Global AI in GreenTech Market Size, Share, Growth Analaysis Report By Component (Software (AI Platforms, Analytics Tools, Predictive Maintenance Software), Services (Managed Services, Professional Services)), By Deployment Mode (On-Premise, Cloud-Based), By Technology (Machine Learning, Natural Language Processing, Computer Vision, Context-Aware Computing, Deep Learning, Others), By Application (Energy Management, Sustainable Agriculture, Climate Monitoring & Carbon Footprint Management, Smart Waste Management, Water Management, Green Building and Smart Cities, Other Applications), By Industry (Energy & Utilities, Agriculture, Manufacturing, Transportation & Logistics, Government & Public Sector, Construction, Waste Management, Water Treatment, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 154165

- Number of Pages: 345

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- U.S. Market Size Statistics

- Growth Factors

- Emerging Trends

- By Component Analysis

- By Deployment Mode Analysis

- By Technology Analysis

- By Application Analysis

- By Industry Analysis

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

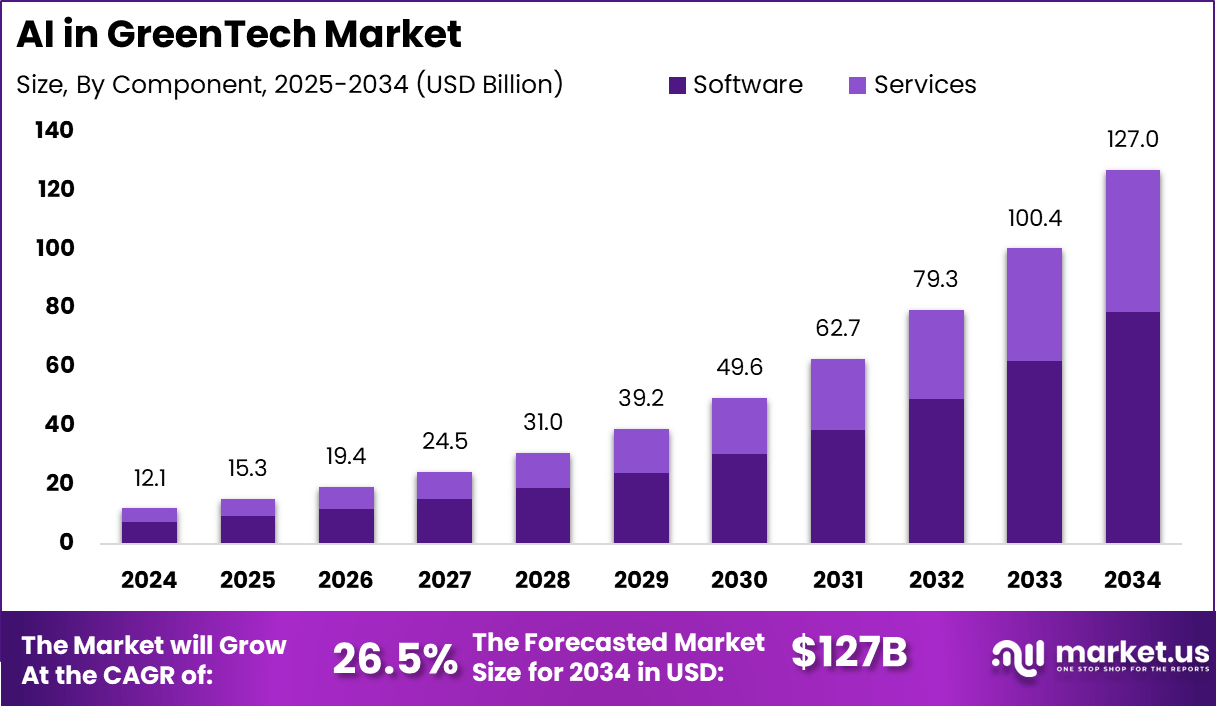

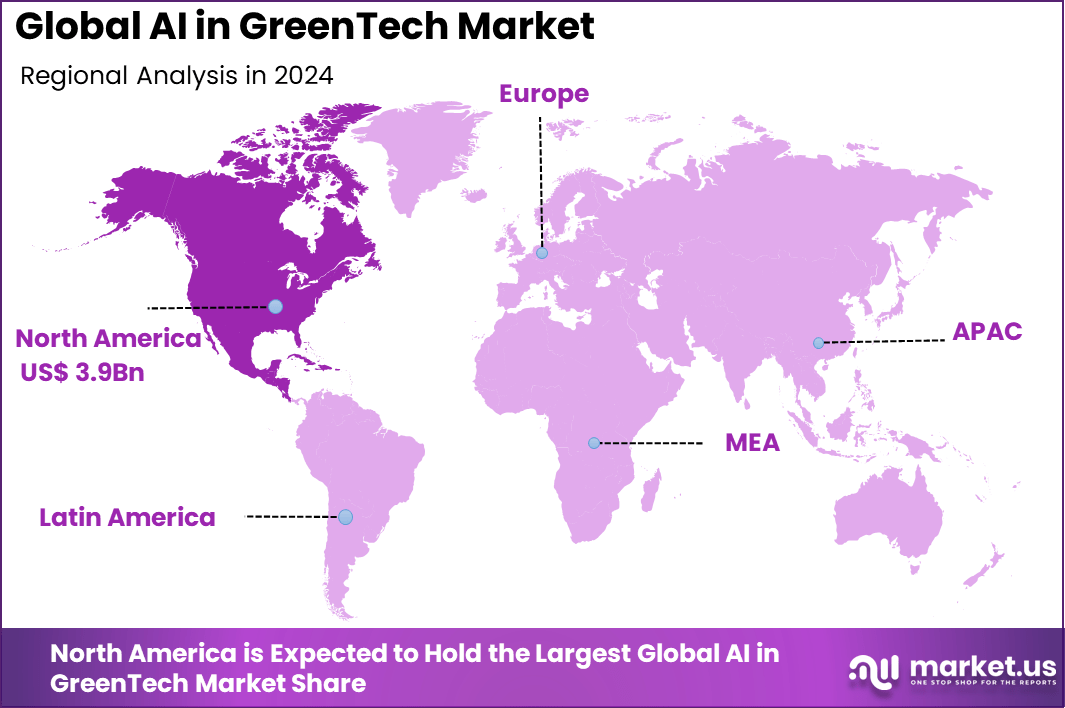

The Global AI in GreenTech Market size is expected to be worth around USD 127 Billion By 2034, from USD 12.1 billion in 2024, growing at a CAGR of 26.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 33% share, holding USD 3.9 Billion revenue.

