Global AI Hardware Market Size, Share, Trends Analysis Report By Hardware Type (Processor, Memory, Network, Storage), By Technology (Machine Learning, Computer Vision, Natural Language Processing, Others), By Industry Vertical (IT & Telecom, BFSI, Manufacturing, Healthcare, Retail and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov. 2024

- Report ID: 130423

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

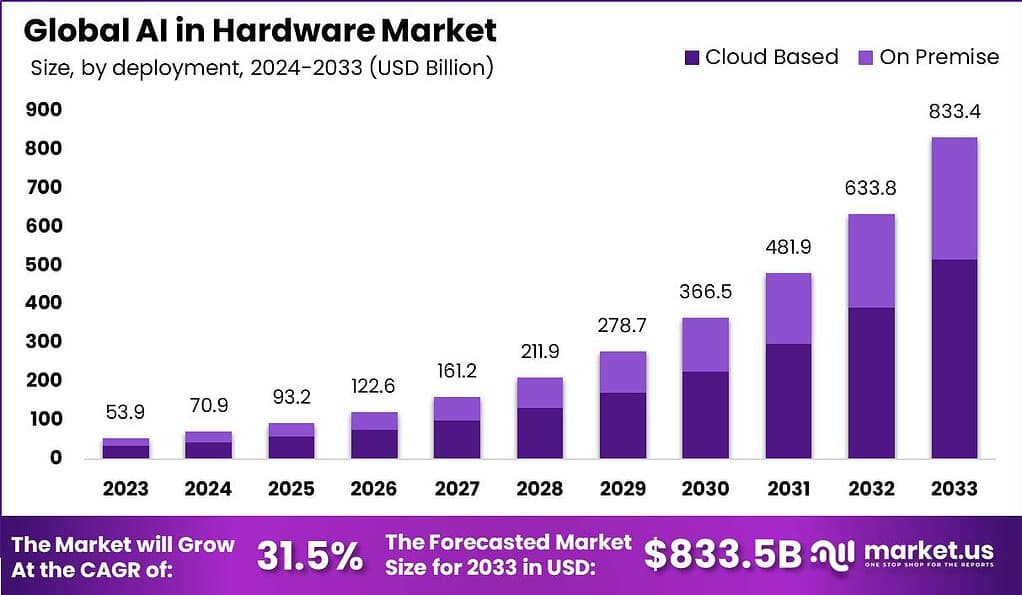

The Global AI Hardware Market size is expected to be worth around USD 833.4 Billion By 2033, from USD 53.9 Billion in 2023, growing at a CAGR of 31.5% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 35.2% share, holding USD 18.9 Billion revenue.

AI hardware refers to the integration of artificial intelligence technology directly into hardware components. This involves the design and deployment of hardware that can support and enhance AI capabilities. Typically, this includes specialized processors like GPUs, TPUs, and AI accelerators that are optimized to handle complex AI algorithms efficiently.

The AI hardware market is experiencing significant growth as industries increasingly rely on AI technologies. This market includes manufacturers and developers of AI-specific chipsets, advanced sensors, and other related hardware that supports AI operations. Key players in this field are focusing on creating more powerful and energy-efficient hardware solutions to support complex AI algorithms, which are becoming crucial in consumer electronics, automotive, healthcare, and data centers.

The growth of the AI hardware market is primarily driven by the increasing adoption of cloud-based AI services, which require robust hardware support for optimal performance. Advances in machine learning and deep learning technologies have also necessitated the development of specialized hardware to efficiently process large datasets with speed and accuracy.

Moreover, the proliferation of smart devices and IoT applications continues to fuel the demand for AI-capable chips that can process data locally, reducing latency and improving responsiveness. The demand for AI hardware is set to expand as AI becomes integral to more technological solutions across various sectors. This includes everything from smart home devices to complex industrial machinery.

The opportunity in the AI hardware market lies in the ongoing need for innovation in chip technology to meet the growing requirements for AI applications. These innovations promise considerable returns for stakeholders as sectors such as automotive, healthcare, and manufacturing increasingly rely on AI for operational improvements and new product developments.

The AI hardware market is expanding into new geographic and sectoral territories. This expansion is fueled by the global digital transformation trend where companies and governments are investing in smart infrastructure, such as smart cities and automated public services. The push towards edge computing, where data is processed locally on devices, is also broadening the market scope, opening up new opportunities in both developed and emerging economies.

Key Takeaways

- The global AI hardware market size is estimated to reach a USD 833.4 billion in the year 2033 with a CAGR of 31.5% during the forecast period and was valued at USD 53.9 billion in the year 2023.

