Global AI Infrastructure Security Market Size, Share, Industry Analysis Report By Security Type (Hardware Security, Software Security, Network Security), By Deployment Mode (On-premises, Cloud, Hybrid), By End-User (Enterprises, Cloud Service Providers (CSPs), Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 168034

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- AI-Driven Cyber Risk Landscape

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Security Type Analysis

- Deployment Mode Analysis

- End-User Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

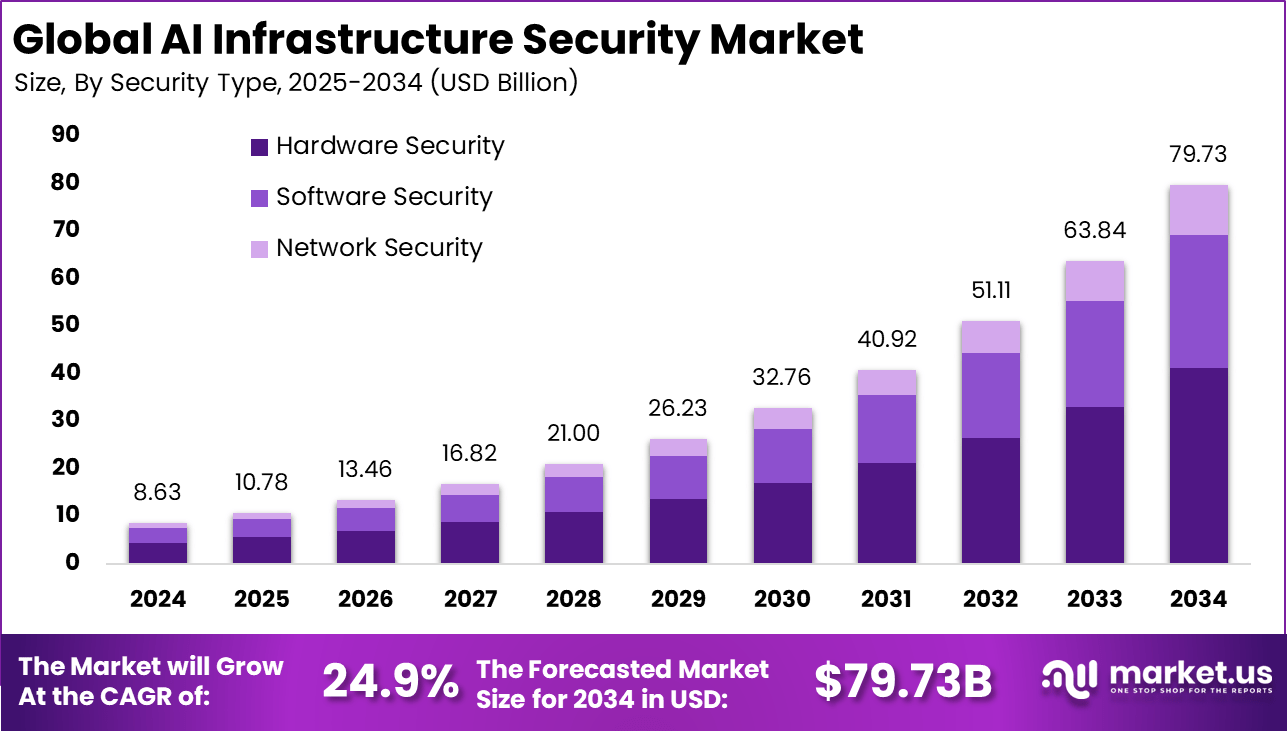

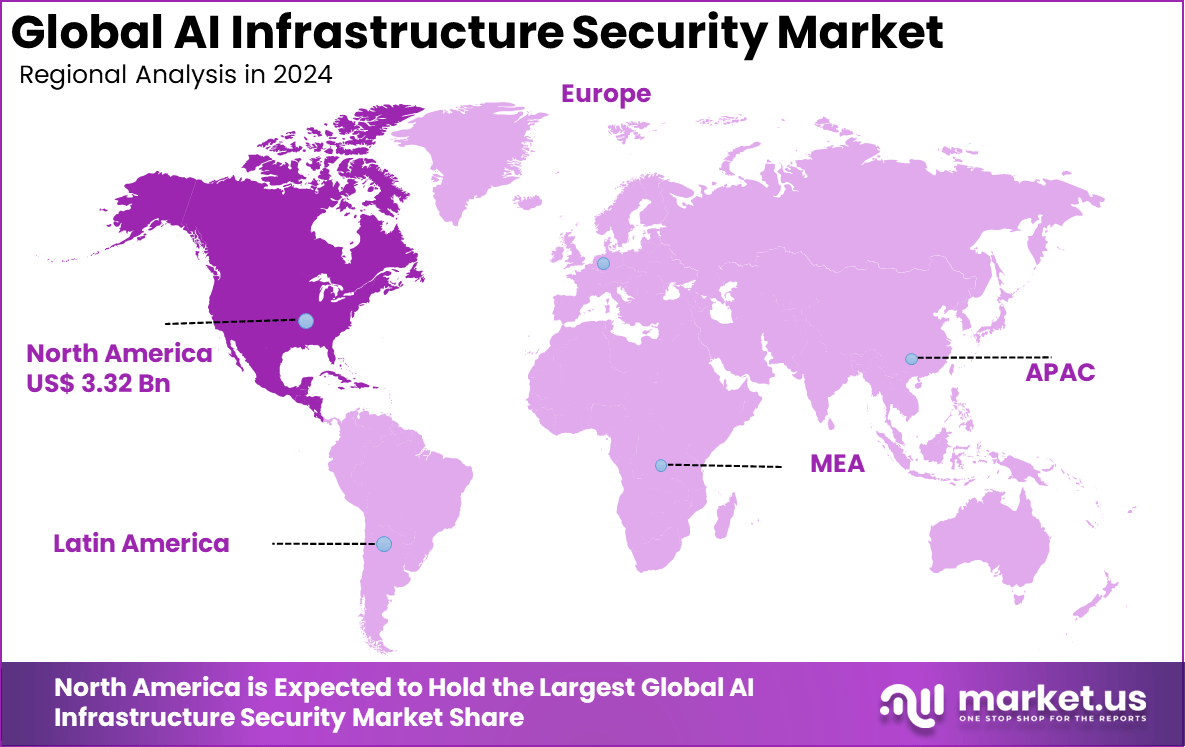

The Global AI Infrastructure Security Market size is expected to be worth around USD 79.73 billion by 2034, from USD 8.63 billion in 2024, growing at a CAGR of 32.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.5% share, holding USD 3.32 billion in revenue.

AI infrastructure security focuses on protecting the hardware, software, and data environments that support artificial intelligence systems. It safeguards AI models, training data, APIs, and the entire AI pipeline from threats like unauthorized access, cyberattacks, and data breaches. Security measures include strong encryption, access control, continuous monitoring, and compliance with relevant regulations to ensure data integrity and operational reliability.

