Global AI Wearable Market Size, Share, Industry Analysis Report By Type (Smartwatches, Smart Eyewear, Smart Earwear, Others), By Application (Consumer Electronics, Healthcare, Automotive, Military & Defense, Media & Entertainment, Others), By Operations (On-device AI, Cloud-based AI), By Component (Processor, Connectivity IC, Sensors), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 161665

- Number of Pages: 263

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Quick Market Facts

- US Market Size

- By Type: Smartwatches

- By Application: Consumer Electronics

- By Operations: On-device AI

- By Component: Processor

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

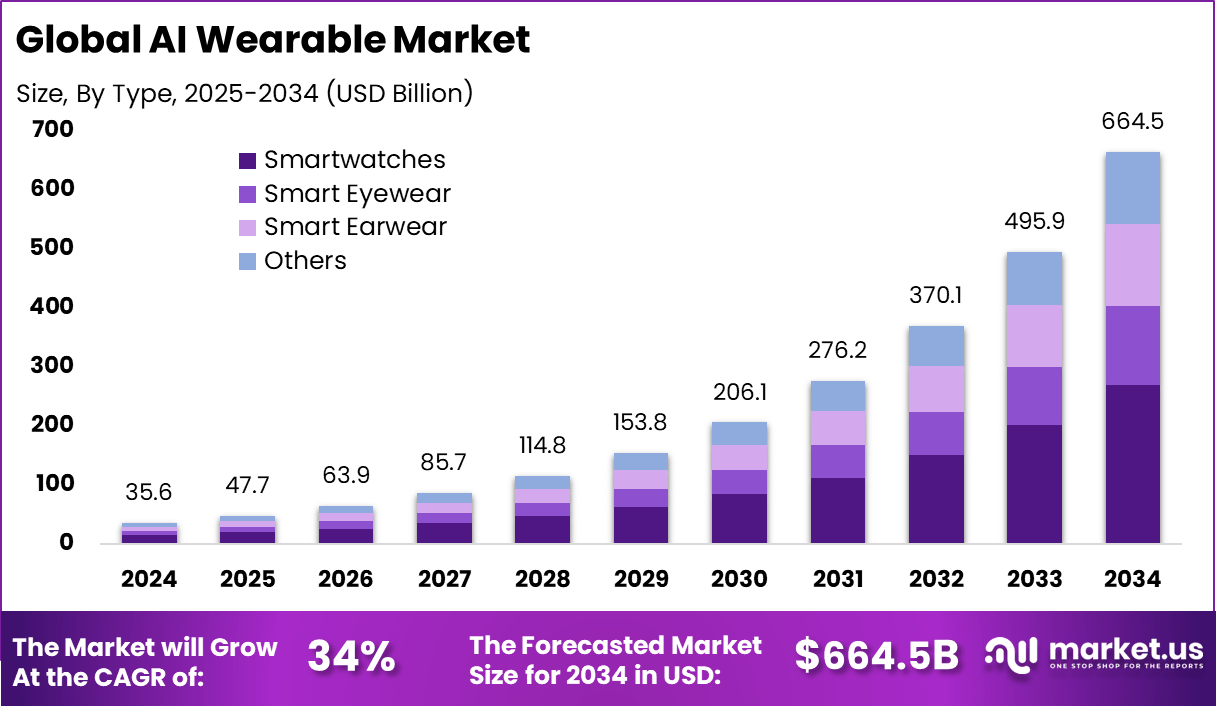

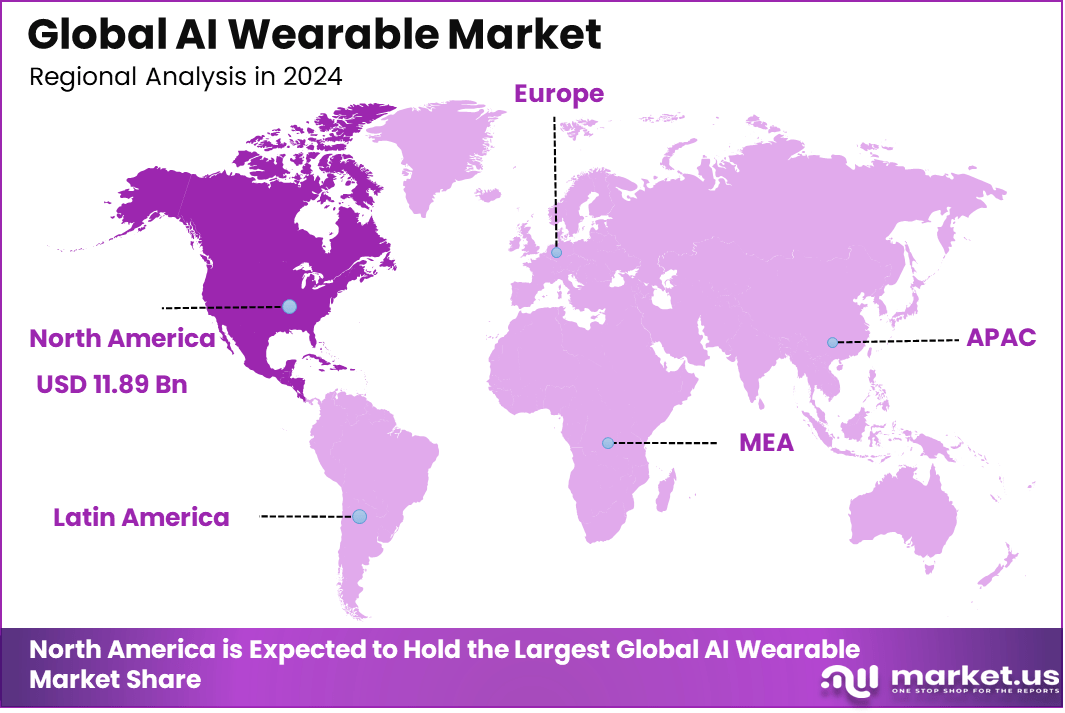

The Global AI Wearable Market generated USD 35.6 billion in 2024 and is predicted to register growth from USD 47.7 billion in 2025 to about USD 664.5 billion by 2034, recording a CAGR of 34% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 33.4% share, holding USD 11.89 Billion revenue.

The AI wearable market is transforming rapidly as artificial intelligence integrates with wearable devices like smartwatches, smart glasses, and fitness bands. These devices now go beyond simple tracking to offer real-time, personalized insights thanks to AI-powered features such as predictive analytics, voice control, and health monitoring. This market thrives on technological advances in sensors and AI chips that fit into compact devices, making wearables smarter, more accurate, and accessible.

The demand for health-focused wearables is fueled by rising health awareness, with consumers and enterprises alike adopting AI wearables for fitness, chronic disease management, safety, and productivity enhancement. The interconnection with IoT, smartphones, and cloud platforms further enhances their value as comprehensive digital companions in everyday life.

The primary driving factors behind the AI wearable market include increasing health consciousness, consumer preference for personalized data, and the push for continuous, real-time monitoring of biometric signals. AI algorithms help analyze heart rate variability, sleep quality, and even stress levels, offering individualized suggestions that improve well-being.

Advances in edge AI allow data to be processed directly on devices, ensuring better privacy and lower energy use. Additionally, deployment of 5G networks considerably improves wearables’ connectivity and responsiveness. Workplace safety applications and eldercare, via AI fall detection and emergency alert systems, are gaining traction, expanding the market beyond consumer fitness watches.

Top Market Takeaways

- Smartwatches hold around 40.7%, showing they are the most widely adopted AI-enabled wearable category.

