Global AI Operations (AIOps) Market Size, Share Analysis Report By Offering (Platform, Services), By Deployment Mode (On-Premises, Cloud), By Enterprise Size (Small & Medium Enterprise Size (SME's), Large Enterprises), By Application (Application Performance Management, Infrastructure Management, Network and Security Management, Real-Time Analytics, Others (Predictive Analytics, Root Cause Analysis)), By Industry (IT & Telecom, Retail & E-Commerce, Energy & Utilities, Media & Entertainment, BFSI, Healthcare, Government, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: January 2025

- Report ID: 137811

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- U.S. AIOps Market Size

- Business Benefits

- Offering Analysis

- Deployment Mode Analysis

- Enterprise Size Analysis

- Application Analysis

- Industry Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

The Global AI Operations (AIOps) Market size is expected to be worth around USD 123.1 Billion By 2034, from USD 12.4 Billion in 2024, growing at a CAGR of 25.80% during the forecast period from 2025 to 2034. In 2024, North America dominated the AIOps market, accounting for over 45.5% of the market share, with total revenues reaching USD 5.6 billion.

AIOps, or Artificial Intelligence for IT Operations, refers to the deployment of machine learning and artificial intelligence to enhance and automate the management of IT operations. This technology integrates various AI capabilities, including machine learning and analytics, to transform big data from IT operations into actionable insights.

The AIOps market is driven by the increasing complexity of IT environments and the growing volume of data they generate. Businesses are turning to AIOps to enhance operational efficiency, reduce downtime, and improve response times. This market encompasses a range of solutions designed to address various IT operational needs across industries, leveraging AI to predict, analyze, and mitigate IT issues before they impact the business operations.

Key drivers of the AIOps market include the growing complexity of IT environments, the increasing volume of data generated by modern IT infrastructures, and the need for enhanced IT operational agility. As businesses adopt more cloud-based services and face rising security threats, the ability to quickly analyze and respond to IT issues becomes crucial.

AIOps platforms meet these challenges by automating processes and providing insights that would be difficult or impossible to achieve manually. Demand in the AIOps market is fueled by the need for automated real-time analytics and the ability to preemptively resolve IT issues. Companies across various sectors are adopting AIOps platforms to ensure their IT systems are resilient, efficient, and capable of supporting digital business activities.

The business benefits of AIOps are significant and varied. By automating routine and complex tasks, AIOps frees up IT staff to focus on more strategic initiatives. It also reduces the mean time to detect and resolve issues, which minimizes downtime and improves business continuity. Moreover, AIOps enhances security posture by proactively identifying and addressing vulnerabilities and threats, ultimately supporting a more robust IT infrastructure.

According to OpsRamp, a prominent provider in the service-centric AIOps platform market, an impressive 87% of organizations report that AIOps tools have successfully delivered value. This statistic underscores a growing confidence in AIOps technology within the IT industry. As the technology continues to evolve at a rapid pace, we can anticipate its increased integration across various IT operations.Technological innovations are continually shaping the AIOps landscape. Developments in AI, machine learning, and data processing technologies have enabled AIOps platforms to offer more precise analytics, better predict IT issues, and automate more complex operations. These advancements enhance the capability of AIOps tools to manage larger data sets more effectively and with greater accuracy

Key Takeaways

- The Global AI Operations (AIOps) market is projected to grow from USD 12.4 billion in 2024 to USD 123.1 billion by 2034, reflecting a CAGR of 25.80% during the forecast period from 2025 to 2034.

- In 2024, the Platform segment dominated the AIOps market, holding more than 67.5% of the total market share.

- The On-Premises segment led the AIOps market in 2024, capturing more than 58.9% of the market share.

