Global AI-Powered Supply Chain Planning Software Market Size, Share and Analysis Report By Offering (Software, Services (Managed Services, Professional Services)), By Deployment (Cloud, On-Premises, Hybrid), By Organization Size (Large Organization, SMEs), By Application (Demand Planning & Forecasting, Procurement & Sourcing, Inventory Management, Production Planning & Scheduling, Warehouse & Transportation Management, Supply Chain Risk Management, Others), By End-Use Industry (Retail, Healthcare & Pharmaceuticals, Automotive, Logistics & Transportation, Aerospace & Defense, Chemicals, Electronics & Semiconductor, Energy & Utilities, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 174550

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

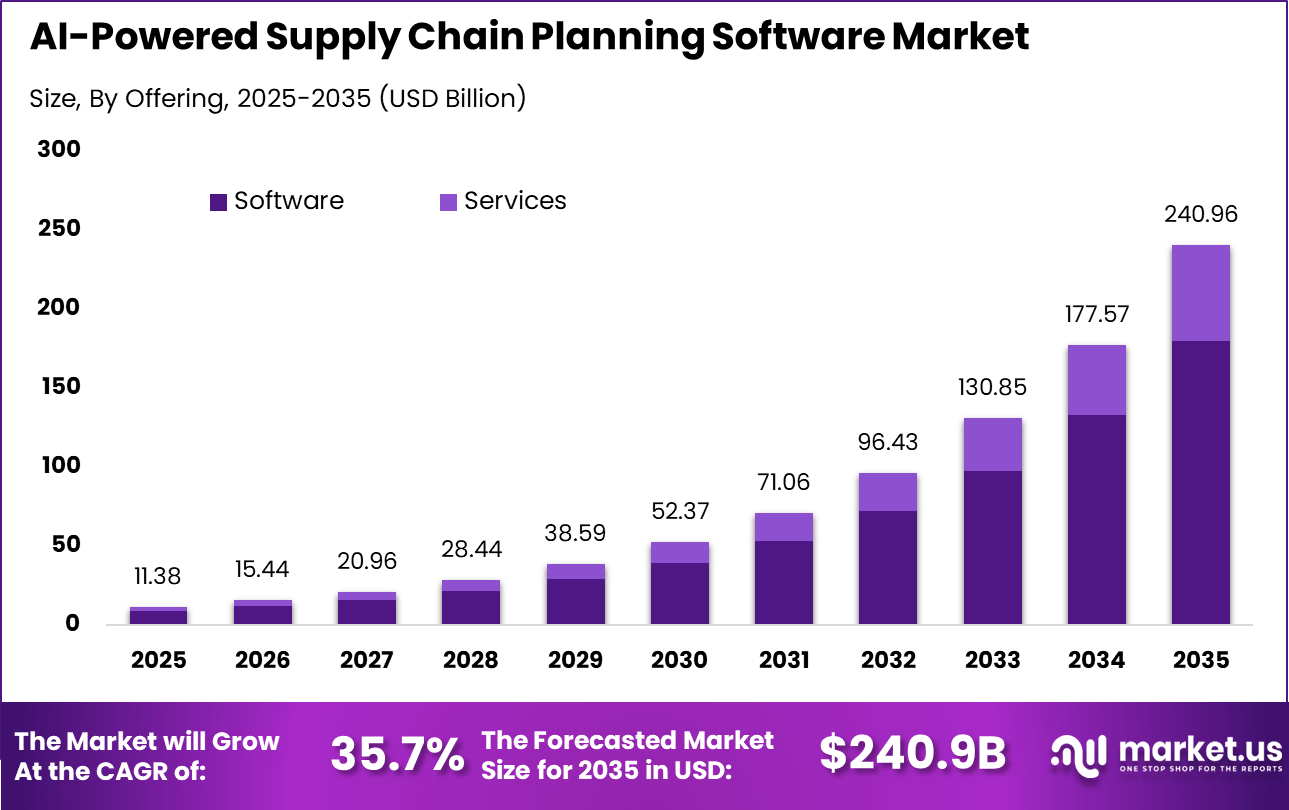

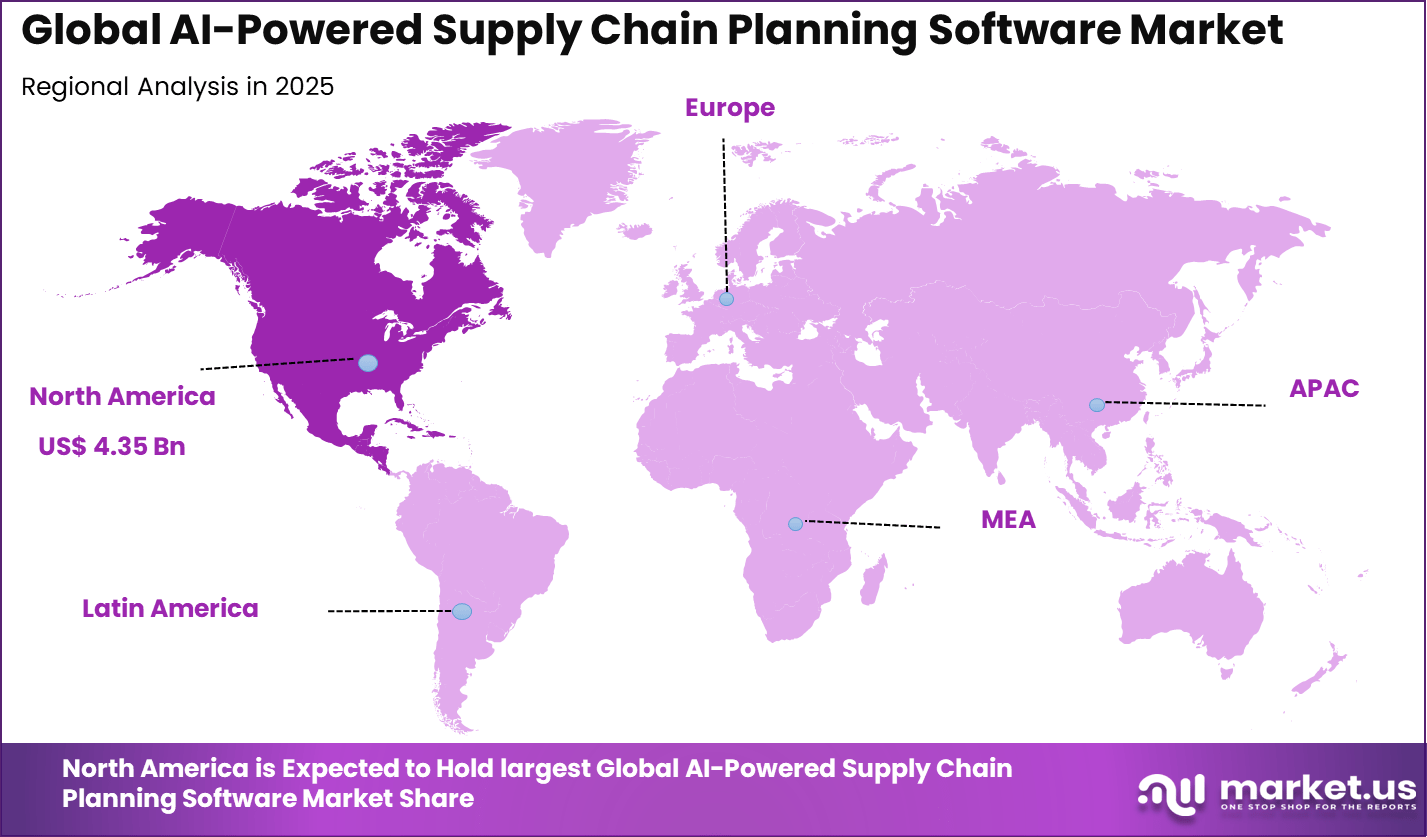

The Global AI-Powered Supply Chain Planning Software Market size is expected to be worth around USD 240.96 billion by 2035, from USD 11.38 billion in 2025, growing at a CAGR of 35.7% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 38.3% share, holding USD 4.35 billion in revenue.

