Global AI-Powered PTZ Webcam Market Size, Share and Analysis Report Analysis By Price Range (Prosumer, Professional, High-End), By Resolution (4K UHD, 1080p Full HD, HD/720p), By Application (Corporate Work, Education & Remote Learning, Content Creation & Live Streaming, Live Events & Broadcasting, Telemedicine, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 175070

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Key Insights Summary

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- Price Range Analysis

- Resolution Analysis

- Application Analysis

- Regional Analysis

- Investment Opportunities

- Business Benefits

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

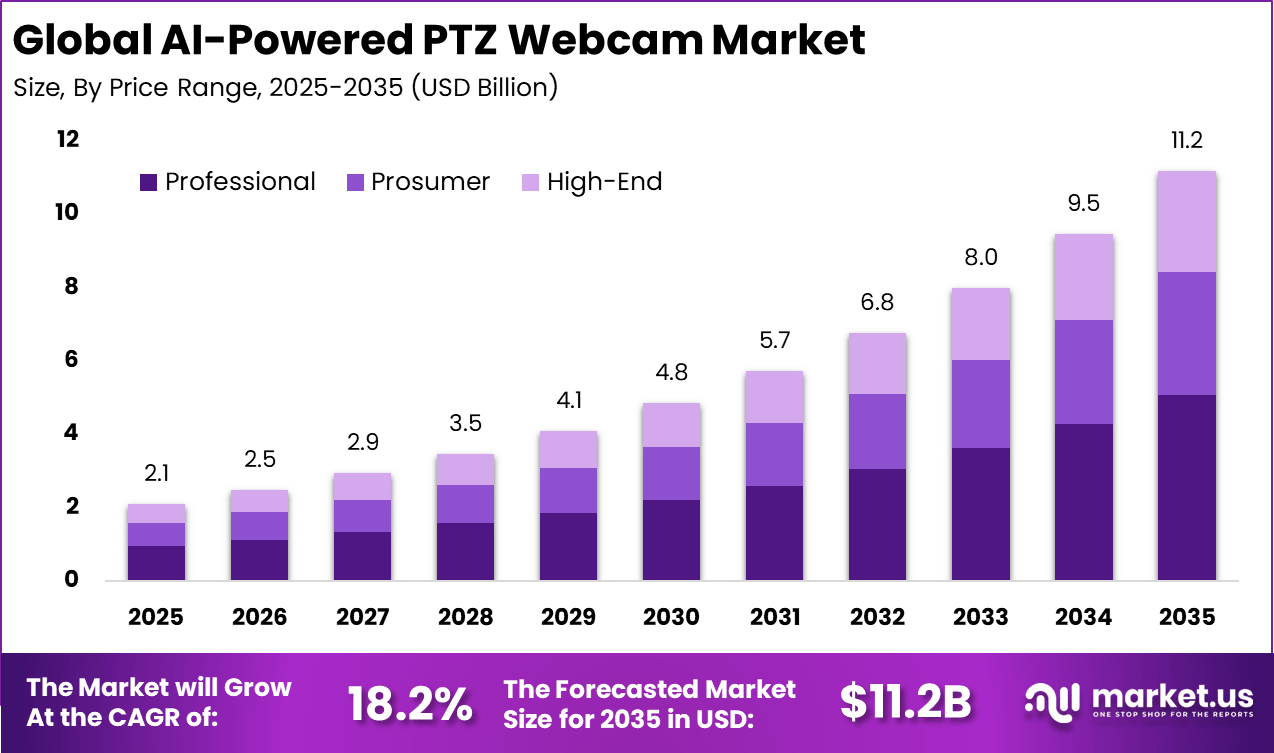

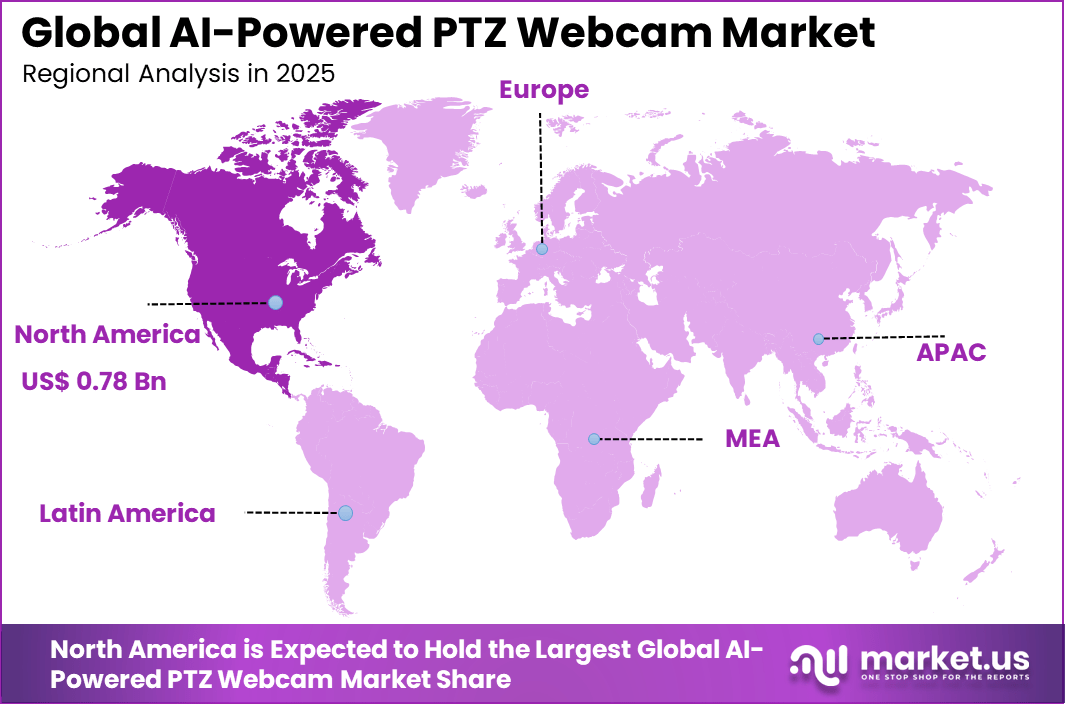

The Global AI-Powered PTZ Webcam Market size is expected to be worth around USD 11.2 billion by 2035, from USD 2.1 billion in 2025, growing at a CAGR of 18.2% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 37.6% share, holding USD 0.78 billion in revenue.

The AI-powered PTZ (pan-tilt-zoom) webcam market refers to advanced video cameras that use artificial intelligence to automatically control the camera’s movement and focus. These web cameras are designed to track motion, zoom in on subjects, and adjust settings based on real-time analysis, eliminating the need for manual intervention. AI capabilities enhance the user experience in video conferencing, streaming, surveillance, and remote learning applications.