- Based on type, the processor segment has the dominated the market with a share of 37% in the year 2023.

- Based on the deployment, the cloud based segment is leading the market with a share of 62% in the year 2023.

- By segmenting based on technology, the machine learning (ML) segment dominates the market with a share of 40% in the year 2023.

- Based on the application, the Image and diagnosis segment has the largest market share of 22% in the year 2023.

- Based on the end user, the Telecommunication and IT segment has the largest market share of 20% in the year 2023.

North America AI Hardware Market Size

In 2023, North America held a dominant market position in the AI hardware Market, capturing more than a 35.2% share with revenues amounting to USD 18.9 Billion. This region’s leadership is underpinned by a robust technological infrastructure and a strong presence of leading AI firms that continue to push the boundaries of innovation in hardware solutions.

The growth in this market is largely driven by the increasing adoption of AI technologies across various industries including healthcare, automotive, and manufacturing which are significantly investing in AI to gain competitive advantages. The United States is a key contributor to North America’s leadership in the AI hardware Market.

The presence of Silicon Valley, a global center for technology and innovation, along with substantial investments from both private and public sectors in AI research and development, further cements the region’s leading position. Moreover, initiatives by major U.S.-based companies to integrate AI into consumer and enterprise hardware, such as smartphones and data centers, have propelled the market growth.

Canada and Mexico are also showing promising growth in the AI hardware sector. Canada’s advancement in AI is facilitated by government funding and collaborations between research institutions and the tech industry, which are pivotal in developing innovative AI solutions. Mexico, on the other hand, has been increasingly adopting industrial automation, powered by AI hardware, to enhance manufacturing capabilities and improve economic output.

Furthermore, North America is expected to maintain its leading position over the forecast period, driven by continuous technological advancements and the integration of AI in emerging technologies such as the Internet of Things (IoT) and 5G. The region’s market is characterized by high competition with companies continually investing in new product developments and partnerships to leverage the expanding scope of AI applications.

Hardware Type Analysis

In 2023, the Processor segment held a dominant market position within the AI hardware market, capturing more than a 37% share. This lead can be attributed primarily to the extensive deployment of advanced processors in AI applications that demand high-speed computation and real-time data processing.

Processors, such as CPUs and GPUs, are integral to training and operating AI models, handling complex algorithms and neural networks efficiently. Their capability to perform parallel processing enables faster and more efficient AI computations, which is crucial for applications in autonomous vehicles, voice and image recognition technologies, and other AI-driven solutions.

The prominence of the Processor segment is further bolstered by continuous advancements in semiconductor technology. Innovations such as increasing transistor density and integration of AI-specific capabilities like tensor cores have significantly enhanced the performance of these processors.

Moreover, the escalating demand for AI capabilities across various industry sectors including healthcare, automotive, and consumer electronics has led to a surge in investments and R&D focused on processor technology.

Companies like NVIDIA and Intel are at the forefront, pushing the boundaries of processor performance to meet the growing computational demands of AI systems. Another factor contributing to the dominance of the Processor segment is the strategic collaborations and partnerships between chip manufacturers and technology firms.

These alliances aim to tailor processors specifically for optimized AI performance, which reduces operational costs and energy consumption while maximizing output. This trend is particularly evident in the development of custom AI chips, which are designed to handle specific AI tasks more efficiently than general-purpose processors.

Technology Analysis

In 2023, the Machine Learning segment held a dominant market position in the AI hardware market, capturing more than a 40% share. This leading status can be attributed to the widespread integration of machine learning technologies across a diverse range of applications, from predictive analytics and customer service to automation and enhanced decision-making processes.

The versatility and broad applicability of machine learning drive its substantial adoption, as businesses seek to leverage data-driven insights for a competitive edge. The demand for machine learning is further fueled by the continuous advancements in algorithms and the availability of large datasets, which enable more effective and efficient learning processes.

This technology segment benefits significantly from the increasing volumes of data generated by digital interactions and business operations, necessitating robust hardware solutions that can rapidly process and analyze this data in real-time. Moreover, the integration of machine learning with other emerging technologies like IoT and big data analytics has expanded its application scope.

Industries such as automotive, healthcare, finance, and manufacturing are increasingly relying on machine learning-powered hardware to innovate and optimize operations. This convergence facilitates the creation of smarter, more adaptive technologies that can learn and evolve in response to complex environments.

Overall, the Machine Learning segment’s prominence within the AI hardware market is likely to grow, supported by technological advancements and increasing investments in AI research and development. As organizations continue to recognize the value of machine learning in gaining insights and enhancing operational efficiencies, its market share is expected to expand further, reinforcing its position as a cornerstone of AI technology adoption.