The AI powered supply chain planning software market refers to digital platforms that use artificial intelligence to plan, forecast, and optimize supply chain activities. These tools support demand forecasting, inventory planning, production scheduling, and distribution coordination. AI powered planning software analyzes historical data and real-time signals to improve planning accuracy. Adoption spans manufacturing, retail, logistics, healthcare, and consumer goods industries.

One major driving factor of the AI powered supply chain planning software market is the need for better demand forecasting. Inaccurate forecasts lead to excess inventory or stock shortages. AI models improve forecast accuracy by analyzing multiple demand drivers. This helps organizations align supply with actual market needs. Improved forecasting reduces operational risk.

For instance, in December 2025, NVIDIA Corporation expanded its AI supply chain offerings with the Blackwell platform integration into enterprise planning tools, enabling hyper-accurate demand forecasting. Partnerships with SAP and Oracle leverage GPUs for real-time simulations, powering 10x faster scenario analysis amid chip shortages.

Demand for AI powered supply chain planning solutions is influenced by rising cost pressures. Inventory holding, transportation, and production inefficiencies directly affect profitability. Organizations seek tools that optimize resource allocation. AI driven planning reduces waste and inefficiency. Cost management needs strengthen demand.

Key Takeaway

- In 2025, the software segment led the market with a 74.7% share, reflecting strong reliance on AI driven platforms that support forecasting, optimization, and end to end supply chain visibility.

- The cloud deployment model captured a 65.3% share, supported by scalability, faster implementation, and easier integration across distributed supply chain networks.

- Large enterprises dominated adoption with a 75.5% share, driven by complex global operations, high data volumes, and sustained investment in advanced planning technologies.

