Global AI Supercomputer Market Size, Share, Industry Analysis Report By Component (Hardware, Software, Services), By Deployment Mode (Cloud-based, On-Premises), By Technology (Machine Learning (ML)/Deep Learning (DL), Natural Language Processing (NLP), Computer Vision), By Application (AI Research & Model Training, Drug Discovery & Healthcare, Autonomous Systems, Financial Modeling, Climate & Weather Research, Others), By End-User (Hyperscalers & Cloud Providers, Government & Defense Labs, Academic & Research Institutions, Enterprises), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 167716

- Number of Pages: 232

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

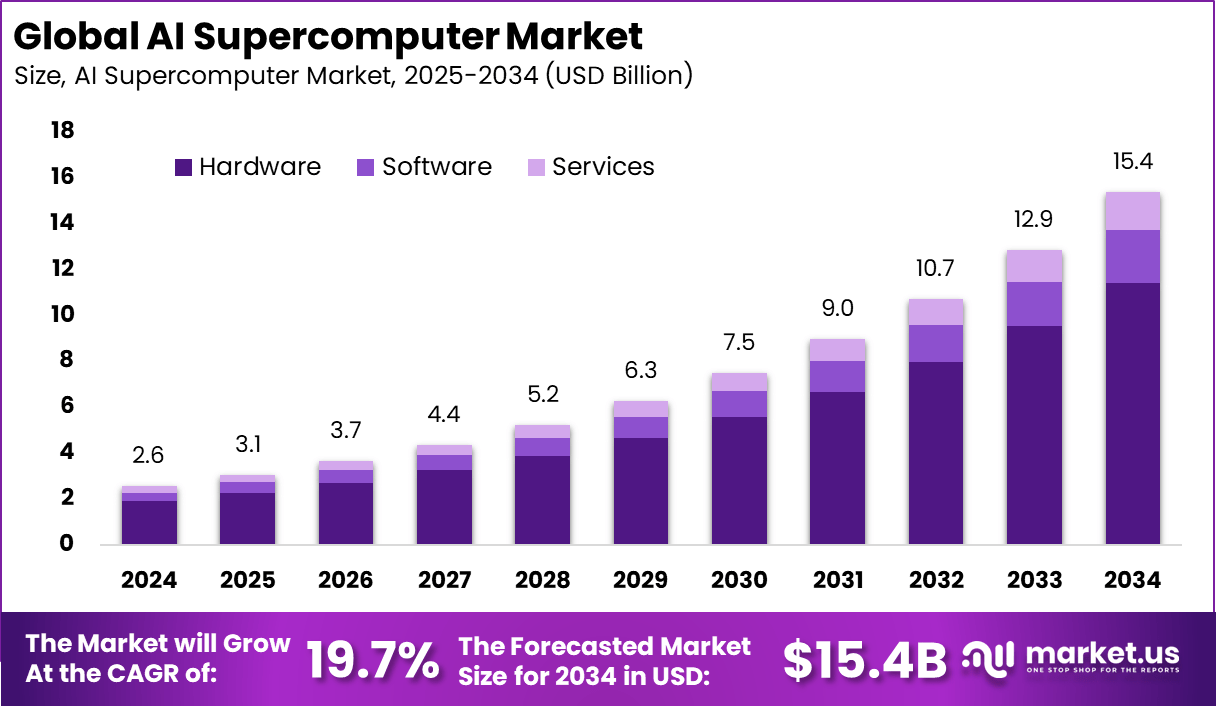

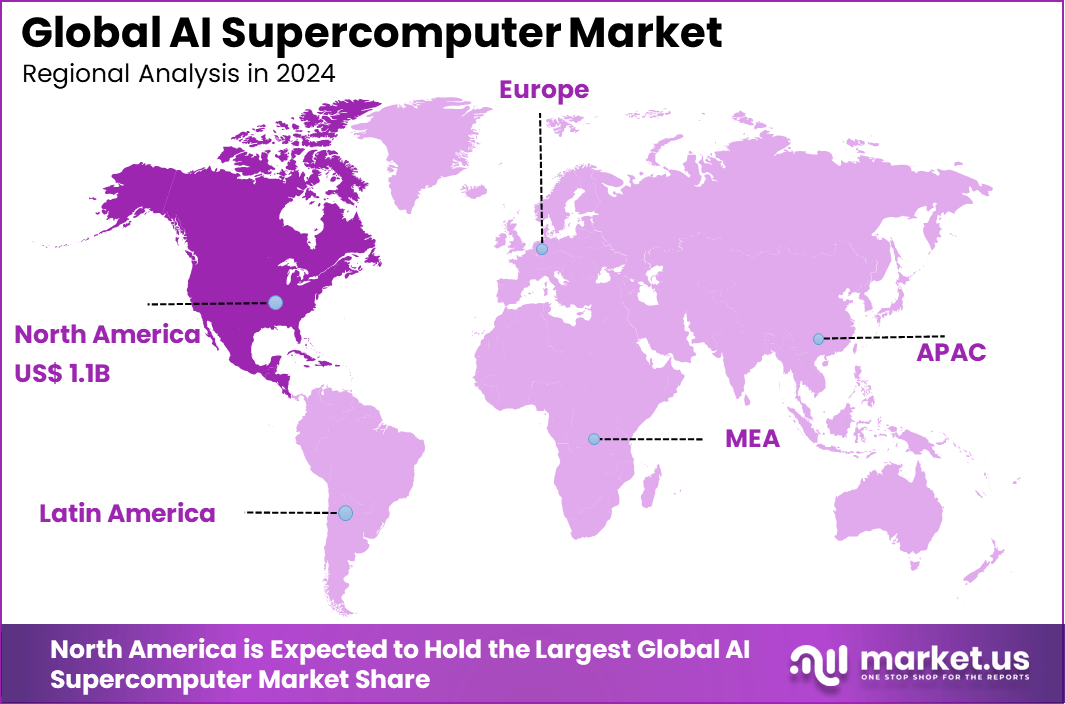

The Global AI Supercomputer Market generated USD 2.6 billion in 2024 and is predicted to register growth from USD 3.1 billion in 2025 to about USD 15.4 billion by 2034, recording a CAGR of 19.7% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 42.5% share, holding USD 1.1 Billion revenue.

The AI supercomputer market has expanded as organisations require powerful computing systems to train large scale AI models, support scientific research and run complex simulations. Growth reflects rising demand for high performance computing resources and the increasing role of AI in advanced analytics. These systems combine accelerated processors, high bandwidth memory and specialised interconnects to deliver very high compute density for intensive workloads.

The growth of the market can be attributed to increasing use of generative AI, expansion of scientific research programs and the need for faster model training. Industries such as healthcare, climate research, advanced manufacturing and defence rely on AI supercomputers to process massive datasets. Rising interest in automation, digital twins and physics informed modelling further accelerates adoption.

Quick Market Facts

- Hardware remained the dominant component in 2024 with 74.3% share, supported by high demand for GPUs, TPUs, accelerators, and high-performance networking systems.

- Cloud-based deployment accounted for 58.6% share, reflecting strong adoption of remotely managed AI supercomputing capacity for scalable training workloads.

