Global AI in Video Surveillance Market By Component (Hardware, Software, Services), By Deployment Mode (Cloud-Based, On-Premise), By Application (Intrusion Detection, Crowd Monitoring, Traffic Management, Other Applications), By End-Use (Residential, Commercial, Industrial, Government & Public Sector), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2024

- Report ID: 118611

- Number of Pages: 332

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

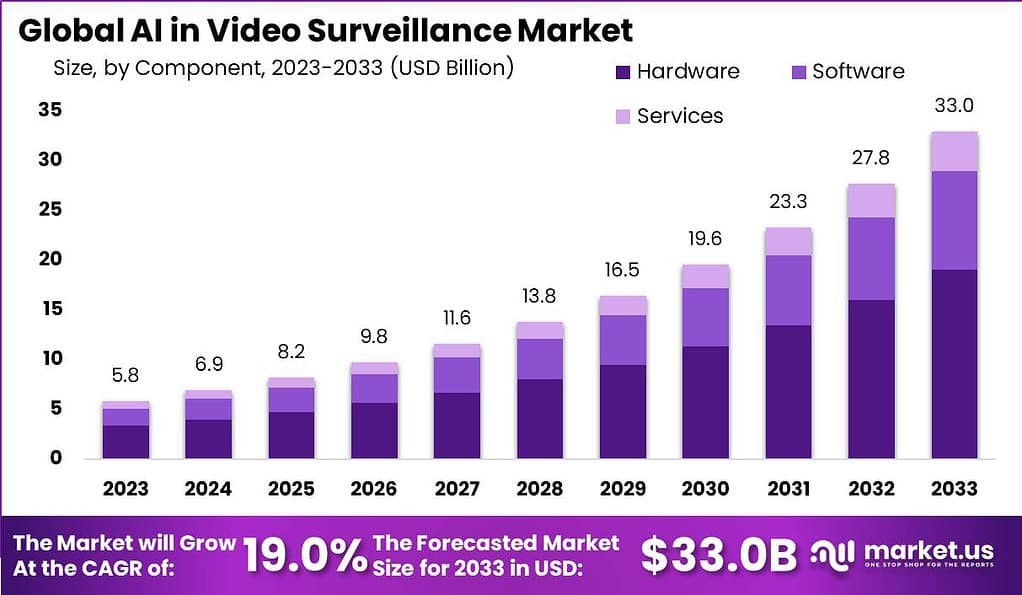

The Global AI in Video Surveillance Market size is expected to be worth around USD 33.0 Billion by 2033, from USD 5.8 Billion in 2023, growing at a CAGR of 19% during the forecast period from 2024 to 2033.

AI in video surveillance refers to the use of artificial intelligence technologies to enhance the capabilities of surveillance systems. These AI-enhanced systems can automatically analyze video footage in real-time, detect and classify objects, recognize patterns, and even predict potential security breaches before they occur. This technology has significantly transformed the landscape of security and surveillance, offering improved accuracy and efficiency in monitoring activities.

The AI in video surveillance market is experiencing rapid growth due to several factors. Firstly, the increasing demand for enhanced public safety and security measures drives the adoption of AI-powered surveillance systems. Additionally, advancements in machine learning and computer vision technologies have made these systems more accessible and effective.

However, the AI in video surveillance market also faces some challenges. One of the major concerns is the potential invasion of privacy. As AI-powered surveillance systems become more sophisticated, there is a need to strike a balance between security and individual privacy rights. Stricter regulations and guidelines regarding data privacy and ethical use of surveillance technologies are being developed to address these concerns.

Another challenge is the high cost associated with implementing AI-powered video surveillance systems. The deployment of advanced cameras, hardware infrastructure, and the development of AI algorithms require significant investments. Additionally, the need for skilled professionals to operate and maintain these systems adds to the overall cost.

