Global AI Training GPU Cluster Sales Market Size, Share and Growth Report By Component (Hardware, Software, Services), By Deployment (On-premises, Public Cloud), By Cluster Scale (Small Scale (< 100 GPUs), Medium Scale (100–1000 GPUs), Large/Hyperscale (> 1000 GPUs)), By End-User (Cloud Service Providers (CSPs) & Hyperscalers, Large Enterprises & Technology Companies, Research Institutions & Academia, Government & Defense Agencies), By Industry Vertical (IT & Technology, Financial Services, Automotive & Manufacturing, Healthcare & Pharmaceuticals, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Dec. 2025

- Report ID: 171387

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

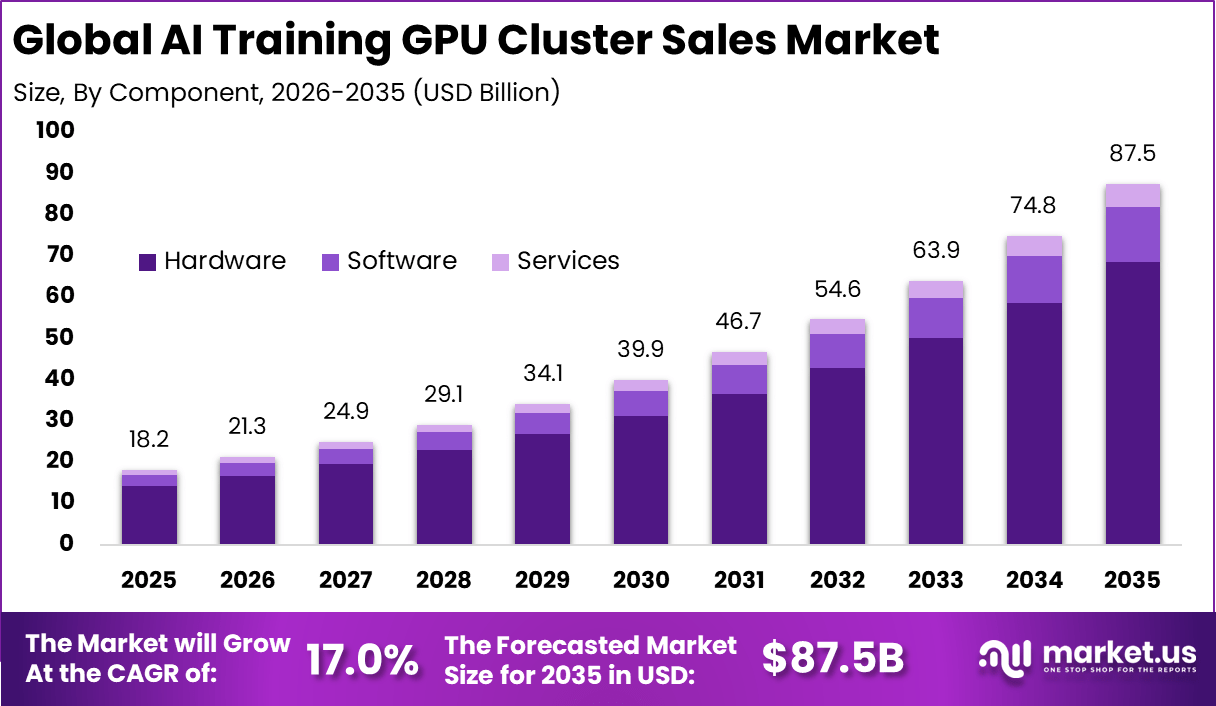

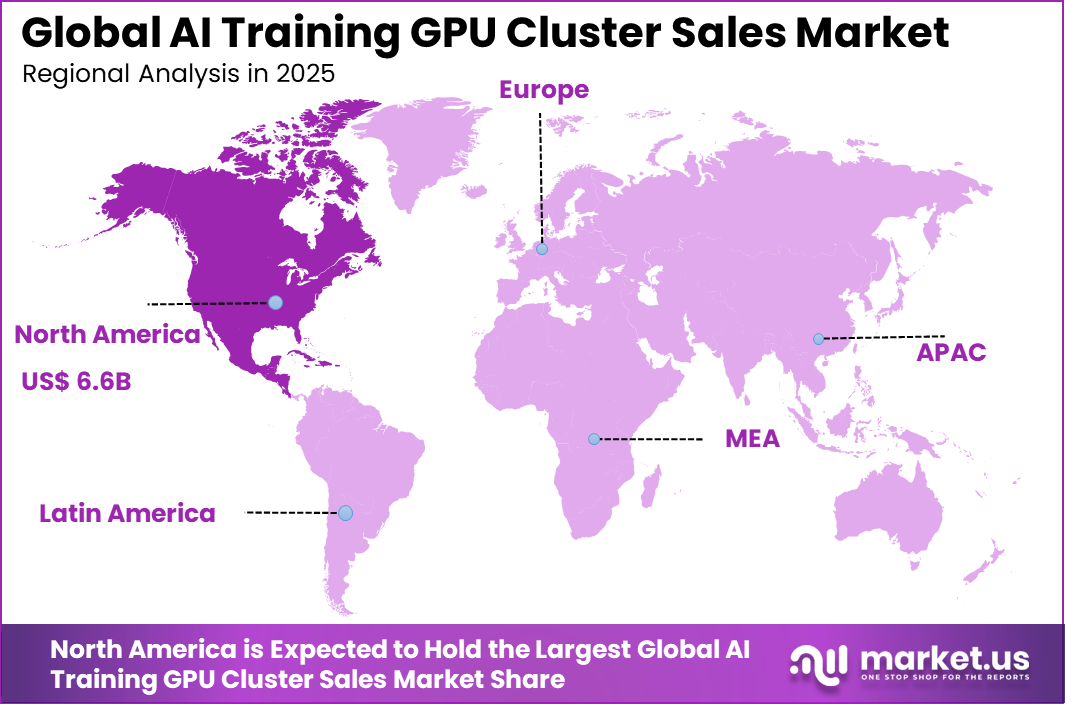

The Global AI Training GPU Cluster Sales Market size is expected to be worth around USD 87.5 Billion By 2035, from USD 18.2 billion in 2025, growing at a CAGR of 17.0% during the forecast period from 2026 to 2035. In 2025, North America held a dominan Market position, capturing more than a 36.5% share, holding USD 6.6 Billion revenue.

The AI training GPU cluster market consists of high-performance computing systems built from graphics processing units (GPUs) specifically configured to train large artificial intelligence models and execute complex machine learning workloads. These clusters provide parallel processing power that is essential for deep learning training tasks where traditional central processing units (CPUs) cannot meet performance requirements.

