Global AI for Recreational Boaters Market Size, Share Analysis Report By Boat Type (Yachts, Sailboats, Personal Watercrafts, Inflatables, Others), By Boat Size, By Engine Placement (Outboards, Inboards, Others), By Engine Type (ICE, Electric), By Technology (Natural Language Processing, Machine Learning, Computer Vision, Robotics & Autonomous Systems, Others), By Power Range (Up to 100 kW, 100-200 kW, Above 200 kW), By Material Type (Aluminum, Fiberglass, Steel, Others), By Activity Type (Cruising + Watersports, Fishing), By Power Source (Engine Powered, Sail Powered, Human Powered), By Distribution Channel (Dealer Network, Boat Shows, Online Sales), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152231

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- US Market Size

- By Boat Type Analysis

- By Boat Size Analysis

- By Engine Placement Analysis

- By Engine Type Analysis

- By Technology Analysis

- By Power Range Analysis

- By Material Type Analysis

- By Activity Type Analysis

- By Power Source Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Emerging Trend

- Driver

- Restraint

- Market Opportunity

- Challenge

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

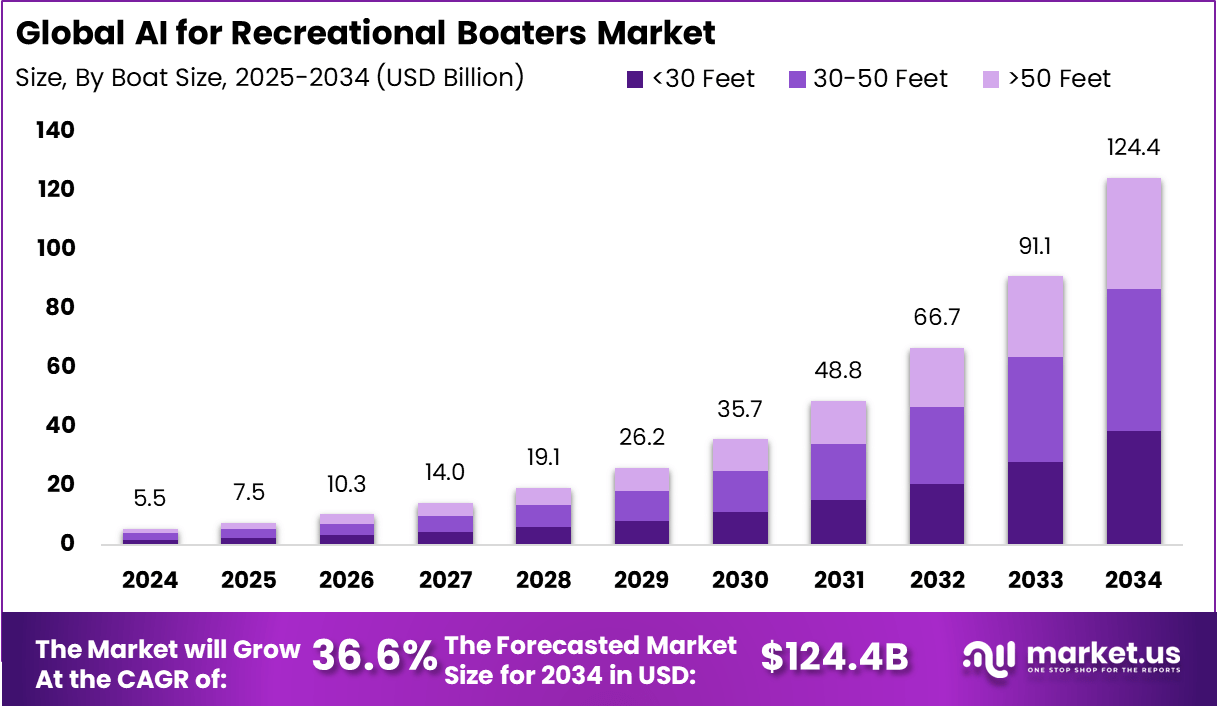

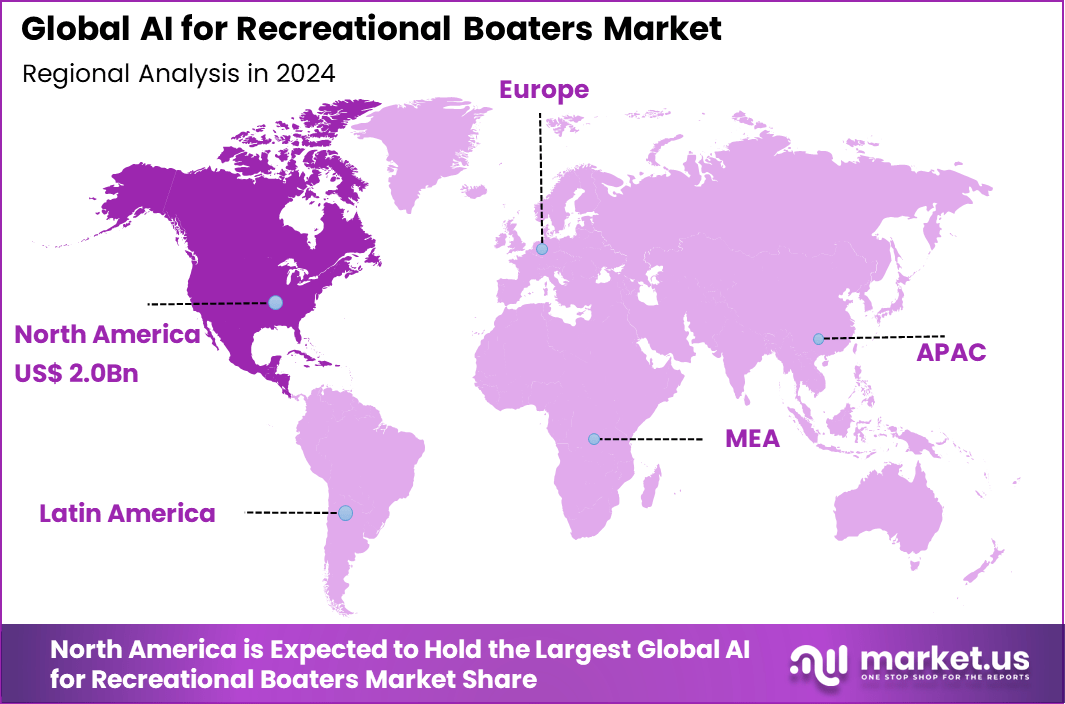

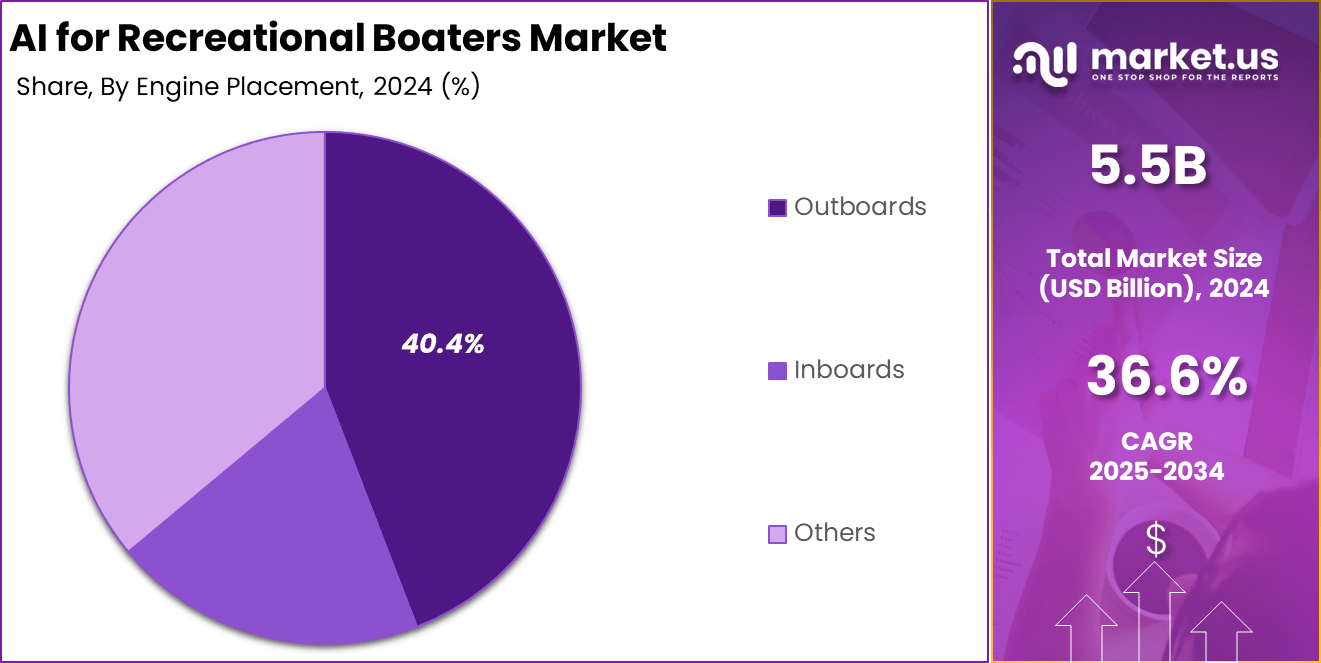