Top driving factors for AI infrastructure security include the rapid expansion of AI adoption across industries, which increases the attack surface, making AI systems prime targets for sophisticated cyberattacks. The rising complexity of AI models and data pipelines also demands tailored security to prevent data poisoning, model theft, or unauthorized manipulation.

The market for AI Infrastructure Security is driven by the rapid adoption of AI technologies across enterprises, which increases the need to protect complex AI systems and sensitive data from sophisticated cyber threats. As businesses integrate AI into critical operations, the demand for advanced security solutions that safeguard AI models, data pipelines, and APIs grows.

For instance, in November 2025, Google LLC launched comprehensive AI infrastructure security innovations, investing $75 billion in 2025 for AI computing infrastructure. They introduced Google Unified Security, integrating threat detection and response across cloud attack surfaces, and AI security agents powered by Gemini for automated security operations. Google also announced acquiring Wiz to enhance multi-cloud cybersecurity capabilities.

Key Takeaway

- By security type, hardware security leads with 51.8%, driven by the need to safeguard AI chips, accelerators, and data center hardware against tampering and unauthorized access.

- By deployment mode, on-premises solutions dominate with 63.8%, reflecting enterprises’ preference for localized control, data sovereignty, and compliance in securing AI workloads.

- By end-user, cloud service providers (CSPs) account for 49.3%, supported by large-scale AI infrastructure deployments that require robust and continuous security measures.

