Global AI Materials Product Optimization Market Size, Share, Industry Analysis Report By Type (Software/Platforms, Services), By Application (Materials Discovery & Design, Property Prediction & Optimization, Process Optimization & Manufacturing, Formulation Optimization, Quality Control & Defect Detection, Lifecycle & Sustainability Assessment, Others), By End-User Industry (Chemicals & Advanced Materials, Energy & Batteries, Automotive & Aerospace, Electronics & Semiconductors, Pharmaceuticals & Life Sciences, Consumer Packaged Goods (CPG) & Food, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 161057

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Efficiency and Innovation Metrics

- Operational and Cost Optimization Data

- Analysts’ Viewpoint

- Role of Generative AI

- Investment and Business benefits

- U.S. Market Size

- Type Analysis

- Application Analysis

- End-User Industry Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

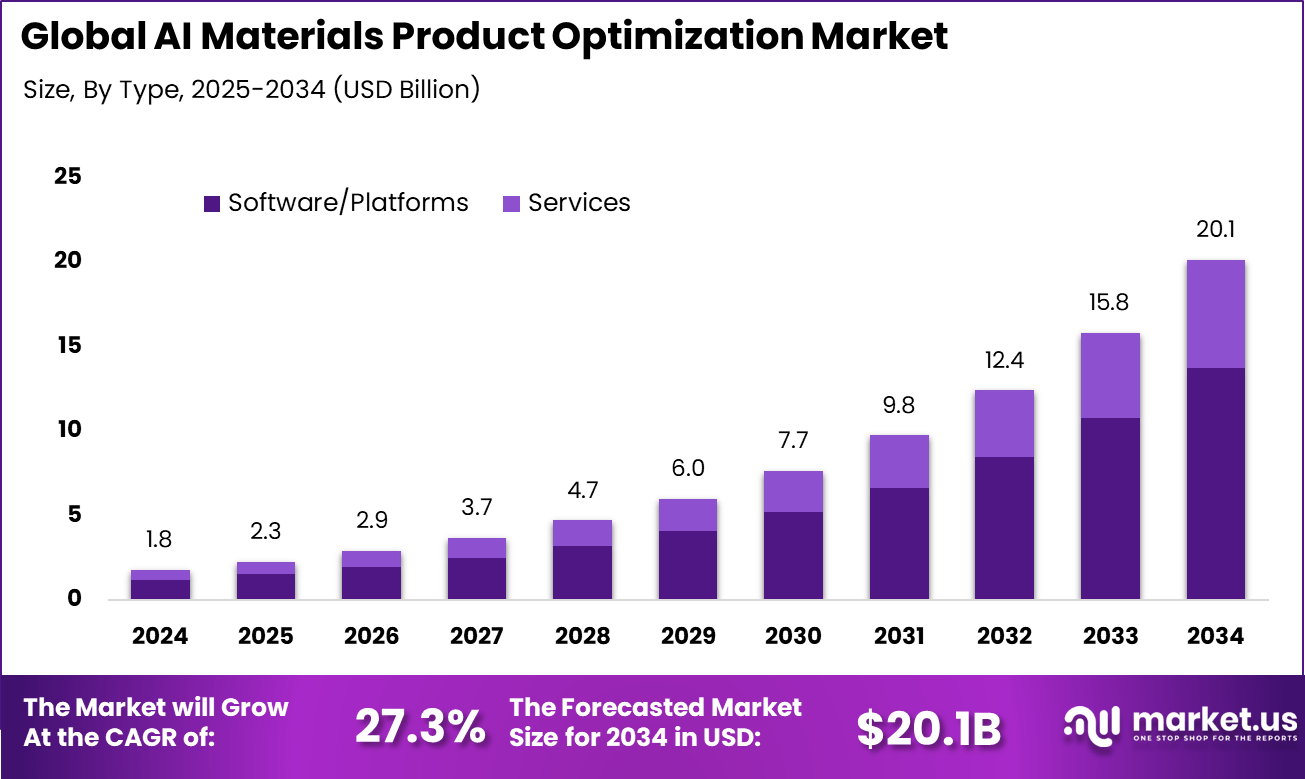

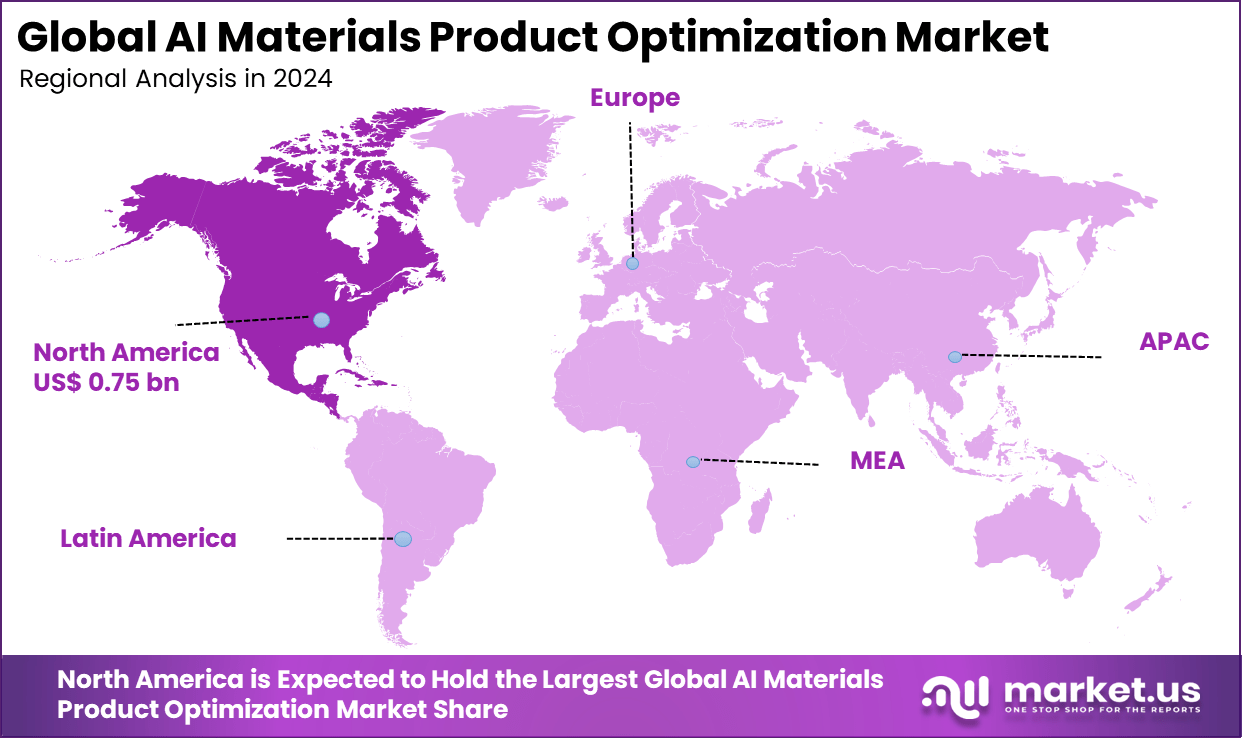

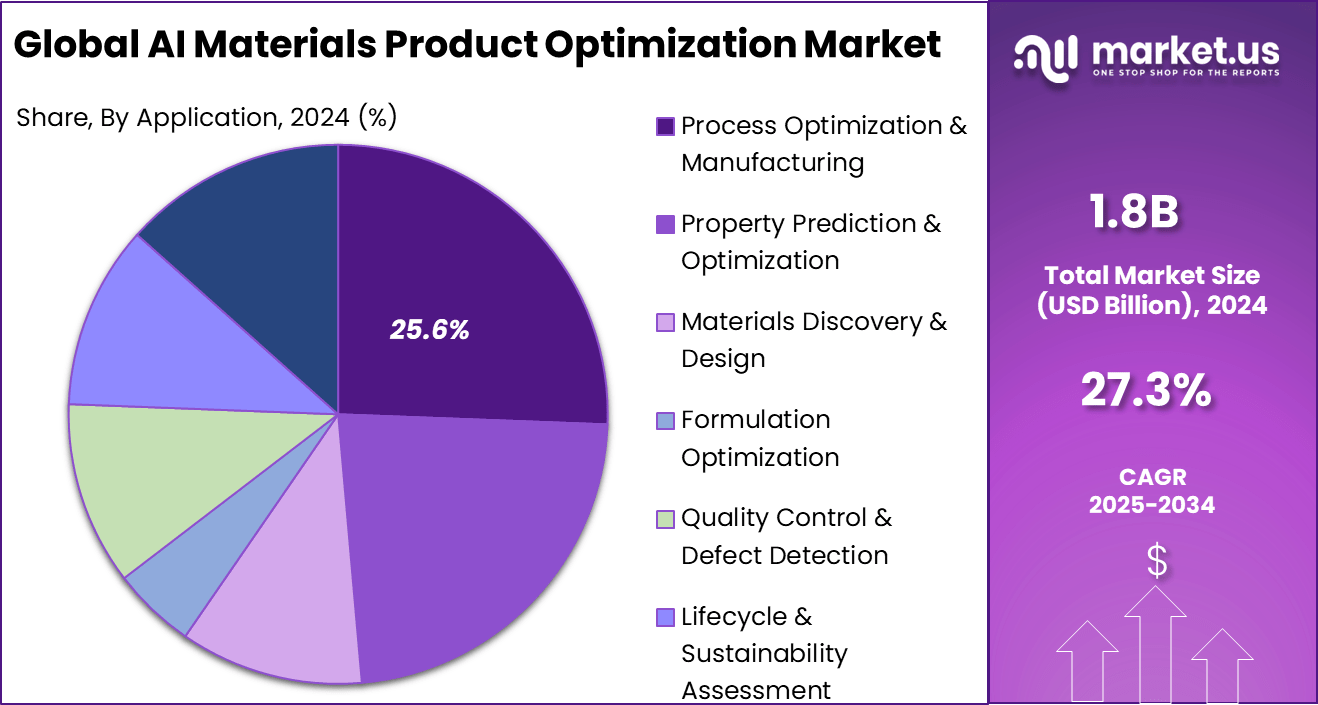

