Global AI Patent Search Market Size, Share, Growth Analysis By Component (Software/Platform, Services [Professional Services, Managed Services]), By Deployment (Cloud-Based, On-Premises), By Application (Prior Art Search & Patent-ability Analysis, Freedom-to-Operate (FTO) & Clearance Search, Invalidity Search, Competitive Intelligence & Landscape Analysis, Patent Portfolio Management & Benchmarking, Others), By End-User (Corporates, Law Firms & IP Consultancies, Research & Academic Institutions, Government & Regulatory Bodies), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167110

- Number of Pages: 381

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

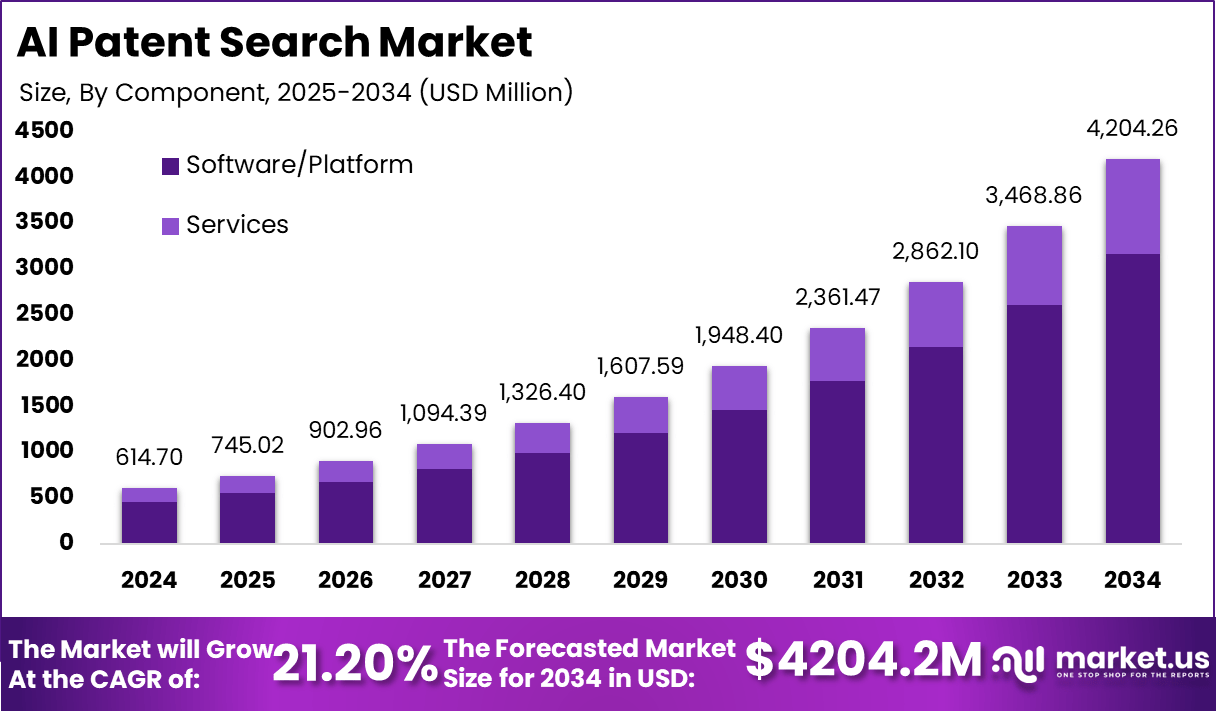

The AI Patent Search Market is entering a period of rapid expansion as organizations increasingly adopt advanced artificial intelligence tools to navigate the growing complexity, volume, and global scope of intellectual property (IP) data. Valued at USD 614.7 million in 2024, the market is projected to surge to USD 4,204.2 million by 2034, registering a strong 21.20% CAGR driven by widespread digital transformation, rising patent filings, and the growing need for accurate, real-time IP insights.

AI-powered patent search systems enable faster prior-art discovery, improved patentability assessment, automated classification, infringement monitoring, competitive intelligence, and landscape mapping—functions that are becoming essential across technology, pharmaceuticals, automotive, semiconductors, and academic research institutions.

