Global Agentic AI in Telecom Market Size, Share Analysis Report By Deployment (Cloud, On-Premises), By Technology (Machine Learning, Natural Language Processing, Big Data, Others (Deep Learning)), By Application (Network/IT Operations Management, Customer Service and Marketing VDAS, CRM Management, Radio Access Network, Customer Experience Management, Predictive Maintenance, Others (Fraud Mitigation)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153343

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

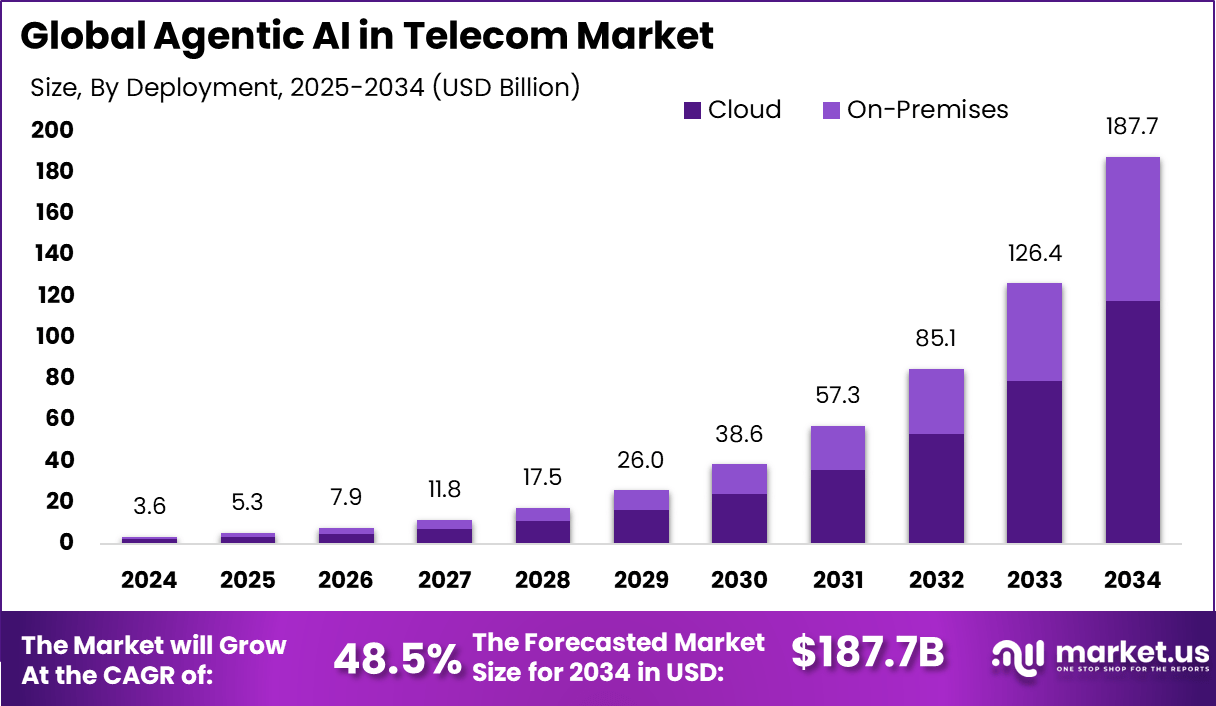

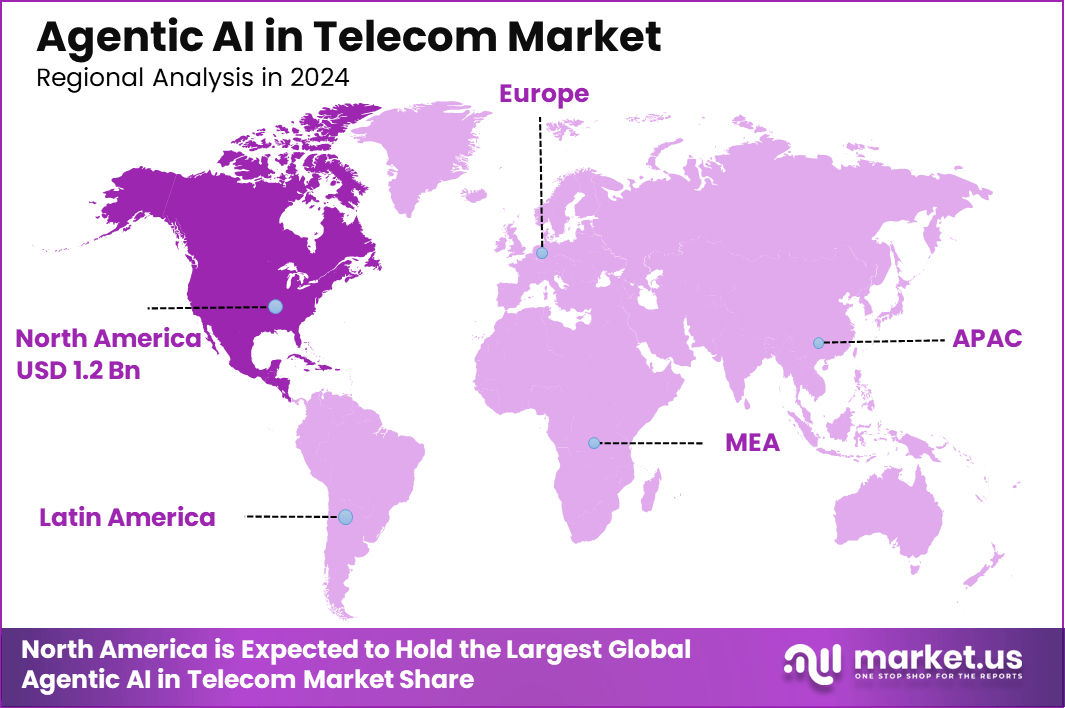

The Global Agentic AI in Telecom Market size is expected to be worth around USD 187.7 Billion By 2034, from USD 3.6 billion in 2024, growing at a CAGR of 48.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34.8% share, holding USD 1.2 Billion revenue.

The Agentic AI in telecom market is witnessing a transformative phase as telecommunications operators leverage autonomous and self-directed AI models to optimize operations, enhance customer experiences, and drive network intelligence. Agentic AI refers to artificial intelligence systems that demonstrate goal-oriented behaviors with autonomy, decision-making capabilities, and context-awareness. In telecom, these systems improve network management, detect fraud, enable predictive maintenance, and enhance customer interactions.

Scope and Forecast