The market structure comprises hardware (GPUs and servers), supporting software (cluster management and orchestration tools), and services (integration, support, and maintenance) tailored to diverse industry needs. Adoption has accelerated across sectors including information technology, finance, healthcare, and automotive, where AI-driven innovation is strategically important. Vendors range from GPU manufacturers and cloud providers to systems integrators and specialized AI infrastructure firms.

Rapid advancements in artificial intelligence have driven demand for GPU-based clusters capable of handling large-scale model training. Complex models such as large language models and deep neural networks require distributed GPU resources to complete training efficiently, making clusters indispensable to modern AI development workflows. The need to reduce time-to-insight for AI research and product deployment has incentivized investment in high-performance clusters.

Enterprises aim to shorten development cycles, enhance accuracy of AI systems, and maintain competitiveness by accelerating training times and optimizing compute throughput. AI development trends suggest further acceleration in the need for GPU clusters. Complex generative models and real-time AI applications will continue to drive cluster usage as compute demands rise sharply, creating sustained growth prospects for the market.

Top Market Takeaways

- Hardware led the AI training GPU cluster sales market with a 78.5% share, as demand remained high for advanced GPUs, high-speed interconnects, and accelerator-optimized systems.

- Public cloud consumption accounted for 54.3%, reflecting strong preference for flexible and scalable access to large GPU clusters without long-term infrastructure commitments.

