Global AI Tablet Market Size, Share, Industry Analysis Report By Product (Detachable, Slate), By Operating System (Android, iOS, Windows), By Screen Size (8’’, 8’’ and Above), By End User (Consumer, Commercial), By Distribution Channel (Online, Offline) , By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 163675

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of Generative AI

- Investment and Business Benefits

- U.S. AI Tablet Market Size

- Product Analysis

- Operating System Analysis

- Screen Size Analysis

- End User Analysis

- Distribution Channel Analysis

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

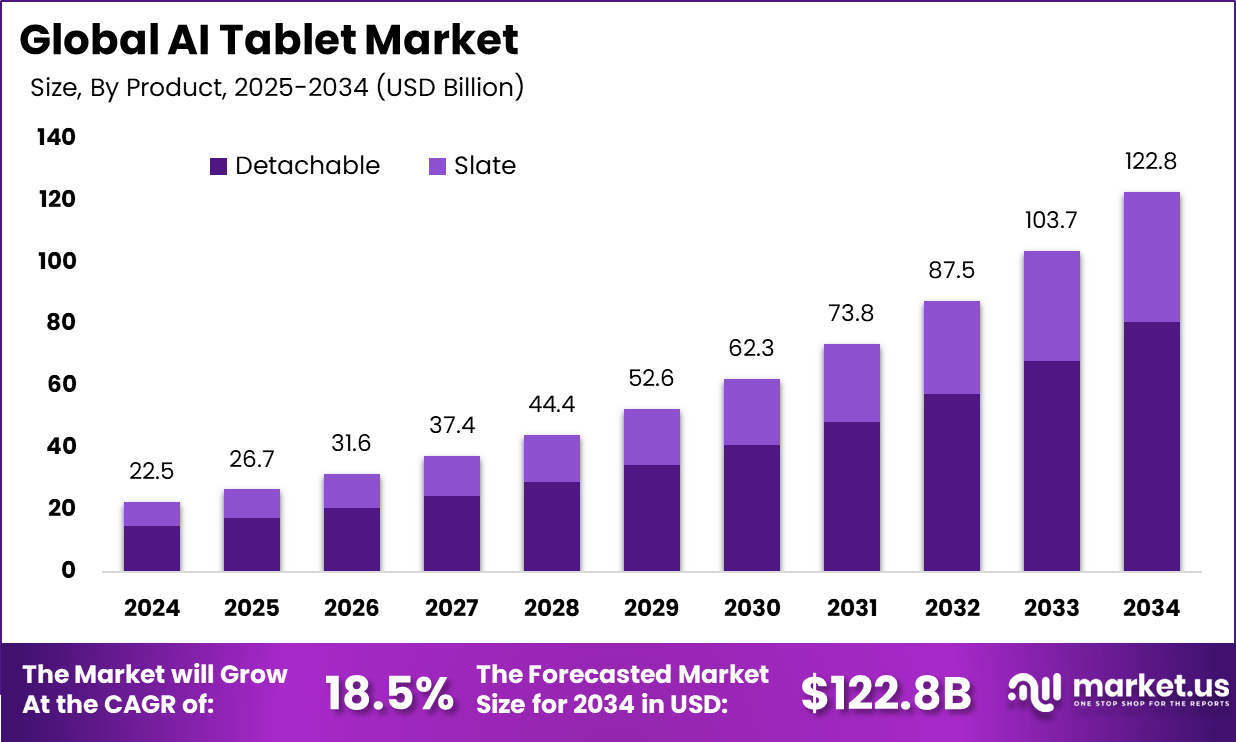

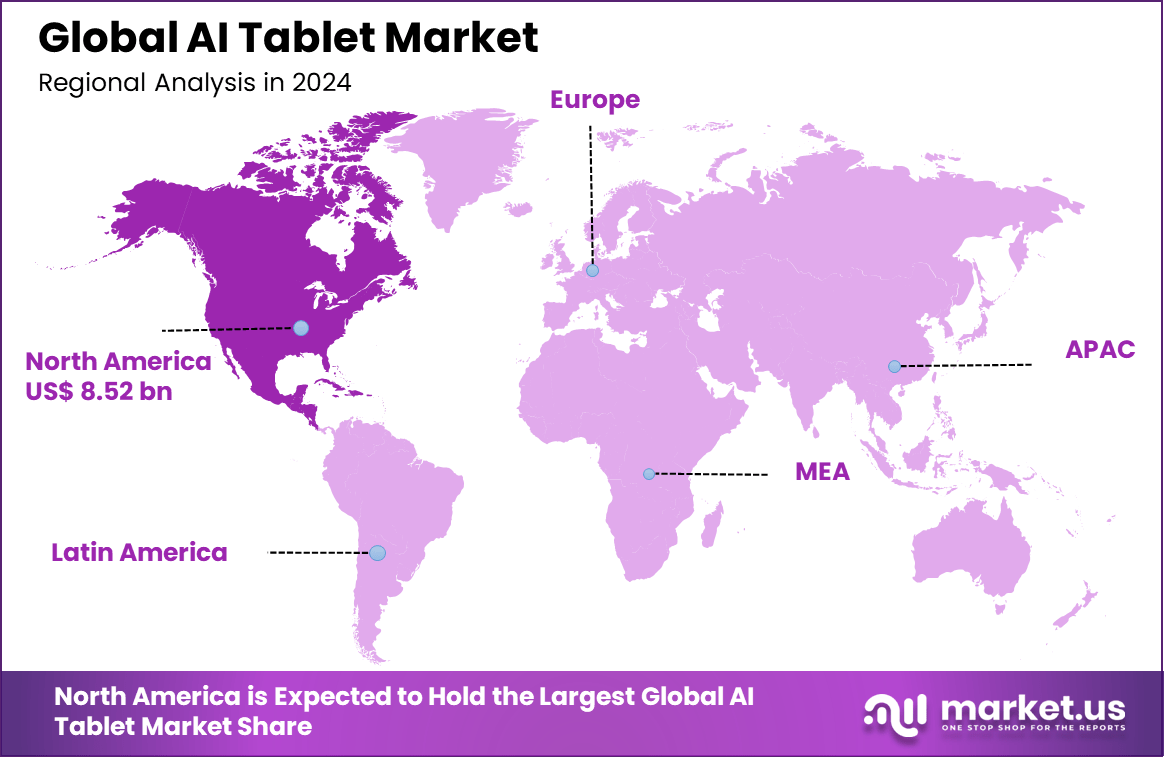

The Global AI tablet Market size is expected to be worth around USD 122.8 billion by 2034, from USD 22.5 billion in 2024, growing at a CAGR of 18.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 37.9% share, holding USD 8.52 billion in revenue.

The AI tablet market is growing steadily, driven by the integration of advanced artificial intelligence features such as image recognition, natural language processing, and personalized user experiences. These features enhance engagement for various user groups, including students, professionals, and everyday consumers looking for smart, seamless technology. Improvements in processor speed and energy efficiency allow complex AI tasks to run smoothly on tablets, supporting diverse applications from education to enterprise work.

Top driving factors include the adoption of cloud-based AI services, which reduce hardware demands while offering powerful AI capabilities. Increasing internet penetration and mobile device adoption worldwide contribute significantly to this growth, especially in regions like North America. The growing importance of personalized learning and productivity tools powered by AI continues to push demand higher.

Demand analysis points to strong consumer and professional interest fueled by continuous innovation in AI technologies such as AR/VR integration and edge computing that enable real-time data processing. Advances in battery life and device performance remain critical purchase drivers. With yearly revenue growth in the tablet space reaching double digits, AI-enabled tablets are becoming key instruments for productivity and entertainment, accounting for an expanding share of the global tablet market.

For instance, in August 2025, Samsung announced the pre-reservation for its upcoming AI-powered tablet, offering early access and additional benefits to customers who book in advance. The new tablet incorporates advanced AI features designed to enhance user experience, productivity, and device performance. Samsung aims to provide seamless integration with its ecosystem, empowering users with smarter multitasking, personalized assistance, and adaptive display capabilities.

