Global AI Earbuds Market Size, Share, Industry Analysis Report By Features (Smart, Non-smart), By Technology (Deep Learning, Machine Learning, Natural Language Processing, Others), By Price Range (Premium Range (Greater than $150), Mid-Range ($50 - $150), Low Range (Less than $50), By Distribution Channel (Multi-Brand Electronic Stores, Hypermarket/Supermarket Stores, Online Stores, Others), By Application (Fitness & Gymming, Gaming, Music & Entertainment, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 161891

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Consumer Trends

- Analyst Viewpoint

- Role of Generative AI

- U.S. AI Earbuds Market Size

- Features Analysis

- Technology Analysis

- Price Range Analysis

- Distribution Channel Analysis

- Application Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Emerging Trends

- Growth Factors

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

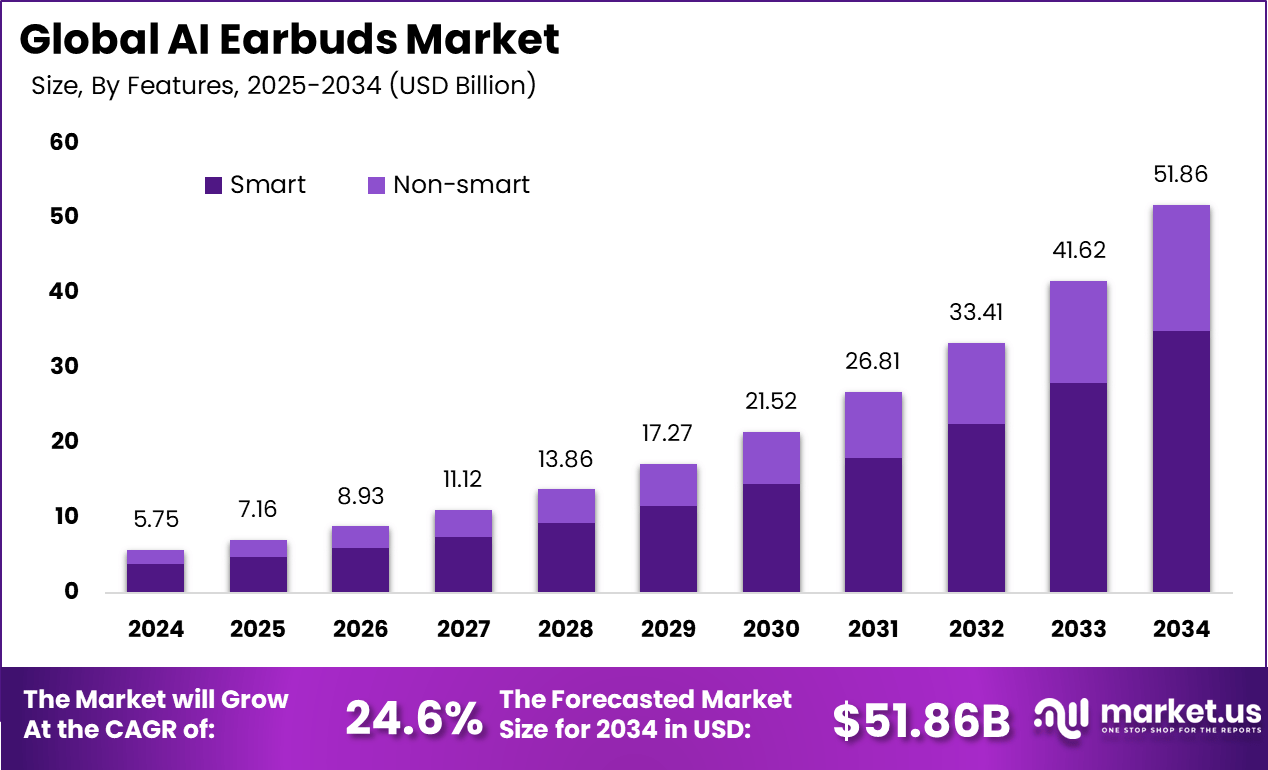

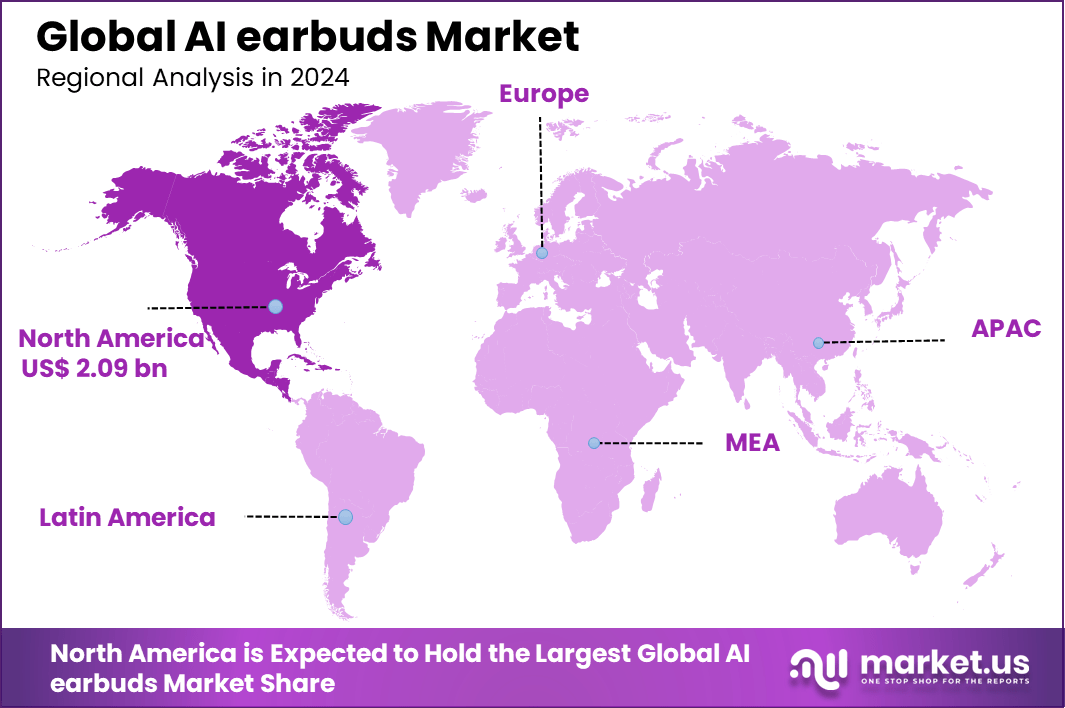

The Global AI earbuds Market size is expected to be worth around USD 51.86 Billion by 2034, from USD 5.75 Billion in 2024, growing at a CAGR of 24.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 36.4% share, holding USD 2.09 Billion in revenue.

The market for AI earbuds is driven by the growing consumer demand for smart, feature-rich audio devices that offer more than just sound playback. Users are increasingly looking for earbuds with real-time translation, advanced noise cancellation, and seamless voice assistant integration, which make daily life more convenient and productive. The desire for personalized and adaptive audio experiences is a key factor encouraging widespread adoption.

