AI in Financial Planning and Analysis (FP&A) Market Size, Share Analysis Report By Technology (Machine Learning, Natural Language Processing (NLP), Robotic Process Automation (RPA), Others), By Deployment (Cloud-based, On-premises, Hybrid), By Application (Forecasting and Budgeting, Financial Reporting, Cash Flow Management, Risk Management and Compliance, Others), By Enterprise Size (Large Enterprises, SMEs), By Industry Vertical (Banking and Financial Services, Retail and E-commerce, Healthcare, Manufacturing, IT & Telecom, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146159

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- US Market Growth

- Technology Analysis

- Deployment Analysis

- Application Analysis

- Enterprise Size Analysis

- Industry Vertical Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

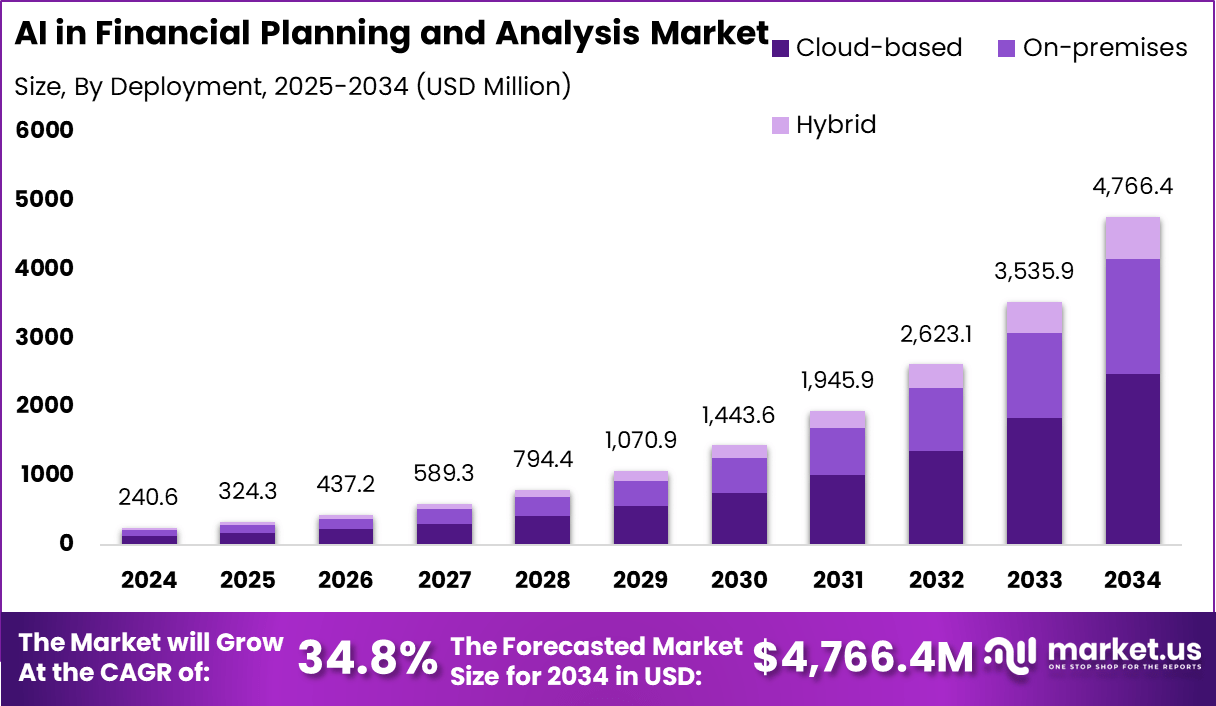

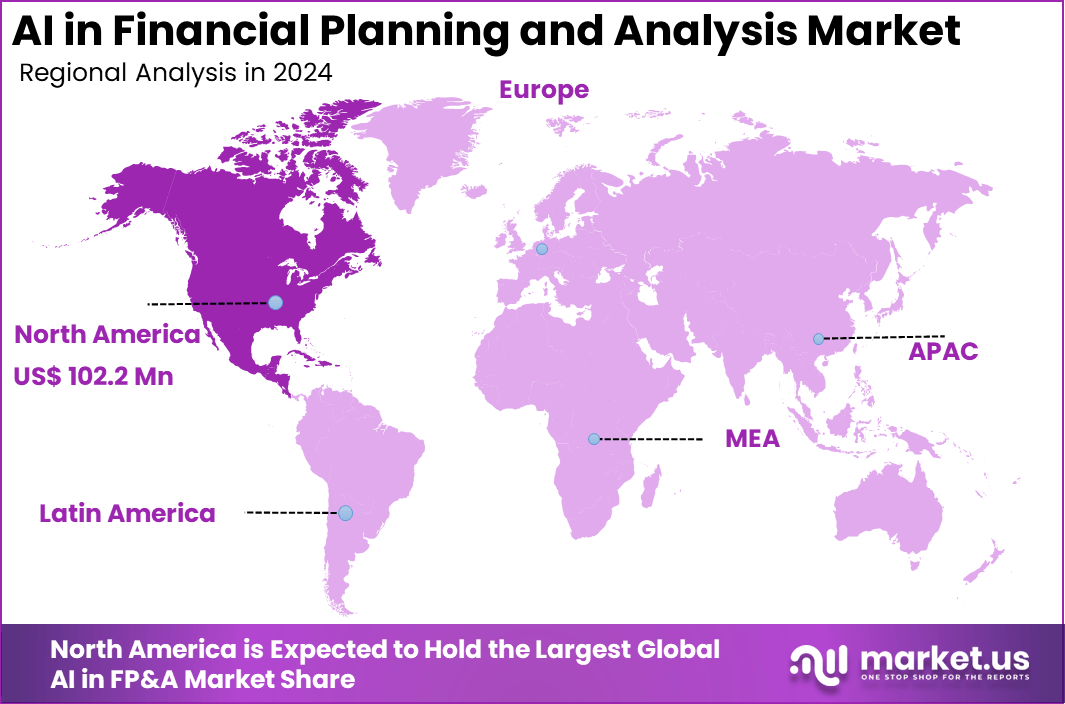

The Global AI in Financial Planning and Analysis (FP&A) Market size is expected to be worth around USD 4,766.4 Million By 2034, from USD 240.6 Million in 2024, growing at a CAGR of 34.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 42.5% share, holding USD 102.2 Million revenue.

The market for AI in FP&A is expanding as businesses seek to leverage AI to gain a competitive edge in financial accuracy and operational efficiency. Key drivers include the need for enhanced data processing capabilities and more accurate forecasting models. AI tools like machine learning algorithms and digital twins are being adopted to simulate financial outcomes and optimize decision-making processes, which are crucial in today’s fast-paced business environments.

The demand for AI in FP&A is increasing as companies seek to reduce the time spent on manual data processing and shift towards strategic activities that offer higher value. This demand is further fueled by the growing complexity of financial data and the need for precision in financial reporting and compliance. The major reason boosting the demand for AI in FP&A is its impact on efficiency and effectiveness in financial operations.

