Global AI Ring Market Size, Share, Industry Analysis Report By Technology (Bluetooth-enabled Smart Rings, NFC-enabled Smart Rings), By Application (Notifications, Security, Payment, Health and Wellness, Data Transfer, Others), By Distribution (Offline, Online), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 163327

- Number of Pages: 385

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

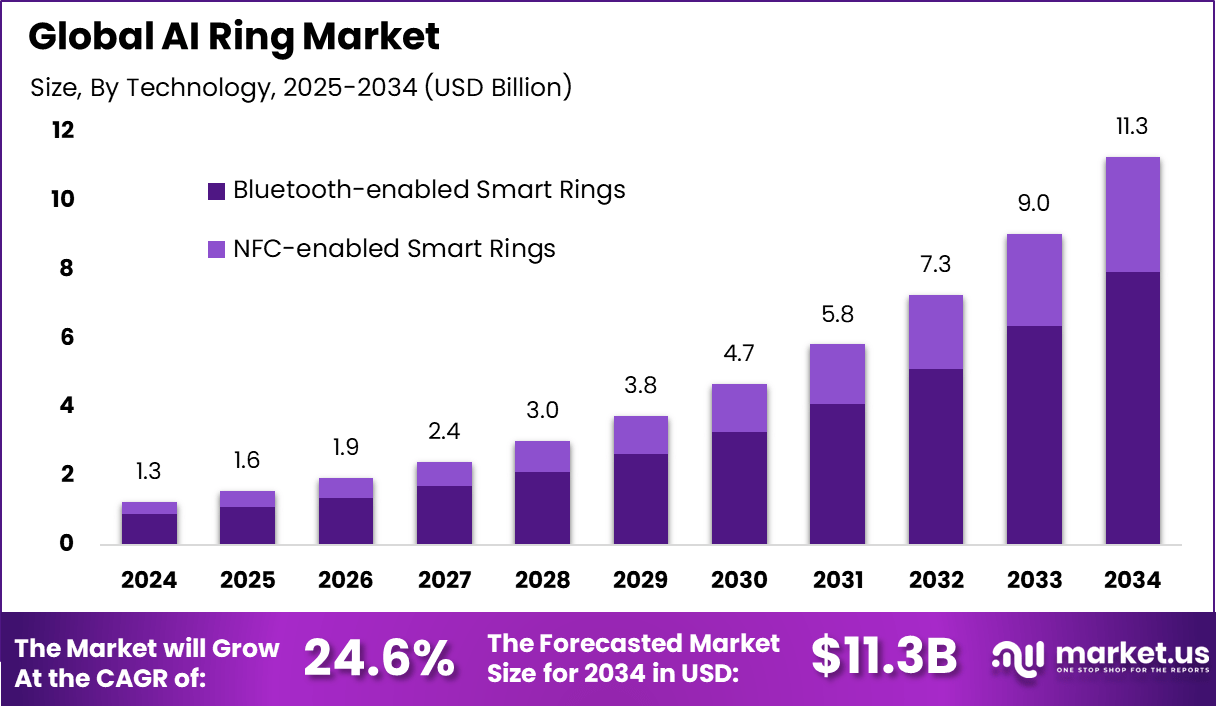

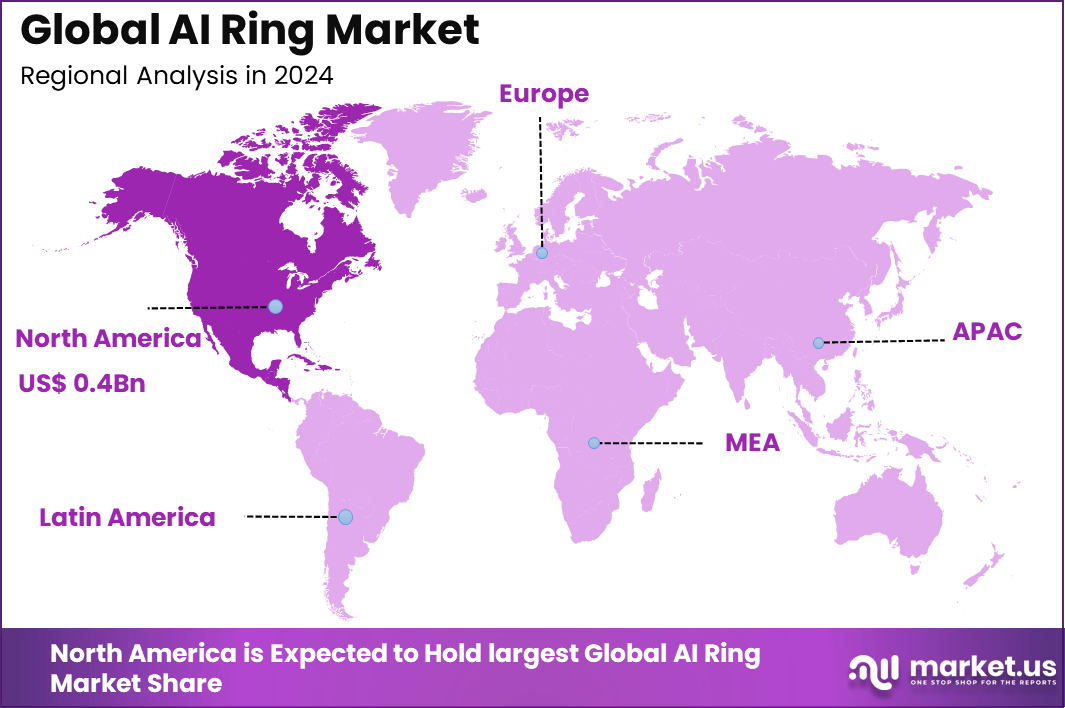

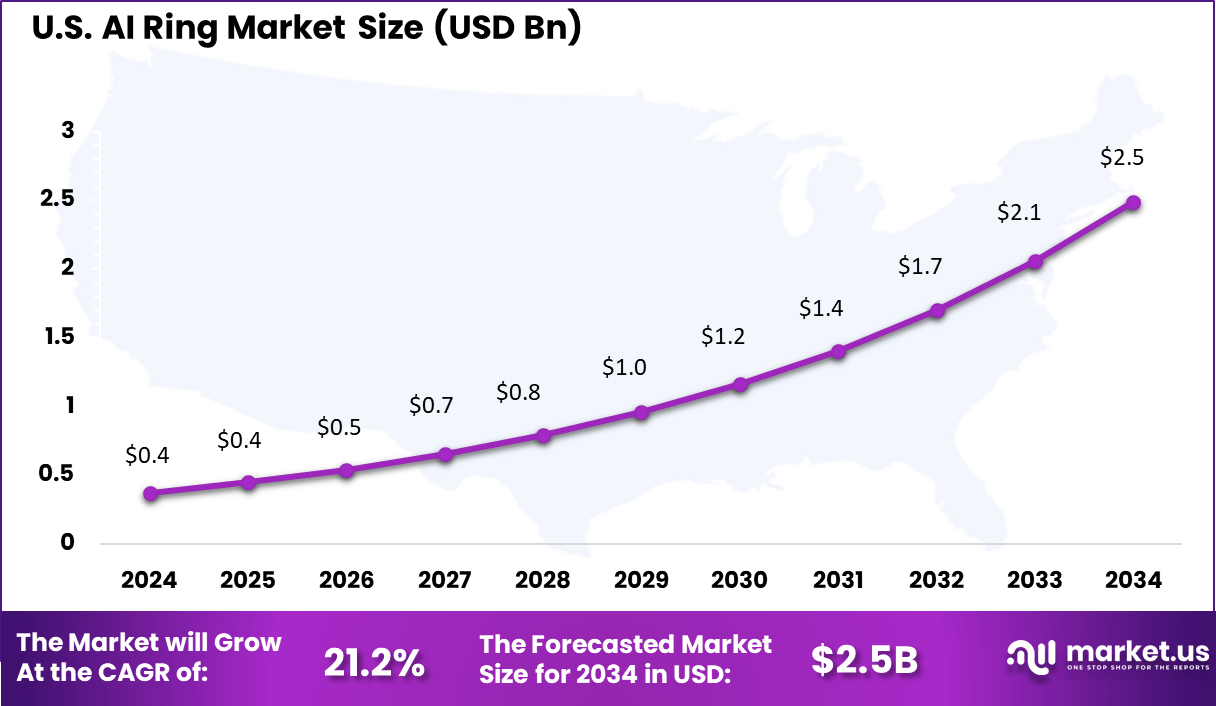

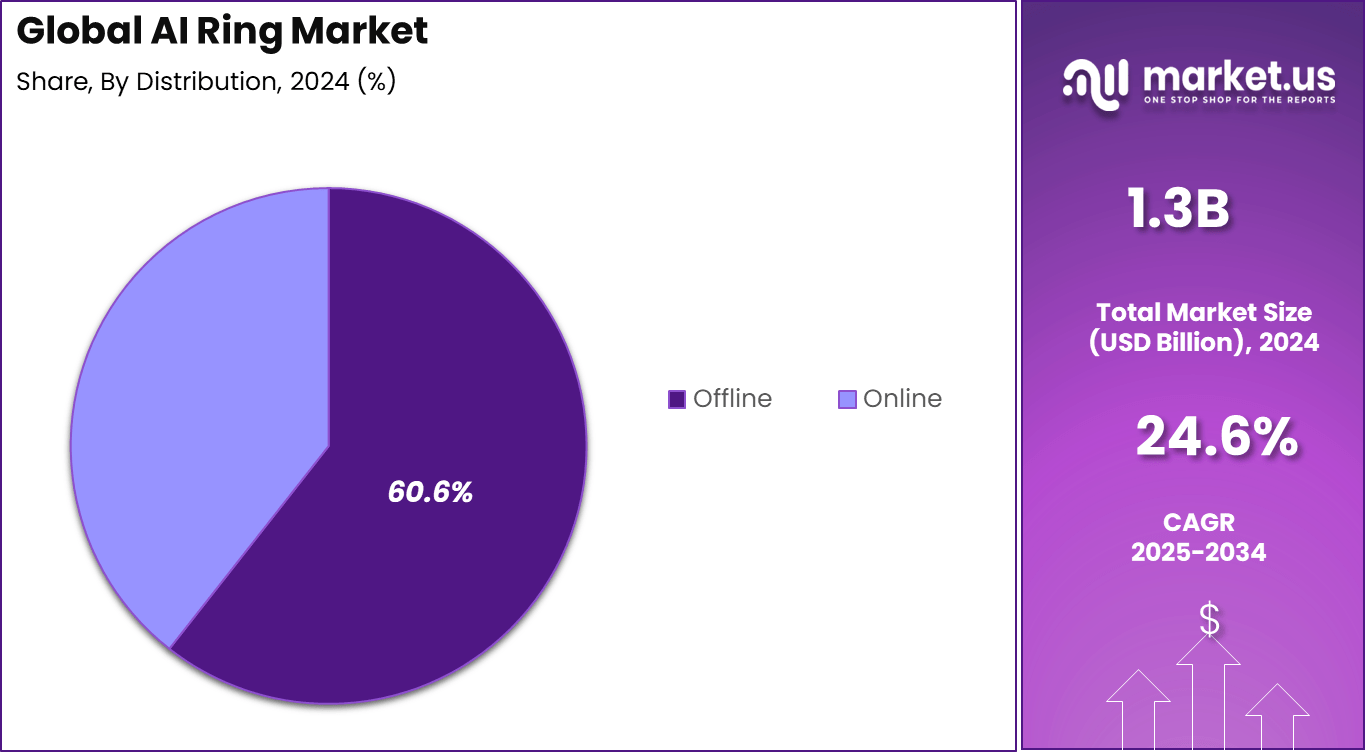

The Global AI Ring Market generated USD 1.3 billion in 2024 and is predicted to register growth from USD 1.6 billion in 2025 to about USD 11.3 billion by 2034, recording a CAGR of 24.6% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 34.7% share, holding USD 0.4 Billion revenue.