Artificial intelligence is increasingly integrated in GreenTech to optimize energy use, manage renewable systems, improve waste processing, and support sustainable agriculture. It enables real‑time environmental monitoring, predictive control for grid stability, and data‑driven decisions in resource management. Smart grid systems and precision agriculture solutions are key areas where AI functions as the intelligence layer driving GreenTech performance.

The primary drivers of AI adoption in GreenTech include heightened regulatory emphasis on ESG compliance, growing investor demand for transparent sustainability reporting, and operational pressures to improve energy efficiency and resilience. Advanced machine learning systems are also being deployed to manage renewable energy intermittency and reduce downtime via predictive maintenance.

Demand for AI‑via‑GreenTech applications is rooted in the need for reliable grid operation amidst surging renewable capacity and infrastructure constraints. AI is being used to expedite energy project interconnections, manage grid bottlenecks, and streamline approval workflows. Utilities are increasingly seeking AI‑powered tools to avoid costly outages, forecast loads, and mitigate infrastructure stress amplified by climate volatility.

According to Market.us, In 2024, the AI in ESG and Sustainability Market was valued at USD 1.24 billion, and it is projected to grow to USD 14.87 billion by 2034, with a CAGR of 28.20%. This surge is driven by rising demand for real-time ESG data, automated reporting, and climate risk analysis powered by AI tools. Companies are adopting AI to meet strict regulations and to enhance their sustainability impact with greater accuracy and speed.