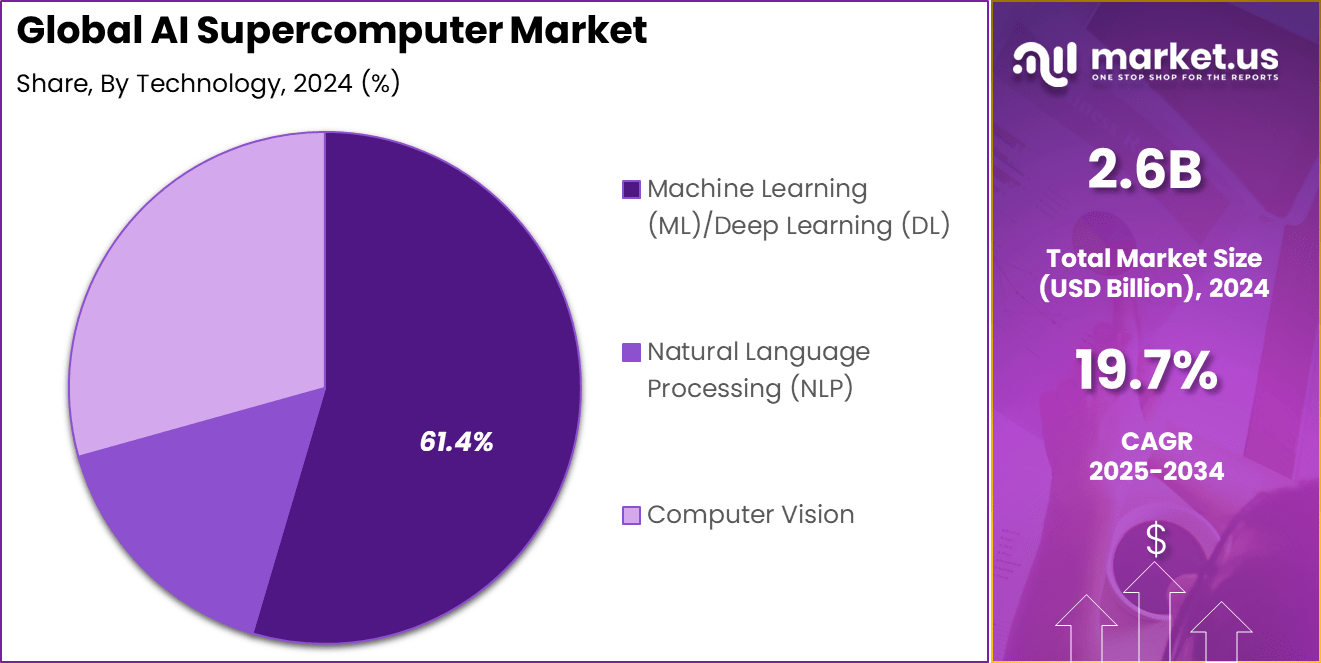

- Machine Learning and Deep Learning technologies led the market with 61.4% share, driven by growing training requirements for large-scale AI models.

- AI Research and Model Training was the largest application segment with 48.2% share, supported by rapid expansion of foundation models and enterprise AI workloads.

- Hyperscalers and Cloud Providers held 46.5% share, as major tech firms continue to build large AI clusters for commercial and research applications.

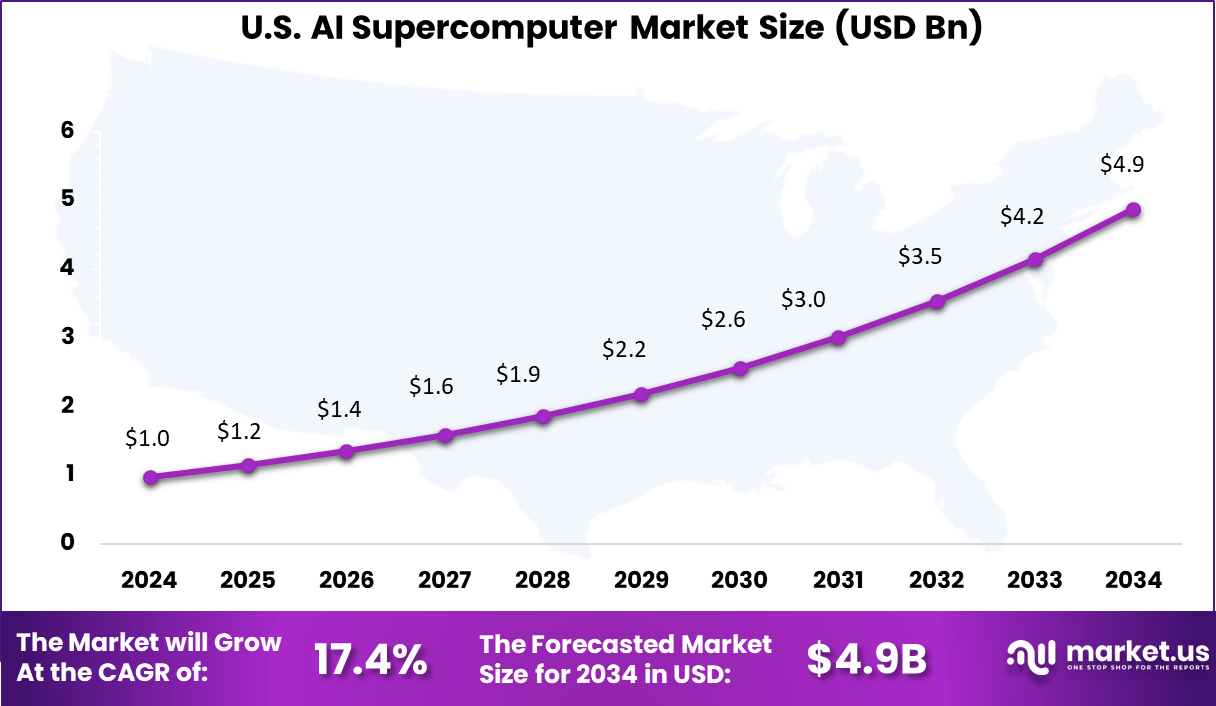

- North America captured 42.5% of global revenue, with the US market valued at USD 0.98 Billion and recording 17.4% growth, supported by strong investments in advanced AI infrastructure.