The Global AI for Recreational Boaters Market size is expected to be worth around USD 124.4 Billion By 2034, from USD 5.5 billion in 2024, growing at a CAGR of 36.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 37.8% share, holding USD 2.0 Billion revenue.

The AI for Recreational Boaters Market refers to the growing integration of artificial intelligence solutions into recreational boating activities to enhance safety, navigation, maintenance, and user experience. This market is shaped by the demand for smarter, more automated vessels that simplify operations for hobbyists and leisure sailors.

Applications include intelligent autopilots, predictive maintenance systems, real-time route optimization, weather and hazard detection, and even voice-controlled onboard assistants. The aim is to make boating more accessible, enjoyable, and secure for users with varying levels of expertise. The top driving factors influencing this market include the increasing preference for technologically advanced vessels and rising awareness of marine safety.

Consumers are seeking smarter boats that minimize human error, reduce operational complexity, and offer seamless connectivity with mobile devices. The need to improve fuel efficiency and optimize routes under changing weather conditions also drives adoption of AI-enabled solutions. Safety features powered by AI, such as collision avoidance and automatic distress signaling, are further motivating recreational boaters to upgrade.

The market is witnessing heightened interest from both individual boat owners and yacht charter companies. The trend of owning or renting connected and intelligent boats is becoming prominent in high-income leisure segments. Boaters are showing an increasing willingness to invest in smart navigation and maintenance systems to minimize risks and enhance comfort.

The demand is particularly strong in regions with a robust marine leisure culture, where consumers expect a premium experience supported by digital technologies. The increasing adoption of technologies such as machine learning, computer vision, and predictive analytics is reshaping the recreational boating landscape. Autonomous docking systems, AI-powered route planning, and voice-interactive controls are emerging as highly sought-after innovations.

Key Insight Summary

- The market is expected to grow significantly from USD 5.5 billion in 2024 to approximately USD 124.4 billion by 2034, achieving a robust CAGR of 36.6%, driven by rising demand for intelligent navigation, safety, and enhanced boating experiences.

- North America dominated in 2024, holding over 37.8% share and generating around USD 2.0 billion in revenue, supported by a mature recreational boating culture and early adoption of AI solutions.