Technological advancements also play a vital role in market growth. Improvements in battery life, neural network-based sound processing, and Bluetooth connectivity enhance user experience and device reliability. The rising penetration of smartphones and smart devices globally further facilitates AI earbud integration into daily life, boosting their popularity across consumer segments. This combination of innovation and user demand continues to propel the AI earbuds market forward.

For instance, in June 2025, OPPO launched its Enco Buds3, true wireless AI earbuds that deliver up to 48 hours of total playback with the charging case. Each earbud provides up to 9.5 hours of continuous listening, supported by fast charging that offers 3 hours of playback from just a 10-minute quick charge. The earbuds maintain over 80% battery capacity even after 1,000 charging cycles, ensuring long-lasting durability.

Real-time noise cancellation and multi-device synchronization are particularly valued, as users want uninterrupted audio that transitions smoothly between smartphones, tablets, and laptops. The growing preference for online sales channels has made these products more accessible, driving volume growth steadily. It is also notable that professional applications, such as enterprise use for multilingual communication, add a new dimension to demand beyond personal use.

The increasing adoption of AI-related technologies, such as machine learning and voice recognition, is a key reason for more users choosing AI earbuds. These technologies enable devices to provide personalized sound profiles, offer contextual awareness for better voice assistant performance, and support evolving smart home and IoT integration. This convergence of technologies delivers convenience and richer functionality, encouraging users to invest in AI earbuds as part of their tech ecosystem.