Key Takeaway

- By product, detachable tablets dominate with 65.7%, driven by the growing demand for hybrid devices offering both portability and productivity.

- By operating system, Android holds 58.7%, reflecting its affordability, customization options, and wide developer ecosystem.

- By screen size, the 8-inch segment leads with 62.6%, favored for its balance between usability and mobility.

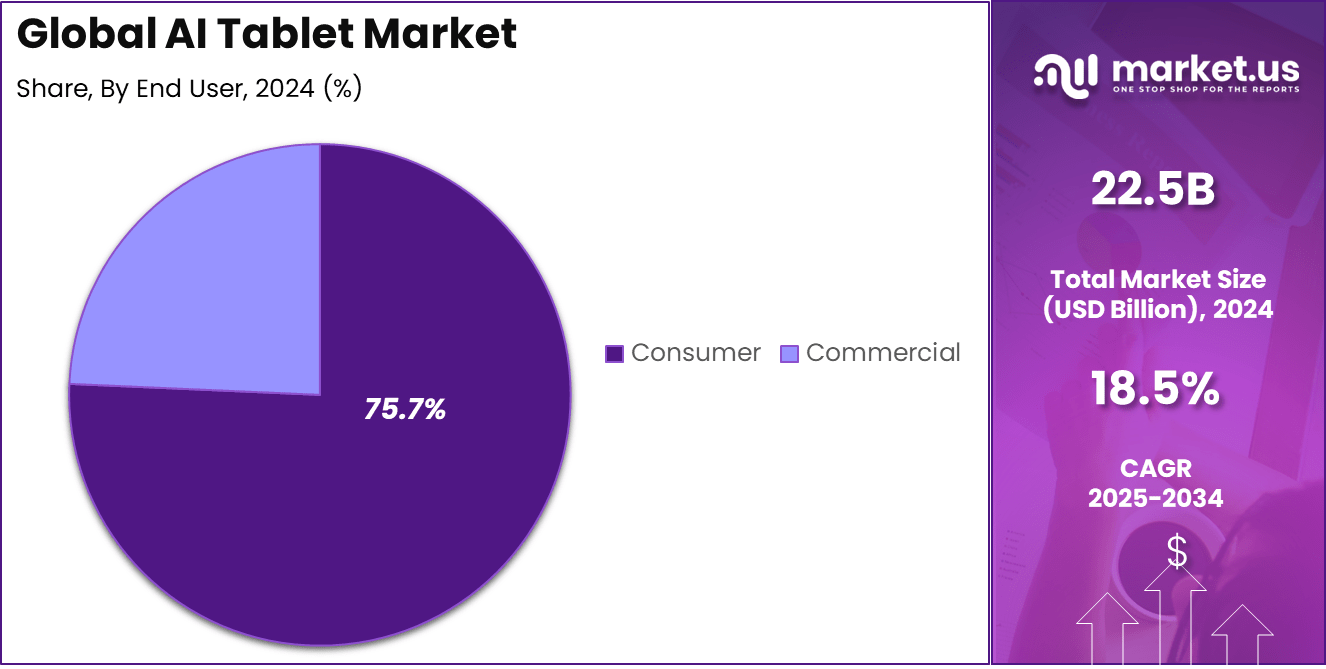

- By end user, consumers represent 75.7%, showcasing high adoption for entertainment, education, and personal productivity.

- By distribution channel, offline sales account for 60.8%, indicating continued consumer preference for in-store experiences and direct device interaction.

- North America captures 37.9%, supported by strong retail presence and integration of AI-driven features in consumer electronics.

- The US market reached USD 7.34 billion and is growing at a healthy CAGR of 15.6%, underscoring robust demand for AI-enabled tablets across households and enterprises.

Role of Generative AI

Generative AI has transformed AI tablets from simple tools into smart assistants capable of creating content and personalizing user experiences. About 53% of people using generative AI apply it for personal tasks, with 30% for work purposes. This technology allows AI tablets to help users write, design, and solve problems on the go, improving productivity and making interactions more efficient.