- North America holds 38.5%, backed by advanced AI data centers, strict regulatory standards, and high enterprise adoption.

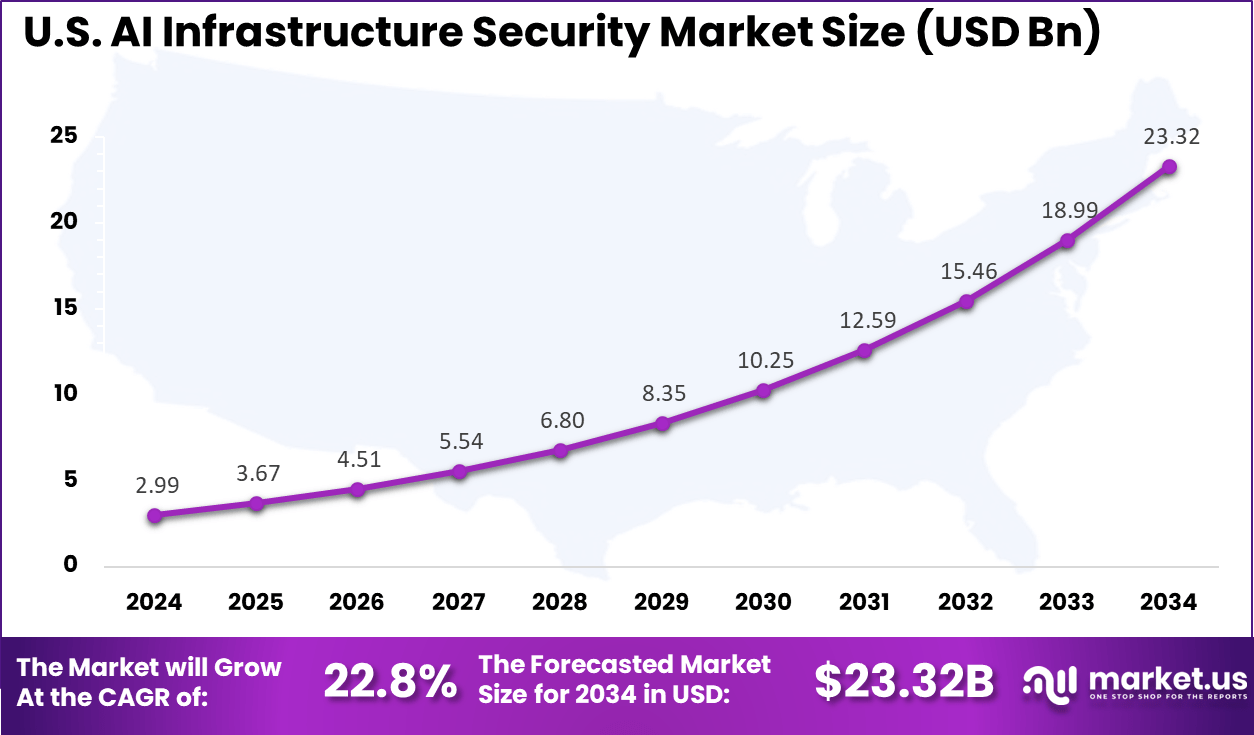

- The US market reached USD 2.99 billion and is expanding at a strong CAGR of 22.8%, highlighting growing investment in securing next-generation AI computing environments.

AI-Driven Cyber Risk Landscape

Threat Landscape

- AI-powered attacks accounted for 16% of all breaches in 2025, with phishing at 37% and deepfakes at 35% among the most common tactics.

- Sensitive data exposure is widespread, as 99% of organizations have data accessible to AI tools such as copilots and unsanctioned applications.

- Governance remains weak, with 63% of breached organizations lacking a formal AI governance policy.

- Unintended AI agent actions are common, with 80% of companies reporting unauthorized data access or sharing. 23% experienced incidents where credentials were extracted by AI systems.

- Shadow AI is a rising threat, with 20% of organizations reporting breaches caused by unsanctioned AI use, adding an average of 670,000 dollars to breach costs.

Defense and Preparedness

- Security AI adoption is increasing, with 51% of enterprises now using AI for defense. These organizations tend to record lower overall breach costs.

- AI-powered security improves speed, helping organizations detect and contain breaches 108 days faster in 2024. This time reduction generated average savings of 1.76 million dollars per incident.