Key Takeaway

- Smart earbuds accounted for 67.5%, showing strong demand for voice assistance, gesture control, and intelligent audio features.

- Deep learning–based capabilities reached 44.6%, reflecting the push toward adaptive sound, personalization, and noise optimization.

- The mid-range price bracket of $50–$150 captured 55.6%, indicating that consumers favor advanced features at accessible pricing.

- Multi-brand electronic stores held 45.7%, as shoppers continue to rely on retail variety and in-person comparison before purchase.

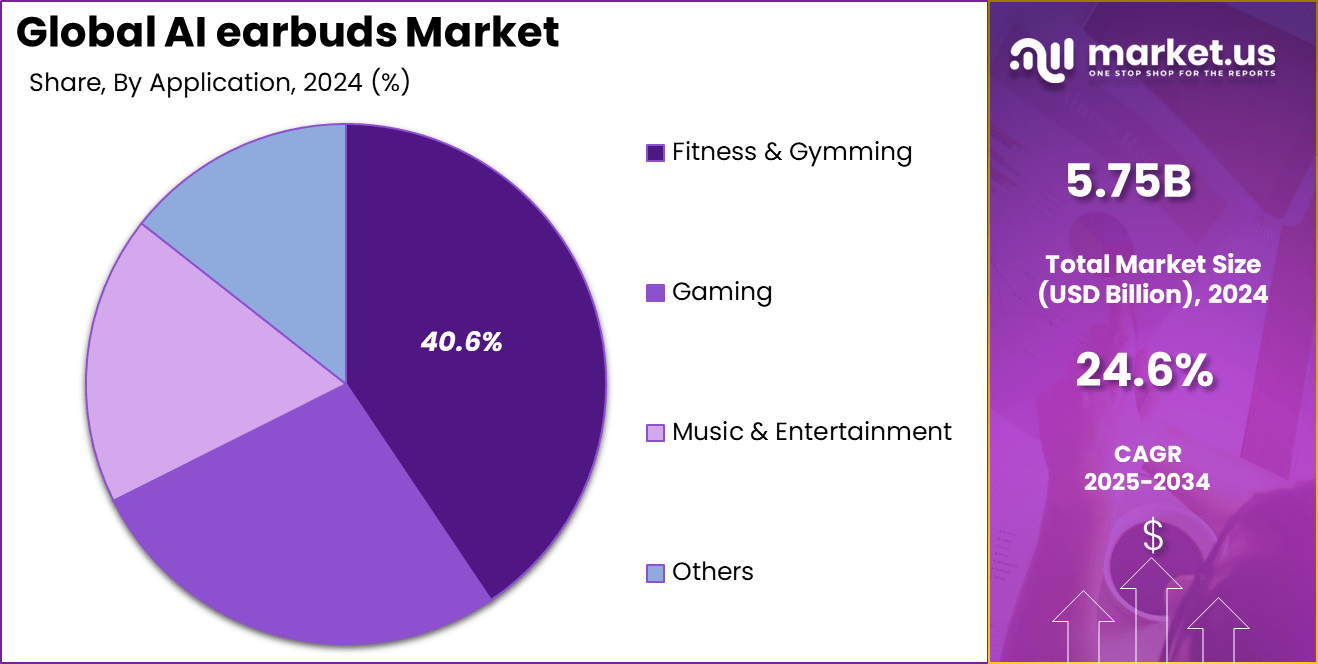

- Fitness and gym users made up 40.6%, driven by interest in health tracking, biometric feedback, and workout personalization.