Its ability to learn and generate outputs in real time has made AI tablets valuable for both casual and professional use. The presence of generative AI in tablets also enables faster, more customized responses, making them clever companions for daily tasks.

Around 40% of adults regularly engage with generative AI, showing how integral it is becoming in supporting creative and administrative work. This delivers a more natural, interactive experience, turning tablets into devices that provide active assistance rather than just passive tools.

Investment and Business Benefits

Investment opportunities within the AI tablet market highlight a growing focus on research and development to advance AI functionalities, improve battery life, and integrate novel sensors. Markets with robust digital infrastructure and rising acceptance of AI technologies present attractive entry points for investors.

Strategies often involve forming partnerships with AI platform providers to access cutting-edge algorithms. The Asia-Pacific region, showing consumer demand growth upward of 20% in several countries, remains a particularly promising landscape for investment. Business benefits from AI tablets include increased productivity, automated routine tasks, and elevated customer experience through smarter interactions.

Enterprises deploying these devices experience improved decision-making processes by leveraging AI data insights. Smaller companies benefit from AI tools that optimize resource management without heavy technical overhead. Enhanced security features powered by AI also foster trust and compliance in sensitive environments.

U.S. AI Tablet Market Size

The market for AI tablets within the U.S. is growing tremendously and is currently valued at USD 7.34 billion, the market has a projected CAGR of 15.6%. The market is growing due to the rising consumer concerns about home security and the increasing adoption of smart home technologies. Homeowners are seeking advanced features such as AI-powered person detection, high-definition video, and night vision to enhance their doorstep security.

Furthermore, the integration of AI with voice assistants and mobile connectivity improves user convenience and control over home access. Reduced hardware costs and expanding online and offline distribution channels further fuel market expansion. The focus on improving device reliability and battery life also supports adoption.

For instance, in October 2025, Apple introduced the powerful new iPad Pro featuring the M5 chip, which delivers up to 3.5x AI performance improvement over previous models. The iPad Pro also includes Wi-Fi 7 support and enhanced cellular connectivity, targeting professional creatives and productivity users seeking advanced AI capabilities.

In 2024, North America held a dominant market position in the Global AI tablet Market, capturing more than a 37.9% share, holding USD 8.52 billion in revenue. This dominance is due to the region’s strong adoption of smart home technologies, high consumer awareness regarding home security, and widespread availability of products through various retail and online channels.

The integration of AI-enabled features such as facial recognition and real-time alerts resonates strongly with security-conscious consumers. Additionally, North America benefits from early IoT technology adoption, high disposable incomes, and compatibility with popular smart home platforms like Amazon Alexa and Google Home. These factors collectively drive robust market growth and make North America one of the most mature and lucrative markets globally.

For instance, in May 2025, Dell advanced its enterprise AI innovation by launching AI infrastructure solutions, including AI-powered laptops and edge computing servers. These developments aim to accelerate AI adoption in business environments with improved performance and security through AI Factory’s collaboration with NVIDIA.

Product Analysis

In 2024, The Detachable segment held a dominant market position, capturing a 65.7% share of the Global AI tablet Market. These tablets offer a unique benefit of switching between device modes, blending the portability of a tablet with the functionality of a laptop. Their appeal lies in versatility, attracting both casual users and professionals who need adaptable devices for work and play.

Advancements in AI have enhanced these devices with features such as voice recognition, personalized task management, and predictive analytics. This ongoing innovation strengthens their market presence by meeting growing consumer demand for smart, multifunctional tools that streamline daily tasks and improve productivity.

For Instance, in September 2025, Acer launched new Iconia series tablets, including the detachable Iconia X12 and X14, at IFA 2025. These devices feature AMOLED and OLED displays with advanced AI tools such as gesture control and posture sensing powered by dedicated AI processors, emphasizing the company’s innovation in detachable AI tablets.

