Global AI in Esports Performance Tracking Market Size, Share and Analysis Report By Component (Hardware, Software, Services), By Deployment Mode (Cloud-based, On-premises), By Type (Performance Analytics AI, Player Behavior AI, Game Strategy AI, Physiological Monitoring AI, Cognitive Skills AI), By Application (Professional Esports Teams, Amateur & Collegiate Players, Esports Coaching Platforms, Streaming & Content Creation, Tournament & Event Management), By Game Type (Multiplayer Online Battle Arena (MOBA), First-Person Shooter (FPS), Battle Royale, Real-Time Strategy (RTS), Sports Simulation Games), By Pricing Model (Subscription-based, License-based, Freemium/Pay-per-use), By End-User (Gamers, Coaches & Trainers, Tournament Organizers, Esports Organizations, Educational Institutes), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 174617

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- AI in Esports Statistics

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- By Component

- By Deployment Mode

- By Type

- By Application

- By Game Type

- By Pricing Model

- By End-User

- By Region

- Investment and Business Benefits

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

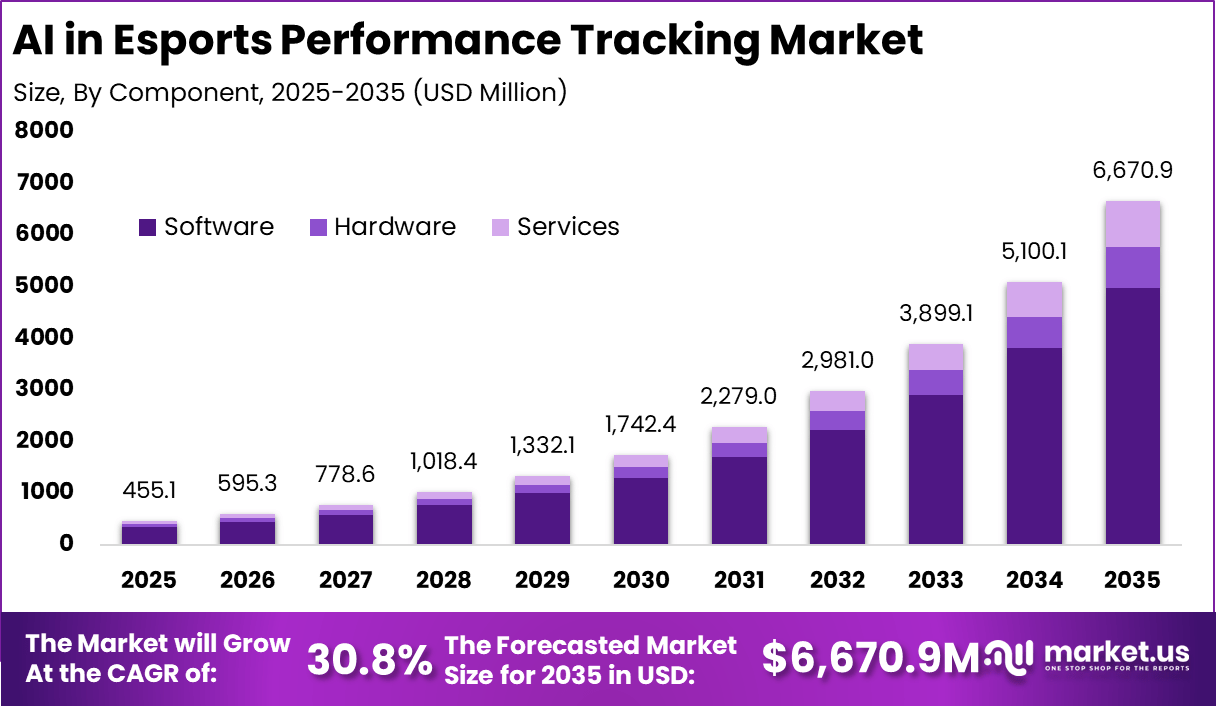

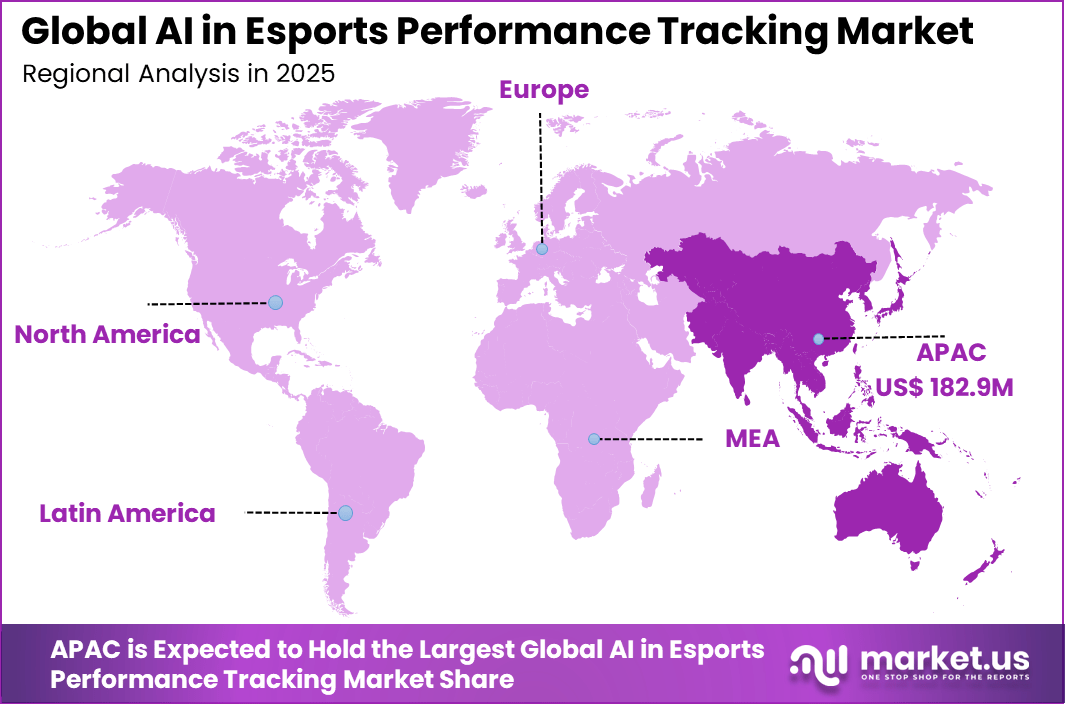

The Global AI in Esports Performance Tracking Market size is expected to be worth around USD 6,670.9 Million By 2035, from USD 455.1 Million in 2025, growing at a CAGR of 30.8% during the forecast period from 2026 to 2035. APAC held a dominan Market position, capturing more than a 40.2% share, holding USD 182.9 Million revenue.

The AI in esports performance tracking market refers to software and analytics platforms that use artificial intelligence to measure, analyze, and improve player and team performance in competitive gaming. These systems track in-game actions, reaction times, decision patterns, and coordination metrics. AI tools convert raw gameplay data into structured performance insights. Adoption is seen among professional esports teams, coaches, training academies, and tournament organizers.