Current trends in the AI in FP&A market include the integration of AI with cloud computing for enhanced data accessibility and processing power, the use of predictive analytics for forward-looking insights, and the increasing reliance on scenario modeling to plan for various financial outcomes.

Technologies that are being increasingly adopted in AI for FP&A include machine learning algorithms for predictive analytics, natural language processing for generating financial insights, and robotic process automation (RPA) to automate routine data entry and processing tasks.

Organizations adopt AI in FP&A primarily to enhance accuracy, speed up financial processes, and reduce operational costs. The ability of AI to provide detailed insights and foresights without human bias is a critical factor in its adoption.

The latest FP&A Trends Survey reveals that only 6% of FP&A departments currently employ AI/ML technologies. However, a significant 59% are considering its adoption soon. This growing interest is largely driven by the need for enhanced forecasting speed and accuracy amid an unpredictable business climate.

The survey highlights a noteworthy trend: while the average satisfaction with forecast quality stands at 42% across organizations, this figure climbs to 65% among those implementing AI/ML solutions. This data underscores the potential of AI/ML to improve financial planning and analysis by delivering more reliable forecasts.

Key Takeaways

- The Global AI in FP&A Market is expected to reach USD 4,766.4 Million by 2034, rising from USD 240.6 Million in 2024.

- The market is set to grow at a rapid CAGR of 34.8% between 2025 and 2034.

- North America leads globally with over 42.5% share, amounting to USD 102.2 Million in 2024.