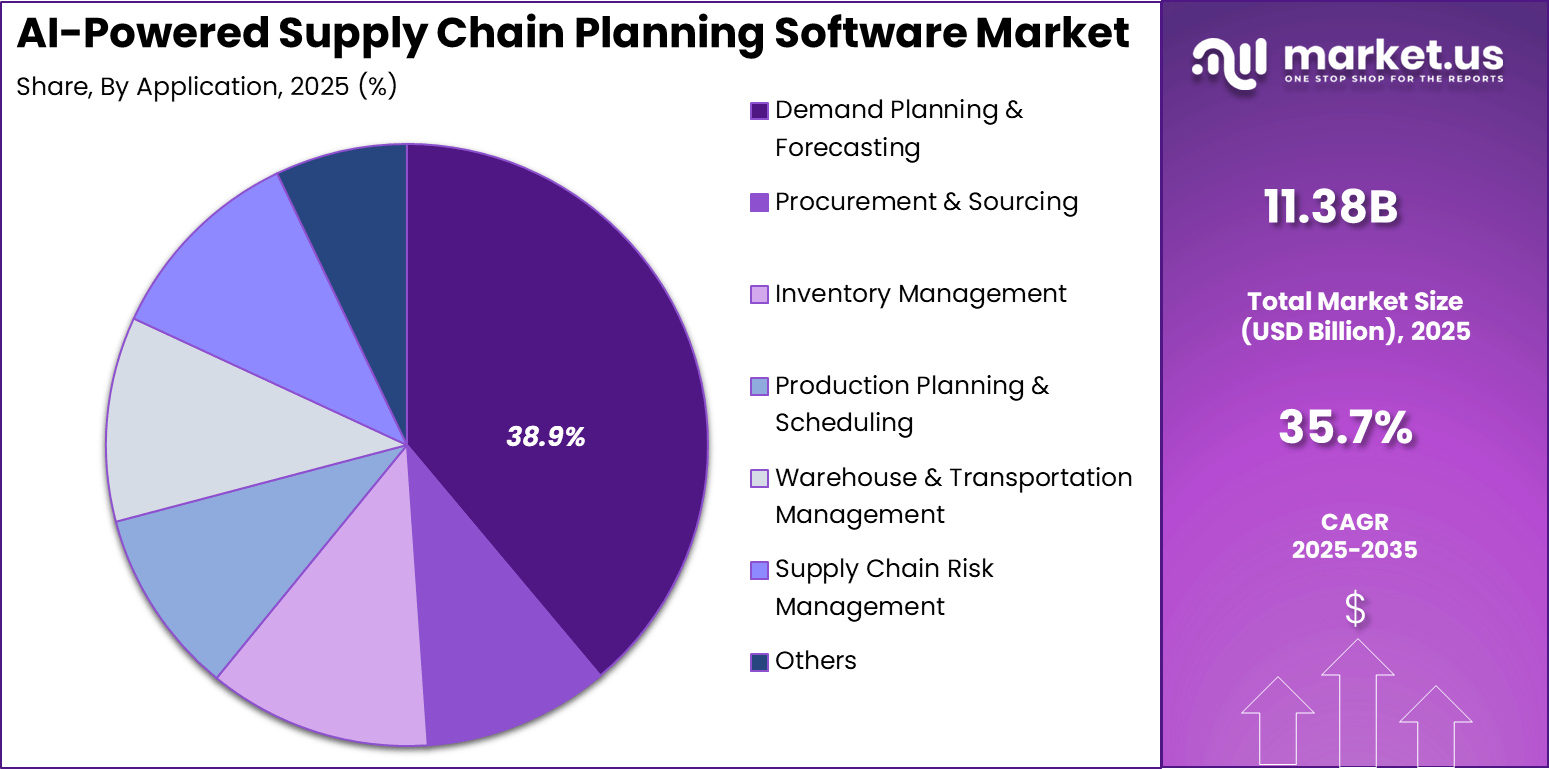

- Demand planning and forecasting emerged as the leading application with a 38.9% share, highlighting the importance of AI in improving forecast accuracy, inventory balance, and responsiveness to market shifts.

- The retail sector held a 34.6% share, reflecting strong use of AI planning tools to manage seasonal demand, omnichannel fulfillment, and real time inventory decisions.