According to the AI Global Surveillance (AIGS) Index, 75 out of 176 countries globally are actively employing AI-based surveillance technologies, illustrating the widespread adoption of these systems. In terms of vehicle detection accuracy, AI-equipped security cameras report a 72% accuracy in the Americas, compared to a slightly lower 57% accuracy in Europe. This indicates a regional disparity in the effectiveness of current AI surveillance systems.

For person detection, the accuracy further varies, with Europe achieving a 37% success rate while the Americas lag at 24%. This highlights the challenges and the ongoing need for improvement in the algorithms used in AI surveillance technologies.

Looking ahead, the International Data Corporation (IDC) forecasts that by 2022, 40% of police agencies will incorporate digital tools such as live video streaming and shared workflows. These tools are aimed at enhancing community safety and developing alternative response frameworks, demonstrating the growing reliance on advanced technology to bolster public security infrastructure. This trend underscores the significant role that AI and digital solutions will continue to play in shaping future security and surveillance strategies

Key Takeaways

- The global AI in Video Surveillance Market is estimated to reach USD 33.0 billion by 2033, with a strong CAGR of 19% throughout the forecast period.

- In 2023, the Hardware segment held a dominant position in the AI in video surveillance market, capturing over 57.8% share.

- The Cloud-Based segment held a dominant market position in 2023, with over 68.1% share.

- Intrusion Detection held a dominant market position in 2023, with over 45% share.

- In 2023, the Commercial segment held a dominant position, capturing more than 38.5% share.

- In 2023, Asia-Pacific held a dominant market position in the AI in video surveillance market, capturing more than a 41.1% share.

- The global artificial intelligence market is projected to reach USD 2,745 billion by 2032, growing from USD 177 billion in 2023 at a CAGR of 36.8% from 2024 to 2033.

- In 2023, edge-based AI processing for video surveillance cameras attracted significant investment, totaling $2.2 billion. This investment was geared towards enhancing smart camera functionalities, enabling quicker response times and minimizing data transmission costs.

- Approximately 75% of law enforcement agencies and government organizations have adopted AI-powered video analytics to improve public safety and crime prevention, resulting in a 20% increase in case clearance rates.

- Investments in AI-enabled video analytics for more accurate object classification and event detection reached approximately $1.4 billion in 2023.

- 68% of transportation and logistics companies implemented AI-powered video surveillance systems in 2023, leading to a 12% reduction in operational losses.

- Around $980 million was invested in 2023 to develop privacy-preserving AI algorithms for video surveillance. These algorithms aim to balance security needs with privacy concerns, complying with data protection regulations while maintaining effective surveillance.

- The video surveillance sector also saw investments totaling $680 million in 2023, directed towards developing cloud-based and subscription-based AI video surveillance services, making the technology more accessible and scalable.

- 70% of healthcare organizations adopted AI-driven video surveillance in 2023 to improve patient safety, monitor staff, and manage facilities, resulting in a 12% decrease in adverse events.

- A significant $820 million was allocated in 2023 for integrating AI-powered video analytics with advanced video management and security information systems, enhancing security orchestration and response capabilities.

- Lastly, 75% of critical infrastructure operators, including those in utilities and energy sectors, utilized AI-powered video surveillance to enhance physical security and prevent unauthorized access, achieving an 18% reduction in security incidents.

Component Analysis

In 2023, the Hardware segment held a dominant position in the AI in video surveillance market, capturing more than a 57.8% share. This leading role can be attributed to the critical importance of high-quality cameras, servers, and storage solutions that form the backbone of any AI-enabled surveillance system.

As AI technologies continue to advance, the need for robust hardware that can support complex algorithms and process vast amounts of video data in real time has become paramount. High-resolution cameras with advanced capabilities such as optical zoom and wide-angle views are increasingly in demand, along with powerful servers capable of handling the data-intensive workloads of AI analytics.

Furthermore, the evolution of edge computing has propelled the hardware segment even further. Edge devices are designed to process data at or near the source of data generation, which in the case of video surveillance, is often at the camera itself. This capability significantly reduces latency and bandwidth usage, making the surveillance system more efficient and responsive.