The Global AI Materials Product Optimization Market size is expected to be worth around USD 20.1 billion by 2034, from USD 1.8 billion in 2024, growing at a CAGR of 27.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 42% share, holding USD 0.75 billion in revenue.

AI Materials Product Optimization refers to the use of machine learning, materials informatics, and autonomous experimentation to design, formulate, and scale materials and products with targeted properties. The approach replaces trial-and-error with data-driven workflows, enabling virtual screening, inverse design, and closed-loop labs that iterate from hypothesis to validated formulation with fewer physical experiments and shorter lead times

Top driving factors for this market include the increasing need for high-performing, lightweight, and eco-friendly materials in advanced industries. AI enables virtual testing of materials under varied real-world conditions, significantly lowering the risk of post-production failures.

The rise of generative AI, capable of creating complex designs and reducing material waste, coupled with the expansion of cloud-based and hybrid AI deployment models, supports faster collaboration and scalable optimization. Growing industry demand for customization and stringent sustainability goals also intensify market growth.

For instance, in May 2024, Schrödinger partnered with Ansys to integrate molecular modeling with multiscale simulation workflows. This collaboration aims to accelerate materials innovation by enabling predictive insights into material behavior from the molecular to the system level. It enhances product development by allowing engineers to evaluate new materials virtually before physical prototyping.

Key Takeaway

- In 2024, the Software/Platforms segment dominated with a 68.2% share, underscoring the importance of AI-driven platforms in accelerating material innovation.

- The Process Optimization & Manufacturing segment held 25.6%, reflecting AI’s role in streamlining production efficiency and reducing costs.

- The Chemicals & Advanced Materials segment led with 28.3%, highlighting strong adoption of AI for developing high-performance and sustainable materials.

