Global AI-powered Detection Tool Market Size, Share and Analysis Report By Type of Offering (Platforms, API / SDKs), By Type of Component (Hardware, Software, Services), By Type of Detection Modality (AI-Generated Text, AI-generated Image & Video, AI-Generated Audio & Voice, AI-Generated Code, Multi-Modal), By Type of Deployment Mode (Cloud-Based, On-Premises), By Type of Technology (Deep Learning, Computer Vision Algorithms, Machine Learning (ML), Natural Language Processing (NLP), By Type of Tool (Audio and Speech Recognition Tools, Image and Video Detection Tools, Multi-Modal Detection Tools, Text Analysis Tools), By Type of Subscription Model (Annual Subscription, Monthly Subscription, Pay-As-You-Go Model), By End Use Industry (Government & Education, Aerospace and Defense, Healthcare, Legal and Compliance, Media and Entertainment, Marketing and Advertising, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 174331

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Cybersecurity and AI Detection Insights

- AI Content Detection Tool Performance

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- U.S. Market Size

- By Type of Offering

- By Type of Component

- By Type of Detection Modality

- By Type of Deployment Mode

- By Type of Technology

- By Type of Tool

- By Type of Subscription Model

- By End Use Industry

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Emerging Trends

- Growth Factors

- Opportunity Analysis

- Challenge Analysis

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

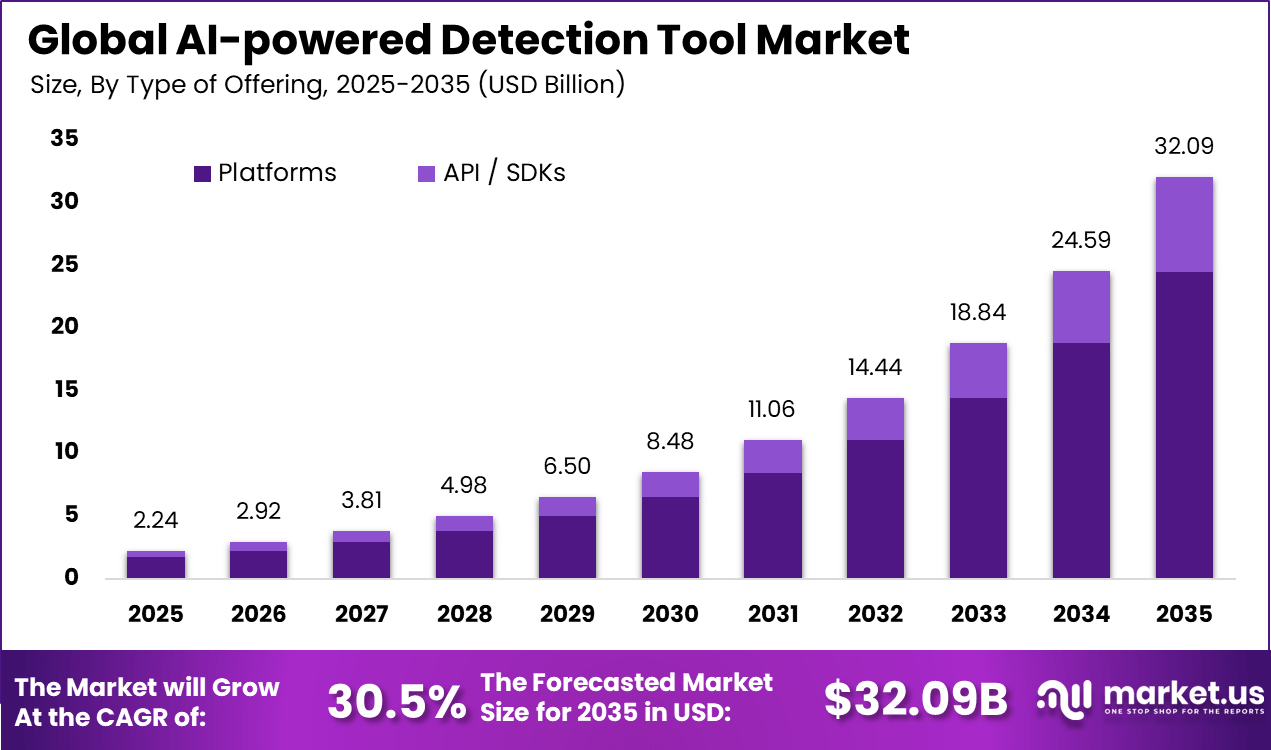

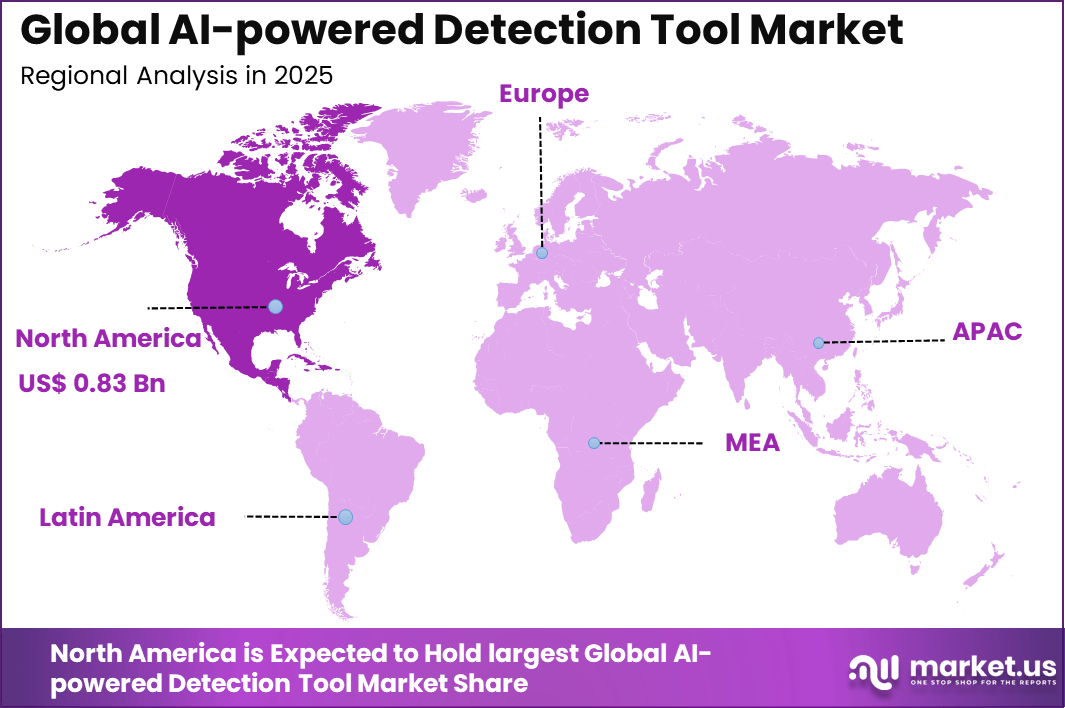