Manufacturers are continually innovating in this area, developing hardware that is not only more powerful but also more energy-efficient and capable of operating in a wider range of environmental conditions. This focus on enhancing hardware functionalities is likely to sustain the growth and dominance of the hardware segment in the AI video surveillance market.

Deployment Mode Analysis

In 2023, the Cloud-Based segment held a dominant market position in the AI in video surveillance market, capturing more than a 68.1% share. This segment’s leadership is primarily due to the flexibility, scalability, and cost-effectiveness that cloud-based solutions offer.

Cloud deployment allows for extensive data storage and sophisticated analytics without the need for heavy upfront investment in physical infrastructure. This model is particularly attractive to organizations that require expansive surveillance coverage across multiple locations but want to avoid the complexities and costs associated with managing on-premise hardware.

Cloud-based AI video surveillance also benefits from quicker updates and improvements in AI algorithms, which can be deployed seamlessly across the system without disrupting the ongoing operations. Moreover, the cloud enables easier integration with other digital systems and IoT devices, enhancing the overall security framework and providing more comprehensive analytics. These systems can also adapt more dynamically to changing security environments or requirements, which is a significant advantage in sectors where threat profiles can evolve rapidly.

Additionally, the increasing concerns about data privacy and security are being addressed through rigorous encryption and advanced security protocols in cloud services, making them more appealing to potential users. As technology providers continue to innovate in cloud security and as regulations around data protection become more stringent, the trust in and reliance on cloud-based AI video surveillance is expected to grow, further consolidating its dominance in the market.

Application Analysis

In 2023, the Intrusion Detection segment held a dominant market position in the AI in video surveillance market, capturing more than a 45% share. This prominence is largely due to the increasing need for enhanced security measures across various sectors, including residential, commercial, and industrial areas.

AI-powered intrusion detection systems offer advanced capabilities such as real-time threat identification, behavior analysis, and immediate alerting, which significantly improve the efficacy of security measures. These systems use sophisticated algorithms to differentiate between normal activities and potential threats, reducing false alarms and ensuring that security personnel can focus on genuine risks.

The adoption of AI in intrusion detection also facilitates the integration of video surveillance with other security technologies, such as access control and alarm systems, creating a comprehensive security solution. This integration capability is particularly valuable in high-security areas like banks, government buildings, and critical infrastructure, where enhanced surveillance is crucial. AI enhances these systems’ ability to “learn” from the observed environment, continually improving their accuracy and effectiveness over time.

Furthermore, as urbanization continues to rise, and the population in cities grows, there is a heightened demand for smarter security solutions to protect people and assets. The capabilities of AI in identifying and responding to unauthorized entries and other security breaches make it an indispensable tool in modern surveillance strategies.

This ongoing demand is expected to sustain the growth and predominance of the Intrusion Detection segment in the AI video surveillance market, as stakeholders continue to invest in technologies that provide reliable and efficient security.

End-Use Analysis

In 2023, the Commercial segment held a dominant market position in the AI in video surveillance market, capturing more than a 38.5% share. This segment’s leadership stems from the widespread need for advanced security solutions across various commercial enterprises including retail spaces, offices, hotels, and entertainment venues.

In these settings, AI-enhanced video surveillance systems are not only used for security purposes but also for customer behavior analysis and operational efficiency improvements. For instance, in retail, these systems can track customer movements and interactions with products, providing valuable insights that can be used to optimize store layouts and improve customer service.

Moreover, the commercial sector often deals with a high volume of foot traffic, making it crucial to monitor and manage the flow of people effectively to ensure safety and security. AI video surveillance systems in commercial settings are equipped with features like facial recognition, crowd density analysis, and anomaly detection, which help in preempting potential security threats and managing emergencies more efficiently.