One major driving factor of the AI-powered PTZ webcam market is the increasing demand for seamless video conferencing and communication solutions. Remote work, virtual meetings, and webinars require high-quality video for professional and engaging interactions. AI-powered PTZ webcams allow for automatic framing and focus, ensuring that all participants are in view without manual adjustments. These enhanced features improve the overall quality of virtual interactions, driving their widespread adoption in corporate environments.

For instance, in March 2024, AVer (AVerMedia group) introduced the PTZ310UNV2 and PTZ310UV2, 4K 12x‑zoom AI PTZ cameras with SmartShoot framing, SRT streaming, and Teams/Zoom integration, strengthening its position in education, worship, and corporate AV installations that demand intelligent tracking.

Demand for AI-powered PTZ webcams is influenced by the ongoing shift toward remote work and hybrid workplace models. As video meetings and virtual presentations become more common, businesses require high-quality video solutions that minimize the need for manual adjustments. AI-powered PTZ webcams provide automatic tracking, making them ideal for large meetings or presentations with multiple participants. This demand for enhanced video conferencing capabilities is driving market growth.

Key Takeaway

- In 2025, the Professional segment dominated the AI-powered PTZ webcam market with a 45.3% share.

- The 1080p Full HD segment captured 54.2% of the market, reflecting a strong preference for high-definition video quality.