This market development has been influenced by the professionalization of the esports industry. Competitive gaming now involves structured training, coaching staff, and performance review processes. Manual analysis of gameplay footage is time consuming and limited in accuracy. AI-powered tracking tools automate analysis and provide objective evaluation. As competition intensifies, data-driven performance management becomes essential.

One major driving factor of the AI in esports performance tracking market is the increasing competitiveness of professional esports. Small performance improvements can determine match outcomes. Teams seek tools that provide detailed and actionable insights. AI systems identify strengths, weaknesses, and improvement areas more accurately than manual review. This performance pressure drives adoption.

Another key driver is the growing use of analytics in sports and esports training. Traditional sports have long used data to improve performance. Esports teams are adopting similar approaches. AI-based tracking brings structure and consistency to training programs. This alignment with modern training methods supports market growth.

According to Market.us, The global eSports market was valued at USD 2.3 billion in 2023 and is expected to expand rapidly over the forecast period. The market is projected to reach approximately USD 16.7 billion by 2033, growing at a strong CAGR of 21.9% from 2024 to 2033. This growth is driven by rising viewership, increasing sponsorship revenues, and expanding digital streaming platforms

Demand for AI-powered esports performance tracking solutions is influenced by the expansion of professional leagues and tournaments. More organized competitions increase the need for structured performance analysis. Teams require consistent tools to prepare for opponents. AI platforms provide comparative and historical performance insights. This demand grows as esports ecosystems mature.

Top Market Takeaways

- Software solutions dominated the market with a 74.7% share, reflecting strong reliance on analytics platforms for player and team performance tracking.