Operating System Analysis

In 2024, the Android segment held a dominant market position, capturing a 58.7% share of the Global AI tablet Market. This dominance is due to its wide adaptability and the open-source ecosystem it supports. This operating system allows manufacturers to customize devices to cater to various consumer needs and budgets, making AI tablets more accessible to a broad audience.

Moreover, Android’s extensive app availability and integration with Google services provide users with a seamless experience. These factors combine to maintain Android’s appeal, especially among consumers seeking affordability without compromising on AI-enhanced functionalities.

For instance, in September 2025, Lenovo unveiled its Yoga Tab and Idea Tab Plus at IFA 2025, both running on Android and packed with AI features such as AI Live Transcript and Smart Capture. The devices offer premium displays and targeted AI-driven productivity tools for creative and everyday users, solidifying Android’s leadership in AI tablets.

Screen Size Analysis

In 2024, The 8 inches segment held a dominant market position, capturing a 62.6% share of the Global AI tablet Market. This dominance is due to its size being favored by many users, balancing portability with sufficient screen real estate to comfortably browse, read, and perform productivity tasks. The compact form allows for easy one-handed use and fits well into bags, making these devices ideal companions for travel and daily commutes.

The popularity of 8-inch tablets stems from their versatility, suiting consumers who want a device for both entertainment and work on the go. This size supports multitasking and content consumption without the bulk of larger tablets, contributing to its dominant market share.

For Instance, in June 2025, Xiaomi launched the Mi Pad 4, an affordable 8-inch tablet featuring a Full HD+ IPS display with a 16:10 aspect ratio. Powered by a Qualcomm Snapdragon 660 processor, it offers variants with 3GB or 4GB RAM and up to 64GB storage. The tablet’s front camera supports an AI-based Face Unlock feature, comparable to Apple’s Face ID, enhancing security and convenience.

End User Analysis

In 2024, The Consumer segment held a dominant market position, capturing a 75.7% share of the Global AI tablet Market. This dominance is due to the increasing incorporation of AI features that improve entertainment, communication, and productivity at home and on the go. Tablets have become integral to daily digital interactions, supporting media consumption, gaming, and smart home connectivity.

Consumers benefit from AI capabilities like personalized content delivery, voice-activated assistants, and learning enhancements, which add significant value to these devices. The large consumer base seeking these features continues to propel growth and innovation in AI tablet offerings tailored for personal use.

For Instance, in October 2025 introduced a new iPad Pro with the M5 chip, significantly boosting AI performance for personal and professional consumers. This launch illustrates how consumer demand is driving AI integration in tablets to deliver advanced user experiences through faster AI processing and smart OS features.

Distribution Channel Analysis

In 2024, The Offline segment held a dominant market position, capturing a 60.8% share of the Global AI tablet Market. Brick-and-mortar stores, electronics retailers, and carrier outlets remain essential for consumers who prefer to see and test devices before purchase. Offline channels also provide direct access to local support and immediate availability, which can be crucial for customers prioritizing hands-on experience.

Despite the rise of online sales, the offline segment retains its importance in many regions due to customer trust, effective marketing displays, and bundled service offers. Retailers continue enhancing in-store experiences with demo zones and personalized assistance to maintain offline sales strength.

For Instance, in May 2025, Dell’s launch of Dell Plus AI laptops and 2-in-1 devices, available through Dell Exclusive Stores and physical retailers in India, underscores the continued importance of offline retail channels in AI device distribution. Consumers prefer in-person service and product experience when purchasing such AI-powered tablets and PCs.

Emerging trends

A significant emerging trend is the rise of AI tablets as practical laptop alternatives, blending high performance with portability and AI-powered features. Around 43% of tablet shipments in certain markets now include AI-driven enhancements such as adaptive display settings, multitasking optimizations, and smart assistant integration.

User demand for tablets that can support complex tasks like creative workflows and business productivity is pushing manufacturers to embed cutting-edge AI processors and software tailored for these uses. Another notable trend is the integration of AI in educational tablets, where personalized learning powered by AI is growing rapidly.