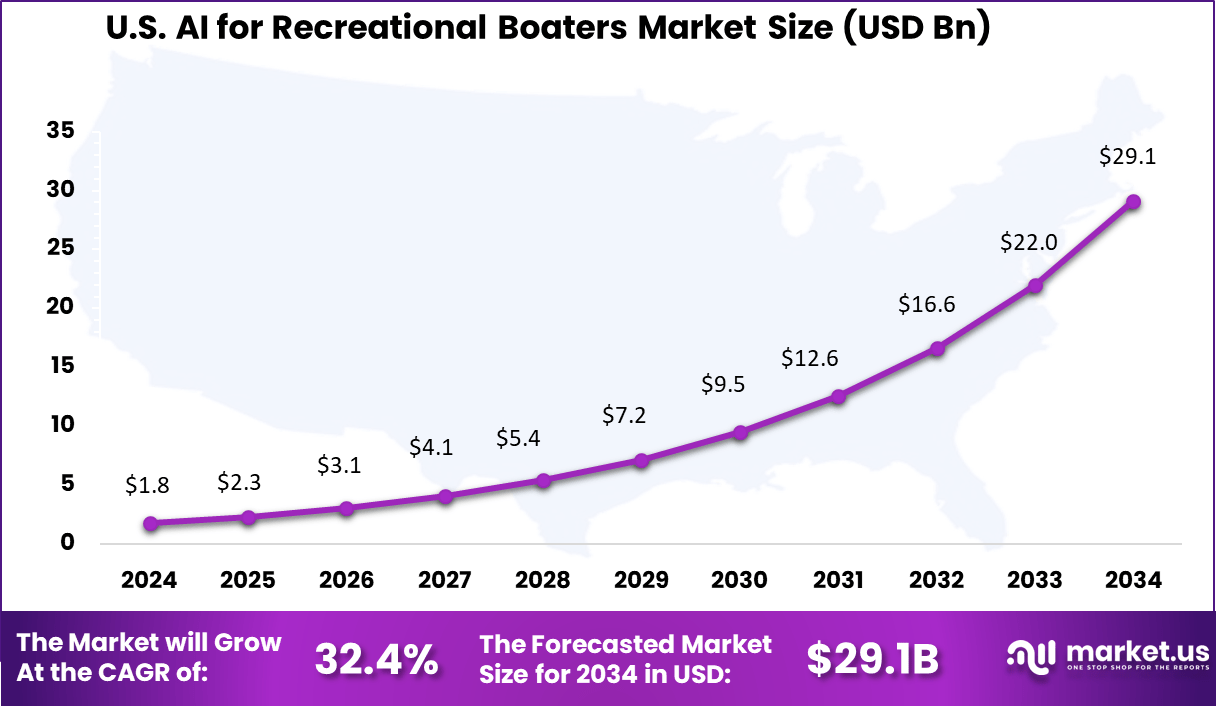

- The U.S. market contributed about USD 1.76 billion in 2024, projected to expand at a strong CAGR of 32.4%, driven by high disposable incomes and growing preference for technology-enhanced leisure boating.

- By boat type, Yachts led with 30.7% share, reflecting growing luxury boating trends and adoption of AI-enabled control and comfort systems.

- In terms of boat size, the 30–50 feet segment accounted for 38.9% share, popular among recreational users for its balance of space, performance, and manageability.

- By engine placement, Outboards dominated with 40.4% share, valued for their efficiency, flexibility, and ease of maintenance.

- Natural Language Processing (NLP) led technology adoption, holding 32.7% share, enabling voice-controlled operations, safety alerts, and user-friendly onboard systems.

- By engine type, Internal Combustion Engines (ICE) held a commanding 58.8% share, remaining the primary propulsion system despite emerging electric alternatives.

- By power range, the 100–200 kW segment accounted for 42.2% share, offering optimal power for mid-size boats and water activities.

- For material type, Aluminum was preferred, with 34.9% share, due to its lightweight, durability, and corrosion resistance.

- By activity, Cruising and Watersports dominated, making up 55.8% share, underscoring the popularity of multi-purpose recreational boating.

- By power source, Engine-Powered boats held 44.4% share, while Dealer Networks remained the leading distribution channel at 45.6%, trusted for after-sales service and expertise.

US Market Size

The U.S. AI for Recreational Boaters Market was valued at USD 1.8 Billion in 2024 and is anticipated to reach approximately USD 29.1 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 32.4% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than a 37.8% share and generating USD 2.0 billion in revenue. This leadership is primarily supported by the region’s strong recreational boating culture, high consumer spending, and rapid integration of smart technologies.

The United States and Canada have witnessed early adoption of AI-powered features such as automatic docking, intelligent navigation, and real-time hazard detection. The maturity of marina infrastructure and the availability of high-speed internet connectivity across major coastal and inland waterways have enabled seamless integration of AI systems into leisure boats.

North America’s dominance is further strengthened by its robust ecosystem of marine technology startups, investor support for maritime innovation, and proactive regulatory bodies. Regional governments and coast guard authorities have introduced trial programs and pilot zones to test autonomous boating technologies under safe conditions.

