Global AI-Powered Data Analysis in Audits Market Size, Share Analysis Report By Component (Solution, Services), By Technology (Machine Learning, Natural Language Processing (NLP), Deep Learning, Others), By Application (Financial Auditing, Compliance Auditing, Risk Assessment, Fraud Detection), By End-User Industry (Banking and Finance, Healthcare, Manufacturing, Retail, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 151887

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- US Market Size

- By Component Analysis

- By Technology Analysis

- By Application Analysis

- By End-User Industry Analysis

- Key Market Segments

- Emerging Trend Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

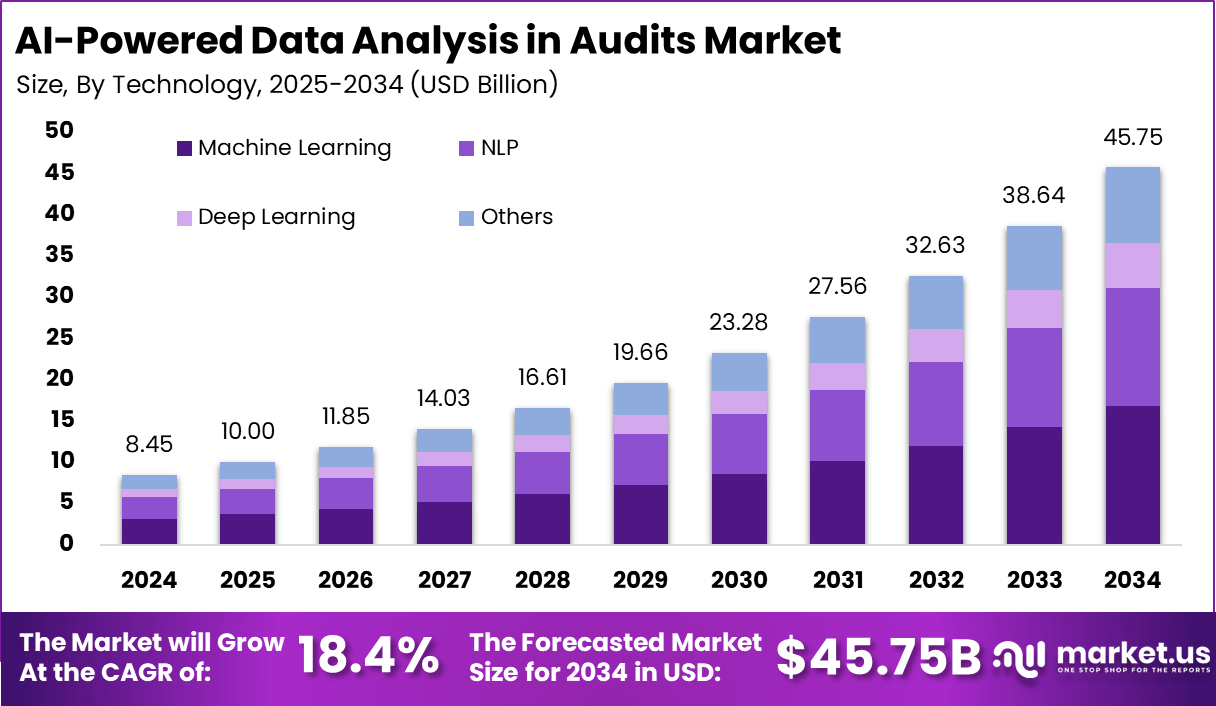

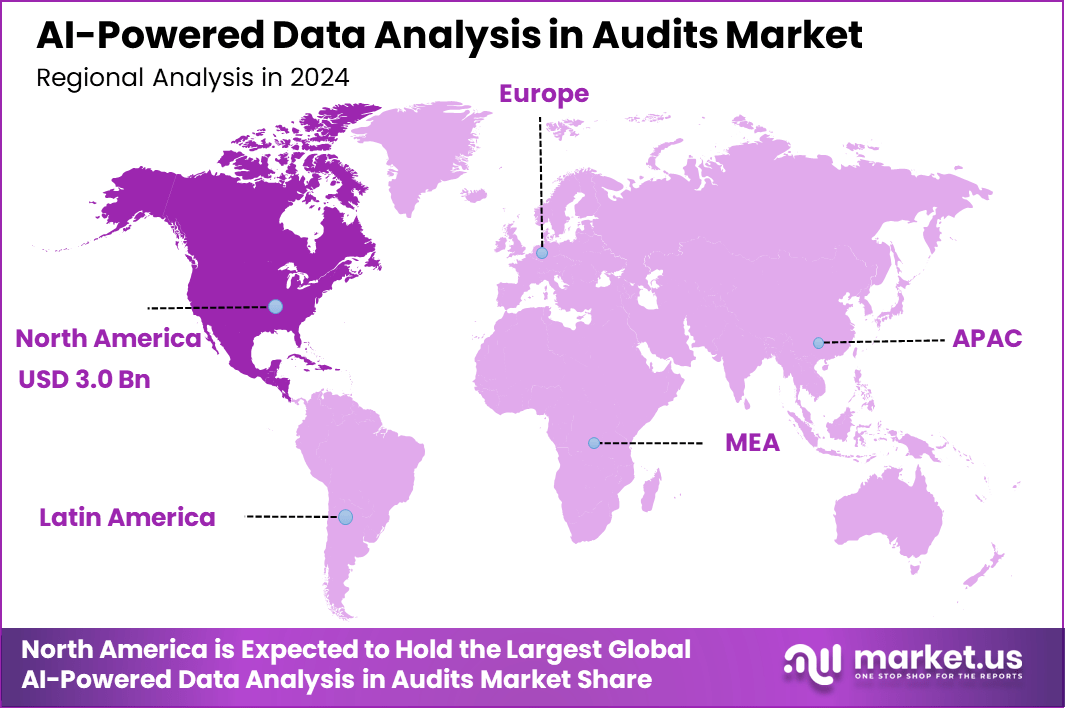

The Global AI-Powered Data Analysis in Audits Market size is expected to be worth around USD 45.75 Billion By 2034, from USD 8.45 billion in 2024, growing at a CAGR of 18.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 35.8% share, holding USD 3.0 Billion revenue.

The AI‑powered data analysis market within the audit profession has undergone rapid evolution due to technological advancements and increasing data volumes. Audit providers have begun leveraging machine learning and generative AI to automate transaction testing, contract review, anomaly detection, and continuous monitoring. The shift from traditional sampling methods to full‑data scanning has increased both the depth and breadth of audit procedures.