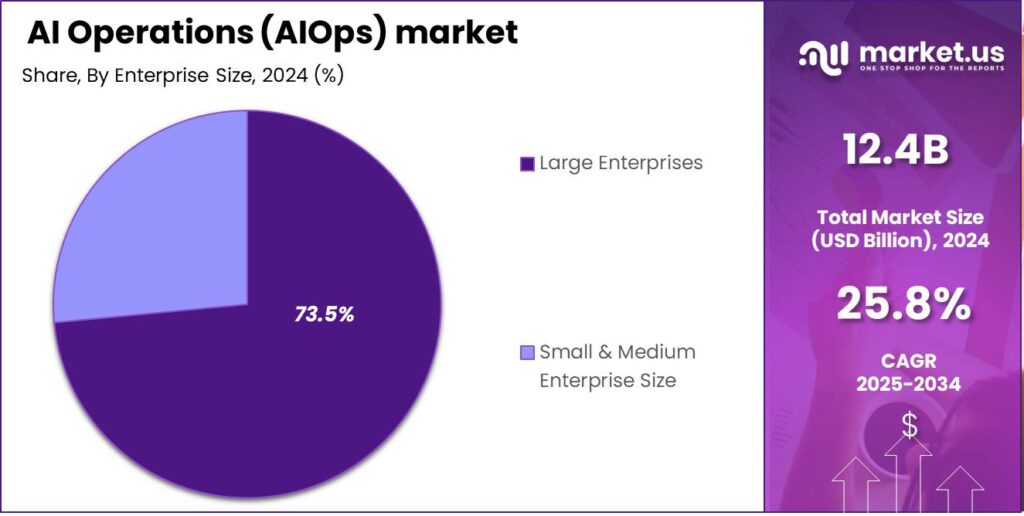

- In 2024, Large Enterprises held a dominant position in the AIOps market, with a market share exceeding 73.5%.

- The Application Performance Management (APM) segment was the leading segment in the AIOps market in 2024, accounting for more than 44.2% of the market share.

- In 2024, the IT & Telecom sector captured more than 31.8% of the AIOps market share, making it the dominant vertical.

- North America was the dominant region in the AIOps market in 2024, holding over 45.5% of the market share, with total revenues amounting to USD 5.6 billion.

- The US AIOps market was valued at USD 4.86 billion in 2024, with a projected CAGR of 26.7%, driven by the increasing adoption of AI solutions to optimize IT operations and reduce downtime.

U.S. AIOps Market Size

The US AI Operations (AIOps) market was valued at USD 4.86 billion in 2024, with a projected compound annual growth rate (CAGR) of 26.7%, reflecting the increasing adoption of AI-driven solutions to optimize IT operations, enhance efficiency, and reduce downtime across various industries.

As organizations increasingly face complex data environments and IT systems, AI-driven tools in AIOps offer vital capabilities to preemptively identify potential disruptions and automate routine tasks. This not only reduces operational downtime but also optimizes resource allocation and boosts overall operational efficiencies.

The growing trend of digital transformation and increased data generation requires advanced management solutions. AIOps platforms, powered by AI and machine learning, efficiently process large datasets to provide actionable insights, helping businesses stay competitive through improved decision-making and rapid adaptation to market changes.

In 2024, North America held a dominant market position in the AIOps landscape, capturing more than a 45.5% share with revenues amounting to USD 5.6 billion. This region’s leadership in the market can be attributed to several key factors, including advanced technological adoption and the presence of major industry players.

The substantial investment in cloud infrastructure and IT services in North America further supports the expansion of the AIOps market. With a high concentration of technology firms and a strong push towards digital transformation, businesses in this region are leveraging AI-driven analytics and machine learning to automate complex operations and optimize performance.

The regulatory landscape in North America drives the adoption of AIOps solutions, as organizations seek tools that ensure compliance with data privacy and security regulations. AIOps platforms, with real-time insights and enhanced monitoring, are well-suited to meet these needs and protect against cyber threats.

The North American AIOps market is set for continued growth, driven by the need to maintain system health and manage increasingly complex IT environments. This demand will be fueled by technological advancements and the growing adoption of IoT and edge computing, requiring more advanced IT operations management solutions.

Business Benefits

AIOps can detect and address IT issues faster than traditional methods. By continuously monitoring systems and identifying unusual patterns, it reduces the time needed to fix problems, leading to less downtime and better service availability.

AIOps analyzes data trends to predict system failures or performance issues, enabling proactive maintenance. This reduces disruptions, ensures smoother operations, and enhances customer satisfaction, ultimately creating more business opportunities.

A smart city project utilized AIOps for real-time traffic management, cutting congestion by 40% and enhancing emergency response times, creating a more efficient and responsive urban environment, as stated in theaiops article.

By implementing predictive AIOps solutions, a leading financial institution reduced system outages by 45%, resulting in significant savings of millions in operational costs.