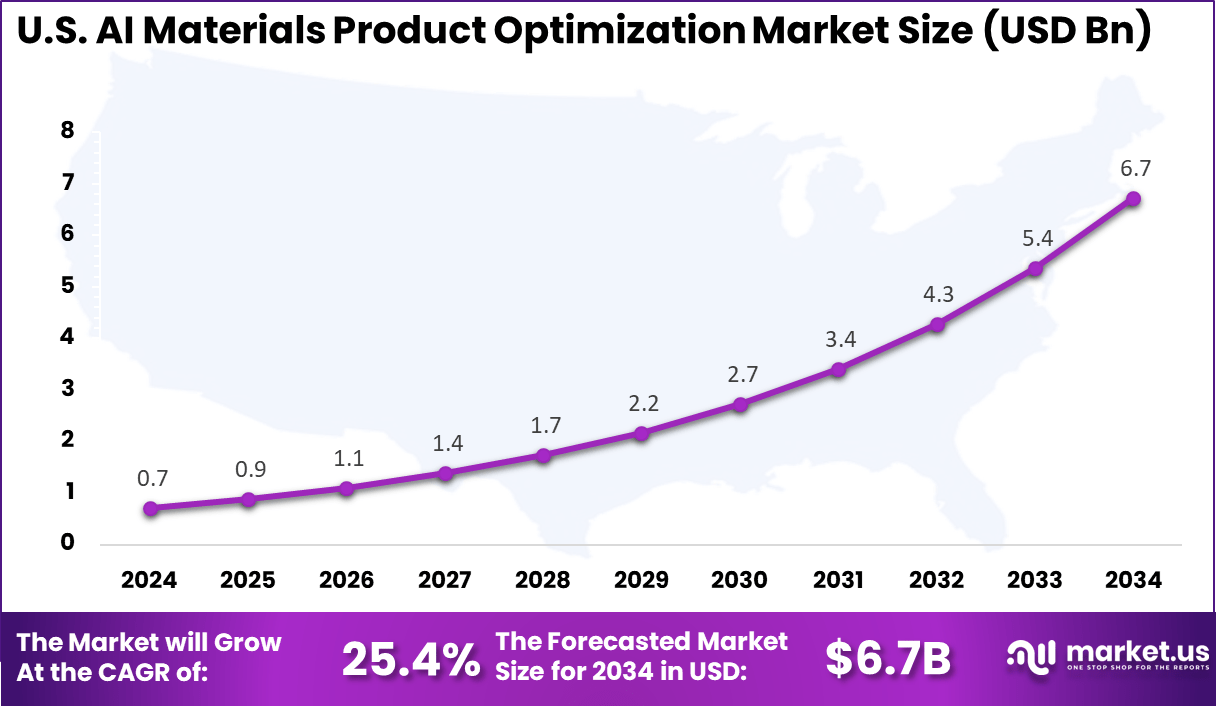

- The US market was valued at USD 0.7 billion in 2024 and is expanding at a robust CAGR of 25.4%, driven by innovation in industrial and materials research.

- North America accounted for more than 42%, supported by advanced R&D infrastructure and strong adoption across chemical, automotive, and aerospace industries.

Efficiency and Innovation Metrics

- Faster time to market: AI identified a promising new battery material from 32 million candidates in nine months, compared to the 20 years it took to develop lithium-ion batteries.

- Accelerated R&D: Citrine AI software evaluated 11.5 million powder and nanoparticle combinations, pinpointed 100 viable candidates, and enabled the launch of commercial alloy AL 7A77 in just two years.

- Improved material properties: In glass fiber reinforced polymer development, AI-selected candidates improved mechanical properties by an average of 21%.

- Automated discovery: The deep learning tool GNoME discovered 2.2 million new crystals, including 380,000 stable materials, demonstrating AI’s ability to accelerate automated materials discovery at scale.

Operational and Cost Optimization Data

- Production and profitability: AI adoption has led to a 10–15% boost in production and a 4–5% increase in EBITA for manufacturing companies.

- Reduced defects: An appliance manufacturer used an AI vision system to lower defects by 30% in six months, saving $500,000 in rework and scrap.

- Energy savings:

- An aluminum producer improved specific power consumption by 5% using AI optimization.

- A cement kiln project achieved 5% lower energy costs with AI-driven process control.

- Reduced equipment damage and downtime: In one cement plant, AI reduced crusher blockages by 82% and cut unplanned stoppages by 20%.