The AI ring market is growing rapidly as consumers and industries recognize its value in combining stylish wearable technology with powerful artificial intelligence capabilities. These smart rings are designed to offer continuous health monitoring, activity tracking, and convenient features such as contactless payments and smart home controls in a discreet form factor.

Top driving factors include consumer preference for discreet and continuous health monitoring tools capable of tracking heart rate, sleep, oxygen levels, and stress. The COVID-19 pandemic heightened focus on health tracking, further motivating adoption of wearable AI devices. Technological advancements in sensor miniaturization and AI-powered personalized feedback allow users to receive actionable health advice instantly.

Additionally, the integration of Near Field Communication (NFC) technology enables secure and easy contactless payments and access management, adding convenience and contributing to market growth. Consumer demand for smart, multifunctional devices that blend fashion with technology is another key motivator.

Quick Market Facts

Key Segment Lead Segment Market Share (%) By Technology Bluetooth-enabled Smart Rings 70.4% By Application Notifications 38.7% By Distribution Offline 60.6% By Region North America 34.7% By Country United States USD 0.37 Billion (CAGR 21.2%) AI Adoption Rate

Across industries

- Finance: 72-78% of companies are fully using or experimenting with AI.

- Healthcare: About 70% of organizations have implemented or are exploring generative AI.

- Retail: Nearly 80% of executives expect to adopt AI automation by 2025.

- High growth areas: Professional services and construction are seeing rapid adoption.

- Lowest adoption: Construction and agriculture currently show the weakest uptake in the U.S., though growth is expected through physical AI and precision farming.

By company size

- Large enterprises: Over 60% of companies with more than 10,000 employees have scaled AI initiatives.

- SMBs in India: Around 78% are adopting or experimenting with AI.

- Global SMBs: Approximately 89% of small businesses use AI for tasks like content creation and data analysis.

North America Market Size

In 2024, North America leads the global AI ring market with a 34.7% share, driven by early adoption of AI-driven wearables and rapid consumer interest in connected health and notification devices. The region’s strong base of smart device manufacturers and effective distribution channels make it a primary hub for innovation and testing. Consumers across this market are integrating AI rings into their digital lifestyle, linking them with home automation and fitness ecosystems.

Within the region, the United States represents about 0.37 billion in market value, expanding at a 21.2% CAGR. The country’s vibrant technology ecosystem and high wearable penetration rate support strong demand across both fashion and fitness categories. Continuous improvements in sensor accuracy and Bluetooth connectivity have boosted product reliability.

By Technology

In 2024, Bluetooth-enabled smart rings dominate the market with a 70.4% share. Their reliance on Bluetooth technology allows seamless connection with smartphones and other smart devices, enabling features like health tracking, notifications, and contactless payments without excessive battery drain.

The convenience of wireless communication and the improvements in Bluetooth low energy standards make these rings highly efficient and preferred by users seeking compact yet powerful wearable technology. The advancement in Bluetooth chipsets has enhanced the performance and range of these smart rings, allowing users to interact with their devices more naturally.

Integration with AI-powered features such as gesture control and biometric processing largely depends on reliable Bluetooth connections, which continue to evolve. This segment’s strong growth reflects the increasing consumer appetite for versatile, unobtrusive wearables that enrich daily digital experiences.

By Application

In 2024, Notifications account for 38.7% of AI ring applications, evidencing widespread user preference for discreet, real-time alerts. Smart rings provide vibration or light signals for calls, messages, and app notifications, allowing seamless connectivity without needing to check a phone constantly. This feature resonates strongly with busy professionals, fitness enthusiasts, and anyone seeking a minimal, hands-free way to stay connected.

Recent AI improvements allow notifications to be prioritized and filtered intelligently, reducing disturbance while ensuring important alerts are never missed. Personalized notification management enhances user experience by learning usage patterns and preferences, making the ring a smart extension of personal communication tools. This application has become a fundamental use case driving adoption across diverse demographics.