By Boat Type Analysis

In 2024, Yachts segment held a dominant market position, capturing more than a 30.7 % share. This leadership can be attributed to the segment’s appeal to high‑end consumers seeking luxury, comfort, and advanced onboard features.

Yachts offer spacious layouts, upscale amenities, and integrated AI-powered navigation and docking systems that cater to a growing demographic of affluent boating enthusiasts. Innovations such as autonomous docking systems and smart propulsion have further strengthened the yachts’ appeal by reducing operational complexity and enhancing safety.

The prominence of yachts in the AI-driven recreational boating market is reinforced by rising disposable incomes and the increasing desire for premium leisure experiences. The yachts segment benefits from its reputation as a luxury lifestyle symbol and a playground for advanced tech deployment. Cutting‑edge AI systems, including autonomous navigation and real‑time vessel analytics, are first adopted in this segment, creating a technological halo that influences the broader market.

By Boat Size Analysis

In 2024, 30‑50 Feet segment held a dominant market position, capturing more than a 38.9 % share. This mid-range segment has achieved leadership status due to its optimal blend of capacity, manageability, and onboard sophistication.

Vessels in this size category offer cabins, galley kitchens, expanded living spaces, and enhanced systems that appeal to both experienced boaters and families. These features position 30‑50 feet boats as a practical option for extended coastal voyages, weekend cruising, and mixed-use recreational activities – all while avoiding the operational and cost complexities associated with larger yachts.

The appeal of the 30‑50 feet segment is further reinforced by its alignment with evolving consumer preferences. Boaters increasingly seek boats that are easy to crew, yet equipped with advanced navigation, safety, and convenience technologies.

As such, this segment has emerged as the primary testing ground for integrating AI-driven systems – such as assisted docking, adaptive autopilots, and predictive maintenance – making it a bellwether for broader technology adoption across the recreational boating industry.

By Engine Placement Analysis

In 2024, Outboards segment held a dominant market position, capturing more than a 40.4 % share. This segment’s leadership can be attributed to its versatility, ease of maintenance, and compatibility with a wide range of recreational vessels.

Outboard engines are self-contained units mounted externally on the transom, which simplifies installation and repairs while enabling trailering and shallow‑water operation. Their modular design and broad power range – from small electric models to high‑horsepower gas units – make them highly adaptable to varied boating use cases such as fishing, cruising, and water sports.

In regions like North America reinforce outboards’ dominance, as over 75 % of new motorboat sales are driven by outboard propulsion systems. Consumer preferences have shifted towards boats that deliver strong performance with minimal upkeep. Outboard systems meet these expectations by offering user‑friendly mechanics, straightforward power upgrades, and increasingly, eco‑friendly options such as electric and four‑stroke engines.

By Engine Type Analysis

In 2024, ICE segment held a dominant market position, capturing more than a 58.8 % share. This dominance is rooted in the ICE engine’s well‑established role across recreational boating categories. Internal combustion engines deliver reliable power and long operational range, which are indispensable for a wide spectrum of boat types and usage scenarios.

ICE systems are compatible with diverse fuel options – gasoline, diesel, natural gas – supporting everything from high‑speed runs and long‑distance cruising to towing and heavy payloads. Such versatility ensures that ICE remains the backbone of recreational boating propulsion.

The longevity and maturity of ICE technology strengthen the segment’s leadership position. Maintenance infrastructure, repair skills, parts availability, and fueling networks are all optimized for combustion engines, reducing operational friction for consumers. Boaters value this reliability and familiarity – traits that are especially critical during unexpected conditions or longer voyages.

By Technology Analysis

In 2024, Natural Language Processing segment held a dominant market position, capturing more than a 32.7 % share. This segment has achieved leadership by enabling intuitive, voice-activated control and conversational interfaces aboard recreational vessels. Boaters increasingly favour hands-free interaction, and NLP systems translate spoken commands into actionable controls – such as charting routes, adjusting climate systems, or querying navigational data – while minimizing manual input.

The strength of the NLP segment also stems from its capability to bridge human-machine communication naturally. Unlike other AI disciplines – such as computer vision or predictive analytics – NLP enables real-time, context-aware verbal exchanges aboard vessels. This proficiency fosters user confidence in autonomous systems and supports onboard situational awareness.