- Detection effectiveness improves with AI, as 63% of security breaches are identified more quickly when AI technologies are part of the security stack.

Gaps and Challenges

- Talent shortages hinder progress, as 83% of executives cite a lack of skilled personnel as a major barrier to securing AI systems.

- Organizational confidence remains low, with only 20% of companies feeling prepared to secure generative AI models.

- Governance adoption is limited, since only 44% of organizations have implemented AI agent governance policies, despite 92% acknowledging their importance.

Role of Generative AI

Generative AI’s role in AI infrastructure security is becoming more central as it enhances threat detection and response. By creating detailed models that learn from vast amounts of data, generative AI helps security teams identify unusual patterns that often indicate cyber threats. This ability allows organizations to spot attacks earlier and react faster, which reduces damage and downtime.

Studies suggest that using generative AI improves detection accuracy by around 30%, helping teams manage increasing cyber risks more effectively. This technology also accelerates vulnerability management by automatically discovering weaknesses and suggesting fixes in complex cloud and network environments.

Generative AI adapts quickly to new threats, reducing the need for constant human oversight. It also helps simulate potential attacks, which prepares organizations to handle future risks that have not yet occurred. This ongoing learning process strengthens infrastructure security over time, making defensive systems more robust and intelligent.

Investment and Business Benefits

Investment opportunities in AI infrastructure security notably focus on data centers, cloud platforms, edge computing, and managed security services. The complexity of AI workloads creates demand for enhanced infrastructure that supports secure processing and storage.

Investors are particularly interested in scalable security solutions tailored for AI, helping organizations comply with evolving regulations and proactively manage new risks. Public-private partnerships and cybersecurity awareness programs also contribute to expanding market opportunities, fostering an environment for innovation and collaboration.

Business benefits of adopting AI infrastructure security include enhanced threat detection accuracy, faster incident response, operational efficiency, and cost savings by reducing manual monitoring efforts. Organizations gain improved risk management and resilience against attacks, safeguarding critical assets and customer trust.

The regulatory environment emphasizes compliance with data protection laws such as GDPR and HIPAA, which require security by design and continuous auditing. A strong governance framework with access controls, model versioning, and incident plans supports sustainable AI deployments while addressing emerging threats.

U.S. Market Size

The market for AI Infrastructure Security within the U.S. is growing tremendously and is currently valued at USD 2.99 billion, the market has a projected CAGR of 22.8%. This growth is driven by increasing cyber threats that demand advanced, AI-driven security solutions to protect complex infrastructure.

Organizations are adopting AI security technologies to safeguard sensitive data and AI workloads, especially in industries like finance, healthcare, and government, where compliance and data protection are critical. Additionally, the rapid expansion of cloud computing and AI deployments requires robust infrastructure security both on-premises and in cloud environments.

Investments in hardware-based security, edge AI, and real-time threat detection are accelerating market growth. Government incentives and increased enterprise awareness about AI risks also contribute to the surging demand for AI infrastructure security solutions in the U.S.

For instance, in October 2025, Palo Alto Networks, Inc. launched Prisma® AIRS™ 2.0, integrating AI-driven security across the entire AI application lifecycle, providing real-time defense against threats like prompt injections, tool misuse, and “Shadow AI” by uniting AI model inspection and continuous red teaming for enterprises in finance, healthcare, and government sectors.

In 2024, North America held a dominant market position in the Global AI Infrastructure Security Market, capturing more than a 38.5% share, holding USD 3.32 billion in revenue. This dominance is driven by strong government support through investments and initiatives that encourage the adoption of AI technologies across key industries.

The region’s leadership is also fueled by the presence of major tech companies pioneering AI infrastructure innovations and the high rate of AI patent filings, which drive continuous advancements and deployment. Additionally, North America’s robust technology ecosystem, coupled with stringent data privacy regulations, compels businesses to adopt advanced AI security solutions.

The expanding applications of AI in healthcare, finance, and public safety further increase demand for secure AI infrastructure, reinforcing the region’s leading market position and accelerating growth in AI infrastructure security services and products.

For instance, in October 2025, NVIDIA Corporation accelerated AI infrastructure security by partnering with major U.S. Department of Energy research labs to deploy advanced AI computing systems designed with cutting-edge security features to protect sensitive scientific data and national research assets.