Industry Vertical Analysis

In 2023, the Telecommunication and IT industry segment held a dominant market position in the AI hardware market, capturing more than a 20% share. This leadership is primarily driven by the sector’s foundational role in enabling and advancing AI technologies. As data generation and connectivity demands skyrocket, telecommunications and IT firms increasingly rely on AI hardware to optimize network management, improve service delivery, and enhance user experiences.

The rapid evolution of 5G technology and IoT connectivity has amplified the need for AI-driven solutions in this sector. AI hardware facilitates the processing and analysis of vast amounts of data transmitted across networks, helping to manage traffic, detect anomalies, and maintain system integrity. These capabilities are critical as the industry moves toward more integrated and complex network environments.

Moreover, the telecommunication and IT industry’s investment in cloud computing and edge computing technologies further underscores its reliance on AI hardware. These technologies, powered by AI, enable faster processing at or near the data source, reducing latency and enhancing the efficiency of data-centric operations. The growing demand for cloud services and the expansion of edge computing infrastructures are testament to how integral AI hardware has become to the sector’s development.

Overall, the dominance of the Telecommunication and IT industry in the AI hardware market is expected to persist as the need for advanced computational power and real-time data processing continues to grow. This segment’s leadership reflects its pivotal role in the broader adoption and integration of AI technologies across various industries.

Key Market Segments

By Type

- Processor

- Memory

- Network

- Storage

By Technology

- Machine Learning

- Computer Vision

- Natural Language Processing

- Expert Systems

By Industry Vertical

- Telecommunication and IT industry

- Banking and Finance Sectors

- Education

- E-commerce

- Navigation

- Robotics

- Agriculture

- Healthcare

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Increasing Demand in Healthcare

The AI hardware market is significantly driven by its expanding use in the healthcare sector. AI-enabled hardware devices are revolutionizing medical imaging and diagnostics by providing real-time, accurate interpretations of complex images such as X-rays and MRIs.

This capability is enhancing early detection of diseases and supporting the personalized medicine approach, where treatments are tailored to individual genetic profiles and health histories. This trend is not only improving patient outcomes but also optimizing the operational efficiency of healthcare systems, thereby propelling the market growth of AI hardware.

Restraint

High Cost of Implementation

One major restraint in the AI hardware market is the high cost associated with developing and deploying AI technologies. The need for specialized components and advanced technology solutions leads to significant initial investments, which can be prohibitive for smaller organizations and startups.

Additionally, integrating these technologies into existing systems presents complexities that require further financial and human resource investments, making it challenging for wider adoption across various industries.

Opportunity

Scalability Needs in Retail

In the retail sector, there is a burgeoning opportunity for AI hardware due to the critical need for scalability and efficiency. Retailers are increasingly adopting AI-powered solutions like smart shelves and autonomous service robots to enhance inventory management and customer service.

The ability of AI hardware to process and analyze customer data in real-time enables personalized shopping experiences, thereby improving customer satisfaction and loyalty. This trend is expected to continue as retailers seek to leverage technology to stay competitive in a rapidly evolving market landscape.

Challenge

Integration and Heat Management

A significant challenge facing the AI hardware market is the technical difficulty associated with integrating AI systems into existing infrastructures. Compatibility issues and the specialized nature of AI hardware can hinder seamless integration.

Moreover, AI hardware, especially high-performing processors, generates a substantial amount of heat, posing challenges in heat management within systems. Addressing these thermal management issues is crucial for maintaining system performance and longevity, adding another layer of complexity to the use of AI hardware.

Growth Factors

The AI hardware market is experiencing robust growth, driven by several pivotal factors. One of the primary growth drivers is the increasing adoption of AI across various industries, which necessitates advanced hardware to manage and process AI tasks effectively.

Industries such as healthcare, automotive, and manufacturing are integrating AI hardware to enhance efficiency and innovate their operations. The healthcare sector, in particular, is leveraging AI for diagnostics and patient care management, significantly propelling the demand for specialized AI hardware.

Additionally, the continuous advancements in semiconductor technologies are fueling the development of more sophisticated AI hardware. This includes the production of custom AI chips and energy-efficient hardware solutions, which are critical for supporting the high-performance requirements of modern AI applications.

Emerging Trends

Several emerging trends are shaping the future of the AI hardware market. Notably, the integration of AI with edge computing is gaining traction. This trend involves deploying AI hardware that can process data at or near the source of data generation, such as in IoT devices and local servers, which minimizes latency and reduces bandwidth usage.