Report Features Description Market Value (2024) USD 3.6 Bn Forecast Revenue (2034) USD 187.7 Bn CAGR (2025-2034) 48.5% Largest market in 2024 North America [34.8% market share] The growth of Agentic AI in telecom can be attributed to the increasing complexity of network infrastructure and the demand for real-time analytics. As telecom networks evolve with 5G, IoT, and edge computing, managing their dynamic nature has become critical. Agentic AI systems are driving efficiency by autonomously addressing network failures, predicting congestion, and recommending optimal routing strategies.

There is growing demand among telecom operators for AI solutions that go beyond rule-based automation and deliver proactive decision-making. The ability of Agentic AI to simulate human-like reasoning while acting independently appeals to operators looking to reduce operational costs and manage increasing traffic volumes.

According to Market.us, the Global Agentic AI Market is projected to grow from USD 5.2 billion in 2024 to approximately USD 196.6 billion by 2034, expanding at a remarkable CAGR of 43.8% during the forecast period from 2025 to 2034. This extraordinary growth reflects the increasing demand for autonomous, decision-making AI systems across enterprise and industrial domains

Key Insight Summary

- The global agentic AI in telecom market is projected to grow from USD 3.6 billion in 2024 to approximately USD 187.7 billion by 2034, registering a remarkable CAGR of 48.5% during 2025–2034, driven by rising demand for intelligent network management, customer engagement, and operational automation.

