Global AI Companion Robot Market Size, Share Analysis By Component (Hardware, Software, Services), By Mobility (Stationary, Mobile), By Interaction Type (Voice-Based, Gesture-Based, Touch-Based, Multimodal), By Age Group (Children, Adults, Elderly), By Application (Elderly Care & Assisted Living, Child Education & Learning, Companionship for Individuals (Mental Health Support, Social Isolation)), Entertainment & Gaming, Customer Service & Hospitality, Others (Disability Support, Smart Home Assistants), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154772

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Analysts’ Viewpoint

- Role of AI

- Top 5 Growth Factors

- US Market Size

- Emerging Trends

- By Component: Hardware (48.2 %)

- By Mobility: Mobile (56.5 %)

- By Interaction Type: Multimodal (38.7 %)

- By Age Group: Elderly (44.1 %)

- By Application: Elderly Care & Assisted Living (29.4 %)

- By End‑User: Residential (52.3 %)

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Landscape

- Recent Developments

- Report Scope

Report Overview

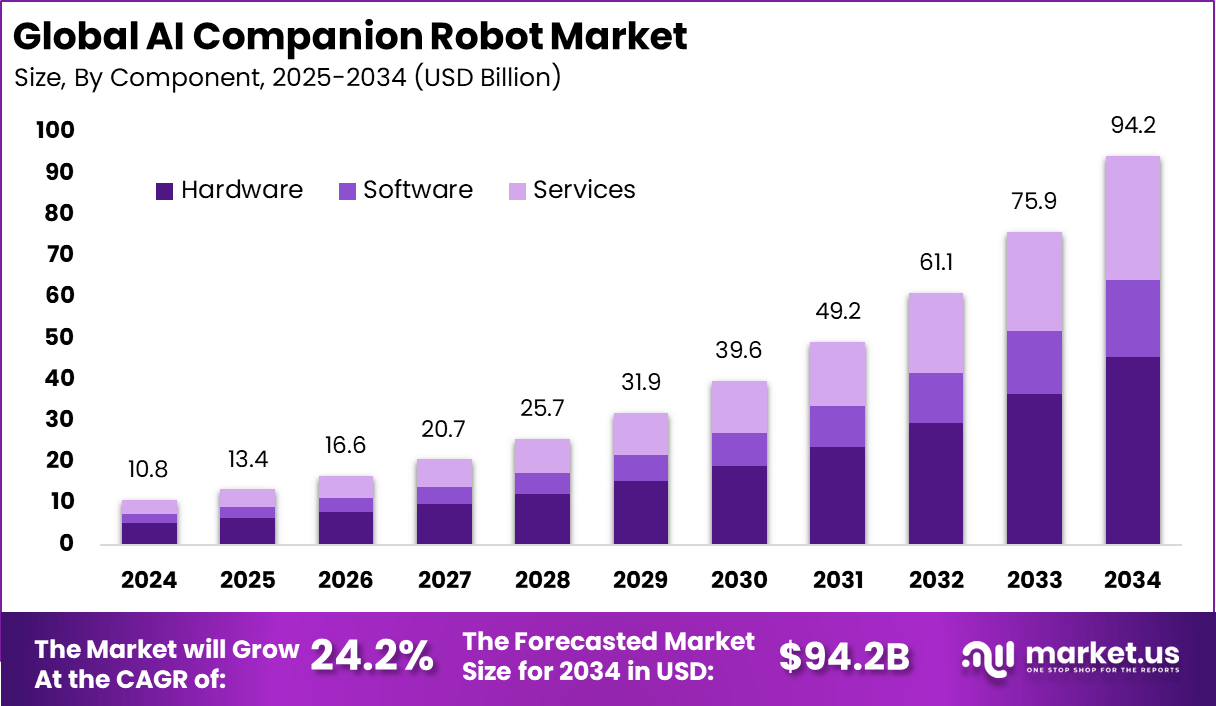

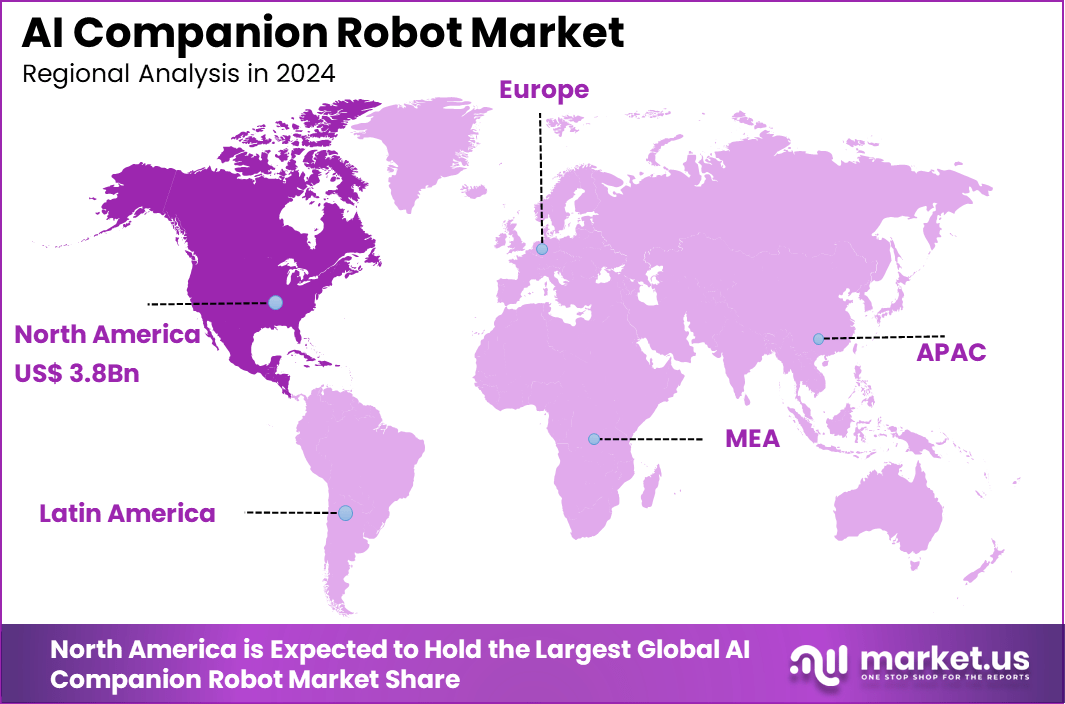

The Global AI Companion Robot Market size is expected to be worth around USD 94.2 Billion By 2034, from USD 10.8 billion in 2024, growing at a CAGR of 24.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominan Market position, capturing more than a 35.6% share, holding USD 3.8 Billion revenue.