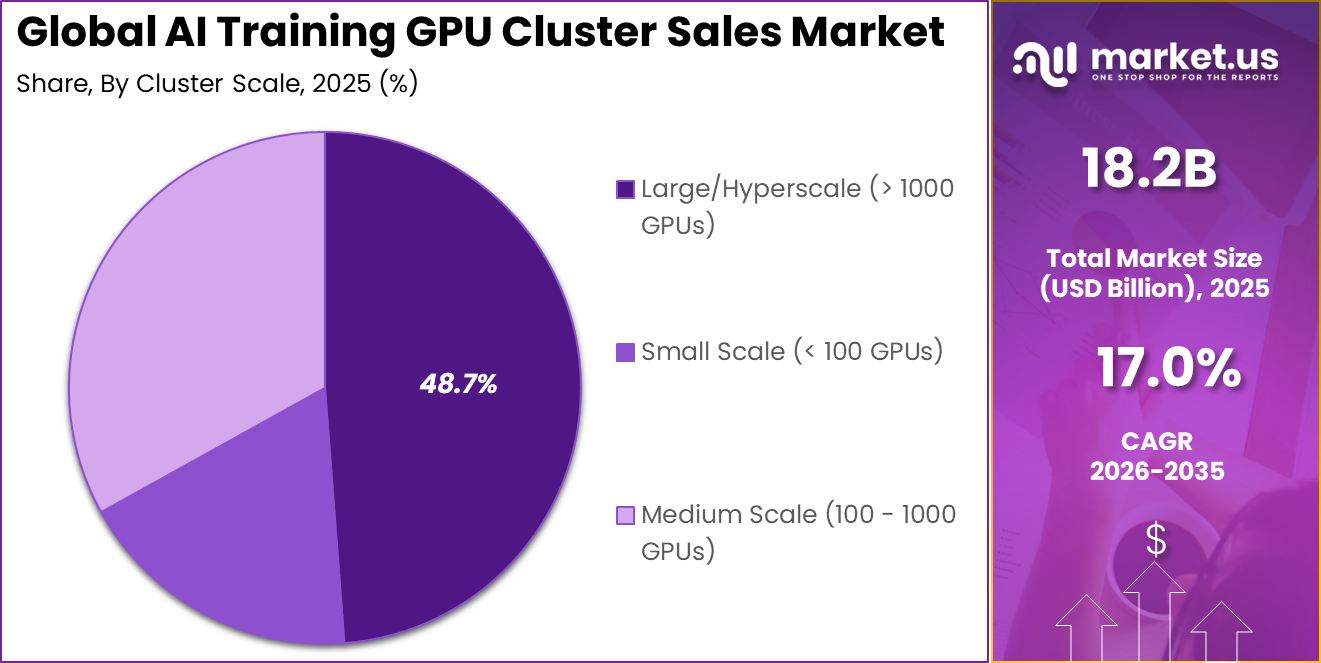

- Large and hyperscale clusters captured 48.7%, driven by the growing scale and complexity of AI model training workloads.

- Cloud service providers represented 62.8% of total demand, as they continue to expand GPU capacity to support enterprise and AI-native use cases.

- The IT and technology sector dominated with 65.9%, supported by continuous model development, retraining cycles, and innovation-led demand.

- North America held a 36.5% share, supported by advanced data center ecosystems and sustained investment in AI infrastructure.