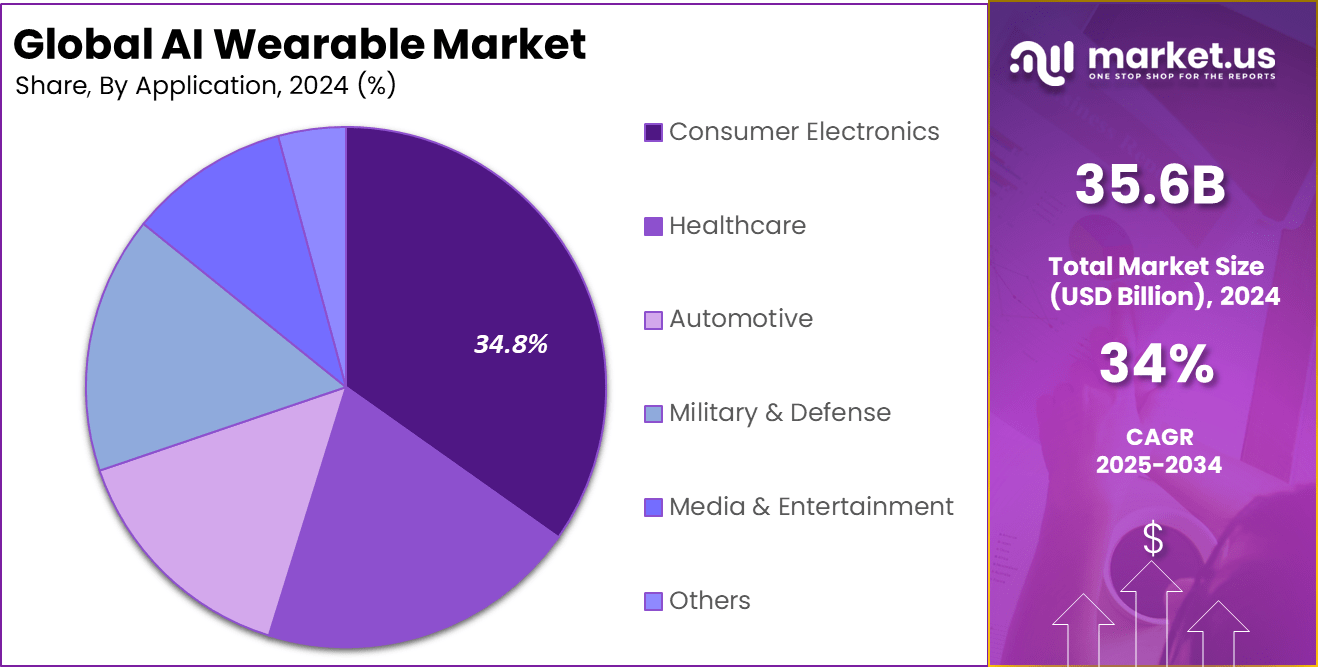

- Consumer electronics account for nearly 34.8%, driven by lifestyle integration, personal monitoring, and convenience features.

- On-device AI makes up about 62.6%, reflecting the shift toward faster processing, privacy, and offline functionality.

- Processors contribute close to 54.7%, indicating strong demand for high-performance chipsets in wearable devices.

- North America represents roughly 33.4%, supported by strong spending power and rapid technology adoption.