Top Driving Factors include increasing regulatory scrutiny and expectations for transparency, which compel audit firms to adopt more robust and objective analytical capabilities. The inefficiencies of manual auditing have also encouraged investment in automated risk scoring and contract review tools, enabling auditors to focus on areas of highest risk.

Increasing Adoption Technologies include machine learning for pattern recognition, natural language processing to extract insights from contracts and meeting minutes, and continuous auditing platforms that flag anomalies automatically. These technologies are being embedded across the audit lifecycle – from planning and risk assessment to fieldwork and reporting.

Key Reasons for Adopting AI are enhanced data accuracy, deeper risk insight, audit process automation, and strengthened fraud detection. AI improves the identification of outliers and supports scalable assurance, allowing auditors to shift focus onto judgment-based tasks. Investment Opportunities exist in developing audit‑specific AI platforms, assurance services for AI‑generated client data, and platforms that measure AI’s impact on audit quality.

Key Insight Summary

- North America led the market in 2024, holding over 35.8% share, with the US alone contributing USD 2.72 billion, driven by early AI adoption and strong regulatory focus.

- The market is projected to grow at a CAGR of 18.4% from 2025 to 2034, supported by the rising demand for automated, real-time insights in audit functions.

- Solutions accounted for the largest component share at 71.4%, indicating that enterprises are prioritizing platform-based deployments over services.

- Machine Learning was the dominant technology, capturing 36.8% share, as it enables predictive insights, anomaly detection, and pattern recognition in financial records.