Security Type Analysis

In 2024, The Hardware Security segment held a dominant market position, capturing a 51.8% share of the Global AI Infrastructure Security Market. This prominence comes from the critical role hardware components such as GPUs, CPUs, and specialized processors play in accelerating AI workloads while ensuring robust security.

These devices are designed to provide foundational protection by integrating secure execution environments and cryptographic modules, thus safeguarding AI models and sensitive data during processing. The market for AI hardware security is driven by advances in silicon design and the demand for high-performance AI computing.

Vendors are increasingly embedding AI capabilities directly into firewall hardware and other security appliances to enable real-time threat detection, low-latency processing, and accurate anomaly identification. This approach improves overall system resilience by reducing reliance on software-only defenses, which may lag behind sophisticated cyber threats.

For Instance, In October 2025, NVIDIA Corporation and Palo Alto Networks integrated the Prisma AIRS platform with NVIDIA BlueField to provide real time zero trust protection directly on DPUs. The solution strengthens security across the AI lifecycle while maintaining performance, highlighting the growing role of hardware based protection in modern AI systems.

Deployment Mode Analysis

In 2024, the On-premises segment held a dominant market position, capturing a 63.8% share of the Global AI Infrastructure Security Market. Many organizations prioritize this mode due to its ability to offer high control over data privacy and security, especially in sectors with strict regulatory requirements such as healthcare and finance.

Being physically local, on-premises infrastructure also minimizes latency in handling AI workloads, which is critical for real-time applications. Despite the growing popularity of cloud, the on-premises model is favored for its customization and governance benefits. It allows enterprises to tailor security protocols to specific operational needs and maintain direct oversight of their infrastructure.

For instance, in October 2025, Microsoft Corporation announced plans to double its AI-enabled data center capacity worldwide over two years, emphasizing on-premises AI infrastructure expansion. This substantial investment reflects the importance of physical control over AI workloads for organizations needing low latency and stringent data governance, especially in regulated industries.

End-User Analysis

In 2024, The Cloud Service Providers (CSPs) segment held a dominant market position, capturing a 49.3% share of the Global AI Infrastructure Security Market. CSPs are at the forefront of adopting AI infrastructure security technologies as they support a rapidly expanding customer base demanding secure and scalable AI computing services.

These providers focus on integrating advanced hardware and software security solutions to protect multi-tenant environments and manage growing data volumes. The cloud service segment benefits from economies of scale, allowing CSPs to invest heavily in cutting-edge AI security infrastructure such as hardware-accelerated firewalls and AI-enhanced threat monitoring tools.

For Instance, in June 2025, Amazon Web Services, Inc., enhanced its cloud security services with new features in AWS Security Hub and Amazon GuardDuty, focusing on container security and advanced threat detection for cloud AI workloads. These enhancements cater to the growing security requirements of CSPs managing distributed AI infrastructure for cloud customers.

Emerging Trends

A dominant trend in AI infrastructure security for 2025 is the adoption of unified security platforms that integrate endpoint detection, network monitoring, and cloud security into a single system. This shift aims to reduce complexity, improve visibility, and enable faster incident response.

Industry observations indicate that organizations adopting integrated platforms report a 25% reduction in average response times to security incidents, enhancing their ability to mitigate damage effectively. Alongside this, there is an increasing reliance on AI-powered threat detection using machine learning models that constantly learn from new attack techniques.

These models improve detection rates while lowering false alarms, which can drain cybersecurity resources. In addition, there is a strong move towards quantum-safe cryptography as organizations prepare for future quantum computing threats. The combination of these trends signals a more automated, precise, and adaptive security landscape evolving to meet sophisticated and fast-moving cyber risks.

Growth Factors

The growth of AI infrastructure security is strongly driven by the expanding complexity and volume of cyber threats impacting critical infrastructure. As digital transformation accelerates, the number of connected devices and endpoints grows, creating more potential vulnerabilities. This has fueled a 35% increase in demand for advanced AI-driven security solutions capable of managing complex environments with limited human oversight.