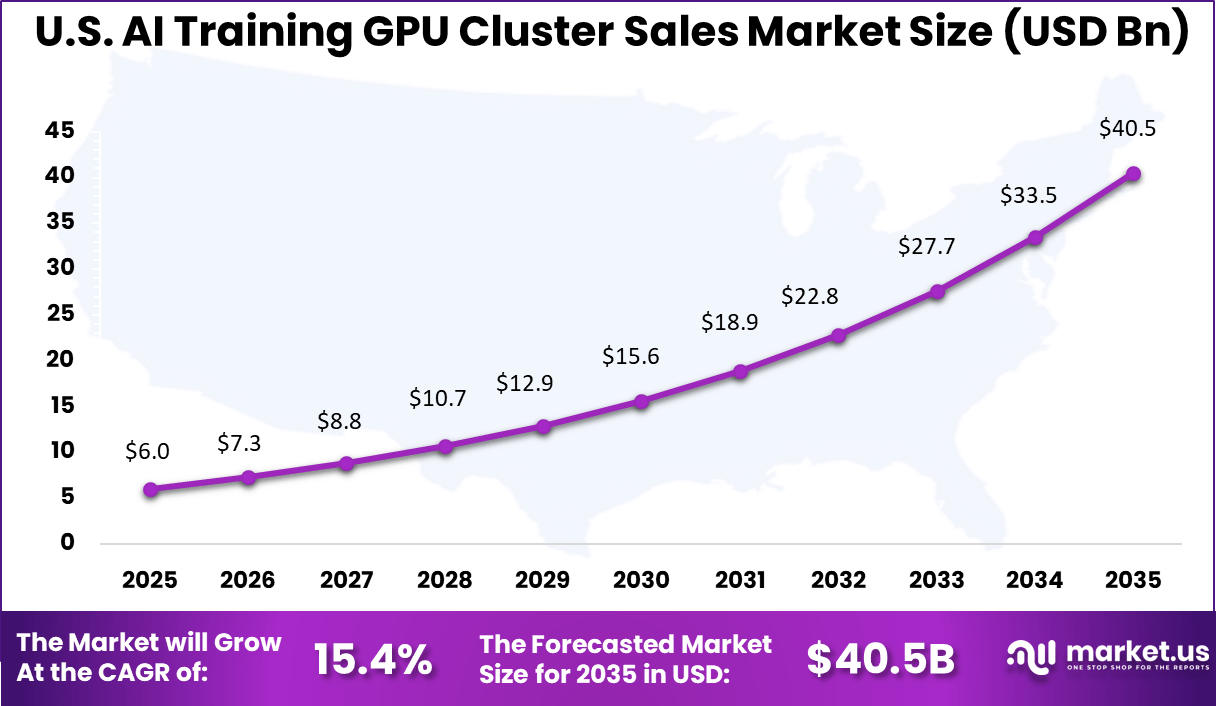

- The U.S. market reached USD 6.01 billion in 2024 and is expanding at a 15.42% CAGR, driven by large-scale AI training requirements and cloud-led capacity growth.

Quick Market Facts

Rising demand for generative AI and large language models pushes sales of GPU clusters, as training these requires immense parallel compute power. Cloud providers race to offer more capacity, with partnerships like Microsoft-NVIDIA fueling large orders for clusters. Hyperscalers invested nearly USD 200 billion in CapEx in 2024, much of it on GPU infrastructure. Supply chain expansions and government support for AI hardware also drive the market.

In India, USD 1.24 billion in approvals target at least 10,000 GPUs for new clusters. Asia Pacific grows fastest, led by China and Japan building AI data centers. GPU clusters pair with high-bandwidth memory and custom interconnects to speed up distributed training. Liquid cooling systems handle the high power density of dense racks running AI workloads. NVIDIA’s data center products took over 89% of its Q3 FY2026 revenue from such tech.

Heterogeneous CPU-GPU setups and software-defined networking boost performance for mixed workloads. Subscription leasing models make clusters accessible without huge upfront costs. Opportunities lie in edge AI expansions and new fabs with government subsidies. India’s sector adds 604 MW capacity by 2026 with USD 3.8 billion investment. Cooling tech firms see demand from heat-intensive setups. Networking providers benefit from cluster interconnect needs.

By Component

Hardware accounts for 78.5%, showing that physical computing infrastructure is the main driver of AI training GPU cluster sales. These hardware systems include GPUs, servers, networking equipment, and cooling components required for large-scale AI model training. High performance hardware is essential to process massive datasets efficiently. Reliability and compute density remain key purchasing factors.

The dominance of hardware is driven by increasing complexity of AI models and higher training workloads. Organizations invest heavily in advanced hardware to reduce training time and improve accuracy. Continuous upgrades in GPU architecture support sustained demand. Hardware remains the foundation of AI training environments.

By Deployment

Public cloud consumption holds 54.3%, reflecting strong preference for on-demand access to GPU clusters. Cloud deployment allows organizations to scale training resources without owning physical infrastructure. This model supports flexibility for varying training workloads. It also reduces upfront capital spending.

Growth in this segment is driven by ease of access and rapid provisioning. Organizations can start training models quickly using cloud-based clusters. Public cloud platforms also support collaboration across distributed teams. These advantages continue to strengthen adoption.