It also aids accessibility and safety, especially during complex maneuvers. Thus, NLP’s capacity to deliver accurate language comprehension positions it as the leading technology in recreational boating AI. Furthermore, NLP acts as the foundational layer upon which other AI modules are integrated. When combined with computer vision or machine learning, natural language interfaces simplify configuration, alert delivery, and onboard diagnostics.

By Power Range Analysis

In 2024, 100‑200 kW segment held a dominant market position, capturing more than a 42.2 % share. This mid-range power bracket has emerged as the preferred option among recreational boaters seeking a balance of performance, efficiency, and handling.

Vessels operating within 100‑200 kW deliver sufficient thrust for tasks like cruising, water sports, and coastal navigation without the operational complexity associated with larger power units. This “sweet spot” power range caters to a broad user base, from seasoned hobbyists to families aiming for comfortable on‑water experiences with moderate speed and agility.

The leadership of the 100‑200 kW segment is reinforced by its alignment with consumer priorities centered on versatility and cost efficiency. Units in this range support advanced features – such as integrated AI-based throttle control, adaptive routing, and digital monitoring – while maintaining manageable fuel consumption and servicing needs.

Moreover, the 100‑200 kW range represents a strategic threshold for technological innovation. AI-driven navigation aids, intelligent diagnostics, and predictive maintenance platforms are optimally deployed in boats powered by this class of engines. Boaters benefit from enhanced reliability and data-led decision-making without incurring excessive costs or needing specialized crew.

By Material Type Analysis

In 2024, Aluminum segment held a dominant market position, capturing more than a 34.9 % share. This leadership is grounded in aluminum’s exceptional combination of lightweight properties, structural strength, and corrosion resistance, which aligns closely with consumer needs for practical and durable recreational vessels.

Boats constructed from aluminum are easier to tow, launch, and maneuver compared to heavier alternatives like steel and fiberglass, which enhances their appeal among weekend boaters and anglers. The Aluminum segment also benefits from its adaptability to technological integration and evolving leisure trends.

It supports efficient hull designs that accommodate mid-size powerboats, fishing vessels, and emerging electric propulsion systems, thereby satisfying a growing demand for eco-friendly and smart boating options. Moreover, aluminum boats serve as ideal platforms for AI-enabled features – such as predictive maintenance, onboard diagnostics, and lightweight sensor installations – because their construction supports flexibility and ease of retrofitting.

By Activity Type Analysis

In 2024, Cruising + Watersports segment held a dominant market position, capturing more than a 55.8% share. This leadership can be attributed to strong consumer interest in leisure boating that combines relaxation with physical activity. The integration of AI technologies in this segment has significantly improved onboard safety, navigation, and real-time performance monitoring.

Automated route planning, voice-assisted controls, and collision avoidance systems have made cruising and watersports vessels more user-friendly, particularly for non-professional boaters. These features reduce operational stress and improve the overall experience, driving higher adoption among recreational users.

Furthermore, rising demand for marine tourism and coastal leisure activities has reinforced the popularity of cruising and watersports boats across key regions. The increasing number of boat rental services, marina developments, and organized water-based events has boosted accessibility to AI-enabled vessels.

These boats often serve dual purposes, making them more cost-effective for operators and more attractive for consumers seeking diverse activities. As interest in connected boating grows, this segment is expected to remain at the forefront of adoption due to its compatibility with AI-powered enhancements that support both casual cruising and dynamic watersports.

By Power Source Analysis

In 2024, Engine Powered segment held a dominant market position, capturing more than a 44.4 % share. This leadership can be attributed to the advanced integration of internal combustion engines in recreational vessels, which provide well-established reliability, extensive refuelling infrastructure, and high power output.

Such performance is crucial for varied boating applications, including long-range cruising, high-speed watersports, and sport fishing. As a result, engine powered boats have become the preferred choice for recreational boaters seeking versatility and consistent performance. Further strength in the engine powered segment arises from its rapid adoption of intelligent systems that enhance user control and safety.