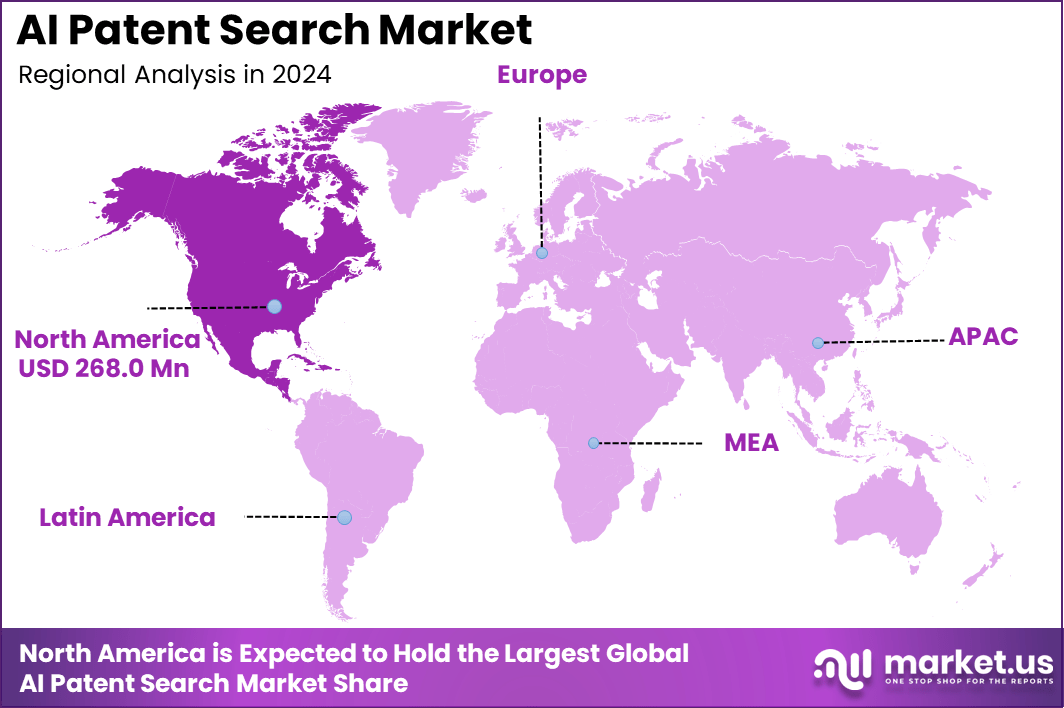

North America accounts for a commanding 43.6% share of the global market, valued at USD 268.0 million in 2024, supported by strong IP protection frameworks, high innovation intensity, and early adoption of AI-driven legaltech solutions.