A Deloitte study emphasizes that integrating AIOps with DevOps not only reduces release failures by 30% but also accelerates deployment cycles by 20%. This synergy enhances overall operational efficiency, ensuring faster, more reliable software delivery and improved collaboration between development and IT teams.

Offering Analysis

In 2024, the Platform segment held a dominant market position in the AI Operations (AIOps) market, capturing more than a 67.5% share. This significant market share can be attributed to the comprehensive range of functionalities these platforms offer, including real-time analytics, machine learning capabilities, and automation tools.

The Platform segment leads by offering significant cost savings through automation of routine tasks and optimization of IT resources. This cost-efficiency drives adoption, especially among large enterprises managing vast IT infrastructures and data.

Additionally, the Platform segment benefits from its scalability and adaptability to various IT environments. These platforms are designed to grow with the business, accommodating increased data loads and more complex operations without sacrificing performance.

The ability to integrate seamlessly with existing systems while also offering the flexibility to incorporate new technologies as they emerge makes AIOps platforms a preferred choice for businesses looking to future-proof their operations.

Deployment Mode Analysis

In 2024, the On-Premises segment of the AI Operations (AIOps) market held a dominant position, capturing more than a 58.9% share. This segment’s leadership can be attributed to several key factors that align with the requirements of businesses seeking enhanced control and security over their AI operations.

On-premises deployment allows organizations to maintain all their data and infrastructure within their physical facilities, which significantly mitigates security risks associated with data breaches and cyber threats. This is particularly appealing to industries such as finance, healthcare, and government, where data sensitivity and compliance with stringent regulatory standards are paramount.

Furthermore, the On-Premises model provides organizations with greater control over their IT environments. Companies can customize their systems to specific needs and integrate them seamlessly with existing infrastructure, which is often a critical requirement for legacy systems prevalent in established industries.

This customization capability, coupled with the ability to oversee the entire AI operation lifecycle, from development to deployment and maintenance, ensures that enterprises can optimize their AI solutions effectively, leading to improved operational efficiency and reduced downtime.

Enterprise Size Analysis

In 2024, the Large Enterprises segment held a dominant market position within the AI Operations (AIOps) market, capturing more than a 73.5% share. This predominance is largely due to the extensive resources and capital that large enterprises can allocate towards advanced AI technologies.

Such organizations are often at the forefront of adopting innovative solutions that promise to enhance operational efficiencies and competitive advantage. With the scale of their IT operations, large enterprises face complex and voluminous data management challenges that AIOps solutions are particularly well-suited to address, thereby driving the segment’s substantial market share.

Large enterprises also benefit significantly from the comprehensive integration capabilities of AIOps platforms. These organizations typically have complex, multi-layered IT infrastructures that require robust systems to monitor, analyze, and manage operations across various departments and services.

Large enterprises invest in On-Premises AIOps solutions to meet strict risk management and compliance requirements. These systems help proactively identify issues, ensure compliance, and automate IT operations, making them essential for managing operational risks.

Application Analysis

In 2024, the Application Performance Management (APM) segment held a dominant position within the AIOps market, capturing more than a 44.2% share. This segment leads primarily due to the increasing complexity of IT infrastructure and the growing demand for enhanced visibility into application performance.

Organizations are increasingly reliant on real-time monitoring tools to detect, diagnose, and address application issues before they affect the end-user experience. APM solutions empower businesses with critical insights into application behavior, thereby optimizing operational efficiency and minimizing downtime.

The prominence of the APM segment can also be attributed to its role in digital transformation initiatives. As enterprises continue to integrate digital technologies, the need for robust APM solutions escalates. These solutions facilitate effective management of software applications and IT systems, which are pivotal in supporting digital services and operations.

Moreover, the APM segment is fueled by advancements in artificial intelligence and machine learning technologies. These innovations enhance APM solutions, enabling them to predict potential issues and automate root cause analysis. This predictive capability is crucial for maintaining application performance and supports proactive management strategies, which are essential for modern IT environments.

Industry Analysis

In 2024, the IT & Telecom segment held a dominant position in the AIOps market, capturing more than a 31.8% share. This sector’s leadership can be attributed primarily to its high dependency on complex IT infrastructures and networks that require robust management to ensure uninterrupted service delivery.