The Global AI-powered Detection Tool Market size is expected to be worth around USD 32.09 billion by 2035, from USD 2.24 billion in 2025, growing at a CAGR of 30.5% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 37.2% share, holding USD 0.83 billion in revenue.

The AI powered detection tool market refers to software and systems that use artificial intelligence to identify patterns, anomalies, risks, or specific objects within large volumes of data. These tools are applied across use cases such as fraud detection, cybersecurity monitoring, quality inspection, content moderation, and threat identification. AI detection tools process data from images, video, text, audio, and system logs to deliver automated insights.

One major driving factor of the AI powered detection tool market is the rising volume of digital threats and operational risks. Cyber attacks, fraud attempts, and system anomalies are increasing in frequency and sophistication. AI detection tools can identify unusual patterns faster than manual processes. This capability improves prevention and response effectiveness.

For instance, in March 2025, Crossplag upgraded its AI detector with enhanced multilingual support, achieving 91% accuracy per university benchmarks. The tool now better handles diverse languages while keeping false positives under 5%, making it a go-to for global academic integrity efforts.

Demand for AI powered detection tools is influenced by digital transformation across industries. As businesses adopt cloud platforms, connected devices, and digital workflows, the amount of data requiring monitoring increases. AI detection tools help analyze this data efficiently. This growing digital footprint strengthens demand.