Moreover, the rise of cloud computing and edge technologies compels organizations to invest in AI security capabilities tailored to distributed and hybrid environments. These environments require seamless protection that adapts in real-time to shifting attack surfaces. Data shows that companies deploying AI security solutions in cloud environments achieve 20% higher operational efficiency in threat management, reinforcing the momentum behind this growth factor.

Key Market Segments

By Security Type

- Hardware Security

- Secure Processors (CPU/GPU/TPU)

- Hardware Security Modules (HSMs)

- Trusted Platform Modules (TPMs)

- Others

- Software Security

- Application Security

- Secure Software Development Lifecycle (SDLC)

- Others

- Network Security

- Encryption (In-transit)

- Intrusion Detection/Prevention Systems (IDS/IPS)

- Zero Trust Network Access (ZTNA)

- Others

By Deployment Mode

- On-premises

- Cloud

- Hybrid

By End-User

- Enterprises

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare & Life Sciences

- IT & Telecommunications

- Retail & E-commerce

- Automotive & Manufacturing

- Government & Defense

- Others

- Cloud Service Providers (CSPs)

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing Enterprise AI Adoption

The rapid increase in enterprise adoption of artificial intelligence is driving the demand for AI infrastructure security. As businesses in sectors like banking, healthcare, and manufacturing integrate AI to run critical operations, they face more complex security risks that require advanced protection. This growing reliance on AI technology increases the attack surface, making security solutions essential to safeguard sensitive information and maintain trust.

This growth is fueled by advancements in automation, behavioral analytics, and threat intelligence that employ AI to protect AI workloads themselves. Companies are focusing on securing AI components like machine learning models, data pipelines, and APIs, which are vulnerable points in the infrastructure. The drive for compliance with data privacy regulations also amplifies the need for specialized AI security protocols, especially in highly regulated sectors.

For instance, In November 2025, Amazon Web Services (AWS) announced a 50 billion dollar investment to expand AI and high performance computing infrastructure for U.S. government agencies. The plan strengthens secure AI systems by adding specialized chips and cloud services designed for sensitive workloads. The initiative reflects rising demand for protected AI infrastructure that can support advanced government operations while maintaining strict security for national data.

Restraint

High Cost and Complexity

The high cost of deploying and maintaining AI infrastructure security solutions is restraining market growth. Implementing advanced security technologies requires significant initial investment in hardware, software, and skilled personnel. Many traditional enterprises find these costs prohibitive, especially small and medium businesses with limited budgets. Complex integration challenges with legacy systems and scalability issues add to the expense and slow adoption rates.

Additionally, ensuring security across hybrid and multi-cloud environments involves continuous operational costs. The requirement for constant updates to keep pace with evolving threats increases the financial burden. These factors make enterprises cautious, delaying purchase decisions or opting for less comprehensive security measures. The complexity of AI infrastructure, combined with expense concerns, remains a key market barrier for widespread security solution adoption.

For instance, In October 2025, Microsoft released its 2025 Digital Defense Report highlighting the rising complexity and cost of securing AI systems. The report noted that new AI driven threats require continuous updates, stronger governance, and significant resources. It showed that many enterprises struggle to balance rapid AI innovation with the need for strict risk management, making cybersecurity a major business priority that demands ongoing investment.

Opportunities

Expansion in Emerging Markets

Emerging markets offer significant growth opportunities for AI infrastructure security solutions. Regions such as Asia Pacific, Latin America, and the Middle East & Africa are rapidly digitizing, with increased AI adoption driven by government initiatives and private sector investments.

Expanding cloud infrastructure, smart manufacturing, fintech innovations, and growing cybersecurity awareness are fueling demand for robust AI security in these regions. These markets are also benefiting from public-private partnerships aimed at strengthening national cybersecurity frameworks. As regulatory requirements evolve, demand for compliant AI security solutions is rising.

Vendors can leverage these developments by offering scalable cloud-based and managed security services that cater to enterprises with varying capabilities. The surge in digital transformation and AI use cases in these regions is propelling the AI infrastructure security market growth at a higher rate than in mature markets.

For instance, In September 2025, CrowdStrike introduced its Agentic Security Platform to strengthen AI security across enterprise environments. Through collaborations with leading AI and cloud providers, the platform delivers unified intelligence and response capabilities tailored for AI driven operations. The launch reflects growing demand for scalable AI ready security solutions and supports new growth opportunities in the expanding AI infrastructure security landscape.