By Cluster Scale

Large and hyperscale clusters account for 48.7%, highlighting demand for high-capacity training environments. These clusters support training of large language models and complex AI systems. High cluster scale enables faster processing of massive datasets. Performance consistency is critical at this level.

Adoption of large clusters is driven by growing model size and data volume. Enterprises and cloud providers invest in hyperscale systems to stay competitive. These clusters improve training efficiency and reduce time to deployment. Demand continues to rise with AI advancement.

By End User

Cloud service providers represent 62.8%, making them the largest end-user group. CSPs offer GPU clusters as a service to enterprises, startups, and research organizations. They manage large infrastructure environments to support diverse AI workloads. High utilization rates support their investments.

Adoption by CSPs is driven by growing demand for AI training services. Providers expand GPU capacity to attract customers and improve service offerings. Scalable infrastructure allows them to meet fluctuating workload needs. This strengthens their role in the market.

By Industry Vertical

The IT and technology sector holds 65.9%, reflecting strong adoption of AI training infrastructure. Companies in this sector develop software, platforms, and AI-based products. GPU clusters are essential for model development and testing. Continuous innovation drives infrastructure demand.

Growth in this segment is supported by rapid AI integration across products and services. Technology firms invest in training capabilities to maintain competitiveness. GPU clusters enable faster experimentation and deployment. This sustains long-term demand.

By Region

North America accounts for 36.5%, supported by advanced cloud infrastructure and strong AI adoption. Organizations in the region invest heavily in AI training capabilities. High availability of technical expertise supports market growth. Infrastructure readiness remains a key advantage.

The United States reached USD 6.01 Billion with a CAGR of 15.42%, reflecting steady expansion of GPU cluster sales. Growth is driven by rising AI workloads and cloud-based training demand. Enterprises and CSPs continue to scale infrastructure. AI investment remains a strategic priority.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Deployment

- On-premises

- Public Cloud

By Cluster Scale

- Large/Hyperscale (> 1000 GPUs)

- Small Scale (< 100 GPUs)

- Medium Scale (100 – 1000 GPUs)

By End-User

- Cloud Service Providers (CSPs) & Hyperscalers

- Large Enterprises & Technology Companies

- Research Institutions & Academia

- Government & Defense Agencies

By Industry Vertical

- IT & Technology

- Financial Services

- Automotive & Manufacturing

- Healthcare & Pharmaceuticals

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

One of the strongest drivers of the AI training GPU cluster sales market is the rapid increase in model size and training complexity. Modern AI models require massive parallel computing power to process large datasets efficiently. Traditional computing systems are unable to meet these performance demands within reasonable timeframes. As a result, organizations are increasingly investing in GPU clusters to accelerate AI development cycles.

Another important driver is the growing adoption of AI across core business operations. Enterprises are integrating AI into product design, customer analytics, fraud detection, and scientific research. These use cases demand high-performance infrastructure that can support continuous model training and refinement. GPU clusters provide the scalability and reliability needed to support such workloads.

Restraint

High upfront capital investment is a key restraint affecting the adoption of AI training GPU clusters. Purchasing GPUs, networking equipment, and supporting infrastructure requires significant financial resources. Smaller organizations often struggle to justify these costs, especially when returns are not immediate. This limits adoption primarily to large enterprises and well-funded research institutions.

Operational costs also act as a restraint for market growth. GPU clusters consume substantial power and require advanced cooling systems to maintain performance stability. Maintenance and skilled workforce requirements further increase total cost of ownership. These factors slow down adoption in cost-sensitive markets.

Opportunity

A major opportunity lies in the expansion of cloud-based AI training services. Cloud providers offer on-demand access to GPU clusters, allowing organizations to scale resources without heavy capital investment. This model lowers entry barriers for startups, research teams, and mid-sized enterprises. As AI adoption broadens, demand for flexible GPU access continues to rise.

Another opportunity is the growing interest in industry-specific AI solutions. Sectors such as healthcare, automotive, and financial services are developing customized AI models for their unique needs. This drives demand for specialized GPU cluster configurations optimized for particular workloads. Vendors offering tailored solutions are well positioned to capture this opportunity.