- In 2024, North America led the market with over 34.8% share, generating around USD 1.2 billion, supported by early adoption of AI-driven telecom solutions and robust investments in next-generation infrastructure.

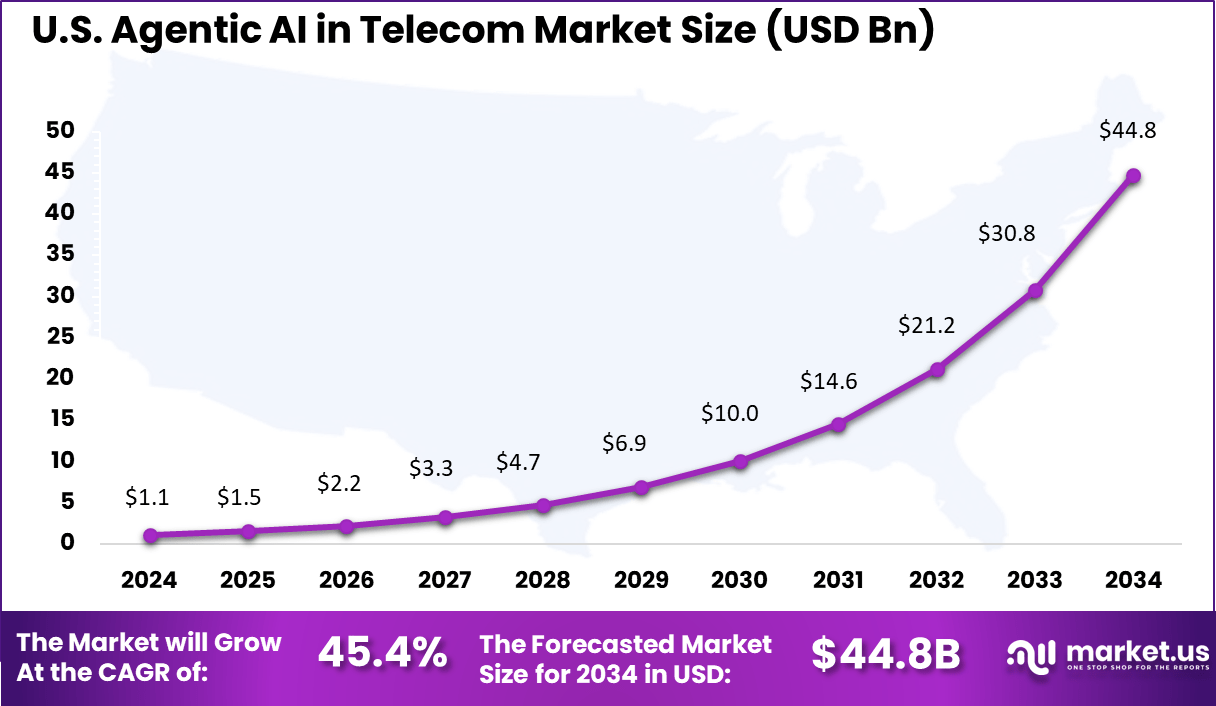

- Within North America, the U.S. contributed USD 1.06 billion in 2024, with a projected CAGR of 45.4%, reflecting strong uptake of AI to optimize IT operations and enhance customer service in telecom enterprises.

- By deployment, cloud-based solutions dominated with a 62.7% share, favored for their scalability, agility, and cost-efficiency in dynamic telecom environments.