The AI companion robot market is emerging as a transformative force in technology, driven largely by the need for enhanced human interaction and support across various age groups, especially among aging populations. AI companion robots are designed to provide companionship, emotional support, and practical assistance, offering a technological bridge for people facing loneliness or requiring daily help. These smart machines are now used in homes, healthcare, and education, changing how people interact with technology.

One of the top driving factors behind the increasing demand for AI companion robots is the growing recognition of mental and emotional health needs. Many individuals, including the elderly and those with limited mobility or chronic conditions, are seeking new ways to combat isolation. AI robots empowered with advanced natural language processing and emotional intelligence features have proven effective in engaging in lifelike conversations, offering users a non-judgmental space to share their feelings and get daily reminders or advice.

Market Size and Growth

Metric Statistic / Value Market Value (2024) USD 10.8 Bn Forecast Revenue (2034) USD 94.2 Bn CAGR(2025-2034) 24.2% Leading Segment Mobile: 56.5% Region with Largest Share North America [35.6% Market Share] Largest Country U.S. [USD 3.66 Bn Market Revenue], CAGR: 23.1% Key Insight Summary

- The market is projected to grow from USD 10.8 billion in 2024 to USD 94.2 billion by 2034, registering a strong CAGR of 24.2%, driven by aging populations and demand for emotionally intelligent robotic care.

- North America led the global market with a 35.6% share, generating USD 3.8 billion in revenue, supported by healthcare innovation, aging demographics, and consumer tech adoption.