By Distribution

In 2024, Offline distribution leads with 60.6% share, reflecting consumer preference for physically experiencing the product before purchase. Many buyers want to test fit, comfort, and design in stores, which online platforms cannot fully provide. Brick-and-mortar stores, electronics retailers, and brand-specific outlets offer hands-on demonstrations and immediate customer service support, building trust and educating consumers about new AI ring functionalities.

The offline channel often complements online sales through hybrid purchase models that incorporate direct pickup or showroom visits after browsing online. This combination helps consumers make informed decisions and increases satisfaction. Despite rapid e-commerce growth, offline presence remains crucial for wearable tech, where personal fit and tactile experience heavily influence purchase behavior.

Emerging Trends

A significant trend in the AI ring market is the rising demand for health-focused features. Search interest for fitness tracking smart rings hit a peak normalized value of 95 in early 2025, indicating strong consumer focus on health and wellness. This demand is driving manufacturers to improve the precision of sensors and integrate AI-powered analytics for continuous health monitoring.

Another emerging trend is the use of AI rings for contactless payments and smart home controls through NFC technology. This trend is growing as consumers seek more convenience in their daily lives. More than 20% of U.S. adults are adopting AI wearable technology, with smart rings favored for their discreet design and ease of use. The shift is towards seamless integration of multiple functionalities in a single device.

Growth Factors

The growth of AI rings is fueled by increasing health awareness and the need for preventive care. Non-communicable diseases make up over 70% of global deaths, which encourages consumers to actively monitor health indicators using wearables. AI rings offer continuous tracking of heart rate, blood oxygen, and sleep patterns, empowering users to manage their well-being proactively.

Technological advancements such as improved battery life, with some AI rings lasting up to a week per charge, and enhanced AI algorithms are also driving market growth. This allows users to wear the device continuously without interruption while benefiting from accurate and personalized health insights. Convenience coupled with enhanced functionality is boosting the appeal of AI rings.

Key Market Segments

By Technology

- Bluetooth-enabled Smart Rings

- NFC-enabled Smart Rings

By Application

- Notifications

- Security

- Payment

- Health and wellness

- Data transfer

- Others

By Distribution

- Offline

- Online

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Growing Demand for Health and Fitness Monitoring

The AI ring market is driven by the increasing consumer focus on health and fitness. These rings provide continuous, non-intrusive monitoring of vital signs such as heart rate, sleep patterns, and activity levels. AI algorithms analyze this data in real time to offer personalized health insights and recommendations. This makes AI rings highly attractive to users who want convenient tools for proactive health management without the bulk of larger wearables.

Additionally, the compact and stylish design of AI rings appeals to tech-savvy and health-conscious consumers who prefer discreet devices. Their ability to provide real-time feedback and support wellness goals is fueling market growth as awareness of lifestyle-related diseases rises globally.

Restraint

High Cost and Limited Consumer Awareness

One major restraint limiting AI ring market growth is the high price of these sophisticated devices. Integrating AI, sensors, and biometric features significantly increases costs compared to traditional jewelry or simpler wearables. This pricing limits accessibility for many potential customers especially in emerging markets or cost-sensitive segments.

Moreover, despite rising interest, consumer awareness about AI rings remains relatively low compared to other wearables like smartwatches. Many users are unfamiliar with the technology or unsure of its benefits, which slows adoption and market penetration. Greater education and marketing efforts are needed to overcome this barrier.

Opportunity

Integration with Contactless Payments and Smart Home

AI rings offer a notable opportunity through their integration with NFC technology for contactless payments, access control, and smart home interaction. This convenience, combined with health tracking, makes AI rings multifunctional devices that simplify everyday tasks. Users can make payments or unlock doors with a simple tap, reducing reliance on phones or cards.

This expanding use case attracts diverse consumer groups, from fitness enthusiasts to busy urban dwellers seeking seamless lifestyle gadgets. As more companies develop AI-enabled rings with payment and smart security functions, manufacturers can tap into growing demand for versatile, all-in-one wearable devices.