Meanwhile, the ESG Consulting Market stood at USD 8.12 billion in 2024 and is expected to reach USD 39 billion by 2034, growing at a CAGR of 16.90%. The expansion is supported by increasing global pressure for transparent sustainability practices. Organizations are turning to consultants to navigate evolving ESG standards, improve governance structures, and design net-zero strategies.

Market Size and Growth

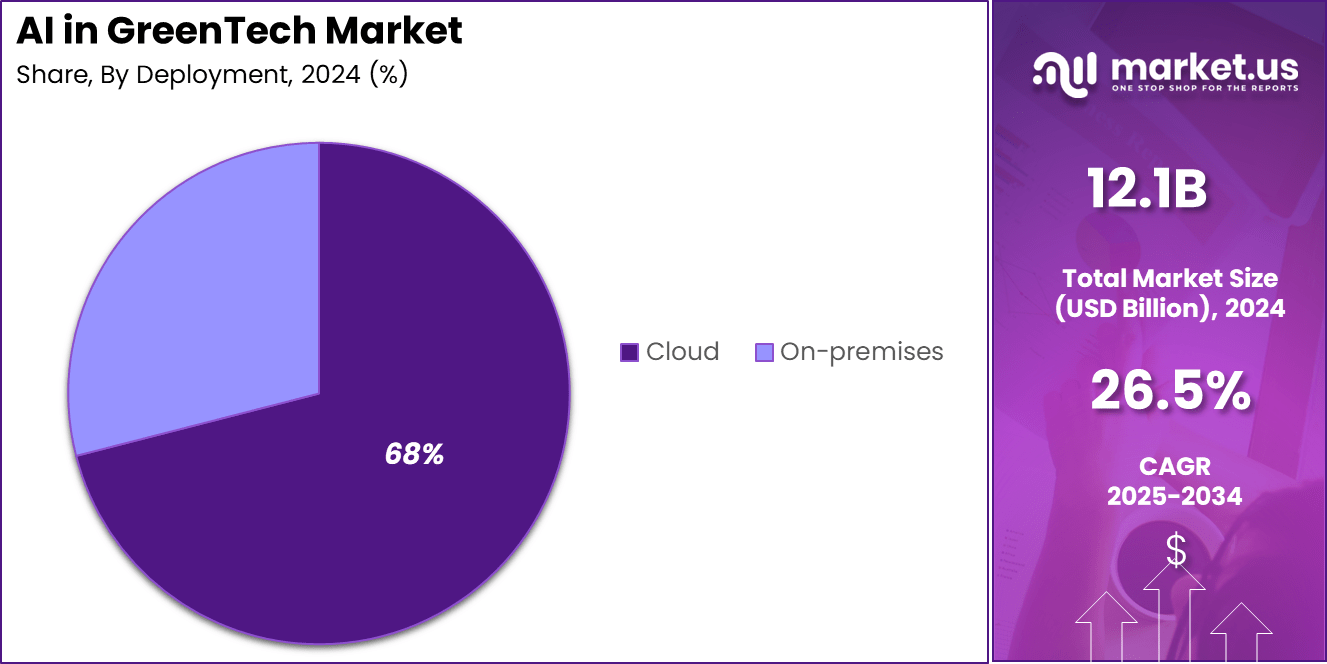

Report Features Description Market Value (2024) USD 12.1 Bn Forecast Revenue (2034) USD 127 Bn CAGR(2025-2034) 26.5% Leading Segment Cloud-based: 68% Largest Market North America [33% Market Share] Largest Country U.S. [USD 3.82 Billion Market Revenue], CAGR: 24.1% Based on data from Wifitalents, 65% of green industry companies have adopted AI technologies to improve operational efficiency. In landscaping, AI-driven predictive analytics help reduce water usage by up to 30%, while 45% of firms use AI for pest control, leading to a 20% boost in efficiency. Greenhouse management has also benefited, with AI increasing crop yields by an average of 25%.

Notably, 78% of arborists rely on AI tools for tree health monitoring and risk assessments, signaling widespread trust in automated environmental diagnostics. AI is also making significant contributions to energy and planting operations. Machine learning models are used to manage eco-building systems, reducing energy consumption by 15–20%.