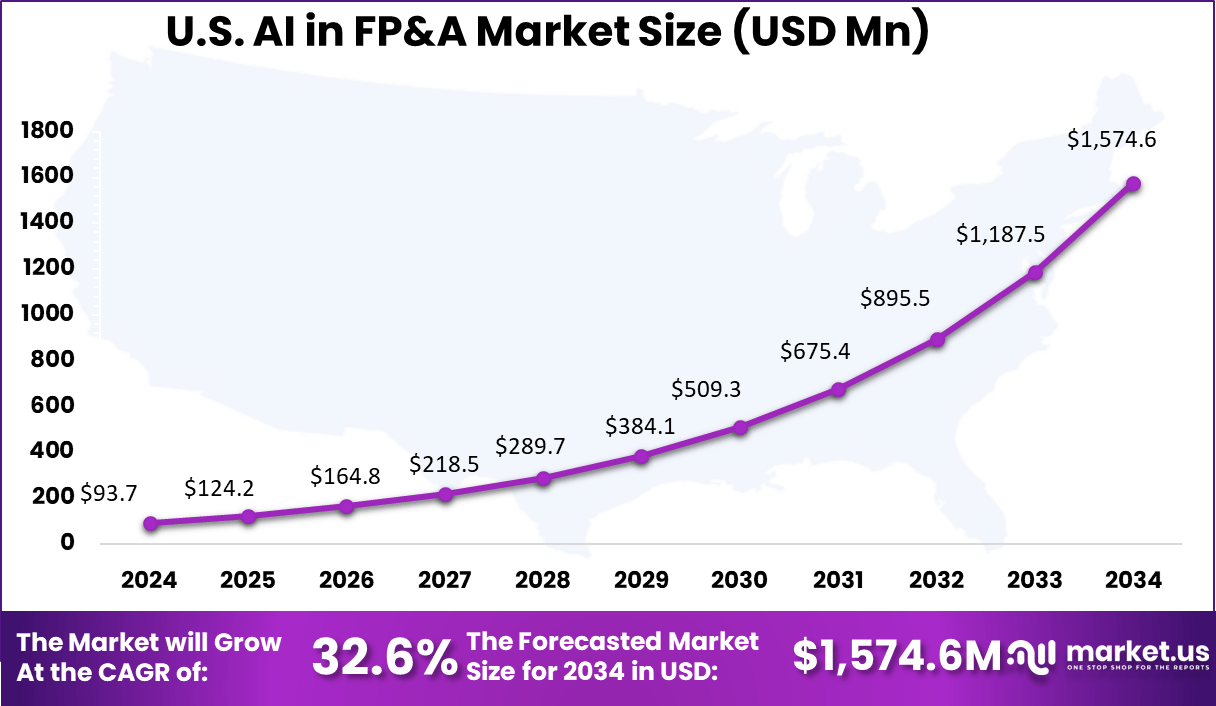

- The U.S. market alone stands at USD 93.7 Million in 2024.

- U.S. revenue is projected to reach USD 1,574.6 Million by 2034, growing at a CAGR of 32.6% from 2025 onward.

- Machine Learning dominates the technology segment, contributing 39.78% share in 2024.

- Cloud-based deployment leads with a 52.14% share, driven by scalability and ease of integration.

- Forecasting and Budgeting is the top application, capturing 31.5% share, as firms seek real-time predictive insights.