Personalized content delivery and adaptive assessment systems driven by AI algorithms represent over 25% of new educational tablet applications. This makes learning more engaging and efficient, allowing students to progress at their own pace with tools that adjust to their needs. Overall, AI is driving both consumer and educational tablet markets toward more intelligent, versatile devices.

Growth Factors

One of the main growth drivers for AI tablets is the increasing consumer appetite for smarter, more interactive devices that can handle multitasking and creative tasks simultaneously. The percentage of users seeking AI-enhanced capabilities in tablets has grown by more than 30% year over year, fueled by improvements in processor technology and AI algorithms that deliver faster, more intuitive user experiences.

This makes AI tablets especially attractive for professionals and students, accessible to a broader range of users. Charging speeds, battery life improvements, and AI-powered power management systems contribute to the appeal. Markets report that over 40% of new tablet models released in 2025 include AI-driven battery and performance optimizations, reflecting strong development efforts to meet user needs effectively in this competitive space.

Key Market Segments

By Product

- Detachable

- Slate

By Operating System

- Android

- iOS

- Windows

By Screen Size

- 8 inches

- 8 inches and Above

By End User

- Consumer

- Commercial

By Distribution Channel

- Online

- Offline

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Enhanced AI Capabilities Boost Adoption

The integration of advanced AI functions such as voice recognition, natural language processing, and personalized assistance is significantly increasing the appeal of AI tablets. These features improve how users interact with their devices, offering smarter and more intuitive experiences that go beyond conventional tablet capabilities.

Users benefit from AI that can adapt to their needs, making these tablets more useful for work, education, and entertainment. Behind this adoption is the continuous improvement in hardware that supports AI processes efficiently. Faster processors and optimized energy use allow complex AI algorithms to run smoothly. This technical progress encourages manufacturers to push the boundaries of what AI tablets can do, helping to expand their appeal across diverse user groups.

For instance, In September 2025, Acer introduced new AI-powered tablets and laptops at IFA 2025, featuring AMD Ryzen AI processors and AI-enhanced performance for creative and professional users. The company’s focus on generative AI and smart productivity tools highlights how advanced AI capabilities are driving user adoption through improved efficiency and experience.

Restraint

High Cost Limits Accessibility

One barrier limiting the widespread adoption of AI tablets is their premium price compared to regular tablets. This higher cost makes it difficult for many consumers to justify upgrading, especially in markets where budget options are preferred. The expense creates a divide, with AI tablets often remaining out of reach for cost-conscious buyers who still desire advanced features.

Furthermore, keeping AI technology updated and effective requires ongoing investment from producers, which contributes to sustaining these higher prices. Until there is a significant drop in production costs or widespread availability of more affordable options, the high price tag will continue to hold back many potential users from the market.

For instance, in January 2025, HP revealed high-end AI-powered laptops and tablets like the EliteBook series with powerful AI SoCs that come at premium prices aimed at enterprise users. These offerings, while cutting-edge, highlight cost challenges in broader consumer adoption of AI tablets outside professional markets.

Opportunities

Expanding Educational Use

Educational institutions are increasingly interested in AI tablets because of their ability to customize learning experiences for students. These devices can support tailored lessons, interactive content, and real-time feedback that help engage learners more effectively than traditional methods. This growing interest presents a promising market where AI tablets can play a central role in digital education transformation.

Additionally, the rise of digital learning platforms creates new ways to integrate AI tablets into classrooms and remote learning setups. Companies have an opportunity to design AI tablet solutions that directly address the unique challenges and needs of education systems.

For instance, in September 2025, Lenovo launched AI-powered Yoga Tab and Idea Tab Plus models featuring AI-driven productivity and creative tools preloaded with specialized apps like Adobe Creative Suite. These tablets target both professional creators and educational users, signaling Lenovo’s push to leverage AI tablets for education through adaptive learning and content creation capabilities.

Challenges

Data Privacy Concerns

The reliance of AI tablets on collecting and processing personal data raises ongoing privacy issues for users. Many people are cautious about how their information is handled, worrying about unauthorized access or misuse. This concern can create resistance to adopting AI tablets, especially in regions with strict privacy laws or strong user awareness about data protection.