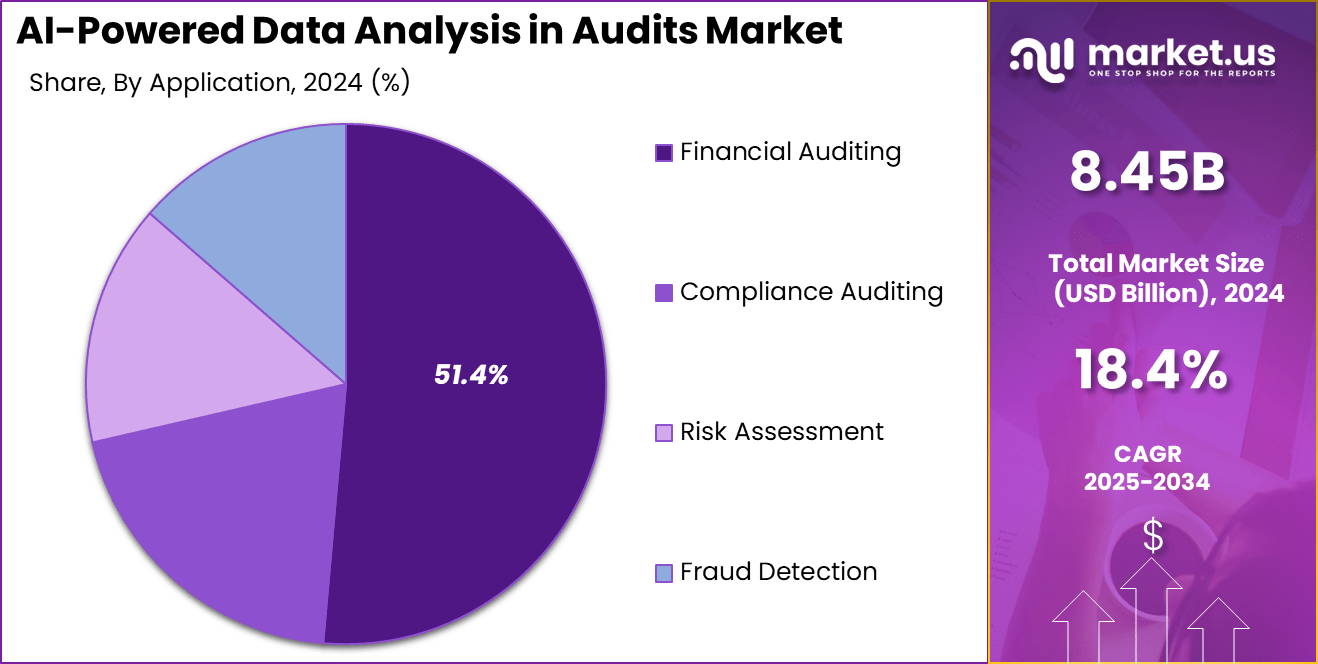

- Financial Auditing led all applications, with a share of 51.4%, due to increased use of AI in automating transactional and compliance checks.

- Banking and Finance emerged as the top end-user industry, contributing 29.7%, reflecting its heavy regulatory burden and large volume of structured data.