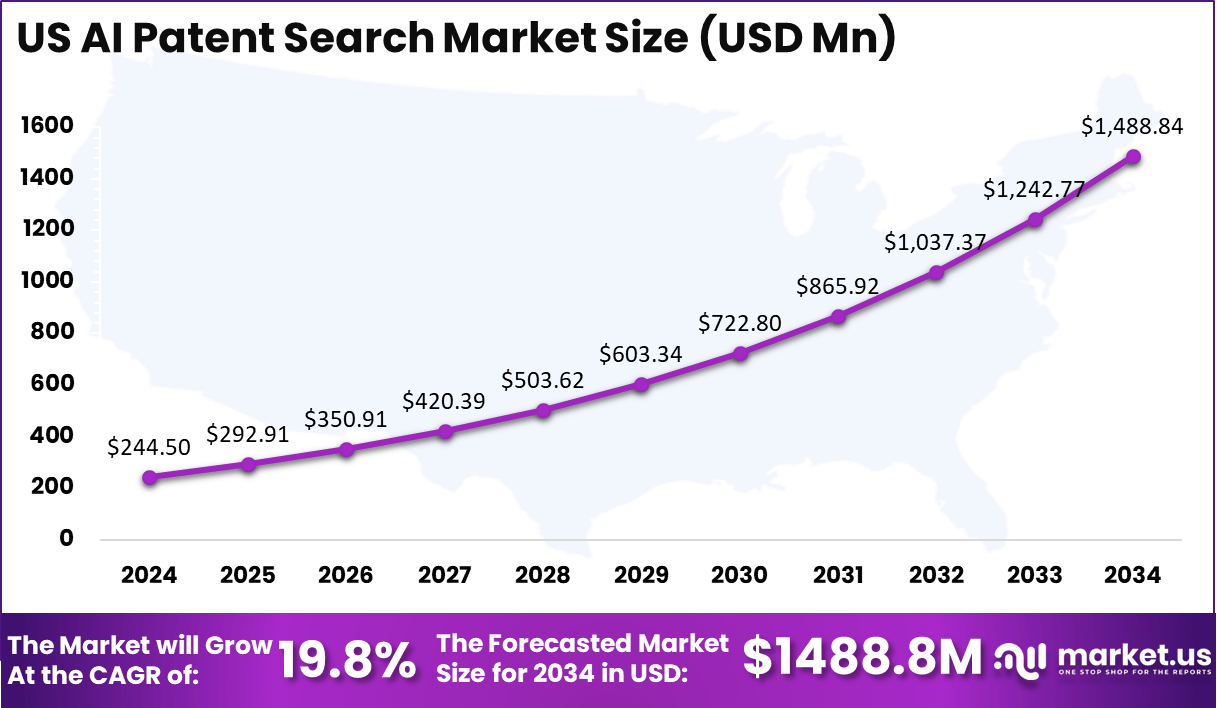

The US alone contributed USD 244.5 million and is expected to reach USD 1,488.8 million by 2034 at a 19.8% CAGR, reflecting the growing reliance of corporations, law firms, and patent offices on automated search and analytics. With AI models becoming increasingly multimodal—capable of interpreting text, images, claims, citations, and technical drawings—the market is set for transformative growth over the next decade.

The AI Patent Search market is rapidly evolving as organizations confront an unprecedented rise in global patent filings, complex technical disclosures, and the growing need for faster, more accurate intellectual property (IP) analysis. Traditional manual patent search methods are no longer sufficient to handle millions of documents across jurisdictions, leading industries, law firms, and research institutions to adopt AI-powered solutions capable of automating prior-art discovery, claim comparison, infringement detection, and technology landscape mapping.

AI-driven tools leverage natural language processing, semantic search, machine learning, and multimodal analysis to interpret patent text, diagrams, citations, and classification codes with greater precision and speed than conventional systems. These advancements enable innovators to streamline R&D decision-making, avoid costly IP conflicts, and strengthen patent portfolios.

Enterprises in sectors such as semiconductors, pharmaceuticals, automotive, electronics, biotechnology, and software increasingly rely on AI to sift through vast patent databases and extract actionable insights. The integration of AI in patent search also supports examiner workflows in patent offices, research institutions, and universities by improving search consistency and reducing evaluation time.

As global competition intensifies and innovation cycles shorten, AI-enabled patent search is becoming a critical tool for maintaining technological leadership, protecting strategic assets, and enhancing overall IP management efficiency.

Recent activity around AI patent search tools shows steady product launches, fresh funding, and more AI features being added into traditional patent databases, all pointing to a market that is getting more automated and data‑heavy. In funding, one younger AI‑driven IP workflow platform raised about 14 million dollars in a Series A round in early 2025, taking its total funding to roughly 21 million dollars within nine months, which signals strong investor belief that AI can transform how patents are drafted, searched, and managed.

Another specialist GenAI patent search startup closed a 1.5 million dollar seed round in 2024, with investors backing its ability to run relevance analysis across long and technical patent texts, so that users can quickly see which documents really matter in a search set. On the product side, established IP search vendors are rolling out new AI layers: a major patent intelligence provider launched an AI‑based search module in its global Derwent platform in December 2024, using transformer models on more than 160 million patent records and over 62 million invention families to cut first‑pass patentability reviews from “hundreds of documents” down to a much smaller, more targeted list.

Another provider released an AI and machine‑learning powered patent search solution in 2023 that combines natural‑language queries, intelligent analytics, and collaboration tools to help users find hard‑to‑spot scientific and technical prior art more quickly.

Independent market research on AI in patent and market‑intelligence software notes that vendors are actively extending their portfolios through new product development, mergers, and acquisitions, as they invest in more advanced AI models and data infrastructure to support tasks such as prior‑art search, competitive landscaping, and patent valuation.

At a broader level, sector‑wide M&A data shows that AI deals overall are still rising, with some analyses projecting more than 300 AI‑related deals and over 30% year‑on‑year growth in 2024, which indirectly supports continued consolidation and capability building in narrow verticals like patent analytics as larger platforms buy or partner with AI specialists.

Funding and launch activity for AI patent tools is also happening against a backdrop of rapid growth in AI patenting itself, where official datasets now track AI in millions of patent documents and recent landscape reports show that the share of generative AI patents within overall AI filings has increased from a little over 4% in 2017 to more than 6% by 2023, creating direct demand for stronger, AI‑assisted search and statistics across a much bigger and more complex patent corpus.

Key Takeaways

- The AI Patent Search Market reached USD 614.7 Million in 2024 and is projected to grow to USD 4,204.2 Million by 2034 at a 21.20% CAGR.

- North America led the global market with a 43.6% share, valued at USD 268.0 Million in 2024.

- The US market accounted for USD 244.5 Million in 2024 and is expected to reach USD 1,488.8 Million by 2034, growing at a 19.8% CAGR.