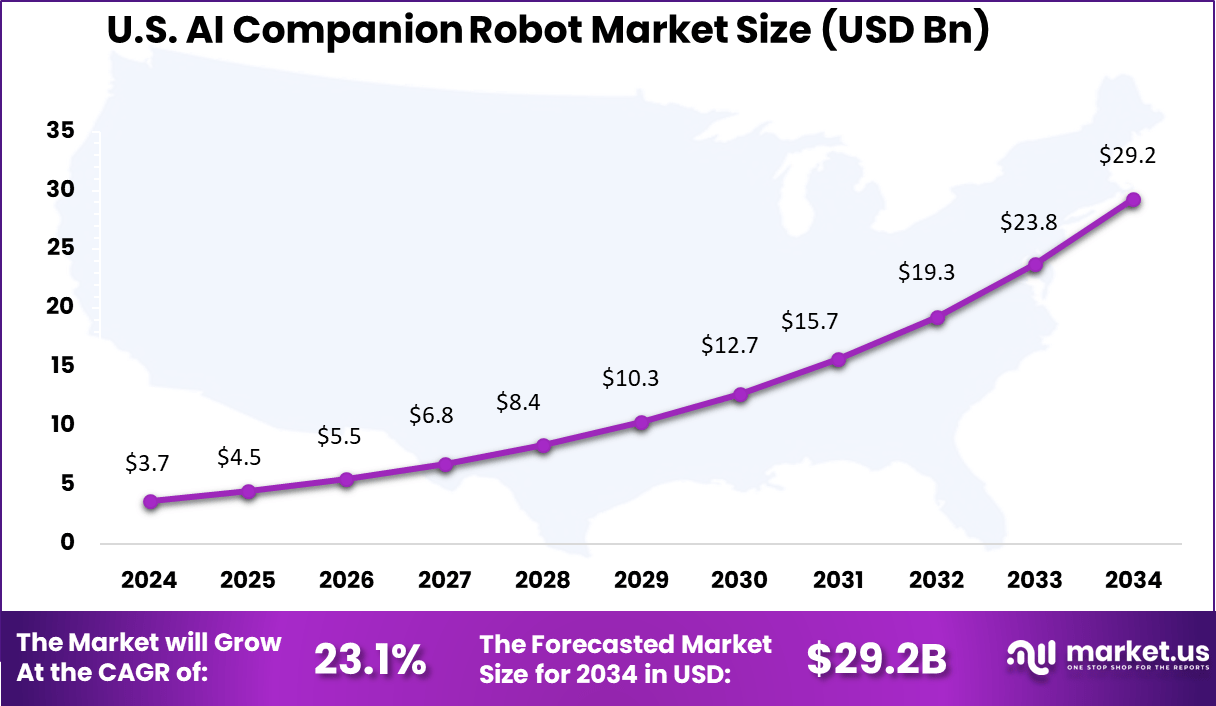

- The U.S. market alone accounted for USD 3.66 billion and is expected to grow at a CAGR of 23.1%, reflecting robust investment in AI-powered home care and personal assistance technologies.

- The Hardware segment held the largest share at 48.2%, driven by advancements in sensors, actuators, and humanoid design improving real-world interaction.

- Mobile robots dominated mobility types with a 56.5% share, as movement is essential for companionship, caregiving, and household assistance.

- Multimodal interaction led the interaction category at 38.7%, integrating voice, touch, gesture, and emotion recognition to enhance user engagement.

- The Elderly age group represented the largest user base, accounting for 44.1%, as companion robots become increasingly essential for emotional support and routine assistance.

- Elderly Care & Assisted Living emerged as the leading application at 29.4%, particularly in addressing loneliness, medication reminders, and cognitive stimulation.

- Residential use held a commanding 52.3% share, reflecting growing consumer acceptance of AI companions in personal and family environments.

Analysts’ Viewpoint

Demand is rising as households seek emotional support and daily help from robots, especially in elder care, nursing homes, and mental wellness settings. Growth is stronger where human contact is limited or costly, with interest higher for robots that offer features like medication reminders or casual conversations.

Organizations adopt these robots for both emotional connection and cost-saving benefits. In care centers, they help reduce non-clinical staffing needs and support tasks like safety checks and medication tracking. Their natural interaction builds trust, making them more accepted in daily life.