AI-powered drones have improved large-scale planting and site monitoring, increasing planting speed by 40%. Furthermore, 52% of green industry professionals expect AI to enhance decision-making capabilities in the coming years. Reflecting this momentum, the AI segment within the green industry is projected to expand at a CAGR of 23% over the next five years.

Key Insight Summary

- The global market is projected to grow from USD 12.1 Billion in 2024 to USD 127 Billion by 2034, advancing at a robust CAGR of 26.5%.

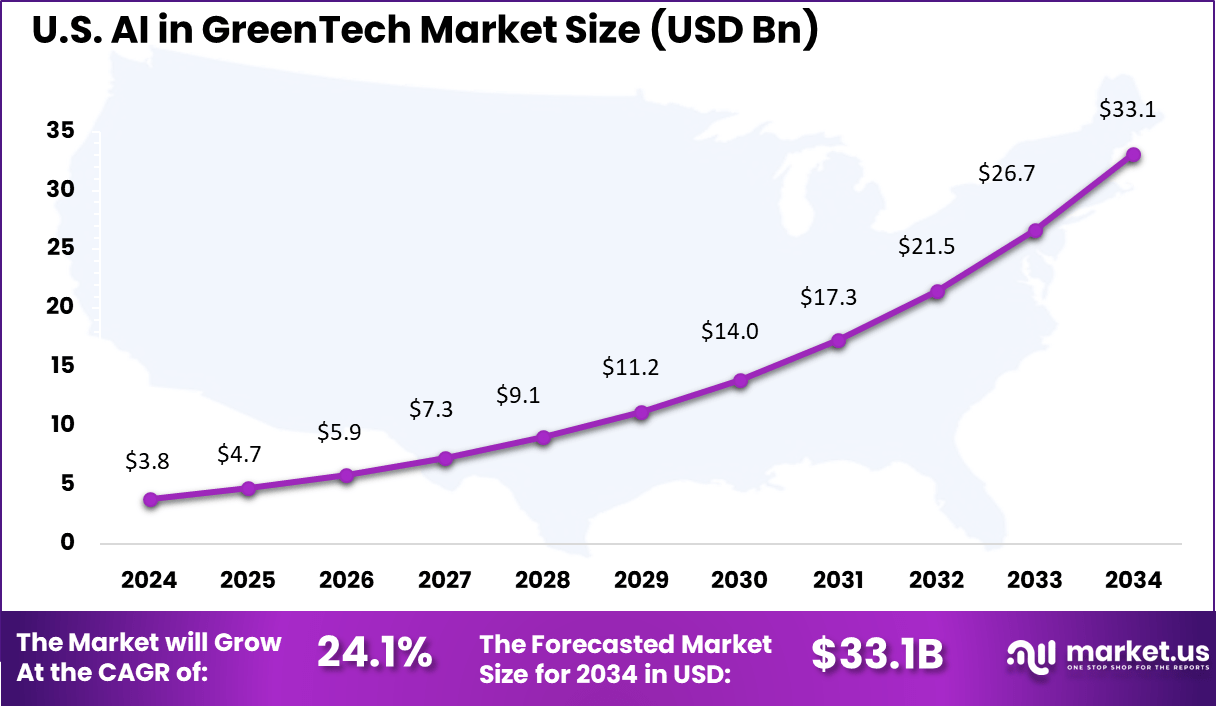

- The U.S. market reached USD 3.82 Billion in 2024 and is forecast to grow steadily at a CAGR of 24.1%, driven by aggressive climate goals and AI-led energy optimization programs.

- By component, Software dominated with a 62% share, reflecting the demand for AI-powered analytics, environmental modeling, and intelligent automation tools.

- Cloud-based deployment captured 68%, supported by the need for scalable infrastructure, remote monitoring, and seamless data integration across geographies.

- Machine Learning led the technology segment with a 31% share, as predictive algorithms and adaptive systems enable smarter decision-making in sustainability planning.

- In terms of application, Energy Management held 27% share, driven by AI’s role in reducing energy waste, balancing load demands, and forecasting renewable energy output.

- By industry, Energy & Utilities held 35.8%, emerged as a major adopter, as grid operators, power plants, and utility firms invest in AI for clean energy transitions and operational efficiency.