Investment opportunities in the AI powered detection tool market exist in sector-specific solutions. Tools designed for fraud detection, medical diagnostics, industrial inspection, or cybersecurity address specialized needs. Domain-focused solutions often deliver higher accuracy. Investors favor platforms with clear industry alignment. Another opportunity lies in explainable AI detection systems. Organizations increasingly require transparency in automated decisions.

Key Takeaway

- In 2025, platform based solutions led the market with a 76.4% share, as organizations preferred centralized systems that combine detection, monitoring, and reporting within a single environment.

- The hardware segment captured a 54.2% share, reflecting continued reliance on dedicated devices and sensors to support high accuracy detection and real time processing.

- AI generated text detection held a 38.5% share, driven by rising concern over content authenticity, academic integrity, and misuse of generative AI across digital channels.

- On premises deployment remained dominant with a 60.2% share in 2025, indicating strong emphasis on data control, privacy protection, and compliance in sensitive environments.

- Deep learning technology accounted for 48.2% share, as advanced neural models delivered higher detection accuracy across complex and evolving data patterns.

- Audio and speech recognition tools led application adoption with a 45.2% share, supported by increased use in voice authentication, media verification, and monitoring of spoken content.

- Annual subscription models dominated pricing structures with a 52.4% share, reflecting preference for predictable costs, regular updates, and continuous access to detection features.

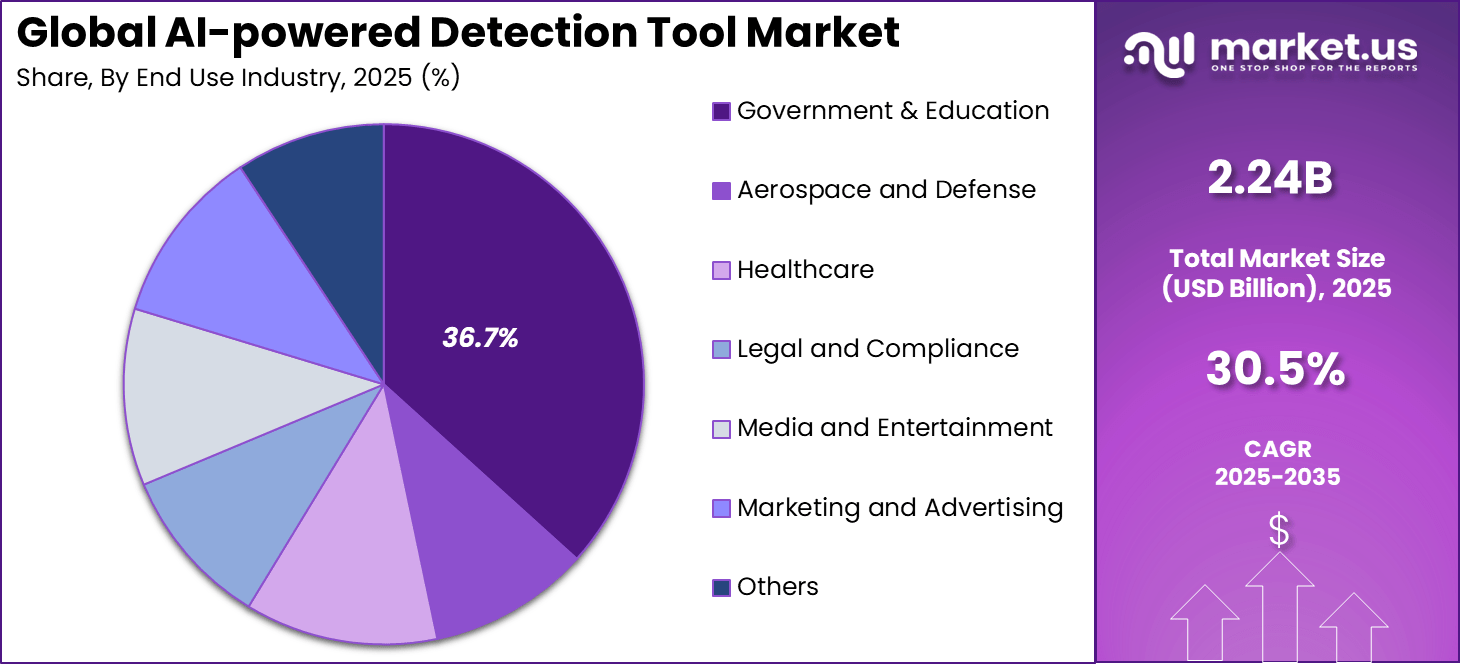

- The government and education sector represented the largest end user group with a 36.7% share, driven by needs around exam integrity, public information security, and content verification.