Investment opportunities are growing in aging regions and smart home markets. Specialized use cases like autism care, mental wellness, and service roles in retail or hospitality show strong potential. Innovation is likely to accelerate through partnerships combining established firms and startups focused on sensors, language models, and robot design.

Role of AI

Role/Function Description Natural Language Processing Powers conversation, voice commands, empathetic dialogue, and personalized communication Emotion Recognition Detects and responds to user emotions through facial, vocal, or sensor input Adaptive Personalization AI tailors interactions, routines, and interventions to individual behaviors and health data Learning & Memory Companions remember preferences, routines, and adjust over time Integration & Interoperability Connect with IoT/smart home devices for environmental control, reminders, and health monitoring Real-world Assistance Remind, monitor, support mobility or medication, provide social or therapeutic engagement Top 5 Growth Factors

Key Factors Description Aging Global Population Rising numbers of elderly people drive demand for caregiving and companionship support Mental Health Awareness Increased focus on wellness, loneliness, and therapy—especially post-pandemic Tech Advancements in Robotics Progress in AI, NLP, robotics hardware, and sensor tech enables more natural, effective robots Smart Home & IoT Adoption Seamless integration with connected environments expands use cases and user value Healthcare/Assistive Needs Growing demand for patient monitoring, therapy, and daily assistance in homes and institutional care US Market Size

The U.S. AI Companion Robot Market was valued at USD 3.7 Billion in 2024 and is anticipated to reach approximately USD 29.2 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 23.1% during the forecast period from 2025 to 2034.

The United States is leading the AI companion robot market primarily due to its early adoption of advanced AI technologies, high consumer awareness, and strong presence of innovation ecosystems. The country has been at the forefront of integrating artificial intelligence with robotics for emotional and social interaction, driven by increasing demand in home care, elder support, and mental wellness sectors.

In 2024, North America held a dominant market position, capturing more than 35.6% share, with revenue totaling USD 3.8 Billion in the AI companion robot sector. This regional leadership has been shaped by high consumer awareness, strong purchasing power, and the early adoption of assistive technologies across both individual and institutional settings.

The presence of robust digital infrastructure and rising demand for socially assistive robots in elderly care, mental wellness, and special education has significantly influenced market growth. Additionally, the integration of AI with home automation systems in this region has encouraged wider deployment of emotionally responsive robots in domestic environments.

North America’s edge is also supported by an ecosystem that includes advanced research facilities, strong collaborations between academia and industry, and access to cutting-edge AI components. There is growing traction for personalized robotic companions in healthcare facilities, particularly among aging populations, where such devices are being used to reduce loneliness and support medication adherence.

Emerging Trends

Trend/Innovation Description Emotional Intelligence Enhanced empathy, emotional response, and adaptive interactions through AI/ML Cloud AI & Continuous Updates Robots increasingly leverage cloud AI and federated learning for better, ever-evolving capabilities Robot-Therapy Applications Specialized models for autism, dementia, and mental wellness—proven in research and healthcare Hybrid & Multi-Modal Interfaces Voice, gesture, touch, and facial recognition bring more natural, intuitive user experience Affordability & Accessibility Costs decline as hardware, miniaturization, and production scale; more accessible to consumers By Component: Hardware (48.2 %)

The hardware segment is the dominant component in the AI companion robot market. This pre‑eminent position is attributed to the foundational role of physical infrastructure – sensors, actuators and processors – which enable perception, movement and interaction.

The continued emphasis on advanced robotics applications is supported by robust demand for reliable hardware that ensures precision and operational stability. Growth in deployment across healthcare, service and residential use cases reinforces the necessity for scalable hardware platforms.

Investment in physical infrastructure is being elevated by technological advancements in sensor miniaturization and improved energy efficiency. As robots are expected to operate autonomously over extended periods, hardware innovation is being prioritized over software alone. The significance of durable and efficient physical components is thereby ensured across diverse environments.

By Mobility: Mobile (56.5 %)

The mobile category is the leading mobility segment within the AI companion robot domain. Mobility enables robots to navigate environments and to deliver flexible, multi‑room assistance – especially important in residential and care settings.

Mobile platforms offer clear advantages over stationary units due to their adaptability and capacity to follow users or relocate to task-specific areas. Adoption of mobile companion robots is being driven by a requirement for agility in daily living scenarios.