- Software/Platform dominated the Component segment with a 75.3% market share.

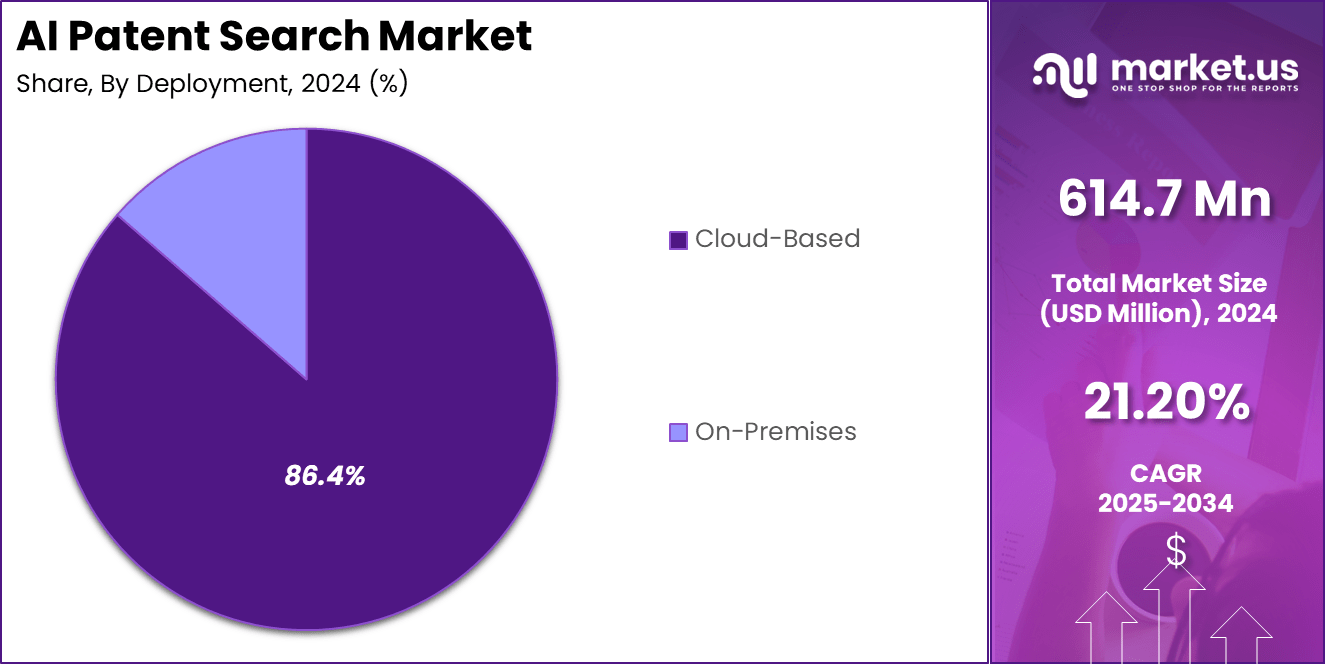

- Cloud-based deployment remained the preferred model, capturing 86.4% of the market.

- Competitive Intelligence & Landscape Analysis led the Application segment with a 30.7% share.

- Corporations were the largest End-User category, contributing 52.2% to the overall market.

Role of AI

Artificial intelligence plays a central role in transforming patent search by dramatically improving accuracy, speed, and efficiency across the entire intellectual property (IP) lifecycle. With more than 3.4 million global patent applications filed annually and over 90 million active patent documents worldwide, manual search processes are no longer sufficient to handle the scale and complexity.

AI enables semantic understanding of patent language, which is often highly technical and written in non-standard formats. Advanced NLP models can analyze claim structures, compare technical concepts, and identify prior art with far greater precision than keyword-based systems, reducing search time by 60–80%.

Machine learning systems continuously learn from millions of citations, classifications, and legal outcomes, improving the relevance of search results and minimizing the risk of missed prior art—one of the costliest challenges for innovators. Multimodal AI further enhances capabilities by interpreting diagrams, chemical structures, and engineering schematics alongside text, enabling deeper technical evaluation within seconds.

AI tools also support real-time competitive intelligence by tracking thousands of assignees and over 150 patent offices globally, helping organizations identify emerging technologies and potential infringements earlier. As innovation cycles shorten and R&D investment grows, AI-driven patent search has become essential for corporate IP teams, patent attorneys, examiners, and research institutions seeking faster, more reliable, and data-driven decision-making.