- Cloud-based deployment led adoption at 94.3%, supported by real-time data access, scalability, and remote performance monitoring.

- Performance analytics AI accounted for 40.8%, highlighting demand for AI-driven insights into gameplay efficiency, reaction time, and strategy optimization.

- Professional esports teams represented 43.6% of application usage, driven by competitive pressure to improve training outcomes and match performance.

- Multiplayer Online Battle Arena games led by game type with a 46.5% share, supported by their structured gameplay and high data availability.

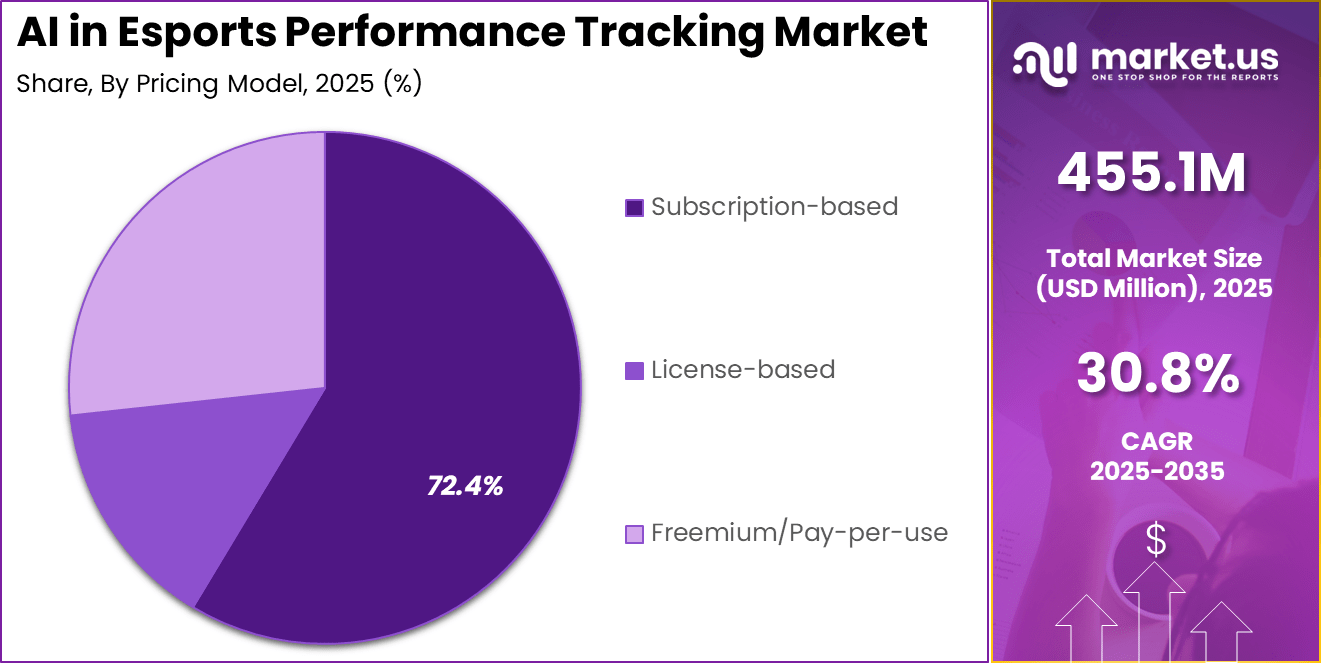

- Subscription-based pricing models held 72.4%, indicating preference for continuous updates, analytics upgrades, and recurring service access.

- Gamers formed the largest end-user group with 51.9%, reflecting rising adoption of personal performance tracking and skill improvement tools.

- Asia-Pacific held a leading 40.2% regional share, supported by strong esports infrastructure and high player engagement.