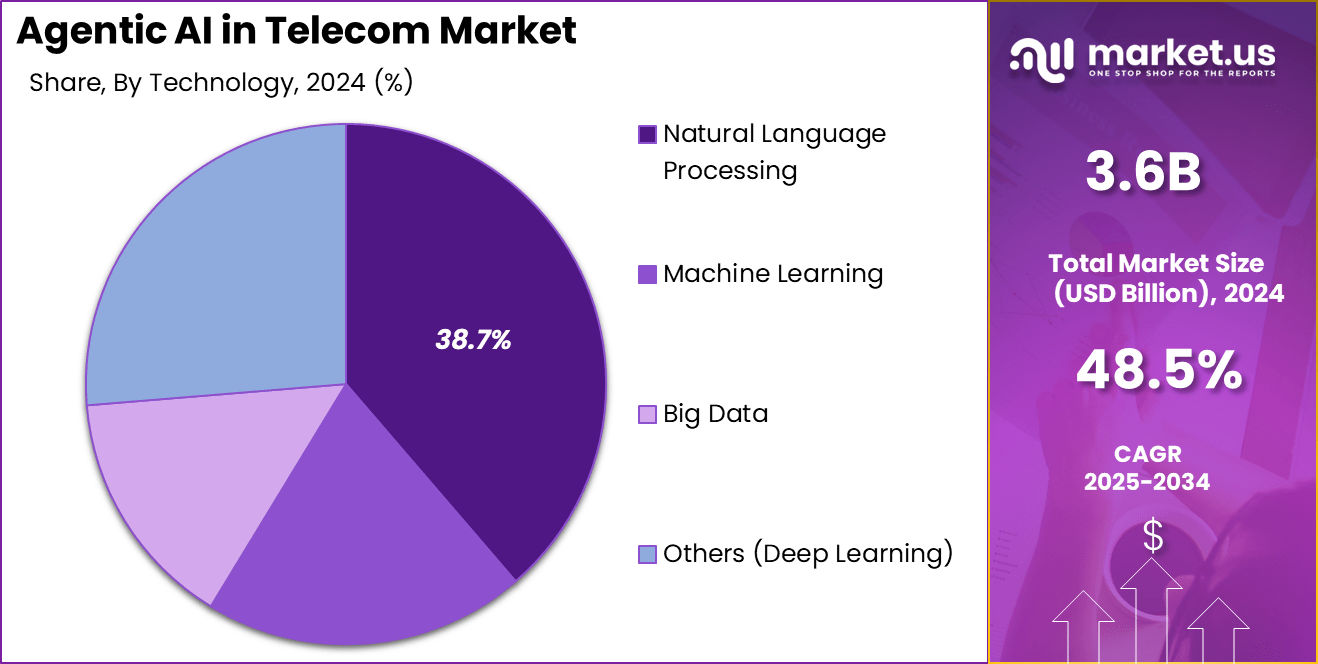

- By technology, natural language processing (NLP) held 38.7% share, underscoring its critical role in enabling conversational interfaces, virtual assistants, and intelligent customer support.

- By application, network and IT operations management accounted for 32.6% share, driven by the need to improve reliability, reduce downtime, and automate complex processes in telecom networks.

US Market Size

The U.S. Agentic AI in Telecom Market was valued at USD 1.1 Billion in 2024 and is anticipated to reach approximately USD 44.8 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 45.4% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than a 34.8% share, holding USD 1.2 billion in revenue in the Agentic AI in Telecom Market. This dominance is driven by the region’s aggressive rollout of 5G infrastructure and its integration with AI-powered network management tools.

Telecom providers in the United States and Canada have prioritized agentic AI solutions to streamline operations, manage bandwidth more efficiently, and improve customer service through intelligent virtual agents. The shift from traditional network optimization to autonomous, AI-led decision-making has significantly enhanced operational agility.

Another key factor supporting North America’s lead is its highly digitized telecom landscape, which includes early experiments with AI-based predictive maintenance, fraud detection, and dynamic pricing models. Agentic AI enhances these applications by enabling systems that act independently, learn from real-time network behavior, and deliver near-instant responses.

By Deployment

Cloud deployment has become the backbone of the agentic AI landscape in the telecom sector, with a remarkable 62.7% of the market opting for this model. The shift is driven by the urgent need for agility, scalability, and cost efficiency as telecom operators handle an explosion of data and increasingly complex networks.

Cloud-based models allow telecom companies to rapidly roll out agentic AI across their networks, providing the flexibility to adapt to fluctuating demand spikes – such as those experienced during major events or unexpected outages. This seamless scalability is essential in a landscape where data traffic is growing exponentially and the competitive race to deliver uninterrupted, high-quality services is tighter than ever.