Industry Adoption

Industry adoption of AI-driven patent search solutions is accelerating as organizations face a dramatic rise in global innovation activity, shorter product cycles, and increasingly complex intellectual property landscapes. In 2024 alone, more than 3.4 million patent applications were filed worldwide, prompting corporations, law firms, research institutions, and government agencies to adopt AI tools that streamline prior-art searches, competitive analysis, and patentability assessments.

Technology-intensive sectors such as semiconductors, pharmaceuticals, automotive, biotechnology, electronics, and software are among the earliest adopters, as these industries generate high volumes of technical disclosures and rely heavily on strong IP protection to maintain market leadership.

Corporations represent the largest adoption base, with thousands of R&D teams integrating AI platforms to reduce search time by up to 70% and accelerate innovation decision-making. Law firms increasingly use AI systems not only for patent searches but also for drafting assistance, claim comparison, and infringement risk evaluation, improving workflow efficiency and reducing the likelihood of litigation errors. Patent offices in more than 40 countries have also begun experimenting with AI-assisted examination tools to manage growing workloads and improve search consistency.

As cloud-based IP analytics platforms become more accessible and scalable, industry adoption continues to rise, supported by demand for real-time monitoring of competitor filings, global patent trends, and emerging technologies. AI-driven patent search is quickly becoming a core capability across innovation-led industries.

Emerging Trends

Emerging trends in the AI Patent Search Market reflect a transition toward more intelligent, multimodal, and automated IP analysis systems that significantly enhance the way organizations manage innovation and intellectual property. One of the most notable trends is the rise of multimodal AI models capable of analyzing not only patent text but also diagrams, chemical structures, engineering drawings, and mathematical expressions.

This enables deeper technical understanding and reduces manual interpretation time for complex patents. Another major trend is the adoption of semantic and concept-based search, which goes beyond keyword matching to interpret intent, allowing users to discover relevant prior art even when terminology differs across industries or jurisdictions.

Real-time competitive intelligence is becoming standard, with platforms now tracking millions of filings across 150+ patent offices, alerting users instantly about new applications, emerging assignees, and technology clusters. Generative AI is also reshaping workflows by assisting with claim drafting, patent landscape summaries, and automated categorization of inventions. Additionally, predictive IP analytics is gaining traction, allowing organizations to forecast innovation trends, R&D directions, and potential infringement risks using historical and real-time data.

Cloud-native patent search systems continue to expand due to their scalability and global accessibility, while integration with R&D, legal, and enterprise software ecosystems strengthens operational efficiency. Together, these trends highlight a shift toward faster, smarter, and more proactive IP management.

US Market Size

The US market for AI-driven patent search solutions is witnessing strong expansion as innovation intensity accelerates across technology, pharmaceuticals, automotive, semiconductors, telecommunications, and life sciences. Valued at USD 244.5 million in 2024, the US market is projected to reach USD 1,488.8 million by 2034, advancing at a robust 19.8% CAGR.

This growth is driven by the country’s significant volume of patent filings-over 600,000 applications annually-and the increasing need for advanced tools that can handle complex, technical prior-art searches with greater accuracy and speed. AI-powered patent search platforms reduce manual workloads for corporate IP teams, patent attorneys, research institutions, and government agencies by providing automated claim analysis, semantic search, citation mapping, and infringement detection.

US corporations represent one of the largest user segments, as companies seek to protect high-value innovations, avoid costly litigation, and maintain competitive advantage in fast-evolving markets. Law firms are also rapidly adopting AI-assisted examination tools to improve workflow efficiency and reduce risks associated with missed prior art.

Furthermore, the US Patent and Trademark Office (USPTO) continues exploring AI capabilities to enhance examination processes and manage growing application volumes. As AI models become more capable of analyzing technical drawings, chemical structures, and engineering schematics, the US market is expected to remain a global leader in AI-enabled patent search adoption.

By Component

Software and platform solutions dominate the AI Patent Search Market with a 75.3% share, driven by the rapid adoption of intelligent IP analytics tools across corporates, law firms, and research institutions. These platforms integrate advanced NLP, semantic search, machine learning, and multimodal capabilities that allow users to analyze millions of patents, technical documents, and citations in seconds.

Their ability to automate prior-art search, patentability assessment, infringement detection, competitive intelligence, and technology landscape mapping makes them the preferred choice for organizations managing large R&D pipelines.

Cloud-based platforms further enhance accessibility, enabling teams across different geographies to collaborate on IP evaluations in real time. With innovation cycles shortening across sectors such as semiconductors, pharmaceuticals, automotive, biotechnology, and software, software-based tools offer the scalability needed to keep pace with rising patent volumes.