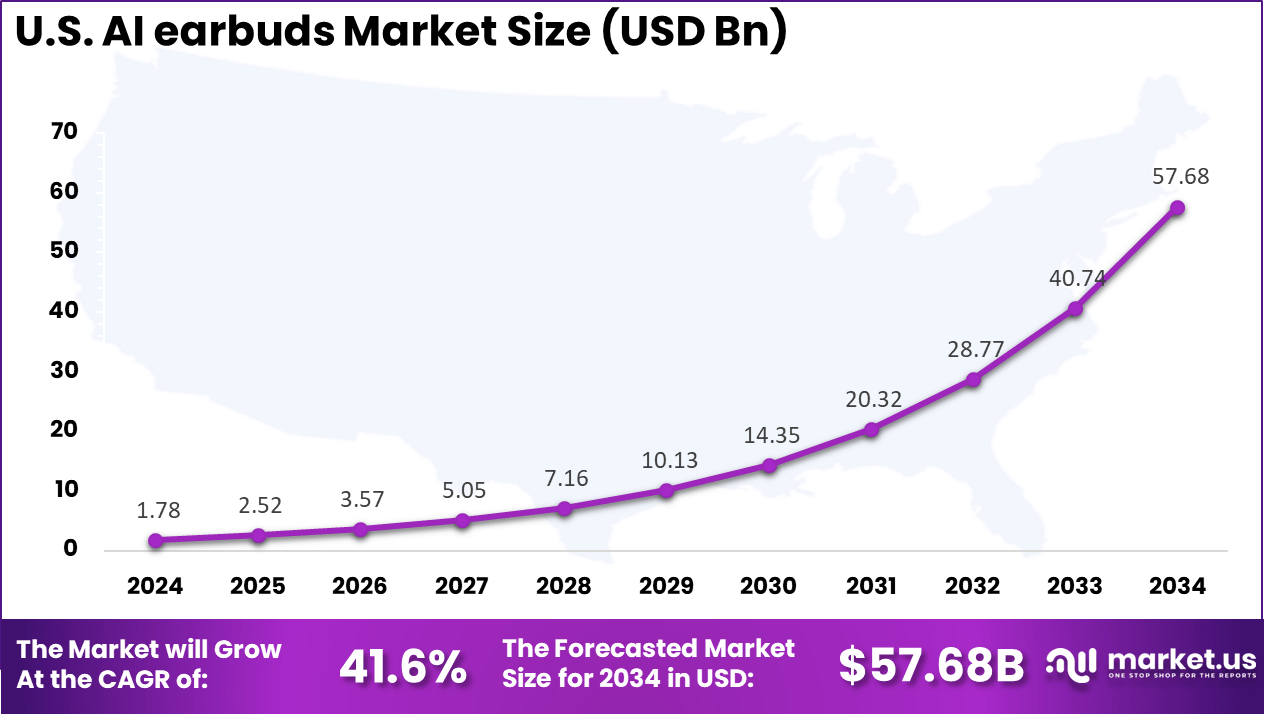

- The US market reached USD 1.78 Billion, supported by a high CAGR of 41.6% and early adoption of AI-based audio tech.

- North America led globally with 36.4%, reflecting strong consumer spending and integration of AI in wearable ecosystems.

Consumer Trends

- Adoption by demographics: In India, a 2024 JBL survey showed that more than 54% of Gen Z and millennials have already adopted AI-powered audio devices, highlighting strong uptake among younger, tech-forward consumers.

- Demand for specific features:

- 33% of Indian consumers prefer personalized sound and audio optimization based on listening habits.

- 30% prioritize improved voice recognition for seamless interaction.

- 20% seek interactive experiences with AI-enabled features.

- Adaptive Active Noise Cancellation (ANC), which adjusts dynamically to the environment, is gaining popularity as a premium differentiator.

- Market focus: Rising demand for advanced AI-driven features is reshaping competition. While premium devices currently lead adoption, brands are increasingly integrating these features into affordable models to capture broader market segments and maintain competitiveness.

Analyst Viewpoint

Technological advances driving the adoption of AI earbuds include machine learning-based noise cancellation and voice recognition that adapts to various accents. Battery life improvements now offer up to 40 hours of playtime, letting users enjoy all-day use without frequent recharging. Around 65% of users appreciate the integration with smart home and IoT devices, which makes these earbuds fit effortlessly into the modern smart device ecosystem.

A key reason people adopt AI earbuds is hands-free control through voice assistants, boosting productivity for 59% of users. Real-time language translation removes communication barriers during travel or meetings. Noise cancellation improves focus and also protects hearing by reducing the need for louder sound levels, with 72% of users reporting better concentration in noisy environments.

Investment opportunities are strong as brands innovate affordable AI earbuds and expand distribution, blending online sales dominance with increased physical retail presence. Focus areas include battery technology, AI software improvements, and secure handling of biometric data. The healthcare and enterprise sectors also see value in these earbuds due to biometric monitoring and real-time translation features.