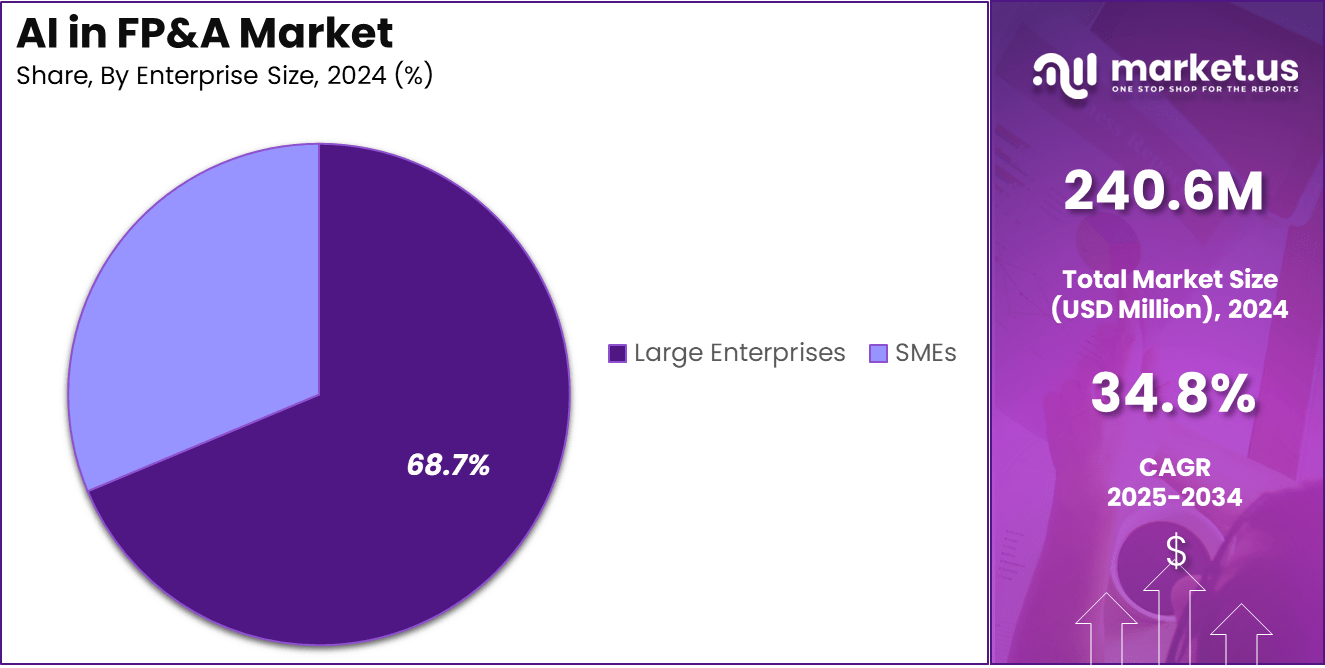

- Large Enterprises hold the largest share at 68.7%, due to higher data volumes and complex FP&A needs.

- Banking and Financial Services lead the industry verticals, contributing 29.74%, as AI streamlines cost controls and compliance.

- The market is driven by real-time data modeling, scenario analysis, and automation of financial workflows.

- Strong demand is observed in risk management, rolling forecasts, and capital planning using AI algorithms.

Analysts’ Viewpoint

The AI in FP&A sector presents significant investment opportunities, especially in developing solutions that offer more intuitive and user-friendly financial analytics tools. Investment is also directed towards technologies that integrate seamlessly with existing financial systems to deliver more cohesive and automated financial planning processes.

Businesses benefit from AI in FP&A through improved financial accuracy, reduced costs associated with financial operations, and enhanced strategic decision-making capabilities. AI’s real-time processing abilities allow companies to stay agile in dynamic economic conditions.

The regulatory environment for AI in FP&A is evolving to address issues related to data privacy, security, and ethical use of AI. Companies are increasingly required to ensure that their AI implementations comply with financial reporting standards and data protection laws.

US Market Growth

The US AI in Financial Planning and Analysis (FP&A) Market is valued at approximately USD 93.7 Million in 2024 and is predicted to increase from USD 124.2 Million in 2025 to approximately USD 1,574.6 Million by 2034, projected at a CAGR of 32.6% from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than a 42.5% share, holding USD 102.2 million revenue. This region leads due to several strategic advantages. Firstly, North America boasts a mature financial market with a strong presence of major technology firms and financial institutions that are early adopters of AI technologies.

This adoption is driven by the need to enhance analytical capabilities and efficiency in financial operations. Secondly, the region has a robust startup ecosystem that continuously innovates in the AI space, supported by significant investments from venture capital firms.

Technology Analysis

In 2024, the Machine Learning (ML) segment held a dominant position in the AI in Financial Planning and Analysis (FP&A) market, capturing over 39.78% of the market share. This leadership is primarily due to ML’s unparalleled ability to process vast datasets, identify intricate patterns, and generate accurate financial forecasts, significantly enhancing decision-making processes.

Organizations leveraging ML in their FP&A functions have reported substantial improvements in forecast accuracy and operational efficiency. For instance, companies have managed to reduce their annual forecasting efforts by approximately 30,000 full-time equivalent hours, enabling real-time identification of market factors that previously took months to analyze .

The surge in ML adoption is also driven by its capacity to automate complex financial tasks, thereby freeing finance professionals to focus on strategic initiatives. By automating data analysis and forecasting, ML allows for rapid scenario planning and real-time financial modeling, which are crucial in today’s dynamic business environment.