Additionally, these AI systems can be integrated with other digital management systems, contributing to smarter building management and energy usage optimization. The increasing emphasis on safeguarding assets and ensuring a safe environment for employees and customers alike continues to drive the adoption of AI in video surveillance within the commercial sector.

As businesses increasingly recognize the benefits of AI in enhancing security and operational insights, the growth of the Commercial segment in the AI video surveillance market is expected to maintain its momentum, supported by continual advancements in AI technology and growing investments in smarter security solutions.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Deployment Mode

- Cloud-Based

- On-Premise

By Application

- Intrusion Detection

- Crowd Monitoring

- Traffic Management

- Other Applications

By End-Use

- Residential

- Commercial

- Industrial

- Government & Public Sector

Driver

Increasing Demand for Enhanced Security

The escalating need for enhanced security measures across various sectors is a significant driver for the AI in video surveillance market. As urban populations grow and public awareness of security threats increases, businesses, government entities, and private individuals are more inclined to invest in advanced surveillance systems.

AI technologies offer superior capabilities in real-time threat detection, behavioral analytics, and incident prediction, which traditional surveillance systems lack. These features not only improve safety but also operational efficiency, making AI-enhanced surveillance an attractive investment for entities aiming to protect people, property, and information.

The growing incidence of criminal activities and the heightened threat of terrorism worldwide further compel organizations and governments to adopt these advanced security solutions, driving continual growth in the AI in video surveillance market.

Restraint

High Cost and Complexity of Implementation

The high cost associated with implementing and maintaining AI-enhanced video surveillance systems is a significant restraint. The initial investment in the necessary hardware, such as high-definition cameras and powerful servers, can be substantial. Additionally, integrating AI technology requires sophisticated software and skilled personnel to manage system operations and analyze data effectively.

For many small and medium-sized enterprises (SMEs), these expenses can be prohibitive, limiting their ability to adopt these advanced systems. Furthermore, the complexity of configuring and maintaining AI systems, including regular updates and management of large data volumes, requires ongoing technical support, adding to the total cost of ownership. These financial and operational challenges can deter potential users from integrating AI into their surveillance strategies.

Opportunity

Integration with Smart City Initiatives

The global push towards smart cities presents a significant opportunity for the growth of the AI in video surveillance market. Smart city initiatives aim to enhance urban efficiency, safety, and sustainability through the integration of various IoT technologies, including AI-driven surveillance systems. These systems are pivotal in monitoring public areas, managing traffic flows, and enhancing emergency response capabilities through real-time analysis and data-driven insights.

As cities continue to evolve and adopt more interconnected technologies, the demand for intelligent surveillance solutions that can seamlessly integrate with other smart infrastructure is expected to rise. This trend provides ample opportunities for market expansion as municipalities seek to harness the benefits of AI to improve city management and public safety.

Challenge

Privacy and Ethical Concerns

Privacy and ethical concerns present a significant challenge to the adoption of AI in video surveillance. As these systems become more capable of performing tasks such as facial recognition and behavioral prediction, fears about surveillance overreach and the erosion of personal privacy intensify. The ability of AI systems to collect, store, and analyze vast amounts of personal data poses potential risks if not managed under strict ethical and legal frameworks.

Ensuring that these technologies are used responsibly and that data protection laws are adhered to is crucial. This challenge requires manufacturers and policymakers to navigate complex privacy issues and implement robust safeguards to maintain public trust while promoting the adoption of AI surveillance technologies.

Emerging Trends

- Edge Computing: Edge computing is increasingly being integrated with AI video surveillance systems. Processing data on or near the camera reduces latency, minimizes bandwidth usage, and enhances real-time analytics capabilities. This trend is accelerating the deployment of more efficient and faster-reacting surveillance solutions.

- Facial Recognition Technology: The use of facial recognition in AI surveillance systems is growing. This technology helps in enhancing security protocols by identifying individuals in crowded spaces or public areas, significantly improving public safety and security management.