The IT & Telecom industry faces the challenge of managing vast amounts of data generated from multiple sources, including real-time data traffic, which necessitates the adoption of AIOps for efficient data analysis and operational automation.

Moreover, the growing demand for cloud-based solutions and services within this segment has further driven the deployment of AIOps platforms, as they offer enhanced capabilities for cloud management and service assurance.

The significant market share of the IT & Telecom segment also reflects the rapid technological advancements in the sector, including the rollout of 5G and the expansion of IoT applications. These developments introduce increased complexity and scalability challenges that traditional IT operations management tools struggle to address effectively.

Key Market Segments

By Offering

- Platform

- Services

By Deployment Mode

- On-Premises

- Cloud

By Enterprise Size

- Small & Medium Enterprise Size (SME’s)

- Large Enterprises

By Application

- Application Performance Management

- Infrastructure Management

- Network and Security Management

- Real-Time Analytics

- Others (Predictive Analytics, Root Cause Analysis)

By Industry

- IT & Telecom

- Retail & E-Commerce

- Energy & Utilities

- Media & Entertainment

- BFSI

- Healthcare

- Government

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Increasing IT complexity

The increasing complexity of IT environments has necessitated the adoption of Artificial Intelligence for IT Operations (AIOps). Modern IT infrastructures encompass a diverse array of technologies, including cloud services, microservices architectures, and Internet of Things (IoT) devices.

This diversity results in vast amounts of data and intricate interdependencies, making traditional IT management approaches inadequate. AIOps addresses these challenges by utilizing advanced analytics and machine learning to automate and enhance IT operations.

By analyzing extensive datasets in real-time, AIOps enables proactive issue detection, efficient resource management, and improved decision-making processes. Consequently, organizations can maintain system reliability and performance amidst growing IT complexity.

Restraint

Integration with Existing Systems

Integrating AIOps solutions into established IT infrastructures presents significant challenges. Many organizations operate with a combination of legacy systems and modern applications, each with distinct data formats and protocols.

Achieving seamless interoperability between AIOps platforms and these heterogeneous systems requires substantial effort. Additionally, the integration process may necessitate modifications to existing workflows and staff training, leading to potential disruptions during the transition period. These factors can impede the swift and effective deployment of AIOps solutions, thereby restraining their widespread adoption.

Opportunity

Enhanced Decision-Making through Predictive Analytics

AIOps offers significant opportunities to enhance decision-making processes within IT operations. By leveraging predictive analytics, AIOps platforms can forecast potential system failures, capacity requirements, and performance bottlenecks before they occur.

This foresight allows organizations to implement preemptive measures, thereby minimizing downtime and optimizing resource allocation. Furthermore, predictive insights support strategic planning and facilitate continuous improvement initiatives, enabling businesses to adapt swiftly to evolving technological landscapes and maintain a competitive edge.

Challenge

Data Quality and Management

The effectiveness of AIOps solutions is heavily dependent on the quality and management of underlying data. IT environments generate vast volumes of data from various sources, often leading to fragmented and inconsistent datasets.

Ensuring data accuracy, completeness, and consistency is a complex task that requires robust data governance frameworks. Poor data quality can result in erroneous analyses and suboptimal decision-making, undermining the benefits of AIOps. Therefore, organizations must invest in comprehensive data management strategies to fully realize the potential of AIOps technologies.

Emerging Trends

Hyperautomation is a key trend, focusing on automating IT tasks for self-healing systems and dynamic workload management. A global e-commerce platform used AIOps to reduce manual interventions by 70%, enabling 50% faster incident resolution during peak traffic and improving overall operations and customer experience.

Another trend is the use of generative AI to make AIOps tools easier to use. Many users find AIOps software complex, which can slow down adoption. By adding generative AI, these tools can offer personalized tutorials and instant help, making them more user-friendly.

Edge computing is also becoming important. With more devices operating at the edge of networks, AIOps needs to process data closer to where it’s created. This allows for real-time monitoring and quicker responses to issues, which is crucial for applications that need immediate attention.

Key Player Analysis

The market for AIOps is rapidly growing, with several companies offering advanced solutions to meet the increasing demands for enhanced IT efficiency.

AppDynamics, a leader in the AIOps market, provides a robust platform focused on application performance management (APM) and IT operations analytics. Their solution enables businesses to gain full visibility into the performance of their applications and infrastructure.