Services—including professional services and managed services—play a supportive but growing role. Professional services assist users with implementation, workflow integration, customization, and training to maximize platform efficiency. Managed services are gaining traction as organizations outsource continuous monitoring, IP auditing, patent landscaping, and competitive analysis to specialized teams.

These services are particularly valuable for small and mid-sized enterprises that lack in-house IP expertise. While software platforms remain the backbone of the market, demand for service-based expertise is expected to rise as AI tools become more advanced and require ongoing optimization for complex IP environments.

By Deployment

Cloud-based deployment dominates the AI Patent Search Market with an 86.4% share, driven by its scalability, cost efficiency, and ability to process massive patent datasets in real time. As global patent databases continue to expand-now exceeding 90 million active records-organizations increasingly rely on cloud infrastructure to handle high computational workloads associated with semantic search, machine learning analysis, citation mapping, and multimodal interpretation.

Cloud-based platforms enable seamless access to updated patent repositories, cross-jurisdictional filings, and global classification systems, which are essential for comprehensive IP research. Their flexibility allows corporates, law firms, and research institutions to scale storage and processing power instantly based on project demands, significantly reducing hardware and maintenance costs.

Moreover, cloud deployment supports collaborative workflows, enabling distributed R&D and legal teams to work simultaneously on prior-art searches, technology landscapes, and competitive intelligence. Continuous updates, AI model enhancements, and integration with third-party IP tools are easier to deliver via the cloud, ensuring users benefit from the latest advancements without manual upgrades.

On-premises solutions remain relevant for organizations with strict data security, confidentiality, or regulatory compliance requirements-common in defense, pharmaceuticals, and government sectors. These setups provide full control over data storage and internal access but come with higher operational costs and limited scalability. While on-premises systems serve niche needs, cloud-based deployment will continue to dominate due to its superior efficiency, speed, and global accessibility.

By Application

Competitive intelligence and landscape analysis lead the AI Patent Search Market with a 30.7% share, driven by organizations’ growing need to monitor emerging technologies, competitor filings, and global innovation patterns. As industries experience rapid technological convergence—such as AI-driven healthcare, autonomous mobility, biotechnology, and advanced materials—companies require deeper, real-time insights to guide R&D investments and strategic decision-making.

AI-powered platforms analyze millions of patents, classify technology clusters, identify white-space opportunities, and map innovation trends across 150+ patent offices, helping businesses stay ahead of competitors. These tools also enable detailed benchmarking of rival portfolios, tracking assignee activity, filing velocity, and geographic expansion. For corporations operating in fast-evolving sectors, landscape analysis reduces strategic blind spots and supports long-term innovation planning.

Other key applications continue to grow steadily. Prior art search and patentability analysis streamline ideation and reduce risks by cutting search time by up to 70%. Freedom-to-operate (FTO) and clearance searches help avoid infringement risks, especially in pharmaceuticals, electronics, and automotive domains.

Invalidity searches support litigation and licensing negotiations by identifying weaknesses in third-party claims. Patent portfolio management is increasingly automated through AI-based categorization, valuation, and maintenance tracking. While these applications collectively strengthen IP strategies, competitive intelligence remains dominant due to its direct impact on market positioning and R&D competitiveness.

By End-User

Corporates dominate the AI Patent Search Market with a 52.2% share, driven by their need to safeguard innovation pipelines, accelerate R&D decision-making, and maintain competitive advantage in fast-evolving industries. Companies in sectors such as semiconductors, pharmaceuticals, biotechnology, automotive, electronics, and software generate thousands of invention disclosures each year, making efficient patent search and IP analytics essential.

AI-powered tools help corporates reduce prior-art search time by 60–80%, improve patentability assessments, monitor competitor filing trends, and identify infringement risks early. These platforms also support strategic functions such as whitespace analysis, technology scouting, M&A due diligence, and portfolio optimization, enabling organizations to make informed investment and innovation decisions.

Law firms and IP consultancies rely on AI systems to enhance search accuracy, streamline drafting workflows, and manage complex litigation-related analyses. With rising patent disputes and global filings, firms increasingly adopt AI-driven semantic search and multimodal analysis to serve clients more efficiently.

Research and academic institutions use AI tools to evaluate invention disclosures, support technology transfer operations, and track scientific advancements. Government and regulatory bodies, including patent offices, are integrating AI to improve examination quality, manage workload surges, and enhance the consistency of prior-art evaluations. While adoption is expanding across all end-user groups, corporates remain the largest and most influential segment due to their high-volume innovation activities and strategic IP dependencies.