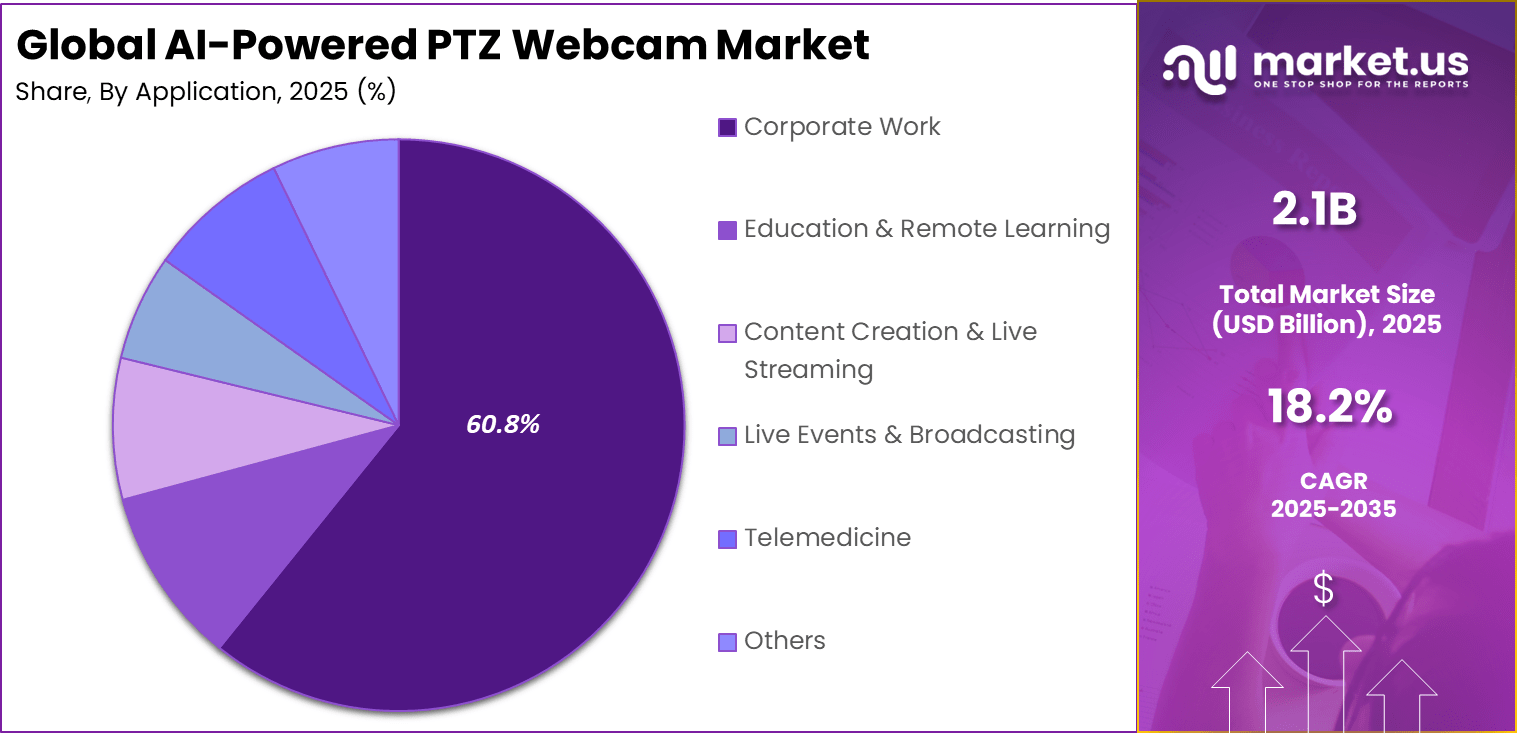

- The Corporate Work segment held 60.8%, driven by the growing demand for AI-powered video solutions in business environments.