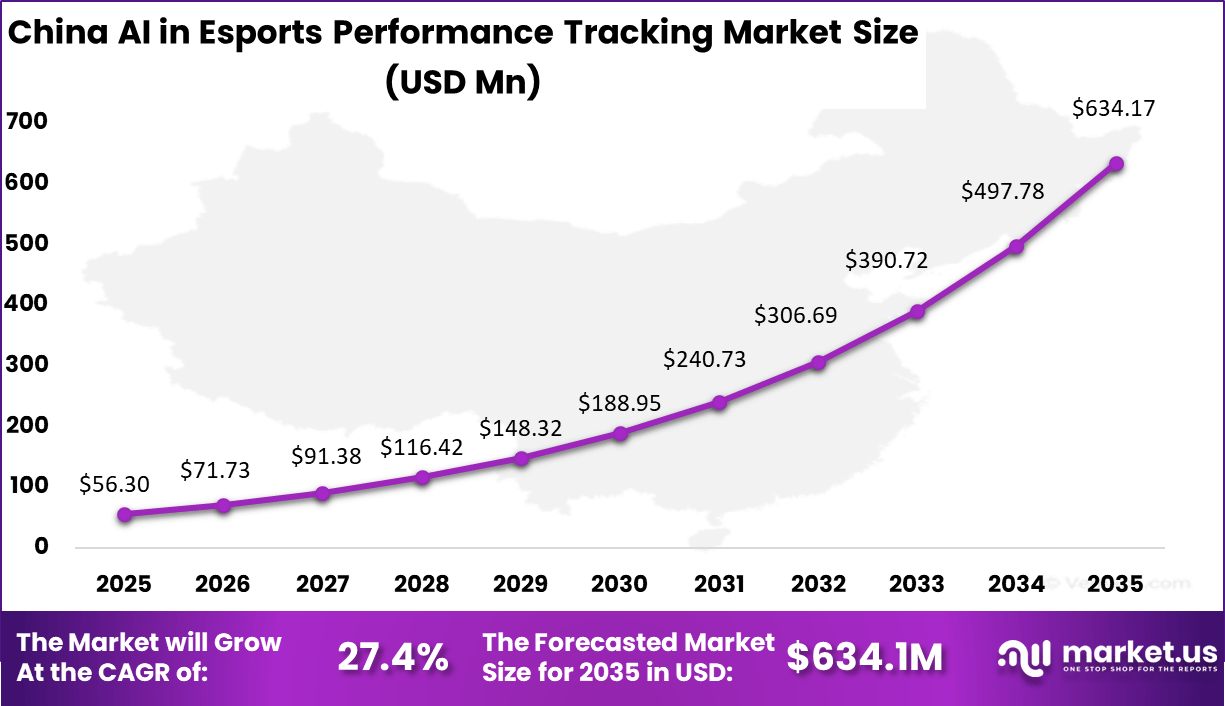

- China emerged as a key market with a value of USD 56.34 Million, driven by professional leagues and large-scale esports participation.

- The market is expanding at a 27.4% CAGR, reflecting sustained investment in AI-driven performance optimization and competitive gaming analytics.

AI in Esports Statistics

- Around 60% of professional sports teams, including esports organizations, have already adopted AI solutions to enhance performance and operational efficiency.

- Teams using AI-driven analytics have recorded a 20% improvement in player performance metrics, with some cases showing an 11% increase in mid-game conversion rates through real-time situational prompts.

- Advanced AI systems have automated large portions of match and strategy analysis, saving more than 10,000 analyst hours per year for top-tier esports organizations.

- AI-powered anti-cheat technologies play a critical role in competitive integrity by detecting abnormal player behavior faster and more accurately than manual review methods.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Professionalization of esports Data driven training and coaching ~7.6% Asia Pacific, North America Short Term Growth of competitive multiplayer games Need for player performance optimization ~6.8% Asia Pacific Short Term Expansion of cloud gaming platforms Real time analytics accessibility ~5.9% Global Mid Term Rising investments in esports teams Performance ROI optimization ~5.1% Global Mid Term Adoption of subscription analytics tools Predictable cost and continuous updates ~4.2% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline Data privacy concerns Collection of player behavioral data ~5.4% Asia Pacific, Europe Short Term High competitive pressure Feature parity among platforms ~4.6% Global Short Term Accuracy limitations Misinterpretation of in game performance ~3.9% Global Mid Term Dependence on game publishers Restricted data access ~3.2% Global Mid Term Monetization challenges Free tools limiting paid adoption ~2.6% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact Limited standardization Different analytics formats per game ~5.8% Global Short to Mid Term High development costs Advanced AI model training ~4.7% Emerging Markets Mid Term Skill gap Shortage of AI and esports analysts ~3.8% Global Mid Term Infrastructure dependency Need for high speed connectivity ~3.0% Emerging Markets Long Term Unclear ROI for amateurs Lower willingness to pay ~2.3% Global Long Term By Component

Software accounts for 74.7%, highlighting its central role in esports performance tracking. Software platforms collect, process, and visualize gameplay data. These tools analyze player actions, strategies, and outcomes. Centralized dashboards support team-wide insights. Accuracy and reliability remain essential.