This shift not only enhances the agility of financial operations but also positions finance teams as strategic partners within their organizations. As a result, ML is not just a technological advancement but a transformative force reshaping the landscape of financial planning and analysis.

Deployment Analysis

In 2024, the cloud-based segment of the AI in Financial Planning and Analysis (FP&A) market held a dominant position, capturing more than a 52.14% share. This prominence is largely attributed to the cloud’s inherent advantages in scalability, flexibility, and cost efficiency, which are essential for deploying advanced AI solutions.

Cloud platforms offer a broad range of AI functionalities, including machine learning and data analytics, without the need for substantial initial investment in physical infrastructure. This makes them an attractive option for organizations looking to integrate sophisticated AI capabilities swiftly and efficiently.

The trend towards cloud adoption is reinforced by its alignment with the growing demand for more dynamic and scalable financial analysis tools that can adjust to changing market conditions and data volumes. Additionally, cloud-based AI solutions in FP&A benefit from regular updates and improvements from providers, ensuring that financial institutions always have access to the latest technologies.

Moreover, the operational agility offered by cloud deployments allows financial institutions to experiment and innovate with AI applications without the risk of substantial sunk costs. This agility is crucial for staying competitive in the rapidly evolving finance sector, where the ability to quickly adapt and respond to new information can significantly impact performance and compliance.

Application Analysis

In 2024, the Forecasting and Budgeting segment in the AI in Financial Planning and Analysis (FP&A) market held a dominant market position, capturing more than a 31.5% share. This dominance is largely due to the critical role that forecasting and budgeting play in organizational financial strategies, making them prime areas for AI integration.

AI significantly enhances the accuracy and efficiency of these processes by analyzing large data sets to predict future financial conditions and performance, which is crucial for strategic planning and resource allocation. The significant adoption of AI in forecasting and budgeting is driven by its ability to provide real-time data analysis and scenario planning capabilities.

These features allow organizations to perform dynamic adjustments to their financial strategies based on varying economic conditions and internal performance metrics. For instance, AI systems enable finance teams to model different scenarios by adjusting key variables like market conditions, sales volumes, and pricing strategies, thereby facilitating more informed decision-making processes.

Furthermore, the integration of AI helps streamline collaborative planning efforts across departments, enhancing the alignment of financial goals with broader business objectives. By automating routine tasks and providing sophisticated analytic tools, AI enables financial analysts to focus more on strategic activities rather than manual data processing, leading to more accurate budgets and forecasts.

Enterprise Size Analysis

In 2024, the Large Enterprises segment held a dominant position in the AI in Financial Planning and Analysis (FP&A) market, capturing more than a 68.7% share. This dominant share is primarily due to the substantial resources that large enterprises can allocate towards advanced AI technologies, allowing them to integrate AI across various departments efficiently.

These organizations utilize AI to optimize operations, enhance decision-making, and improve overall financial management, which are crucial for maintaining competitiveness in their respective industries. Large enterprises have the capital to invest in comprehensive AI solutions that address complex and voluminous financial data.

This capability enables them to automate and refine financial processes, such as transaction handling, risk management, and compliance reporting, which are integral to their operational infrastructure. Furthermore, the scale of their operations necessitates robust AI-driven tools that can deliver precise financial forecasting and analytics, driving efficiency and strategic insights across the organization.

Moreover, the ability of large enterprises to pioneer the adoption of new technologies sets industry standards, influencing broader market trends within the AI in FP&A landscape. Their role in shaping technological adoption provides them with a strategic advantage, allowing them to leverage AI not just for operational efficiency but also as a tool for innovation and market leadership.

Industry Vertical Analysis

In 2024, the Banking and Financial Services segment of the AI in Financial Planning and Analysis (FP&A) market held a dominant market position, capturing more than a 29.74% share. This significant market share can be attributed to the sector’s robust adoption of AI technologies, which are utilized to enhance operational efficiencies, risk management, and customer service.

Financial institutions are leveraging AI to refine their forecasting accuracy, improve the personalization of services, and manage complex regulatory and compliance requirements more effectively. The strong position of this segment is driven by the high volume of financial transactions that require advanced analytical capabilities for fraud detection, risk assessment, and decision-making processes.

AI technologies, including machine learning and deep learning, are particularly adept at handling large datasets typical in banking, enabling more precise and predictive financial analysis. This capability is crucial in navigating the complexities of global financial markets and maintaining competitive advantage.