Challenge

Battery Life and Device Miniaturization

A key challenge for AI rings is balancing miniaturized design with sufficient battery life. Rings must be small and comfortable to wear continuously, which restricts battery size and power capacity. However, AI features and sensors demand constant energy, making it difficult to maintain long battery life without frequent charging.

This technical constraint affects user convenience and satisfaction, especially for health monitoring which ideally requires uninterrupted data collection. Developers are investing in low-power AI algorithms and efficient hardware, but extending battery life while preserving functionality remains a critical hurdle for market expansion.

Competitive Analysis

The AI Ring Market is led by pioneering wearable technology companies such as Oura Health, Ultrahuman, McLear Ltd., and Ringly Inc. These firms are driving innovation in smart rings that combine biometric sensing, AI analytics, and real-time health monitoring. Their devices track metrics such as heart rate, sleep quality, and body temperature, providing users with data-driven insights for fitness and wellness optimization.

Emerging players such as Circular, Motiv, Bellabeat, Sky Labs, and Tokenize Inc. are integrating artificial intelligence with machine learning algorithms to deliver personalized recommendations and seamless connectivity with smartphones and health platforms. Their products often support gesture control, contactless payments, and authentication features, making AI rings multifunctional tools for both personal health management and digital security applications.

Additional participants including Jakcom Technology Co. Ltd., Nimb Inc., Wellnesys Inc., E SENSES, Fujitsu Ltd., Guangdong Jiu Zhi Technology Co. Ltd., and other major players contribute through advancements in sensor accuracy, battery efficiency, and ergonomic design. Their investments in AI-powered signal processing and cloud data integration are enhancing device intelligence and interoperability, positioning AI rings as a key segment in the rapidly evolving smart wearable ecosystem.

Top Key Players in the Market

- Oura Health

- Ultrahuman

- McLear Ltd.

- Ringly Inc.

- Circular

- Motiv

- Bellabeat

- Sky Labs

- Tokenize Inc.

- Jakcom Technology Co. Ltd.

- Nimb Inc.

- Wellnesys Inc.

- E SENSES

- Fujitsu Ltd.

- Guangdong Jiu Zhi Technology Co. Ltd.

- Other Major Players

Recent Developments

- October 2025, Oura Health completed a large Series E funding round, raising over $900 million and valuing the company at approximately $11 billion. This capital infusion is directed toward expanding AI-powered health features and increasing global distribution. Oura reported nearly 3 million smart ring sales in 2025 alone, driving combined device and subscription revenue to an expected $1 billion for the year, doubling 2024’s revenue.

- October 2025, Ultrahuman faced a US International Trade Commission import ban on its Ring Air product following Oura’s patent infringement lawsuit. Ultrahuman is transitioning production to Texas with plans for a “Made in USA” model and is actively developing a next-generation ring for the US market. The company continues full support and firmware updates for existing customers despite the ban

Report Scope

Report Features Description Market Value (2024) USD 1.3 Bn Forecast Revenue (2034) USD 11.3 Bn CAGR(2025-2034) 24.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Technology (Bluetooth-enabled Smart Rings, NFC-enabled Smart Rings), By Application (Notifications, Security, Payment, Health and Wellness, Data Transfer, Others), By Distribution (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Oura Health, Ultrahuman, McLear Ltd., Ringly Inc., Circular, Motiv, Bellabeat, Sky Labs, Tokenize Inc., Jakcom Technology Co. Ltd., Nimb Inc., Wellnesys Inc., E SENSES, Fujitsu Ltd., Guangdong Jiu Zhi Technology Co. Ltd., Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Oura Health

- Ultrahuman

- McLear Ltd.

- Ringly Inc.

- Circular

- Motiv

- Bellabeat

- Sky Labs

- Tokenize Inc.

- Jakcom Technology Co. Ltd.

- Nimb Inc.

- Wellnesys Inc.

- E SENSES

- Fujitsu Ltd.

- Guangdong Jiu Zhi Technology Co. Ltd.

- Other Major Players