The dominance of software is driven by analytics requirements. Esports teams rely on real-time and post-match analysis. Software solutions integrate with games and peripherals. Continuous updates improve analytical depth. This sustains strong demand for software components.

By Deployment Mode

Cloud-based deployment holds 94.3%, reflecting overwhelming preference for remote access. Cloud platforms allow teams to analyze data from any location. Centralized storage supports collaboration among coaches and players. Scalability handles variable data volumes. Maintenance is managed centrally.

Adoption of cloud-based deployment is driven by distributed team structures. Esports teams operate across regions. Cloud access supports rapid updates and sharing. Secure permissions protect competitive data. This keeps cloud deployment dominant.

By Type

Performance analytics AI accounts for 40.8%, making it the leading AI type. These systems evaluate player efficiency and in-game decisions. AI models identify strengths and weaknesses. Insights support targeted training plans. Data-driven feedback improves outcomes.

Growth in this type is driven by competitive pressure. Teams seek measurable performance gains. AI analysis replaces manual review. Continuous learning improves accuracy. This sustains adoption of performance analytics AI.

By Application

Professional esports teams represent 43.6%, making them the primary application area. These teams rely on data to refine strategies. Performance tracking supports match preparation. Coaches use analytics to guide training. Consistency and precision are critical.

Adoption among professional teams is driven by tournament intensity. Marginal improvements can decide outcomes. AI tools provide objective insights. Integration into workflows improves efficiency. This sustains strong use by professional teams.

By Game Type

MOBA games account for 46.5%, making them the leading game type. These games generate rich tactical data. Player coordination and timing are critical. AI tools analyze complex interactions. Detailed metrics support strategy development.

The dominance of MOBA is driven by popularity and structure. Matches produce consistent data points. Teams require deep analysis for roles and lanes. AI supports pattern recognition. This keeps MOBA central to tracking adoption.

By Pricing Model

Subscription-based pricing represents 72.4%, showing preference for ongoing access. Teams and players value continuous updates. Subscriptions support predictable budgeting. Regular improvements enhance value. Access remains uninterrupted.

The preference for subscriptions is driven by service-based delivery. Analytics tools evolve over time. Providers offer tiered plans. Long-term access supports training cycles. This sustains strong subscription adoption.

By End-User

Gamers account for 51.9%, making them the largest end-user group. Individual players use tools to improve skills. Performance feedback supports self-training. Accessibility encourages frequent use. Insights help refine playstyles.

Adoption among gamers is driven by competitive aspirations. Ranked play encourages improvement. AI tools offer personalized analysis. Ease of use supports engagement. This sustains strong gamer participation.

By Region

Asia-Pacific accounts for 40.2%, supported by a strong esports ecosystem. The region has high player participation. Competitive gaming culture drives adoption. Infrastructure supports cloud-based analytics. The region remains influential.

Region Primary Growth Driver Regional Share (%) Regional Value (USD Mn) Adoption Maturity Asia Pacific Large esports audience and MOBA dominance 40.2% USD 183.9 Mn Advanced North America Professional league analytics adoption 29.6% USD 134.7 Mn Advanced Europe Competitive team based gaming 21.4% USD 97.4 Mn Developing to Advanced Latin America Rising mobile esports penetration 5.2% USD 23.7 Mn Developing Middle East and Africa Early esports ecosystem growth 3.6% USD 16.4 Mn Early

China reached USD 56.34 Million with a CAGR of 27.4%, reflecting rapid growth. Expansion is driven by professional leagues and gamers. AI adoption supports performance improvement. Investment in esports continues to rise. Market momentum remains strong.

Investment and Business Benefits

Investment opportunities in the AI in esports performance tracking market exist in platforms designed for multi-game support. Esports organizations often compete across multiple titles. Flexible platforms attract broader user bases. Multi-title compatibility improves scalability. Investors focus on adaptable solutions.

Another opportunity lies in integration with streaming and broadcasting platforms. Performance data can enhance viewer engagement and analysis. Data overlays add value to live broadcasts. Media integration expands use cases. This convergence supports growth potential.

AI-powered performance tracking improves competitive outcomes by enabling continuous improvement. Teams refine strategies based on data insights. Improved preparation increases win potential. Consistent analysis strengthens long-term performance. Competitive advantage improves sustainability.