To overcome this challenge, manufacturers must prioritize strong security measures and clear privacy policies to earn users’ trust. Transparency about data use and vigilance in protecting sensitive information are essential for addressing these worries and supporting broader acceptance of AI tablets.

For instance, in 2025, multiple players, including Apple and Microsoft, emphasize the need for strong privacy and security features within their AI tablets to address increasing user and regulatory concerns over data protection. Apple’s development of AI-powered devices with integrated HomeKit and secure processing aims to build user trust through on-device AI processing and stringent privacy controls.

Key Players Analysis

Apple Inc., Samsung Electronics Co., Ltd., and Huawei Technologies Co., Ltd. are leading the AI Tablet Market with advanced smart features and strong brand ecosystems. Their tablets use AI for real-time performance optimization, battery efficiency, and adaptive user interfaces. Xiaomi Corporation is also gaining traction by introducing AI-powered tablets with integrated voice assistants and smart display capabilities, making devices more interactive and personalized for users in entertainment and productivity applications.

Microsoft Corporation, Dell Technologies Inc., and Hewlett-Packard Company are focusing on AI-driven productivity tools. Their tablets support natural language processing, voice control, and predictive typing features for improved business and education use. Lenovo Group Limited and ASUSTek Computer Inc. are emphasizing hybrid models that use machine learning to enhance multitasking performance and device responsiveness, helping users work seamlessly across multiple apps and platforms.

Acer Inc., Nokia Corporation, and Panasonic Holdings Corporation target niche sectors such as education, healthcare, and industrial operations. They are developing AI-enabled tablets with enhanced security, remote management, and real-time monitoring functions. Other emerging players are investing in AI capabilities like gesture recognition and intelligent content generation, which indicate a steady shift toward more adaptive and context-aware tablet experiences.

Top Key Players in the Market

- Acer Inc.

- Apple Inc.

- ASUSTek Computer Inc.

- Dell Technologies Inc.

- Hewlett-Packard Company

- Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)

- Lenovo Group Limited

- Microsoft Corporation

- Nokia Corporation

- Panasonic Holdings Corporation

- Samsung Electronics Co. Ltd.

- Xiaomi Corporation

- Other Major Players

Recent Developments

- In September 2025, Acer Inc. launched new AI-enabled tablets, Iconia X12 and Iconia X14, at IFA 2025, featuring AMOLED displays, AI Smart Sensing for gesture control, and improved battery life. Acer also expanded its AI PC portfolio, including Copilot+ laptops, focusing on real-world AI solutions and sustainability initiatives in its device lineup.

- In October 2025, Apple Inc. introduced the new iPad Pro powered by the M5 chip, delivering up to 3.5x AI performance boost over previous models. The iPad Pro features Wi-Fi 7 support, enhanced cellular performance, and runs on the latest iPadOS 26, aimed at professional creatives and productivity users.

Report Scope

Report Features Description Market Value (2024) USD 22.5 Bn Forecast Revenue (2034) USD 122.8 Bn CAGR(2025-2034) 18.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product (Detachable, Slate), By Operating System (Android, iOS, Windows), By Screen Size (8’’, 8’’ and Above), By End User (Consumer, Commercial), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Acer Inc., Apple Inc., ASUSTek Computer Inc., Dell Technologies Inc., Hewlett-Packard Company, Huawei Technologies Co. Ltd. (Huawei Investment & Holding Co., Ltd.), Lenovo Group Limited, Microsoft Corporation, Nokia Corporation, Panasonic Holdings Corporation, Samsung Electronics Co. Ltd., Xiaomi Corporation, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Acer Inc.

- Apple Inc.

- ASUSTek Computer Inc.

- Dell Technologies Inc.

- Hewlett-Packard Company

- Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)

- Lenovo Group Limited

- Microsoft Corporation

- Nokia Corporation

- Panasonic Holdings Corporation

- Samsung Electronics Co. Ltd.

- Xiaomi Corporation

- Other Major Players