Another significant trend is the focus on developing energy-efficient AI hardware. As AI technologies become more pervasive and the computational demands increase, there is a growing need for AI hardware that can deliver high performance while minimizing power consumption. This is particularly important in data centers and large-scale AI deployments, where energy efficiency can lead to substantial cost savings and sustainability benefits.

Furthermore, the advent of AI-as-a-Service (AIaaS) is promoting the demand for AI hardware that supports cloud-based AI platforms. This service model allows businesses to access AI capabilities without the need for extensive on-premise infrastructure, which is driving the development of flexible and scalable AI hardware solutions.

Key Players Analysis

Nvidia Corporation has been very active in expanding its capabilities through acquisitions, partnerships, and new product launches. A significant step was the acquisition of Arm Limited, aimed at boosting its technology stack and market reach in the AI sector, although this deal faced regulatory hurdles. Recently, Nvidia launched the Hopper GPU architecture, designed specifically for AI workloads, which significantly improves computing efficiency and speed for AI applications.

Qualcomm Technologies has made substantial advancements in the AI hardware market through strategic collaborations and innovations in AI chipsets. The company recently launched the Snapdragon AI platform, which is integrated into their new mobile chipsets.

This platform enhances on-device AI processing capabilities, catering to the growing demand for smart technology in mobile devices. Additionally, Qualcomm has expanded its reach in the automotive sector by acquiring NUVIA, a move that enhances their capabilities in high-performance processors for next-generation vehicles.

Samsung Electronics Co. Ltd. continues to innovate in the realm of AI hardware, focusing on the development and launch of new products that incorporate AI technologies. One of their notable introductions has been the Exynos AI chip, which is designed to enhance the processing power and efficiency of AI applications in mobile devices and other electronics.

Samsung has also been active in forming partnerships aimed at enhancing their AI capabilities, such as their collaboration with IBM to develop edge computing solutions that are AI-enabled, improving data processing and analytics at the network edge.

Top Key Players in the Market

- Nvidia Corporation

- Qualcomm Technologies

- Samsung Electronics Co. Ltd.

- International Business Machines Corporation (IBM)

- Xilinx Inc.

- Micron Technology Inc.

- Huawei Technologies Co. Ltd.

- Intel Corporation

- Google LLC

- Microsoft Corporation

- Advanced Micro Devices Inc.

- Apple Inc.

- Dell Technologies Inc.

- Amazon Web Services Inc.

- Hewlett Packard Enterprise Company

- Other Key Players

Recent Developments

- Dell Technologies: In 2024, Dell launched the AI Factory in collaboration with Nvidia, offering an end-to-end AI enterprise solution. This includes the integration of Dell’s hardware with Nvidia’s AI infrastructure. The Dell AI Factory supports diverse AI applications, helping organizations accelerate their AI adoption, particularly in enterprise environments.

- Qualcomm Technologies: At Computex 2023, Qualcomm unveiled its Snapdragon chips aimed at advancing AI processing for edge devices and PCs. In early 2024, Qualcomm launched its Qualcomm AI Hub, a platform designed to assist developers in integrating generative AI into devices. This further strengthens its position in mobile AI hardware.

- Advanced Micro Devices (AMD): AMD has been expanding its AI hardware portfolio with the introduction of new GPUs optimized for AI workloads. In 2023, AMD released updates to its MI300 series GPUs, offering enhanced performance for AI inference and model training across various industries.

Report Scope

Report Features Description Market Value (2023) USD 53.9 Bn Forecast Revenue (2033) USD 833.4 Bn CAGR (2024-2033) 31.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Hardware Type (Processor, Memory, Network, Storage), By Technology (Machine Learning, Computer Vision, Natural Language Processing, Others), By Industry Vertical (IT & Telecom, BFSI, Manufacturing, Healthcare, Retail and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Nvidia Corporation, Qualcomm Technologies, Samsung Electronics Co. Ltd., International Business Machines Corporation (IBM), Xilinx Inc., Micron Technology Inc., Huawei Technologies Co. Ltd., Intel Corporation, Google LLC, Microsoft Corporation, Advanced Micro Devices Inc., Apple Inc., Dell Technologies Inc., Amazon Web Services Inc., Hewlett Packard Enterprise Company, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Nvidia Corporation

- Qualcomm Technologies

- Samsung Electronics Co. Ltd.

- International Business Machines Corporation (IBM)

- Xilinx Inc.

- Micron Technology Inc.

- Huawei Technologies Co. Ltd.

- Intel Corporation

- Google LLC

- Microsoft Corporation

- Advanced Micro Devices Inc.

- Apple Inc.

- Dell Technologies Inc.

- Amazon Web Services Inc.

- Hewlett Packard Enterprise Company