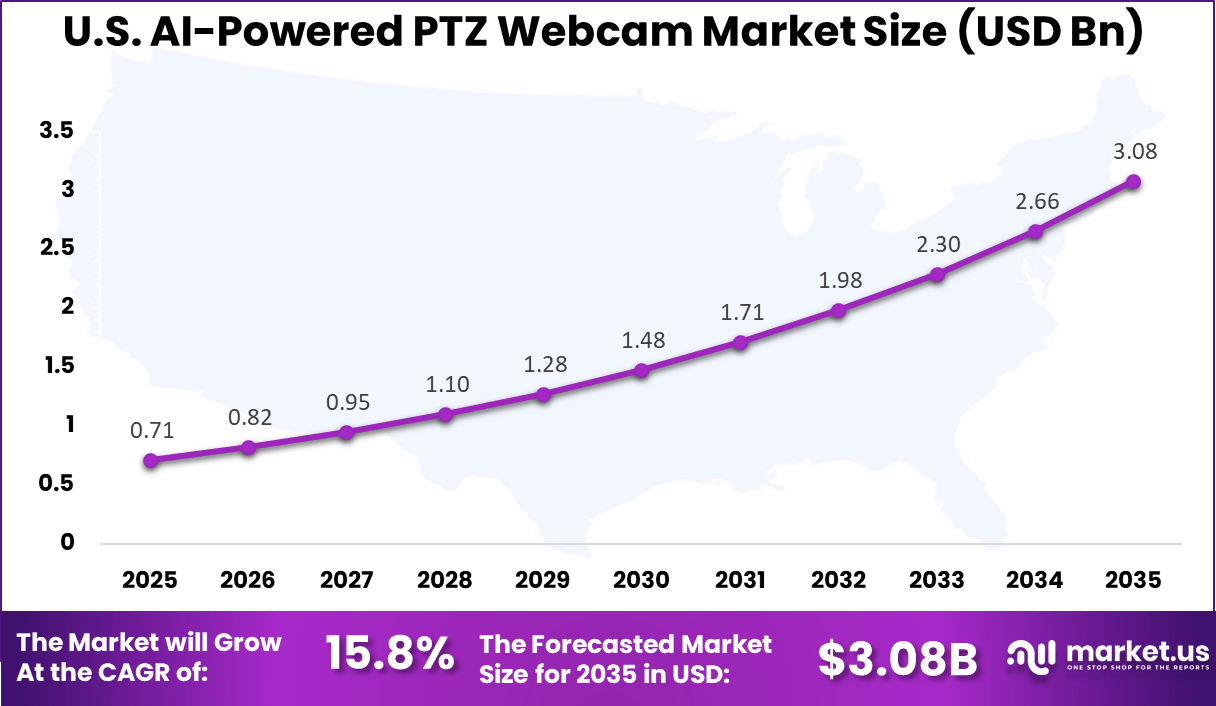

- The U.S. market for AI-powered PTZ webcams was valued at USD 0.71 billion in 2025, growing at a 15.8% CAGR.

- North America led the global market with more than 37.6% market share in 2025, supported by advanced digital infrastructure and high enterprise adoption.

Key Insights Summary

Adoption Rates

- Enterprise Adoption: Approximately 52.6% of market demand comes from the enterprise and corporate sectors, where AI-powered webcams are commonly used in executive offices and conference rooms.

- Usage Frequency: Over 65% of all users rely on webcams for daily professional and personal interactions.

- Global AI Integration: As of 2026, 94% of companies worldwide use AI in at least one business operation, marking a 6% increase from 2025.

Usage Statistics by Sector

- Video Conferencing: This remains the dominant application, accounting for 71.5% of all AI-powered webcam use cases.

- Education:

- 60% of teachers use AI tools regularly in their classroom routines.

- 86% of educational organizations have integrated generative AI.

- 62% of business majors and 59% of STEM students utilize AI for academic work.

- Healthcare: The telehealth sector is growing at a 5.91% CAGR, with providers increasingly adopting diagnostic-grade 4K AI cameras for remote consultations.

Usage Trends & Preferences

- Feature Demand: Approximately 50% of recent webcam innovations focus on AI-driven adaptability, including low-light correction, noise filtering, and auto-framing.

- Connectivity: USB remains the standard, with an 84.7% market share due to its plug-and-play simplicity for hybrid workers.

- Replacement Cycles: The migration of features like speaker tracking and computational lighting into sub-$200 models has led to shorter replacement cycles among creators and remote executives.

- Consumer Perception: While only 33% of consumers believe they are using AI platforms, actual usage through device-embedded AI (including webcams) is estimated at 77%.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Demand for remote collaboration tools Video conferencing adoption ~6.9% North America, Europe Short Term Growth of live streaming and content creation Demand for high quality video streaming ~5.4% Global Short Term Rising demand for automated security systems Surveillance and security camera integration ~4.7% North America, Asia Pacific Mid Term Advances in AI technology Real time intelligent video tracking ~4.2% Global Mid Term Increasing popularity of hybrid working models Remote work video collaboration tools ~3.5% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline High cost of advanced systems Premium pricing for AI powered webcams ~5.1% Emerging Markets Short to Mid Term Data privacy concerns Surveillance and privacy issues ~4.3% Europe, North America Short Term Integration challenges Compatibility with existing conferencing systems ~3.6% Global Mid Term Limited awareness Newer technology adoption barriers ~2.9% Global Mid Term Market fragmentation Variety of solutions and platforms ~2.2% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact High initial investment Cost of AI technology and hardware ~6.3% Emerging Markets Short to Mid Term Technical expertise requirements Need for skilled setup and operation ~5.4% Global Mid Term Data privacy regulations Stricter laws for surveillance tools ~4.8% Europe, North America Mid Term Reliability concerns Performance under diverse conditions ~3.9% Global Long Term Limited consumer awareness Slow uptake in non commercial sectors ~3.2% Global Long Term Price Range Analysis