Challenge

Energy efficiency remains a significant challenge for the AI training GPU cluster market. Dense GPU deployments consume large amounts of electricity, increasing operational costs and environmental concerns. Data centers must balance performance with sustainability targets. Managing energy usage without compromising training speed is an ongoing challenge.

Another challenge is supply chain dependency for advanced GPUs. Limited manufacturing capacity and high global demand can lead to shortages and longer delivery times. This creates uncertainty for organizations planning large-scale deployments. Ensuring stable access to hardware remains a critical issue for market participants.

Competitive Analysis

The competitive landscape of the AI training GPU cluster market is highly concentrated around a small number of technology providers. Competition is driven by performance efficiency, scalability, and ecosystem compatibility. Vendors that offer integrated hardware and software solutions gain a competitive advantage. Strategic partnerships with cloud providers further strengthen market positioning.

Smaller players compete by focusing on niche offerings such as optimized cluster design or specialized AI workloads. Innovation in cooling systems, interconnect technologies, and cluster management software is becoming a key differentiator. Customers increasingly evaluate vendors based on long-term support and system reliability. This keeps competition active and technology-driven.

Top Key Players in the Market

- NVIDIA Corporation

- Advanced Micro Devices, Inc. (AMD)

- Intel Corporation

- Dell Technologies, Inc.

- Hewlett Packard Enterprise Company (HPE)

- Super Micro Computer, Inc.

- Lenovo Group, Ltd.

- IBM Corporation

- Google LLC

- Amazon Web Services, Inc.

- Microsoft Corporation

- Oracle Corporation

- Cisco Systems, Inc.

- Penguin Computing

- Lambda, Inc.

- Others

Recent Developments

- October, 2025 – NVIDIA confirmed Blackwell GPUs (B100/B200/GB200) are sold out through 2025, with over 3.6 million units backlogged and priority to hyperscalers like AWS, Google Cloud and Microsoft Azure, forcing enterprises to plan multi-year AI capacity.

- September, 2025 – AMD Instinct MI300X clusters from Dell and Supermicro topped MLPerf Inference v5.1 rankings, showing near-linear scaling across 8-node setups and heterogeneous MI300X/MI325X mixing for production AI training/inference.

- May, 2025 – Dell launched PowerEdge servers with NVIDIA Blackwell Ultra, scaling to 192–256 GPUs per rack in air/liquid-cooled configs for 4x faster AI model training, named Market Leader for AI servers in 2025 reports.

Report Scope

Report Features Description Market Value (2025) USD 18.2 Bn Forecast Revenue (2035) USD 87.5 Bn CAGR(2026-2035) 17% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Deployment (On-premises, Public Cloud), By Cluster Scale (Small Scale (< 100 GPUs), Medium Scale (100–1000 GPUs), Large/Hyperscale (> 1000 GPUs)), By End-User (Cloud Service Providers (CSPs) & Hyperscalers, Large Enterprises & Technology Companies, Research Institutions & Academia, Government & Defense Agencies), By Industry Vertical (IT & Technology, Financial Services, Automotive & Manufacturing, Healthcare & Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape NVIDIA Corporation, Advanced Micro Devices, Inc. (AMD), Intel Corporation, Dell Technologies, Inc., Hewlett Packard Enterprise Company (HPE), Super Micro Computer, Inc., Lenovo Group, Ltd., IBM Corporation, Google LLC, Amazon Web Services, Inc., Microsoft Corporation, Oracle Corporation, Cisco Systems, Inc., Penguin Computing, Lambda, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI Training GPU Cluster Sales MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

AI Training GPU Cluster Sales MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- NVIDIA Corporation

- Advanced Micro Devices, Inc. (AMD)

- Intel Corporation

- Dell Technologies, Inc.

- Hewlett Packard Enterprise Company (HPE)

- Super Micro Computer, Inc.

- Lenovo Group, Ltd.

- IBM Corporation

- Google LLC

- Amazon Web Services, Inc.

- Microsoft Corporation

- Oracle Corporation

- Cisco Systems, Inc.

- Penguin Computing

- Lambda, Inc.

- Others