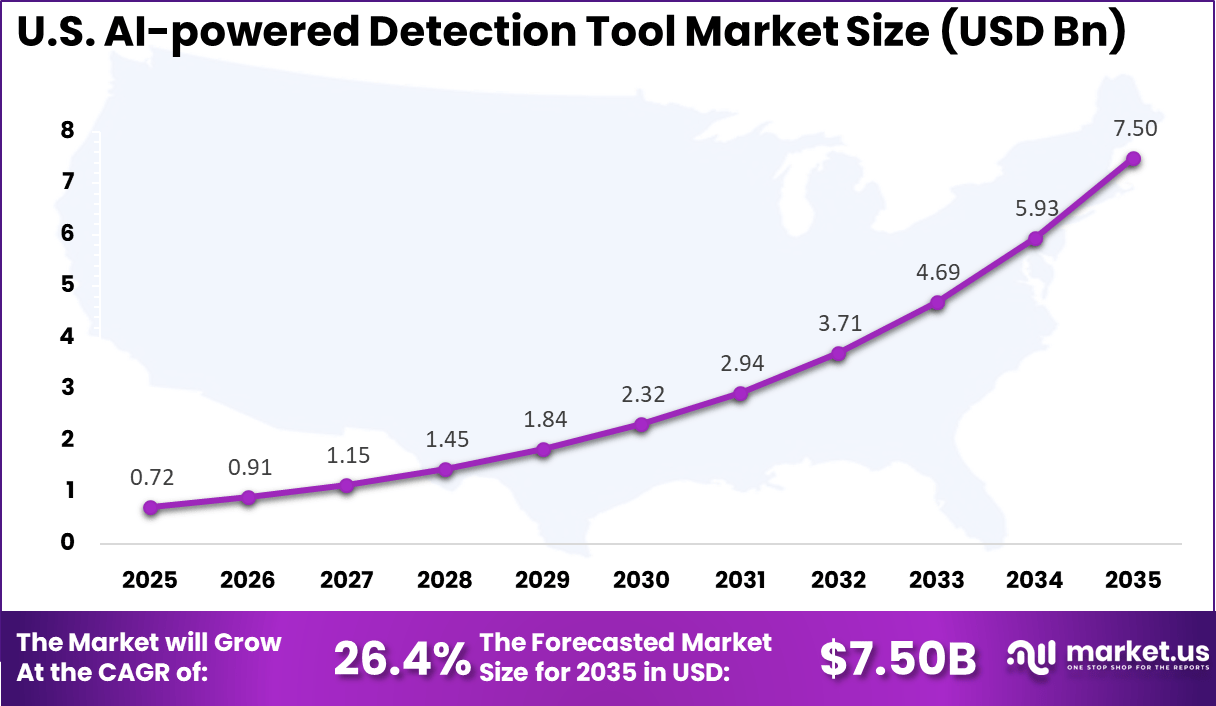

- The U.S. market reached USD 0.72 billion in 2025, expanding at a strong 26.4% growth rate due to rapid adoption across public institutions and enterprises.

- North America held more than 37.2% of the global market in 2025, supported by early technology adoption, strong regulatory focus, and advanced AI infrastructure.

Cybersecurity and AI Detection Insights

- AI adoption in cybersecurity continued to rise, with organizations using AI based security tools reporting an average 12% improvement in threat detection and response effectiveness. In parallel, about 69% of organizations deployed AI specifically for fraud detection use cases.

- Threat sophistication increased, as AI was also used by attackers. Around 40% of phishing emails sent to businesses were generated using AI techniques, increasing scale and realism. As a result, 93% of security leaders expected AI driven attacks to occur on a daily basis by 2025.