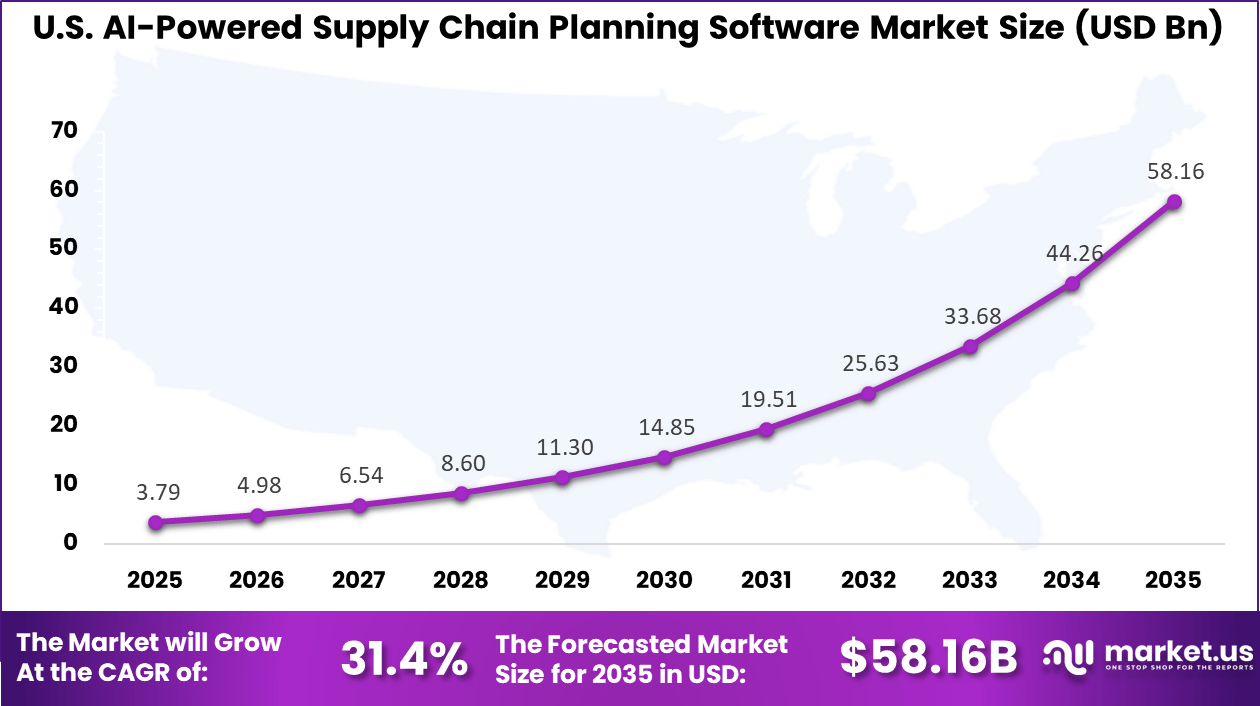

- The U.S. market reached USD 3.79 billion in 2025, expanding at a strong 31.4% growth rate, supported by rapid AI adoption and supply chain digitalization.

- North America maintained regional leadership with more than a 38.3% share in 2025, backed by advanced analytics adoption, mature cloud infrastructure, and strong enterprise investment in AI based supply chain planning solutions.

U.S. Market Size

The market for AI-Powered Supply Chain Planning Software within the U.S. is growing tremendously and is currently valued at USD 3.79 billion, the market has a projected CAGR of 31.4%. The market is growing due to rising demand for real-time visibility amid complex global networks and frequent disruptions like port delays or shortages.

Businesses adopt AI to sharpen demand forecasts, automate inventory, and cut waste through predictive analytics. Cloud adoption speeds deployment while large retailers and manufacturers invest heavily for a competitive edge. E-commerce surges and labor shortages further push firms toward smarter planning tools that boost efficiency and resilience.

For instance, in October 2025, Oracle launched new AI agents embedded in Oracle Fusion Cloud SCM to transform supply chain workflows, automating procurement, manufacturing, inventory management, and decision-making. These agents enhance operational efficiency, margin resilience, and perfect fulfillment, demonstrating U.S. leadership in AI-powered supply chain planning software.

In 2025, North America held a dominant market position in the Global AI-Powered Supply Chain Planning Software Market, capturing more than a 38.3% share, holding USD 4.35 billion in revenue. This dominance is due to advanced tech infrastructure and early adoption by major industries like retail and manufacturing.

Companies here leverage AI for real-time tracking across complex networks, handling disruptions from trade issues or weather better than others. Strong investments in cloud systems and skilled talent pools drive faster rollout. E-commerce growth and focus on efficiency keep North America ahead, setting global standards for smart planning.

For instance, in May 2025, Blue Yonder introduced groundbreaking AI agents that revolutionized supply chain management, enabling machine-speed decision-making to reduce waste, costs, and delays. With over 25 billion daily AI predictions, this underscores North American dominance in intelligent supply chain solutions.

Offering Analysis

In 2025, The Software segment held a dominant market position, capturing a 74.7% share of the Global AI-Powered Supply Chain Planning Software Market. Businesses turn to it for handling daily tasks like predicting demand and spotting issues early. It runs smooth analytics that keep operations flowing without constant human input.

Teams find it reliable for processing large data sets quickly. This focus on software leaves services in the background. Services mainly support initial setups or custom changes rather than core functions. Overall, software meets the real needs of modern supply chains effectively. The edge of software comes from its ability to integrate easily into existing systems.