- Reduced material waste: AI-driven high-throughput screening optimized 13,440 hydrogel combinations in just 13 experiments, minimizing raw material use.

- Lower development costs: By 2025, outsourcing AI development to specialized firms can cut costs by up to 40%.

Analysts’ Viewpoint

In terms of demand analysis, manufacturers are increasingly adopting AI to meet rising performance and regulatory standards, especially in sectors such as aerospace, electric vehicles, medical devices, and semiconductors. AI’s ability to simulate material behavior, predict defects, and optimize manufacturing processes shortens production cycles and improves first-pass yields.

This demand is driven by the growing complexity of applications that require novel, precisely engineered materials that were previously difficult to develop within reasonable timeframes. Technologies fuelling adoption include machine learning for defect detection and performance prediction, generative AI for design automation, and cloud computing for scalable AI deployment.

Machine learning dominates by powering quality control and predictive maintenance, while generative AI rapidly transforms material design through topology optimization and complex geometry creation. Cloud solutions enable real-time monitoring and remote collaboration, essential for manufacturers embracing digital transformation.

Key reasons for adopting AI materials product optimization include enhanced material performance, reduction of waste, and sustainability gains. AI’s precision in predicting required material quantities cuts excess usage and energy consumption, aligning with global environmental goals. Additionally, AI facilitates the development of personalized material solutions tailored to niche applications and regulatory requirements, boosting product differentiation and opening new revenue streams.

Role of Generative AI

AI materials product optimization is reshaping manufacturing and product development by leveraging artificial intelligence to accelerate material discovery, enhance performance, and reduce waste. Generative AI stands out as a key driver, enabling designers to explore thousands of design alternatives quickly, which results in products that are lighter, stronger, and more cost-efficient.

For instance, generative AI can reduce material use by up to 40% while shortening design cycles by around 60%. This approach not only speeds development but also improves product quality by simulating performance in various real-world conditions before production, minimizing physical prototyping and costly errors.

Beyond design, generative AI contributes to predictive maintenance in manufacturing, allowing firms to anticipate equipment failures before they occur. This reduces operational downtime, lowers maintenance costs, and improves overall production efficiency. A striking 86% of manufacturers indicate that smart factory initiatives driven by technologies like generative AI are critical for maintaining competitiveness in the next five years.

Investment and Business benefits

Investment opportunities arise from expanding AI capabilities in additive manufacturing, virtual testing, and sustainable materials discovery. The integration of AI with digital twins and advanced simulation platforms invites investments in cloud infrastructure and AI software development.

Industries with high regulatory burdens, such as pharmaceuticals and aerospace, offer fertile ground for AI tools that ensure compliance while accelerating innovation cycles. Early investments in AI-driven materials design promise competitive advantages with faster time-to-market.

Business benefits of AI materials product optimization include lower R&D costs, improved product reliability, and agile response to market changes. AI enables continuous process improvement through data-driven insights and real-time feedback during production.

Enhanced quality control reduces defects, boosting customer satisfaction and brand reputation. Moreover, AI’s role in predictive maintenance minimizes downtime, increasing operational efficiency and profitability across manufacturing environments.

U.S. Market Size

The market for AI Materials Product Optimization within the U.S. is growing tremendously and is currently valued at USD 0.7 billion, the market has a projected CAGR of 25.4%. The market is expanding rapidly, fueled by strong federal investments in advanced manufacturing, semiconductor innovation, and sustainable technologies.

Strategic initiatives like the CHIPS and Science Act are channeling funding into AI-materials R&D, particularly for energy storage, defense, and electronics. The presence of leading research institutions, tech firms, and AI startups further accelerates innovation. Additionally, increasing demand for next-gen, eco-friendly materials from U.S.-based industries reinforces the need for AI tools that enhance speed, precision, and competitiveness in materials development.

For instance, in September 2025, researchers at the U.S. Department of Energy’s Lawrence Berkeley National Laboratory introduced AutoBot, an AI-powered platform designed to accelerate materials discovery. By integrating machine learning and robotics, AutoBot rapidly synthesizes and characterizes advanced materials, drastically reducing research timelines from up to a year to just a few weeks.