Role of Generative AI

Generative AI is significantly shaping the AI earbuds market by making devices smarter and more user-friendly. About 45% of AI earbuds currently use generative AI technology, allowing them to learn user preferences and personalize audio automatically.

This results in a much-improved listening experience, where sound adjusts based on individual tastes. Additionally, generative AI supports clearer voice commands and real-time language translation, which over 70% of users find useful, especially in multilingual settings.

This technology also powers adaptive noise cancellation that modifies itself depending on the surrounding noise. Around 38% of users report enhanced comfort with this feature during their daily activities, making the earbuds more practical and pleasant to use. These advancements help AI earbuds function more like personal assistants, offering convenience and quality audio tailored to everyday needs.

U.S. AI Earbuds Market Size

The market for AI earbuds within the U.S. is growing tremendously and is currently valued at USD 1.78 Billion, the market has a projected CAGR of 41.6%. The market for AI earbuds within the U.S. is growing tremendously due to consumers’ increasing preference for smart, convenient audio devices that enhance their daily lives.

Features like real-time language translation, advanced noise cancellation, and hands-free voice assistant integration appeal strongly to tech-savvy users. The availability of high-end and mid-range models also attracts a broad consumer base seeking quality along with affordability.

Additionally, the U.S. benefits from a strong technology ecosystem with many startups and established companies driving innovation. Consumers are willing to pay premiums for earbuds that improve communication, fitness tracking, and entertainment experiences. This combination of advanced features, consumer readiness, and innovative development is fueling rapid growth in the U.S. AI earbuds market.

For instance, in January 2025 at CES, Laxis, a U.S. based leader in AI-driven productivity solutions, showcased its AI-powered OSO earbuds, underscoring U.S. dominance in the AI earbuds market. These earbuds emphasize productivity by delivering real-time meeting transcription, AI-generated summarization, and question-answering capabilities, supporting seamless professional communication.

In 2024, North America held a dominant market position in the Global AI earbuds Market, capturing more than a 36.4% share, holding USD 2.09 million in revenue. This dominance is due to its advanced technological infrastructure and high consumer adoption of smart devices.

The region’s strong presence of key technology companies fueled innovation in AI features such as noise cancellation, voice recognition, and real-time translation. Additionally, high disposable incomes and increasing health awareness contributed to demand for AI earbuds with fitness and wellness tracking, solidifying North America’s leadership in this rapidly evolving market.

For instance, in June 2025, Bose revealed the QuietComfort Ultra Earbuds 2nd Gen, reinforcing North America’s dominance in the AI earbuds market. These earbuds feature enhanced AI-powered noise cancellation that smoothly adapts to sudden environmental sounds like passing trains or sirens, providing a refined listening experience. The earbuds incorporate an AI-powered noise suppression system with eight microphones to improve call clarity by isolating the user’s voice.

Features Analysis

In 2024, The Smart segment held a dominant market position, capturing a 67.5% share of the Global AI earbuds Market. This dominance is due to users now expecting more than just audio playback from their devices. These smart earbuds offer advanced features like voice assistants, adaptive noise cancellation, and real-time language translation that respond to the needs of busy, multitasking lifestyles. Such capabilities deliver convenience, helping users stay connected and productive without having to handle their phones constantly.

Consumers appreciate how the smart features create a personalized listening experience, adapting to individual preferences and environments. The integration of these intelligent functions ensures earbuds become essential daily companions rather than simple gadgets, driving loyalty and repeat purchases within this segment.

For Instance, in August 2025, Sony India launched the WF-C710N truly wireless earbuds, featuring dual noise cancellation and smart AI calling capabilities. Equipped with dual microphones, the earbuds effectively filter external sounds, providing a distraction-free listening experience. They also offer an Ambient Sound mode customizable through the Sony Sound Connect app, allowing users to stay aware of their surroundings while enjoying their audio.

Technology Analysis

In 2024, the Deep Learning segment held a dominant market position, capturing a 44.6% share of the Global AI earbuds Market. It enables advanced functionalities, including improved speech recognition, noise suppression, and contextual audio adjustments. Deep learning algorithms process environmental sounds and user inputs to deliver precise, tailored audio, enhancing the earbuds’ responsiveness and usability even in dynamic environments.