Autonomous navigation, obstacle avoidance and user proximity features support safety, responsiveness and convenience. Real‑world deployments in elder care and home assistance continue to reinforce this mobility preference.

By Interaction Type: Multimodal (38.7 %)

Multimodal interaction is the most prominent interaction type segment, encompassing combinations of voice, touch, gesture and visual feedback. This mode is preferred because it delivers a richer, more intuitive user experience, especially for elderly users who may prefer non‑verbal cues or physical controls.

Multimodal systems support natural engagement and improve usability for diverse user profiles. Design of companion robots increasingly prioritizes multimodal interfaces, as reliance on single‑channel input may limit accessibility.

The integration of speech recognition, tactile buttons and visual displays supports user preference and reduces friction in interaction. This design approach boosts user acceptance and operational effectiveness across demographic groups.

By Age Group: Elderly (44.1 %)

The elderly segment is the largest age‑group category within the AI companion robot market. This prominence can be traced to global aging demographics and increasing demand for safe, supportive living solutions. Elderly users benefit from companionship, reminders, safety alerts and health monitoring features that are well suited to AI companion functions

Adoption is further supported by caregiver shortages and rising healthcare costs, which reinforce dependence on technology to supplement traditional in‑person support. Companion robots designed for elderly users are being optimized for ease of use, emotional engagement and reliability, thereby enhancing independence and quality of life.

By Application: Elderly Care & Assisted Living (29.4 %)

Elderly care and assisted living represent the leading application segment. The prevalence of this category reflects a strategic alignment between use‑case requirements and robot capabilities such as fall detection, reminders, conversational interaction and wellness support. The application focus is reinforced due to increasing recognition of the benefits offered by robotic assistance in managing elder dependency.

Robotic solutions are being integrated into assisted living facilities and home environments where consistent monitoring and emotional engagement are needed. The deployment is being catalysed by technology acceptance among caregivers and families seeking scalable and reliable support for elderly individuals.

By End‑User: Residential (52.3 %)

The residential segment is the dominant end‑user category in the AI companion robot sector. The high share is reflective of the strong preference for in‑home deployment of companion devices. Residential settings offer contexts such as daily reminders, companionship, tele‑monitoring and safety alerts, which align closely with robot functionalities.

Deployment in private homes is being supported by increasing consumer awareness and demand for in‑home assistance technologies that promote independence. Residential adoption benefits from growing comfort with AI devices in personal spaces, which enables broader market acceptance and uptake across age groups.

Key Market Segments

By Component

- Hardware

- Sensors (Vision, Touch, Microphones)

- Actuators

- Cameras

- Microcontrollers and Processors

- Others

- Software

- Natural Language Processing (NLP)

- Facial Recognition & Emotion Detection

- Voice Recognition & Speech Synthesis

- AI & Machine Learning Algorithms

- Others

- Services

- Integration & Customization Services

- Support & Maintenance

- Training & Consulting

By Mobility

- Stationary

- Mobile

By Interaction Type

- Voice-Based

- Gesture-Based

- Touch-Based

- Multimodal

By Age Group

- Children

- Adults

- Elderly

By Application

- Elderly Care & Assisted Living

- Child Education & Learning

- Companionship for Individuals (Mental Health Support, Social Isolation)

- Entertainment & Gaming

- Customer Service & Hospitality

- Others (Disability support, Smart Home Assistants)

By End-User

- Residential

- Healthcare Facilities

- Educational Institutions

- Commercial Spaces (Hotels, Retail, Banks, etc.)

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

One key reason people are turning to AI companion robots is the desire for personalized care and human-like interaction. The changing demographics, such as the increase in elderly populations and families living apart, has led many to seek robotic companions who can provide tailored conversations, reminders, or even just a friendly presence. Technology has advanced enough to allow these robots to learn from their daily interactions, which means they continuously improve in meeting the unique needs of their users over time.

Restraint Analysis

A real obstacle to mass adoption of AI companion robots is their high upfront cost. These devices are built with advanced sensors, powerful processors, and complex AI algorithms, all of which drive up the production price.