US Market Size

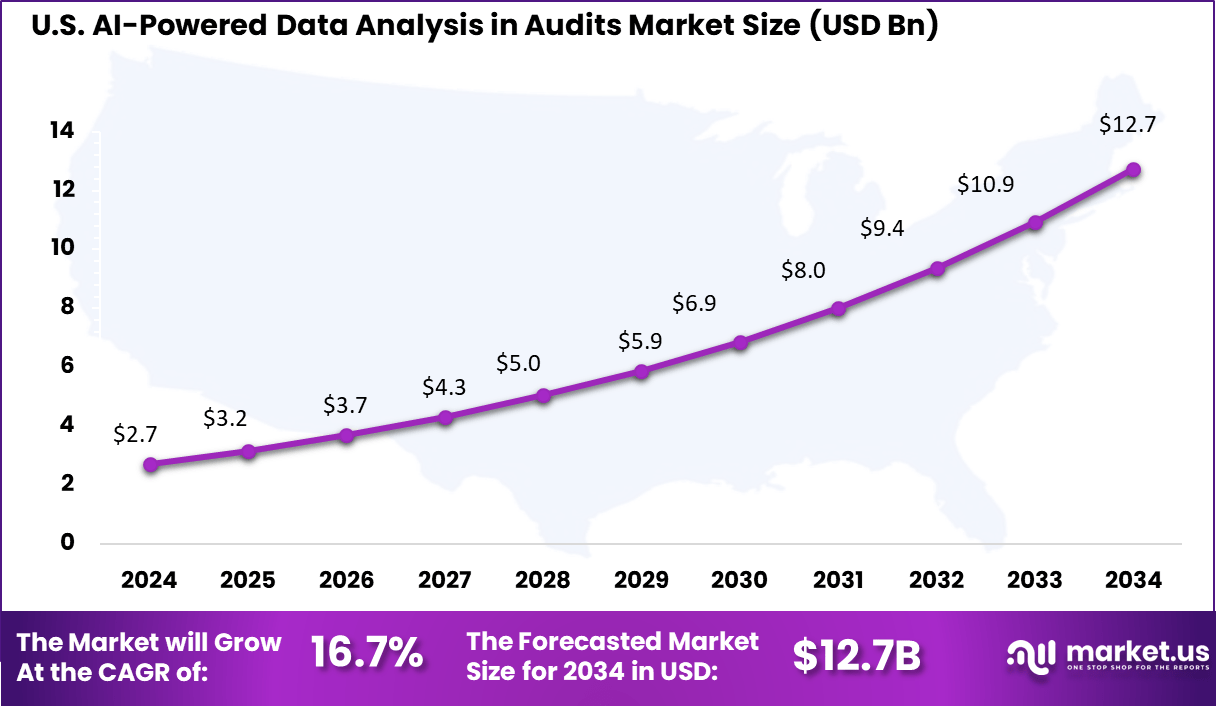

The U.S. AI-Powered Data Analysis in Audits Market was valued at USD 2.7 Billion in 2024 and is anticipated to reach approximately USD 12.7 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 16.7% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than a 35.8% share, holding USD 3.0 Billion revenue. The region’s leadership in AI-powered data analysis in audits can be largely attributed to the rapid integration of advanced technologies within its financial and regulatory systems.

Regulatory authorities and audit firms across the United States and Canada have aggressively adopted AI-driven audit tools to enhance compliance, risk detection, and fraud prevention. The high level of digital maturity among enterprises in North America has further accelerated the use of machine learning and predictive analytics in auditing operations.

Major accounting firms and corporate finance departments are increasingly shifting from traditional sampling-based audits to full-population testing using AI, driving regional dominance. Another contributing factor is the supportive ecosystem of technology providers, start-ups, and academic institutions focused on AI innovation. Government initiatives to ensure transparent financial reporting and mitigate corporate fraud have also played a critical role.

By Component Analysis

In 2024, the Solution segment held a dominant market position, capturing more than a 71.4% share. This leadership is primarily driven by the growing demand for end-to-end AI-powered platforms that can automate complex auditing tasks. These solutions offer capabilities such as data extraction, real-time anomaly detection, and predictive risk scoring, which help auditors analyze full datasets instead of relying on limited samples.

By reducing manual workloads and improving the reliability of findings, these platforms have become essential tools in modern audit environments. The strong performance of this segment is also supported by its ability to enhance audit efficiency and quality at scale. AI-driven solutions enable continuous auditing by monitoring financial data streams in near real-time, thereby improving issue detection and compliance tracking.

Additionally, they integrate with existing enterprise systems and provide visual dashboards that help audit professionals interpret insights quickly and accurately. As companies face increasing regulatory scrutiny and complex financial ecosystems, solution-based offerings are being preferred for their scalability, transparency, and ability to deliver higher-value insights with fewer resources.

By Technology Analysis

In 2024, the Machine Learning segment held a dominant market position in AI-powered data analysis for audits, capturing more than a 36.8 % share. This leadership can be attributed to several key factors. Machine learning (ML) enables auditors to process extensive transaction datasets with high precision, allowing patterns and anomalies to be detected through algorithmic risk scoring rather than traditional sampling.