Integration of AI-assisted joystick docking, GPS-based spot-lock systems, and smart motor management have significantly improved vessel handling, even under challenging conditions. These technologies are commonly implemented first in engine powered boats, reinforcing consumer confidence in their operational ease and technological maturity

By Distribution Channel Analysis

In 2024, Dealer Network segment held a dominant market position, capturing more than a 45.6 % share. This prominence is rooted in the segment’s ability to deliver personalized service and expertise, which remain critical in the purchase of recreational boats.

Dealerships provide consumers with hands-on experiences, detailed walkthroughs, and trustworthy advice – elements that are often lacking in online-only transactions. The established dealer infrastructure also supports after-sales services, financing, warranties, and test drives, reinforcing consumer confidence during and after the buying process.

The Dealer Network segment’s resilience is further driven by its alignment with boaters’ preferences for expert-led purchasing journeys. At dealerships and boat shows, buyers gain access to live demonstrations and can engage directly with sales professionals to explore AI-enabled features such as autonomous docking, predictive maintenance, and advanced navigation systems – an interaction difficult to replicate in digital formats.

Key Market Segments

By Boat Type

- Yachts

- Sailboats

- Personal Watercrafts

- Inflatables

- Others

By Boat Size

- <30 Feet

- 30-50 Feet

- >50 Feet

By Engine Placement

- Outboards

- Inboards

- Others

By Engine Type

- ICE

- Electric

By Technology

- Natural Language Processing

- Machine Learning

- Computer Vision

- Robotics & Autonomous Systems

- Others

By Power Range

- Up to 100 kW

- 100-200 kW

- Above 200 kW

By Material Type

- Aluminum

- Fiberglass

- Steel

- Others

By Activity Type

- Cruising+watersports

- Fishing

By Power Source

- Engine Powered

- Sail Powered

- Human Powered

By Distribution Channel

- Dealer Network

- Boat Shows

- Online Sales

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend

Adoption of Auto‑Docking and Autopilot Systems

A key trend among recreational boaters is the shift toward automated docking with AI assistance. Modern systems ease the stress of maneuvering in tight marina conditions by compensating for wind, current, and boat swing with precision control. This enhances safety and confidence for boat owners and is increasingly popular as ease of operation becomes a priority

Another aspect of this trend is intelligent autopilot functionality tailored to recreational use. These systems adapt dynamically to sea conditions, maintaining heading and speed adjustments without manual input. The result is a more enjoyable experience for boaters, particularly new enthusiasts, who can focus more on leisure and less on handling challenges.

Driver

Enhanced Safety via AI‑Powered Vision Systems

AI vision tools are driving widespread adoption in recreational boating by offering advanced object detection. High-resolution cameras combined with machine learning can identify floating debris, buoys, and non-AIS vessels, even in low light or fog. This significantly reduces collision risk during navigation

These systems are gaining traction due to their real-time alert capabilities. Boat operators benefit from timely notifications about nearby threats, which enables safer maneuvering in crowded or challenging waters. This perceived boost in safety is a strong motivator for owners to invest in AI enhancements.

Restraint

High Complexity and Retrofit Challenges

Integrating AI on recreational boats can be complex due to the need to retrofit sensors, cameras, and processing units into existing systems. Installation often requires vessel modifications and technical expertise, which can become costly and time consuming.

Additionally, the complexity may lead to user reluctance. Many boaters are less inclined to adopt systems that demand frequent updates or technical maintenance. This hesitancy limits adoption to only those willing to manage the ongoing upkeep of sophisticated AI systems.

Market Opportunity

AI‑Assisted Fishing and Oceanographic Analytics

A growing opportunity is the use of AI for recreational fishing and environmental analysis. AI systems process sonar, radar, and water conditions to identify fish hotspots and suggest best locations. This can make fishing trips more successful and engaging.

Tools that combine real-time data with historical patterns help boaters understand ocean temperature, currents, and marine life activity. This progression toward data-driven boating means enhanced experiences with meaningful insights into marine environments.

Challenge

Unclear Regulations for Autonomous Recreational Vessels

The challenge of adopting fully autonomous recreational boats lies in the lack of clear regulations. Rules on collision avoidance and responsibility in mixed traffic still assume human control. This regulatory gap makes manufacturers and boat owners cautious about deploying fully autonomous systems.

Until navigation regulations are updated to account for AI-driven vessels, the market may not fully embrace autonomy. Liability in accidents involving AI autonomous systems remains uncertain, slowing commercial development and consumer trust.