Key Market Segments

By Component

- Software/Platform

- Services

- Professional Services

- Managed Services

By Deployment

- Cloud-Based

- On-Premises

By Application

- Prior Art Search & Patentability Analysis

- Freedom-to-Operate (FTO) & Clearance Search

- Invalidity Search

- Competitive Intelligence & Landscape Analysis

- Patent Portfolio Management & Benchmarking

- Others

By End-User

- Corporates

- Law Firms & IP Consultancies

- Research & Academic Institutions

- Government & Regulatory Bodies

Regional Analysis

North America leads the AI Patent Search Market with a commanding 43.6% share, valued at USD 268.0 million in 2024, supported by a strong innovation ecosystem, advanced digital infrastructure, and early adoption of AI-driven legaltech solutions.

The region benefits from large volumes of patent activity, with the US alone receiving more than 600,000 patent applications annually, creating substantial demand for faster, more accurate, and scalable IP search tools. Corporations across technology, pharmaceuticals, biotechnology, automotive, and electronics rely heavily on AI-based semantic search, multimodal patent analysis, and automated portfolio intelligence to accelerate R&D decisions and protect their competitive edge.

North America also hosts many of the world’s largest AI developers, patent analytics firms, and cloud service providers, enabling rapid integration of advanced NLP, machine learning, and multimodal capabilities into patent search platforms. Law firms and IP consultancies increasingly use AI to strengthen patent drafting, infringement assessment, and litigation strategies. The US Patent and Trademark Office (USPTO) continues exploring AI-assisted examination tools, further driving institutional adoption.

Academic institutions and government agencies also contribute to demand as they manage innovation pipelines and research commercialization efforts. With continuous digital transformation, strong investment in AI R&D, and high IP enforcement intensity, North America is expected to maintain its dominant role in the global market through 2034.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

The AI Patent Search Market is expanding rapidly due to rising global patent activity, digital transformation across R&D functions, and the need for faster, more accurate IP evaluation. With more than 3.4 million patent applications filed worldwide each year, organizations face overwhelming volumes of technical disclosures that traditional search methods cannot efficiently manage. AI tools reduce prior-art search time by 60–80%, enabling corporates, law firms, and patent offices to accelerate innovation decisions.

Growth is further supported by the increasing complexity of patents across semiconductors, biotechnology, automotive, and advanced materials, prompting demand for semantic understanding and multimodal interpretation.

Cloud-based IP analytics platforms now process tens of millions of documents in real time, improving accessibility. Regulatory emphasis on stronger IP protection and the rise of global R&D spending-surpassing USD 2.4 trillion annually-also drives adoption. Together, these factors firmly position AI as an essential technology in modern patent research.

Restraint Factors

Despite strong growth, several restraints limit the broader adoption of AI patent search systems. High implementation costs remain a challenge, as advanced AI engines require substantial computational resources and continuous model training. Accuracy concerns also persist—AI systems can still generate false positives and negatives, particularly when interpreting complex chemical structures, mathematical claims, or engineering diagrams.

Some companies report error rates of 8–12% in niche technical areas, necessitating human cross-verification. Data privacy and confidentiality obligations restrict cloud usage for sensitive IP projects, especially in defense, pharmaceuticals, and government sectors.

Additionally, fragmented global patent formatting and language variations—from Japanese and Korean filings to European multi-jurisdictional documents—require region-specific AI tuning. Legal professionals also express caution due to potential liability risks when relying solely on automated search outputs. These challenges slow adoption among risk-averse industries and reinforce the need for hybrid AI–human workflows.

Growth Opportunities

The AI Patent Search Market presents strong opportunities as organizations invest in automation to manage growing innovation pipelines. A major opportunity lies in multimodal AI, which can analyze text, diagrams, chemical structures, 2D/3D CAD files, and sequence data-expected to unlock new value in pharmaceuticals, materials science, and robotics.

The expansion of global patent filings-projected to surpass 100 million cumulative active patents by 2028-creates significant demand for scalable analytics platforms. Emerging markets in Asia-Pacific, Latin America, and the Middle East offer additional growth potential as R&D investment rises across electronics, automotive, and biotech sectors.

The integration of AI search tools into R&D software, PLM systems, and enterprise knowledge platforms also opens new commercial pathways. Generative AI presents further opportunities by supporting automated claim drafting, patent landscaping, and innovation forecasting. As more than 40 national patent offices explore AI-assisted examination, institutional adoption will accelerate long-term market expansion.