Additionally, the push towards digital transformation in the financial sector has accelerated the adoption of AI. Banks and financial institutions are investing heavily in AI to not only enhance customer experience through personalized banking solutions but also to streamline internal operations and reduce costs. This strategic focus on AI is aligned with the overall industry trend towards more agile and data-driven business models.

Key Market Segments

By Technology

- Machine Learning

- Natural Language Processing (NLP)

- Robotic Process Automation (RPA)

- Others

By Deployment

- Cloud-based

- On-premises

- Hybrid

By Application

- Forecasting and Budgeting

- Financial Reporting

- Cash Flow Management

- Risk Management and Compliance

- Others

By Enterprise Size

- Large Enterprises

- SMEs

By Industry Vertical

- Banking and Financial Services

- Retail and E-commerce

- Healthcare

- Manufacturing

- IT & Telecom

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Advancements in AI Technologies

The rapid advancements in artificial intelligence technologies are the primary driver for the AI in Financial Planning and Analysis (FP&A) market. As AI capabilities such as machine learning, natural language processing, and robotic process automation evolve, they increasingly enable finance teams to automate routine tasks, enhance forecasting accuracy, and provide deeper analytical insights.

This technological evolution transforms traditional financial practices by making data processing and decision-making more efficient and accurate. Finance professionals can now handle large volumes of data quickly, identify trends, and generate predictive insights that help in strategic financial planning and risk management.

The integration of AI not only improves the accuracy and speed of financial processes but also supports more complex, data-driven decision-making frameworks that are vital in today’s fast-paced market environments.

Restraint

Integration and Adoption Challenges

One significant restraint in the adoption of AI within FP&A is the challenge of integrating advanced AI systems with existing financial infrastructures. Many organizations face technical and operational hurdles when trying to embed AI technologies into their legacy systems. These challenges include compatibility issues, data silos, and the disruption of established workflows, which can hinder the seamless integration of AI solutions.

Additionally, there is often a significant learning curve and resistance to change within finance teams, particularly among those accustomed to traditional methods. Overcoming these barriers requires substantial investments in training and change management initiatives to ensure that staff can effectively utilize and benefit from AI-driven systems.

Opportunity

Enhanced Analytical Capabilities and Decision-Making

AI offers tremendous opportunities to enhance the analytical capabilities and decision-making processes within FP&A. With AI, financial analysts can go beyond traditional reporting and into predictive analytics, scenario planning, and real-time financial monitoring. These capabilities allow organizations to anticipate market changes and adjust their strategies quickly.

AI-driven tools provide the ability to simulate various financial scenarios and predict their outcomes, enabling more strategic and informed decision-making. This not only leads to better financial outcomes but also provides a competitive edge in the marketplace by allowing companies to be more agile and proactive in their financial strategies.

Challenge

Data Quality and Management

The quality and management of data represent a significant challenge in the effective implementation of AI in FP&A. AI systems require high-quality, well-structured data to function effectively, and any inaccuracies or inconsistencies in the data can lead to erroneous outputs and poor decision-making. Ensuring data integrity is a major concern, as financial data often comes from diverse sources and may require extensive cleaning and preparation.

Furthermore, as AI systems become more complex, the management of such data becomes increasingly complicated, necessitating advanced data governance and quality control measures. Organizations must invest in robust data management systems and practices to fully leverage AI’s capabilities and mitigate the risks associated with poor data quality.

Growth Factors

The growth of AI in Financial Planning and Analysis (FP&A) is primarily driven by its capacity to enhance decision-making through advanced data analysis and predictive forecasting. As organizations increasingly rely on data to guide strategic decisions, AI tools offer the ability to process and analyze large datasets swiftly, providing valuable insights and forecasts with high accuracy.

This capability enables businesses to respond more rapidly to market changes and plan with greater foresight, significantly improving strategic agility and competitive advantage. The push for digital transformation within finance departments further amplifies this growth, as companies seek to optimize their financial operations and reduce reliance on traditional, labor-intensive processes.

Emerging Trends

Emerging trends in AI for FP&A include the integration of machine learning and deep learning technologies that enhance analytical capabilities and improve forecasting precision. Businesses are increasingly adopting AI-driven systems that facilitate real-time data analysis, enabling proactive management and scenario planning.