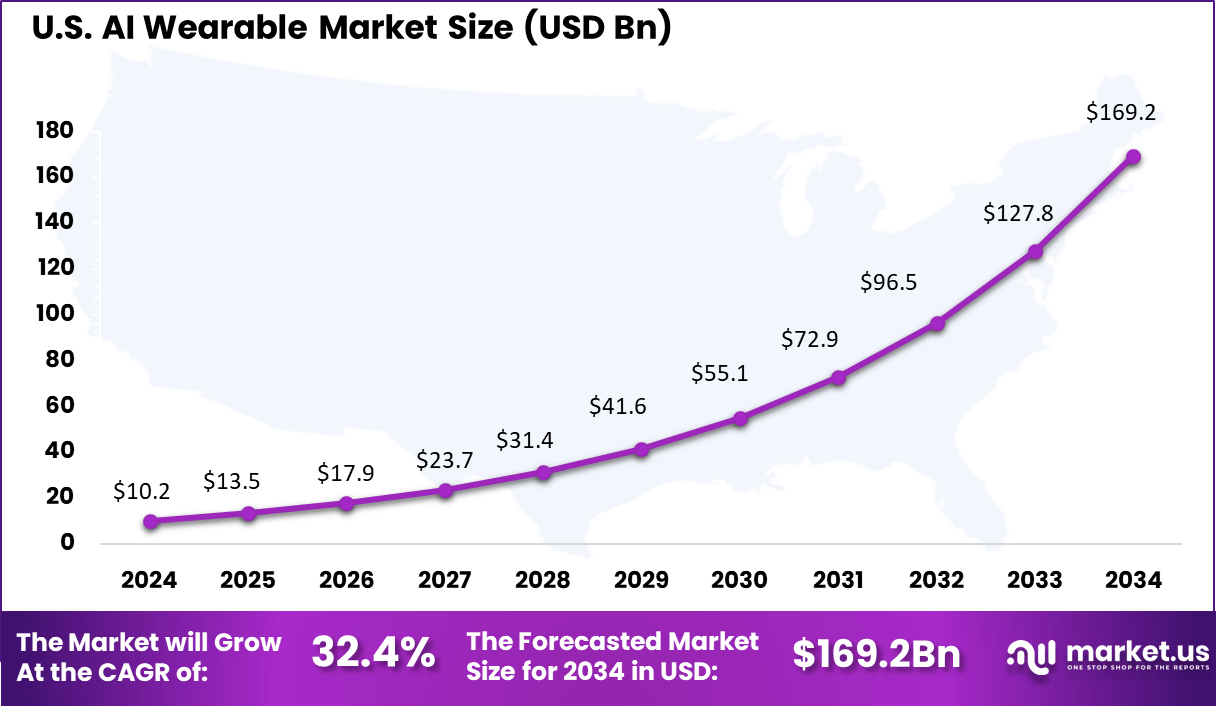

- The U.S. leads regional uptake with mature consumer demand and early integration of AI in personal devices.

- Growth at nearly 32.4% CAGR signals rising interest in intelligent wearables for health, productivity, and entertainment.

Quick Market Facts

Investment opportunities in the AI wearable market are growing as venture capital flows into startups developing innovative health monitoring, augmented reality (AR), and smart assistant wearables. This investment not only fosters new technologies but also drives competition and market expansion. The sector’s appeal is bolstered by industries such as healthcare, sports, enterprise safety, and retail recognizing the benefits of AI wearables to improve outcomes and efficiency.

Business benefits of integrating AI wearables include increased employee productivity through real-time data and communications, enhanced safety protocols reducing workplace accidents, and improved customer engagement by collecting valuable biometric and behavioral data. Companies leveraging wearables see better workflow management and stronger connections with customers, which directly impacts profitability and operational efficiency.

wearable device shipment highlights

Metric Data Total Shipments (2024) 534.6 million units Year-over-Year Growth (2024) 5.4% Wrist-Worn Market Growth (Q1 2025) 10.5% year-over-year Leading Wrist-Worn Vendors (Q1 2025) Huawei, Xiaomi, and Apple Top Product Growth (2025) Hearables are expected to lead growth Product Recovery (2025) Smartwatches are anticipated to have a modest recovery US Market Size

The U.S. market is a critical driver with a valuation surpassing $10 billion and a strong CAGR of 32.4%. This rapid growth is fueled by increasing consumer demand for personalized health insights and smarter wearable technologies. The expansion of telehealth, fitness tracking, and remote patient monitoring using AI-enhanced wearables is a major factor accelerating market growth.

Americans’ high usage of smartwatches and fitness bands reflects a culture increasingly reliant on connected health technology. The proliferation of on-device AI capabilities in these products makes the U.S. a hub of innovation and adoption in the wearable AI space.

North America commands a dominant 33.4% share of the AI wearable market. The region benefits from a mix of advanced technology infrastructure, strong consumer acceptance, and high healthcare investment. The U.S. leads innovation and adoption, partly due to the presence of major technology firms and a large base of health-conscious consumers eager to adopt AI-powered wearables.

Supportive regulatory frameworks and widespread IoT integration further stimulate product development and adoption in health, fitness, and industrial applications. North America remains the most mature and competitive market in the wearable AI sector.

By Type: Smartwatches

In 2024, Smartwatches dominate the AI wearable market with a robust share of 40.7%. This is due to their multifunctionality, combining health tracking, communication, and AI-driven features in one device that appeals broadly to consumers. The convenience of having AI-powered monitoring like heart rate analysis and activity tracking on the wrist makes smartwatches a preferred choice among wearable devices.

The surge in interest is also driven by increasing health awareness and demand for real-time insights, where smartwatches deliver personalized data efficiently. Their growing integration with mobile platforms boosts their usability, ensuring they remain a cornerstone of the wearable AI market.

By Application: Consumer Electronics

In 2024, The consumer electronics segment accounts for 34.8% of the AI wearable market share, making it the largest application area. This segment includes devices like smartwatches, earwear, and fitness bands that are widely adopted by consumers seeking improved lifestyle and fitness management with AI assistance.

AI functionalities such as voice recognition and predictive analytics provide a more tailored and interactive user experience in everyday electronics. The rising demand for smarter personal devices, particularly in health and fitness tracking, drives this segment’s growth. Integration of AI allows consumer electronics to evolve beyond basic functions, bringing intelligent features that adapt and respond dynamically to user needs.