In 2024, North America held a dominant market position in the Global AI Materials Product Optimization Market, capturing more than a 42% share, holding USD 0.75 billion in revenue. This dominance is due to its robust technological infrastructure, strong R&D investments, and strategic government initiatives supporting AI and materials science.

The region benefits from a high concentration of tech giants, research universities, and startup ecosystems focused on AI integration in advanced manufacturing. Furthermore, growing demand from aerospace, automotive, and energy sectors for high-performance, sustainable materials has accelerated the adoption of AI-driven tools, reinforcing North America’s leadership in this evolving market.

For instance, in August 2025, Heidelberg Materials North America launched the High-Performance Resource Optimization Center (HROC), marking a significant step in advancing materials product optimization in the region. The HROC aims to centralize expertise and implement advanced optimization techniques to enhance operational efficiency, sustainability, and technology adoption across its plants.

Type Analysis

In 2024, The software and platforms segment accounts for a dominant 68.2% of the AI materials product optimization market. This leadership position stems from the essential role these AI-driven tools play in accelerating material discovery, design, and process improvements.

These platforms enable companies to simulate material properties, predict performance, and optimize manufacturing parameters with high precision, reducing reliance on costly physical trials. The integration of cloud computing and advanced machine learning techniques ensures scalability and accessibility, making these solutions widely adopted across industries.

Additionally, software platforms often come with workflow automation features that streamline operations and enhance collaboration between R&D, production, and quality control teams. Their ability to incorporate generative AI for designing complex material structures is pushing the limits of what’s possible with advanced materials.

The convenience, adaptability, and growing innovation within this segment keep it central to ongoing market growth. For Instance, in April 2025, Rescale, a cloud-based engineering simulation platform, raised $115 million in funding from Applied Materials, Nvidia, and other investors. The funding aims to accelerate the integration of AI into its software platform, enhancing capabilities for materials modeling and simulation.

Application Analysis

In 2024, The process optimization and manufacturing application segment captures 25.6% of the market as industries seek to enhance production efficiency and product quality. AI tools help streamline workflows by identifying inefficiencies, predicting equipment failures, and fine-tuning process parameters in real time. With the use of digital twins and simulations, manufacturers can test changes virtually, reducing downtime and accelerating innovation cycles.

Process optimization also supports sustainability by reducing waste and energy consumption. AI systems predict exact material needs and optimize resource usage, contributing not only to cost savings but also to improved environmental footprints. This practical application of AI in manufacturing drives its strong adoption across sectors like automotive, aerospace, and electronics.

For instance, in October 2025, Lam Research launched its Fabtex™ Yield Optimizer, an AI-driven software solution designed to improve process optimization in semiconductor manufacturing. By leveraging machine learning and digital twin technology, the tool analyzes real-time process and metrology data to identify yield-limiting factors and reduce production scrap.

End-User Industry Analysis

In 2024, The chemicals and advanced materials sector accounts for 28.3% of AI materials product optimization use. AI technologies support this industry by accelerating material formulation, quality control, and process safety. Predictive analytics minimize off-spec batches and optimize raw material usage, leading to higher efficiency and reduced waste in chemical production.

In advanced materials development, AI accelerates innovation by enabling rapid screening of new composites and polymers with tailored properties. This leads to faster commercialization of materials designed for specific performance needs in sectors such as aerospace and healthcare. The AI-driven focus on precision and sustainability enhances competitiveness within the chemicals and materials industries.

For Instance, In May 2025, Panjab University’s Sophisticated Analytical Instrumentation Facility (SAIF/CIL) received a Rs 1 crore grant from the Vardhman Industrial Group to introduce artificial intelligence (AI) into materials analysis. The funding is intended to support the integration of AI-based tools in materials manufacturing, improving analytical precision and industrial application efficiency.

Emerging Trends

One emerging trend is the growing use of AI-driven predictive modeling to simulate material behavior under various environmental stresses, such as temperature changes and chemical exposure. This reduces reliance on physical testing and accelerates time-to-market.

Additionally, hybrid cloud infrastructure is becoming popular for AI material optimization due to its flexible and cost-effective nature, enabling real-time collaboration and remote monitoring. Another trend is the widening adoption of AI in customizing material properties for niche applications.