These tools also support talent development and scouting. Performance data helps identify promising players. Objective metrics support recruitment decisions. Talent pipelines become more efficient. Organizational growth benefits from structured evaluation.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior Gamers Very High ~51.9% Skill improvement and ranking Subscription based Professional esports teams Very High ~43.6% Competitive advantage Platform wide deployment Esports organizations High ~19% Talent development Long term licensing Streaming platforms Moderate ~12% Viewer engagement insights Selective adoption Amateur leagues Low to Moderate ~7% Performance feedback Limited usage Technology Enablement Analysis

Technology Layer Enablement Role Impact on Market Growth (%) Adoption Status Machine learning analytics Player behavior and skill analysis ~7.9% Growing Computer vision Gameplay and reaction tracking ~6.4% Growing Cloud analytics platforms Real time scalable processing ~5.6% Mature AI driven dashboards Actionable performance insights ~4.2% Developing Data ingestion APIs Game telemetry integration ~3.1% Developing Driver Analysis

The AI in esports performance tracking market is being driven by the escalating demand for deeper, data-driven insights into player performance and competitive outcomes. As competitive gaming evolves into a high-stakes, professionalised industry, teams, coaches, and players seek tools that can analyse in-game actions, behavioural patterns, and strategic choices with precision.

Artificial intelligence technologies enable real-time tracking of performance metrics, opponent tendencies, tactical strengths, and areas for improvement with far greater speed and accuracy than manual analysis. This capability enhances training effectiveness, informs strategic decision-making, and supports performance optimisation that aligns with the increasingly analytics-centric nature of esports competition.

Restraint Analysis

A significant restraint in the AI in esports performance tracking market stems from the complexity of capturing and interpreting diverse data sources inherent in gaming environments. Esports titles differ widely in mechanics, data structures, and in-game telemetry, which can complicate the development of universal tracking models and require customisation for each game’s unique context.

In addition, high-quality AI insights depend on access to comprehensive and clean data, which may be restricted by platform policies or proprietary data formats. These technical and data limitations can slow adoption among organisations seeking broad cross-game performance tracking capabilities.

Opportunity Analysis

Emerging opportunities in the AI in esports performance tracking market are linked to expanding use cases beyond competitive analysis into fan engagement, broadcasting enhancement, and personalised coaching services. AI-generated performance insights can be repurposed to create advanced visualisations, heat maps, and predictive commentary that enrich live streams and spectator experiences.

Beyond team environments, individual players and aspiring professionals can leverage AI tools for personalised training programmes, performance benchmarking, and skill progression tracking. As esports audiences grow and demand more immersive experiences, AI-supported analytics becomes a strategic differentiator for broadcasters, teams, and platform developers.

Challenge Analysis

A central challenge confronting this market is balancing automation with contextual accuracy and interpretability of insights in fast-paced, complex game environments. AI models may struggle to discern nuanced strategic decisions or emergent player behaviours that depend on human judgement and intuition, especially in titles with high variability or meta-evolution.

Ensuring that analytics reflect actionable information rather than superficial patterns requires continuous refinement of models and close collaboration between technologists and esports practitioners. Achieving a balance between real-time responsiveness and deep analytical insight also entails technical trade-offs in latency, processing power, and model complexity.

Emerging Trends

Emerging trends within the AI in esports performance tracking landscape include the integration of multimodal data sources such as video feeds, player biometrics, and chat interactions to enrich performance profiles and behavioural understanding.

Advanced machine learning models are being developed to provide predictive insights, such as likely opponent strategies or performance trajectories based on historical patterns. There is also a growing emphasis on tools that support personalised training paths and adaptive feedback loops that align with individual learning curves and stylistic preferences.

Growth Factors

Growth in the AI in esports performance tracking market is supported by the professionalisation and commercialisation of competitive gaming, which intensifies the focus on measurable performance improvement. The expansion of esports leagues, prize pools, sponsorship investments, and audience viewership elevates the stakes for teams and players to leverage data-driven competitive advantages.