The professional price range accounts for 45.3% of the AI-powered PTZ webcam market, reflecting strong demand from business and institutional users. Professional-grade webcams offer advanced AI features, durable build quality, and consistent performance. These attributes are essential for environments where video quality and reliability are critical.

Organizations invest in professional models to support daily communication and content delivery. AI-driven pan, tilt, and zoom functions enhance framing without manual control. This improves meeting efficiency and presentation quality.

As expectations for video communication rise, professional-grade webcams continue to gain preference. Long-term usage and performance stability support adoption. This segment remains a key contributor to market demand.

For Instance, in January 2026, OBSBOT rolled out enhanced pro-grade AI tracking in its Tiny 2 series for professional setups. Priced for demanding users, the update improves pan-tilt-zoom precision in boardrooms. This boosts reliability for extended corporate sessions, drawing praise from streamers and execs needing flawless video. The firm eyes bigger office adoption with this tweak.

Resolution Analysis

1080p Full HD resolution holds a 54.2% share, making it the most widely adopted resolution category. Full HD provides a balance between video clarity and bandwidth efficiency. This makes it suitable for corporate and professional environments.

Users prefer 1080p resolution for clear facial recognition and visual engagement. AI features further enhance image quality through auto focus and lighting adjustment. These capabilities improve the overall viewing experience.

Despite the availability of higher resolutions, Full HD remains dominant due to compatibility and cost considerations. Its reliability supports widespread adoption. This resolution segment continues to lead the market.

For instance, in December 2025, Razer updated its Kiyo Pro line with sharper 1080p AI PTZ for Full HD fans. The model shines in low light with auto-focus, perfect for gamers and callers. It balances speed and clarity without 4K demands on hardware. Feedback highlights smooth corporate streams.

Application Analysis

Corporate work represents 60.8% of application demand, highlighting the importance of video communication in professional environments. Organizations rely on PTZ webcams for meetings, presentations, and virtual collaboration. AI automation improves framing and tracking during discussions. PTZ webcams support hybrid and remote work models effectively.

Automatic speaker tracking enhances engagement and reduces manual adjustments. This improves communication quality across teams. As corporate video usage becomes routine, demand for intelligent webcams continues to grow. Companies invest in tools that improve productivity and professionalism. Corporate work remains the dominant application segment.

For Instance, in May 2025, Insta360 unveiled Link 2C with corporate-focused AI PTZ for meeting rooms. Gesture controls and deskview mode aid hybrid teams. It auto-frames groups effortlessly, cutting manual pans. Offices report better engagement in calls. This positions Insta360 strongly in work apps.

Regional Analysis

North America holds a 37.6% share of the AI-powered PTZ webcam market, supported by strong enterprise adoption and digital workplace maturity. Organizations across the region invest in advanced video solutions. High acceptance of AI-enabled devices supports market growth.

For instance, in February 2025, Lumina (Lumens Digital Optics Inc.) launched the VC-TR61, a long-range 4K motion-tracking PTZ camera with 30x zoom and secondary tracking optimized for up to 18 meters. From its New York base, this advancement reinforces North American innovation in professional-grade PTZ webcams for large venues like theaters and conference centers.

The United States contributes USD 0.71 billion in market value, driven by corporate demand and technology-focused workplaces. Businesses prioritize communication quality and collaboration efficiency. AI-powered PTZ webcams align well with these needs. A CAGR of 15.8% reflects steady growth across the region. Continued hybrid work adoption supports expansion. North America remains a key market for AI-powered PTZ webcams.

For instance, in January 2026, NexiGo showcased its advanced 4K PTZ webcam lineup, including the N990 model, at CES 2026 in Las Vegas. Featuring real-time PDAF autofocus, three color temperatures, and stepless adjustments, these innovations highlight NexiGo’s leadership from Beaverton, Oregon, in delivering affordable, high-performance PTZ solutions for conferencing and streaming. This demonstrates U.S. dominance in AI-powered webcam technology through superior image quality and user-centric design.