BMC Software, Inc. is another key player in the AIOps landscape, offering an integrated suite of AI-driven solutions for IT operations management. Their BMC Helix platform combines artificial intelligence, automation, and machine learning to help organizations detect, diagnose, and resolve IT issues faster.

Broadcom Inc. is a significant player in the AIOps market, offering a range of solutions that help businesses manage complex IT environments. With its broad portfolio of enterprise software, Broadcom provides advanced AIOps solutions that leverage AI and machine learning to enhance network monitoring, application performance, and infrastructure management.

Top Key Players in the Market

- APPDYNAMICS

- BMC Software, Inc.

- Broadcom Inc.

- HCL Technologies Limited

- IBM Corporation

- Micro Focus International plc

- Dell Inc.

- ProphetStor Data Services, Inc.

- Splunk LLC

- Thales

- Others

Top Opportunities Awaiting for Players

As the AIOps (Artificial Intelligence for IT Operations) market continues to evolve, several key opportunities are emerging that industries and market players can capitalize on to drive growth and innovation.

- Expansion into Emerging Markets: The AIOps market is witnessing rapid growth in regions like Asia-Pacific, driven by increasing digital transformation, technology adoption, and IT infrastructure improvements. Countries such as China, India, and Japan are prime examples where there is a burgeoning demand for scalable IT solutions, offering a fertile ground for AIOps solutions.

- Cloud Deployment: Cloud-based AIOps solutions are becoming increasingly popular due to their flexibility, scalability, and cost-effectiveness. This deployment mode not only allows organizations to adjust resources dynamically based on demand but also aligns with the agile nature of modern IT environments, facilitating quicker integration and adoption.

- Regulatory Compliance and Risk Management: Recent legislative changes in the USA highlight an opportunity for AIOps providers to offer solutions that help industries comply with evolving regulations. As governments worldwide tighten regulations around AI and IT operations, AIOps tools that can ensure compliance and manage risks efficiently are in high demand.

- Enhanced IT Operations Across Diverse Industries: AIOps’ versatility across sectors like BFSI, healthcare, retail, and telecom showcases its potential to transform IT operations. Each sector has unique needs, from managing complex transactions in BFSI to ensuring system uptime in healthcare, demonstrating the broad applicability of AIOps solutions.

- Advancements in AI and Machine Learning Capabilities: As AI and machine learning technologies continue to advance, AIOps platforms are becoming more capable of predictive analytics, real-time data processing, and automated decision-making. This technological progression is opening up new possibilities for improving the speed, accuracy, and efficiency of IT operations management.

Recent Developments

- In February 2024, IBM acquired IntelliMagic, a Netherlands-based company specializing in optimizing z/OS system performance using analytics. This acquisition enhanced IBM’s AIOps offerings by integrating advanced performance insights into their solutions.

- In October 2024, At BMC Connect 2024, BMC unveiled new innovations in its Helix AIOps platform, including the BMC Ask HelixGPT virtual assistant. These updates enhance incident response and risk management by integrating service management, observability, and vulnerability data, streamlining workflows, and leveraging AI for smarter support.

Report Scope

Report Features Description Market Value (2024) USD 12.4 Bn Forecast Revenue (2034) USD 123.1 Bn CAGR (2025-2034) 25.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Offering (Platform, Services), By Deployment Mode (On-Premises, Cloud), By Enterprise Size (Small & Medium Enterprise Size (SME’s), Large Enterprises), By Application (Application Performance Management, Infrastructure Management, Network and Security Management, Real-Time Analytics, Others (Predictive Analytics, Root Cause Analysis)), By Industry (IT & Telecom, Retail & E-Commerce, Energy & Utilities, Media & Entertainment, BFSI, Healthcare, Government, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape APPDYNAMICS, BMC Software, Inc., Broadcom Inc., HCL Technologies Limited, IBM Corporation, Micro Focus International plc, Dell Inc., ProphetStor Data Services, Inc., Splunk LLC, Thales, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI Operations (AIOps) MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample

AI Operations (AIOps) MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- APPDYNAMICS

- BMC Software, Inc.

- Broadcom Inc.

- HCL Technologies Limited

- IBM Corporation

- Micro Focus International plc

- Dell Inc.

- ProphetStor Data Services, Inc.

- Splunk LLC

- Thales

- Others