AI enables manufacturers to meet stricter regulatory and performance standards by fine-tuning composites and polymers for specific industrial needs. Asia Pacific is rapidly growing as a key market region, driven by increased industrialization and government initiatives promoting AI-based manufacturing technologies.

Growth Factors

The rapid digitalization of manufacturing processes is a primary growth factor for AI materials optimization. Companies are increasingly shifting to AI-powered systems to reduce design cycles and improve product durability, leading to enhanced competitiveness.

Large-scale R&D investments and an expanding pool of AI talent contribute to this growth by supporting innovation and the development of sophisticated AI models tailored to specific materials challenges. Sustainability pressures also drive growth, as companies seek to reduce environmental impact while maintaining product quality.

AI’s ability to lower material waste and energy consumption aligns with corporate responsibility goals and regulatory mandates, further pushing adoption. The increasing complexity of products combined with demand for customized solutions fuels the need for AI-enhanced material science.

Key Market Segments

By Type

- Software/Platforms

- Cloud-based

- On-premises

- Services

- Consulting

- Deployment & Integration

- Support & Maintenance

By Application

- Materials Discovery & Design

- Property Prediction & Optimization

- Process Optimization & Manufacturing

- Formulation Optimization

- Quality Control & Defect Detection

- Lifecycle & Sustainability Assessment

- Others

By End-User Industry

- Chemicals & Advanced Materials

- Energy & Batteries

- Automotive & Aerospace

- Electronics & Semiconductors

- Pharmaceuticals & Life Sciences

- Consumer Packaged Goods (CPG) & Food

- Others

Drivers

AI-Driven Process Optimization

AI is significantly transforming semiconductor materials engineering by optimizing process parameters to improve chip performance. Through predictive modeling, AI facilitates the development of energy-efficient materials and enables better heat dissipation, essential for next-generation microelectronics.

Additionally, AI reduces manufacturing complexity and cost by identifying optimal material combinations and production conditions. This integration accelerates innovation and also enhances scalability, helping companies meet the performance demands of edge computing, AI chips, and other advanced semiconductor applications.

For instance, in January 2025, Schrödinger adopted the Sapio Sciences unified informatics platform to streamline its in silico drug discovery and materials research workflows. The integration of Sapio’s LIMS and ELN capabilities enhances data management, traceability, and collaboration, supporting faster and more efficient R&D operations across computational and experimental teams.

Restraint

High Implementation Costs

Despite its advantages, adopting AI for materials product optimization carries significant upfront and ongoing costs. Implementing AI-driven solutions requires investments in advanced software, high-performance computing hardware such as GPUs, and skilled personnel capable of managing complex AI systems.

For many small and medium-sized enterprises, these initial expenses are prohibitive, limiting wider adoption. Additionally, integrating AI technologies with existing manufacturing workflows can be technically challenging and resource-intensive, further adding to the overall cost burden.

Besides setup costs, maintaining and updating AI models demands continuous funding and expert support, raising total ownership costs. Organizations may also face additional expenses for customizing AI solutions to fit specific industry requirements and data environments. These financial barriers restrict the pace at which businesses, particularly smaller players, can leverage AI for material optimization, acting as a core market restraint.

Opportunities

Customized and Sustainable Materials

AI opens new opportunities by enabling the design of materials customized to exact application needs or environmental conditions. Predictive modeling allows businesses to fine-tune properties like elasticity, conductivity, or heat resistance, tailoring materials for niche markets such as wearable electronics, medical devices, or specialty coatings. This personalized approach not only creates new revenue streams but also enhances product differentiation in competitive industries.

Furthermore, AI supports sustainability by identifying eco-friendly materials and optimizing processes to reduce waste and energy consumption. By accurately forecasting material requirements and minimizing scrap, AI contributes to greener manufacturing operations. This capability aligns with global sustainability goals and regulatory demands, encouraging companies to adopt AI-driven material optimization while delivering environmentally responsible products.