U.S. Market Size Statistics

The U.S. AI in GreenTech Market was valued at USD 3.8 Billion in 2024 and is anticipated to reach approximately USD 33.1 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 24.1% during the forecast period from 2025 to 2034. In 2024, the United States held a dominant position in the AI in GreenTech market, capturing more than a significant share of global activity.

This leadership can be attributed to its well-established digital infrastructure, advanced AI research ecosystem, and strong presence of clean technology innovators. U.S. based energy utilities and environmental solution providers have actively integrated AI for grid optimization, energy forecasting, and emission tracking. The nation’s robust startup ecosystem and access to high-performance computing further strengthen its role in deploying AI for environmental applications.

The U.S. regulatory and policy framework has also supported this growth. Federal and state-level climate initiatives such as decarbonization mandates, clean energy tax incentives, and AI-driven environmental monitoring programs have pushed both public and private sectors to invest in AI-enabled sustainability tools. Moreover, academic collaborations and government-funded research in environmental AI applications have accelerated technological advancements.

In 2024, North America held a dominant market position, capturing more than a 33% share, holding USD 3.9 billion in revenue in the AI in GreenTech market. This leadership is rooted in its early adoption of artificial intelligence across clean energy, smart infrastructure, and environmental monitoring. The region benefits from mature digital frameworks, strong public-private investment in sustainability, and government mandates targeting carbon reduction.

The U.S. and Canada have both emphasized decarbonization and digital transformation as national priorities, which has accelerated AI investments in solar forecasting, precision agriculture, and emissions tracking tools. Incentives from the Inflation Reduction Act and Canada’s Clean Technology Investment Tax Credit have encouraged adoption at scale.

Growth Factors

Key Factor Description Regulatory push for ESG/sustainability Regulatory mandates and climate goals (e.g., net zero targets, ESG reporting) are driving adoption of AI-powered solutions for tracking and reducing carbon emissions, waste, and other environmental impacts. Investments in digital and frontier tech Continued investment in AI, IoT, and related digital technologies to enhance efficiency, productivity, and sustainability in operations—even during challenging economic times. Real-time data analytics and optimization AI and IoT enable real-time tracking of resource use, carbon footprints, emissions, and waste, allowing for dynamic optimization and rapid response to inefficiencies. Need for cost savings and resource efficiency Companies adopt AI to highlight inefficiencies, reduce costs, and optimize resource management—key for energy, logistics, and manufacturing. Consumer and stakeholder expectations Growing consumer awareness and stakeholder demands for eco-friendly business practices increase investments in predictive analytics for green strategies. Circular economy models AI enables advanced waste management, recycling, and supply chain transparency to support circular economic practices and sustainability certification. Emerging Trends

Key Points Description Integration of Generative AI Gen AI is used for rapid prototyping of green solutions, code optimization, carbon footprint visualization, and real-time decision support — accelerating innovation in eco-friendly applications. Applied/Analytical AI Machine learning, computer vision, and NLP are deployed in predictive maintenance, energy optimization, environmental monitoring, and supply chain management for sustainability. Edge AI & IoT Edge AI and IoT sensors enable local, real-time data processing for smart energy grids, precision agriculture, and smart city infrastructure, enhancing scalability and responsiveness of green solutions. AI-powered compliance & reporting Automated monitoring and reporting on ESG and carbon emissions for transparency, accuracy, and regulatory compliance, powered by AI and blockchain-based platforms. Climate risk prediction Gen AI and predictive analytics forecast weather extremes and climate change impacts, supporting infrastructure resilience, risk management, and policymaking. Sectoral and personalized solutions AI-driven tools for industry-specific needs (e.g., e-mobility, agriculture, energy, manufacturing) and individualized carbon reduction plans for consumers and businesses. Focus on green AI itself Efforts to ensure that AI development and deployment consume less energy and are themselves sustainable, minimizing the environmental footprint of advanced algorithms and hardware. By Component Analysis

In 2024, the Software segment held a commanding 62% share in the AI in GreenTech Market. This dominance is due to the widespread use of AI-powered platforms for analyzing environmental data, forecasting emissions, and optimizing energy systems. Software solutions enable organizations to integrate real-time data from multiple sources, allowing smarter resource planning and efficient carbon footprint tracking.