Advances in artificial intelligence, powerful computing platforms, and real-time telemetry capture enhance the feasibility of sophisticated analytics across diverse game titles. As performance tracking becomes a standard component of training regimens and competitive preparation, demand for AI-enabled tools continues to rise, reinforcing their role as strategic assets in esports ecosystems.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Deployment Mode

- Cloud-based

- On-premises

By Type

- Performance Analytics AI

- Player Behavior AI

- Game Strategy AI

- Physiological Monitoring AI

- Cognitive Skills AI

By Application

- Professional Esports Teams

- Amateur & Collegiate Players

- Esports Coaching Platforms

- Streaming & Content Creation

- Tournament & Event Management

By Game Type

- Multiplayer Online Battle Arena (MOBA)

- First-Person Shooter (FPS)

- Battle Royale

- Real-Time Strategy (RTS)

- Sports Simulation Games

By Pricing Model

- Subscription-based

- License-based

- Freemium/Pay-per-use

By End-User

- Gamers

- Coaches & Trainers

- Tournament Organizers

- Esports Organizations

- Educational Institutes

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

Key players such as Mobalytics, GRID Esports, and Dojo Madness focus on data driven player and team performance insights. Their platforms use AI to analyze in game behavior, match statistics, and decision patterns. Stats Perform strengthens the market with advanced data modeling and predictive analytics. These companies support professional teams, coaches, and tournament organizers.

Skill development and training focused players such as ProGuides, Aim Lab, and TrackGG apply AI to individual player improvement. Their solutions track reaction time, accuracy, and consistency. Metafy and Omnicoach support personalized coaching models. These platforms are widely adopted by amateur and semi professional players. Growth is supported by rising interest in structured esports training.

Analytics and fan engagement oriented players such as Esports One, Rivalry, and Skybox expand advanced visualization and real time insights. ProSettings and Zone4 address performance optimization needs. Other regional vendors add competitive depth. This diverse ecosystem supports steady innovation and wider adoption across professional esports and gaming communities.

Top Key Players in the Market

- Mobalytics

- GRID Esports

- Dojo Madness

- Stats Perform

- ProGuides

- Aim Lab (by Statespace)

- TrackGG

- Metafy

- Omnicoach

- Popdog

- Leet

- Zone4

- ProSettings

- Esports One

- Rivalry (Data Division)

- Skybox (by NVIDIA)

- Others

Recent Developments

- November, 2025 – Aimlabs reached 40+ million users with AI-powered aim trainer featuring adaptive tasks, Valorant/R6 Siege official partnerships and Aimlabs+ with ProGuides bootcamps, offering real-time analytics and esports pro courses for skill benchmarking.

- June, 2025 – GRID Esports launched GRID Insights, an AI-powered analytics product delivering real-time predictive context for esports broadcasts and betting, generating player streaks, weapon stats and record chases from official in-game data for CCT and European Pro League.

- March, 2025 – ESL FACEIT Group acquired Mobalytics to expand its digital portfolio with League of Legends analytics, GPI performance metrics and Tobii eye-tracking integration, deepening ties with developers like Riot and Bungie while keeping it standalone.

Report Scope

Report Features Description Market Value (2025) USD 455.1 Mn Forecast Revenue (2035) USD 6,670.9 Mn CAGR(2026-2035) 30.8% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Deployment Mode (Cloud-based, On-premises), By Type (Performance Analytics AI, Player Behavior AI, Game Strategy AI, Physiological Monitoring AI, Cognitive Skills AI), By Application (Professional Esports Teams, Amateur & Collegiate Players, Esports Coaching Platforms, Streaming & Content Creation, Tournament & Event Management), By Game Type (Multiplayer Online Battle Arena (MOBA), First-Person Shooter (FPS), Battle Royale, Real-Time Strategy (RTS), Sports Simulation Games), By Pricing Model (Subscription-based, License-based, Freemium/Pay-per-use), By End-User (Gamers, Coaches & Trainers, Tournament Organizers, Esports Organizations, Educational Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Mobalytics, GRID Esports, Dojo Madness, Stats Perform, ProGuides, Aim Lab (by Statespace), TrackGG, Metafy, Omnicoach, Popdog, Leet, Zone4, ProSettings, Esports One, Rivalry (Data Division), Skybox (by NVIDIA), Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI in Esports Performance Tracking MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

AI in Esports Performance Tracking MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Mobalytics

- GRID Esports

- Dojo Madness

- Stats Perform

- ProGuides

- Aim Lab (by Statespace)

- TrackGG

- Metafy

- Omnicoach

- Popdog

- Leet

- Zone4

- ProSettings

- Esports One

- Rivalry (Data Division)

- Skybox (by NVIDIA)

- Others