- Behavioral Analytics: AI systems are now being equipped with sophisticated behavioral analytics to predict and detect unusual behavior before a threat escalates. This trend is particularly useful in crowded public settings such as airports, malls, and sports arenas.

- Integration with IoT and Smart Devices: There is a growing trend towards the integration of AI surveillance systems with IoT devices and other smart infrastructure. This convergence enables more comprehensive monitoring and management systems, enhancing security measures across various sectors.

- Cloud-Based Solutions: The shift towards cloud-based video surveillance solutions is becoming more pronounced. These systems offer scalable, flexible storage solutions and enhanced accessibility, allowing for remote monitoring and management of surveillance footage from anywhere in the world.

Growth Factors

- Increasing Security Concerns: Rising concerns about public and private security are driving the adoption of AI in video surveillance. Organizations are looking for advanced systems that can provide enhanced monitoring capabilities to prevent theft, vandalism, and other security threats.

- Technological Advancements: Continuous improvements in AI, machine learning, and computer vision technologies are significant growth factors. These advancements enhance the accuracy and efficiency of video surveillance systems, making them more appealing to potential users.

- Government Initiatives for Public Safety: Many governments are implementing strict regulations and initiatives to enhance public safety, which include significant investments in surveillance infrastructure. This regulatory push is a critical growth driver for the AI video surveillance market.

- Rising Demand for Smart City Projects: As cities around the world evolve into smart cities, there is a growing need for intelligent surveillance systems that can integrate seamlessly with other smart technologies, driving further growth in the AI surveillance market.

- Reduction in Crime Rates: AI-enhanced surveillance systems have proven effective in reducing crime rates, making them a critical component of modern security strategies. Their ability to monitor, analyze, and act upon video data in real time helps in preventing potential security breaches, thereby encouraging their adoption across various sectors.

Regional Analysis

In 2023, Asia-Pacific held a dominant market position in the AI in video surveillance market, capturing more than a 41.1% share. This region’s leadership is primarily due to its rapid urbanization and significant investments in infrastructure development, including public safety measures. The demand for AI in Video Surveillance in Asia-Pacific was valued at USD 2.4 billion in 2023 and is anticipated to grow significantly in the forecast period.

Countries such as China, Japan, and South Korea are at the forefront of technological innovations, particularly in AI and IoT, which are integral components of modern surveillance systems. The large-scale implementation of smart city projects across the region also fuels the demand for advanced surveillance systems that incorporate AI to enhance security and operational efficiency.

Furthermore, the region’s focus on enhancing public security in light of rising crime rates and terrorism threats has prompted governments to invest heavily in AI-enhanced surveillance technology. For example, China’s extensive public surveillance network utilizes AI to monitor and analyze pedestrian and traffic patterns, playing a crucial role in both security and urban planning.

This governmental push is complemented by a robust manufacturing sector capable of producing high-quality, cost-effective surveillance equipment, making advanced technologies more accessible and affordable.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The AI in video surveillance market includes a range of key players, each contributing with their unique technologies and market strategies. Prominent companies such as Hikvision, Dahua Technology, and Axis Communications are leading the way with advanced surveillance cameras and integrated AI capabilities.

These players focus on continuous innovation in image processing and analytics to maintain a competitive edge. For instance, Hikvision and Dahua have developed AI-powered cameras that can perform real-time facial recognition and motion analysis, which are essential for security applications in both public and private sectors.

Additionally, tech giants like IBM and Cisco are also significant contributors to the market, offering AI software solutions that enhance video analytics capabilities. These solutions include features like crowd monitoring and situation awareness, essential for applications ranging from city surveillance to traffic management.

Top Market Leaders

- Hangzhou Hikvision Digital Technology Co. Ltd.

- Axis Communications AB

- Dahua Technology Co. Ltd.

- Avigilon Corporation

- Hanwha Vision Co. Ltd.

- Robert Bosch GmbH

- Panasonic Corporation

- VIVOTEK Inc.