This technology allows earbuds to continuously improve with use, adapting to unique user patterns and preferences. Deep learning’s role in noise cancellation and sound personalization particularly stands out as a driver of customer satisfaction, encouraging its widespread adoption in mid to high-tier devices.

For instance, in August 2025, Viaim announced its OpenNote earbuds at IFA 2025, featuring advanced AI functions powered by deep learning algorithms for real-time transcription, conversation summarization, and task management. The earbuds feature an open-ear design with aerospace-grade memory titanium for comfort and situational awareness, suitable for extended wear and active lifestyles.

Price Range Analysis

In 2024, The Mid-Range ($50 – $150) segment held a dominant market position, capturing a 55.6% share of the Global AI earbuds Market. This range strikes a balance between affordability and desirable features, offering benefits like noise cancellation, voice assistant support, and solid battery life, all within accessible pricing. It appeals to users who seek value without compromising on performance.

Mid-range earbuds benefit from wide availability both online and offline, making them attractive to a broad consumer base, including students, professionals, and casual listeners. These products drive mainstream adoption as technology advances, lower production costs while maintaining quality.

For Instance, in August 2025, Sony WF-C710N earbuds, priced around $120-$130 depending on region and offer dual noise sensor technology with AI-powered voice pickup for clear calls in noisy environments. They also provide ambient sound control and up to 40 hours of battery life with fast charging, combining smart AI features with a comfortable, stylish design for daily use.

Distribution Channel Analysis

In 2024, The Multi-Brand Electronic Stores segment held a dominant market position, capturing a 45.7% share of the Global AI earbuds Market. This dominance is due to the value consumers place on hands-on product trials and expert advice. Physical retail stores offer a tangible experience where buyers can test audio quality, fit, and comfort before making a purchase decision, which is crucial for tech products integrating AI.

Even as e-commerce grows, physical stores play a critical role in consumer decision-making, providing immediate product availability and support services. This hybrid retail dynamic helps brands reach diverse customer segments effectively, balancing convenience with personalized shopping experiences.

For Instance, in October 2025, the Itissoft AI Language-Translation Earbuds were prominently featured in multi-brand electronic stores like Walmart during a flash sale, priced at just $28, down from $100. These earbuds offer real-time translation in over 140 languages with up to 97% accuracy, powered by four leading AI engines. Besides translation, they include noise-canceling capabilities and can function as regular headphones for music and calls.

Application Analysis

In 2024, The Fitness & Gymming segment held a dominant market position, capturing a 40.6% share of the Global AI earbuds Market. These users seek earbuds equipped with sweat resistance, a comfortable fit, and health-tracking functionalities such as heart rate monitoring and activity tracking. The demand for earbuds that combine audio performance with fitness features continues to grow sharply, especially among health-conscious consumers.

The popularity of wearable health tech is facilitating this trend, with users increasingly expecting smart earbuds to deliver rich fitness data alongside superior sound quality. This drives innovation in biometric sensors and real-time feedback functions, reinforcing the fitness application segment’s market position.

For Instance, in March 2024, Boult launched its AI-powered Z40 Ultra TWS earbuds in India, designed to cater to fitness and gym users. These earbuds offer an impressive battery life of up to 100 hours, ensuring extended use during long workout sessions. They include 32 dB Active Noise Cancellation, allowing users to focus amidst noisy gym environments.

Key Market Segments

By Features

- Smart

- Non-smart

By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Others

By Price Range

- Premium Range (Greater than $150)

- Mid-Range ($50 – $150)

- Low Range (Less than $50)

By Distribution Channel

- Multi-Brand Electronic Stores

- Hypermarket/Supermarket Stores

- Online Stores

- Others

By Application

- Fitness & Gymming

- Gaming

- Music & Entertainment

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing Demand for Smart Features

The demand for smart features is a major driver in the AI earbuds market. The consumers now expect earbuds to do more than simply play music. Features like real-time translation, voice assistants, and adaptive noise cancellation enhance daily convenience by allowing users to multitask without constantly handling their devices. This shift toward smarter, more interactive earbuds aligns with modern lifestyles where efficiency and connectivity are priorities.

The manufacturers are now focused on integrating intelligent functions that personalize and improve the audio experience. This has led to increased consumer interest as people look for devices that adapt to their needs and environments. By offering these smart features, brands attract tech-savvy users who see earbuds as essential tools for communication, entertainment, and productivity. This demand propels innovation and growth in the AI earbuds sector.