By Component

Hardware accounts for 74.3% of the AI market segment, highlighting its critical role in powering AI applications. Hardware components such as GPUs, CPUs, and AI accelerators provide the necessary computing power to execute data-intensive machine learning and deep learning tasks. Advancements in these technologies are essential for improving both speed and efficiency in AI operations.

This reliance on hardware is driven by the need to support complex model training and real-time inference in various use cases. Data centers and edge devices alike depend heavily on specialized hardware to meet performance demands, making hardware investment a priority across industries embracing AI.

By Deployment Mode

Cloud-based AI holds 58.6% of the deployment mode share, as businesses increasingly favor cloud environments for their flexibility and scalability. Cloud platforms enable organizations to access AI computing power on demand, avoiding heavy upfront infrastructure costs. This makes AI more accessible for companies of different sizes and speeds up time to market.

The cloud’s ability to support continuous updates, collaboration, and resource scaling aligns well with AI’s evolving nature. With hyperscalers and cloud providers investing in expansive infrastructure, cloud deployment remains the preferred choice for many AI projects.

By Technology

Machine learning and deep learning together hold 61.4% of the technology segment, confirming their central role in AI innovation. These technologies enable systems to learn from large datasets and improve decision-making over time. As a result, they power many AI applications, including image recognition, natural language processing, and autonomous systems.

Their widespread use across industries like healthcare and finance continues to expand as algorithms improve and computational power grows. This makes machine learning and deep learning the backbone of current AI advancements.

By Application

AI research and model training represent 48.2% of the application segment, indicating a strong focus on developing new AI capabilities. Training AI models requires significant computing resources and access to large datasets, which drives investment in specialized infrastructure. Research efforts are essential for advancing AI accuracy and efficiency.

Cloud-based AI training is increasingly favored because it offers elastic compute power needed to manage large datasets and complex model architectures without capital expenditure. This trend shows a growing emphasis on foundational work in AI before deployment, highlighting research as a critical investment area for long-term AI advancement.

By End-User

Hyperscalers and cloud providers make up 46.5% of AI end users, reflecting their leading role in AI infrastructure and services. They operate large-scale data centers that provide the compute power necessary for extensive AI workloads. Their ability to scale resources quickly supports many businesses relying on cloud AI services.

Hyperscalers continue to expand capacity aggressively, driven by growing AI workloads and cloud adoption. Their infrastructure investments and innovations not only support their own AI services but also empower enterprises across industries to harness AI. This end-user segment benefits from economies of scale and high capital infusion, which positions them as critical facilitators of AI’s growth trajectory worldwide.

North America Market Size

In 2024, North America leads the AI market with over 42.5% share, reflecting a strong ecosystem built on technology innovation, talent, and capital investment. The region, particularly the United States, stands out because of its advanced digital infrastructure and significant R&D in AI technologies. Businesses across various sectors adopt AI at a rapid pace, supported by a robust venture capital ecosystem and government initiatives that foster AI commercialization.

The leadership role of North America is also sustained by the presence of key technology hubs, research institutions, and an entrepreneur-friendly environment that accelerates AI startup growth and innovation. This dominance shapes global AI trends, setting standards for adoption and technology development.

The US holds a sizable portion of the AI market within North America and globally, accounting for about 17.4% of this segment’s share. The US market is distinguished by large-scale investments in AI development, supported by both private sector funding and government programs. These investments promote research, infrastructure expansion, and rapid deployment of AI solutions across industries ranging from healthcare to finance.