By Operations: On-device AI

In 2024, On-device AI dominates with a significant 62.6% share, highlighting the preference for AI processing carried out locally on the device rather than in the cloud. This reduces latency and enhances privacy as data is processed without needing to be sent externally. Wearables benefit greatly from on-device AI by providing fast real-time analytics and making devices more energy-efficient and responsive.

This local AI approach also supports critical use cases like health monitoring and security where immediate data processing is essential. Increasing sophistication in AI chipsets has propelled on-device AI adoption, positioning it as the backbone operation in wearable AI technology.

By Component: Processor

In 2024, Processors represent the largest component segment at 54.7% in wearable AI devices. The advancement in low-power, high-performance processors enables wearables to execute complex AI algorithms smoothly while conserving battery life. Processors drive the core functionalities of AI wearables, from analyzing sensor data to supporting machine learning models embedded in the device.

The emphasis on efficient processors has become critical as wearables demand more computing power to deliver sophisticated AI features like pattern recognition, health diagnostics, and voice assistance. Continued improvements in processor architectures specifically designed for wearables are central to market expansion.

Emerging Trends

One notable trend in AI wearables is the rapid evolution of form factors like smart rings, AR glasses, and hearables, which are expected to account for 30% of new device launches in 2025. These devices emphasize seamless integration with daily routines, providing discreet yet intelligent assistance. Additionally, on-device AI processing is growing, with 38% of wearables now operating AI computations locally rather than relying fully on cloud connectivity, enhancing privacy and responsiveness.

Another emerging trend is the rise of AI-powered emotional recognition features, where wearables interpret physiological signals to gauge mood and stress levels. Around 28% of new high-end wearables are incorporating such capabilities, which opens new pathways for mental wellness applications. These innovations are pushing the market toward more holistic health and lifestyle solutions.

Growth Factors

Health consciousness remains the strongest growth factor for AI wearables, with 72% of consumers globally prioritizing technology that helps them track fitness, sleep, and chronic conditions. The increased demand for continuous, real-time health monitoring combined with advances in miniaturized sensors and better battery life supports stronger adoption rates.

The expansion of 5G and edge AI also fuels growth by enabling faster data processing and more accurate analytics on wearable devices. Analysts note that 46% of wearables in 2025 benefit from edge AI architectures, allowing for improved user autonomy and lower latency in delivering insights. This technical progress continues to unlock new use cases across healthcare, sports, and enterprise sectors.

Key Market Segments

By Type

- Smartwatches

- Smart Eyewear

- Smart Earwear

- Others

By Application

- Consumer Electronics

- Healthcare

- Automotive

- Military & Defense

- Media & Entertainment

- Others

By Operations

- On-device AI

- Cloud-based AI

By Component

- Processor

- Connectivity IC

- Sensors

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Growing Health and Fitness Awareness

The growing awareness around health and fitness is a key driver for the AI wearable market. As consumers become more health-conscious, demand for devices that track heart rate, sleep, activity levels, and other vital signs has surged.

AI integration enhances the value of these devices by offering personalized insights and predictive health alerts, which help users make informed lifestyle choices. This trend is especially strong in regions where preventive healthcare is prioritized, contributing to rapid market growth.

AI wearables now deliver real-time health monitoring that was not possible before, enabling early detection of potential health issues. Healthcare providers increasingly adopt these devices for remote patient monitoring, a practice accelerating post-pandemic. The convenience and improved health outcomes from AI-driven personalized coaching are motivating more users to adopt wearable technology for fitness and wellness tracking.

Restraint

Limited Battery Life

Battery life limitations present a significant restraint on the wearable AI market. Many AI-powered wearables demand substantial processing power for continuous data analysis, which quickly drains battery capacity. Consumers often find frequent charging inconvenient and frustrating, impacting user satisfaction and adoption rates.

Additionally, some AI wearables generate excess heat due to their intensive operations, which can reduce device comfort and battery efficiency. These limitations require manufacturers to invest heavily in battery technology and power management solutions. Until breakthroughs occur, battery life issues remain a notable barrier to seamless user experience and broader market penetration.