Companies value how it updates automatically and scales with growth. In contrast, services often cost more over time without adding the same value. Software tools let planners make better choices based on real-time insights. This shift saves time and reduces errors in planning. As supply chains grow complex, software stands out as the go-to choice. It empowers users without needing extra experts on hand.

For Instance, in October 2025, Oracle launched AI agents in Fusion Cloud SCM to automate supply chain processes. These agents handle planning, procurement, and inventory with embedded analytics. By acting as advisors, they analyze data and generate insights, making software central for efficient operations. Customers gain without extra costs, boosting software adoption.

Deployment Analysis

In 2025, the Cloud segment held a dominant market position, capturing a 65.3% share of the Global AI-Powered Supply Chain Planning Software Market. It offers easy access from any location, which suits teams spread across regions. Data stays secure and available around the clock. Companies like this because it cuts down on hardware costs and maintenance hassles.

Cloud setups handle sudden spikes in demand without slowdowns. This makes it perfect for fast-paced environments. On-premise options fall short in flexibility and speed to launch. Many firms choose the cloud for its quick rollout and low entry barriers. Updates roll out seamlessly, keeping tools current with new tech. It also supports teamwork across departments without location limits.

On-premise systems require big upfront investments and in-house skills. Cloud wins by letting businesses focus on strategy over tech upkeep. As remote work grows, this deployment type fits right in. It builds resilience into supply chain operations naturally.

For instance, in January 2026, SAP announced Supply Chain Orchestration for early 2026 on its cloud platform. This AI tool spots disruptions early and triggers actions across planning and logistics. With Joule assistants, it unifies cloud-based processes, making deployment flexible and responsive for global operations. Cloud takes center stage for quick setups.

Organization Size Analysis

In 2025, The Large Organization segment held a dominant market position, capturing a 75.5% share of the Global AI-Powered Supply Chain Planning Software Market. They deal with vast networks and high volumes, so AI helps tie everything together. It cuts delays and optimizes routes across borders. These firms have budgets to invest in advanced features.

Smaller players lag because they handle simpler needs at first. Large setups benefit most from deep analytics and automation. This size drives the bulk of adoption today. Big companies use AI to manage risks in global operations smoothly. It spots patterns across suppliers and markets fast.

Resources allow them to train staff and customize solutions. Small and medium businesses grow into it later, starting basic. Large organizations lead by testing innovations first. Their scale amplifies the gains from better planning. Over time, this pulls the market toward enterprise-level tools.

For Instance, in December 2025, Blue Yonder updated its AI planning solutions for large-scale retail operations. New cognitive tools optimize inventory and forecasting with ML agents. Customers like Super Retail Group cut inventory by 20% through precise plans. Large organizations benefit most from this scale-ready software.

Application Analysis

In 2025, The Demand Planning & Forecasting segment held a dominant market position, capturing a 38.9% share of the Global AI-Powered Supply Chain Planning Software Market. It uses data from sales and trends to predict needs accurately. This avoids overstock or empty shelves that hurt profits. AI processes weather or events that affect buying too.

Businesses rely on it to stay ahead of shifts. Other apps like inventory tracking follow, but don’t match its impact. Forecasting builds the foundation for smart decisions. Teams love how AI sharpens forecasts beyond old methods. It blends historical data with live inputs for precise outlooks. This cuts waste and boosts customer satisfaction through a steady supply.

For Instance, in December 2025, Blue Yonder released AI fixes for traditional forecasting flaws. Its platform mixes ML models for accurate demand sensing, including external factors like weather. Clients like Swire Coca-Cola boosted responsiveness and service levels. This leads to demand planning apps with real-world results.

End-Use Industry Analysis

In 2025, The Retail segment held a dominant market position, capturing a 34.6% share of the Global AI-Powered Supply Chain Planning Software Market. Stores face quick changes in customer tastes and seasons. AI matches stock to real demand, speeding deliveries. It handles promotions or trends without excess inventory. This keeps shelves full and costs down. Other sectors like manufacturing trail in adoption speed. Retail’s high volume makes AI a game-changer here.