- Pelco

- Teledyne FLIR LLC

- Verkada Inc.

- Videonetics Technology Pvt. Ltd.

- Other Key Players

Recent Developments

- In March 2023, Honeywell partnered with Bengaluru City Police to implement the Safe City project, deploying over 4,100 video cameras across strategic locations in the city. These cameras, connected to a command center utilizing machine learning and AI, aim to enhance situational awareness and facilitate prompt police response.

- In May 2023, Dahua Technology introduced AcuPick video search technology, a cutting-edge solution designed to improve the efficiency and accuracy of locating target videos. With its user-friendly interface and advanced search capabilities, AcuPick sets a new standard in the industry by providing quick and precise video search operations.

- In May 2023, Motorola Solutions, through its subsidiary Avigilion, unveiled the V700 body camera. This mobile broadband-enabled camera offers real-time field intelligence and collaboration for public safety agencies. With its high-definition sensor adapting to low lighting conditions, the V700 ensures clear, accurate recordings of events, resembling the visual capabilities of the human eye.

Report Scope

Report Features Description Market Value (2023) USD 5.8 Bn Forecast Revenue (2033) USD 33 Bn CAGR (2024-2033) 19% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, Services), By Deployment Mode (Cloud-Based, On-Premise), By Application (Intrusion Detection, Crowd Monitoring, Traffic Management, Other Applications), By End-Use (Residential, Commercial, Industrial, Government & Public Sector) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Hangzhou Hikvision Digital Technology Co. Ltd., Axis Communications AB, Dahua Technology Co. Ltd., Avigilon Corporation, Hanwha Vision Co. Ltd., Robert Bosch GmbH, Panasonic Corporation, VIVOTEK Inc., Pelco, Teledyne FLIR LLC, Verkada Inc., Videonetics Technology Pvt. Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is AI in video surveillance?AI in video surveillance refers to the integration of artificial intelligence technologies, such as machine learning and computer vision, into surveillance systems to enhance their capabilities in detecting, analyzing, and responding to events or anomalies in real-time video streams.

How big is AI in Video Surveillance Market?The Global AI in Video Surveillance Market size is expected to be worth around USD 33.0 Billion by 2033, from USD 5.8 Billion in 2023, growing at a CAGR of 19% during the forecast period from 2024 to 2033.

Who are the key players of AI in video surveillance market?Hangzhou Hikvision Digital Technology Co. Ltd., Axis Communications AB, Dahua Technology Co. Ltd., Avigilon Corporation, Hanwha Vision Co. Ltd., Robert Bosch GmbH, Panasonic Corporation, VIVOTEK Inc., Pelco, Teledyne FLIR LLC, Verkada Inc., Videonetics Technology Pvt. Ltd., Other Key Players

What is the driving factor of AI in video surveillance market growth?The driving factor of AI in the video surveillance market growth is the need for advanced threat detection and analysis capabilities, which AI technologies offer through improved accuracy, efficiency, and automation in identifying security risks and anomalies in real-time video streams.

Which region is leading the AI in video surveillance market?In 2023, Asia-Pacific held a dominant market position in the AI in video surveillance market, capturing more than a 41.1% share.

What are the challenges associated with AI in video surveillance?Challenges include concerns about privacy and ethics, ensuring the reliability and robustness of AI algorithms, managing and analyzing vast amounts of video data, addressing biases in AI models, and navigating regulatory requirements and compliance standards related to surveillance technology.

AI in Video Surveillance MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

AI in Video Surveillance MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Hangzhou Hikvision Digital Technology Co. Ltd.

- Axis Communications AB

- Dahua Technology Co. Ltd.

- Avigilon Corporation

- Hanwha Vision Co. Ltd.

- Robert Bosch GmbH

- Panasonic Corporation

- VIVOTEK Inc.

- Pelco

- Teledyne FLIR LLC

- Verkada Inc.

- Videonetics Technology Pvt. Ltd.

- Other Key Players