There is also a notable shift towards self-service AI tools that democratize data analysis, allowing non-experts to generate insights and make informed decisions without the need for deep technical knowledge. Additionally, the focus on improving data integration and quality is crucial, as these factors significantly enhance the reliability of AI outputs, thereby enabling more accurate and actionable financial planning.

Business Benefits

The integration of AI into FP&A processes yields substantial business benefits, including enhanced efficiency, accuracy, and strategic insight. AI automates routine data processing tasks, freeing up finance professionals to focus on higher-value activities such as strategic analysis and decision support. This shift not only reduces operational costs but also minimizes errors associated with manual data handling.

Furthermore, AI-driven analytics provide deeper insights into financial performance, enabling more precise budgeting, forecasting, and resource allocation. Companies utilizing AI in FP&A can adapt more swiftly to market dynamics, optimize financial outcomes, and maintain a stronger competitive stance in their respective industries.

Key Player Analysis

The top three companies leading the AI in Financial Planning and Analysis (FP&A) market, focusing on their recent acquisitions, product launches, and partnerships:

In February 2025, IBM acquired DataStax, a company specializing in AI applications, to enhance its data infrastructure capabilities. Additionally, in March 2025, IBM unveiled the z17 mainframe, designed specifically for the AI era. This system integrates advanced AI processors and supports over 250 AI use cases across various industries, including finance.

In March 2025, Google Cloud introduced Agentspace and Agent2Agent protocols, facilitating the deployment of AI agents for data analysis and customer service tasks. Furthermore, Google expanded its AI capabilities with the launch of Gemini 2.5 Pro and Flash models, enhancing multimodal reasoning and simulation capabilities.

In October 2024, Microsoft, in collaboration with the London Stock Exchange Group, launched “Meeting Prep for Financial Services.” This tool integrates generative AI to assist professionals in preparing for client meetings by synthesizing critical insights. Additionally, Microsoft introduced Copilot for Finance, an AI-powered assistant within Microsoft 365 applications, designed to streamline financial processes such as audits, collections, and reporting.

Top Key Players in the Market

- IBM Corporation

- Google LLC

- Microsoft Corporation

- Amazon Web Services, Inc.

- Salesforce, Inc.

- DataRobot, Inc.

- H2O.ai, Inc.

- Alteryx, Inc.

- OpenAI, LP

- SAS Institute Inc.

- Palantir Technologies Inc.

- TIBCO Software Inc.

- Other Major Players

Recent Developments

- February 2025: An IBM study indicated that only 8% of banks were systematically developing generative AI in 2024. However, projections suggest a significant increase in adoption by 2025, aiming to elevate financial performance.

- January 2025: Google Cloud introduced “Agentspace,” a platform enabling financial institutions to deploy AI agents for tasks like data analysis and customer service. Banco BV, a major Brazilian bank, adopted this platform to enhance its operations.

- October 2024: Microsoft, in collaboration with the London Stock Exchange Group, launched “Meeting Prep for Financial Services.” This tool integrates generative AI to assist professionals in preparing for client meetings by synthesizing critical insights.

Report Scope

Report Features Description Market Value (2024) USD 240.6 Mn Forecast Revenue (2034) USD 4,766.4 Bn CAGR (2025-2034) 34.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Technology (Machine Learning, Natural Language Processing (NLP), Robotic Process Automation (RPA), Others), By Deployment (Cloud-based, On-premises, Hybrid), By Application (Forecasting and Budgeting, Financial Reporting, Cash Flow Management, Risk Management and Compliance, Others), By Enterprise Size (Large Enterprises, SMEs), By Industry Vertical (Banking and Financial Services, Retail and E-commerce, Healthcare, Manufacturing, IT & Telecom, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, Google LLC, Microsoft Corporation, Amazon Web Services, Inc., Salesforce, Inc., DataRobot, Inc., H2O.ai, Inc., Alteryx, Inc., OpenAI, LP, SAS Institute Inc., Palantir Technologies Inc., TIBCO Software Inc., Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI in Financial Planning and Analysis MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

AI in Financial Planning and Analysis MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Google LLC

- Microsoft Corporation

- Amazon Web Services, Inc.

- Salesforce, Inc.

- DataRobot, Inc.

- H2O.ai, Inc.

- Alteryx, Inc.

- OpenAI, LP

- SAS Institute Inc.

- Palantir Technologies Inc.

- TIBCO Software Inc.

- Other Major Players