Retailers gain from AI spotting buying patterns early. It adjusts orders based on foot traffic or online surges. This edge helps compete in tight margins. Fresh produce or fashion needs fast turns, and AI delivers. The industry pushes tools that link stores, warehouses, and suppliers tightly. Overstock vanishes, and loyalty grows. Retail leads by necessity and results.

For Instance, in January 2026, Blue Yonder launched AI innovations for retail supply chains at NRF. Enhancements bring precision forecasting and real-time decisions to optimize inventory. Facing margin pressures, retailers use these for unified planning across stores and warehouses. It transforms execution for customer wins.

Key Market Segments

By Offering

- Software

- Services

- Managed Services

- Professional Services

By Deployment

- Cloud

- On-Premises

- Hybrid

By Organization Size

- Large Organization

- SME’s

By Application

- Demand Planning & Forecasting

- Procurement & Sourcing

- Inventory Management

- Production Planning & Scheduling

- Warehouse & Transportation Management

- Supply Chain Risk Management

- Others

By End-Use Industry

- Retail

- Healthcare & Pharmaceuticals

- Automotive

- Logistics & Transportation

- Aerospace & Defense

- Chemicals

- Electronics & Semiconductor

- Energy & Utilities

- Others

Key Players Analysis

One of the leading players in March 2025, at Kinexions 2025, Kinaxis partnered with Databricks to supercharge the Maestro platform with generative AI agents for real-time monitoring and natural language queries. This boosts predictive forecasting and data sharing via Delta Sharing, making supply chains more resilient without siloed data headaches.

Top Key Players in the Market

- SAP SE

- Oracle

- Blue Yonder Group, Inc.

- Kinaxis Inc.

- Manhattan Associates

- NVIDIA Corporation

- Advanced Micro Devices, Inc.

- Intel Corporation

- Micron Technology, Inc.

- Qualcomm Technologies, Inc.

- Others

Recent Developments

- In January 2026, Blue Yonder launched AI-driven Cognitive Solutions for retail supply chains, featuring planning agents that optimize inventory and forecasts in milliseconds. During 2025 Thanksgiving, it handled 1.2 billion SKUs for delivery estimates, cutting waste, while IDC praised its agility for profitable growth.

- In May 2025, Manhattan Associates introduced Agentic AI agents like Intelligent Store Manager and Labor Optimizer in Manhattan Active solutions. Powered by large language models, they handle autonomous workflows and natural interactions, slashing configuration time. Manhattan Agent Foundry lets users build custom agents fast.

Report Scope

Report Features Description Market Value (2025) USD 11.3 Bn Forecast Revenue (2035) USD 240.9 Bn CAGR(2026-2035) 35.7% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Offering (Software, Services), By Deployment (Cloud, On-Premises, Hybrid), By Organization Size (Large Organization, SME’s), By Application (Demand Planning & Forecasting, Procurement & Sourcing, Inventory Management, Production Planning & Scheduling, Warehouse & Transportation Management, Supply Chain Risk Management, Others), By End-Use Industry (Retail, Healthcare & Pharmaceuticals, Automotive, Logistics & Transportation, Aerospace & Defense, Chemicals, Electronics & Semiconductor, Energy & Utilities, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SAP SE, Oracle, Blue Yonder Group, Inc., Kinaxis Inc., Manhattan Associates, NVIDIA Corporation, Advanced Micro Devices, Inc., Intel Corporation, Micron Technology, Inc., Qualcomm Technologies, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI-Powered Supply Chain Planning Software MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

AI-Powered Supply Chain Planning Software MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- SAP SE

- Oracle

- Blue Yonder Group, Inc.

- Kinaxis Inc.

- Manhattan Associates

- NVIDIA Corporation

- Advanced Micro Devices, Inc.

- Intel Corporation

- Micron Technology, Inc.

- Qualcomm Technologies, Inc.

- Others