Opportunity

Expansion in Remote Patient Monitoring

The integration of AI wearable devices within remote patient monitoring systems offers a huge growth opportunity. Healthcare systems globally are shifting towards telehealth and preventive care models, where continuous, non-invasive patient monitoring is crucial. AI wearables can capture real-time biometric data and use predictive analytics to alert healthcare providers about abnormalities before they become serious.

This opportunity extends beyond traditional healthcare to managing chronic diseases and post-surgery care, improving patient outcomes and reducing hospital visits. Emerging markets also show strong potential as digital health infrastructure grows. Companies innovating in this space can capitalize on partnerships with healthcare providers and insurer programs focused on health tech adoption.

Challenge

Data Privacy and Security Concerns

Data privacy and security concerns present a major challenge for the wearable AI market. Wearable devices collect sensitive personal health information, which raises fears about unauthorized data access, misuse, and compliance with privacy regulations. Users and regulators alike demand robust encryption, secure data storage, and transparent privacy policies.

Regulatory compliance across different countries further complicates the landscape, requiring companies to carefully navigate complex rules. Breaches or leaks could severely damage consumer trust and brand reputation. Therefore, manufacturers must prioritize security in device design and invest in ongoing cybersecurity measures to build confidence and ensure sustained growth.

Competitive Analysis

The AI Wearable Market is dominated by major technology firms such as Apple Inc., Samsung Electronics Co. Ltd., Google Inc., and Amazon.com, Inc. These companies integrate AI into smartwatches, earbuds, and fitness devices to deliver personalized health tracking, voice assistance, predictive insights, and seamless connectivity with digital ecosystems. Their strong hardware-software integration and global reach drive mainstream adoption.

Key contributors including Fitbit, Inc., Garmin Ltd., Huawei Technologies Co. Ltd., and Sony Corporation focus on AI-driven fitness analytics, sleep monitoring, biometric sensing, and smart coaching features. Their devices are widely used in consumer wellness, sports performance, and lifestyle monitoring, supported by companion apps and cloud-based data platforms.

Additional players such as IBM, Motorola Solutions, Inc., and TomTom International B.V., along with other emerging participants, provide AI capabilities for specialized wearable applications. These include enterprise-grade safety devices, AI-powered navigation wearables, and remote health monitoring tools. Together, these companies expand the market across consumer, enterprise, and healthcare segments.

Top Key Players in the Market

- Amazon.com, Inc.

- Fitbit, Inc.

- Garmin Ltd.

- Google, Inc.

- Huawei Technologies Co. Ltd.

- IBM

- Motorola Solutions, Inc.

- TomTom International B.V.

- Apple, Inc.

- Samsung Electronics Co. Ltd.

- Sony Corporation

- Other Major Players

Recent Developments

- July 2025, Amazon confirmed the acquisition of Bee, a San Francisco-based AI wearable startup known for a $49.99 AI-infused bracelet that constantly listens and transcribes conversations to create to-do lists and reminders. This deal marks Amazon’s strategic move into affordable, mass-market AI wearables that act as personal assistants beyond just fitness tracking.

- August 2025, Fitbit announced a major update to its Premium service with the introduction of an AI health coach powered by Google’s Gemini AI system, launching in October. This coach personalizes fitness, sleep, and wellness advice by analyzing individual user data and integrating multiple health metrics in real-time, shifting Fitbit from a data tracker to a proactive wellness guide.

Report Scope

Report Features Description Market Value (2024) USD 35.6 Bn Forecast Revenue (2034) USD 664.5 Bn CAGR(2025-2034) 34% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Smartwatches, Smart Eyewear, Smart Earwear, Others), By Application (Consumer Electronics, Healthcare, Automotive, Military & Defense, Media & Entertainment, Others), By Operations (On-device AI, Cloud-based AI), By Component (Processor, Connectivity IC, Sensors Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon.com, Inc., Fitbit, Inc., Garmin Ltd., Google, Inc., Huawei Technologies Co. Ltd., IBM, Motorola Solutions, Inc., TomTom International B.V., Apple, Inc., Samsung Electronics Co. Ltd., Sony Corporation, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amazon.com, Inc.

- Fitbit, Inc.

- Garmin Ltd.

- Google, Inc.

- Huawei Technologies Co. Ltd.

- IBM

- Motorola Solutions, Inc.

- TomTom International B.V.

- Apple, Inc.

- Samsung Electronics Co. Ltd.

- Sony Corporation

- Other Major Players