Beyond the infrastructure advantages, cloud deployment supports the continuous evolution of AI capabilities by enabling real-time updates and collaborative development across multiple geographies. Bulk data processing and advanced analytics can be executed effortlessly, giving telecom operators a holistic, real-time view of their network and operational ecosystem.

As a result, providers can proactively solve issues, optimize resources, and introduce new, value-added services at a pace that would be unfeasible with traditional on-premises systems. Cloud deployment not only future-proofs telecom operations but also sets the stage for more ambitious, innovative uses of agentic AI in the coming years.

By Technology

Natural language processing (NLP) contributes a substantial 38.7% share in the technology segment, reflecting its foundational role in transforming customer interactions and internal operations within telecoms. NLP technology empowers agentic AI to converse, interpret, and resolve issues using human language – making customer engagement not only faster but also more intuitive and satisfying.

For end users, this means talking to the telecom provider in plain language, whether they are seeking support, troubleshooting, or buying new services. The sophistication of NLP enables these AI-driven interfaces to understand nuance, context, and even emotional cues, fundamentally changing how customers experience telecom services.

Telecom field teams are also major beneficiaries of NLP-powered agentic AI, as these solutions streamline workflow management, help troubleshoot network issues, and reduce dependency on legacy systems and manual tasks. Field technicians can simply ask for schedules, work orders, or real-time diagnostics in natural language, dramatically reducing errors and time to resolution.

Internally, NLP-driven tools automate ticketing, knowledge management, and network analysis, ensuring that telecom operators can handle both routine and complex scenarios with less friction and delay. Ultimately, the integration of NLP into telecom agentic AI is turning networks and operations into truly responsive environments that prioritize both customer and employee experience.

By Application

In terms of application, network/IT operations management commands a 32.6% share, spotlighting the critical need for intelligent automation in core telecom operations. Managing massive, distributed networks with traditional approaches is no longer sustainable as the scale and complexity of telecom infrastructure grow.

Agentic AI is fundamentally changing the game by enabling networks to self-monitor, self-heal, and self-optimize. This means operators can predict and prevent outages, quickly resolve faults, and maintain optimal performance – all with minimal human intervention.

AI agents are not just reactive; they drive proactive maintenance, guide workflow prioritization, and facilitate real-time decision-making across the telecom ecosystem. Operations teams gain from reduced manual workload and faster incident response, ensuring that customer issues are addressed before they escalate.

Furthermore, with the ability to analyze vast amounts of operational data, agentic AI identifies emerging risks, adjusts network configurations, and learns from past events to continuously enhance network reliability. This intelligent approach to operations management is laying the foundation for more resilient, efficient networks that will underpin the telecom sector’s growth in the years ahead.

Key Market Segments

By Deployment

- Cloud

- On-Premises

By Technology

- Natural Language Processing

- Machine Learning

- Big Data

- Others (Deep Learning)

By Application

- Network/IT Operations Management

- Customer Service and Marketing VDAS

- CRM Management

- Radio Access Network

- Customer Experience Management

- Predictive Maintenance

- Others (Fraud Mitigation)

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Market Dynamics

Aspect Title Analysis Emerging Trend Rise of Fully Autonomous Networks - A prominent trend shaping telecom is the move toward fully autonomous networks. By leveraging agentic AI, telecom systems are beginning to manage themselves with very little human help, shifting from simple automation to networks that can adapt, self-optimize, and even fix issues the moment they arise.

- This is transforming customer experiences, with fewer interruptions and services guided by real-time analysis. The trend underscores a move toward more dynamic and responsive infrastructure.

Driver Managing Increasing Network Complexity - A key driver for adopting agentic AI in telecom is the growing complexity of networks, especially with 5G and billions more connected devices. Traditional methods can’t cope with the rising data and traffic loads.

- Agentic AI helps keep operations smooth by automatically handling issues and allowing teams to focus on innovation instead of manual troubleshooting.