The prevalence of ML in auditing stems also from its relative maturity and versatility. Simple ML approaches, such as regression analysis and decision trees, are well established within audit workflows due to their interpretability and ease of integration . These “simple AI” solutions are implemented more rapidly compared to deep learning or NLP systems, which typically demand greater computational resources, extensive data cleaning, and more complex model validation.

Additionally, regulatory bodies have expressed caution regarding the unchecked use of advanced AI, encouraging incremental implementation of ML tools that can be traced and audited. Moreover, the proven impact of ML on audit efficiency reinforces its market leadership. Machine learning systems have demonstrated the capacity to analyze every transaction within seconds, moving audits away from small sample testing and toward comprehensive, data-driven assurance.

By Application Analysis

In 2024, the Financial Auditing application segment held a dominant market position, capturing more than a 51.4% share. This dominance is attributed to the foundational role that financial audit processes occupy within organizations and regulatory frameworks. Enterprises and regulators alike prioritize financial statement accuracy, driving a focus on tools that can validate every transaction, ledger entry, and account balance.

AI technologies have enabled a shift from sampling methods to full‑population analysis, enhancing both the reliability and transparency of financial reporting. The emphasis on continuous, real‑time monitoring has reinforced the centrality of financial auditing among AI applications, given that it addresses mandatory disclosure obligations and investor assurance needs most directly.

The superiority of financial auditing as the leading application stems from its ability to deliver immediate value in terms of compliance and credibility. By leveraging AI, organizations are able to detect anomalies, discrepancies, and irregularities in financial data with greater precision and speed – thereby reducing audit cycles and improving stakeholder confidence.

By End-User Industry Analysis

In 2024, the Banking and Finance segment held a dominant market position, capturing more than a 29.7 % share. This leadership is rooted in the sector’s volume and complexity of financial transactions, which generate significant demand for AI‑powered audit tools capable of real‑time anomaly detection, compliance monitoring, and risk scoring.

The high regulatory intensity in banking and finance has incentivized the adoption of AI to enhance audit accuracy and operational efficiency – driving the segment’s prominence within the broader market. The segment’s role as the frontrunner is further underscored by its strategic adoption of generative AI and machine learning models, which facilitate automation of audit routines, rapid identification of errors or fraudulent patterns, and consistent oversight across large datasets.

Key Market Segments

By Component

- Solution

- Services

By Technology

- Machine Learning

- Natural Language Processing (NLP)

- Deep Learning

- Others

By Application

- Financial Auditing

- Compliance Auditing

- Risk Assessment

- Fraud Detection

By End-User Industry

- Banking and Finance

- Healthcare

- Manufacturing

- Retail

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend Analysis

Full‑Population Analytics

AI‑driven audit systems are evolving from sample‑based testing to full‑population analytics, enabling auditors to review all transactions rather than just a subset. This capability enhances audit effectiveness by increasing the chance of detecting anomalies and reducing reliance on extrapolation. Its deployment is increasingly observed across large audits, especially in financial services.

The shift to full‑population reviews is also accelerating auditor transformation: routine tasks are automated, allowing professionals to focus on interpretation and judgment. As a result, audit quality and depth of insight are expected to improve in the longer term, though consistent governance remains essential.

Driver Analysis

Efficiency & Risk Detection Enhancement

The primary driver for AI adoption in audits is the significant improvement in efficiency and risk detection. Machine learning models can rapidly process vast datasets, flagging suspicious entries and patterns that may elude human reviewers. This acceleration reduces manual burden and permits greater coverage of audit population.

Furthermore, faster processing enables more frequent or even continuous auditing cycles, fostering a proactive risk environment. Auditors can allocate saved time toward high‑risk areas and advisory tasks, enhancing both operational and strategic value in audit engagements.

Restraint Analysis

Monitoring & Bias Risk

Despite widespread implementation, formal oversight of AI tools remains limited. For instance, regulators have noted that major firms often track deployment volume rather than quality or outcomes of AI usage, and lack robust KPIs to measure its audit impact.

