- Aircharter Network

- APERTUS Aviation

- Aurea Aviation

- Aviation Technologies

- EWA Charter

Recent Developments

- Air Charter Service (ACS): In October 2022, ACS launched a dedicated time-critical division called ACS Critical Time. This division streamlines various services for urgent shipment requests, combining integrated trucking solutions, on-demand cargo airplane charters with onboard couriers, and next-flight-out alternatives.

- Air Partner: In January 2022, Wheels Up, a US-based private aviation company, acquired Air Partner, a UK-based aircraft charter service provider. The acquisition strengthened Wheels Up’s international presence and expanded its offerings in personal aviation services

Report Scope

Report Features Description Market Value (2023) USD 1,769.5 Mn Forecast Revenue (2033) USD 2,496.1 Mn CAGR (2024-2033) 3.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Passenger Charter, Cargo Charter), By Application (Private Charter Services, Business Charter Services), By Broker Categories (Agent of the Customer, Agent of the Air Carrier, Indirect Air Carrier) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Air Charter Service, Air Partner, Chapman Freeborn, Foxtrot Charter, Buteair, Europair, Stratos Jet Charters, Aircharter Network, APERTUS Aviation, Aurea Aviation, Aviation Technologies, EWA Charter Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is an air charter broker?An air charter broker is a company or individual that acts as an intermediary between clients seeking private air travel and aircraft operators. They facilitate the chartering of private jets, helicopters, or other aircraft for various purposes, such as business travel, leisure trips, medical evacuation, or cargo transport.

How big is Air Charter Broker Market?The Global Air Charter Broker Market size is expected to be worth around USD 2,496.1 Million by 2033, from USD 1,769.5 Million in 2023, growing at a CAGR of 3.5% during the forecast period from 2024 to 2033.

Which are the driving factors of the air charter broker market?Driving factors of the air charter broker market include increasing demand for personalized travel, flexibility, and convenience, as well as growing corporate travel needs.

What is the restraining factor of the air charter broker market?The restraining factor of the air charter broker market is often the high cost associated with chartering flights compared to traditional commercial air travel options.

Who are the key players in the Air Charter Broker Market?Air Charter Service, Air Partner, Chapman Freeborn, Foxtrot Charter, Buteair, Europair, Stratos Jet Charters, Aircharter Network, APERTUS Aviation, Aurea Aviation, Aviation Technologies, EWA Charter

Air Charter Broker MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Air Charter Broker MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Air Charter Service

- Air Partner

- Chapman Freeborn

- Foxtrot Charter

- Buteair

- Europair

- Stratos Jet Charters

- Aircharter Network

- APERTUS Aviation

- Aurea Aviation

- Aviation Technologies

- EWA Charter