Their modularity and compatibility with existing systems have made them the preferred choice over hardware. Additionally, the rise of SaaS-based sustainability tools and open-source AI frameworks has expanded access for small and medium enterprises. These platforms not only assist in operational efficiency but also help meet regulatory reporting requirements, further strengthening the demand for software-led solutions.

By Deployment Mode Analysis

In 2024, Cloud-based solutions led the market with a strong 68% share, reflecting the need for scalable, flexible, and cost-effective deployment models. Cloud platforms enable real-time monitoring, seamless data integration, and remote accessibility, which are critical for GreenTech operations spread across diverse geographies.

Organizations prefer cloud solutions for their lower upfront costs and quick AI deployment in areas such as energy prediction and waste management. Furthermore, the cloud model supports large-scale environmental simulations and high-speed data processing, essential for climate modeling and smart grid optimization.

By Technology Analysis

In 2024, Machine Learning accounted for 31% of the technology segment in 2024, emerging as the most widely adopted AI technique in GreenTech. Its strength lies in analyzing complex environmental patterns, forecasting energy demand, and identifying anomalies in pollution levels. ML models are trained using historical data to automate sustainability tasks such as water usage optimization, predictive maintenance of renewable energy assets, and climate risk assessments.

Machine learning is also being used to support autonomous decision-making in smart buildings and agriculture. As data availability grows through sensors and IoT systems, machine learning algorithms will become increasingly vital in accelerating the transition to sustainable energy and resource practices.

By Application Analysis

In 2024, Energy Management emerged as the leading application, contributing 27% of the market share. AI technologies are being actively used to balance electricity supply and demand, enhance grid efficiency, and integrate renewable energy sources like solar and wind. Smart energy systems powered by AI enable real-time tracking of consumption, allowing households and industries to optimize usage patterns and reduce energy waste.

This application is especially relevant in urban infrastructure and commercial facilities where energy costs and emissions need to be minimized. AI-driven tools such as automated thermostats, load forecasting software, and distributed energy resource management systems are key contributors to this segment’s strength.

By Industry Analysis

In 2024, The Energy & Utilities sector accounted for 35.8% of the market in 2024, making it the most prominent end-user of AI in GreenTech. This industry’s heavy carbon footprint and growing regulatory pressure to decarbonize have accelerated the adoption of intelligent solutions. From optimizing power generation to forecasting grid fluctuations, AI helps utility companies reduce operational costs and meet clean energy targets.

The sector also uses AI for fault detection, infrastructure monitoring, and predictive maintenance, improving both safety and efficiency. As countries invest in smart grids and renewable energy infrastructure, the integration of AI tools across utility networks is expected to expand further.

Key Market Segments

By Component

- Software

- AI Platforms

- Analytics Tools

- Predictive Maintenance Software

- Services

- Managed Services

- Professional Services

By Deployment Mode

- On-Premise

- Cloud-Based

By Technology

- Machine Learning

- Natural Language Processing

- Computer Vision

- Context-Aware Computing

- Deep Learning

- Others

By Application

- Energy Management

- Sustainable Agriculture

- Climate Monitoring & Carbon Footprint Management

- Smart Waste Management

- Water Management

- Green Building and Smart Cities

- Other Applications

By Industry

- Energy & Utilities

- Agriculture

- Manufacturing

- Transportation & Logistics

- Government & Public Sector

- Construction

- Waste Management

- Water Treatment

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Real-Time Data Analysis and Resource Optimization

A major driver accelerating AI adoption in GreenTech is its powerful ability to analyze massive datasets from sensors, satellites, and smart devices. AI enables energy grids and urban systems to adapt to real-time changes, cuts waste, and helps predict demand without human intervention. This shift toward data-driven automation and optimization allows businesses and communities to make better decisions, save resources, and move closer to environmental goals with increased efficiency.