For instance, in February 2024, researchers at the University of Southern California (USC) introduced a groundbreaking AI platform designed to revolutionize the discovery of future materials. The platform integrates advanced machine learning algorithms to predict and optimize the properties of novel materials, accelerating the development of high-performance, sustainable solutions.

Challenges

Dependence on High-Quality Data

A major challenge in AI materials product optimization is the reliance on large, accurate datasets. The effectiveness of AI models depends on comprehensive, clean, and consistent data describing material properties and behaviors. However, data fragmentation, lack of standardized formats, and proprietary restrictions frequently hamper data availability and quality.

Incomplete or noisy data can lead to inaccurate predictions, undermining trust in AI tools and potentially causing safety or reliability issues. Additionally, issues related to data privacy and intellectual property rights limit sharing and collaboration across organizations, further restricting the data pool available for training AI models.

Establishing robust data governance frameworks and improving data integration practices are essential but difficult steps. Until these challenges are resolved, dependency on high-quality data will constrain AI’s full potential in materials optimization.

Key Players Analysis

The AI Materials Product Optimization Market is driven by established software innovators such as Schrödinger, Dassault Systèmes, and Citrine Informatics, which leverage AI and simulation tools to accelerate material discovery and performance prediction. Their platforms enable faster formulation, testing, and optimization processes across industries including chemicals, electronics, and pharmaceuticals.

Emerging technology companies like Kebotix, Exabyte.io, MAT3RA, and Phaseshift Technologies focus on automating materials R&D using machine learning and cloud computing. Their solutions reduce experimentation costs and time-to-market by integrating AI-driven design workflows and predictive analytics into product development cycles.

Notable contributors such as MaterialsZone Ltd., BASF, AI Materia, Intellegens, Arzeda, Polymerize, Innophore, and Rescale, along with other key players, are expanding AI adoption in material innovation. Their collaboration with industrial manufacturers strengthens the development of sustainable, high-performance materials tailored for energy, automotive, and healthcare applications.

Top Key Players in the Market

- Schrödinger

- Dassault Systèmes

- Citrine Informatics

- Kebotix

- Exabyte.io

- MAT3RA

- Phaseshift Technologies

- MaterialsZone Ltd.

- BASF

- AI Materia

- Intellegens

- Arzeda

- Polymerize

- Innophore

- Rescale

- Others

Recent Developments

- In October 2025, Dassault Systèmes announced plans to expand its presence in India with a new facility in Pune and a targeted 10% increase in workforce. Aimed at reaching $1 billion in regional revenue, the expansion supports growing demand for its 3DEXPERIENCE platform, particularly in sectors like advanced manufacturing and materials innovation.

- In September 2025, the UK’s National Composites Centre (NCC) transitioned to Dassault Systèmes’ 3DEXPERIENCE platform on the cloud to enhance its research in composite materials. This move enables seamless collaboration, accelerates virtual twin development, and improves integration across design, simulation, and manufacturing workflows.

Report Scope

Report Features Description Market Value (2024) USD 1.8 Bn Forecast Revenue (2034) USD 20.1 Bn CAGR(2025-2034) 27.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Software/Platforms, Services), By Application (Materials Discovery & Design, Property Prediction & Optimization, Process Optimization & Manufacturing, Formulation Optimization, Quality Control & Defect Detection, Lifecycle & Sustainability Assessment, Others), By End-User Industry (Chemicals & Advanced Materials, Energy & Batteries, Automotive & Aerospace, Electronics & Semiconductors, Pharmaceuticals & Life Sciences, Consumer Packaged Goods (CPG) & Food, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Schrödinger, Dassault Systèmes, Citrine Informatics, Kebotix, Exabyte.io, MAT3RA, Phaseshift Technologies, MaterialsZone Ltd., BASF, AI Materia, Intellegens, Arzeda, Polymerize, Innophore, Rescale, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI Materials Product Optimization MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

AI Materials Product Optimization MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Schrödinger

- Dassault Systèmes

- Citrine Informatics

- Kebotix

- Exabyte.io

- MAT3RA

- Phaseshift Technologies

- MaterialsZone Ltd.

- BASF

- AI Materia

- Intellegens

- Arzeda

- Polymerize

- Innophore

- Rescale

- Others