For instance, in October 2025, Chinese AI giant iFLYTEK launched its next-generation AI Translation Earbuds at GITEX Global in Dubai. These earbuds offer real-time, high-fidelity speech-to-speech translation between Arabic, English, and Chinese with latency as low as two seconds. Supported by proprietary end-to-end AI architecture, the earbuds deliver near-native quality Arabic translation, revolutionizing cross-cultural communication in the Middle East and beyond.

Restraint

High Production Costs and Privacy Concerns

A major restraint for AI earbuds is the high production cost associated with advanced components and assembly. Materials such as high-quality drivers, sensors, and batteries, plus the sophisticated AI chips, significantly raise costs. Labor-intensive assembly, quality control, and certification processes add to expenses, often leading to a retail price that limits accessibility for some consumer segments.

Balancing production efficiency with high standards remains a challenge for manufacturers working to keep products affordable. Privacy concerns also act as a barrier to wider adoption. AI earbuds collect sensitive data, including voice commands and biometric information. Companies must invest heavily in data protection measures and comply with stringent regulations to build consumer trust. This adds complexity and cost to product development and marketing strategies.

For instance, in July 2025, several U.S. states, including Colorado, California, and Montana, enacted privacy laws aimed at protecting brain data collected by consumer devices such as AI earbuds. These laws require companies to obtain explicit consent before collecting or sharing sensitive neural data generated outside traditional medical settings. The regulations also mandate options for consumers to delete their data, addressing growing concerns about privacy and unauthorized third-party access.

Opportunities

Integration with Health and Fitness

AI earbuds are becoming essential health companions by integrating advanced biometric sensors that track heart rate, activity levels, and other vital signs. These sensors provide real-time data during workouts, helping users monitor performance and avoid injuries. Unlike traditional fitness devices, smart earbuds can offer personalized coaching, giving immediate feedback on posture or pace, which enhances workout effectiveness.

Moreover, these earbuds can monitor blood pressure or detect irregular heart rhythms, alerting users to potential health issues early. This proactive health management supports users in maintaining wellness and preventing serious conditions. The convenience of having these capabilities embedded in everyday audio devices encourages wider adoption among health-conscious consumers seeking seamless integration between fitness and lifestyle.

For instance, in September 2025, Doctorpresso, a leading AI mental health technology company, announced it would showcase Therapods at CES 2026 in Las Vegas. Therapods are the world’s first AI-powered earbuds designed specifically for virtual group therapy. These earbuds use advanced AI and multimodal biosensing to track voice patterns, brainwaves, and heart rate variability, providing real-time emotional insights with over 90% accuracy.

Challenges

Battery Life and Technological Complexity

Battery life remains a key challenge for AI earbuds, as advanced features such as active noise cancellation and voice assistants consume a significant amount of power. Users expect earbuds to last through long commutes or workouts, but the energy demands of AI functionalities often result in shorter battery life than desired. Engineers face the difficult task of balancing power-intensive features while maintaining a practical usage duration.

Moreover, the compact design of AI earbuds creates technological complexity, limiting the size of batteries that can fit inside. The proximity of electronic components within small earbud casings leads to temperature variations that contribute to battery degradation over time. This complexity can affect reliability and increase production costs. Manufacturers must innovate to extend battery life while maintaining sophisticated AI capabilities, or risk slowing adoption due to user inconvenience and dissatisfaction.

For instance, in March 2024, Boult launched its AI-powered Z40 Ultra TWS earbuds in India, tackling the battery life challenge prevalent in AI earbuds. The Z40 Ultra boasts an impressive battery life of up to 100 hours of total playtime, significantly addressing user concerns about limited usage time. This extended battery support is a major advancement, especially considering the power-consuming AI features like 32 dB Active Noise Cancellation and intelligent voice processing integrated into the earbuds.

Emerging Trends

Emerging trends in AI earbuds highlight increasing adoption of true wireless stereo (TWS) models that offer freedom from wires combined with smart features. The global TWS market expanded by 18% in just the first quarter of 2025, showing strong regional uptake worldwide. Users now demand earbuds with AI-powered translation, health monitoring, and improved battery life that integrate smoothly with everyday devices.