Restraint Analysis

High Energy Demands of AI Systems

Despite its promise, the energy consumption of advanced AI systems is a significant restraint. Training and deploying large AI models require huge amounts of electricity, often putting a strain on power grids and potentially outweighing some of the environmental benefits AI is supposed to bring. There is a growing debate about balancing the eco-friendly tools AI offers with the need to ensure its development does not add to carbon emissions or deplete finite resources.

Opportunity Analysis

Smarter Cities and Circular Economy

An exciting opportunity lies in the creation of AI-powered smart cities and support for circular economy initiatives. By continuously monitoring waste, energy, and environmental conditions, AI can help guide city management toward lower emissions, optimized recycling, and better urban planning. This opens doors for tailored solutions that maximize resource reuse, cut pollution, and enable cities and organizations to hit tightening green targets more effectively.

Challenge Analysis

Managing the Environmental Footprint of AI

One of the toughest challenges is finding ways to maximize the positive effect of AI on the environment while minimizing its own resource consumption. This means not only making algorithms more energy-efficient but also designing hardware with a longer life cycle, ensuring recyclability, and promoting transparency in measuring environmental impacts. Achieving this balance will require cross-sector collaboration, innovative public policies, and a focus on both the immediate and long-term consequences of AI deployment in the green sector.

Key Player Analysis

In the AI in GreenTech Market, major technology firms like Microsoft Corporation, IBM Corporation, and Google LLC (Alphabet Inc.) are playing a central role. These companies are investing in AI-powered sustainability platforms, carbon emission tracking, and smart grid management. Their global presence and extensive R&D capabilities enable them to support climate-conscious digital transformation across industries.

Hardware and chip design leaders such as Intel Corporation are also shaping the AI in GreenTech ecosystem. Their energy-efficient processors and edge computing platforms support green AI applications, including water management and precision agriculture. Alongside them, cloud-based CRM and analytics provider Salesforce offers climate-centric data tools and sustainability dashboards that help businesses track environmental KPIs.

Emerging players like STACC, Xeven Solutions, and established industrial giants such as Schneider Electric and General Electric (GE) are reinforcing this market’s diversity. STACC and Xeven Solutions are focusing on AI for environmental data analysis and smart resource planning. Meanwhile, Schneider Electric and GE are integrating AI into building automation, grid intelligence, and eco-industrial solutions.

Leading companies in the AutoML market include:

- Microsoft Corporation

- IBM Corporation

- Google LLC (Alphabet Inc.)

- Intel Corporation

- Salesforce

- STACC

- Xeven Solutions

- Schneider Electric

- General Electric (GE)

- Others

Recent Developments

- November 2024: IBM, in collaboration with Sustainable Energy for All at COP29, publicly launched AI-powered tools for sustainable urban development. Their “Open Building Insights” platform leverages AI models to optimize building usage and plan greener infrastructure, focusing on developing regions.

- May 2024: Microsoft signed a $10 billion partnership with Brookfield Asset Management to secure 10.5 gigawatts of renewable energy globally, making it the largest corporate renewable energy agreement in history. This ambitious move will fuel Microsoft’s AI-powered data centers worldwide, supporting both its rapid AI scaling and carbon-negative commitment.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software (AI Platforms, Analytics Tools, Predictive Maintenance Software), Services (Managed Services, Professional Services)), By Deployment Mode (On-Premise, Cloud-Based), By Technology (Machine Learning, Natural Language Processing, Computer Vision, Context-Aware Computing, Deep Learning, Others), By Application (Energy Management, Sustainable Agriculture, Climate Monitoring & Carbon Footprint Management, Smart Waste Management, Water Management, Green Building and Smart Cities, Other Applications), By Industry (Energy & Utilities, Agriculture, Manufacturing, Transportation & Logistics, Government & Public Sector, Construction, Waste Management, Water Treatment, Others), Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft Corporation, IBM Corporation, Google LLC (Alphabet Inc.), Intel Corporation, Salesforce, STACC, Xeven Solutions, Schneider Electric, General Electric (GE), Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Microsoft Corporation

- IBM Corporation

- Google LLC (Alphabet Inc.)

- Intel Corporation

- Salesforce

- STACC

- Xeven Solutions

- Schneider Electric

- General Electric (GE)

- Others