Trending Factors

Several emerging trends are reshaping the AI Patent Search Market. Multimodal AI is one of the most significant, enabling systems to interpret diagrams, schematics, formulas, and chemical structures alongside text-dramatically improving accuracy in complex fields. The rise of semantic, concept-based search allows users to find prior art even when terminology differs, reducing dependency on keywords.

Generative AI is becoming a key trend, with tools now capable of drafting patent claims, summarizing landscapes, and predicting technology trajectories. Real-time competitive intelligence is also growing, with platforms monitoring 150+ patent offices worldwide to deliver instant alerts on new filings and competitor moves.

Cloud-native IP analytics continues to trend upward, supported by demand for collaboration across distributed R&D teams. Finally, predictive analytics is gaining importance as organizations use AI models to forecast innovation shifts, identify white-space opportunities, and assess portfolio strength. These trends collectively indicate a shift toward fully intelligent, proactive IP management systems.

Competitive Analysis

The competitive landscape of the AI Patent Search Market is intensifying as technology providers, IP analytics firms, and emerging AI startups scale their capabilities to meet rising global demand. Leading platform providers collectively generate USD 1.1–1.4 billion in annual revenue from AI-driven patent analytics, supported by advanced NLP engines, multimodal interpretation tools, and cloud infrastructures capable of processing over 50 million documents per day.

These companies dominate due to their ability to integrate global patent databases, deliver sub-second semantic search results, and support enterprise-grade security and compliance. Their platforms often cover filings from 150+ patent offices, offering unmatched global coverage.

Meanwhile, high-growth startups contribute approximately USD 180–250 million in yearly revenue, expanding rapidly by offering niche capabilities such as chemical structure recognition, AI-driven prior-art mapping, and domain-specific search engines for biotechnology, semiconductors, and pharmaceuticals.

Many of these emerging players serve 3,000–5,000 enterprise and legal users, gaining traction through cost-effective, customizable, and API-driven solutions. Competitive intensity is further heightened by the rise of collaboration agreements—over 90 new partnerships in the last two years—between AI developers, law firms, Fortune 500 corporations, and research institutions.

As generative AI and multimodal systems advance, differentiation now hinges on accuracy, speed, global coverage, and integration depth. Companies capable of reducing search time by 70% or more, supporting multilingual search across 40+ languages, and offering real-time competitive intelligence are emerging as leaders in this rapidly evolving market.

Top Key Players in the Market

- Clarivate

- LexisNexis

- Questel

- Patentfield

- Ambercite

- Perplexity

- PQAI

- IPRally Technologies Oy

- PatSeer Technologies Pvt. Ltd.

- Patsnap

- Novelty

- InnovationQ Plus

- Visualize IP

- NLpatent

- Amplified

- Octimine

- Others

Recent Developments

- November 20, 2025: Clarivate introduced an upgraded AI-powered patent intelligence engine integrating multimodal analysis for technical drawings, chemical structures, and semiconductor schematics, improving prior-art accuracy across complex domains for corporate R&D teams and law firms.

- November 7, 2025: LexisNexis launched its next-generation PatentSight+ platform featuring real-time AI-driven competitive landscape tracking, enabling enterprises to monitor global filings, assignee movements, and emerging technology clusters across more than 150 patent offices.

- October 30, 2025: WIPO announced enhancements to its AI-assisted patent translation and search tools, expanding support for additional Asian and European languages to improve cross-border examination and facilitate multilingual prior-art discovery for innovators worldwide.

Report Scope

Report Features Description Market Value (2024) USD 614.7 Million Forecast Revenue (2034) USD 4204.2 Million CAGR(2025-2034) 21.20% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Component (Software/Platform, Services [Professional Services, Managed Services]), By Deployment (Cloud-Based, On-Premises), By Application (Prior Art Search & Patentability Analysis, Freedom-to-Operate (FTO) & Clearance Search, Invalidity Search, Competitive Intelligence & Landscape Analysis, Patent Portfolio Management & Benchmarking, Others), By End-User (Corporates, Law Firms & IP Consultancies, Research & Academic Institutions, Government & Regulatory Bodies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Clarivate, LexisNexis, Questel, Patentfield, Ambercite, Perplexity, PQAI, IPRally Technologies Oy, PatSeer Technologies Pvt. Ltd., Patsnap, Novelty, InnovationQ Plus, Visualize IP, NLpatent, Amplified, Octimine, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Clarivate

- LexisNexis

- Questel

- Patentfield

- Ambercite

- Perplexity

- PQAI

- IPRally Technologies Oy

- PatSeer Technologies Pvt. Ltd.

- Patsnap

- Novelty

- InnovationQ Plus

- Visualize IP

- NLpatent

- Amplified

- Octimine

- Others