Investment Opportunities

Investment opportunities in the AI-powered PTZ webcam market exist in the integration of these devices with collaboration and content creation platforms. Video conferencing and live-streaming platforms benefit from seamless integration with AI-powered PTZ cameras, improving the user experience. As more organizations invest in digital transformation, providing easy-to-use, high-quality video solutions presents a strong market opportunity. Investors focusing on the intersection of AI and video technology are likely to see significant growth.

Another opportunity lies in the education and healthcare sectors, where AI-powered PTZ webcams can facilitate remote learning, telemedicine, and virtual consultations. The automation and quality provided by these systems can greatly enhance the delivery of remote services. Investing in solutions tailored for these industries can lead to high demand, as educational institutions and healthcare providers seek effective ways to deliver content and services remotely.

Business Benefits

AI-powered PTZ webcams improve operational efficiency by reducing the need for manual camera adjustments. In video conferencing, remote learning, and live streaming, automatic tracking and zooming ensure that participants or subjects remain in focus throughout sessions. This enhances productivity and minimizes interruptions during meetings and broadcasts. Increased operational efficiency supports businesses in managing large-scale, real-time video communications.

These systems also enhance the overall user experience by providing consistent, high-quality visuals. In environments like remote work and streaming, the ability to automate camera operations enhances user satisfaction and engagement. High-quality, seamless interactions contribute to better outcomes, whether in business meetings or live broadcasts. Improving user experience through AI-powered solutions drives long-term value for organizations and users alike.

Key Market Segments

By Price Range

- Prosumer

- Professional

- High-End

By Resolution

- 4K UHD

- 1080p Full HD

- HD/720p

By Application

- Corporate Work

- Education & Remote Learning

- Content Creation & Live Streaming

- Live Events & Broadcasting

- Telemedicine

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players such as OBSBOT, Insta360, and NexiGo focus on AI-driven auto tracking and gesture control. Their PTZ webcams use computer vision to follow speakers and frame subjects automatically. These features support content creators, educators, and remote professionals. Ease of setup and compact design improve adoption. Demand is supported by growth in live streaming, online education, and hybrid work environments.

Enterprise and professional grade vendors such as Sony, Dell, and Lenovo emphasize video quality and reliability. Their AI-powered PTZ cameras integrate with conferencing platforms and enterprise IT systems. Logitech strengthens the segment with AI-based auto framing and noise reduction. These players benefit from strong enterprise relationships and global distribution networks.

Creator focused brands such as Razer and AVerMedia address streaming and gaming use cases. Their products support smooth motion tracking and customizable presets. AI enhances subject detection in dynamic scenes. Other regional vendors expand price options and feature variety. This competitive landscape supports continuous innovation and wider access to AI-powered PTZ webcam solutions across professional and consumer segments.

Top Key Players in the Market

- OBSBOT

- Insta360

- NexiGo

- Lumina

- Sony

- Dell

- Lenovo

- Razer

- Logitech

- AVerMedia

- Others

Recent Developments

- In January 2025, Insta360 unveiled the Link 2, a 4K AI webcam with advanced auto-tracking and gesture controls at CES. Dual-camera setup offers room-wide views or face zoom, ideal for meetings and content creation. This launch cements Insta360’s push into versatile AI PTZ solutions for creators.

- In March 2025, Sony released Tail 2, the world’s first three-axis PTZR 4K camera with AI Tracking 2.0. Broadcast-quality imaging and voice commands make it a game-changer for events and filmmaking. OBSBOT’s evolution shows strong momentum in AI-driven PTZ tech.

Report Scope

Report Features Description Market Value (2025) USD 2.1 Bn Forecast Revenue (2035) USD 11.2 Bn CAGR(2026-2035) 18.2% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Price Range (Prosumer, Professional, High-End), By Resolution (4K UHD, 1080p Full HD, HD/720p), By Application (Corporate Work, Education & Remote Learning, Content Creation & Live Streaming, Live Events & Broadcasting, Telemedicine, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape OBSBOT, Insta360, NexiGo, Lumina, Sony, Dell, Lenovo, Razer, Logitech, AVerMedia, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI-Powered PTZ Webcam MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

AI-Powered PTZ Webcam MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- OBSBOT

- Insta360

- NexiGo

- Lumina

- Sony

- Dell

- Lenovo

- Razer

- Logitech

- AVerMedia

- Others