Emerging Trends

Key Trends Description Collaboration of AI and Quantum Computing AI supercomputers are increasingly being designed to combine traditional AI processing with quantum computing elements, aiming for breakthroughs in speed and problem-solving capability. Focus on Energy Efficiency and Sustainability As supercomputers demand huge power, greener technologies and more efficient architectures are rising trends to reduce energy consumption while maintaining performance. Specialized AI Architectures Supercomputers tailored for specific AI workloads, like natural language processing or computer vision, are becoming popular to maximize efficiency and output. Cloud Integration and Accessibility More AI supercomputing power is offered as cloud services, allowing wider access without heavy infrastructure investment for businesses and researchers. Geographic Expansion and Diversity Strong market growth is seen in North America, Asia-Pacific, and Europe, with new investments pouring in to boost local AI supercomputing capabilities and innovation hubs. Growth Factors

Key Factors Description Rising Demand for Complex AI Workloads Increasing use of AI in areas like autonomous vehicles, drug discovery, and big data analytics drives the need for powerful supercomputers that can handle intensive tasks. Technological Advances in Hardware Innovations in GPUs, TPUs, and custom AI chips fuel the performance improvements that enable AI supercomputers to grow more capable and efficient. Expansion of Cloud Computing Platforms Cloud providers offering AI supercomputing as-a-service lower entry barriers, accelerating market growth by reaching more users and industries. Government and Private Investments Substantial funding from governments and industry players to develop advanced AI infrastructure supports ongoing growth and innovation in supercomputing. Industry-Specific Applications Adoption of AI supercomputers in healthcare, finance, automotive, and scientific research for tailored solutions encourages specialized market demand. Future Outlook

New growth opportunities are present in:

- Increasing specialization of AI supercomputers for specific applications will unlock new market segments.

- Integration with hybrid and multi-cloud environments will make AI supercomputing more accessible and scalable.

- Growth in AI-driven services across healthcare, finance, manufacturing, and education.

- Expansion of AI supercomputing hubs, supported by government and private investments, fostering new innovation ecosystems.

- Development of sustainable AI supercomputing technologies to reduce power consumption and environmental impact.

- Opportunities in academic and research collaborations for next-generation AI applications like climate modeling, personalized medicine, and robotics.

Key Market Segments

By Component

- Hardware

- Processors/Compute

- Central Processing Units (CPU)

- Graphics Processing Units (GPU)

- Application-Specific Integrated Circuits (ASICS)

- Field-Programmable Gate Arrays (FPGAS)

- Memory & Storage

- Interconnect & Networking

- Processors/Compute

- Software

- AI Software Frameworks

- Cluster Management & Orchestration

- Developer Tools & Libraries

- Services

- Integration & Deployment

- Support & Maintenance

- Consulting

By Deployment Mode

- Cloud-based

- On-Premises

By Technology

- Machine Learning (ML)/Deep Learning (DL)

- Natural Language Processing (NLP)

- Computer Vision

By Application

- AI Research & Model Training

- Drug Discovery & Healthcare

- Autonomous Systems

- Financial Modeling

- Climate & Weather Research

- Others

By End-User

- Hyperscalers & Cloud Providers

- Government & Defense Labs

- Academic & Research Institutions

- Enterprises

- BFSI

- Healthcare

- Automotive

- Retail

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Growing AI Applications in Diverse Industries

The rise in AI supercomputers is driven mainly by the growing demand across industries such as healthcare, finance, and automotive. AI supercomputers accelerate complex tasks like drug discovery, autonomous driving, and risk management, delivering faster and more precise outcomes. This expanding use of AI technologies pushes organizations to invest heavily in these super powerful systems to handle large datasets and advanced AI workloads efficiently.

By enabling faster research cycles, smarter data analysis, and more accurate simulations, AI supercomputers give companies a competitive edge and open new avenues for innovation. The healthcare sector, for example, benefits from reduced drug development times, while the finance industry leverages AI supercomputers for real-time trading and fraud detection, fueling continued market demand and adoption.

Restraint

High Cost of Acquisition and Maintenance

The AI supercomputer market faces significant challenges from the substantial costs involved in building and maintaining these systems. High-performance hardware components like GPUs and TPUs are expensive, requiring a large upfront investment. In addition to purchasing costs, operational expenses such as specialized cooling systems, power infrastructure, and dedicated data centers add to the financial burden.

This steep cost barrier limits access mostly to large corporations, research institutions, and governments, preventing smaller organizations from adopting AI supercomputing technologies. Furthermore, frequent hardware upgrades are necessary to keep pace with advancing AI models, creating ongoing maintenance expenses that restrain broader market growth.

Opportunity

Expansion in Emerging Markets and Cloud Integration

Emerging markets in Asia-Pacific and Latin America offer significant growth opportunities for AI supercomputers. Rapid industrialization and rising investments in AI infrastructure, especially in countries like China and India, are driving demand for advanced computing power. These regions are becoming important innovation hubs supporting AI development, fueling the adoption of AI supercomputing solutions beyond traditional markets.