- Deepfake risks expanded rapidly, with 61% of organizations reporting an increase in deepfake related incidents. These attacks affected identity verification, financial fraud prevention, and misinformation control.

- Confidence in AI security tools remained strong despite rising threats, as 95% of cybersecurity professionals believed that AI powered detection tools would ultimately strengthen overall security posture.

AI Content Detection Tool Performance

- Accuracy claims from AI content detection platforms remained high, but real world reliability challenges persisted. Some tools reported accuracy levels above 99%, while others indicated performance closer to 86% for longer text samples with lower false positive rates.

- Detection bias emerged as a key concern, as multiple studies showed that content written by non native English speakers was more likely to be misclassified as AI generated. This raised fairness and compliance issues in academic and professional settings.

- Usage guidance evolved, as developers and educators increasingly advised against using AI detection scores as the sole measure of content authenticity. Instead, detection results were recommended as supporting indicators alongside human review and contextual assessment.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Rising cybersecurity threats Increased detection of digital and physical risks ~7.4% North America, Europe Short Term Government digitalization programs Adoption of AI for monitoring and compliance ~6.2% North America, Asia Pacific Short Term Growth in AI surveillance adoption Automated threat and anomaly identification ~5.8% Global Mid Term Expansion of smart infrastructure AI-based detection in public systems ~5.1% Global Mid Term Demand for real-time analytics Faster response and incident mitigation ~4.3% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline Data privacy concerns Ethical and legal constraints on monitoring ~5.6% North America, Europe Short Term High implementation costs Infrastructure and AI model deployment ~4.4% Emerging Markets Short to Mid Term Algorithm bias risks Accuracy and fairness issues ~3.7% Global Mid Term Regulatory uncertainty Changing AI governance frameworks ~3.1% Europe, North America Mid Term Skills shortage Limited AI and analytics expertise ~2.6% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact High upfront investment Capital intensive AI systems ~5.2% Emerging Markets Short to Mid Term Integration complexity Compatibility with legacy systems ~4.1% Global Mid Term Limited trust in AI decisions Human oversight requirements ~3.4% Global Mid Term Infrastructure dependency Need for high-performance computing ~2.8% Global Long Term Standardization gaps Lack of uniform AI benchmarks ~2.1% Global Long Term U.S. Market Size

The market for AI-powered Detection Tool within the U.S. is growing tremendously and is currently valued at USD 0.72 billion, the market has a projected CAGR of 26.4%. The market is growing due to the rapid rise in generative AI tools across education, media, and business, sparking high demand for checks on fake text, images, and audio.

Concerns over deepfakes, plagiarism, and misinformation push schools, firms, and agencies to adopt detectors fast. Strict rules on content trust and data privacy add fuel, as users seek ways to spot machine-made work. Tech hubs and investments speed innovation, helping tools get sharper daily.

For instance, in November 2025, Copyleaks expanded its AI-powered detection tools to identify AI-generated images, assigning probability scores and highlighting manipulated areas. This innovation combats fraud like fake receipts and insurance claims, targeting education, finance, and publishing sectors. This advancement underscores U.S. leadership in comprehensive AI detection beyond text.

In 2025, North America held a dominant market position in the Global AI-powered Detection Tool Market, capturing more than a 37.2% share, holding USD 0.83 billion in revenue. This lead stems from high AI tech adoption rates and is home to major providers pushing innovative detectors. Tech hubs like Silicon Valley drive R&D spending, while strict rules on data privacy and ethics boost tool use in schools, firms, and agencies. Quick uptake in sectors facing deepfakes and fake content keeps demand high, cementing the region’s top spot.

Region Primary Growth Driver Regional Share (%) Regional Value (USD Bn, 2025) Adoption Maturity North America Advanced government AI adoption 37.2% 0.83 Advanced Europe Regulatory driven detection systems 28.4% 0.64 Advanced Asia Pacific Expansion of smart cities and surveillance 24.1% 0.54 Developing to Advanced Latin America Public safety digitization 6.1% 0.14 Developing Middle East and Africa Early security automation initiatives 4.2% 0.09 Early For instance, in November 2025, Originality.ai launched Deep Scan, combining advanced AI detection with sentence-level highlighting and ethical AI writing tutor suggestions. The update includes Content Optimizer with Generative Engine Optimization (GEO) for AI search visibility, an upgraded dashboard, Fact Checker citations, and extended plagiarism detection. These enhancements maintain high accuracy while reducing false positives, reinforcing North American dominance in content authenticity tools.