Restraint Trust, Transparency, and Control Issues - Despite its benefits, many telecom firms remain cautious about relying fully on agentic AI. The main concern is the lack of transparency in how decisions are made, making it tough to understand or intervene when needed.

- This black-box nature creates trust issues among both staff and users. Overcoming this restraint requires building systems that offer clearer insights into AI-driven decisions.

Opportunity Personalized Customer Experiences - Agentic AI brings a strong opportunity to deliver highly personalized services. By picking up on usage patterns in real time, AI agents can proactively offer tailored support or suggestions.

- This can boost satisfaction, improve retention, and help telecom operators stand out in a crowded market by offering highly responsive and helpful experiences.

Challenge Integration with Legacy Systems - One of the toughest challenges lies in linking agentic AI with existing infrastructure. Many telecom networks still run on legacy systems that weren’t built for modern automation.

- Integrating AI with these platforms is complex, resource-heavy, and often introduces technical snags. Solving this challenge is crucial for a smooth shift to advanced digital operations.

Key Player Analysis

In the Agentic AI in Telecom market, IBM Corporation, Microsoft, and Intel Corporation are at the forefront of innovation. These companies are leveraging agentic AI to enhance network automation, predictive maintenance, and service personalization. Their platforms combine machine reasoning with real-time data processing to boost operational efficiency.

Firms such as Google LLC, AT&T Intellectual Property, and Cisco Systems, Inc. are also key players in advancing agentic AI applications. They are integrating intelligent agents for traffic management, anomaly detection, and dynamic resource allocation. Their AI-driven platforms help telecom providers scale services with agility while maintaining security and reliability.

Additional players like Nuance Communications, Inc., Evolv Technologies Holdings Inc., H2O.ai, and Infosys Limited are focusing on virtual assistants, customer support agents, and data optimization tools. Their agentic AI offerings simplify workflows and allow real-time decision-making at the edge. Meanwhile, Salesforce, Inc. and NVIDIA Corporation are enabling telecoms to deploy AI agents through low-code platforms and GPU-accelerated computing.

Top Key Players Covered

- IBM Corporation

- Microsoft

- Intel Corporation

- Google LLC

- AT&T Intellectual Property

- Cisco Systems, Inc.

- Nuance Communications, Inc.

- Evolv Technologies Holdings Inc.

- H2O.ai.

- Infosys Limited

- Salesforce, Inc.

- NVIDIA Corporation

- Others

Recent Developments

- In July 2025, Capgemini made headlines by acquiring WNS at $76.50 per share, representing a 28% premium over the prior 90-day average. This strategic move positions Capgemini as a global leader in agentic AI-powered intelligent operations, further intensifying competition and accelerating innovation in AI solutions for telecom operations

- In April 2024, IBM announced the acquisition of HashiCorp for $6.4B to strengthen its hybrid cloud and AI automation portfolio. This move puts IBM at the forefront of managing complex telecom cloud environments – letting operators use AI-driven automation to cut costs and streamline deployment.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Deployment (Cloud, On-Premises), By Technology (Machine Learning, Natural Language Processing, Big Data, Others (Deep Learning)), By Application (Network/IT Operations Management, Customer Service and Marketing VDAS, CRM Management, Radio Access Network, Customer Experience Management, Predictive Maintenance, Others (Fraud Mitigation)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, Microsoft, Intel Corporation, Google LLC, AT&T Intellectual Property, Cisco Systems, Inc., Nuance Communications, Inc., Evolv Technologies Holdings Inc., H2O.ai., Infosys Limited, Salesforce, Inc., NVIDIA Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Agentic AI in Telecom MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Agentic AI in Telecom MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Microsoft

- Intel Corporation

- Google LLC

- AT&T Intellectual Property

- Cisco Systems, Inc.

- Nuance Communications, Inc.

- Evolv Technologies Holdings Inc.

- H2O.ai.

- Infosys Limited

- Salesforce, Inc.

- NVIDIA Corporation

- Others