Additionally, integration of AI supercomputers with cloud platforms and hybrid computing environments is enabling wider accessibility and scalability. Cloud-based AI supercomputing services allow organizations to utilize high-performance resources on-demand without hefty capital investments, opening doors for smaller enterprises and startups to leverage AI capabilities and boosting market expansion.

Challenge

Energy Consumption and Sustainability Concerns

One of the pressing challenges for AI supercomputers is their massive energy consumption. These systems require enormous power, often sourced from non-renewable energy, creating significant environmental impacts and increasing operational costs. The demand for cooling and continuous high electricity usage contributes to a large carbon footprint.

As sustainability becomes a global priority, companies and governments face growing pressure to adopt greener technologies or improve energy efficiency. Meeting environmental regulations and reducing carbon emissions while maintaining performance presents a tough balancing act for AI supercomputer providers and users. This environmental challenge could slow down adoption or increase costs related to green technology investments.

Competitive Analysis

NVIDIA, Intel, AMD, Samsung, Micron, IBM, Meta, and Dell lead the AI supercomputer market with high-performance processors, advanced memory systems, and optimized architectures for large-scale AI workloads. Their platforms power model training, simulation, and complex scientific computing. These companies focus on boosting compute density, improving energy efficiency, and enabling faster data throughput.

Huawei, Microsoft, Cerebras, HPE, Fujitsu, Tesla, and Atos strengthen the competitive landscape with customized AI supercomputing systems designed for enterprise, research, and national computing programs. Their solutions integrate specialized AI accelerators, high-bandwidth memory, and advanced interconnects to support multi-node performance. These providers help organizations run large AI models, manage distributed workloads, and scale computational capacity.

NEC, Oracle, AWS, and other participants expand the market with cloud-based AI supercomputing, hybrid infrastructure, and on-demand accelerated compute. Their platforms provide accessible large-scale training environments for companies of all sizes. These providers emphasize scalability, cost efficiency, and seamless deployment of AI workloads. Increasing use of generative AI, autonomous systems, and scientific research drives strong demand for flexible AI supercomputing solutions worldwide.

Top Key Players in the Market

- Nvidia Corporation

- Intel Corporation

- Advanced Micro Devices Inc.

- Samsung Electronics

- Micron Technology Inc.

- IBM Corporation

- META

- Dell Inc.

- Huawei Technologies Co. Ltd.

- Microsoft

- Cerebras

- Hewlett Packard Enterprise Development LP

- Fujitsu

- Tesla

- Atos SE

- NEC Corporation

- Oracle

- Amazon Web Services Inc.

- Others

Recent Developments

- September 2025, Nvidia Corporation announced a strategic partnership with OpenAI to deploy at least 10 gigawatts of Nvidia systems powering OpenAI’s next-generation AI infrastructure. Nvidia intends to invest up to $100 billion to support this large-scale deployment, which will start going online in the second half of 2026 with their Vera Rubin platform.

- October 2025, Advanced Micro Devices Inc. secured a $1 billion deal with the US Department of Energy to build two AI supercomputers. The first, named Lux, will use AMD’s MI355X AI chips and become operational in six months, delivering triple the AI power of current systems. The Discovery system using MI430 chips is expected by 2029.

Report Scope

Report Features Description Market Value (2024) USD 2.6 Bn Forecast Revenue (2034) USD 15.4 Bn CAGR(2025-2034) 19.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Deployment Mode (Cloud-based, On-Premises), By Technology (Machine Learning (ML)/Deep Learning (DL), Natural Language Processing (NLP), Computer Vision), By Application (AI Research & Model Training, Drug Discovery & Healthcare, Autonomous Systems, Financial Modeling, Climate & Weather Research, Others), By End-User (Hyperscalers & Cloud Providers, Government & Defense Labs, Academic & Research Institutions, Enterprises) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Nvidia Corporation, Intel Corporation, Advanced Micro Devices Inc., Samsung Electronics, Micron Technology Inc., IBM Corporation, META, Dell Inc., Huawei Technologies Co. Ltd., Microsoft, Cerebras, Hewlett Packard Enterprise Development LP, Fujitsu, Tesla, Atos SE, NEC Corporation, Oracle, Amazon Web Services Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-