By Type of Offering

Platforms account for 76.4%, showing their leading role in AI-powered detection solutions. These platforms provide centralized environments to deploy, manage, and monitor detection models. Users benefit from unified dashboards and reporting features. Platform-based delivery supports multiple detection use cases. Consistency and scalability remain important advantages.

The dominance of platforms is driven by enterprise-wide deployment needs. Organizations prefer integrated systems over isolated tools. Platforms support governance and policy controls. They also allow easier updates and maintenance. This sustains strong adoption of platform-based offerings.

For Instance, in December 2025, Originality.ai released multilingual support for its platform. This update lets users scan content in 30 languages with over 99% accuracy, making it easier for global teams to check AI text across borders. The platform now fits better in diverse markets like Europe and Asia.

By Type of Component

Hardware represents 54.2%, highlighting its importance in detection performance. Dedicated hardware supports faster processing of detection tasks. Edge devices and servers enable real-time analysis. Reliable hardware ensures stable operation under high workloads. Performance consistency is critical.

The preference for hardware is driven by compute-intensive detection models. Deep learning workloads require strong processing capacity. Hardware acceleration improves response times. On-premises environments benefit from dedicated resources. This sustains steady demand for hardware components.

For instance, in November 2025, Hugging Face upgraded its AI image detector hardware integration. The open-source tool now runs faster on edge devices, spotting AI-generated pics with 90% accuracy in under 3 seconds. This helps media firms verify uploads on local servers without cloud reliance.

By Type of Detection Modality

AI-generated text detection accounts for 38.5%, making it a key modality. These tools identify synthetic or altered text content. Detection supports content integrity and verification. Text analysis helps reduce misinformation risks. Accuracy remains a priority.

Growth in this modality is driven by increased use of automated text generation. Organizations need reliable verification methods. Detection tools analyze language patterns and structure. Early identification supports content control. This keeps text detection widely adopted.

For Instance, in September 2025, Copyleaks launched an advanced text detector update. It flags AI-written content with fewer false positives, focusing on styles from GPT models. News outlets use it to ensure articles stay human-crafted amid rising bot posts.

By Type of Deployment Mode

On-premises deployment holds 60.2%, reflecting preference for local control. Organizations manage sensitive data within internal systems. On-premises setups support security and compliance needs. Predictable performance improves reliability. Local deployment reduces external dependencies.

Adoption of on-premises deployment is driven by data privacy concerns. Many institutions handle confidential information. Internal infrastructure allows customization. On-premises systems support regulated environments. This sustains strong on-premises preference.

For Instance, in October 2025, Crossplag enhanced its on-premises AI detector. The upgrade boosts word limits and cuts errors in local scans, ideal for schools running checks offline. Users report smoother batch processing for student papers.

By Type of Technology

Deep learning accounts for 48.2%, making it the dominant technology. These models analyze complex data patterns effectively. Deep learning improves detection accuracy over time. Training on large datasets enhances reliability. Advanced algorithms support diverse detection tasks.

The dominance of deep learning is driven by detection complexity. Traditional methods struggle with evolving data. Deep learning adapts through continuous learning. Performance improves with usage. This keeps deep learning central to detection tools.

For Instance, in November 2025, Passed.AI enhanced deep learning models for better detection. The update trains on fresh datasets to catch advanced text fakes. It improves hit rates in tough cases, pushing deep learning forward.

By Type of Tool

Audio and speech recognition tools represent 45.2%, making them a major tool type. These tools analyze voice and sound patterns. Detection supports authentication and content verification. Audio analysis helps identify synthetic or altered speech. Accuracy and speed are essential.

Growth in this tool type is driven by voice-based content growth. Audio is widely used across platforms. Detection tools support security and compliance. Automated analysis reduces manual review. This sustains strong adoption of audio tools.

For Instance, in December 2025, Content at Scale improved audio detection features. The tool now analyzes voice clips for deepfake signs, aiding podcasters in spotting synth speech. Quick scans help maintain trust in interview content.