Additionally, unintended bias is a concern, as AI models may generate skewed results when based on training data that does not fully reflect real‑world diversity or complexity. This raises ethical, legal, and reputational risks unless consciously managed.

Opportunity Analysis

AI Assurance Services

An emerging opportunity lies in auditing AI‑based systems themselves. With the proliferation of AI across enterprises, there is growing demand for certification and assurance of algorithmic integrity, robustness, and compliance.

By developing AI assurance service offerings, auditors can extend their value chain from financial data to digital validation. This shift may create a new revenue stream and align with existing ESG assurance frameworks, positioning firms as trusted guardians of AI governance.

Challenge Analysis

Skills & System Integration

A critical challenge is the mismatch between current skillsets and required competencies. Surveys have shown that around 70% of audit professionals acknowledge the need for enhanced AI knowledge to remain effective. The shortage of AI‑savvy auditors may slow adoption and create reliance on external experts.

Furthermore, legacy IT infrastructures and compliance constraints impede seamless integration of AI tools. Many organisations struggle to embed AI within established processes without disrupting controls or violating regulations.

Key Player Analysis

In the AI-powered data analysis for audits domain, AuditBoard, Inc., Alteryx, Inc., and MindBridge Ai have emerged as pivotal players. These companies are leveraging automation and machine learning to enhance internal audit workflows, anomaly detection, and risk analysis. AuditBoard focuses on real-time controls monitoring, while Alteryx emphasizes no-code advanced analytics for auditors.

MindBridge uses AI to analyze general ledgers for risk scoring. Their innovations are streamlining traditional auditing processes, allowing faster and more accurate decision-making for enterprise compliance teams. Thomson Reuters Corporation, Grant Thornton LLP, and Trullion, Inc. are also strengthening their positions. Thomson Reuters integrates AI into its audit intelligence platforms for deeper insights and regulatory alignment.

Grant Thornton has adopted machine learning to automate complex audit reviews and improve data consistency. Trullion, on the other hand, offers AI-based audit-ready revenue recognition and lease accounting tools. These players are focusing on transparency and compliance, ensuring that data-driven insights meet evolving regulatory expectations across finance departments.

Top Key Players Covered

- AuditBoard, Inc.

- Alteryx, Inc.

- MindBridge Ai

- Thomson Reuters Corporation

- Grant Thornton LLP

- Trullion, Inc.

- KPMG International Cooperative

- PricewaterhouseCoopers International Limited (PwC

- Ernst & Young Global Limited (EY)

- Kanini, Inc.

- Impact Analytics, Inc

- Linkurious

- ThetaRay

- Others

Recent Developments

- In May 2024, AuditBoard entered into a definitive agreement to be acquired by Hg in a transaction valued at over USD 3 billion, marking a historic exit in the audit‑tech space and underscoring the growing investor confidence in AI‑enhanced compliance platforms.

Report Scope

Report Features Description Market Value (2024) USD 8.45 Bn Forecast Revenue (2034) USD 45.75 Bn CAGR (2025-2034) 18.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solution, Services), By Technology (Machine Learning, Natural Language Processing (NLP), Deep Learning, Others), By Application (Financial Auditing, Compliance Auditing, Risk Assessment, Fraud Detection), By End-User Industry (Banking and Finance, Healthcare, Manufacturing, Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AuditBoard, Inc., Alteryx, Inc., MindBridge Ai, Thomson Reuters Corporation, Grant Thornton LLP, Trullion, Inc., KPMG International Cooperative, PricewaterhouseCoopers International Limited (PwC), Ernst & Young Global Limited (EY), Kanini, Inc., Impact Analytics, Inc, Linkurious, ThetaRay, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI-Powered Data Analysis in Audits MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

AI-Powered Data Analysis in Audits MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AuditBoard, Inc.

- Alteryx, Inc.

- MindBridge Ai

- Thomson Reuters Corporation

- Grant Thornton LLP

- Trullion, Inc.

- KPMG International Cooperative

- PricewaterhouseCoopers International Limited (PwC

- Ernst & Young Global Limited (EY)

- Kanini, Inc.

- Impact Analytics, Inc

- Linkurious

- ThetaRay

- Others