Challenges

Evolving AI Security Threats

The rapidly evolving nature of cyber threats targeting AI systems poses a major challenge for infrastructure security. Attackers are developing sophisticated techniques such as model extraction, data poisoning, and adversarial attacks that exploit AI vulnerabilities. These new threats require continuous innovation in security tools to detect and mitigate risks effectively.

Traditional cybersecurity methods are often inadequate against AI-specific attacks, necessitating ongoing research and development in AI-driven security solutions. Moreover, shortages of skilled cybersecurity experts familiar with AI technologies complicate threat response efforts. Organizations must balance innovation with risk management, ensuring security without hindering AI performance.

Regulatory compliance demands and interoperability between diverse AI platforms add further complexity. This dynamic threat landscape requires proactive monitoring, real-time threat intelligence sharing, and collaborative defense strategies to protect AI infrastructure effectively.

For instance, In June 2025, Palo Alto Networks released its State of Generative AI 2025 report showing how generative AI has expanded the threat landscape. The report noted a sharp rise in high risk AI applications vulnerable to data leakage, shadow AI, and jailbreak attacks. These threats were described as requiring continuous innovation and adaptive security measures, creating significant challenges for organizations and infrastructure security providers.

Key Players Analysis

One of the leading players in the market, in November 2025, Amazon Web Services, Inc. (AWS), collaborated with SentinelOne to advance AI-native security on the AWS cloud. SentinelOne announced new integrations and marketplace tools focused on safeguarding generative AI workflows and AI infrastructure. These solutions offer real-time visibility and policy enforcement, especially addressing risks like shadow AI and prompt injections while supporting a secure AI adoption.

Top Key Players in the Market

- NVIDIA Corporation

- Palo Alto Networks, Inc.

- CrowdStrike Holdings, Inc.

- Microsoft Corporation

- Amazon Web Services, Inc.

- Google LLC

- International Business Machines Corporation (IBM)

- Intel Corporation

- Fortinet, Inc.

- Check Point Software Technologies Ltd.

- Broadcom Inc.

- Cisco Systems, Inc.

- McAfee Corp.

- Trend Micro Incorporated

- Tenable Holdings, Inc.

- Others

Recent Developments

- In November 2025, new AI driven security tools such as Falcon for XIoT and Charlotte Agentic SOAR were introduced, along with a partnership with CoreWeave to strengthen secure AI cloud foundations. These advancements focused on automation to improve threat detection and response, reinforcing the company’s position in AI powered cybersecurity.

- In April 2025, Google LLC introduced new AI infrastructure security capabilities while investing 75 billion dollars in AI computing for the year. The company launched Google Unified Security to integrate detection and response across cloud environments and deployed AI security agents powered by Gemini for automated operations. It also moved to acquire Wiz to strengthen multi cloud cybersecurity.

Report Scope

Report Features Description Market Value (2024) USD 8.63 Bn Forecast Revenue (2034) USD 79.7 Bn CAGR(2025-2034) 24.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Security Type (Hardware Security, Software Security, Network Security), By Deployment Mode (On-premises, Cloud, Hybrid), By End-User (Enterprises, Cloud Service Providers (CSPs), Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape NVIDIA Corporation, Palo Alto Networks, Inc., CrowdStrike Holdings, Inc., Microsoft Corporation, Amazon Web Services, Inc., Google LLC, International Business Machines Corporation (IBM), Intel Corporation, Fortinet, Inc., Check Point Software Technologies Ltd., Broadcom Inc., Cisco Systems, Inc., McAfee Corp., Trend Micro Incorporated, Tenable Holdings, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI Infrastructure Security MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

AI Infrastructure Security MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- NVIDIA Corporation

- Palo Alto Networks, Inc.

- CrowdStrike Holdings, Inc.

- Microsoft Corporation

- Amazon Web Services, Inc.

- Google LLC

- International Business Machines Corporation (IBM)

- Intel Corporation

- Fortinet, Inc.

- Check Point Software Technologies Ltd.

- Broadcom Inc.

- Cisco Systems, Inc.

- McAfee Corp.

- Trend Micro Incorporated

- Tenable Holdings, Inc.

- Others