As a result, for many individuals or families, the investment remains out of reach. Additionally, ongoing costs related to maintenance and updates further limit their affordability, especially in regions where income levels are lower or alternative forms of companionship, like human caregivers, are already available.

Opportunity Analysis

Repeatedly, industry watchers point out that integrating AI robots with other smart home devices presents an exciting growth opportunity. Imagine a robot not only responding to your conversation but also adjusting the home environment, reminding you to take medicine, or syncing with wearables to monitor health.

When AI robots can share real-time data and work with IoT devices seamlessly, they become indispensable helpers for families, the elderly, or anyone wanting extra support at home. This level of connectivity can redefine daily living, making homes safer and more attentive to personal needs.

Challenge Analysis

Despite the promise, designing robots that people can genuinely trust poses a major challenge. For these robots to feel like true companions, they must handle private information, such as health data and personal preferences, with great sensitivity.

If users don’t trust that their data is secure and that the robots act ethically, adoption will remain limited. Balancing advanced features with rigorous safeguards for privacy, safety, and transparent behavior is a hurdle developers and policymakers need to overcome to build public confidence in AI companion technology.

Competitive Landscape

In the AI companion robot market, several players have taken the lead by focusing on innovation, emotional intelligence, and care-driven functionality. SoftBank Robotics, Sony Corporation, and Ubtech Robotics are driving the market through social robot development, using AI-powered features for interactive communication and assistance. These companies are well-known for integrating speech recognition, motion sensing, and autonomous learning.

A second group of companies is focusing on human-like social interaction and therapeutic engagement. Furhat Robotics, Hanson Robotics, Intuition Robotics, and PARO Robots are leveraging facial animation, voice interaction, and behavioral AI. Their solutions are being adopted across eldercare, mental wellness, and rehabilitation environments.

Smaller but impactful firms like Hyodol, Robot Care Systems, Emotix, No Isolation, Shenzhen Yunzhixing Technology, Blue Frog Robotics, Skycatch, and Confluent Robotics are also contributing significantly. These companies target niche applications such as autism support, educational companionship, and remote caregiving. Their innovations include compact designs, multilingual capabilities, and AI-enabled real-time monitoring.

Top Key Players in the Market

- SoftBank Robotics

- Furhat Robotics

- Hanson Robotics

- Intuition Robotics

- PARO Robots

- Sony Corporation

- Ubtech Robotics

- Hyodol

- Robot Care Systems

- Emotix

- No Isolation

- Shenzhen Yunzhixing Technology

- Blue Frog Robotics

- Skycatch

- Confluent Robotics

- Others

Recent Developments

- In February 2024, SoftBank Group launched a joint venture with Alat (a Saudi PIF-backed company), aimed at manufacturing industrial and AI-driven robots. This JV is set to debut a next-generation manufacturing hub in Riyadh by December 2024, backed by an initial investment of $150 million.

- At CES February 2024, Intuition Robotics launched the ElliQ 3 – an upgraded AI companion explicitly targeting older adults to combat loneliness and elevate home care through enhanced emotional intelligence and conversation abilities.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Mobility (Stationary, Mobile), By Interaction Type (Voice-Based, Gesture-Based, Touch-Based, Multimodal), By Age Group (Children, Adults, Elderly), By Application (Elderly Care & Assisted Living, Child Education & Learning, Companionship for Individuals (Mental Health Support, Social Isolation)), Entertainment & Gaming, Customer Service & Hospitality, Others (Disability Support, Smart Home Assistants) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SoftBank Robotics, Furhat Robotics, Hanson Robotics, Intuition Robotics, PARO Robots, Sony Corporation, Ubtech Robotics, Hyodol, Robot Care Systems, Emotix, No Isolation, Shenzhen Yunzhixing Technology, Blue Frog Robotics, Skycatch, Confluent Robotics, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI Companion Robot MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

AI Companion Robot MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- SoftBank Robotics

- Furhat Robotics

- Hanson Robotics

- Intuition Robotics

- PARO Robots

- Sony Corporation

- Ubtech Robotics

- Hyodol

- Robot Care Systems

- Emotix

- No Isolation

- Shenzhen Yunzhixing Technology

- Blue Frog Robotics

- Skycatch

- Confluent Robotics

- Others