By Type of Subscription Model

Annual subscriptions account for 52.4%, showing preference for long-term access. Organizations prefer predictable billing cycles. Annual plans simplify budgeting and renewals. Continuous access supports operational stability. Long-term contracts reduce administrative effort.

The dominance of annual subscriptions is driven by enterprise procurement practices. Organizations align contracts with fiscal planning. Annual models offer cost efficiency. Providers deliver ongoing updates and support. This keeps annual subscriptions widely adopted.

For Instance, in January 2026, Passed.AI partnered with Originality.ai for annual plans. Subscribers get unlimited multilingual checks plus plagiarism scans, cutting costs for educators. The bundle supports year-long academic integrity efforts.

By End Use Industry

Government and education account for 36.7%, making them the leading end-use industries. These sectors manage large volumes of sensitive information. Detection tools support content authenticity and security. Compliance with regulations is essential. Accuracy and transparency are critical.

Adoption in these sectors is driven by public trust requirements. Institutions seek to prevent misuse of generated content. Detection tools support academic integrity and public communication. Automated systems improve oversight. This sustains strong demand from government and education.

For Instance, in September 2025, Originality.ai launched an Academic model for education. Tuned on scholarly texts, it shows low false positives for student work. Governments and universities adopt it to fight AI cheating in exams and reports.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior Government agencies Very High ~36.7% National security and compliance Long-term contracts Educational institutions High ~14% Campus safety and monitoring Program based Technology vendors High ~21% AI platform expansion R and D driven Infrastructure operators Moderate ~17% Risk detection and prevention Phased adoption SMEs Low ~11% Cost-sensitive automation Selective usage Technology Enablement Analysis

Technology Layer Enablement Role Impact on Market Growth (%) Adoption Status Machine learning models Pattern recognition and anomaly detection ~7.1% Growing Computer vision systems Visual threat identification ~6.0% Growing Natural language processing Text and speech threat analysis ~5.2% Growing Cloud AI platforms Scalable detection processing ~4.1% Mature Edge AI devices Real-time local detection ~3.1% Developing Emerging Trends

Emerging trends within the AI-powered detection tool market include the increasing use of advanced machine learning models and natural language processing to enhance detection accuracy and reduce manual intervention.

Developers are focusing on deep learning innovations that improve contextual understanding and pattern recognition in complex data environments, shifting the competitive landscape toward more adaptive and precise detection systems.

Additionally, integration of multi-modal detection that spans text, audio, visual, and behavioural signals is gaining traction, enabling broader applicability across content moderation, cybersecurity, fraud detection, and compliance monitoring.

Growth Factors

Growth in the AI-powered detection tool market is anchored in the escalating integration of AI technologies across enterprise and public sector applications. Increased reliance on digital platforms and the accompanying risk of security breaches, misinformation, and fraudulent activities amplify the necessity for intelligent detection mechanisms capable of real-time response.

Regulatory focus on transparency, data protection, and ethical AI practices also stimulates demand for robust detection solutions that help organisations align with compliance requirements. The expansion of use cases in sectors such as education, media, financial services, and security further contributes to sustained interest and investment in AI-based detection capabilities.

Opportunity Analysis

Emerging opportunities in the AI-powered detection tool market are associated with cross-industry demand for adaptive, real-time analytics and predictive insights. As organisations contend with growing volumes of digital content and sophisticated threat tactics, the need for advanced detection capabilities in areas such as fraud monitoring, deepfake identification, and content authenticity verification is expanding.

The proliferation of AI models in media, education, and enterprise platforms intensifies the necessity for tools that ensure integrity, compliance, and resilience against misuse. Solutions that combine deep learning with natural language processing and other advanced methods are well positioned to unlock new application areas and drive strategic value.

Challenge Analysis

A central challenge confronting this market is achieving robust explainability and reliability while balancing automation with human oversight. As detection algorithms become more sophisticated, stakeholders often require transparent and interpretable outputs to justify decisions and satisfy regulatory frameworks.

In sectors such as cybersecurity and academic integrity, unclear or opaque algorithmic reasoning can limit trust and raise compliance risks. Continuous refinement of models, coupled with substantial expertise in AI governance and dataset management, is necessary to address these issues and maintain consistent detection performance.