Another trend is the growing interest in personalized audio experiences driven by AI algorithms that tailor sound profiles to individual hearing preferences. This personalization trend is supported by a rise in smart device penetration and consumer willingness to invest in advanced audio technologies. Approximately 44% of healthcare organizations already use voice technology, with 39% planning adoption soon, emphasizing AI earbuds’ role beyond entertainment into wellness and productivity.

Growth Factors

Growth factors for AI earbuds revolve strongly around technological advancements and consumer behavior shifts. Improvements in AI algorithms allow for noise cancellation and voice interaction that create more enjoyable and convenient experiences. Rising disposable incomes worldwide support purchases of premium AI earbuds with health and wellness features, enhancing market uptake.

Smartphone and smart device proliferation further boosts growth by enabling seamless integration with AI earbuds, making them essential for users who multitask and value hands-free technology. This tech ecosystem growth, coupled with increasing AI feature innovation, is a powerful driver that sustains demand growth in this market segment.

Key Players Analysis

The AI Earbuds Market is led by major consumer electronics brands such as Samsung, Sony Corporation, Google, Motorola Mobility LLC, and Xiaomi. These companies integrate AI capabilities into earbuds to enable smart noise cancellation, adaptive sound profiles, voice assistant support, and real-time audio enhancements. Their strong global presence and ecosystem integration drive large-scale adoption across premium and mid-range consumer segments.

Audio technology specialists such as Bose Corporation, Jabra, and Sennheiser contribute with AI-optimized hearing features, intelligent sound calibration, and seamless device connectivity. Their products emphasize call clarity, fitness tracking integration, and personalized listening experiences. These brands continue to innovate by incorporating edge AI chips and advanced microphone arrays.

Emerging and niche players including Hong Kong Future Intelligent Technology Co., Ltd., Laxis, Inc., timekettle, Langogo, Pocketalk, Translators Club, WeTalk, Zytra, and other contributors focus on AI-based translation, speech recognition, and contextual audio assistance. Their solutions target travel, education, professional communication, and accessibility needs.

Top Key Players in the Market

- Hong Kong Future Intelligent Technology Co., Ltd.

- Laxis, Inc.

- Samsung

- timekettle

- Motorola Mobility LLC

- Sony Corporation

- Bose Corporation

- Jabra

- Sennheiser

- Xiaomi

- Langogo

- Translators Club

- WeTalk

- Pocketalk

- Zytra

- Others

Recent Developments

- In July 2025, Sony launched its WF-C710N truly wireless active noise-cancelling earbuds, featuring smart AI calling capabilities. The earbuds incorporate dual sensory technology with two microphones to detect and filter external sounds, ensuring an uninterrupted audio experience. They offer Ambient Mode with 20 adjustable levels and adaptive sound control that automatically changes settings based on the user’s environment and activities, such as home, gym, or work.

- In July 2025, Indian electronics brand Mivi launched its AI Buds in India, priced at Rs 6,999. These wireless earbuds feature AI-powered virtual assistants, called AI Avatars, that can perform tasks through voice commands, including offering recipe guidance, mock interviews, personalized news updates, and emotional support.

Report Scope

Report Features Description Market Value (2024) USD 5.75 Bn Forecast Revenue (2034) USD 51.86 Bn CAGR(2025-2034) 24.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Features (Smart, Non-smart), By Technology (Deep Learning, Machine Learning, Natural Language Processing, Others), By Price Range (Premium Range (Greater than $150), Mid-Range ($50 – $150), Low Range (Less than $50), By Distribution Channel (Multi-Brand Electronic Stores, Hypermarket/Supermarket Stores, Online Stores, Others), By Application (Fitness & Gymming, Gaming, Music & Entertainment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Hong Kong Future Intelligent Technology Co., Ltd., Laxis, Inc., Samsung, timekettle, Motorola Mobility LLC, Sony Corporation, Bose Corporation, Jabra, Google, Sennheiser, Xiaomi, Langogo, Translators Club, WeTalk, Pocketalk, Zytra, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Hong Kong Future Intelligent Technology Co., Ltd.

- Laxis, Inc.

- Samsung

- timekettle

- Motorola Mobility LLC

- Sony Corporation

- Bose Corporation

- Jabra

- Sennheiser

- Xiaomi

- Langogo

- Translators Club

- WeTalk

- Pocketalk

- Zytra

- Others