Key Player Analysis

The AI for recreational boaters market is gaining traction through strategic contributions from major marine technology players. Kongsberg Discovery, ABB, and Rolls-Royce plc are central to advancing autonomous navigation, predictive maintenance, and AI-assisted propulsion systems. Their innovations are rooted in maritime automation and sensor fusion, offering safe and energy-efficient boating experiences.

Brunswick Corporation, Yamaha Motor Company, and Wärtsilä are playing key roles in bringing AI to consumer-facing boating segments. Their focus is on smart controls, route optimization, and real-time diagnostics tailored for private vessels. These firms have integrated AI with IoT dashboards to improve safety, reduce fuel use, and enhance comfort.

Fugro, SubSea Craft Limited, and BAE Systems support the ecosystem with advanced marine surveying, unmanned vessel development, and defense-grade AI navigation tools that also influence the recreational sector indirectly. Leisure boat manufacturers such as Groupe Beneteau, Malibu Boats, Ferretti S.P.A, and Polaris Inc. are increasingly embedding AI to meet demand for intelligent cruise control, collision avoidance, and user-centric automation.

New entrants like Avikus Co. Ltd, Yachting Firecrown, and Navier are driving innovation in electric and hybrid boats with AI-integrated piloting and docking systems. These developments are shaping a smarter, safer, and more intuitive boating future, supported by rising consumer interest and improved onboard digital ecosystems.

Top Key Players Covered

- Kongsberg Discovery

- ABB

- Brunswick Corporation

- Rolls-Royce plc

- Yamaha Motor Company

- Fugro

- Groupe Beneteau

- Malibu Boats

- Ferretti S.P.A

- Polaris Inc.

- Wärtsilä

- SubSea Craft Limited

- BAE Systems

- Navier

- Avikus Co. Ltd

- Yachting Firecrown

- Others

Recent Developments

- In Mar 2025, A strategic AI partnership with Viam was launched at the Palm Beach International Boat Show. The integration targets the Simrad SY50 sonar, enhancing real‑time fish‑finding with AI‑driven tuning and cloud connectivity – designed for both commercial and recreational fleets.

- In March 2025, Kongsberg Discovery announced a strategic partnership with Viam, integrating its Simrad SY50 sonar with AI-driven analytics to enhance both recreational and commercial fishing. This initiative uses AI to interpret sonar output, automate settings, and connect fleets to cloud systems – cutting fuel use, reducing bycatch, and improving navigation safety.

Report Scope

Report Features Description Market Value (2024) USD 5.5 Bn Forecast Revenue (2034) USD 124.4Bn CAGR (2025-2034) 36.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Boat Type (Yachts, Sailboats, Personal Watercrafts, Inflatables, Others), By Boat Size (<30 Feet, 30-50 Feet, >50 Feet), By Engine Placement (Outboards, Inboards, Others), By Engine Type (ICE, Electric), By Technology (Natural Language Processing, Machine Learning, Computer Vision, Robotics & Autonomous Systems, Others), By Power Range (Up to 100 kW, 100-200 kW, Above 200 kW), By Material Type (Aluminum, Fiberglass, Steel, Others), By Activity Type (Cruising + Watersports, Fishing), By Power Source (Engine Powered, Sail Powered, Human Powered), By Distribution Channel (Dealer Network, Boat Shows, Online Sales) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Kongsberg Discovery, ABB, Brunswick Corporation, Rolls-Royce plc, Yamaha Motor Company, Fugro, Groupe Beneteau, Malibu Boats, Ferretti S.P.A, Polaris Inc., Wärtsilä, SubSea Craft Limited, BAE Systems, Navier, Avikus Co. Ltd, Yachting Firecrown, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI for Recreational Boaters MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

AI for Recreational Boaters MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Kongsberg Discovery

- ABB

- Brunswick Corporation

- Rolls-Royce plc

- Yamaha Motor Company

- Fugro

- Groupe Beneteau

- Malibu Boats

- Ferretti S.P.A

- Polaris Inc.

- Wärtsilä

- SubSea Craft Limited

- BAE Systems

- Navier

- Avikus Co. Ltd

- Yachting Firecrown

- Others