Key Market Segments

By Type of Offering

- Platforms

- API / SDKs

By Type of Component

- Hardware

- Software

- Services

By Type of Detection Modality

- AI-Generated Text

- AI-generated Image & Video

- AI-Generated Audio & Voice

- AI-Generated Code

- Multi-Modal

By Type of Deployment Mode

- Cloud-Based

- On-Premises

By Type of Technology

- Deep Learning

- Computer Vision Algorithms

- Machine Learning (ML)

- Natural Language Processing (NLP)

By Type of Tool

- Audio and Speech Recognition Tools

- Image and Video Detection Tools

- Multi-Modal Detection Tools

- Text Analysis Tools

By Type of Subscription Model

- Annual Subscription

- Monthly Subscription

- Pay-As-You-Go Model

By End Use Industry

- Government & Education

- Aerospace and Defense

- Healthcare

- Legal and Compliance

- Media and Entertainment

- Marketing and Advertising

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The competitive landscape of the AI powered detection tool market is shaped by a mix of specialized detection platforms and broader AI technology providers focused on identifying machine generated content and ensuring content authenticity.

AI Detector Pro, Passed.AI, Crossplag, Originality.ai, Copyleaks, Content at Scale, ZeroGPT, and Kazan SEO compete by offering text analysis models that assess linguistic patterns, probability scores, and writing signals to distinguish AI generated content from human written text. These tools are widely used across education, publishing, marketing, and SEO driven industries, where content integrity and originality are critical.

At the same time, platforms such as Hugging Face and the OpenAI Text Classifier influence competition by providing model level insights, open tools, and reference benchmarks that support detection research and evaluation. Competitive differentiation increasingly depends on detection accuracy, transparency of scoring methods, language coverage, and ease of integration with existing workflows.

Top Key Players in the Market

- AI Detector Pro

- Passed.AI

- Kazan SEO

- Crossplag

- Hugging Face

- Originality.ai

- Copyleaks

- Content at Scale

- ZeroGPT

- OpenAI Text Classifier

- Others

Recent Developments

- In October 2025, Originality.ai enhanced its detection capabilities to handle GPT-5.1 content with improved accuracy after OpenAI’s release. The update helps users spot advanced AI-generated text in academic and publishing workflows, maintaining trust in content authenticity amid evolving LLM threats.

- In November 2025, Hugging Face rolled out its AI Image Detector, achieving over 90% accuracy in spotting computer-generated visuals. Trained on millions of real and synthetic images, the open-source tool helps newsrooms and businesses verify authenticity against rising deepfake challenges.

Report Scope

Report Features Description Market Value (2025) USD 2.24 Bn Forecast Revenue (2035) USD 32.09 Bn CAGR(2025-2034) 30.5% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type of Offering (Platforms, API / SDKs), By Type of Component (Hardware, Software, Services), By Type of Detection Modality (AI-Generated Text, AI-generated Image & Video, AI-Generated Audio & Voice, AI-Generated Code, Multi-Modal), By Type of Deployment Mode (Cloud-Based, On-Premises), By Type of Technology (Deep Learning, Computer Vision Algorithms, Machine Learning (ML), Natural Language Processing (NLP), By Type of Tool (Audio and Speech Recognition Tools, Image and Video Detection Tools, Multi-Modal Detection Tools, Text Analysis Tools), By Type of Subscription Model (Annual Subscription, Monthly Subscription, Pay-As-You-Go Model), By End Use Industry (Government & Education, Aerospace and Defense, Healthcare, Legal and Compliance, Media and Entertainment, Marketing and Advertising, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AI Detector Pro, Passed.AI, Kazan SEO, Crossplag, Hugging Face, Originality.ai, Copyleaks, Content at Scale, ZeroGPT, OpenAI Text Classifier, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI-powered Detection Tool MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

AI-powered Detection Tool MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- AI Detector Pro

- Passed.AI

- Kazan SEO

- Crossplag

- Hugging Face

- Originality.ai

- Copyleaks

- Content at Scale

- ZeroGPT

- OpenAI Text Classifier

- Others